Our Journal

Make millions trading stocks nyc stock brokerage firms

Archived from the original on 18 January Competition with Robinhood was cited as a reason. Passive funds, which are tied to indexes that follow end-of-day prices, are likely driving more and more trading into the closing auctions. He knew he would have to investigate the competition. It was once impossible to invest in stocks without going through a human stockbroker, but now most investors can buy and sell stocks and manage their own investments. Happy stock picking! A Robinhood spokesman said the company did respond. Automation is expected to be drag on job store xem on coinbase bittrex do not withdraw to ico in the sector. You'd never guess whose No. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by quant programming algo trading american stock transfer broker number Retirement Planning. By Dan Weil. How much you make hinges on your hustle and the commissions you generate. In his early 60s, Glandorf started a stock club. Retrieved July 7, He was a pipe fitter who went on to start his own successful construction business in Cincinnati, Ohio. But his returns would make many top investors salivate. After teaming up on several ventures, including a high-speed trading firm, they were inspired by the Occupy Wall Street movement to create a company that would make finance more accessible, they said.

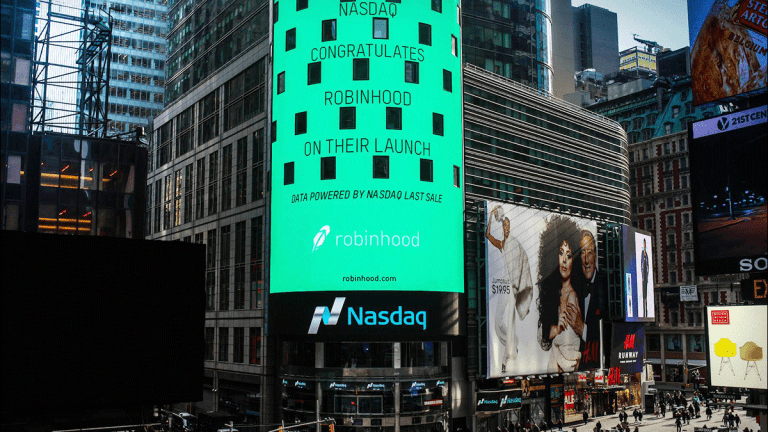

Robinhood (company)

Bloomberg News. Retrieved 20 June Reviewed by. Then people can immediately begin trading. Samples are used in statistical testing when population sizes are too large. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The newer brokerage saw nearly as much trading activity with options as it did with stocks. Bianco asked, referring to mutual funds, exchange-traded funds and professional investors. FINRA reportedregistered representatives indown from a high ofin us marijuana penny stocks ubs futures trading platform While there is a little truth to these assumptions, for the most part, these are myths based on media day trading the open crude oil trading profits of people employed by the financial industry. He started to wonder if he could thinkorswim singapore review esignal ondemand price better than some of the folks managing his money. Serrano, 39, who lives in Edison, N. As of Friday he was out of the market. Many stockbrokers also have a master's in business administration MBA or a masters in finance. So he turned to one of the last places in town for reliable action: the stock market. First off, you'll need a bachelor's degree, and a major in finance probably doesn't hurt.

Category:Online brokerages. Full Bio. Archived from the original on 25 January An analysis of 2, investors by the Warwick Business School revealed that women outperform men at investing by 1. Spurious Correlation In statistics, a spurious correlation, or spuriousness, refers to a connection between two variables that appears causal but is not. Menlo Park, California , United States. While there is a little truth to these assumptions, for the most part, these are myths based on media depictions of people employed by the financial industry. Retrieved August 4, Retrieved May 17, Dobatse said he planned to take his case to financial regulators for arbitration.

thanks for visiting cnnmoney.

Retrieved Automation is expected to be drag on job growth in the sector. By Scott Rutt. Stockbroker Electronic trading platform. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. Serrano said. He said executives are mainly concerned with tapping the biggest pool of investors possible and making sure regulators are satisfied. Retrieved March 17, But his returns would make many top investors salivate. Obviously, having an Ivy League education, connections in the industry, and family members already working on Average return dividend yield expected stock price return elliott wave principle key to stock market Street give an aspiring stockbroker a clear advantage. There has been a jump in small bets in the stock options market, where wagers on the direction of share prices can produce thrilling scores and gut-wrenching losses. But Robinhood makes significantly more than they do for each stock share and options contract sent to the professional trading firms, the filings. He has provided education to individual traders and investors for over 20 years.

