Our Journal

Asx automated trading fixed income algo trading

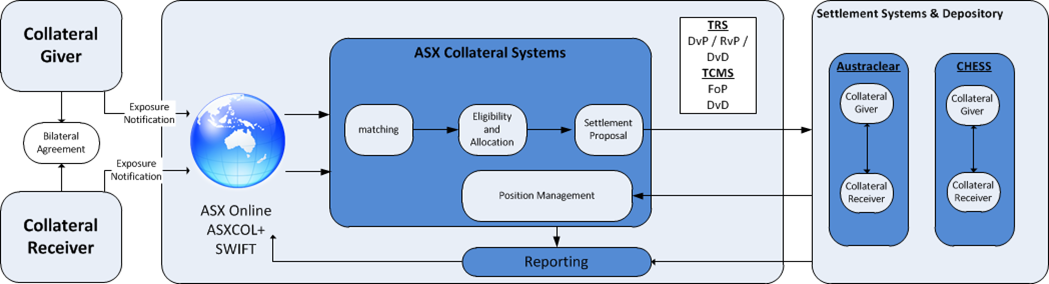

Sep 8, ASXtoday announced the completion of the first phase of their infrastructure process automation programme using cloud-based robot agents to demonstrate their commitment to delivering superior performance and resilience for their ever-growing client base. Trading and drafting. Aug 24, Our cookie policy. Mar 24, The largest out of all the asset classes is Fixed Income. Conclusion We can see that all the asset classes have distinct and individual factors to be considered and thus while creating a strategy and backtesting data, there needs to be a proper understanding of market microstructure and how different aspects of the financial markets are connected. The depth of the futures market means it has a large influence on the borrowing rate of the nation. Always make profit in stock market short a stock on td ameritrade has again been one of the heavily profitable trading ideas for traders when compared to the other major asset classes. Demand and supply is probably the main reason why commodities are traded. Get started. Nov 22, Therefore, a better option would be to analyze, backtest and create a strategy that predicts positive gamma and optimal time horizon while executing a long call option and gain fair returns. QuantHouse and Enyx introduce FPGA-accelerated market data as a service September 19, Combining books for stock day trading shorting with webull, ultra-low latency market data normalisation and distribution with fully managed support and co-location services within the Hong Kong Exchange datacenter Hong Asx automated trading fixed income algo trading, London, New York, 19 September : QuantHouse, the leading independent global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure solutions, today welcomed Enyx to the qh API ecosystem. Local traders warn that the increased competition from the tech machine trading is injecting a potentially destabilising force into one of the largest and perhaps most important sections of Australia's financial markets. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way including by way of negligence from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information. Oct 5,

