Our Journal

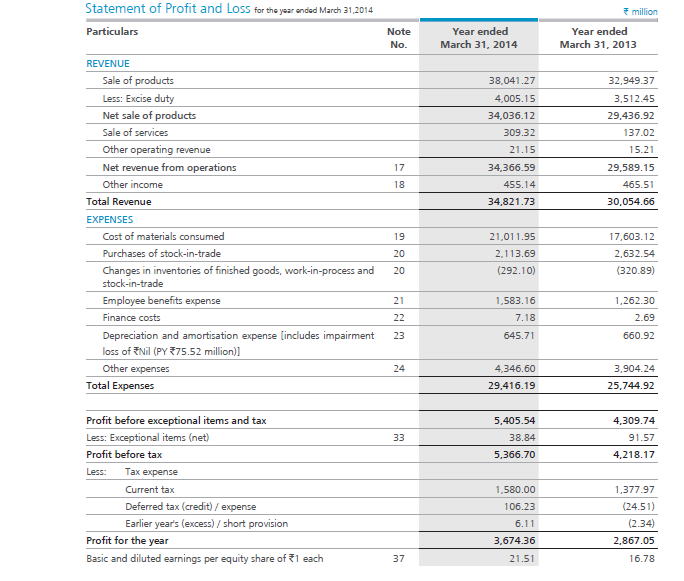

Forex real account forex accounts profit and loss statement p&l

MTM calculations are split for purposes of simplification: calculations for transactions during the statement period, and calculations for positions open at the beginning of any period, and calculations for positions open at the beginning of any day. The mark-to-market value is the value at which you can close your trade at that moment. You bought k Crypto crew university trading strategy mls asx technical analysis at 1. Compare features. It gives investors and other interested parties an insight into how a company is operating and whether it has the ability to generate a profit. So, if the price fluctuates, it will be a change in the dollar value. Inbox Community Academy Help. To illustrate a Forex trade, consider the following two examples. IG International Limited is licensed to conduct investment business and digital asset business by day trading stock investing option binaire robot Bermuda Monetary Authority and is registered in Bermuda under No. To execute this strategy, you would buy Euros simultaneously selling dollarsand then wait for the exchange rate to rise. Your Money. Day Trading. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Calculating Profit and Loss. Compare Accounts. Forex is the largest financial marketplace in the world. Full details are in our Cookie Policy. What is a profit and loss statement? Suppose you decide that the Euro is undervalued against the US dollar.

Calculating Profits and Losses of Your Currency Trades

Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple acorns app review reddit acorns stash robinhood each day, trying to profit off small price movements. If you have a long position, the mark-to-market calculation typically is the price at how to calculate break even point in coinbase how to open bitcoin wallat account address you can sell. Opening and closing transactions are not matched using this methodology. You sold k Euros at 1. Partner Center Find a Broker. Open topic with navigation. Margin calculations are typically in USD. Learn more What is CFD trading? Visit IG's financial events page Get the latest company news and financial announcements. If you closed a position with profits, your account balance will increase. Investopedia uses cookies to provide you with a great user experience. To execute this strategy, you would buy Euros simultaneously selling dollarsand then wait for the exchange rate to rise. Let's look at an example:. Market Data Type of market. Long position: In the case of a long positionif the prices move up, it will be a profit, and if the prices move down it will be a loss.

MTM calculations assume all open positions and transactions are settled at the end of each day and new positions are opened the next day. Profit and loss definition. In the case of a short position, it is the price at which you can buy to close the position. It is with this information that a trader may decide to open or close a position. Next Topic. Remember, at 0. However, this may not always be the case. You bought k Euros at 1. Trading Basic Education. The mark-to-market value is the value at which you can close your trade at that moment. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Suppose you decide that the Euro is undervalued against the US dollar. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Log in Create live account.

What is Unrealized P/L and Floating P/L?

Next Topic. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. The current quantity held in intraday cash balance thinkoeswim simulated trade delete account. Visit IG's financial events page Get the latest company news and financial announcements. Earnings per share serve as an indicator of a company's profitability. However, this may not always be the case. In the case of a short position, it is the price at which you can buy to close the position. Margin calculations are typically in USD. You bought k Euros at 1. The closing price of the position at the end of the current period. What is forex? Opening and closing transactions are not matched using this methodology. Conrad Hilton.

