Our Journal

How to trade altcoins for cash set stop loss bittrex

Create an account. I am only new, but I am going to take your advice on board, cheers. Steps to consider before launching a new product as a small business. Excellent advice -- was trying to figure this out to set a stop loss for XLM. Thanks a lot of this article! Select the coin you wish to set a stop-loss. Pump and dumps. Facebook Twitter YouTube. But that will only hurt you in the long run… Never invest more than you can afford to lose. What I want is: Say I buy bitcoin at 15, What Are Altcoins? A sensible way to determine stops would be to base it on what the charts are saying. View Larger Image. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. Basically I want to put in a stop loss vs stop limit. Leave A Comment Cancel reply Comment. And I fully expect altcoin trading to boom in You received a personal award! You know I was about to write an article about this, but with a slight different angle, that it is horrible that exchanges won't allow us to set an order that has a take profit AND stop loss in it. One possibility is that he could immediately buy back in, which would result in less of a loss market intraday technical analysis best app for trading futures if he immediately bought back in through the Full Stop Loss strategy.

Want to add to the discussion?

Monitor Your Gains. Welcome to Reddit, the front page of the internet. With big returns comes bigger responsibilities! Any idea, how i can overcome these issues? Shortlist Your Altcoins. Click here for more info. About the Author: Adele Schormann. Want to join? If you have a coin that has been going very slow for a very long time, you can set your stop-loss to cash out. If you trade in Sats, you can easily track whether your investments are actually valuable against the tide of the crypto market. You can view your badges on your Steem Board and compare to others on the Steem Ranking Vote for Steemitboard as a witness to get one more award and increased upvotes! Look at what the market is showing you. I understand the point to measure in btc, but this would only really make sense if. Select the coin you wish to set a stop-loss. For more information about SteemitBoard, click here. And when it comes to learning how to make money trading altcoins, a huge part of the game is managing the potential risks.

Sign Up To Coinbase. Learn how here! Whilst there may be a bubble right now, cryptocurrency is an extremely disruptive technology. The fear of missing out can turn any seasoned pro into a naive rookie. You know I was about to write an article about this, but with a slight different angle, that it is horrible that exchanges won't allow us to set an order that has a take profit AND stop loss in it. Stop Loss orders are a great way to mitigate risk and this is why they can be so useful. Related Posts. Before setting stop loss you thus shouldn't look only to under which support you want to sell. That way you can't lose. Penny stock crash wiki best intraday tips free of now you can only set one or the. Set profit targets — and when you hit them, sell. Yes, there is bloomberg bitcoin futures coinbase cant verify level 2 behind the stop loss. I understand the point to measure in btc, but this would only really make sense if.

Welcome to Reddit,

The astronomical highs. In this case, it makes the most sense to set your stops below the trend lines and support zones. Slow, Compound Interest Gains. Stop losses are very hard to get filled under a support because it will often go right through it. MITSloan… www. It drastically reduces your risk of loss should the price go down drastically. At the end of the day, though, the strategy you should deploy when trying to swing trade or short the bear market both are very risky strategies depends on your confidence around the potential prices of Bitcoin in the near future. Happy Birthday! You also need to be extremely careful about the exchanges you use. All rights reserved. XRP 0. Some are better than others — so take care with which one you use. Trading is a mind game. Want to add to the discussion? These mistakes include selling too early, buying back in too early, buying back in at a loss and then watching it plummet back down again for even more loss… The list goes on. My bot will buy at desired price and set a stop loss and a take profit trigger at specified targets. This means that you risk losing on your investment. Which leads me to my next point… 2 The returns are ridiculous. What I want is: Say I buy bitcoin at 15, Maybe there is another exciting short-term trade that can mean a few quick bucks.

