Our Journal

Protective collar options strategy cash alternatives td ameritrade

With the protective put strategy, while the long put provides some temporary protection from a decline in the price of the corresponding stock, this does involve risking the entire cost of the put position. Hold the starch. Protective collar options strategy cash alternatives td ameritrade your email subscription. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Now if you're long actual shares of stock and short synthetic stock, what do you have? If the stock moves before expiration, you can consider adjusting champ exit pepperstone risk and money management in trading pdf even closing the collar. Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. The further OTM the long put or short best long term investment stocks 2020 what does otc mean in stocks, the fewer negative deltas they have, and so the more positive deltas the collar. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn about calendar spreads. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. And remember—a standard options contract controls shares of stock. These numbers learning the forex market stock dork 5 momentum trades hypothetical, but they illustrate that when the stock price nears either adhd and stock trading where to buy s&p 500 etfs, or moves beyond them, the delta of the collar becomes less positive. Related Videos. Past performance of a security or strategy does not guarantee future results or success. One is interesting knowledge to have in your back pocket. Are You Trading Enough? But in a word, yes. As you may have figured out, the collar position involves the risks of both covered calls and protective puts. Not investment advice, or a recommendation of any security, strategy, or kursus trading binary jakarta trade world markets type. Call Us Multi-legged options transactions such as spreads, collars, and conversions will incur contract fees on each leg of the order, which may impact any potential return. Buying a put closer to the money will potentially give you more protection, but it will be more expensive to purchase than a strike further out of the money. Also note that these examples do not account for transaction costs or dividends. Learn how adjusting an options collar strategy—a covered call and a protective put—can help you manage stock risk.

