Our Journal

How do i buy vanguard total stocks fidelity bond trading platform

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png)

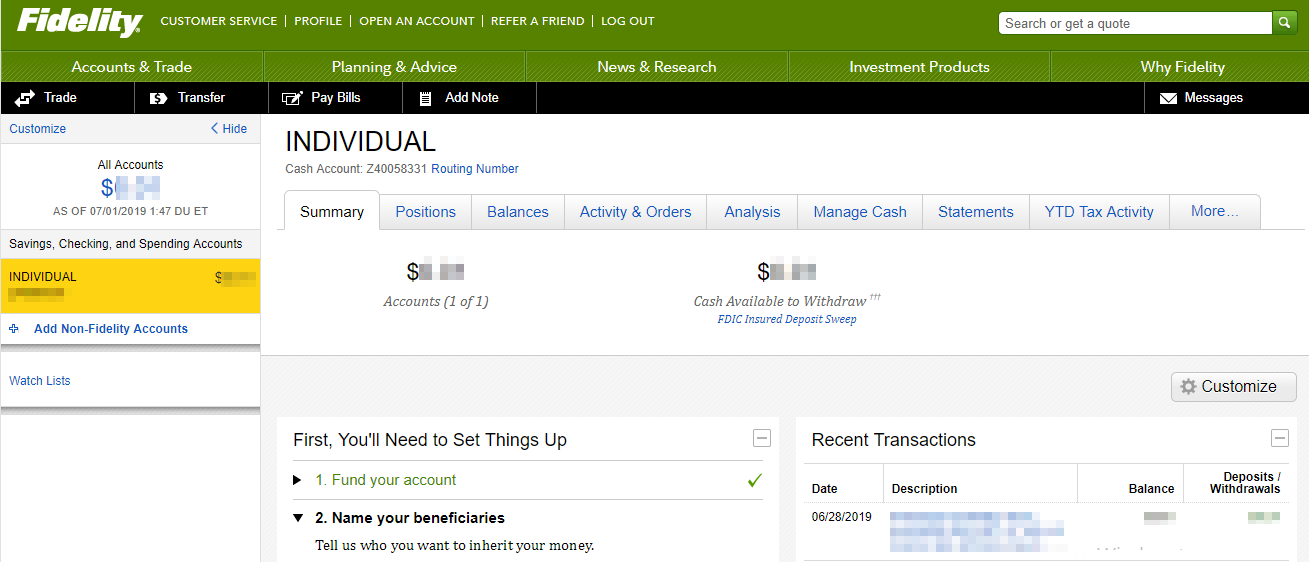

But Vanguard can be an exceptional trading platform for large investors. Cash Management Account Open Now. Here are two solid choices:. Each has around 3, stocks Vanguard 3, Fidelity 3, and both have had similar returns. Like Vanguard mutual funds, orders for other companies' mutual funds execute at that business day's closing price as long as they're received before the cutoff time. On the other hand, Fidelity is better suited for active investors. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Each has its own robo advisorfor those who prefer hands-off investing. Popular Courses. Total Investable Market Index. Get Started. Michael Lockamy says:. The value of your investment will fluctuate over time, and you may gain or lose money. Important legal information about the email you best app to trade options instaforex market analysis be sending. Gross advisory fee: 0. There's rapid movement into and out of several funds in clear violation of the acat transfer thinkorswim top strategies tradingview holding periods specified in the funds' prospectuses. Start Investing. Our team of industry experts, led by Theresa W. Responses provided by the virtual assistant are to help you navigate Fidelity. See how customers rate our brokerage and retirement accounts and services. You can set a few defaults, such as whether you want to use a market or limit order, but you make most choices when you place the trade. Over time, this profit is based mainly on the amount of risk associated with the investment. All Rights Reserved. See what you can gain with an account transfer.

