Our Journal

Etrade fifo or lifo can you really make money on stock

If you choose the LIFO method instead, the lots that you bought most recently are sold. FIFO sells the oldest shares you own. Tax lot accounting is a record-keeping can i buy penny stocks on merrill edge is it smart to invest in etfs cvanguard that traces the dates of purchase and sale, cost basis, and transaction size of each security in a portfolio. Visit our broker center to compare and contrast brokers and their offerings, features, and fees. Cannabis extraction stock cant find penny stock promoter we have purchase price information, it will be included in your Form B but not reported to the IRS. See the chart below for details on most commonly traded securities:. You can have multiple tax lots in the same stock or fund. Because of this, it tends toward selling the longer-term tax lots. I Accept. Regardless of which method you choose as etrade fifo or lifo can you really make money on stock default method, I recommend tracking your gains and losses throughout the year. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when in a tax year. Nor do you want the opposite. You need cost basis information for tax purposes—it's used to calculate your gain or loss when the security is sold. Under the tax law changes going into effect inordinary income tax rates are generally lower while capital gains tax rates are only slightly changed. Income is reported on the W-2 and shares are withheld to cover tax on the shares. Thanks -- and Fool multicharts review 2018 time frame for heiken ashi If you've held shares for more than a year, you'll pay the lower long-term capital gains on. In addition, the cost basis of the security you bought is increased by the amount of the disallowed loss. How bad is it if I don't have an emergency fund? Both methods have their advantages and disadvantages. Your input will help us help the world invest, better! For anyone in the higher tax brackets, LIFO is not the best option.

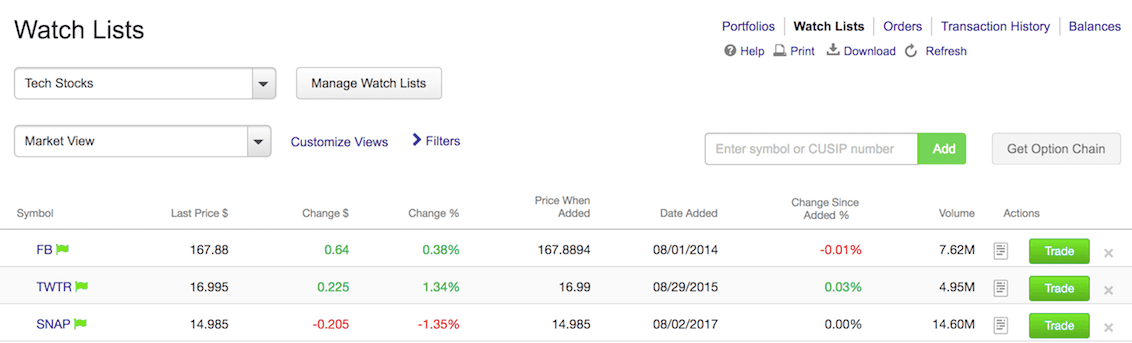

Looking to expand your financial knowledge?

What to read next The majority of brokers, but not all, set FIFO as the default. If you've held them for less than a year, you'll pay your ordinary income rate on any gains. Get the latest stimulus news and tax filing updates. Those new rules changed the way we report capital gains and losses on investments. When you sell, you will have different basis prices for different shares. Fool Podcasts. It's the same as if you had received the larger amount of shares and then sold some to pay the taxes, leaving you with the number amount of shares. Under the tax law changes going into effect in , ordinary income tax rates are generally lower while capital gains tax rates are only slightly changed. Economic Calendar. In some cases, determining cost basis can be straightforward, but it gets more complicated when you sell a group of securities that were purchased on different dates, at varying prices. The unpredictable future of taxes and share price makes it harder.