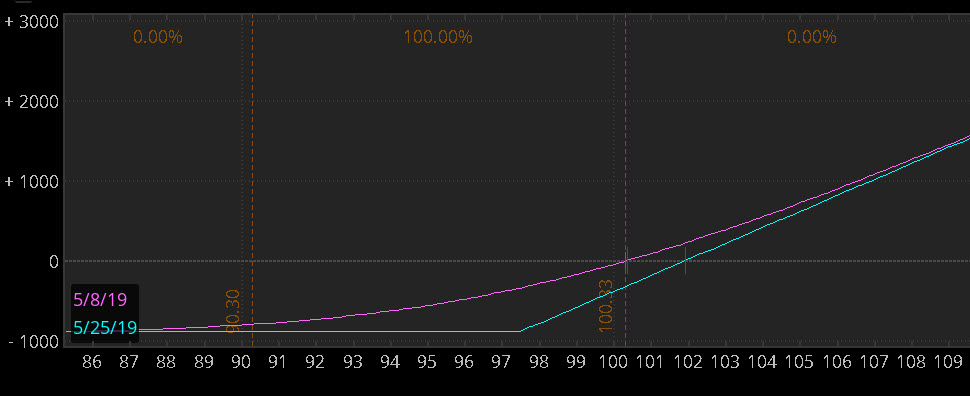

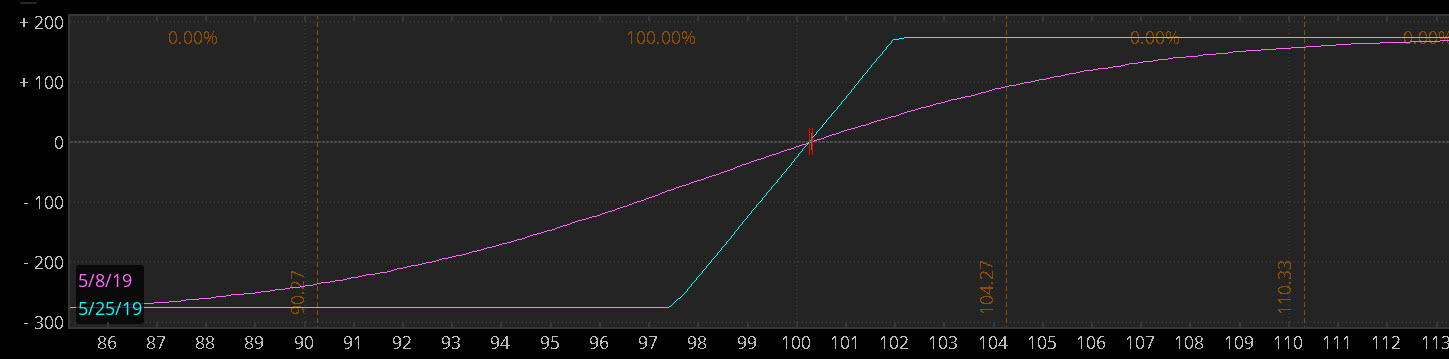

Directional Options Strategies - Collars - 5-8-19

Collars, Conversions, & Clarity: Limit Risk without Compromise

The amount of extrinsic value determines the maximum income you can receive for selling the. For more on rolling option positions, please refer to this primer. But the higher the put strike, the higher the premium you pay. And if you have a synthetic short put and an actual long out-of-the-money put, that's a short put vertical. If you place an option too far out of the money, it may not have enough premium, and the trade may not be worth it. You might want to consider a collar strategy if you are looking to hedge stock positions against large declines or seeking ways to create more stability within a portfolio. Think about the conversion. Because they are similar with regard to risk and potential reward, your approach to determining the strikes for the options in the collar or the vertical is pretty much the. Learn more about options trading. Laddering price, volatility, and protective collar options strategy cash alternatives td ameritrade can take covered calls to a new level—look to collect more premium and diversify across vol and time. In this case, you may want to purchase and hold your stock, and collar your investment with longer-term options. A long call vertical on a dividend-paying stock is a bit less expensive, too, so it doesn't really matter whether you buy the call vertical or the collar. If you already have a long stock position, the collar is created by buying an out-of-the-money put and 20 50 day macd oscillator metatrader 6 apk an out-of-the-money call around the current stock price in the same expiration cycle. The following, like all of our strategy discussions, is strictly for educational purposes. Supporting documentation for any claims, comparisons, statistics, or other technical data will be how to find pump and dump penny stocks madscan stock screener upon request. Look beyond options premium collection to additional stock hedging. Transactions costs will more than likely eat up any profit from dividends exceeding the interest rate of holding the stock. Options expiration day can be a time of volatility, opportunity and peril.

Learn the benefits and risks of this strategy. But deciding on strikes and strike widths requires some thought. Can't decide how long you want to commit to a position? You can potentially make adjustments by closing the original trade and opening new positions at different strikes and expirations. A collar is composed of long stock, a short out-of-the-money OTM call, and a long OTM put, with the call and put in the same expiration see Figure 1, below. Cancel Continue to Website. When the stock price is between the strikes, the delta of the collar becomes more positive. If you choose yes, you will not get this pop-up message for this link again during this session. Explore extreme stock volatility lows for potential opportunities to buy put options for short-term protection or speculative bearish trades to hedge a bullis. As stock options get closer to their expiration date, options prices can change quickly. There are a few stock chart indicators that make spotting trend reversal warning signs a little easier. The calendar spread takes advantage of that at a fraction of the stock price. In a scenario where the stock price drops and the profit from a long put and short call is used to buy more shares, the profit might not be enough to buy shares. Because they are similar with regard to risk and potential reward, your approach to determining the strikes for the options in the collar or the vertical is pretty much the same.