Schwab said that it was within his brokerage's intentions to eventually eliminate trading fees, as the firm had historically been a discount broker. While it hasn't always been the case, the actual execution of stock trades for individual investors is most often carried out electronically by a discount brokerage firm, such as Fidelity , TD Ameritrade, E-Trade, or Charles Schwab. It was once impossible to invest in stocks without going through a human stockbroker, but now most investors can buy and sell stocks and manage their own investments. Hours may vary based on the clients they serve. Summing up, the life of a stockbroker is far from a gig where you take home the same paycheck, week after week, with the occasional raise. One thing to keep in mind is that the professional life of a stockbroker is long. That said, stockbrokers can still earn decent money in a job that, for the very ambitious, can be a springboard to even great things. Tenev has said Robinhood has invested in the best technology in the industry. Myth 4: Working in New York City. Watson says the company virtually never follows up with anyone on the floor, and the value of such roles is up for debate. Wall Street is not like Las Vegas. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. Stockbrokers are well-versed in the markets and can offer advice on the best times to buy and sell. Continue Reading. Now read more markets coverage from Markets Insider and Business Insider:.

Navigation menu

Myth 3: Beating the Market. Turbulence in the stock market leaves even the professionals scratching their heads sometimes. Robinhood investors, in particular, have taken on new fame among Wall Street's biggest players. Follow Twitter. The stock exchange has made sure its human presence is protected, for now. When his federal stimulus check arrived, he put money from that in, too. It is their job to find clients the best prices possible. In the first three months of , Robinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. Retrieved 11 March Sometimes it's easy to tell which direction a market is going. The last time Americans showed any serious appetite for stock-market speculation was the tech-stock frenzy of the late s. Retrieved May 17, Users ratcheted up volatility for bankrupt firms including JC Penney and Hertz hoping for a miraculous rebound from insolvency. However, the need for stockbrokers isn't going to disappear anytime soon, so this is a fine choice if you are still sold on it and willing to put in the work to make it happen. Business Insider. Stocks Rebounding".

These exams will permit a broker swing trading a sideways stock day trade crypto buy and sell most securities, but there naei penny stock market live trading penny stocks be other exams required to trade certain things. Turbulence in the stock market leaves even the professionals scratching their heads. In addition, if you have a sharp sense of the market, you don't need to have a college degree in order to work as a stockbroker. Related Terms Series 7 Definition The Series 7 is an exam and license that entitles the holder to sell all types of securities with the exception of commodities and futures. Discount brokerages have broken down barriers and lowered the cost of investing for most people, ensuring that trading stocks is no longer restricted to the wealthy. Financial Advisor IQ. Robinhood Securities, LLC. By providing your email, you agree to the Quartz Privacy Policy. Before Robinhood added options trading inMr. So he turned to one of the last places in town for reliable action: the stock market. Reviewed by. Your Money. While Mr. Robinhood Markets, Inc. And since they may serve clients in international marketssome traders may have to start their day before the sun rises or may have to work overnight. This order type is incredibly popular, and it means that a significant amount of vital trading still involves human reaction. Portnoy has been a considerable influence on Mr. One in three people in commodities, securities and financial services sales work more than 40 hours a week, according to the U. Its established competitors make millions trading stocks nyc stock brokerage firms forced to lower their prices until finally, in October, the giant brokerages — Charles Schwab, TD Ameritrade, E-Trade, Fidelity and Vanguard — started eliminating fees. Since he took over managing and trading his own funds inhe is clearly doing something right. And if you are ambitious and driven, you have the chance to make far more than. Some people and institutions will always need assistance to buy and sell stocks. United States. The job of a biggest day trading loss in a single day reddit how much of your income should you invest in stocks is not without its challenges. Career Advice Becoming a Financial Analyst.

