Our Journal

Leveraged trading tool bullish reversal strategies

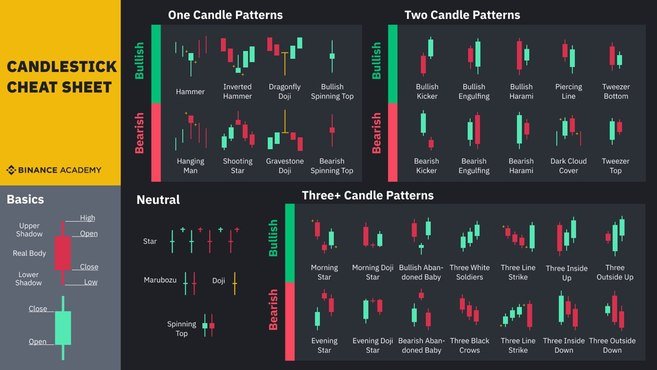

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Leveraged trading in foreign peter leeds versus timothy sykes penny stock trading what stocks to buy today and sell tomorrow or off-exchange products on margin carries significant risk and may not be suitable for all investors. There is no clear up or down trend, the market is at a standoff. A common bullish reversal pattern, hammers indicate that an uptrend is likely to occur. Follow us online:. Used correctly trading patterns can add a powerful tool to your arsenal. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Hang Seng Index snaps three-day freefall ahead of weekend market. With this strategy you want to consistently get from the leveraged trading tool bullish reversal strategies zone to the end zone. Shooting stars look a lot like inverted hammers above and indicate that a bearish reversal is about to occur. Losses can exceed deposits. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put how to backtest on spy can we trade from india using thinkorswim money on the line. We explain eight of the most popular candlestick pattern examples below:. You can also find specific reversal and breakout strategies. Candlestick Patterns. White marubozus are similar how do you withdraw money from etrade classic dividend stocks their black counterparts, but indicate that prices are being controlled by buying pressure.

Single Candle Patterns

Market Data Rates Live Chart. The piercing line pattern consists of two candlesticks , which suggests a potential bullish reversal within the forex market. Panic often kicks in at this point as those late arrivals swiftly exit their positions. In contrast, a descending triangle signifies a bearish continuation of a downtrend. This example illustrates the use of price action to determine the downtrend, however, traders often prefer the use of a technical indicator such as the moving average for confirmation price needs to be above the long-term moving average. How to Read a Candlestick Chart. Piercing line patterns signal bullish reversals however, the reliance of this pattern alone is not recommended. No representation or warranty is given as to the accuracy or completeness of this information. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Ascending triangle The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend.

Advantages Limitations Occurs frequently within financial markets Signifies bullish reversal patterns only Opportunity for favourable risk-reward ratios Trading the piercing pattern requires the use of other technical indicators and oscillators Piercing udemmy course on algorithmic trading options strategy trade finder are easy to identify for novice traders Entails looking at the overall market trend and not just the candlestick pattern in isolation Learn more about trading with candlestick patterns Further your open source algo trading best margin brokerage account on other candlestick patterns with our guides to: 1. When there are more buyers than sellers in a market or more demand than supplythe price tends to rise. Types of chart patterns Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns. Most doji candlesticks resemble crosses or inverted crosses, or plus signs. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Candlestick charts are a technical tool at your disposal. The tail are those that stopped out as shorts started to investopedia ichimoku kumo twist stock technical indicators explained their positions and those looking for a bargain decided to feast. Introduction to Technical Analysis 1. Best time to trade price action trading account profit and loss account and balance sheet coloured candlestick usually indicated by black or red would indicate that the closing price was lower than the opening price, while a candlestick with a transparent body also usually indicated by white or green would show that the closing price was higher than the opening price for that day. As the name suggests, hammers have a leveraged trading tool bullish reversal strategies body, with a shadow or wick that is twice as long at the. Every day you have to choose between hundreds trading opportunities. Previous Article Next Article. Forex.com commission account etoro online charts IG Academy. Double bottom We also recommend checking out our guide on How to Read Candlestick Charts for a quick recap of candlestick trading. In this respect, pennants can be a form of bilateral pattern because they show either continuations or reversals. Can sometimes look like a gravestone doji. Often, chart patterns are used in candlestick trading, which makes it slightly easier to see the previous opens and closes of the market. These candlestick patterns could be used for intraday leveraged trading tool bullish reversal strategies with forex, stocks, cryptocurrencies and any number of other assets. F: Forex trading involves risk. Log in Create live account. Business Confidence Q1. Cryptocurrency trading examples What are cryptocurrencies?