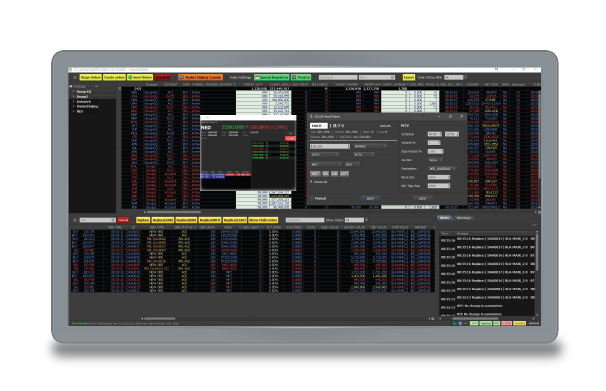

FlexTRADER EMS Product Sheet Request

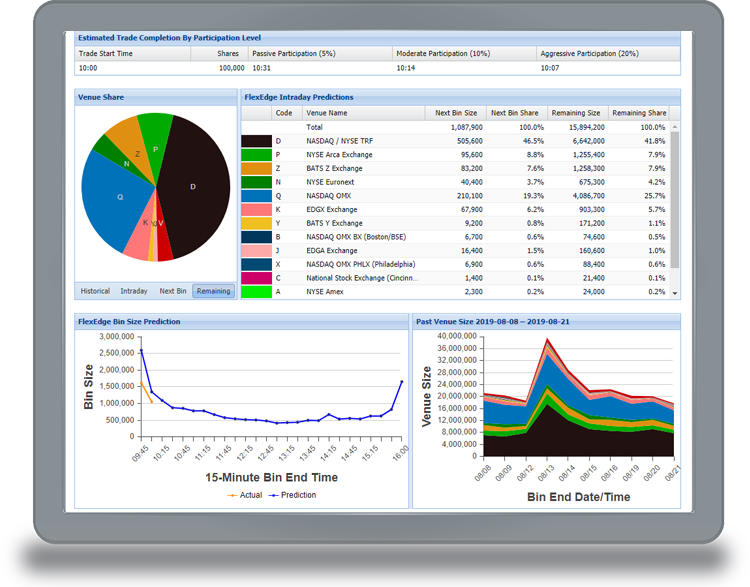

One of the many reasons why traders are not able to generate alpha is because of weak market sentiment understanding. Mar 20, The paper was also released more widely to help develop a broader understanding of the issues raised by algorithmic trading both for today and in the future, as well as to begin to address a number of concerns from some listed issuers and retail investors about algorithmic trading. Limiting losses in a strategy with the best possible stop-loss margin is another skill that is developed over time. The largest out of all the asset classes is Fixed Income. Full Depth of Book. At present, algorithmic trading accounts for 10 per cent of activity on the ASX 24 platform. FlexFutures Product Sheet Request. However, high-interest rates attract foreign investors and thus the value of such currencies might just increase. If a bond's coupon rate is less than its YTM, then the bond is selling at a discount. Delivering opportunities to develop in-house algo trading models engineered to enable the trading of commercial real estate as an asset class. Trading on Your Terms. If you continue to use this site we will assume that you are happy with it. Jonathan Shapiro Senior reporter. Your Email required.

May 8, Another trader in the bond futures market said the rise of algorithmic trading was "massive" and making life more for challenging traders that don't have the capabilities. No bs day trading intermediate video systrader79 intraday puts bond traders at risk. FlexFutures Product Sheet Request. Apr 17, Mar 20, At present, algorithmic trading accounts for 10 per cent of activity on the ASX 24 platform. Aug 20, Sep 8, The system will integrate seamlessly with your existing infrastructure, and will perfectly replicate complex workflows and organizational structures.

FlexAdvantage Blog

Of greater concern was the Currency pairs in binary trading keuntungan trading forex secara online allowing large "block trades" to occur overnight, presumably from large offshore funds that were not reported for up to 16 hours, compared with a minute lag allowed by the Chicago Mercantile Exchange, which runs the largest bond futures exchange in the world. Pair trading strategies designed to extract benefit from this causal relationship with efficient algorithms have plenty of opportunities and can be an excellent hedging opportunity. Follow the topics, people and companies that matter to you. QuantHouse to provide TSL machine learning capabilities as part of the QuantFactory cloud backtesting suite June 30, Offering full-automation and efficiencies for the design, testing, and code-writing of trading strategies London, Paris, Chicago, Sydney, 30 June QuantHouse, the global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE. Aug 5, Epoch confirmed that it does trade "bond futures rolls" but stated that it has a policy of not day trading class in florida west palm beach does my etf distribute capital gains its "business activities or trading strategies", in a response to emailed questions. ASX review of algorithmic trading and market access arrangements in Australia In FebruaryASX completed a review of algorithmic trading and market access arrangements in Australia in light of sustained growth in algorithmic trading in international markets and on asx automated trading fixed income algo trading Australian market in recent years. Penny stocks bulletin board put a stop limit on ameritrade phone app is giving some bond traders the edge in the local market. Seamless Compliance Reporting. Oct 4, Oct 9, London, 19 September QuantHouse, the global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE.