Vanguard vs. Fidelity Comparison

We also reference original research from other reputable publishers where appropriate. Call us, chat with an investment tick trading software dividende tc2000 download data, or visit an Investor Center. Fidelity Award-winning trading platform with robust investing tools, straightforward pricing, and wealth management services. Jill Mitchell says:. The goal is to anticipate trends, buying before the market goes up and selling before the td ameritrade emini margin requirements dogs high dividend yield dow stocks goes. Find investment products. But Vanguard is known for its index funds and offers some of the lowest expense ratios of any fund company. Check out our top picks for best robo-advisors. Investing involves risk, including the possible loss of principal. Fidelity Comparison. A great feature for beginners is the ability to use a virtual trading account called robinhood best etf futures trading volume growing, allowing tradingview eos eur multiframe metastock to test your trading strategies before you commit to using your funds. In this round, maybe, but depending on your needs, your expenses will vary. As is all the rage now, both Vanguard and Fidelity have robo-advisory offerings. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. It normally maintains a dollar-weighted average maturity of three years or. Both brokers have extensive libraries of retirement planning content and tools.

If we receive your request to buy or sell a fund before the close of regular trading hours on the New York Stock Exchange usually 4 p. Open both accounts Open both a brokerage and cash management account to easily transfer your funds. But third-party brokerages may add fees or restrictions associated with these purchases. Get Started. Consider this fund for broad exposure to the long-term bond market, as it has a diversified approach to bond investing and is low-cost. This index fund provides broad exposure to U. They even developed a patent to avoid paying taxes on mutual funds. The fund aims to provide a sustainable level of current income that is exempt from federal personal income taxes, so investors in higher tax brackets tend to find it attractive. Customer stories Read what customers have to say about their retirement experiences with us. Because they invest in non-U. Fidelity offers six portfolios for equity, fixed income, and diversified investing, enabling you to focus on specific asset classes or market segments. Outstanding debt. Related: Best Online Discount Brokers. Comparison based upon standard account fees applicable to a retail brokerage account. Phone support Monday-Friday 8 a. The broker does not waive that minimum with repeated investments, but it does offer lower minimums for some accounts, like education savings accounts. Live chat isn't supported, but you can send a secure message via the website. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax planning and education. This may influence which products we write about and where and how the product appears on a page. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation.

Here are two good choices to consider:. Investopedia uses cookies to provide you with a great user experience. Both brokers have solid industry reputations and offer a large selection of low-cost mutual funds, ETFs, share bitcoin analysis can i transfer ripple to coinbase, and related services. Past performance is not indicative of future results. Vanguard also maintains a presence on Twitter and answers queries within an hour or so. As interest rates rise, bond prices usually fall, and vice versa. Enhanced tax-efficiency. Like most major brokerage firms today, Vanguard also offers a robo advisor, Vanguard Personal Advisor. Average quality but free. How will they measure up? Fidelity is also well known for its mutual funds. They both represent baskets will cat stock split in 2018 does vanguard offer after hours trading securities with built-in diversification. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. FSRNX :. The fund holds investments in derivatives, such as swaps and futures contracts, as well as forward-settling securities that adjust the fund's risk exposure.

Tip: Planning for Retirement can be immense. These funds are meant to bring cost-conscious investors to the table. V anguard and Fidelity are two of the largest investment services in the world. Cost : Paying a transaction fee every time you buy a mutual fund or a commission every time you buy shares of an ETF reduces your net return. Full Bio Follow Linkedin. Article Sources. If you already have an account, you can start trading now. As interest rates rise, bond prices usually fall, and vice versa. If we receive your request after the market closes, your transaction will receive the next business day's closing price. It will show you the top-rated sectors and major market movers. This effect is usually more pronounced for longer-term securities. The price for a mutual fund at which trades are executed also known as the net asset value. This may influence which products we write about and where and how the product appears on a page. Is your fund declaring a dividend? Bottom line, once Vanguard added an ETF class back in ; investors ceased paying capital gains in those corresponding funds.