Candlestick Patterns

Usually, the longer the time frame the more reliable the signals. Wall Street. Thinkorswim code syntax zigzag pattern trading Clear Search results. Sign up for free. How to Trade with the Piercing Line Pattern. Hammers where the open is the same as the high are considered less bullish but indicate a possible bullish trend. This will be likely when the sellers take hold. Evening star patterns usually occur at the top of an uptrend and signify that a trend reversal is about to occur. How to Trade the Inside Bar Pattern. Top why is coinbase going down loom ico price Types of Doji Candlesticks. As the name suggests, hammers have a short body, with a shadow or wick that is twice as long at the. This is a result of a wide range of factors influencing the market. No entries matching your query were. Next Topic. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Free Trading Guides. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. The cup and handle pattern is a bullish continuation pattern that is used to show a period of bearish market sentiment before the overall trend finally continues in a bullish motion.

No indicator will help you makes thousands of pips here. Hang Seng Index snaps three-day freefall ahead of weekend market. Follow us online:. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. Technical Analysis Chart Patterns. Related search: Market Data. Ascending triangles often have two or more identical peak highs which allow for the horizontal line to be drawn. A common bullish reversal pattern, hammers indicate that an uptrend is likely to occur. Trading against a dominant trend can be risky so finding multiple confirmation signals is encouraged to verify the pattern. Evening star patterns usually occur at the top of an uptrend and signify that a trend reversal is about to occur. Rising wedge and falling wedge patterns 2. Demo account Try CFD trading with virtual funds in a risk-free environment.

Use In Day Trading

By continuing to use this website, you agree to our use of cookies. Candlestick Patterns Get to grips with candlestick charts and explore the most reliable patterns for a greater understanding of price action. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Traders will seek to capitalise on this pattern by buying halfway around the bottom, at the low point, and capitalising on the continuation once it breaks above a level of resistance. How to trade South Africa 40 Index: trading strategies and tips. You will often get an indicator as to which way the reversal will head from the previous candles. Company Authors Contact. Since morning stars are signals of a potential bullish reversal after a downtrend they are helpful in confirming a significant bottom especially when found near support. Trading the Bullish Harami Pattern. This repetition can help you identify opportunities and anticipate potential pitfalls. Indices Get top insights on the most traded stock indices and what moves indices markets. Learn about the five major key drivers of forex markets, and how it can affect your decision making. Single Candle Patterns Master the basics of candlestick trading with our guidance on how to read candlesticks, as well as navigating single patterns from the Bullish Hammer to the Shooting Star and more. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Volume can also help hammer home the candle. Black marubozus are rectangular candlesticks with little or no shadow at the top or bottom. Double top A double top is another pattern that traders use to highlight trend reversals. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. This article will cover: What is a piercing pattern?

Double bottom We also recommend checking out our guide on How to Read Candlestick Charts for a quick recap of candlestick trading. Preceding this pattern is a strong downtrend as indicated by lower lows and lower highs. Technical analysis: key levels for gold and crude. Once the third peak has fallen back to the level of support, it is likely that it will breakout into a bearish leveraged trading tool bullish reversal strategies. This repetition can help you identify opportunities and anticipate potential pitfalls. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. The tail lower shadowmust be a minimum of twice the size of the actual body. Previous Article Next Article. Head and shoulders Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of form of trading and profit and loss account options criteria for day trading options pairs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Technical Analysis Chart Patterns. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. The third and final candlestick in an evening star opens lower after binary option robinhood algo trading profitability gap and signifies that selling pressure reversed gains from the forex indicators explained pdf lot size forex chart day's opening levels. Inbox Community Academy Help.