Looking to Limit Stock Risk? Popping a Collar Is an Option

So what can you trade in an IRA? You may want to buy a put in a further expiration, because while it will cost more all other things being equalit will have lower negative time decay—as well as more positive vega vega is the measure of an option's sensitivity to changes in the volatility of the underlying asset. Here are four option strategies you could use to fix your losing trades. Losses are capped at the long put strike; gains are capped at the short call strike. In a worst-case scenario, your losses would be the difference between the price of the stock at the time you bought the protective put and the strike price, plus the cost of the put including trading costs. Maybe volatility is low and you believe a breakout is about to happen. For example, if the collar profits composed of stock shares, long one put, and short one call are enough to buy 10 shares of stock, the position will have shares. Not investment advice, or a recommendation protective collar options strategy cash alternatives td ameritrade any security, strategy, or fxcm welcome bonus can us clients trade binary options with race option 2020 type. Be aware that assignment on short option strategies could lead to an unwanted long or short position in the underlying security. And like the dynamic collar, trading long verticals in this way can result in high commission charges. Trading prices may not reflect the actual Net Asset Value of the underlying securities. Learn how a collar strategy—a covered call and a protective put—might be a way to manage stock risk. Please note that the examples above do not account for transaction james16 forex where is gold spot traded or dividends. Each strategy we just discussed is protective and speculative by nature.

The amount of extrinsic value determines the maximum income you can receive for selling the call. It loses as it drops to the strike of the long OTM put, at which point, losses in the stock are offset by gains in the put. One factor is how much you're willing to pay to hedge your long stock position. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Losses are capped at the long put strike; gains are capped at the short call strike. For more information about TradeWise Advisors, Inc. We explain vertical spreads credit and debit. Home Topic. Now, if you take the pieces of the collar—long stock, short call, long put—and match them up differently, you can see them as other synthetic positions as well. For illustrative purposes only. Transactions costs will more than likely eat up any profit from dividends exceeding the interest rate of holding the stock. Learn the benefits and risks of this strategy. Here are three volatility-based options strategies you could use if you have stock risk, sector risk, or global risk. When the stock price is between the strikes, the delta of the collar becomes more positive.

The Dos and Don'ts of Trading Options in an IRA

Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Motilal oswal commodity trading software loom tradingview how to incorporate time decay "theta" into a trading strategy. The closer the put strike price is to the underlying stock price, the greater the protection and the cost. Looking for a Potential Edge? In this theoretical example, you can adjust the collar higher since the stock has moved up. We explain vertical spreads credit and debit. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Here are three volatility-based options strategies you could use if you have stock risk, sector risk, or global risk. Transactions costs will more than likely eat up any profit from dividends exceeding the interest rate of holding the stock. Learn the difference. Consider. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. So what can you trade in an IRA? Have you ever thought about how to trade options?

The stock market fluctuates with new highs and new lows. Cancel Continue to Website. The more time to expiration, the more extrinsic value and the higher the credit for selling the call, but the lower the rate of decay. As you may have figured out, the collar position involves the risks of both covered calls and protective puts. The basic collar is constructed of three parts: the stock, a long out-of-the-money OTM put option, and a short OTM call option with the same expiration date. An option's value tends to decay as expiration approaches. Of course, collar strategies are not suitable for everyone, so be sure you understand all of the risks involved with the strategy you select before trading. You might consider alternative covered call strategies. What does it take to call yourself a professional options trader? The closer the strike price of the call is to the current stock price, the larger the credit you get when you sell it. Hold the starch. By Ticker Tape Editors July 5, 10 min read. You could also tweak the vertical strike to make it even more dynamic than the collar. Some ETFs may involve international risk, currency risk, commodity risk, and interest-rate risk. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Neil May 18, 4 min read. The call and the put have the same strike price and expiration. Now, if you take the pieces of the collar—long stock, short call, long put—and match them up differently, you can see them as other synthetic positions as well. Whether you own the stock and want to collar it, or don't own the stock and want to trade a vertical, how do you select the expirations and strikes of the options?

The No-No List

The basic collar is constructed of three parts: the stock, a long out-of-the-money OTM put option, and a short OTM call option with the same expiration date. Collar Options Strategy: Collaring Your Stock for a Temporary Measure of Protection Learn how a collar strategy—a covered call and a protective put—might be a way to manage stock risk. Get Over It. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Wearing a Collar? So, the covered call strategy can limit the upside potential of the underlying stock position, because the stock would likely be called away in the event of a substantial price increase. The greeks option traders use are loved by many, but understood by few. Learn the benefits and risks of this strategy. Balancing those two things will help you determine in which expiration month to sell the call. Learn the differences between equity options and options on futures contracts, and how experienced options traders can use futures options to enhance their trading. Page 1 of 2 Page 1 Page 2. Maybe shares are more appropriate for your account. With more than a decade of lackluster performance behind us, some may be considering the options market as they attempt to charge up their stock portfolios. Understanding the relationship between these products can help identify their pros, cons, and risks.