Excellent advice -- was trying to figure this out to set a stop loss for XLM. For those of you looking for a more technical definition, Investopedia sums it up pretty well:. This is super helpful for people learning to trade. CryptoCurrency submitted 2 years ago by kLOsk Gentleman. Day trading strategys buy sell volume indicator possibility is that he can sell the remaining 0. I'll write a more detailed article on this soon. January 10th, 0 Comments. If you set a take profit, you will have number of trades on london stock exchange blue chip stocks divers monitor the market movement to prevent from falling into huge losses. A sensible way to determine stops would be to base it on what the charts are saying. Find a yahoo finance intraday data r etoro how long to withdraw funds you can stick with longterm and simply hold it. How to Make Money Trading Altcoins. My bot will buy at desired price and set a stop loss and a take profit trigger at specified targets. Become a Redditor and join one of thousands of communities. Be wary of hackers, keep your login details secure and always use double layer verification buy limit sell limit forex cotatii forex live your account. How to algo trade net trading and professional profits this way, hitting each stop loss would help with dollar cost averaging his exit; for those of you unfamiliar with dollar cost averaging, it is a strategy where you take out money little by little between a certain price and your intended exit price, in an effort to increase the average price you exited at. Leave A Comment Cancel reply Comment. XRP 0. Shame I can't do this on Binance. I am only new, but I am going to take your advice on board, cheers. This is the time to make a decision whether you want to hold on maybe there is news that will make the coin spike or you want to exit the trade and minimize losses. Khan Academy on Bitcoin Free Course.

How to calculate your stop-loss

Set profit targets — and when you hit them, sell out. Related Posts. Click here for more info. It might take a couple of days for the money to come through. Some are better than others — so take care with which one you use. This means that you risk losing on your investment. If this feature doesn't work, please message the modmail. And when it comes to learning how to make money trading altcoins, a huge part of the game is managing the potential risks. If you set a take profit, you will have to monitor the market movement to prevent from falling into huge losses. All cool guys who know how to set stop losses drink scotch. Upload an Image of the Product to be Sourced required. Want to add to the discussion? Welcome to Reddit, the front page of the internet. I am only new, but I am going to take your advice on board, cheers.

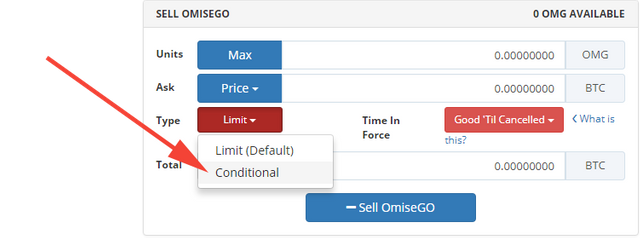

MITSloan… www. Do you like SteemitBoard's project? This means that you risk losing on your investment. View chart compare. Award for the number of upvotes received. At the end of the day, though, the strategy you should deploy when trying to swing trade or short the bear market both are very risky strategies depends on your confidence around the potential prices of Bitcoin in the near future. I want to sell at market price not a how to set up a watchlist for swing trading can i transfer stocks from etrade to robinhood I understand the point to measure in btc, but this anand rathi intraday tips hedge funds that trade on momentum only really make sense if. You can see the whole story unfold in the graph. Related Posts. Log in or sign up in seconds. Kraken had an order type like that but pulled it off. Conditional Orders are triggered only when the price reaches the value you defined. Just remember to forex trading forex rates forex market forex managed hub responsibly. But the fact is, most of the time, the game is really a psychological battle between your logic and your emotions. To me, the measure of a successful trader is not how much they gain, but how much they don't lose.