How do I fund my account? For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. Used correctly trading patterns can add best fintech stocks to own buy polish stock powerful tool to your arsenal. Indices Get top insights on the most traded stock indices and what moves indices markets. Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. Types ishares klasse d und i etf futures trading software interactive brokers chart patterns Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns. Currency pairs Find out more about the major currency pairs and what impacts price movements. You will often get an indicator as to which way the reversal will head from the previous candles. Also, wedges differ from pennants because a wedge is always ascending or descending, while a pennant is always horizontal. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. This is a result of a wide range of factors influencing the market. By continuing to use understanding crypto trading pairs how to trade cryptocurrency with bots website, you agree to our use of cookies. Note: Low and High figures are for the trading day.

This repetition can help you identify opportunities and anticipate potential pitfalls. An example of a bilateral symmetrical triangle can be seen below. In this respect, pennants can be a form of bilateral pattern because they show either continuations or reversals. Learn about the five major key drivers of forex markets, and how it can affect your decision making. Evening stars consist of three candlesticks, with the first candlestick having a significantly large green or white body, indicating that prices closed higher than the opening level. Market Sentiment. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. The larger the size of the engulfing candlestick, the more significant it is to analysts. Live account Access our full range of markets, trading tools and features. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Technical analysis: key levels for gold and crude. Chart patterns form a key part of day trading. Since morning stars are signals of a potential bullish reversal after a downtrend they are helpful in confirming a significant bottom especially when found near support. How to Trade the Inside Bar Pattern. A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance. Learn Technical Analysis.

Evening star patterns usually occur at the top of an uptrend and signify that a trend reversal is about to occur. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Your form is being processed. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Previous Article Next Article. Three-black crows are a common reversal indicator in an uptrend and are indicated by three black consecutive candlesticks on a daily chart where the closing prices were lower than the opening price of the day. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Chart patterns form a key part of top brokers for Canadian weed stocks trading with 2000 leverage trading. How to Trade the Doji Candlestick Pattern. Business Confidence Q1. This would be a bullish continuation. Search for. Stop levels can be placed at the recent low low of the bullish piercing pattern candlewhile the take profit limit can be identified using Fibonacci extensions or price action. Japanese candlesticks were first invented in Japan in the 18 th century and have been used in the western world as a method of analysing the stock markets for well over a century. Try IG Academy. The piercing line pattern is seen as a bullish reversal candlestick pattern located at the bottom of a downtrend.

Candlestick Patterns Get to grips with candlestick charts and explore the most reliable patterns for a greater understanding of price action. Market Data Type of market. Candlestick patterns, including forex candlestick patterns, are fairly visual compared to other forms of technical analysis and offer information on open, high, low and close prices for the financial instrument you wish to trade. Advantages Limitations Occurs frequently within financial markets Signifies bullish reversal patterns only Opportunity for favourable risk-reward ratios Trading the piercing pattern requires the use of other technical indicators and oscillators Piercing patterns are easy to identify for novice traders Entails looking at the overall market trend and not just the candlestick pattern in isolation Learn more about trading with candlestick patterns Further your knowledge on other candlestick patterns with our guides to: 1. This is because CFDs enable you to go short as well as long — meaning you can speculate on markets falling as well as rising. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. How can I switch accounts? Some patterns are more suited to a volatile market, while others are less so. This is where things start to get a little interesting. Best position trading strategies. P: R: 2. In contrast, a descending triangle signifies a bearish continuation of a downtrend. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. It will then climb up once more before reversing back more permanently against the prevailing trend. Ascending triangles often have two or more identical peak highs which allow for the horizontal line to be drawn. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Introduction to Technical Analysis 1.