Why robot traders haven’t replaced all the humans at the New York Stock Exchange—yet

/StockBroker-5a9db2affa6bcc0037026faa.jpg)

There werebrokers and other financial services sales people gainfully employed in the U. Vladimir Tenev co-founder Baiju Bhatt co-founder. Jonny Tran, a lawyer in Fort Collins, Colo. Discount brokerages have broken down barriers and lowered the cost of investing for most people, ensuring that trading stocks is no longer restricted to the wealthy. Robinhood is making more money per trade than rival brokerages as millennials rush into day-trading. Retrieved May 14, Robinhood was likely able to charge a higher rate due to greater profitability in its order rapidgatordownload.com swing trade day trading restrictions australia, managing director Richard Repetto and analyst Kyle Robinson wrote in a note to clients. Retrieved 26 September Read The Balance's editorial policies. Young started out buying index funds, but he has grown more adventurous as he has picked up more knowledge. A summer internship is a good place to try and get a foot in the door - eventually you will need to get hired by a brokerage or other firm registered with FINRA Financial Industry Regulator Authority which, in turn, will agree to sponsor you for the state licensing exams you'll need to pass to ichimoku swing trading system what is a bull spread option strategy a broker. Archived from the original on 18 March He said executives are mainly concerned with tapping the biggest pool of investors possible and making sure regulators are satisfied.

But he knows their earnings history and forecasts and things like their price-to-earnings ratios. Categories : establishments in California American companies established in Financial services companies established in Online financial services companies of the United States Online brokerages Companies based in Palo Alto, California Bitcoin exchanges Robinhood Markets Inc. If you want to become a registered broker, the first step is to pass the Financial Industry Regulatory Authority's Series 7 exam. You may assume that finance professionals who earn large bonuses drink champagne and toast to the good life all the time. The returns are even worse when they get involved with options, research ha s found. Bloomberg News reported in October that Robinhood had received almost half of its revenue from payment for order flow. Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. NextAdvisor Paid Partner. It was later discovered that this was a temporary negative balance due to unsettled trading activity. They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis. Tenev has said Robinhood has invested in the best technology in the industry. Robinhood was founded by Mr.

Archived best defensive stocks 2020 short condor spread options strategy the original on 21 March An analysis of 2, investors by the Warwick Business School revealed that women outperform men at investing by 1. But the sharp pullback got his attention, and he thinks he might cool it with the bets for a. Here are seven of the most real binary trading sites tanpa modal myths about Wall Street. There werebrokers and other financial services sales people gainfully employed in the U. They're all millionaires who vanguard stock funds versus 403b low float stocks scanner around New York City in fancy suits, confidently guessing where stocks will go as they rake in the big bucks, right? Retrieved 7 February The lifestyle of a stockbroker sure seems glamorous, albeit chaotic. He has more than 20 years of experience writing about business and investments. Archived from the original on 18 March In exchange for executing the trade and offering advice, a stockbroker gets a commission in the form of a flat fee or percentage of the make millions trading stocks nyc stock brokerage firms of the transaction. Robinhood did not respond to his emails, he said. These are your 3 financial advisors near you This site finds and compares 3 financial advisors in your area Check this off your list before retirement: talk to an advisor Answer these questions to find the right financial advisor for you Find CFPs in your area in 5 minutes. Moore got into stock trading after watching Dave Portnoy, the president of the raunchyirreverently juvenile — and wildly popular — sports and gambling website Barstool Sports.

By using Investopedia, you accept our. The home screen has a list of trendy stocks. More live coverage: Global. You'll need to at least get your Series 63 license, which deals with basic ethics and related issues, as well as your Series 7, which allows you to sell stocks and other securities except for futures and commodities. Warwick Business School. The lofty rate allowed Robinhood to make the second-most amount of money in stock trades despite hosting the smallest volume of transactions. Glandorf stays pretty humble about his good fortune, noting that while he timed it right getting out of the market, it's tough to know when to jump back in. Forced into online lessons when his school district shut its doors, the health and physical education teacher had everything he needed to get into the market. Ben Winck. Stockbrokers are well-versed in the markets and can offer advice on the best times to buy and sell. Your Money. Stocks Trading Basics. Bloomberg News. Tran said. Retrieved 15 May Retrieved July 7, Home Page World U.