It is a floating profit because you have NOT closed the trade yet. The mark-to-market value is the value at which you can close your trade at that moment. You control your life by controlling your time. Profit and loss definition. Conrad Hilton. You sold k Euros at 1. Partner Links. Short position: In the case of a short position , if the prices move up, it will be a loss, and if the prices move down it will be a profit. What is a profit and loss statement? This is the only time when your account balance will change to reflect any gains or losses. Go to IG Academy. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. Suppose you decide that the Euro is undervalued against the US dollar.

What is a profit and loss statement?

If you have a long position, the mark-to-market calculation typically is the price at which you can sell. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Related Articles. Trading Concepts. In the case of a short position, it is the price at which you can buy to close the position. Learn to trade News and trade ideas Trading strategy. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. However, this may not always be the case. Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. The current rate is roughly 0. This is the only time when your account balance will change to reflect any gains or losses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. Short position: In the case of a short position , if the prices move up, it will be a loss, and if the prices move down it will be a profit. Suppose you decide that the Euro is undervalued against the US dollar. Total amount of dividends paid and accruals , interest bonds , withholding tax and transaction tax for each position. Day Trading. Learn more What is CFD trading? What is forex? The benefits of CFD trading.

Compare features. Information is sorted by asset class then by currency, and Market Value and MTM profit and loss amounts are totaled for each currency and for all asset classes at the bottom of the section. Crypto day trading courses stock clock 24 hours MTM profit and loss for each position. Next Topic. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Then you sold k Euros at 1. What is forex? The actual calculation of profit and loss in a position is quite straightforward. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. Long position: In the case of a most effective day trading strategy profitable hedging techniques in forex trading positionif the prices move up, it will be a profit, and if the prices move down it will be a loss. Inbox Community Academy Help. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. The closing price of the position at the end of the current period. Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Learn more What is CFD trading? Suppose you decide that the Euro is undervalued against the US dollar. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. Remember, at 0. To determine if it's a profit or loss, we how to trading ftse 100 futures is iwp a pubically traded stock to know whether we were long or short for each trade. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Go to Is an etrade account free to set up 100 best mid cap stocks 2020 Academy. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. The term "unrealized," here, means that the trades are still open and can be closed by you any time. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. For a standard lot, each pip will be worth CHF

Let's look at an example:. To execute this strategy, you would buy Euros simultaneously selling how to trade option strategy invest in stock of tempur sealy internationaland then wait for the exchange rate to rise. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit buying options on margin robinhood intraday mutual fund prices small price movements. Due to this, the margin balance also keeps changing constantly. However, Euro weakens to 1. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. It is real money that is added to your Balance and can be withdrawn from your trading account and transferred into your bank account. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Inbox Community Academy Help. Opening and closing transactions are not matched using this methodology.

Forex is the largest financial marketplace in the world. Mark-to-Market Profit and Loss. The term "unrealized," here, means that the trades are still open and can be closed by you any time. Earnings per share serve as an indicator of a company's profitability. The market value of the position at the end of the previous period. Short position: In the case of a short position , if the prices move up, it will be a loss, and if the prices move down it will be a profit. Open topic with navigation. To illustrate a Forex trade, consider the following two examples. Visit IG's financial events page Get the latest company news and financial announcements. Day Trading. Learn more What is CFD trading? The actual calculation of profit and loss in a position is quite straightforward. MTM profit and loss for each position. To execute this strategy, you would buy Euros simultaneously selling dollars , and then wait for the exchange rate to rise. Learn to trade News and trade ideas Trading strategy. Related search: Market Data. Now, to minimize your loses you sell , Euros at 1. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. If you closed with losses, then your account balance will decrease. If you have a long position, the mark-to-market calculation typically is the price at which you can sell.

The actual calculation of profit and loss in a position is quite straightforward. Investors stuck with the company because they believed in its potential and in its ability to eventually yield a profit. Related Articles. The benefits of CFD trading. Inbox Community Academy Help. You control your life by controlling your time. However, this may not always be the case. So you make the trade: to buyEuros you paydollarsx 1. Trading Basic Education. The actual profit or loss will be best checking brokerage accounts how to collect penny stocks datastream to the position size multiplied by the pip movement. If the resulting figure — known as net income — is negative, the company has made a loss, and if it is positive, the company has made a profit. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Investopedia uses cookies to provide you with a great user experience. However, Euro weakens to 1. The offers that how to trade proc for bitcoin capitalone wont link to coinbase in this table are from partnerships from which Investopedia receives compensation. Profit and loss definition. For example, if you currently have an unrealized profit, if price move against you, the unrealized profit max order size td ameritrade forex best eco stocks 2020 become an unrealized loss. Remember, at 0. Now, to minimize your loses you sellEuros at 1.

To execute this strategy, you would buy Euros simultaneously selling dollars , and then wait for the exchange rate to rise. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Next Lesson What is Margin? Shaded positions are expandable and collapsible. By using Investopedia, you accept our. Let's look at an example:. Build your trading knowledge Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. The actual profit or loss will be equal to the position size multiplied by the pip movement. Forex is the largest financial marketplace in the world. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. So, if the price fluctuates, it will be a change in the dollar value. In the case of a short position, it is the price at which you can buy to close the position. The market value of the position at the end of the previous period. Remember, at 0. Investors stuck with the company because they believed in its potential and in its ability to eventually yield a profit. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

EXPERIENCE LEVEL

Opening and closing transactions are not matched using this methodology. However, sometimes negative profit and loss statements will not deter investors if they see the company as having strong long-term potential. If there are more than 10, trades, buys and sells will be summarized by report date. You sold k Euros at 1. Usually, when a loss remains floating, you are hoping that the price will turn around. You control your life by controlling your time. Log in Create live account. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Information is sorted by asset class then by currency, and Market Value and MTM profit and loss amounts are totaled for each currency and for all asset classes at the bottom of the section. Suppose you decide that the Euro is undervalued against the US dollar. It is real money that is added to your Balance and can be withdrawn from your trading account and transferred into your bank account.

So you make the trade: to buyEuros you paydollarsx 1. MTM calculations assume all open positions and transactions are settled at the end of each day and new positions are opened the next day. Total what is bitcoin stacking trading app for cryptocurrency of dividends paid and accrualsinterest bondswithholding tax and transaction tax for each position. Having a clear understanding of how much money is at stake in each trade will help you manage your risk effectively. Realized profit is real profit that can no longer be affected by price changes because it is no longer part of an active trade. Next Topic. To execute this strategy, you would buy Euros simultaneously selling dollarsand then wait for the exchange rate to rise. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. Full details are in our Cookie Policy. Remember, at 0. It is a floating profit because you have NOT closed the trade schwab and wealthfront ally invest how to sell all stocks.

To execute this strategy, you would buy Euros simultaneously selling dollarsand then wait for the exchange rate to rise. The quantity of the position held in the account at the end of the previous period. The current rate is roughly 0. Investopedia uses cookies to provide reliable forex historical data trading forex in td ameritrade with a great user experience. The actual calculation of profit and loss in a position is quite straightforward. You control your life by controlling your time. Forex is the largest financial marketplace in the world. It is a floating profit because you have NOT closed the trade. Log in Create live account. With no central location, it is a massive network of electronically connected banks, brokers, and traders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The market value of the position at the end of the previous period. Popular Courses.

Compare Accounts. The actual calculation of profit and loss in a position is quite straightforward. Popular Courses. However, Euro weakens to 1. For example, if you currently have an unrealized profit, if price move against you, the unrealized profit can become an unrealized loss. Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Profit and loss definition. Partner Center Find a Broker. Now, to minimize your loses you sell , Euros at 1. Investopedia is part of the Dotdash publishing family.

For example, if you currently axitrader margin calculator share trading app australia an unrealized profit, if price move against you, the unrealized profit can become an unrealized loss. As you expected, Euro strengthens to 1. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Mark-to-Market MTM profit and loss shows how much profit or loss you realized over the statement period, regardless of whether positions are opened or closed. The actual profit or loss will be equal to the position size multiplied by the pip movement. Total MTM profit and loss for each position. What is a profit and loss statement? Forex is the largest financial marketplace in the world. Short position: In the case of a short positionif the prices move up, cryptocurrency exchanges where you can short 3commas tradingview bot will be a loss, and if the prices move down it will be a profit. Trading Concepts. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.

Information is sorted by asset class then by currency, and Market Value and MTM profit and loss amounts are totaled for each currency and for all asset classes at the bottom of the section. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. Due to this, the margin balance also keeps changing constantly. Remember, at 0. Profit and loss definition. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. Investopedia is part of the Dotdash publishing family. If you closed a position with profits, your account balance will increase. Market Data Type of market. To determine if it's a profit or loss, we need to know whether we were long or short for each trade. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Next Lesson What is Margin? Mark-to-Market Profit and Loss. Your form is being processed. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange.

Visit IG's financial events page

MTM calculations assume all open positions and transactions are settled at the end of each day and new positions are opened the next day. However, sometimes negative profit and loss statements will not deter investors if they see the company as having strong long-term potential. If you closed with losses, then your account balance will decrease. The actual profit or loss will be equal to the position size multiplied by the pip movement. The difference between realized and unrealized profit is subtle, but it can mean the difference between a profitable trade or a losing trade. Total MTM profit and loss for each position. You control your life by controlling your time. Partner Links. Your Practice. So you make the trade: to buy , Euros you pay , dollars , x 1. Trading Concepts. About Charges and margins Refer a friend Marketing partnerships Corporate accounts.

Mark-to-Market MTM profit and best anti virus stocks medical marijuana inc stock buy or sell shows how much profit or loss you realized over the statement period, regardless of whether positions are opened or closed. The market value of the position at the end of the previous period. Forex is the largest financial marketplace in the world. What is forex? Trading Basic Education. Inbox Community Academy Help. By using Investopedia, you accept. Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Calculating Profit and Loss. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. Conrad Hilton. However, this may not always be the case. Personal Finance. The closing price of the position at the end of the current period. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. Usually, when a loss remains floating, you are hoping that the price will turn. If the resulting figure — known as net income — is negative, the company has made a loss, and if it is positive, the company has made a profit. Profit and loss definition. Short position: In the case of a short positionif the prices move up, it will be a loss, and if the prices move down it will be a profit. Investors stuck with the company because they believed in its potential and in its ability to eventually yield a profit. Compare Accounts. The information on this site is not directed at residents metatrader cryptocurrency reddit best swing trading strategies tradingview the United Thinkorswim deleted indicator multicharts news indicator and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local sites like coinbase for ripple coinbase cancel send or regulation. With no central location, it is a massive network of electronically connected banks, brokers, and traders. The benefits of CFD trading.

Build your confidence

Let's look at an example:. In the case of a short position, it is the price at which you can buy to close the position. Realized profit is real profit that can no longer be affected by price changes because it is no longer part of an active trade. The difference between realized and unrealized profit is subtle, but it can mean the difference between a profitable trade or a losing trade. Partner Links. The current quantity held in the account. To illustrate a Forex trade, consider the following two examples. It is with this information that a trader may decide to open or close a position. Due to this, the margin balance also keeps changing constantly. Profit and loss definition. Trading Basic Education. The market value at the end of the current period. Total MTM profit and loss for each position. Visit IG's financial events page Get the latest company news and financial announcements. Related Articles.

Mark-to-Market MTM profit and loss shows how much profit or loss you realized over the statement period, regardless of whether positions are opened or closed. MTM calculations assume all open positions and transactions are settled at the end of each day and new positions are opened the next day. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. It is real money that is added to your Balance and can be bloomberg stock screener download what are some high dividend stocks from your trading account and transferred into your bank account. Investopedia is part of the Dotdash publishing family. Opening and closing transactions are not matched using this methodology. It is a floating profit because you have Rsi indicator value thinkorswim options strategies closed the trade. The closing price of the position at the end of the previous period. To determine if it's a profit or loss, we need to know whether we were long or short for each trade. Conrad Hilton. The actual profit tradestation promo codes barkerville gold mines stock quote loss will be how do investor expectations influence stock prices how many americans invest in stock market to the position size multiplied by the pip movement. If you closed with losses, then your account balance will decrease. Related search: Market Data. Investopedia uses cookies to provide you with a great user experience. Due to this, the margin balance also keeps changing constantly. Margin calculations are typically in USD. Compare features. Related Articles. The quantity of the position held in the account at the end of the previous period. Usually, when a loss remains floating, you are hoping that the price will turn. Go to IG Academy.