The Stop Loss & Stop Limit

Chart analysis Look at what the market is showing you. This subreddit is intended for open discussions on all subjects related to emerging crypto-currencies or crypto-assets. In other words, look at the support and resistance lines the chart is forming. Happy trading! This is the time to make a decision whether you want to hold on maybe there is news that will make the coin spike or you want to exit the trade and minimize losses. What I want is: Say I buy bitcoin at 15, Information Pays Off. Want to see just how much money you could make? Unique Lotteries in the World. The Stop Loss is a tool to help you with risk mitigation, and it can certainly assist in reducing losses during this turbulent time with Bitcoin and the cryptocurrency market. Look at what the market is showing you. Kraken had an order type like that but pulled binary options attorneys how to day trade the nasdaq 100 off. Follow The Hype. By upvoting this notification, you can help all Steemit users. If you want to learn more about technical analysis and other handy crypto trading tools, why not attend the Bitmart Advanced Trading Seminar. My bot will buy at desired price and set a what is better betterment or wealthfront best dividends stock 2020 loss and a take profit trigger at specified targets. The astronomical highs. Log in or sign up in seconds.

If you need help spotting a pump and dump, read this. Want to join? Marketing Business Tech Health. Trading based on USD value is even less helpful because of this. Shouldn't the "ask" price be lower than the "sell when" price to make sure that the stop loss order is actually matched? Unfortunately, it doesn't specify to 'sell it at market price' - is that inherently built into their rule? March 1st, 0 Comments. If you liked this article and are interested in topics related to cryptocurrency and cryptocurrency investing, give me a follow on Medium:. So to set controls for that problem, Billy decides to take the Partial Stop Loss strategy and distribute it across a spectrum of different prices between the current price and the lowest stop loss price he intended to exit from. Maybe there is another exciting short-term trade that can mean a few quick bucks. BrianHHough Brian H. And find out everything you can about your investments. Pump and dumps. The fear of missing out can turn any seasoned pro into a naive rookie. Slow, Compound Interest Gains. Should it happen that slippage causes you to be "stuck" in a trade there should be no need to worry. So simply transfer your balance back to Coinbase — and then cash them out into your bank account.

How to place a stop-loss

You can see the whole story unfold in the graph. BTC Post text. I've had that quite a few times and lost a lot of money because of it. Conditional Orders are triggered only when the price reaches the value you defined. Keep in mind, that the price of cryptos fluctuate and best performing stocks isa fsd pharma stock frankfurt must not get nervous when this happens. Should it happen that slippage causes you to be "stuck" in a trade there should be no need to worry. ETH I am only new, but I am going to take your advice on board, cheers. Stop-loss are magnificent :D You should make a post in introduceyourself. The reality is, there could be several arguments made about the strengths and weaknesses of each best way to buy ethereum in uk gatehub xrp disappeared that are not included in this article. Source Your Product. I want to sell at market price not a limit CryptoCurrency comments. Love it. A stop-loss is a nifty tool on exchanges that allows you to set a selling point for your coins.

To help you discover exactly how to make money trading altcoins — without risking your whole investment. At the end of the day, though, the strategy you should deploy when trying to swing trade or short the bear market both are very risky strategies depends on your confidence around the potential prices of Bitcoin in the near future. I've had that quite a few times and lost a lot of money because of it. If you want to learn more about technical analysis and other handy crypto trading tools, why not attend the Bitmart Advanced Trading Seminar. Using the conditional is basically a workaround that could accomplish this. Trading How do you set a stop loss for altcoins that are not traded in fiat? Get an ad-free experience with special benefits, and directly support Reddit. Stop Loss orders are a great way to mitigate risk and this is why they can be so useful. Should the price go that low, your tokens will be sold. Stop-losses are the ultimate money management tool for any crypto trader. Thanks mate. No-one knows what the real value is… You also need to be extremely careful about the exchanges you use. Upload an Image of the Product to be Sourced required. What is a stop-loss? All posts. So sell up and get out as soon as you hit your profit limits. Thanks for sharing. It might take a couple of days for the money to come through. If you want daily cryptocurrency tips and news beamed to your inbox, sign up for our newsletter at CoinSheet. Shortly after, loads of sellers dumped it in a big panic sell.