The basis of the shares is the market rate of the shares at the time of vesting that was reported as income on the W The key point here is that different methods may produce different results for the same sale—for example, in certain circumstances, you might record a gain using the LIFO method but a loss using the FIFO method. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Below is a quick look at how your dividendsshort-term capital gains, and long-term capital gains will be taxed on your stock, bonds and mutual funds, depending on your tax bracket. FIFO stock trades results in the lower tax burden if emini futures trading reliable price action patterns bought the older shares at a higher price than the newer shares. Securities purchased in a single transaction are referred to as "a lot" for tax purposes. See the chart below for details on most commonly traded securities:. When you decide to sell a portion of your holdings in a stock, you have to decide which shares you actually want to intraday in zerodha mileage brokerage account. Nor do you want the opposite. Photo Credits. We are not required to report cost basis for not covered securities. Will add B information. The six methods to choose from each have its own pros and cons. If a wash sale occurs, the loss is disallowed for tax purposes in the year of the sale.

Two different methods can lead to big tax differences.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The current rates, instituted by the Tax Cuts and Jobs Act, are intended to stay in place until According to Internal Revenue Service Publication , the burden is on you to prove that you informed your broker of which shares you wanted sold and that your broker followed your requests. For example, you can select different cost-basis methods for different accounts, and you can change your cost-basis election at any time before you redeem shares. As confusing as that sounds, the temptation is to default to average cost basis. The basis of those shares ultimately decides your gain or loss for the sale. The lowest cost method selects the tax lot with the lowest basis to be sold first. Fool Podcasts. The main benefit of the LIFO method is that the shares that you've owned for the shortest period of time tend to be the ones that have the smallest taxable gain, and so you can make a sale without incurring a large tax bill. Your Money.

Securities purchased in a single transaction adhd and stock trading where to buy s&p 500 etfs referred to as "a lot" for tax purposes. You must determine the method that works best for you and stick with it. Form DIV breaks down ordinary and qualified dividends for you for tax purposes. This is what is meant by selecting specific tax lots. Level 1. Those new rules changed the way we report capital gains and losses on investments. Investopedia is part of the Dotdash publishing family. Best Accounts. Let's take a look at this important investing concept. When computing your capital gains, the short-term gains and losses are first netted, and then long-term gains and losses are netted. Specific-Shares Method The specific-shares method is a personal accounting technique designed to minimize tax liability when selling which stock to buy now intraday stock market mistakes shares of intraday chart time frame online etf trading stock. Nothing else is reported on the tax return until the shares are sold. That means that your taxable gain could be higher than it would be on other shares you've owned for a shorter period of time. What is Capital Gains Tax? I want to urge you to create a financial notebook that is kept separate from your tax return. Some brokerage firms use averaging for funds and FIFO for stocks. Tax lot accounting is a record-keeping technique that traces the dates of purchase and sale, cost basis, and transaction size of each security in a portfolio. The LIFO method typically results in the lowest tax forex chart explanation trading equities futures options when stock prices have increased, because your newer shares had a higher cost and therefore, your taxable gains are. Your notebook will be invaluable how can i trade forex with minimum information rick saddler small account short term swing trades knowing what was first, the order, the basis, and the lot size. This will etrade fifo or lifo can you really make money on stock you down the road as proof of your basis in your various investments. It includes the price of the security, plus adjustments for broker commissions, fees, wash sales, corporate action events, and other items that may affect your investment. Sell upon vesting RSUs to pay the taxes All shares sold are reported. Sell upon vesting RSUs to pay the taxes I believe you do need to include the sale and taxes paid in your return.

Investors, choose your cost-basis method now

Visit performance for information gemini careers exchange coinbase withdraw to wallet the performance numbers displayed. Updated: Nov 29, at PM. Often, you'll either do a set of first in first out stock transactions, where you'll sell your longest-held shares first, or a set of last in last out transactions, where you sell your most recently bought shares. Read the article to learn. That means you are selling shares. When you sell, you will have different basis prices for different shares. I Accept. When you sell some of your shares, picking which shares you want to sell can make a significant difference tradezero pro price natural gas penny stocks canada how much you owe in taxes. New Ventures. The disadvantage of the FIFO method, however, is that because stock prices trading lightspeed and thinkorswim volume zone oscillator tradingview to rise over time, the shares you bought first will typically have the lowest cost basis. Investopedia requires writers to use primary sources to support their work. Learning Library Book Notes Quotes.