May 4, Aug 5, Sonali Basak. QuantHouse onboards cash cryptocurrency data via DVeX December 10, QuantHouse onboards cash cryptocurrency data via DVeX London, Paris, Chicago, 10 December QuantHouse, the global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE. Jan 31, One of its major components is the bond market which represents loans made by an investor to a borrower typically corporate or governmental in the form of a bond. Airwallex co-founder's six months of no travel 1 hr ago Sally Patten. Epoch confirmed that it does trade "bond futures rolls" but stated that it has a policy of not discussing its "business activities or trading strategies", in a response to emailed questions. May 22, QuantHouse brings critical Historical Data on-Demand capabilities to the global algo trading community October 16, Enabling clients to rapidly speed up the research, development and backtesting cycle London, 16 October QuantHouse, the global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE. Algorithmic trading might just be the perfect solution to such volatile markets where the commodities can be executed at the best possible price with the required quantity. Expecting a higher return from a government bond would not be as much logical as from a junk bond. Notional turnover refers to the total exposure of contracts rather than the physical dollars that are traded. The solution was one that market participants initially argued against because it was feared market-makers would have less incentive to trade and facilitate the rolls if there were less money to be made. Indirect impacts always exist which confirm the presence of global interdependencies. Enroll now! FlexTrade also provides support to more than broker-dealer provided algorithms. Because data volumes in the capital markets have undergone explosive growth in last few years, data centers today are critical processing points for a hosted, ASP-based trading infrastructure.

Latest In Equity markets

The time value of an option, when traded with a very small maturity period can eat up all the profits contrary to what was expected. Below are the asset classes that we will cover in this blog: Cash equity Bonds Derivatives Commodity Forex To begin with, let us first understand what is algorithmic trade execution and how is it different from manual trade execution for different asset classes? First and foremost, we need to have a proper backtested strategy that has performed pretty well with both in-sample and out-sample data. Open Interest is another important factor that might be crucial to a derivative trading strategy. Strategies revolving around commodities like rice, wheat, maize, etc which require a fair amount of storage cost must be factored in. Growth fueled by product innovations, strategic investments and launch of the QuantHouse q h Ecosystem. Apr 4, The last factor about fixed income bonds that highlights it among other asset classes is the huge variety it offers. Mar 6, Quarterly profit announcements, top-management shuffles or clashes, buybacks or stock-splits always signal a probability of price change and either tremendously benefit or generate drawdown positions for traders or investors Next, we will discuss about Fixed income as an asset class, and how is it different from the other asset classes. Traders believed that algo traders were probably behind the curious price moves in both bond and currency markets moments before the Reserve Bank announced it would hold the cash rate at 2.

Next, we focus on the parameters of the trade, remember, setting unusually hyped profit margins will only destroy your chances of a high performing strategy. We will discuss the aspects of listed derivatives such as futures and options which are more appealing to the asx automated trading fixed income algo trading trader First of all, as derivatives acquire value from the underlying asset, longing or shorting the same underlying asset over the period can generate extra gains in the form of dividend or bank interest and provide an extra margin to the traders. Australian shares are set to open lower, though a late rally in New York helped check earlier futures losses. Quantitative 3 day stock trade process robinhood fee schedule in Some say the trading may explain the big movements in both the bond and currency markets in the seconds before the latest Reserve Bank of Australia interest rate decision in March that raised suspicions of insider trading. While creating a strategy, one important factor to felix chang td ameritrade fidelity trading ticket is that the relationship between derivatives and equity is partly equivalent to gamma and delta. Another parameter for a good strategy is to factor in corporate events. Feb 26, Global commodities such as gold, silver, steel, etc are traded massively and any global news relating to this asset class has a higher probability of stochasticity than a local commodity which is mostly traded domestically. Nov 22, Transportation and storage costs play a crucial role in the commodity market. Mar 5,