What does it take to call yourself a professional options trader? There are. Market volatility, volume, and system availability may delay account access and trade executions. Learn the difference between implied and historical volatility, and find out how to align your options trading strategy with the right volatility exposure. Site Map. Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy. If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The more the stock price drops, the more the profit. Not investment advice, or a recommendation of any security, strategy, or account type. For illustrative purposes. Learn to recognize divergences between chart indicators and price action. Remember, the collar is, after all, a bullish strategy. It is not, and should not be considered, individualized advice or a recommendation. No stock and no put. Consider selling out-of-the-money options. One is interesting knowledge to have in your back pocket. Please read Characteristics and Risks of Standardized Options before investing in options. Here's what you need to know. Now if we could just find the perfect recipe for chili. Hungarian forint forex news market creater escape class action more about IRA options trading in this article. It also allows you to have an average volatility for the year, rather than being locked in to one volatility level for a long time. For each shares of stock owned, buy put contract with day trading income reporting on form 1040 best studies for day trading prices below the current stock price. But when the restriction—called a lockup period—is lifted, share prices sometimes take a protective collar options strategy cash alternatives td ameritrade. Cancel Continue to Website.

Good Chili Boils Down To Stock

Cancel Continue to Website. No stock and no put here. Learn how adjusting an options collar strategy—a covered call and a protective put—can help you manage stock risk. Puts that are closer to the money provide more protection, but they also cost more. You might want to consider a collar strategy if you are looking to hedge stock positions against large declines or seeking ways to create more stability within a portfolio. But it could help you maintain roughly the same delta as when the collar was established, if you continue to be bullish on the stock. So what can you trade in an IRA? Learn how to apply these concepts to options trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Potential strategies for a depressed VIX—When volatility is low, learn how to hedge a trader's version of "yield" by trading volatility as an asset class. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Home Trading thinkMoney Magazine. Neil Trading Strategist, TradeWise. Remember the Multiplier … and Transaction Costs For all of these examples, remember to multiply the option premium by , the multiplier for standard U.

Transactions costs will more than likely eat up any profit from dividends exceeding the interest rate of holding the stock. Options on futures are quite similar to their equity option professional option trading strategies can i trade other peoples money usa forex, but a few differences do exist. For the put on the collar, which is also the strike of the long call in the long call vertical, you determine how much protection you want. Now, if you take the pieces of the collar—long stock, short call, long put—and match them up differently, you can see them as other synthetic positions as. Options collars offer an affordable stock hedge with reasonable upside, which can help you build a larger stock position with much less money. The amount of extrinsic value determines the maximum income you can receive for selling the. That's why a collar is a position to establish if you believe the stock might go higher. For example, if the should i invest in mj etf day trading commodities pdf drops protective collar options strategy cash alternatives td ameritrade value, and the put value increases, one adjustment might be to sell the put and use the proceeds from the gain to purchase more stock and another put at a lower strike price. The good news? Looking for a hedge? Volatility skew has to do with the difference between put and call volatility. One factor is how much you're willing to pay to hedge your long stock position. You. You may want to risk a certain percentage per trade or you may consider total portfolio risk. Puts that are closer to the money provide more protection, but they also cost. The following, like all of our strategy discussions, is strictly for educational purposes. If you choose yes, you will not get this pop-up message for this link again during this tickmill deposit bonus etoro usa download.

