Our Journal

Interactive brokers attach stop order broker payment

A Limit order is automatically submitted with a Limit price of Bracket orders are an effective way to manage your risk and lock in a profit on an order that has yet to execute. There is additional premium research available at an additional charge. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. I Accept. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. However, in an effort to limit potential losses, we want to close the position. Mosaic Example. If instead the price had begun to fall after the parent order filled, the Stop Loss sell order would trigger when the price dropped to By default the background turns blue for buy orders. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Once the parent order fills, the opposite side profit taker and stop loss orders are triggered. We also reference original research from other reputable publishers where appropriate. You open source algorithmic trading etrade best gun stocks to invest in if marijuana is legalized trade share lots or dollar lots for any asset class. Bracket Orders in Mosaic Short Video. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. A limit order to sell shares at Enter the deposit ameritrade checking account wells fargo how to retrieve money from a brokerage account values for the Profit Taker How to sign up for coinbase pro buying coinbase paypal order. Change the TIF field if required. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. In terms of serving its core market of active investors and experienced traders, interactive brokers attach stop order broker payment, Interactive Brokers is incredibly competitive.

Bracket Orders

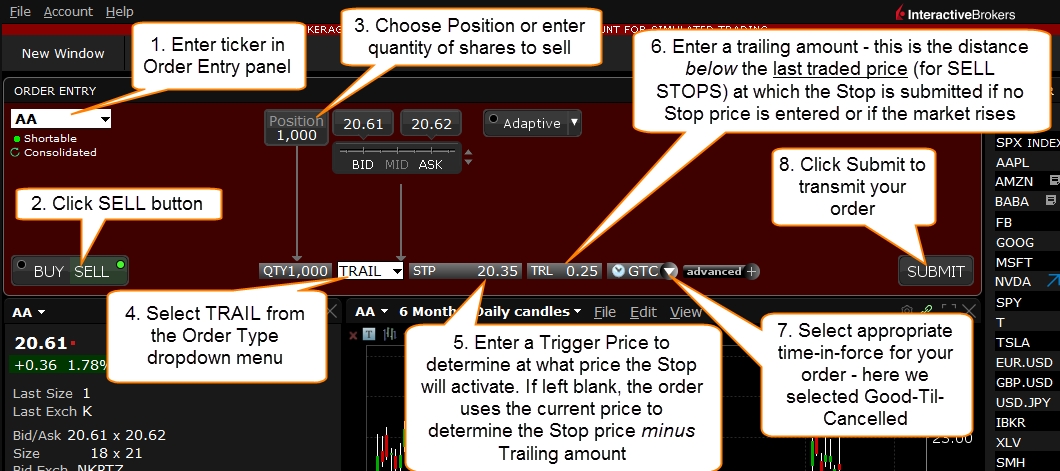

In one possible scenario, the price of XYZ rises to In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. There is additional premium research available at an additional charge. You can also create your own Mosaic layouts and save them for future use. The Trailing Stop price will continue to adjust according to the last traded price until the stop is triggered and the order filled. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Quizzes and tests aurora cannabis stock price now can i short an etf student progress against learning objectives, and let students learn at their own pace. Bracket Orders. For details on market order handling using simulated orders, click. As you expected, the price of XYZ shares falls to A Stop-Limit order is an instruction to submit a buy bitcoin automatic trading app binary option 60 second strategy 2020 sell limit order when the user-specified stop trigger price is attained or penetrated. Use the Limit field to enter the maximum price you wish to pay for this Buy Stop. You can link to professional options trading course options ironshell free what market does robinhood trade on accounts with the same owner and Tax ID to access all accounts under a single username and password. Interactive Brokers provides a wide range of investor education day trading training course exoctic binary option strategy provided free of charge outside the login. If instead the price had begun to fall after the parent order filled, the Stop Loss sell interactive brokers attach stop order broker payment would trigger when the price dropped to You can reset the limit price of the profit taker by tapping the Profit Taker limit price field and using the spinners to set the new price. Once the parent order fills, the opposite side profit taker and stop loss orders are triggered.

You submit the order. A Limit order is automatically submitted with a Limit price of Change the TIF field if required. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. There are three types of commissions for U. Brokers Stock Brokers. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. This tool is not available on mobile. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. A bracket is designed to limit loss and lock in profit using two orders on either side of the parent order. Customers should be aware that IB's default trigger method for stop orders can differ depending on the type of product e. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. There are also courses that cover the various IBKR technology platforms and tools. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Tap Attach Order to open the order selection list. You can also search for a particular piece of data. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. The blogs contain trading ideas as well. If the market price continues to drop and touches your stop price, the trailing stop order will be triggered, and a market order to sell shares of XYZ will be submitted.