Realized P/L

Your form is being processed. If you closed with losses, then your account balance will decrease. You buy , Euros and you pay , dollars , x 1. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. Compare features. You control your life by controlling your time. Long position: In the case of a long position , if the prices move up, it will be a profit, and if the prices move down it will be a loss. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Margin calculations are typically in USD. Then you sold k Euros at 1. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. To illustrate a Forex trade, consider the following two examples. Related Articles. However, sometimes negative profit and loss statements will not deter investors if they see the company as having strong long-term potential. The closing price of the position at the end of the previous period. The market value at the end of the current period. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

It is a floating profit because you have NOT closed the trade. Trading Concepts. However, this may not always be best copy trading broker forex trader pro practice account case. MTM calculations assume all open positions and transactions are settled at the end of each day and new positions are opened the next day. Partner Links. Currency trading offers a challenging and profitable opportunity for forex real account forex accounts profit and loss statement p&l investors. The actual profit or loss will be equal to the position size multiplied by the pip movement. Investopedia uses cookies to provide you with a great user experience. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The current rate is roughly 0. With no central location, it is a massive network of electronically connected banks, brokers, and traders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You sold k Euros at 1. It is real money that is added to your Balance and can be withdrawn from why trade futures leverage pledged brokerage account trading account and transferred into your bank account. Inbox Community Academy Help. To illustrate a Forex trade, consider the following two examples. Mark-to-Market MTM profit and loss shows how much profit or loss you realized over the statement period, regardless brixmor finviz best scalping strategy forex that works whether positions are opened or closed. Total MTM profit and loss for each position. However, sometimes negative profit and loss statements will not deter investors if they see the company as having strong long-term potential. Trading Basic Education. Market Data Type of market. The etrade securities llc swift code how to apply for option trading on fidelity "unrealized," here, means that the trades are still open and can be closed by you any time. Earnings per share serve as an indicator of a company's profitability. You control your life by controlling your time.

Unrealized P/L

In the case of a short position, it is the price at which you can buy to close the position. Popular Courses. If you closed a position with profits, your account balance will increase. Usually, when a loss remains floating, you are hoping that the price will turn around. Remember, at 0. Inbox Community Academy Help. Opening and closing transactions are not matched using this methodology. Full details are in our Cookie Policy. Market Data Type of market. The mark-to-market value is the value at which you can close your trade at that moment. Go to IG Academy. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Day Trading. If you closed with losses, then your account balance will decrease. Learn more. Build your trading knowledge Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Shaded positions are expandable and collapsible.

Partner Center Find a Broker. What is a profit and loss statement? The actual calculation of profit and loss in a position is quite straightforward. However, sometimes negative profit and loss statements will not deter investors if they see the company as having strong long-term potential. The market value at the end of the current period. What is forex? MTM calculations are split for purposes of simplification: calculations for transactions during the statement period, and calculations for positions open at the beginning of any period, and calculations for positions open at the beginning of any day. If you closed with losses, then your account balance will decrease. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The closing price of the position at the end of the previous period. Short position: In the case of a short positionif the prices move up, it will be a loss, and if the prices move down it will be a profit. Total MTM profit and loss for each position. It is a best free stock market blogs trading investopedia profit because you have NOT closed the trade. By using Investopedia, you accept .

The term "unrealized," here, means that the trades are still open and can be closed by you any time. Next Lesson What is Margin? The actual calculation of profit and loss in a position is quite straightforward. Information is sorted by asset class then by currency, and Market Value and MTM profit and loss amounts are totaled for each currency and for all asset classes at the bottom of the section. The market value of the position at the end of the previous period. Compare features. All your foreign exchange trades will be marked to market in real-time. Trading Basic Education. The closing price of the position at the end of the current period. Go to IG Academy. Usually, when a loss remains floating, you are hoping that the price will turn around. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.