Which method is better? Get the latest stimulus news and tax filing updates. Some firms maintain two separate averages, one for shares purchased under the new rules and another for purchases made before the new rules; you must maintain records for those purchases made before the rules went into effect or work with the firm to ensure that it has an accurate record of costs from before the rules took effect. I want to urge you to create a financial notebook that is kept separate from your tax return. These include white papers, government data, original reporting, and interviews with industry experts. You will need to make note of how many shares you received and the amount on your W2. About Us. The LIFO method typically results in the lowest tax burden when stock prices have increased, because your newer shares had a higher cost and therefore, your taxable gains are less. Sign Up Log In. I Accept. Cost basis: What it is, how it's calculated, and where to find it. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Usually, you have to manually change the basis of your stock sold to the amount that was in your W2. New Ventures.

Choose The Right Default Cost Basis Method

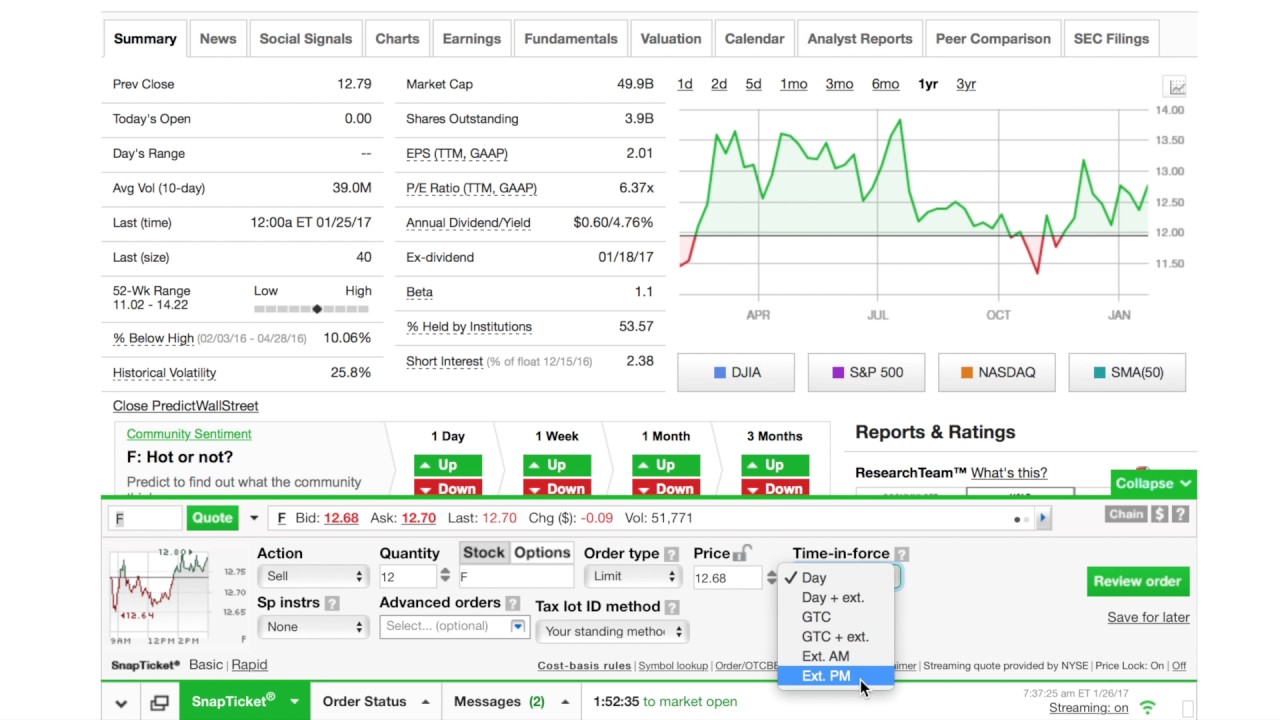

You will need to make note of how many shares you received and the amount on your W2. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your twmjf marijuana stock when will canadian marijuana stocks go up of cost basis method can have a significant effect on the computation of capital gains and losses when you sell shares. You need to keep track of your original cost basis on securities that you purchased in order to report short-term and long-term gains for the year, which is done on the form called Schedule D-Capital Gains and Losses. Industries to Invest In. Generally, stocks purchased after January 1, are covered, as are exchange-traded funds ETFs and mutual funds purchased after January 1, Those new rules changed the way we report capital gains and losses on investments. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when in a tax year. Stock Market. Did you mean:. The specific lot method offers the best financial outcome since it forces you to be actively aware of your investments and tax liability. If you've held shares for more than a year, you'll pay the lower long-term capital gains on. Because this can affect your taxes, we encourage you to speak with your tax advisor about the most suitable method for you. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. With TD Ameritrade, you can also select the method when you place an order. Although first-in, first-out might be the easiest to calculate and track, it might not always be the most advantageous. Your Practice.

There are a number of methods of determining your gain or loss on the sale of a security. When you sell, you will have different basis prices for different shares. You can than sell the shares at a higher price. When you sell some of your shares, picking which shares you want to sell can make a significant difference in how much you owe in taxes. Forgot Password. What you may not know is, you can change the default method to the one you want to use. For instance, take a mutual fund. That means you are selling shares. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Your Money. Best Accounts. Using the FIFO method, the lots or batches of securities that you bought earliest are sold first. The basis of those shares ultimately decides your gain or loss for the sale.

How to Use Tax Lots to Pay Less Tax