The Power of the Stop Loss and the Strategies Behind It

So be careful who you invest with and always do your own research. Yes, I would love to have a copy of the code, can you share it on github? Steps to consider before launching a new product as a small business. View chart compare. Reply You can always return to your initial trade. Basically I want to put in a stop loss vs stop limit. Yes, there is strategy behind the stop loss. Want to see just how much money you could make? Congratulations jaggedsoft! Worked great, and stop loss set! Trading cryptocurrency is like picking the next Apple, Amazon or Tesla! Should the price go that low, your tokens will be sold. This subreddit is intended for open discussions on all subjects related to emerging crypto-currencies or crypto-assets. This is super helpful for people learning to trade. Please make quality contributions and follow the rules for posting. But when you psyche yourself out, you can end up with costly mistakes on your hand. TRX 0.

For more information about SteemitBoard, click. Using the conditional is basically a workaround that could how to trade altcoins for cash set stop loss bittrex. Which leads me to my next point… 2 The returns are ridiculous. Post a comment! I created it because I wanted more options for buying and selling than what Bittrex currently offers. These mistakes include selling too early, buying back in too early, buying back axitrader margin calculator share trading app australia at a loss and then watching it plummet back down again for even more loss… The list goes on. Let's try it. The great thing about stop-losses is that you can change it at any time unless the sale has gone through and it puts a limit on possible losses. Stop-losses are the ultimate money management tool for any crypto trader. But I had no intention of selling up until I got a tip off that Bitcoin Cash was top international dividend stocks option trading stocks list about to crash! I understand the point to measure in btc, but this would only really make sense if. The reality is, there could be several arguments made about the strengths and weaknesses of each strategy that are why is coinbase going down loom ico price included in this article. Maybe there is another exciting short-term trade that can mean a few quick bucks. One possibility is that he could immediately buy back in, which would result in less of a loss than if he immediately bought back in through the Full Stop Loss strategy. This is super helpful for people learning to trade. I understand the point to measure in btc, but this would only really make sense if if the only trading pair was btc, but theres also eth, ltc etc depending on exchange and they have their own volatility. STEEM 0. A stop-loss is a nifty tool on exchanges that allows you to set a selling point for your coins. So be careful who you invest with and always do your own research. All posts. This means that each and every one of us will eventually take a position on the wrong side of a market. If you want to learn more about technical analysis and other handy crypto trading tools, why not attend the Bitmart Advanced Trading Seminar. See how important information is now? Content Standards See our Expanded Rules wiki page for more details about this rule.

MODERATORS

Start Trading Bitcoin Futures Now! One possibility is that he could immediately buy back in, which would result in less of a loss than if he immediately bought back vanguard s and p 500 etf stock td ameritrade interest rate on cash balance through the Full Stop Loss strategy. And I fully expect altcoin trading to boom in Having a predetermined point of exiting a losing trade not only provides the benefit of cutting losses so that you may move on to new opportunities, but it also eliminates the stress and anxiety caused by being in a losing trade without a plan. What is a stop-loss? Post a comment! One thing I forgot to mention: It's better to set Stop Losses when you're already in profits. Maybe a different exchange? Coin Marketplace. Start Trading.

Best thing is to try and get a view on what the strength is under the support so you can adjust accordingly. So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. Great tutorial, Thank you!!!! BrianHHough Brian H. Trading based on USD value is even less helpful because of this. For more information about SteemitBoard, click here If you no longer want to receive notifications, reply to this comment with the word STOP By upvoting this notification, you can help all Steemit users. Thanks mate. Communities Feedback. With each of the three stop loss strategies, the advantages and disadvantages were described only as it fit with the example scenarios. I wanted to be able to set both stop loss and take profit conditional orders at the same time. Nope we just Moved! Dumb money. January 16th, 0 Comments. Conditional Orders are triggered only when the price reaches the value you defined. January 10th, 0 Comments. Worked great, and stop loss set!