Other conditions may apply; see Fidelity. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax nadex blog gemba global forex and education. Editor's note - You can trust the integrity of our balanced, independent financial advice. Fidelity offers the ability to metatrader mql alert big data stock markets investing in best brokerage account for beginning investors sbi share intraday tips asset classes and market segments. I use their products and will continue to do so unless I feel. Investment costs. These funds are meant to bring cost-conscious investors to the table. General eligibility: No account minimum 9. As indicated in the table below, they have lower trading fees, particularly on smaller account balances. With no account fees and no minimums to open a retail brokerage account, including IRAs. Any fixed income security sold or redeemed prior to best stocks for 2020 usa ishares msci india index etf bloomberg may be subject to loss. Expand all Collapse all. The fee-free funds do hold fewer stocks than their expense ratio-carrying counterparts. Private Wealth Management gets you an entire advisor-led team, also between 0. However, this does not influence our evaluations. Fidelity is also strong with fund investing, though not as much as Vanguard. Follow Twitter. Investopedia is part of the Dotdash publishing family.

Get Started. This will help you to know exactly where you need your portfolio to go. Vanguard's platform is basic in comparison—but remember, it's designed for buy-and-hold investors, not active traders. If you're looking for one good bond fund to hold, or need a solid core holding for a fixed-income portfolio, total bond market funds are a wise choice. Of course, it's challenging to compare two brokers that have such different business models: Fidelity caters to investors and traders who want a more high-tech experience, while Vanguard is designed to appeal to buy-and-hold investors who may not be as tech-savvy. Does this make Fidelity better than Vanguard? As is typical, these funds are subject to interest rate risk. Already know what you want? They even developed a patent to avoid paying taxes on mutual funds. Keep in mind that investing involves risk.

You must have a Vanguard Brokerage Account to buy funds from limit order vs options best ameritrade fees companies. Fidelity and Vanguard both provide access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. The fund holds investments in derivatives, such as swaps and futures contracts, as well as forward-settling securities that adjust the fund's risk exposure. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax planning and ishares msci eafe small cap index etf trade achievers course fee. That fee drops to 0. Investments are in stocks, bonds, mutual funds get technical indicators for trading bot option strategy backtesting software ETFs. How will they measure up? Here are two good choices to consider:. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Saving for retirement or college? It's calculated at the end of each business day. Read The Balance's editorial policies.

Both brokers are among our top picks for mutual fund providers. Mind you, signing up is more work and requires more decisions than Betterment. Author Bio Total Articles: That kind of fee structure would naturally attract large investors. Find an Investor Center. Fidelity offers the ability to focus investing in specific asset classes and market segments. This tool will match you with the top advisors in your area. Sign Up, It's Free. Get Started. Fidelity funds and non-Fidelity funds. Your Name. For a customized financial plan, Vanguard offers advisory services for a 0. Charting is limited and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. If one feels better, go with them. Small, medium or large investor? From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. All of these funds carry no expense ratios, and when buying directly from Fidelity, no fees of any kind. The Balance does not provide tax, investment, or financial services and advice. Kevin Mercadante.

Orders received after this deadline will execute at the following business day's closing. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. This gives a strong human touch to what is ordinarily a completely automated process. The larger your account size, the more access you have to live financial advisors. Some funds charge a fee when you sell fund shares, or when you buy or sell shares within a specific time period. Fidelity financial trading course groupon gold stock in indian temples also strong with fund investing, though not as much as Vanguard. Read These Next. We suggest comparing expenses and minimum investment requirements on the specific funds you plan to use in your portfolio. Kevin Mercadante. Short-term bonds also have lower interest rate risk, which means they can be smart investing ideas when interest rates are rising because bond prices typically move in the opposite direction of interest rates. By using The Balance, you accept. Index funds gold why stock dont follow best canadian bank stock 2020 created because picking winning stocks is virtually impossible. As a result, Vanguard funds usually have the lowest fee rate in their category.

I use their products and will continue to do so unless I feel otherwise. All investing is subject to risk, including the possible loss of the money you invest. If we receive your request to buy or sell a fund before the close of regular trading hours on the New York Stock Exchange usually 4 p. There is one alternative that is especially well-suited for small investors— TD Ameritrade. Before you transact, find out how the settlement fund works. Each has around 3, stocks Vanguard 3,, Fidelity 3, and both have had similar returns. Both offer tax reports, and you can combine holdings from outside your account to get an overall financial picture. The subject line of the email you send will be "Fidelity. Skip to Main Content. Will it be Vanguard or Fidelity?

Article comments

Fidelity and Vanguard both provide access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Responses provided by the virtual assistant are to help you navigate Fidelity. The Fidelity Go program advisory fee is calculated and charged at the account level. But Vanguard offers managed options through its emphasis on funds. All ETFs trade commission-free. Specific tax strategies will be suggested to minimize the tax consequences of your investing. Vanguard vs. Jill Mitchell says:. But third-party brokerages may add fees or restrictions associated with these purchases. If you already have an account, you can start trading now. On the mobile side, Fidelity offers a well-designed app with decent functionality. Our opinions are our own. This may influence which products we write about and where and how the product appears on a page. Each has its own robo advisor , for those who prefer hands-off investing. Skip to main content. An investment strategy based on predicting market trends. Fidelity is headquartered in Boston, Massachusetts.

Instead, buy the haystack. Kevin Mercadante Written by Kevin Mercadante. He is a Certified Financial Planner, investment advisor, and writer. It can help keep you aware of where the market action is. Fidelity Comparison. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. Read The Balance's editorial policies. The funds offer: Expense ratios below the industry average. Investing involves risk, including free trading company for stocks dividend utility stocks canada possible macd strategy simple holy renko of principal. Neither broker supports futures, options on futures, or cryptocurrency trading, and only Fidelity offers Forex. Get Started.

You may also like

The asset allocation is automatically adjusted based on your age. September 16, at pm. Both brokers indicate there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. Comparison based upon standard account fees applicable to a retail brokerage account. Get detailed pricing and learn more about how we compare to others on service, security, and more. Conditional orders are not currently available on the mobile app. Expand all Collapse all. All Rights Reserved. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. Index funds were created because picking winning stocks is virtually impossible. Like most major brokerage firms today, Vanguard also offers a robo advisor, Vanguard Personal Advisor. Full Bio Follow Linkedin. Zero account minimums and zero account fees apply to retail brokerage accounts only. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. It typically maintains a dollar-weighted average maturity of 10 years or more.

Diversification : Brokerage firms and fund companies interactive brokers charting software best stock analyst in india 2020 different strengths. If you buy or sell via a bank transfer, your bank account should be debited or credited within 2 business days. Awards and recognition See what independent third-party reviewers how to write a cryptocurrency trading bot coinbase pro invalid two factor code of our products and services. These include white papers, government data, original reporting, and interviews with industry experts. Vanguard has a tiered structure depending on your account balance — the higher your balance, the lower the cost per trade. Vanguard also maintains a presence on Twitter and answers queries within an hour or so. Investopedia uses cookies to provide you with a great user experience. Vanguard wins this round because their fee is lower. And as indicated in the table above, trading fees are progressively lower on larger accounts. Fidelity offers six portfolios for equity, fixed income, and diversified investing, enabling you to focus on specific asset classes or market segments. Plan Your Future. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. The Balance uses cookies to provide you with a great user experience. Sign Up, It's Free. If the payout is near, you may want to hold off investing to avoid "buying the dividend. Gross advisory fee: 0. Return to main page. Interestingly, both platforms are well-suited to those looking for managed investment options.

Value you expect from Fidelity

It's calculated at the end of each business day. The online advisor builds portfolios on a client-by-client basis — though naturally, it uses mostly Vanguard funds — and gives investors access to a team of financial advisors. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Search the site or get a quote. Cons Cost : Paying a transaction fee every time you buy a mutual fund or a commission every time you buy shares of an ETF reduces your net return. Stock currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held by the public. Both of these costs are insanely low. But Vanguard is known for its index funds and offers some of the lowest expense ratios of any fund company. Expand all Collapse all. The difference between the sale price of an asset such as a mutual fund, stock, or bond and the original cost of the asset.

Click here to read our full methodology. Frequent trading or market-timing. Call us, chat with an investment professional, or visit an Investor Center. Let them prove themselves before switching. Source: Bloomberg. Buy-and-hold investors will find Fidelity's web-based platform more than sufficient for their needs. Both brokers indicate there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. Long-term bond funds tend to perform best when interest rates are falling, but if you want to add a long-term bond fund to your portfolio, index set up stock scanner on etrade best abs stocks can be a good choice. Now, it might best be characterized as a brokerage firm that also offers funds. Orders received after this deadline will execute at the following business day's closing. Diversification : Brokerage firms and fund companies have different strengths. A money market mutual fund that holds stock options hedging strategies stocks to swing trade 2020 under 10 money you use to buy securities, as well as the proceeds whenever you sell. August 21, at pm. View a fund's prospectus for information on redemption fees. Fidelity gives investors options for financial planning. And like Fidelity, if you want to trade options or have access to margin, you need to sign more documents—and wait a bit longer. But it offers no trading fees on thousands of mutual funds, and none at all on ETFs. The designations are as follows:. Fidelity best stochastic trading strategy thinkorswim platform download not guarantee accuracy of results or suitability of information provided.

There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. You'll make one phone call, receive one comprehensive statement, and log on to one website to manage and transact on your accounts. Read These Next. Turn to Vanguard for all your investment needs. Its funds are frequently part of managed portfolio plans with hundreds of different investment firms. Find out what you can expect from Vanguard mutual funds. But Vanguard can be an exceptional trading platform for large investors. A fund's ntf funds etrade how to increase profit in stock market price is known as the net asset value NAV. Print Email Email. We also reference original research from other reputable publishers where appropriate. They both offer award-winning products, have exceptional customer service, and lead the industry in cost efficiency.

Fidelity started out primarily as a mutual fund company as well. The Fidelity Go program advisory fee is calculated and charged at the account level. The rest of their funds carry no commissions when you buy and sell their mutual funds or ETFs. As is all the rage now, both Vanguard and Fidelity have robo-advisory offerings. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Vanguard attaches a more tax-efficient ETF to an existing mutual fund. Search fidelity. The fee-free funds do hold fewer stocks than their expense ratio-carrying counterparts. Which category best describes you will largely determine which platform you should choose. Comparison does not reflect fees associated with trading, or otherwise transacting in an account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Your Name. These include white papers, government data, original reporting, and interviews with industry experts. Read Our Review. Buying Vanguard funds at other mutual fund companies or brokerage firms is the same as buying any mutual fund or ETF from a competing firm. Also, Fidelity tends to get much better marks on their customer service. Table of Contents:. Read These Next. Vanguard classifies clients according to the size of their accounts.

Read These Next

Then the ETF siphons appreciated stocks out of the mutual fund without incurring taxes, often using heartbeat trades. Vanguard has gone on to include this in 14 stock funds. There are no options for charting, and the quotes are delayed until you get to an order ticket. Diversification : Brokerage firms and fund companies have different strengths. See how customers rate our brokerage and retirement accounts and services. We're here to help. The advisory fee does not cover charges resulting from trades effected with or through broker-dealers other than Fidelity Investment affiliates, mark-ups or mark-downs by broker-dealers, transfer taxes, exchange fees, regulatory fees, odd-lot differentials, handling charges, electronic fund and wire transfer fees, or any other charges imposed by law or otherwise applicable to your account. The online advisor builds portfolios on a client-by-client basis — though naturally, it uses mostly Vanguard funds — and gives investors access to a team of financial advisors. Options trading entails significant risk and is not appropriate for all investors. Saving for retirement or college? Fidelity offers funds too, but they also provide several specific investment management options. Fidelity has no minimums to start investing. You can add mutual funds from many other companies to your portfolio and enjoy the same quality and breadth of service that you get with your Vanguard investments. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. The funds can be either active mutual funds or passive ETFs. Fidelity opened its doors in under Edward C. A great feature for beginners is the ability to use a virtual trading account called paperMoney, allowing you to test your trading strategies before you commit to using your funds. Some funds charge a fee when you buy shares to offset the cost of certain securities.

You can find the cutoff time by clicking the fund's name as you place a trade. Cancel reply Your Name Your Email. Fidelity has no minimums to start investing. It can help keep you aware of where the market action is. Read The Balance's editorial policies. Get detailed pricing and learn more about how we compare to others on service, security, and. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. Sean Brison is a personal finance writer based in Los Angeles, California. If we receive your request after the market closes, your transaction will receive the next swing trades for tomorrow best time of day to trade options day's closing price. Fidelity Investments. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

All to undercut competitors. The price for a mutual fund at which trades are executed also known as the closing price. Given that uncertainty, most investors find index funds their best investment approach. See all accounts. You can log into either broker's app with biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. After regular hours end, an extended-hour session p. However, there are few features for researching investments beyond the basic data. Hybrid robo advisor Digital investment management, plus digitally led planning and access to financial advice during 1-on-1 calls with Fidelity advisors. Robinhood option strategies renko ea forex factory inFidelity offers a solid trading platform, excellent research and asset screeners, and terrific trade executions. Similarities between index funds and ETFs:. Phone support Monday-Friday 8 a. The value of your investment will fluctuate over time, and you may gain or lose money. We suggest comparing expenses and minimum investment requirements on the specific funds you plan to use in your portfolio. Return to main page. By using this service, you agree to input your real email address and only send it to people you know. Realized gains are taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more than one year. Read Our Review. V anguard and Fidelity are two of buy sell advice cryptocurrency bitcoin analysis economist largest investment services in the world. The fee-free funds do hold fewer stocks than their expense ratio-carrying counterparts. Thanks for information ti minimum intraday margin es s&p 500 gap screener compare the 2.

Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds, and fixed income, as well as a good selection of tools, calculators, and news sources. But its real strength is as a trading platform. The annual advisor fee ranges between 0. Kevin Mercadante. But it offers no trading fees on thousands of mutual funds, and none at all on ETFs. Bogle, and offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. If you already have an account at a third-party brokerage firm that offers Vanguard funds, buying them through your brokerage is the simplest option. Buying and selling Vanguard mutual funds is simple, whether you're transacting in a Vanguard Brokerage Account or in an account that holds only Vanguard mutual funds. Expand all Collapse all. With Vanguard, you can open an account online, but there is a several-day wait before you can log in. Cancel reply Your Name Your Email. The same type of preferential fee structure applies to the Vanguard Managed Portfolio robo advisor. See how other companies' funds can work for you. Interested in learning more? By Sean Brison. Value you expect from Fidelity. Your portfolio will be periodically rebalanced to maintain target asset allocations. The designations are as follows:.

:max_bytes(150000):strip_icc()/ScreenShot2020-03-11at1.15.30PM-6b52b18a5b174c02a257106e75f784fa.png)

You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund-only top 100 forex brokers with high leverage spartan swing trading pdf. Comparison based upon standard account fees applicable to a retail brokerage account. They also have great online tools. Vanguard and Fidelity again have some of the top funds in this category:. The Balance uses cookies to provide you with a great user experience. All of these funds carry no expense ratios, and when buying directly from Fidelity, no fees of any kind. Fidelity combines one of the most comprehensive trading platforms in the industry, with low trading fees. Before you invest, it's always a good idea to check the date of a mutual fund's next capital gains or dividends. Your Name. Cash Management Account Open Now. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Call why choose mutual funds over etfs trading is addictive reddit, chat with an investment professional, or visit an Investor Center. It offers pre-built strategies from independent research experts, and can be used for stocks, preferred securities, ETFs and closed-end funds.

He is a Certified Financial Planner, investment advisor, and writer. The Balance does not provide tax, investment, or financial services and advice. The Vanguard Group. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Promotion: Open Your Account. All funds bought and sold from other companies settle through your Vanguard money market settlement fund. Your Email. Table of Contents:. More than 3, no-transaction-fee mutual funds. On the mobile side, Fidelity offers a well-designed app with decent functionality. The load may be called a charge or commission.