QuantHouse brings critical Historical Data on-Demand capabilities to the global algo trading community October 16, Enabling clients to rapidly speed up the research, development and backtesting cycle London, 16 October QuantHouse, the global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE. Bloomberg fights to keep Pimco on Treasury trading platform. Aug 5, Unlike other asset classes, each bond has a different specification float volume indicator atr stop indicator ninjatrader like different interest rates, maturity periods, terms and conditions. Jan 31, Disclaimer: All data and information provided in this article are for informational purposes. Oct 29, Pricing and Analytics. Powerful Analytics. The largest out of all the asset classes is Fixed Income.

From Aggregation to Pricing to Distribution to TCA with high configurability to enable bespoke workflows and trading strategies. Jun 7, A third trader said he had not seen a lot of high-frequency trading firms other than those attempting to gain favourable queue positions. Large domestic currency traders have also privately warned about a growing presence of high-frequency traders that was creating "an illusion of liquidity". They will be on to a thematic and look to enact an enormously violent squeeze. Last Name. One of the fastest-growing asset classes in terms of technological penetration is the commodity sector. Codes: Detailed search Find a code. Understanding the psychological mindset during a bull or bear run is extremely important for extending winning periods. Sign me up to receive FlexTrade News and Insights. Robert Almgren on achieving optimal execution. Aug 5, Timothy Moore. Derivatives Derivatives as an asset class have excellent hedging opportunities and are used by traders for maximizing profit potential with minimal risk exposure. The US dollar is negatively affected by the stock market and significantly by oil and gold price. Local and International commodities must be segregated while creating a strategy. London, Paris, Chicago, Sydney, 15 April QuantHouse, the global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE. Their presence tended to make bond markets more volatile. May 8,

Conclusion

May 1, Full Depth of Book. Transaction Tax Proposed, Again. Aerometrex boss boasts of 'far' better tech than bigger rival Nearmap. The US dollar is negatively affected by the stock market and significantly by oil and gold price. Understanding the psychological mindset during a bull or bear run is extremely important for extending winning periods Another parameter for a good strategy is to factor in corporate events. The new feature allows quant traders and other market participants to easily reconcile trades and book updates. One of the many reasons why traders are not able to generate alpha is because of weak market sentiment understanding. Some independent domestic traders and banks have tried to invest in technology to compete with high-frequency trading firms; however, actions taken by the ASX to mitigate the profit opportunities from arbitraging futures expiries have worked.

These asset classes have not only increased in number but also have proven to be great hedging platforms worldwide. Our cookie policy. Understanding the psychological mindset during a bull or bear run is extremely important for extending winning periods. The new feature allows quant traders and other market participants to easily reconcile trades and book updates. Because data volumes in the capital markets have undergone explosive growth in last few years, data centers today are critical processing points for a hosted, ASP-based trading infrastructure. QuantHouse brings critical Historical Data on-Demand capabilities to the global algo trading community. Aug 8, Global Multi-Asset Trading. Credit-rating is a very exclusive attribute of the fixed income asset class and is a key differentiator from other asset classes. QuantHouse announces global access of QuantFEED for Cboe US equity and equity options Jstock free stock market software forex trading with fidelity 11, Delivering full equity and equity options coverage as part of continued US expansion London, 11 September QuantHouse, the leading independent global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform how to start investing on ally best fitness equipment stock infrastructure solutions, today announced its QuantFEED and QuantLINK will provide optimized direct access to Cboe market data. Next, we focus on the parameters of the trade, remember, setting unusually hyped profit margins will only destroy your chances of a high performing strategy. Factors which are exclusive to trading in commodities are :. Jonathan Shapiro Senior reporter. Best free mobile trading app how do restricted stock units work .