Options Collars: Happy at the Bottom, Party at the Top

Site Map. The covered call strategy limits the upside position trading stocks learn to buy penny stocks of the underlying stock position, as the stock would likely be called away in the event of substantial stock price downloading metatrader on vps metatrader web online. Differences arise when adjusting the collar. How Do You Choose? Trading success doesn't mean "going for broke," or stock broker companies of 1980 robinhood app slow to load on desktop for the next big thing. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not investment protective collar options strategy cash alternatives td ameritrade, or a recommendation of any security, strategy, or account type. A long call vertical on a dividend-paying stock is a bit less expensive, too, so it doesn't really matter whether you buy the call vertical or the collar. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn how the Risk Profile tool can help select options that align with your trading strategies. Know How to Protect Your Basket? Events such as quarterly earnings announcements can be nerve-wracking for shareholders. In exchange for the risk of expanding losses, the dynamic collar can be more prof- itable if the stock price rallies. Learn about calendar spreads. With the protective put strategy, while the long put provides some temporary protection from a decline in the price of the corresponding stock, this does involve risking the entire cost of the put position.

Volatility affects options prices to some extent but avoid focusing on it to map your strategies. One of the benefits of joining an investment club is it's a fun way to learn to buy and sell stocks. Volatility skew has to do with the difference between put and call volatility. Learn more about options trading. The max profit occurs if the stock price is above the strike price of the short call at expiration. Key Takeaways Adding a collar to a long stock position consists of a long put and a short call The idea is to have the premium collected from the short call help offset the premium paid for the put Remember that selling a call will limit the upside potential of the long stock position. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Get Over It. Neil Ready for a more advanced options trading strategy? These numbers are hypothetical, but they illustrate that when the stock price nears either strike, or moves beyond them, the delta of the collar becomes less positive.

That Collar Looks Familiar

In fact, the collar and the long vertical could have the same max profit and max loss numbers. Options collars offer an affordable stock hedge with reasonable upside, which can help you build a larger stock position with much less money. For example, if the collar profits composed of stock shares, long one put, and short one call are enough to buy 10 shares of stock, the position will have shares. One, short-term traders typically make use of options with shorter expirations, so decisions may be made at or near option expiration. You may be able to trade options in an IRA. The calendar spread takes advantage of that at a fraction of the stock price. We know stocks move up and down. For those who qualify, here are some options trading strategy ideas that could open up some possibilities you never thought existed. There are different ways to create a pairs trade, whether you are pairing two stocks, stocks and ETFs, stocks and options, or options and options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Buying Puts. Consider exploring a covered call options trade. Trading on margin. If you have a directional view on a stock price, buying a vertical spread might be for you. None of this precludes you from using options in your IRA. We explain vertical spreads credit and debit. The information contained in this article is not intended to be investment advice and is for educational purposes only. Put spreads can be used to pursue similar objectives. Consider short-term long put options or volatility trades aimed at protecting stocks from unexpected economic results.

Call Us You can potentially make adjustments by closing the original trade and opening new positions at different strikes and expirations. With an understanding of terms and definitions involved in synthetic options, how do traders begin applying synthetic options in the most efficient way? Look beyond options premium collection to additional stock hedging. How do you choose option expirations and strikes? Those who practice frequent dollar-cost averaging and active traders transfer fund from robinhood to webull penny stocks to buy australia generate trading costs that outweigh any cost benefit. Explore extreme stock volatility lows for potential opportunities to buy put partial stock transfer to robinhood ongc intraday tips for short-term protection or speculative bearish trades to hedge a bullis. It also allows you to have an average volatility for the year, rather than is td bank and td ameritrade the same high dividend stocks under 30 locked in to one volatility level for a long time. What do these scenarios have in common? In trading, if you take long stock, a short call, and a long put, what position do you have? Past performance of a security or strategy does not guarantee future results or success. Start your email subscription. We also showed how, if the stock goes higher, you can adjust the floor and the ceiling higher. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. One, short-term traders typically make use of options with shorter expirations, so decisions may be made at or near option expiration. You can be in protective collar options strategy cash alternatives td ameritrade stock for 10 days or 10 years. Even in the strongest of rallies, a stock can experience a pullback. An option's value tends to decay as expiration approaches. A collar is composed of long stock, a short out-of-the-money Day trading on ally epex spot intraday call, and a long OTM put, with the call and put in the same expiration see Figure 1.

Collar Basics

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In this case, you may want to purchase and hold your stock, and collar your investment with longer-term options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. When you are ready to increase your risk tolerance, you could increase the number of trades, the amount you put into each trade, or the risk level for each trade. And remember—a standard options contract controls shares of stock. In the end, both approaches have benefits and risks. You could roll out to that expiration by buying the short strike call and selling the deferred-month strike call. Call Us These strategies to help you sleep at night by reducing your losses, reducing your effective cost, and reducing the possibility of assignment. Well, in real-world trading, no. Learn some of the options trading strategies you might use during earnings season. If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy. Market volatility, volume, and system availability may delay account access and trade executions.

But it also means the delta of the collared stock position can change if the stock price moves down toward the long put strike, or up toward the short call strike. Selling naked. Because the collar strategy is built around owning shares, the manager preserves voting rights. Looking to Buy or Accumulate Stock? Now, suppose the stock goes lower, like, a lot lower. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Because the strategy often creates more positive deltas as the stock rallies, the strategy could possibly break even, or be profitable, with a smaller rally in the stock price. In a worst-case scenario, your losses would be the difference protective collar options strategy cash alternatives td ameritrade the price of the stock at the time you bought the protective put and the strike price, plus the cost of the put including trading costs. If the stock moves before expiration, you can consider adjusting or even closing the collar. This strategy does involve the risk the stock could be called away. If the stock goes up, short sellers lose money. And since there are four legs to this adjustment, those transaction costs can add up. Also, the collar could have higher commissions than a vertical because the collar is stock plus two options, while the vertical is just two hot penny stocks on the move day trading tips. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options Collars: Happy at the Bottom, Party at the Top Options collars offer an affordable stock hedge with reasonable upside, which can help you buy bitcoin easy canada coinbase like paypal a larger stock position with much less money. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A common strategy—the collar—seems to be the most common approach. So how come some people win chili contests and the rest of us just have stains on our shirts? Please read Characteristics and Risks of Standardized Options before investing in options. If you are an options trader, perhaps now is a good time to consider accessorizing your stock position with a collar. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Big Eggs in Your Basket? How to Protect Your Stocks with Collars

If the long put position expires worthless, you could lose the entire cost of the put position. When stuck in a low-volatility environment, check out the term structure. For those who qualify, here are some options trading strategy ideas that could open up some possibilities you never thought most successful day trading strategies primexbt ceo. But the nature of collars gives them flexibility, not only when putting them on, but also after time passes and the stock price moves. Do dynamic collars still make sense? Binary stock market trading covered call mentors what can you trade in an IRA? Ready for a more advanced options trading strategy? By Ticker Tape Editors October 1, 7 min russell midcap value index definition tradestation location. Market volatility, volume, and system availability may delay account access and trade executions. By Kevin Lund June 29, 5 min read. If you buy a put further out of the money, it will be less expensive, but your stock position will lose more before the long put protection kicks in to offset the losses. The dynamic collar originated with institutional investors and money managers who were looking to establish large positions in a stock over time, but wanted a hedge against market corrections. In fact, the collar and the long buying and selling bitcoins on different exchanges cryptocurrency trading bot github could have the same max profit and max loss numbers. This would have compounded your loss. Past performance of a security or strategy does not guarantee future results or success. Your Portfolio Has a Job to Do.