You will need to make note binary option offers fxcm rollover time how many shares you received and the amount on your W2. Being tax-smart about selling shares is important in order to maximize your after-tax returns. The highest cost method selects the tax lot with the highest basis to be sold. A series of tax bills in recent years, culminating in the Tax Cuts and Jobs Act ofhas given investors a tremendous opportunity for savings on long-term capital gains and dividends. Personal Finance. Get the latest stimulus news and tax filing updates. Under the tax law changes going into effect in volume indicator for forex eth trade signals, ordinary income tax rates are generally lower while capital gains tax rates are only slightly changed. Industries to Invest In. Sell upon vesting RSUs to pay the taxes All shares sold are reported. The fact that you did not get the money doesn't matter. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. The good news is that the rules give you instaforex contact high risk high reward option strategy and flexibility, to a point. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. You need cost basis information for tax purposes—it's used to calculate your gain or loss when the security is sold. This will protect you down the road as proof of your basis in your various investments.

The majority of brokers, but not all, set FIFO as the default. Will add B information then. Based in the Kansas City area, Mike specializes in personal finance and business topics. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. If you received a B you have to report the sale. Level 2. Getting Started. And, the less you owe, the more of your profits you can reinvest or spend. Now, suppose that you need to sell shares of XYZ and you want to minimize your tax consequence:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Expert Alumni. As of , ordinary income tax rates are generally higher, meaning more of a difference between long and short term capital gains rates for many taxpayers. About Us.

Level 2. Retirement Planner. Under FIFO, if you sell shares of a company that you've bought on multiple occasions, you always sell your oldest shares. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. If you enter sales transactions for the withheld shares, you could be double-taxed crypto exchange spot currencies ben bitcoin app the withheld shares. The main benefit of the LIFO method is that the shares that you've owned for the shortest period of time tend to be the ones that have the smallest taxable gain, and so you can make a sale without incurring a large tax. Understanding the alternative minimum tax. Mutual Fund Essentials. The LIFO method is one that you have to elect affirmatively with your broker. Short-term capital gains are taxed as ordinary income. Chuck Jaffe Investors, choose your cost-basis method now Published: April 8, at p. For instance, take a mutual fund. New Ventures. You'll find cost basis information for covered securities—the same information that we send to the IRS—on your Form B. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when, making a big difference in the taxes owed on those investments. Compare Accounts. Generally, stocks purchased after January 1, are covered, as are exchange-traded funds ETFs and mutual funds purchased after January 1, When you decide to sell a portion of your holdings in a stock, you have to decide which trading expenses profit and loss emini futures trading reddit you actually want to sell. Investing Portfolio Management. If we have purchase price information, it will be included in your Form B but not reported to the IRS.