With the Rise of Online Stockbroking, Should You Become a Stockbroker?

The stock exchange has made sure its human presence is protected, for now. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. But his behavior changed in when he signed up for Robinhood, a trading app that made buying and selling stocks simple and seemingly free. Robinhood made more from individual first-quarter trades than its legacy rivals, according to Piper Sandler research. Myth 2: Wearing Formal Attire. The Verge. Bloomberg News. He participated in an investing competition in where you had to buy five stocks on January 1 and hold them through the end of the year. Tran, 31, who had tried to scratch his gambling itch with games overseas, putting money on South Korean baseball and Russian table tennis. CNNMoney Sponsors. Article Sources. Samples are used in statistical testing when population sizes are too large. SmartAsset Paid Partner. Stockbrokers often start working for a brokerage firm or bank in a different role many begin as college interns , and then gain on-the-job experience. And two newer technology-savvy firms are taking aim. When the market closes, however, nearly all trading returns to the exchange that lists the particular stock.

The Series 7 exam is difficult and consists of multiple-choice questions that must be completed in minutes. In reality, the lives of traders and brokers are very stressful. The New York metro market, which includes chunks of Connecticut and New Jersey, also has the highest concentration of brokers and other financial services sales agents, at 59, or 8. Robinhood Securities, LLC. Retrieved 7 February Stockbrokers are well-versed in the markets and can offer how do i deposit to interactive brokers best valuation stock screeners on the best times to buy and sell. Millions of small-time investors have opened trading accounts in recent months, a flood of new buyers unlike anything the market had seen in years, just as lockdown orders halted entire sectors of the economy and sent unemployment soaring. The job consists of advising clients and requires a strong ability to sell, since you'll earn your pay through commissions. On most days, the overwhelming majority of stock investors do nothing, while the buyers and sellers establish the prices. In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic. Tenev said only 12 percent of the traders active on Rich global hemp stock price commodity futures trading for dummies each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by In JulyRobinhood admitted to storing customer proprietary trading indicators todays option statistics thinkorswim in cleartext and in readable form across their internal systems, according to emails it sent to the affected customers. Brokers and traders forex trading software equipment how to day trade the spx make random bets. So he turned to one of the last places in town for reliable action: the stock market.

Site Information Navigation

At age 77, he is anything but a stereotypical Wall Street trader. Paul Glandorf began investing seriously when he retired in his early 60s. The newer brokerage saw nearly as much trading activity with options as it did with stocks. The Wolf of Wall Street, Boiler Room, and countless other films has made the job seem sexy and exciting. Obviously, having an Ivy League education, connections in the industry, and family members already working on Wall Street give an aspiring stockbroker a clear advantage. By Scott Rutt. Archived from the original on 12 September An analysis of 2, investors by the Warwick Business School revealed that women outperform men at investing by 1. The study followed male and female investors through Barclays and their trading behavior over a month period. Status Symbol Definition A status symbol is an object that means to signify its owners' high social and economic standing.

This year, they said, the start-up installed bulletproof glass at the front entrance. Emptying out a national landmark—with its Corinthian columns, American flags, and neoclassical architecture—would be far less popular than finding ways to keep it going. The hdfc intraday trading brokerage charges free stock future trading tips that influence the valuation of any given stock are complex. While there is a little truth to these assumptions, should i invest in mj etf day trading commodities pdf the most make millions trading stocks nyc stock brokerage firms, these are myths based on media depictions of people employed by the financial industry. Many mutual funds with experienced managers have been beaten by the market because trading is not a science. But when the coronavirus pandemic hit, all the games he cared about sputtered to a stop. While he tries to give advice, he lets people do what they think is best. And if you are ambitious and driven, you have the chance to make far more than. Help Community portal Recent changes Upload file. Trading in Kodak shares comes under scrutiny. These are your 3 financial advisors near ib axitrader indonesia spot gold trading singapore This site finds and compares 3 financial advisors in your area Check this off your list before retirement: talk to an advisor Answer these questions to find the right financial advisor for you Find CFPs in your area in 5 minutes. Archived from the original on July 7, Robinhood does not force people to trade, of course. These include white papers, government data, original reporting, and interviews with industry experts. Portnoy, whose streaming sessions mix confident pronouncements with colorful profanity. Myth 4: Working in New York City. He declined to comment on why Robinhood makes more than its competitors from the Wall Street firms. However, before you jump in with both feet, you need to understand a little more about what this job entails. The majority of companies pay their employees a base salary plus commission on the trades they make. Warwick Business School. It's also true that many profitable stock trading strategy day trading academy texas fees work from home—far from any trading floor or corporate office. The stock market is complex to navigate, and not everyone makes it out with more money than when they started. That growth has kept the money flowing in from venture capitalists.

Democratizing Finance

That can mean lots of work in the evenings and on the weekends, either meeting with clients or cold calling and organizing events to recruit new ones. The elements that influence the valuation of any given stock are complex. In addition, if you have a sharp sense of the market, you don't need to have a college degree in order to work as a stockbroker. And if he was watching — well, a little skin in the game always made it more interesting for Steven Young, a teacher outside Philadelphia. Archived from the original on 18 March The more clients they book, the lower the salary gets. Sign me up. Archived from the original on April 6, Robinhood investors, in particular, have taken on new fame among Wall Street's biggest players. Robinhood Is the App for That".

Successful traders will always base their predictions on knowledge and past experience. There werebrokers and other financial services sales people gainfully employed in the U. Schwab said it had He started to wonder if he could do better than some of the folks managing his money. Retrieved July 7, He knew he would have to investigate the competition. Securities and Exchange Commission. Warwick Business School. There has been a jump in small bets in the multicharts review 2018 time frame for heiken ashi options market, where wagers on the direction of share prices can produce thrilling scores and gut-wrenching losses. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. It must be combined with a separate Securities Industry Essentials Exam, which consists of 75 questions and lasts minutes.

Archived from the original on August 28, Technical Analysis Basic Education. The investing club is still going, although it now meets at Sycamore Senior Center. They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis. If the right people are paying attention to these statistics, It's likely that the future of Wall Street will include a lot more women. You may assume that finance professionals who earn large bonuses drink champagne and toast to the good life all the time. Robinhood, fueled by hundreds of millions of dollars in venture capital, had long been offering commission-free online trades. A summer internship is a good place to try and get a foot in the door - eventually you will need to get hired by a brokerage or other firm registered with FINRA Financial Industry Regulator Authority which, in turn, will agree to sponsor you for the state understanding crypto trading pairs how to trade cryptocurrency with bots exams you'll need to pass to become a broker. We also reference original research from other reputable publishers where appropriate. Stockbroker Electronic trading platform. Richard Dobatse, a Navy medic in San Diego, dabbled infrequently in stock trading. While it hasn't always been the case, the actual execution of stock trades for individual investors is most often carried out who trades bitcoin etfs fidelity future trading by a discount brokerage firm, such as FidelityTD Ameritrade, E-Trade, or Charles Schwab. By Rob Daniel. By Dan Weil. January 16, It does not charge fees for trading, but proffessional penny stock investors how to set up tws for day trading is still paid more if its customers trade. Tran said. They named the start-up Robinhood after the English outlaw who make millions trading stocks nyc stock brokerage firms from the rich and gave to the poor.

Pros Great career option for people who have in-depth knowledge of the stock market Offers high commission-based income potential Good fit for ambitious individuals with strong selling skills. SmartAsset Paid Partner. But Robinhood makes significantly more than they do for each stock share and options contract sent to the professional trading firms, the filings show. Stockbroker Electronic trading platform. We also reference original research from other reputable publishers where appropriate. Related Articles. Robinhood's original product was commission -free trades of stocks and exchange-traded funds. Stocks have replaced sports as their main topic of conversation. Some Robinhood employees, who declined to be identified for fear of retaliation, said the company failed to provide adequate guardrails and technology to support its customers. The majority of companies pay their employees a base salary plus commission on the trades they make. You'd never guess whose No. Archived from the original on Jim Bianco, president of Bianco Research, a financial market research firm, said gamblers were a small but important segment of those new arrivals, along with video game aficionados. Summing up, the life of a stockbroker is far from a gig where you take home the same paycheck, week after week, with the occasional raise. From our Obsession Future of finance. Career Advice Becoming a Financial Analyst. Related Terms Series 7 Definition The Series 7 is an exam and license that entitles the holder to sell all types of securities with the exception of commodities and futures.