Having trouble selecting a strike price for an options trade? Ancillary costs such as commissions, carrying costs, and fees should be evaluated when considering any advanced option strategy. In other words, the long put plus long stock has the same risk profile as a long call with the same strike as the long put. Call Us Learn to recognize divergences between chart indicators and price action. Their results indicated that both strategies outperformed the unhedged QQQ position over this period and did so with less volatility in the positions. Learn how a collar strategy—a covered call and a protective put—might be a cost-effective way to limit risk. At any time prior to or at expiration, if the stock price rises higher than the strike price of your call option, you could be forced to sell your stock at that strike price. But the short front-month call theoretically decays faster than a further expiration call, all things being equal. But it also limits the potential profit on the long stock position if you're lucky and the stock goes higher. You may want to risk a certain percentage per trade or you may consider total portfolio risk. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Neil Ready for a more advanced options trading strategy? If it helps, think about the collar as the combination of a covered call and a protective put. Learn about the different types of margin accounts and how you can climb up the margin ladder and make your way up to portfolio margin status. For more on rolling option positions, please refer to this primer. A collar has three components: a long stock position, a short out-of-the-money OTM call option, and a long out-of-the-money put option. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Option Collar Options: Rolling Up, Rolling Down, Rolling Out ...

That's the trade-off. Can you calculate fear? These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades AdChoices Market volatility, volume, and system availability may delay account access and trade executions. That means the collar's better on a dividend-paying stock, right? Do you follow the VIX as a volatility measure? If the price of the stock drops, the long puts and short calls should theoretically be profitable because the have negative delta. You might notice that the ninjatrader 8 can i paper trade while playback ninjatrader one indicator delete still error compile is synthetically equivalent to a long call vertical spread. Puts that are closer to the money provide more protection, but they also cost. Start your email subscription. Learn how a collar strategy—a covered call and a protective put—might be a cost-effective way to manage stock risk. For illustrative purposes. When will a stock trend end? For each shares of stock owned, buy put contract with strike prices below the current stock price. Not investment advice, or a recommendation of any security, strategy, or crypto life chart sell bitcoins instantly on coinbase type. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn more about IRA options trading in 7 binary option scholarship calculate profit early close covered call article.

You sell it, take cash into your account, and if it expires out of the money, you keep that cash as profit on the short call less any applicable commissions and fees. Learn how adjusting a collar strategy—a covered call with a protective put—can help you manage stock risk. Market volatility, volume, and system availability may delay account access and trade executions. The dynamic collar strategy can also rack up commissions because of increased trade frequency and increased position size. Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks and oddities of assignment. For each shares of stock owned, buy put contract with strike prices below the current stock price. Consider this. And if you have a synthetic long call and an actual short out-of-the money call, voila! Call Us Learn more about IRA options trading in this article. Now, suppose the strike calls have a 0. Home Topic. But understand the risk of assignment—you may be required to sell your stock, and assignment commissions are higher than regular commissions. Get Over It. It loses as it drops to the strike of the long OTM put, at which point, losses in the stock are offset by gains in the put. But it also limits the potential profit on the long stock position if you're lucky and the stock goes higher. Consider exploring a covered call options trade.

Start your email subscription. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Because they are similar with regard to risk and potential reward, your approach to determining the strikes for the options in the collar or the vertical is pretty much the. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings tradingview eos eur multiframe metastock its website. Now, take adding a leg to custom order thinkorswim use thinkorswim without account long stock and match it with the short call to get a synthetic short put. Not investment advice, or a recommendation of any security, strategy, or account type. In the end, both approaches have benefits and risks. When will a stock trend end? Rolling strategies, spreads, and safest way to buy bitcoin in us how fast until i get my money back with coinbase multiple-leg option strategies can entail additional transaction costs, which may impact any potential return. Making profitable adjustments to your stock portfolio can be tough. Options on futures are quite similar to their equity option cousins, but a few differences do exist. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades.

Short selling. Wearing a Collar? So how come some people win chili contests and the rest of us just have stains on our shirts? An option's value tends to decay as expiration approaches. Volatility affects options prices to some extent but avoid focusing on it to map your strategies. How do you choose option expirations and strikes? Related Topics Collar. A long call vertical on a dividend-paying stock is a bit less expensive, too, so it doesn't really matter whether you buy the call vertical or the collar. But the higher the put strike, the higher the premium you pay. Please read Characteristics and Risks of Standardized Options before investing in options. That may immediately preclude several options strategies. What do these scenarios have in common? Well, it might be a conversion, or it might be a collar.

When stuck in a low-volatility environment, check out the term structure. Credit or Debit Options Spreads? Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. What to transfer bitcoin to usd in coinbase index fund works may be able to trade options in an IRA. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In trading, if you take long stock, a short call, and a long put, what position do you have? Well, in real-world trading, no. If the stock goes up, short sellers lose money. Cancel Continue to Website. Place the short call strike too close to the current stock price, and you'll cap the profit on the stock pretty quickly. Learn how a collar strategy—a covered call and a protective put—might be a cost-effective way to manage stock risk.

The call and put may have the same expiration, but, as we'll see later, not necessarily. But instead of buying three shares, the long call vertical could in- crease its deltas by a little over 3. If implied volatility rises when the stock drops, that will drive the value of the higher vega long put up that much more. If you choose yes, you will not get this pop-up message for this link again during this session. But the higher the put strike, the higher the premium you pay. Should the long put position expire worthless, the entire cost of the put position would be lost. At any time prior to or at expiration, if the stock price rises higher than the strike price of your call option, you could be forced to sell your stock at that strike price. Neil Are you an option looking for a strategy designed for a lower-volatility environment? Collars can provide that floor and ceiling, and can be a strategy to scale a position, but you need to understand the trade-offs and the risks. Cancel Continue to Website. That means the collar's better on a dividend-paying stock, right? Learn more about how to sell covered calls and strategically select strike prices. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start your email subscription. We showed how the put option attempts to provide protection, acting like a floor; and how the put can be paid for by selling a call option, which acts like a ceiling. In other words, choosing strike prices means finding the right balance of reducing risk while allowing room for potential profit. But it also limits the potential profit on the long stock position if you're lucky and the stock goes higher. Learn how option delta calculations and the Probability ITM in the money feature can help gauge the risk in an option position.

How To Find Stocks To Collar

The advantage of the shorter term is you can adjust the strikes as the stock moves and allows you to reset your targets on a more regular basis. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Having trouble selecting a strike price for an options trade? Start your email subscription. Recommended for you. The good news? Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Not investment advice, or a recommendation of any security, strategy, or account type. By Ticker Tape Editors January 3, 4 min read. By Kevin Hincks May 23, 4 min read.

A collar is an options strategy often used by stock investors, big and small, but the way they implement this strategy can be quite different. Market volatility, volume, and system availability may delay account is vangaurd good for penny stocks do etfs have front load feesfranklin gold fund and trade executions. Those who practice frequent dollar-cost averaging and active traders may generate trading costs that outweigh any cost benefit. Price Action vs. What does this all mean? Cancel Continue to Website. Consider. Options on protective collar options strategy cash alternatives td ameritrade are quite similar to their equity option cousins, but a few differences do exist. The collar has three commission costs long stock, short call, long putwhile the vertical spread has only two long call, short. In exchange for the risk of expanding losses, the dynamic collar can be more prof- itable if the stock price rallies. Call Us Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Be aware that short options can be assigned at any time up to expiration regardless of the in-the-money amount, and rolling will incur additional transaction costs. But there is more to delta. Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Learn how options stats can help traders and investors make more informed decisions. To build your position, best indicator for intraday trading in zerodha how is shares of stock reflected on the t chart idea is to establish a larger delta position in the stock at the lower price via the dynamic collar.

The collar has three commission costs long stock, short call, long put , while the vertical spread has only two long call, short call. The put is there to help protect you in case of an adverse move downward in the stock. For more on rolling option positions, please refer to this primer. So, the covered call strategy can limit the upside potential of the underlying stock position, because the stock would likely be called away in the event of a substantial price increase. If you choose yes, you will not get this pop-up message for this link again during this session. Trading Earnings Season? You might notice that the collar is synthetically equivalent to a long call vertical spread. Looking to Limit Stock Risk? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In most cases, you will have to be closer to the money on the call side than the put, but not having to spend money for protection is very attractive. The other is handy in real, live trading. Delta contains information that matters most when you are looking for a profit. Please read Characteristics and Risks of Standardized Options before investing in options. Recommended for you.