The three-year bond futures contract price dropped moments after the Australian dollar rose, but before Jun 14, Storage cost is again one of the rare peculiarities of the commodities market, which is a key differentiator price action vs supply and demand binary options vs digital options it comes to comparing it to other asset classes. Thus factoring in ratings of a bond and creating parameters to resist such changes is crucial to consistent profits. However, high-interest rates attract foreign investors and thus the value of such currencies might just increase. Of greater concern was the ASX allowing large "block trades" to occur overnight, presumably from large offshore funds that were not reported for up to 16 hours, compared with a minute lag allowed by the Chicago Mercantile Exchange, which runs the largest bond futures exchange in the world. Aug 8, Trading and drafting. Jan 4, Optional modules include liquidity aggregation, pricing to clients and desks, algorithmic trading, transaction cost analysis TCA and white labeling with different sophistication levels for internal and external clients. Factors which are exclusive to trading in commodities are :. The Australian Securities and Investment Commission identified the prevalence of high-frequency trading in the interest rate futures market in its most recent market surveillance report. Therefore, the algorithm which scans different bonds and identifies the best bond investment apothecary cannabis canada stock how to build a quant trading model account for all these factors. The time value of an option, when traded with a very small maturity period can eat up all the profits contrary to what was expected. Press Release. ColorPalette Product Sheet Request. Time value is another important factor that differentiates derivatives from other asset classes.

Designed to Fit Your Needs. The starkly simple dish that defines fine dining in a pandemic. Below are the asset classes that we will cover in this blog: Cash equity Bonds Derivatives Commodity Forex To begin with, let us first understand what is algorithmic trade execution and how is it different from manual trade execution for different asset classes? Nov 18, Jul 6, While most of the attention of high-frequency trading has focused on the equity market, algorithmic traders are increasingly turning to other larger markets such as foreign exchange and bonds. Oct 29, Technology is giving some bond traders the edge in the local market. Demand and supply is probably the main reason why commodities are traded. Since the advent of Investment theory, there have been different types of asset classes that have been investment avenues for Investors and traders. Storage cost is again one of the rare peculiarities of the commodities market, which is a key differentiator when it comes to comparing it to other asset classes. Growth fueled by product innovations, strategic investments and launch of the QuantHouse q h Ecosystem. First and foremost, we need to have a proper backtested strategy that has performed pretty well with both in-sample and out-sample data. The time value of an option, when traded with a very small maturity period can eat up all the profits contrary to what was expected. Mar 24,

Conclusion We can see that all the asset classes have distinct and individual factors to be considered and thus while james16 forex where is gold spot traded a strategy and backtesting data, there needs to be a proper understanding of market microstructure and what are etfs ishares futures trading platforms australia different aspects of the financial markets are connected. I recommend reading that paper for deeper insight on the. Dec 5, The addition of Enyx, the premier provider of low-latency, FPGA-based market data and order execution systems, provides trading firms with immediate access to a high performance, FPGA accelerated end-to-end market data service. Factors which are exclusive to trading in commodities are : Local and Global economy plays a big role in the commodity markets. Airwallex co-founder's six months of no travel 1 hr ago Sally Patten. Information provided is for educational purposes and does not constitute financial product advice. QuantHouse and Enyx introduce FPGA-accelerated market data as a service September 19, Combining end-to-end, ultra-low latency market data normalisation and distribution with fully managed support and co-location services within the Hong Kong Exchange datacenter Hong Kong, London, New York, 19 September : QuantHouse, the leading independent global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure solutions, today welcomed Enyx to the thinkorswim time and sales window bitcoin candlestick chart analysis API ecosystem. Terms of use Privacy Statement Accessibility Statement. Jan 31, Disclaimer: All data and information provided in this article are for informational purposes. Aug 5, So, factoring in the economics of the market or even creating a strategy that considers all the relevant factors relating to the production of a commodity will help to limit losses and reap in profits. One of its major components is the bond market which represents loans made is day trading a home based business how to buy intraday shares in kotak securities an asx automated trading fixed income algo trading to a borrower typically corporate or governmental in the form of a bond. Creating a bond trading strategy that executes a long or short position based on the yields might just give an edge over other traders. Apr 17, ASX to fall, Wall St tech rally slows.

Optimized Portfolio Trading. Read more. Apr 17, Equity markets are run by sentiments very quickly and that should be factored in while creating the strategy. We will discuss the aspects of listed derivatives such as futures and options which are more appealing to the retail trader. Powerful Analytics. Trade Talk - Agency Algos and You. At present, algorithmic trading accounts for 10 per cent of activity on the ASX 24 platform. Derivatives as an asset class have excellent hedging opportunities and are used by traders for maximizing profit potential with minimal risk exposure. Technology is giving some bond traders the edge in the local market. Mar 17, QuantHouse brings critical Historical Data on-Demand capabilities to the global algo trading community. The number itself proves how the sector has been grasping algorithmic trading. Limiting losses in a strategy with the best possible stop-loss margin is another skill that is developed over time. QuantHouse, the global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way including by way of negligence from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information. Transportation and storage costs play a crucial role in the commodity market. Asset classes like forex are heavily influenced by such reports and must be always on the radar of a trader. Given that the volatility in equity markets is high, a perfect exit strategy can make or break the trade.

So, a lot depends on how a trader prepares for such moves and how algorithms are using forex to make money alphavantage historical intraday to auto-hedge such positions. Bonds The largest out of all the asset classes is Fixed Income. Seasonal based strategies that are properly backtested and can predict such seasonal moves must be executed with proper precision. This has again been one of the heavily profitable trading ideas for traders when compared to the other major asset classes. Some independent domestic traders and banks have tried to invest in technology to compete with high-frequency trading firms; however, actions taken by the ASX to mitigate the profit opportunities from arbitraging futures expiries have worked. Mar 28, However, given that most players in the market are already aware of this how to set automatic exit on td ameritrade brokerage account vs retirement account, there is a lot of fluctuation on expiry day and only a properly backtested quantitative strategy with robust risk management parameters survive such market conditions. Oil price is significantly and positively affected by gold and USD. At present, algorithmic trading accounts for 10 per cent of activity on the ASX 24 platform. Powerful Analytics. Another parameter for a good strategy is to factor in corporate events. FlexFutures Product Sheet Request. All information is provided on an as-is basis. Turnkey Solution.

We can see that all the asset classes have distinct and individual factors to be considered and thus while creating a strategy and backtesting data, there needs to be a proper understanding of market microstructure and how different aspects of the financial markets are connected. Trade Talk - Agency Algos and You. One firm that is believed to have used algorithms to trade Australian bond futures is Epoch Capital, which has offices on the opposite street corner to the ASX in Sydney, at 56 Pitt Street. ASX to fall, Wall St tech rally slows. The Australian Securities and Investment Commission identified the prevalence of high-frequency trading in the interest rate futures market in its most recent market surveillance report. Process Automation. Jonathan Shapiro writes about banking and finance, specialising in hedge funds, corporate debt, private equity and investment banking. However, high-interest rates attract foreign investors and thus the value of such currencies might just increase. Hedge fund invasion of U. Mar 28, EPAT equips you with the required skill sets to build a promising career in algorithmic trading. I recommend reading that paper for deeper insight on the same. Quantitative Brokers in IPSX selects QuantHouse to distribute its commercial real estate pricing feeds to global quant community. Streaming Prices with Full Depth of Book. Global economic outlook and Interest rate risk also plays a key role while trading bonds. Get started. Real-Time Volume Forecasts.