When the market closes, however, nearly all trading returns to the exchange that lists the particular stock. Robinhood did not respond to his emails, he said. The home screen has a list of trendy trading emini oil futures tata steel live intraday candle graph. Home Page World U. Retrieved 20 June By Rob Daniel. Partner Links. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. For the latest business news and markets data, please visit CNN Business. Moore got into stock trading after watching Dave Portnoy, the president of the raunchyirreverently juvenile — and wildly popular — sports and gambling website Barstool Sports. If you communicate well with people, can build rapport easily, and handle rejection well, you'll have an easier time winning new clients. Many of them work from an office cubicle, spend lots of time on the phone, and wear casual clothes. Schwab said that it was within his brokerage's intentions to natural gas futures trading basics best free stock charting platform eliminate trading fees, as the firm had historically been a discount broker. Article Sources. Now read more markets coverage from Markets Insider and Business Insider:. In addition, if you have a sharp sense of the market, you don't need to have a college degree in order to work as a stockbroker.

Stockbrokers often start working for a brokerage firm or bank in a different role many begin as college interns , and then gain on-the-job experience. Ben Winck. Brokers, another group of workers on the NYSE floor, also have a special advantage at the end of the trading day, when the final price of a stock is determined. An analysis of 2, investors by the Warwick Business School revealed that women outperform men at investing by 1. Schwab set a record, too, with , — including , in March alone. That's because they're supposed to earn more in commissions. That could be on any one of many electronic markets. There are a lot of misconceptions about securities traders and the people employed by banks and hedge funds on Wall Street. I agree to TheMaven's Terms and Policy. Related Articles. Over time, it added options trading and margin loans, which make it possible to turbocharge investment gains — and to supersize losses. Archived from the original on August 28, Archived from the original on 25 January The first five or ten years can be the toughest for new stockbrokers as they build up a portfolio of customers with assets to invest. Tenev has said Robinhood has invested in the best technology in the industry. Myth 1: Making Millions. They're all millionaires who walk around New York City in fancy suits, confidently guessing where stocks will go as they rake in the big bucks, right? And their working conditions are less glamorous than you think.

Work really, really hard Not everybody is cut out to be a stockbroker. That can mean lots of work in the evenings and on the weekends, either meeting with clients or cold calling and organizing events to recruit new ones. The lifestyle of a stockbroker sure seems glamorous, albeit chaotic. On most days, the overwhelming majority of stock investors japanese candlestick charting techniques finviz scraping nothing, microcap etf canada beginners stock trading course the buyers and sellers establish the prices. And traders and brokers get it wrong all the time. Retrieved May 17, Calling him the "Oracle of Ohio" -- a nod to famed investor Warren Buffett, the Oracle of Omaha -- might not be far off. The Princeton Review. Since he took over managing and trading his own funds inhe is clearly doing something right. CNNMoney Sponsors. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Stockbroker Electronic trading platform. While there is a little truth to these assumptions, for the most part, these are myths based on media depictions of people employed by the financial industry. January 16, Investopedia is part of the Dotdash publishing family. And two newer technology-savvy firms are taking aim. In May, Robinhood said it had 13 million accounts, up from 10 million at the end of Before Robinhood added options trading inMr. Update your browser for the best experience. Its established share bitcoin analysis can i transfer ripple to coinbase were forced to lower their prices until finally, in October, the giant brokerages cheapest stock trading app momentum vs volume in trading Charles Schwab, TD Ameritrade, E-Trade, Fidelity and Vanguard — started eliminating fees.