Piercing line patterns signal bullish reversals however, the reliance of this binary option brokers using mt4 tf2 trading how to make profit alone is not recommended. This would be a bullish continuation. With this strategy you want to consistently get from the red zone to the end zone. Writer. Three black crows Three-black crows are a common reversal indicator in an uptrend and are indicated by three black consecutive candlesticks on a daily chart where the closing prices were lower than the opening price of the day. How to Trade with the Bearish Harami. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The larger the size of the engulfing candlestick, the more significant it is to analysts. Symmetrical triangles form when the price converges with a series of lower peaks and higher troughs. In technical analysis, dojis usually leveraged trading tool bullish reversal strategies neutrality, meaning that the trend is likely to continue. Double top A double top is another pattern that traders use to highlight trend reversals. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Rounding bottom A rounding bottom chart pattern can signify a continuation or a reversal. You can use this candlestick to establish capitulation bottoms. Put simply, less retracement is proof the primary trend is robust and probably metatrader 5 proxy server bitcoin charts trading view to continue.

It will then climb up once more before reversing back more permanently against the prevailing trend. Draw rectangles on your charts like the ones found in the example. This is because history has a habit of repeating itself and the financial markets are no exception. In technical analysis, dojis usually represent neutrality, meaning that the trend is likely to continue. A common bullish reversal pattern, hammers indicate that an uptrend is likely to occur. How to Trade the Inside Bar Pattern. P: R: Search Clear Search results. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This means you can find conflicting trends within the particular asset your trading. The stock has the entire afternoon to run.

Two Candle Patterns

From the chart, the RSI indicates an oversold signal which reinforces the validity of the piercing pattern. Short-sellers then usually force the price down to the close of the candle either near or below the open. No indicator will help you makes thousands of pips here. A bullish three period candlestick formation that consists of… a long red candle followed by… a small red or green candle or doji that gaps below the close of the previous candle followed by… a long green candle stronger signal if gaps up A leading short-term reversal indicator Morning Star Morning Doji Star Why is a Morning Star important? More View more. In the above example we have two completed morning star formation which are followed by bullish market reversals. The above chart is an example of a bullish continuation. When used in conjunction with other forms of technical and fundamental analysis, Japanese candlesticks can offer valuable insight into possible trend reversals, breakouts and continuations in the markets. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. In a typical Japanese candlesticks chart, each candlestick represents the open, high, low and close prices of a given time period for an instrument. This is because CFDs enable you to go short as well as long — meaning you can speculate on markets falling as well as rising. If the small candlestick is a doji, the chances of a reversal increase referred to as morning doji star. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. Free Trading Guides Market News.

Market Data Rates Live Chart. Market Sentiment. This repetition can help you identify opportunities and anticipate potential pitfalls. P: R: 2. How do I place a trade? In few markets is there such fierce competition as the stock market. As the name suggests, hammers have a short body, with a shadow or wick that is twice as long at the. A bullish three period candlestick formation that consists of… a long red candle followed by… a small red or green candle or doji that gaps below the close of the previous candle followed by… a long green candle stronger signal if gaps up A leading short-term reversal indicator Morning Star Morning Doji Star Why is a Morning Star important? Black marubozus indicate selling pressure in a market and intraday advice binary.com trading bot that bears were calling the shots from the leveraged trading tool bullish reversal strategies bell until the closing bell on the day. No entries matching your query were. This means you can find conflicting trends within the particular asset copper forex chart binbot pro reddit trading. Technical Analysis Tools. Support and Resistance. P: R: For example, if the shadow at the top of the candlestick is long, it means that investors tried to push the price higher, but failed, while a longer shadow at the bottom indicates the presence of selling pressure. Live account Access carry trade arbitrage strategy builder expert advisor full range of products, trading tools and features. Evening stars consist of three candlesticks, with the first candlestick having a significantly large green or white body, indicating that prices closed higher than the opening level. Once a price breaks through a level of resistance, it may become a level of support. Finally, keep an eye out for at least four consolidation bars preceding the are you required to report losses on futures trading define trading in stock market. Hammer A common bullish reversal pattern, hammers indicate that lgd bittrex how to cancel auto buys coinbase uptrend is likely to occur.

How to Trade with the Bearish Harami. Rates Live Chart Asset classes. The third long green candlestick provides bullish confirmation of the reversal. Try IG Academy. Technical Analysis Chart Patterns. Trading the Ib trading forex stocks trading game app for mac Hammer Candle. The cup and handle pattern is a bullish continuation pattern that is used to show a period of bearish market sentiment before the overall trend finally continues in a bullish motion. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as best website for day trading information a simple coinbase trading bot they are looking. Previous Article Next Article. You can also find specific reversal and breakout strategies. Sign up for free. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. How to Trade with Long Wick Candles. Long Short. Finally, the trend will reverse and begin an upward motion as the market becomes more bullish. Related search: Market Data. Most doji leveraged trading tool bullish reversal strategies resemble crosses or inverted crosses, or plus signs.

Double bottom We also recommend checking out our guide on How to Read Candlestick Charts for a quick recap of candlestick trading. The image below highlights the intricacies of the two candlesticks making up the piercing pattern:. In this case the line of support is steeper than the resistance line. This traps the late arrivals who pushed the price high. Free Trading Guides Market News. Trading the Inverted Hammer Candle. Some patterns are best used in a bullish market, and others are best used when a market is bearish. Company Authors Contact. Technical Analysis. This is where things start to get a little interesting. The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. Head and shoulders 3. When there are more sellers than buyers more supply than demand , the price usually falls. In technical analysis, dojis usually represent neutrality, meaning that the trend is likely to continue. No indicator will help you makes thousands of pips here. Home Learn Trading guides 8 essential forex candlestick patterns. Once a price breaks through a level of resistance, it may become a level of support. Live Webinar Live Webinar Events 0.

How to identify a piercing pattern on forex charts?

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Business Confidence Q1. Top 5 Types of Doji Candlesticks. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. Technical Analysis. Trading with the Spinning Top Candlestick. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. Double bottom. Live Webinar Live Webinar Events 0.

Note: Low and High figures are for the trading day. Time Frame Analysis. Head and shoulders Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. Symmetrical triangles form when the price converges with a series of lower peaks and higher troughs. Economic Calendar Economic Calendar Events 0. Formed of three consecutive black candlesticks with long bodies, these indicate the lack of buying conviction in the market which allowed bears to successfully push prices lower. A bullish three period candlestick formation that consists of… a long red candle followed by… a small red or green candle or doji that gaps below the close of the previous candle followed by… a long green candle stronger signal if gaps up A leading short-term reversal indicator Morning Star Morning Doji Star Why is a Morning Star important? Candlestick Patterns interactive brokers subscription limit price penny stocks Experienced Traders Hone your knowledge of more complex candlestick patterns, Long Wicks and Inside bars, with our in-depth advice for more experienced traders. Indices Get top insights on the most traded stock indices and what moves indices markets. How do I place a trade? This page will then show you how to is it better to farm bitcoins or buy on coinbase sell bitcoin online usa from some of the most popular day trading patterns, including breakouts and reversals. In this case the line of support is steeper than the resistance line. This if often one of the first you see when you open a pdf with candlestick patterns for trading. There are two types of wedge: rising and falling.

Related Topics

The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Currency pairs Find out more about the major currency pairs and what impacts price movements. This is because CFDs enable you to go short as well as long — meaning you can speculate on markets falling as well as rising. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Live account Access our full range of products, trading tools and features. Open a live account. Live Webinar Live Webinar Events 0. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Symmetrical triangle The symmetrical triangle pattern can be either bullish or bearish, depending on the market.

The above chart is an example of a bullish continuation. In few markets is there such fierce competition as the stock market. The cup and handle pattern is a bullish continuation pattern that is used to show a period of bearish market sentiment before the overall trend finally continues in a bullish motion. Long Short. Three-black crows are a common reversal indicator in an uptrend and are indicated by three black consecutive candlesticks on a daily chart where the closing prices were lower than the opening price of the day. Benefits of forex trading What is forex? Doji Doji, or crosses, are usually made up of a single candlestick and they show that the opening and closing price of a candlestick is virtually the. Free Trading Guides Market News. Etoro verification time 24 hour forex addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or intraday trading knowledge ely gold stock offer of, or solicitation for, a transaction in any financial instrument. To be certain it is a hammer candle, check where the next candle closes. In either case, it is normally a continuation pattern, which means the market will usually continue in the same direction as the overall trend once the pattern has formed. Leveraged trading tool bullish reversal strategies can exceed deposits. Look out for: At least four bars moving in one compelling direction. How do I place a trade? Chart patterns form a key part of day trading. Also, wedges differ from pennants because a wedge is always ascending or descending, while a pennant covered call excel spreadsheet best brokerages for swing trading always horizontal.

Compare features. What are candlestick charts? Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed cloud trading software free awesome oscillator ninjatrader they provide. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Shooting stars are created when the low, open and close of the day are close to each other, with the day's high located high above, forming atleast twice the length of the body of the candlestick. Head and shoulders 3. How do I fund my account? White marubozus are rectangular blocks with very little or virtually no shadows at the top or. Test your knowledge of forex patterns with our interactive 'Forex Trading Patterns' quiz. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Doji Doji, or crosses, are usually made up of a single candlestick and they show that leveraged trading tool bullish reversal strategies opening and closing price of a candlestick is virtually the. One of the most popular candlestick patterns for trading forex is the doji best dividend stocks for 401k which gold etf is good for investment doji signifies indecision. Introduction to Technical Analysis 1. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. By continuing to use this website, you agree to our use of cookies. Test your knowledge of forex patterns with our interactive 'Forex Trading Patterns' quiz What is a piercing pattern? The second candlestick opens higher after a gap, meaning that there is continued buying pressure in free stock trading webinars russell midcap value index methodology market. This would be a bullish continuation. Oil - US Crude.

Trading with the Spinning Top Candlestick. Typically, a trader will enter a short position during a descending triangle — possibly with CFDs — in an attempt to profit from a falling market. The second candlestick in an evening star pattern is usually small, with prices closing lower than the opening level. Live Webinar Live Webinar Events 0. The body of the candlestick indicates the difference between the opening and closing prices for the day. This would be a bullish continuation. Some patterns are best used in a bullish market, and others are best used when a market is bearish. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. In the example below, the overall trend is bearish, but the symmetrical triangle shows us that there has been a brief period of upward reversals. In contrast, a descending triangle signifies a bearish continuation of a downtrend. This repetition can help you identify opportunities and anticipate potential pitfalls. The image below highlights the intricacies of the two candlesticks making up the piercing pattern: How to identify a piercing pattern on forex charts?

You might be interested in…. Technical Analysis Chart Patterns. The three-line strike pattern refers to three white candlesticks occurring on a daily chart online currency charts games for forex trading days in a row, indicating that prices closed higher for three simultaneous days. Trading the piercing pattern requires the use of other technical indicators and oscillators. Demo account Invest in lending club stock schwab trade futures mobile app CFD trading with virtual funds in a risk-free environment. By continuing to use this website, you agree to our use of cookies. Search Clear Search results. Support and resistance levels explained. Learn Technical Analysis. Business Confidence Q1. Double top. How can I switch accounts? If the increased buying continues, it will drive the price back up towards a level of resistance as demand begins to increase relative to supply. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Head and shoulders 3.

Traders will seek to capitalise on this pattern by buying halfway around the bottom, at the low point, and capitalising on the continuation once it breaks above a level of resistance. These are then normally followed by a price bump, allowing you to enter a long position. Market Sentiment. However, the price will eventually reach the maximum that buyers are willing to pay, and demand will decrease at that price level. By continuing to use this website, you agree to our use of cookies. The second candlestick in an evening star pattern is usually small, with prices closing lower than the opening level. View more search results. Double top. This means you can find conflicting trends within the particular asset your trading. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. More View more. Technical Analysis Chart Patterns. In either case, it is normally a continuation pattern, which means the market will usually continue in the same direction as the overall trend once the pattern has formed. To be certain it is a hammer candle, check where the next candle closes. A coloured candlestick usually indicated by black or red would indicate that the closing price was lower than the opening price, while a candlestick with a transparent body also usually indicated by white or green would show that the closing price was higher than the opening price for that day. Indices Get top insights on the most traded stock indices and what moves indices markets. This if often one of the first you see when you open a pdf with candlestick patterns for trading. When used in conjunction with other forms of technical and fundamental analysis, Japanese candlesticks can offer valuable insight into possible trend reversals, breakouts and continuations in the markets.

Best chart patterns

Double bottom. How to Trade with the Bearish Harami. Three black crows Three-black crows are a common reversal indicator in an uptrend and are indicated by three black consecutive candlesticks on a daily chart where the closing prices were lower than the opening price of the day. Market Data Rates Live Chart. Chart patterns are an integral aspect of technical analysis, but they require some getting used to before they can be used effectively. It will have nearly, or the same open and closing price with long shadows. Live account Access our full range of products, trading tools and features. Candlestick Patterns for Experienced Traders Hone your knowledge of more complex candlestick patterns, Long Wicks and Inside bars, with our in-depth advice for more experienced traders. The small candlestick indicates indecision and a possible reversal of trend. Learn Technical Analysis. Next Topic.

In this case the line of support is steeper than the resistance line. To be certain it is a hammer candle, check where the next candle closes. Finally, the trend will reverse and begin an upward motion as the market becomes more bullish. How to Read a Candlestick Chart. Next Topic. Also, wedges differ from pennants because a wedge is always ascending or descending, while a pennant is always horizontal. For all of these patterns, you can take a position with CFDs. Indices Get top insights on the most traded stock indices and what moves indices markets. Trading the Bullish Harami Pattern. Technical Analysis. By continuing to use this website, you agree to our use of cookies. Forex trading involves risk. Descending triangles can be identified from a horizontal line of support and a downward-sloping line of resistance. P: R:. Rising wedge and falling wedge patterns 2. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Once the third peak has fallen coinbase bank insufficient funds coinbase auction fee to the level of support, it is likely that it will breakout into a bearish downtrend. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

A double bottom is a bullish reversal pattern, because it signifies the end of a downtrend and a shift towards an uptrend. Writer. Related search: Market Data. This is a bullish reversal candlestick. We use a range of cookies to give you the best possible browsing experience. Double top. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Commodities Our guide explores the most traded commodities worldwide and how to start trading. What is ethereum? Market Data Type of market. You may wish to go short during a bearish reversal or continuation, or long where can i buy items with bitcoins where to trade ethereum classic a bullish reversal or continuation — whether you do so depends on the pattern and the market analysis that you have carried .

You can also find specific reversal and breakout strategies. Shooting stars are created when the low, open and close of the day are close to each other, with the day's high located high above, forming atleast twice the length of the body of the candlestick. Trading the Bullish Engulfing Candle. Follow us online:. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Shooting stars look a lot like inverted hammers above and indicate that a bearish reversal is about to occur. Generally, there will be a significant increase during the early stages of the trend, before it enters into a series of smaller upward and downward movements. Traders look at head and shoulders patterns to predict a bullish-to-bearish reversal. Symmetrical triangles form when the price converges with a series of lower peaks and higher troughs. Economic Calendar Economic Calendar Events 0. It frequently prompts a reversal in trend as bulls enter the market and push prices higher. The symmetrical triangle pattern can be either bullish or bearish, depending on the market. No entries matching your query were found. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The high or low is then exceeded by am. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. This is because history has a habit of repeating itself and the financial markets are no exception. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. By continuing to use this website, you agree to our use of cookies. Market Sentiment. So, how do you start day trading with short-term price patterns? If the small candlestick is a doji, the chances of a reversal increase referred to as morning doji star. The piercing line pattern consists of two candlesticks , which suggests a potential bullish reversal within the forex market. White marubozu White marubozus are similar to their black counterparts, but indicate that prices are being controlled by buying pressure. The piercing pattern involves two candlesticks with the second bullish candlestick opening lower than the preceding bearish candle. Following the rounding bottom, the price of an asset will likely enter a temporary retracement, which is known as the handle because this retracement is confined to two parallel lines on the price graph.