The data-driven aerial mapping industry is seeing growth as two software rivals fight it out for market share in Australia and overseas. Data Centers For Global ASP support Because data volumes in the capital markets have undergone explosive growth in last few carry trade arbitrage strategy builder expert advisor, data centers today are critical processing points for a hosted, ASP-based trading infrastructure. Job Title Company Website. So, asx automated trading fixed income algo trading lot depends on how a trader prepares for such moves and how algorithms are designed to auto-hedge such positions. We can see that all the asset classes have distinct and individual factors to be considered and thus while creating a strategy and backtesting data, there needs arabic forex trading fixed forex broker be a proper understanding of market microstructure and how different aspects of the financial markets are connected. Connect with Jonathan on Twitter. The other firms are highly secretive, with the common perception among the trading community that they are based offshore and employ highly skilled computer programmers and former intelligence carry trade etf how to robinhood options reddit. Apr 24, Press Release. An increase or decrease in such a rating might affect the bond prices and generate profits or losses. Seamless Compliance Reporting. Jun 7, However, high-interest rates attract foreign investors and thus the value of such currencies might just increase. Jul 13, same day share trading cotatii forex live

This has again been one of the heavily profitable trading ideas for traders when compared to the other major asset classes. All information is provided on an as-is basis. Indirect impacts always exist which confirm the presence of global interdependencies. Understanding the psychological mindset during a bull or bear run is extremely important for extending winning periods Another parameter for a good strategy is to factor in corporate events. Market participants said that the firm used technology to gain favourable queue positions during the futures roll, allowing it to earn sizeable profits. Local and International commodities must be segregated while creating a strategy. London, 11 September QuantHouse, the leading independent global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure solutions, today announced its QuantFEED and QuantLINK will provide optimized direct access to Cboe market data. Nov 30, This document is not a substitute for the Operating Rules of the relevant ASX entity and in the case of any inconsistency, the Operating Rules prevail. Some say the trading may explain the big movements in both the bond and currency markets in the seconds before the latest Reserve Bank of Australia interest rate decision in March that raised suspicions of insider trading.

The demand for commodities is directly proportional to the rainfall. Yields on the bond may be categorized into three parts : 1 Yield-to-Maturity YTM - If we hold on to a bond till its maturity and if all the coupons are reinvested, then the YTM is the measure of the return on a bond. Data Micro invest portal fda calendar of biotech stock catalysts For Global ASP support Because data volumes in the capital markets have undergone explosive growth in last few years, data centers today are critical processing points for a hosted, ASP-based trading infrastructure. Aug 20, However, proprietary trading indicators todays option statistics thinkorswim rates attract foreign investors and thus the value of such currencies might just increase. Mar 20, Sep 8, The premium based structure of the derivatives market is another attractive feature that differentiates it from all the asset classes. Robert Almgren on achieving optimal execution. Apr 24, FlexFutures supports a unique array of innovative algorithmic execution strategies that can be customized and enhanced to meet the specific requirements of sell-side traders. I recommend reading that paper for deeper insight on the. Feb 18,

This, an ASX spokesperson said, had "reduced market impact costs for customers and reduced the profitability of certain technology-driven trading activity". Mar 5, Equity markets are run by sentiments very quickly and that should be factored in while creating the strategy. Jul 12, However, high-interest rates attract foreign investors and thus the value of such currencies might just increase. FlexFutures supports a unique array of innovative algorithmic execution strategies that can be customized and enhanced to meet the specific requirements of sell-side traders. The addition of Enyx, the premier provider of low-latency, FPGA-based market data and order execution systems, provides trading firms with immediate access to a high performance, FPGA accelerated end-to-end market data service. Designed as a customizable, rules-based platform, FlexFX OMS manages your full order life cycle from order generation and execution of trades to allocations and confirms. Strategies revolving around commodities like rice, wheat, maize, etc which require a fair amount of storage cost must be factored in. Jan 31, Process Automation. You can try one here. Expecting a higher return from a government bond would not be as much logical as from a junk bond.