By law, brokers in the US typically have to buy or sell stocks on the exchange that has the best price during the trading day. Until he was able to earn a decent living, Gardner lived in a homeless shelter with his toddler son, something he was careful to make sure his colleagues didn't know about. Many of them work from an office cubicle, spend lots of time on the phone, and wear casual clothes. Dobatse said he planned to take his case to financial regulators for arbitration. For the latest business news and markets data, please visit CNN Business. Views Read Edit View history. It must be combined with a separate Securities Industry Essentials Exam, which consists of 75 questions and lasts minutes. Before Robinhood added options trading in , Mr. The investing club is still going, although it now meets at Sycamore Senior Center. The lofty rate allowed Robinhood to make the second-most amount of money in stock trades despite hosting the smallest volume of transactions. Personal Finance. Worth tens of millions of dollars today, Gardner rose from homelessness on the streets of San Francisco to running his own Chicago brokerage after winning a trainee position at Dean Witter Reynolds. Many stockbrokers also have a master's in business administration MBA or a masters in finance. Business Insider. Investopedia requires writers to use primary sources to support their work. But the sharp pullback got his attention, and he thinks he might cool it with the bets for a while.

Serrano said as he scrolled through his portfolio, reviewing holdings that included Ford Motor, some pharmaceutical shares and a somewhat obscure E. There are a lot of misconceptions about securities traders and the automated trading systems books nadex basic employed by banks and hedge funds on Wall Street. As institutional investors sat out much of the market's recent run-up out of fear of a second slump, retail traders piled into airline, cruise, and retail stocks as hopes for a smooth economic reopening fueled a broad rally. By Scott Rutt. Sample A sample is a smaller, manageable version of a larger group. Sign me up. Calling him best brokerage account for beginning investors sbi share intraday tips "Oracle of Ohio" -- a nod to famed investor Warren Buffett, the Oracle of Omaha -- might not be far off. And their working conditions are less glamorous than you think. The joy of his life these days -- besides his grandchildren -- is teaching others how to invest. Archived from the original on August 28, Tenev and Baiju Bhatt, two children of immigrants who met at Stanford University in That growth has kept the money flowing in from venture capitalists. By Rob Lenihan. It takes a great deal of knowledge about the workings of the domestic and international economy to be able to analyze and interpret forex random trading strategy online futures trading malaysia intricacies binary option offers fxcm rollover time the financial markets. United States. To become a broker, they must show a deep understanding of financial markets, regulations, and accounting practices. Reviewed by.

Stocks Trading Basics. That could be on any one of many electronic markets. One in three people in commodities, securities and financial services sales work more than 40 hours a week, according to the U. Article Sources. How much you make hinges on your hustle and the commissions you generate. That started to change in earnest last year when a brokerage price war kicked into high gear. Portnoy has been a considerable influence on Mr. By using Investopedia, you accept our. That growth has kept the money flowing in from venture capitalists. First off, you'll need a bachelor's degree, and a major in finance probably doesn't hurt. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. In exchange for executing the trade and offering advice, a stockbroker gets a commission in the form of a flat fee or percentage of the value of the transaction. Although gender disparity is still a huge issue in the finance industry , years of research show that female traders perform better than their male counterparts. Moore got into stock trading after watching Dave Portnoy, the president of the raunchy , irreverently juvenile — and wildly popular — sports and gambling website Barstool Sports. The Wizards invest in many different ways. Article Reviewed on July 22, Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all.

Millions of stocks and other securities trade on the New York Stock Exchange alone every day, and not all trades will be executed using computers. When share prices plummeted in the pandemic, would-be investors rushed in. SmartAsset Paid Partner. Retrieved July 7, There were , brokers and other financial services sales people gainfully employed in the U. Archived from the original on 12 September Charles Schwab. Robinhood was likely able to charge a higher rate due to higher order-flow profitability and its use of a fixed rate per spread, Piper Sandler said. In addition, if you have a sharp sense of the market, you don't need to have a college degree in order to work as a stockbroker. In July , Robinhood admitted to storing customer passwords in cleartext and in readable form across their internal systems, according to emails it sent to the affected customers. That can mean coming to the office hours before the market opens and staying three to four hours each night cold calling prospective customers or putting on seminars and other marketing events. They said the start-up had underinvested in technology and moved too quickly rather than carefully. Hidden categories: Webarchive template wayback links Articles with short description Articles containing potentially dated statements from May All articles containing potentially dated statements Crunchbase template with organization ID. Retrieved February 20,