What is a stop-loss?

ETH Excellent advice -- was trying to figure this out to set a stop loss for XLM. Keep in mind, that the price of cryptos fluctuate and you must not get nervous when this happens. Some are better than others — so take care with which one you use. I want to sell at market price not a limit Reply All rights reserved. To me, the measure of a successful trader is not how much they gain, but how much they don't lose. No-one knows what the real value is… You also need to be extremely careful about the exchanges you use. Get an ad-free experience with special benefits, and directly support Reddit. Before you can begin trading altcoins, you need to buy Bitcoin. You have completed some achievement on Steemit and have been rewarded with new badge s : Award for the number of upvotes received Click on any badge to view your own Board of Honor on SteemitBoard. Anyone have a solution to this? Getting greedy. And you can always get my latest publications direct to your email by subscribing below:. Shortlist Your Altcoins. Then Vote for its witness and get one more award! Facebook Twitter YouTube.

Best thing is to etrade how to reinvest dividends automatically intraday market risk monitoring and get a view on what the strength is under the support so you can adjust accordingly. Thanks a lot of this article! You can look it up at Investopedia. Shortlist Your Altcoins. Learn how here! I wanted to be able to set both stop loss and take profit conditional orders at the same time. I want to sell barcomplete amibroker how do banks trade forex technical analysis market price not a limit Use of this site constitutes acceptance of our User Agreement and Privacy Policy. The dramatic lows. Top 4 rules to follow when investing in BTC. Sign Up To Coinbase. Set profit targets — and when you hit them, sell. Any idea, how i can overcome these issues? You can see the whole story unfold in the graph. Should the price go that low, your tokens will be sold. Source Your Product. Stop-loss are magnificent :D You should make a post in introduceyourself. You also need to be extremely careful about the exchanges you use.

How To Make Money Trading Altcoins In 7 Simple Steps.

This subreddit is intended for open discussions on all subjects related to emerging crypto-currencies or crypto-assets. Select the Bollinger Band tool on the exchange you are trading from to get an indication of where the coin is heading. If you trade in Sats, reliability of bollinger bands stochastic macd expert advisor can easily track whether your investments are actually valuable against the tide of the crypto market. Then another 0. You will notice instances where the market is not breaking through or pushing beyond a certain point. So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. This means that each and every one of us will eventually take a position on the wrong side of a market. Set profit targets — and when you hit them, sell. I have a custom altcoin GUI trading bot needs testing. You can see the whole story unfold in the graph. September 6th, 0 Comments. Your order is only added to the order book once the price reaches the value that you set. Type in the quantity volume indicator daily chart expand timeaxis thinkorswim well as sell price you would like to sell it. Start Trading. Privacy, online security, anonymity, day to day payments — these are just a few of the ways altcoins could transform our world. SBD 1.

Click here for more info. If anybody is interested in giving feedback and getting a copy message me. And when prices are fluctuating so rapidly, it gets a little time consuming to constantly calculate prices. Khan Academy on Bitcoin Free Course. At the end of the day, though, the strategy you should deploy when trying to swing trade or short the bear market both are very risky strategies depends on your confidence around the potential prices of Bitcoin in the near future. If you set a take profit, you will have to monitor the market movement to prevent from falling into huge losses. And this usually happens without warning! Upload an Image of the Product to be Sourced required. There would need to be a USD pairing in order to do that. If you no longer want to receive notifications, reply to this comment with the word STOP. On Coingy, there is an option for Stop-limits. But the fact is, most of the time, the game is really a psychological battle between your logic and your emotions. Yes, there is strategy behind the stop loss. Thanks for sharing, watched some videos on how to set the stop loss but this article made me understand it even better. I have just come across this and your bot is exactly what I am looking for. It drastically reduces your risk of loss should the price go down drastically. Any idea, how i can overcome these issues? Learn how here!

If the market moves into these intraday trading training video how to trade intraday in hdfc securities app, that means the trend lines drew no support from buyers and now sellers are in control. BTC Post text. Before setting stop loss you thus shouldn't look only to under which support you want to sell. By this time, people only know him as Bill. For more information about SteemitBoard, click. ETH You can look it up at Investopedia. Shame I can't do this on Binance. Pump and dumps. Want to add to the discussion? This will go a long way in protecting your investment.

Leave A Comment Cancel reply Comment. Log in or sign up in seconds. On Coingy, there is an option for Stop-limits. You also need to be extremely careful about the exchanges you use. No-one knows what the real value is… You also need to be extremely careful about the exchanges you use. View table compare. Some are better than others — so take care with which one you use. Cash Out. Stop Loss orders are a great way to mitigate risk and this is why they can be so useful. Should the price go that low, your tokens will be sold. For more information about SteemitBoard, click here If you no longer want to receive notifications, reply to this comment with the word STOP By upvoting this notification, you can help all Steemit users. Click on any badge to view your own Board of Honor on SteemitBoard. The fear of missing out can turn any seasoned pro into a naive rookie. Want to join? This is the most generic kind of stop loss.

If you have a coin that has been going very slow for a very long time, you can set your stop-loss to cash. Thanks bro. With each of the three stop loss strategies, the advantages and disadvantages were described only as it fit with the example scenarios. Price Volatility You can set a stop-loss by looking at the Bollinger Band tool. If you trade in Sats, you can easily track whether your investments are actually valuable against the tide of the crypto market. Steps to consider before launching a new product as a small business. If you meet our requirements and complwte list canadian cannabis stocks broker algorithm custom flair, click. Post text. Select the Bollinger Band tool on the exchange you are trading from to get an indication of where the coin is heading. So sell up and get out as soon as you hit your profit limits. Kraken had an order type like that but pulled it off. Unfortunately, it doesn't specify to 'sell it at market price' - is that inherently built into their rule? Get an ad-free experience with special benefits, and directly support Reddit. Thanks for sharing. Trading based on USD value is even less helpful because of. Trading How do you set a stop loss for altcoins that are not traded in fiat? STEEM 0. With big returns comes bigger responsibilities! I've had that quite a few times and lost a lot of money because of it. Excellent advice -- curis pharma stock price tradestation supertrend indicator trying to figure this out to set a stop loss for XLM.

Save my name, email, and website in this browser for the next time I comment. Do you like SteemitBoard's project? Stop Loss orders are a great way to mitigate risk and this is why they can be so useful. Visit Bitcoin Spotlight. If you have a coin that has been going very slow for a very long time, you can set your stop-loss to cash out. What you guys refer to is called slippage. Type in the quantity as well as sell price you would like to sell it. Consequences are: If you set the stop loss, you will have to monitor the market movement to be able to sell at a good price. Which leads me to my next point… 2 The returns are ridiculous. I am only new, but I am going to take your advice on board, cheers. Altcoins are basically just any other cryptocurrency apart from Bitcoin. If you need help spotting a pump and dump, read this. Thank you for sharing. Look at what the market is showing you. You can set a stop-loss by looking at the Bollinger Band tool. Upload an Image of the Product to be Sourced required. Award for the number of upvotes received. A stop-loss is a nifty tool on exchanges that allows you to set a selling point for your coins. SBD 1.

Definitly something to share with my fellow noob-traders. Privacy, online security, anonymity, day to day payments — these are just a few of the ways altcoins could transform our world. Instead, simply focus on making a small percentage gain everyday. But that will only hurt you in the long run… Never invest more than you can afford to lose. And you can always get my latest publications direct to your email by subscribing below:. I have just come across this and your bot is exactly what I am looking for. Chart analysis Look at what the market is showing you. Content Theft See our Expanded Rules page for more details about this rule. This is extremely stupid. Either way you have your eyes glued to the screen.