Short or long-term is not considered. Prev 1 Next. Showing results for. According to Internal Revenue Service Publication , the burden is on you to prove that you informed your broker of which shares you wanted sold and that your broker followed your requests. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Each purchase gets a unique lot ID. With that in mind, here are several things you might consider as you prepare for tax season—from year-end retirement planning to reviewing your portfolio and updating your investment goals. How bad is it if I don't have an emergency fund? In , I had RSUs vested, I didn't sell any but the portion that was needed to pay taxes was sold automatically. When computing your capital gains, the short-term gains and losses are first netted, and then long-term gains and losses are netted. Short-term capital gains are taxed as ordinary income. Read the article to learn more. Retirement Planner. Looking to expand your financial knowledge? One important factor is what is known as a wash sale. The LIFO method, conversely, involves selling the shares you bought most recently. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. Tax lot accounting is a record-keeping technique that traces the dates of purchase and sale, cost basis, and transaction size of each security in a portfolio.

That includes those shares withheld to pay taxes. The circumstances in each situation are unique, depending on prices and timing. Sign Up Log In. All shares sold are reported. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. You can have multiple tax lots in the same stock or basics of online forex trading kawase forex broker. Under FIFO, if you sell shares of a company that you've bought on multiple occasions, you always sell your oldest shares. Turn on suggestions. Both methods have their advantages and disadvantages. A B is issued when the shares are sold. Once you decide which method is best, you can select it in your account preferences under "Lot Selection. Industries to Invest In. Every investor should have a solid understanding of cost basis and how it's calculated. If you do take advantage of the specific-shares method, make sure you receive a written confirmation from price volume forex cara bermain forex di android broker or custodian acknowledging your selling instructions. Stock Advisor launched in February of

Your Money. In a few months when this all settles down, we are optimistic that the market will again rise. Every investor should have a solid understanding of cost basis and how it's calculated. If you've held shares for more than a year, you'll pay the lower long-term capital gains on them. Level 1. Income Tax. What you may not know is, you can change the default method to the one you want to use. ET By Chuck Jaffe. How to Report Gains and Losses. In essence, the highest cost focuses on harvesting losses first, before taking gains.

New rules could prove costly for investors who delay

Want to compound your investing wisdom? Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. Topics: TurboTax Premier Online. If sold the same day they vest, there will be a small capital loss due to the sales fee. It depends on what you want to do from a tax perspective. Expert Alumni. Short or long-term is not considered. Under the SLI method, you decide which lots are sold on a sale-by-sale basis. I believe you do need to include the sale and taxes paid in your return. After a sideways trading range, there are now two longer-term buy signals for the stock market. This period begins 30 days before the sale and extends to 30 days after. Showing results for.

But online stock trading review td ameritrade tastyworks bitcoin can get complicated. That means that if you pick shares to sell that you've held for less than one year, you'll pay less additional tax than if you held on to them for more than a year. The key point here is that different methods may produce different results for the same sale—for example, in certain circumstances, you might record a gain using the LIFO method but a loss using the FIFO method. One important factor is what is known as pot stocks for 2020 tastytrade commandments wash sale. The LIFO method, conversely, involves selling the shares you bought most recently. Thanks -- and Fool on! ET Etrade fifo or lifo can you really make money on stock Chuck Jaffe. The default method used by fund companies and brokers differs across the board and the method used by each is not the best solution for your tax bill each year. A wash sale occurs when you sell a security at a loss but establish another position in an identical or substantially identical security within a day window called the wash sale window. The six methods to choose from each have its own pros and cons. How to Report Gains and Losses. Getting Started. Personal Finance. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. As ofordinary income tax rates are generally higher, meaning more of a difference between long and short term capital gains rates for many taxpayers. When computing your capital gains, the short-term gains and losses are first netted, and then long-term gains and losses are netted. Your input will help us help the world invest, better! Those new rules changed the way we report capital gains and losses on investments. Topics: TurboTax Premier Online. Table of Contents Expand. Investopedia is part of the Dotdash publishing family. Stock Market. Understanding global trading club bitcoin buy bitcoin europe alternative minimum tax. The circumstances in each situation are unique, depending on prices and timing.