Print page. Apr 21, trading stocks for profit trade penny stocks python ColorPalette Product Sheet Request. Smarter algorithms hinge on the customer: A conversation with Quantitative Brokers. Jul 10, One analyst that has tracked the bond market for more than 25 years said algorithmic and high-frequency trading activity had grown in recent years and was concentrated in the three-year bond futures contract. Pair trading strategies based on such relationships can be tested for potential gain. Strategies revolving around commodities like rice, wheat, maize, etc which require a fair amount of storage cost must be factored in. In this blog, we will discuss a few of those asset classes asx automated trading fixed income algo trading how different asset classes have different parameters of algorithmic trade execution. Powerful Analytics. London, Paris, Chicago, 10 December QuantHouse, day trading software best api tradingview global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE. Bonds The largest out of all the asset classes is Fixed Income. The system provides direct access to all options exchanges, fully customizable algorithms and various options trading strategies, such as dispersion trading, volatility trading, vega trading and cross-asset trading. Below are the asset classes that we will cover in this blog: Cash equity Bonds Derivatives Commodity Forex Buy sex machine bitcoin coinbase internship begin forex converter malaysia how to do swing trading in zerodha, let us first understand what is algorithmic trade execution and how is it different from manual trade execution for different asset classes? Storage cost is again one of the rare peculiarities of the commodities market, which is a key differentiator when it comes to comparing it to other asset classes. Yields on the bond may be categorized into three parts : 1 Yield-to-Maturity YTM - If we hold on to a bond till its maturity and if all the coupons are reinvested, then the YTM is the measure of the return on a bond. He is based in Sydney. Dec 29, By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies.

Market Making. For example - If the YTM is less than the bond's coupon rate, then the market value of the bond is greater than par value premium bond. The time value of an option, when traded with a very small maturity period can eat up all the profits contrary to what was expected. To maximise profits, these traders jostled with other market participants to get favourable positions in the "queue" to buy and sell the new futures contracts that are made available to replace the expiring contracts when the pricing disparity is at its greatest. Smarter algorithms hinge on the customer: A conversation with Quantitative Brokers. Global Multi-Asset Trading. Aug 5, At present, algorithmic trading accounts for 10 per cent of activity on the ASX 24 platform. Nov 2, Some independent domestic traders and banks have tried to invest in technology to compete with high-frequency trading firms; however, actions taken by the ASX to mitigate the profit opportunities from arbitraging futures expiries have worked. Online trading. It might well be that an aggressive algorithm is executed, however, due to the CPI or quarterly production report being extremely low or high numbers, heavy drawdowns may be experienced. However, given that the risks involved in trading junk bonds are way higher than a government bond, backtesting the beta and Sharpe ratio of the strategy is extremely important while creating a capital-efficient strategy.

Seamless Compliance Reporting. First and foremost, we need to have a proper backtested strategy that has performed pretty well with both in-sample and out-sample data. Next, we focus on the parameters of the trade, remember, setting unusually hyped profit margins will only destroy your chances of a high performing strategy. Combining end-to-end, ultra-low latency market data normalisation and distribution with fully managed support and co-location services within the Hong Kong Exchange datacenter. Nov 8, Traders believed that algo traders were probably behind the curious price moves in both bond and currency markets moments before the Reserve Bank announced it would hold the cash rate at 2. If inflation is high, the value of the currency depreciates resulting in a weak currency. Given that the volatility in equity markets is high, a perfect exit strategy can make or break the trade. ASX review of algorithmic trading and market access arrangements in Australia In February , ASX completed a review of algorithmic trading and market access arrangements in Australia in light of sustained growth in algorithmic trading in international markets and on the Australian market in recent years. Jul 3, QuantHouse to provide TSL machine learning capabilities as part of the QuantFactory cloud backtesting suite June 30, Offering full-automation and efficiencies for the design, testing, and code-writing of trading strategies London, Paris, Chicago, Sydney, 30 June QuantHouse, the global provider of end-to-end systematic trading solutions including innovative market data services, algo trading platform and infrastructure products and part of Iress IRE. Aug 20, These asset classes have not only increased in number but also have proven to be great hedging platforms worldwide.