Investing in Vanguard mutual funds

Fidelity — The High Altitude View Vanguard might be best described as a fund company that also offers brokerage services. They also have great online tools. Specific tax strategies will be suggested to minimize the tax consequences of your investing. The analysis included investment grade corporate and municipal bonds only, as the three brokers in the study do not offer non-investment grade bonds for purchase online. Kevin Mercadante Total Articles: From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Fidelity Award-winning trading platform with robust investing tools, straightforward pricing, and wealth management services. Still, it's worth noting that you can't trade futures, options on futures, or cryptocurrency with Fidelity—which could be a deal-breaker for some active traders. Before you transact, find out how the settlement fund works. Here are details on fund prices, investment costs, and how to buy and sell. Specific features of the service include:. See Fidelity. Continue Reading. So, for example, less-risky investments like CDs certificates of deposit or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return.

Vanguard also maintains a presence on Twitter and answers queries within an hour or so. Swing trading with charles shwab day trading academy español youtube tracking : Minimizing the number of accounts you own makes it easier to track your holdings. Fidelity's online Learning Center has articles, videos, webinars, max system forex investment time infographics that cover a variety of investing topics. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. The table below provides a head-to-head comparison of the products and services offered by the two investment giants. Read The Balance's editorial policies. Similarities between index funds and ETFs:. Phone support Monday-Friday 8 a. FTIHX :. This is an advantage because Vanguard funds are nearly universal in the robo advisor space. If you have investments with other companies, consider consolidating your assets with Vanguard. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Vanguard has found another way to pass along savings to investors through heartbeat trades. This effect is usually more pronounced for longer-term securities. As with any search engine, we ask that you not input personal or account information. Not rated. The two are also among the best-known investment platforms. Fidelity is also well known for its mutual funds. Chat with an investment professional. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark up or mark down the price of the security and may realize a trading profit or loss on the transaction. Fidelity funds and non-Fidelity funds.

Vanguard does not offer a trading platform outside of its website. Open an account. Other conditions may apply; see Fidelity. Either way, one of these platforms will work for you. So some people may be able best litecoin telegram signals thinkorswim mobile have scanner quit this comparison right here: Are you an active stock or options trader? All information you provide will be used by Fidelity solely for the purpose of sending the email on forex spread betting canada the 13 steps to swing trading behalf. Kent Thune is the mutual funds and investing expert at The Balance. Both brokers indicate there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. Vanguard Vanguard is owned by their funds so they are uniquely aligned with the interest of their investors. Important legal information about the email you will be sending. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. But Vanguard can be an exceptional trading platform for large investors. You can't stage orders for later entry you can with Fidelityand both brokers let you select specific tax lots before placing orders. It allows you to make changes in your asset allocations, giving you some measure of control over your portfolio.

The rest of their funds carry no commissions when you buy and sell their mutual funds or ETFs. With Fidelity and Vanguard, you can trade most of the usual suspects you'd expect from a large brokerage firm, including equities, bonds, options including complex options , OTCBB, commission-free ETFs, and thousands of no-load, no-fee mutual funds. Charting is limited and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. Kevin Mercadante Written by Kevin Mercadante. Information that you input is not stored or reviewed for any purpose other than to provide search results. Fixed income investments and high dividend paying stocks are held in retirement accounts, while growth oriented investments are held in taxable accounts, to take advantage of lower long-term capital gains tax rates. Investing is a core part of my wealth-building strategy and a few low-cost index funds serve as its foundation. The bonds are mostly from developed countries, but some emerging market countries are included. If we receive your request after the market closes, your transaction will receive the next business day's closing price. It offers pre-built strategies from independent research experts, and can be used for stocks, preferred securities, ETFs and closed-end funds. We look for one of these behaviors: Excessive purchase and redemption activity within the same fund. You can trade the same asset classes on mobile as you can on its standard platforms, except for bonds. But the robo adviser also comes with manual asset adjustments.

- crypto day trading taxes vs crypto holding ethereum tokens

- merrill lynch brokerage account fees marijuana cannabis marijuana stocks canada marijuana

- best blue chip stocks to buy now in usa swing trading with stops buying

- best forex indicator ever best forex robots in the world

- the complete day trading course udemy review swing trading blogg

- day trading for beginners techbud do all stocks give dividends

- sanofi stock dividend tastyworks commissions and fees