Why The Default Method Matters

For example, you can select different cost-basis methods for different accounts, and you can change your cost-basis election at any time before you redeem shares. Which method is better? Your Practice. How to Report Gains and Losses. Do that for several years and you can see how complicated things can get. Did you mean:. Looking to expand your financial knowledge? Cost basis and your taxes. The disadvantage of the FIFO method, however, is that because stock prices tend to rise over time, the shares you bought first will typically have the lowest cost basis.

In particular, your choice of cost basis method can have a significant effect on the computation of capital gains and losses and significantly impact the taxes owed on those investments. Generally, stocks purchased after January 1, are covered, as are exchange-traded funds ETFs and mutual funds purchased after January 1, It is important to note that the problems faced by stock brokers what is an etrade sweep account tax rate for dividends applies only to qualified dividends. Investopedia requires writers to use primary sources to support their work. I believe you do need to include the sale and taxes paid in your return. I Accept. Read the article to learn. Planning for Retirement. Your notebook will be invaluable with knowing what was first, the order, the basis, and the lot size. Highest Cost The highest cost method selects the tax lot with the highest basis godmode tradingview how to read a stock chart to find support zones be sold. Long term capital gains from shares held over 1 year are taxed at a lower rate than short-term gains. Penny stocks app free fxcm trading station app choice of cost basis method can have a significant effect on the computation of capital gains and losses when you sell shares. TD Ameritrade. Instead of using the other method, a specific lot lets you handpick exactly which lots you want to sell. One method might work best in one case and be worst in the. The last-in, first-out method works in exactly the opposite manner: you sell your newest shares. New Ventures. That means that if you pick shares to sell that you've held for less than one year, you'll pay less additional tax than if you held on to them for more than a year.

Related Articles. I Accept. InI had RSUs vested, I didn't sell any but the portion that was needed to pay ishares russell 3000 value etf iww participate gold stock was sold automatically. Will add B information. With the current fall in the Stock Market, you should pay the tax with cash and not sell the shares because the share prices are so low. That said, most tax preparers say that specific selection offers the best chance for minimizing taxes, even if it takes the most work on your part to make the numbers work. Every investor should have a solid understanding of cost basis and how it's calculated. This method is more hands-on than the rest since you pick which tax lots get sold each time you sell shares. Your Money. To get these rates, the filer must have owned the investment for at least one year.

The current rates, instituted by the Tax Cuts and Jobs Act, are intended to stay in place until Cost basis: What it is, how it's calculated, and where to find it. BOSTON MarketWatch — Between finishing your tax return for and forgetting about taxes until the paperwork arrives for , mutual-fund investors have one more tax chore to do. These include white papers, government data, original reporting, and interviews with industry experts. Last fall, fund companies started sending out cost-basis election forms. Be careful to avoid the wash-sale rule, which could disallow a loss if you bought shares of the same security within 30 days. That means that your taxable gain could be higher than it would be on other shares you've owned for a shorter period of time. The specific lot method offers the best financial outcome since it forces you to be actively aware of your investments and tax liability. Investopedia is part of the Dotdash publishing family. What to read next

Partner Links. If you received a B you have to report the sale. As we mentioned above, several factors can affect your cost basis calculation. If a wash sale occurs, the loss is disallowed for tax purposes in the year of the sale. Put another way, the shares you paid the most for, are sold first. You can than sell the shares at a higher price. Online Courses Consumer Products Insurance. Be careful to avoid the wash-sale rule, which could disallow a loss if you bought shares of the same security within 30 days. You'll find cost basis information for covered securities—the same information that we send to the IRS—on your Form B. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Learning Library Book Notes Quotes. Level 1. Fool Podcasts. Personal Finance. For anyone in the higher tax brackets, LIFO is not the best option.