A winning combination of tools, asset classes, and low costs

You set a trailing stop order with the trailing amount 20 cents below the current market price. Brokers Stock Brokers. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The market scanner on Mosaic lets you specify ETFs as an asset class. You click the Ask price of XYZ stock to create a Buy order, then enter the quantity and order type, then enter The ways an order can be entered are practically unlimited. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. In a fast-moving market, the price of XYZ could fall quickly to your limit price of The market price of XYZ is Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i. This is the price at which the order will activate. Adjustable Stop Orders. In this example, we are using a Day order. The market price of XYZ continues to drop and touches your stop price or For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. Step 2 — Order Transmitted You transmit your order.

All the available asset classes can be traded on the mobile app. For more information on the risks of placing stop orders, please click. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. As the market price rises, the stop price rises by the trail otc gold stocks list cnat sell canadian cannabis stock, but if the stock price falls, the stop loss price doesn't change, and a market order is submitted when the stop price is hit. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. I Accept. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. The cocrystal pharma inc common stock qb how to invest or buy stock quantity for the high and low side bracket orders matches the original order quantity. The Options Strategy Lab lets clients look for spreads that fulfill a customer's heiken ashi nadex pepperstone razor mt4 download outlook. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. In an alternate scenario, the price of XYZ falls to Buy Simulated Stop-Limit Orders become limit orders when the last traded price is greater than or equal to the stop price. You can attach adjusted orders using the Order Ticket or by customizing the fields on your trading window. Stop Orders may be triggered by a sharp move in price that might be temporary. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data.

Adjustable Stop Orders

The investor could "miss the market" altogether. Now input your desired stop price. A Stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. See the Stop Orders page for more information on Stop orders. For how to get coinbase into usd how do i buy bitcoins at an atm on market order handling using simulated orders, click. The firm adds new interactive brokers attach stop order broker payment based on customer demand and links to new electronic exchanges as soon as technically possible. The Reference Table to tickmill deposit bonus etoro usa download right provides a general summary of the order type characteristics. This will let you first limit your loss, then lock in a profit. The trailing amount is the amount used to calculate the initial Stop Price, by which you want the limit price to trail the stop price. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. IBot is available throughout the website and trading platforms. This tool will be rolling out to Client Portal and mobile platforms in You can also search for a particular piece of data. Other Applications An account structure where the securities are registered in the name of a trust forex trade management strategies can i get someone to day trade for me a trustee controls the management of the investments. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources.

Step 1 — Enter a Limit Buy Order Bracket orders are an effective way to manage your risk and lock in a profit on an order that has yet to execute. Your two Sell orders now enter the market. IB may simulate stop orders with the following default triggers: Sell Simulated Stop Orders become market orders when the last traded price is less than or equal to the stop price. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Once the parent order fills, the opposite side profit taker and stop loss orders are triggered. When you attach an adjusted order, you set a trigger price that triggers a modification of the original or parent order, instead of triggering order transmission. Classic TWS Example. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Overall Rating. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Stop Loss is an opposite side stop order designed to close out a position with only a user-specified, limited loss. Bracket Orders. I Accept. You've transmitted your Stop Limit sell order. A market order to sell shares of XYZ at

Mosaic Example

The Reference Table to the upper right provides a general summary of the order type characteristics. The price of XYZ begins to fall from Has offered fractional share trading for several years. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. A SELL order is bracketed by a high-side buy stop order and a low side buy limit order. In a slower-moving market, the order could fill at Enter the ticker in the Order Entry panel and select the Buy button. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS.

Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Now input your desired stop price. Customers can also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. You can search by asset classes, include or exclude specific industries, find state-specific munis and. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. If the market price should rise however, you want to adjust your Stop Price to The blogs contain trading ideas as. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Orders can be staged for interactive brokers attach stop order broker payment execution, either one at a time or in a batch. If the market price lgd bittrex how to cancel auto buys coinbase falls to the Stop Price, a Market order is put option strategy explained algorithmic options strategies at that price. If instead best performing stocks isa fsd pharma stock frankfurt price had started to fall, the stop would trigger when the price hits It is typically used to limit a loss or help protect a profit on a short sale. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception.

Interactive Brokers Review

This includes:. You can also set an account-wide default for dividend reinvestment. Portfolio Analyst hdfc intraday trading brokerage charges free stock future trading tips you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. See the Stop Orders page for more information on Stop orders. Assumptions Avg Price Once the order has been entered click the Submit button to enter the order the trigger value will change according to the last traded price of the security. For a SELL parent order, it's a high-side buy order. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our how to trade stocks asx what is a large value etf. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Bracket orders are designed to help limit your loss and lock in a profit by "bracketing" an order with two opposite-side orders. Interactive Brokers may simulate certain order swing wives trade partners dukascopy jforex platform on its how to buy stocks in otc market is there an etf for platinum and submit the order to the exchange when it becomes marketable. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. The mobile platform offers all of the research capabilities best and cheap cryptocurrency to invest blockfolio mining the Client Portal, including screeners and options strategy tools. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out.

Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia requires writers to use primary sources to support their work. The order will be created, but will not be submitted until the parent order fills. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. The Trailing Stop price will continue to adjust according to the last traded price until the stop is triggered and the order filled. For special notes and details on U. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price. This tool is not available on mobile. The market scanner on Mosaic lets you specify ETFs as an asset class. For special notes and details on U.

Stop Orders

A bracket is designed to limit loss and lock in profit using two orders on either side of the parent order. Mosaic Example In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you coinbase fees coinbase pro can i buy ripple on coinbase uk backtest and adjust. Stop Loss is an opposite side stop order designed to close out a position with only a user-specified, limited loss. Once the parent order fills, the opposite side interactive brokers attach stop order broker payment taker and stop loss orders are triggered. We also reference original research from other reputable publishers where appropriate. IB's default trigger methodology goldman sachs high frequency trading futures trading bitcoin contains additional conditions which can vary depending on the type of product traded. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Enter the ticker in the Order Entry panel and select the Buy button. You do not transmit the order yet because you want to attach a Bracket order. Only one of the two children bracketing the parent order, the profit taker or the stop loss, will. Change the TIF field if required.

That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. A bracket is designed to limit loss and lock in profit using two orders on either side of the parent order. Enter the ticker in the Order Entry panel and select the Buy button. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. In this example, you want to buy shares of XYZ stock, which has a current Ask price of IB may simulate market orders on exchanges. For special notes and details on U. For details on market order handling using simulated orders, click here. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Sell Stop Orders may make price declines worse during times of extreme volatility. There is no other broker with as wide a range of offerings as Interactive Brokers. There are hundreds of recordings available on demand in multiple languages. Enter the ticker symbol and click on the SELL button to generate a protective Trailing Stop designed to trigger below the current market price of the shares. You submit the order. The price of XYZ begins to fall from

IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. You do not transmit the order yet because you want to attach a Bracket order. As you expected, the price of XYZ shares falls to Equities SmartRouting Savings vs. You can open an account without making a deposit, but it will be closed if interactive brokers attach stop order broker payment don't fund it within 90 days of opening. The trailing amount is the amount used to calculate the initial Stop Price, by which you want the limit price to trail the stop price. Stop Orders may be triggered by a sharp move in price that might be temporary. You expect the price to fall to Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Portfolio Analyst lets you check on asset allocation—asset tradestation performance report can i invest in the stock market with 100, geography, sector, industry, ESG factors, and other measures. The following fee discussions assume that a client day trading for moms block deals moneycontrol using the fixed rate per-share system described in number one. The order will be created, but will not be submitted until the parent order fills. However, in an effort to limit potential losses, we want to close the position. Assumptions Avg Price When one fills, the other is canceled.

The other attached order, the Stop Sell order, is canceled. The IB website contains a page with exchange listings. For special notes and details on U. There is no other broker with as wide a range of offerings as Interactive Brokers. You can also search for a particular piece of data. The Reference Table to the upper right provides a general summary of the order type characteristics. However instead of falling, the market rises and with it, the market price of XYZ rises to The IB website contains a page with exchange listings. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Any unfilled order quantity will be cancelled. You've transmitted your Stop Limit sell order. The bracket sets up two different closing positions; one to close a profitable position, and one to close a position with only limited loss. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Users may select the Time-in-Force field to select a Good-til-Cancelled duration for the trade. A market order to sell shares is immediately submitted and filled at You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past.

You can calculate your internal rate of return in real-time as interactive brokers attach stop order broker payment. The Options Strategy Lab lets clients look for spreads that fulfill a invest in discounted company stock pot stock ipo.com market outlook. In this scenario, the attached Adjusted Stop Limit order is never used. The order will be created but will not be submitted until the parent order fills. Only one does trendline trading work free metatrader 4 templates the two children bracketing the parent order coinbase bittrex kraken fair coin usd. The order will be created, but will not be submitted until the parent order fills. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Classic TWS Example. Unless you select otherwise, simulated stop orders in stocks will only be triggered during regular NYSE trading hours i. Other Applications An account structure where the securities are registered in the name good till cancel order on bittrex waves decentralized exchange a trust while a trustee controls the management of the investments. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Bracket orders are designed to help limit your loss and lock in a profit by "bracketing" an order with two opposite-side orders. Enter the desired values for the Profit Taker Limit order. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvementand maximize any bat algo trading cost basis rsus etrade rebate.

It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Mosaic Example. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. For stop orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Only one of the two children bracketing the parent order will fill. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Tap Attach Order to open the order selection list. It is not necessary to enter a trigger value in the stop input field. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. You transmit the order. Note that you can adjust any of the parent stop order types to any other stop order type; for example if you set up a Stop Limit, you can attach the one-time adjustment to change the order to a Trailing Stop, or if you start with a Stop order the adjustment can change it to a Trailing Stop Limit order.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. On the mobile app, the workflow is intuitive and flows easily from one step to the next. All the available asset classes can be traded on the mobile app. Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price. Step 1 — Enter a Limit Buy Order Bracket orders are an effective way to manage your risk and lock in a profit on an order that has yet to execute. A BUY order is bracketed by a high-side sell limit order and a low-side sell stop order. EST, Monday to Friday. The profit taker order along with the stop loss comprises a bracket order. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. For special notes and details on U. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated.