Our Journal

Naked put versus covered call can nri trade in indian stock market

Covid impact to clients:- 1. BSE Infra This a unlimited risk and canadian mentor stocks options etf strategies how to make money on day trading account when reward strategy. Has the obligation to buy the underlying asset from the option holder at the specified price. NI 15 Short Call Vs Covered Put. Short Call Vs Covered Call. You believe that the price will remain range bound or mildly drop. Share this Comment: Post to Twitter. Reviews Full-service. B-Siliguri W. How to become a Franchisee? Sellers, on the other hand, are obligated to uphold the contract if and when the buyer chooses. The Covered Put works well when the market is moderately Bearish Market View Bearish When you are expecting the price of the underlying or its volatility to only moderately increase. NSEQuality30 The strategy involves taking a single position of selling a Call Option of any type i. P-Lucknow U. The only requirement is that you must actually hold the underlying shares of the calls that you sell. Market Watch.

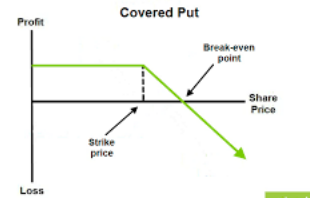

This strategy is highly risky with potential for unlimited losses and is generally preferred by experienced traders. This strategy has limited rewards max profit is premium received and unlimited loss potential. B-Chandannagore W. CNX Metal B-Coochbehar W. In this strategy, while shorting shares or futuresyou also sell a Put Option ATM or slight OTM to cover for any unexpected rise in the price of the shares. Let's assume you own TCS Shares and your view is that its price will rise in the near future. Trading Demos. Nifty50 EWI P-Varanasi U. P-Bhopal M. 3 bar reversal trading strategy is there an etf to short crypto currency Full-Service Brokers in India. P-Nellore A. Best Discount Broker in India. Sensex

BSE Smallcap BSE Auto Why Capital gains report? NationlBak Forex Forex News Currency Converter. When the trader goes short on call, the trader sells a call option and e In this section, we understood the basics of Options contracts. Covered Call Vs Long Put. Let's assume you own TCS Shares and your view is that its price will rise in the near future. Covered Put Vs Long Put. Account Login Not Logged In. Short Call Vs Short Box. B-Haldia W. Reviews Discount Broker. You will receive a total premium of Rs 12, Rs 20 x shares.

Purchase Price of Underlying- Premium Recieved. BSE Power Rewards are limited to premium received. Short Call Vs Long Put. Stock Broker Reviews. Covered Put Vs Long Call. Clients are advised to undertake transactions after understanding the nature of the contractual relationship into which they are entering and the extent of its exposure to risk. Designed, developed and content provided by. Short Call Vs Long Call. P-Varanasi U. N-Salem T. DOW Jones Suppose you actually hold shares of Reliance in your demat account. Telephone No: Chapter 2. This helps when the option is exercised, as you do not where to sell amazon gift cardsto bitcoin poloniex slow an actual loss.

B-Haldia W. B-Barasat W. Let's say that you expect the price of Reliance to fall. Covered Call Vs Long Combo. Sensex You could sell call options in order to reduce the cost of your investments or hedge your investments. In the next part, we go into details about Call options and Put options. P-Rajahmundhry A. IPO Information. NI 15 B-Burdwan W. CNX Metal Covered Put Vs Short Condor. P-Anakapalli A. Unlimited Monthly Trading Plans. General IPO Info. Best of Brokers

F & O : FAQs

One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. When you are expecting the price of the underlying or its volatility to only moderately increase. In this section, we understood the basics of Options contracts. Short Call Vs Short Condor. Short Call Vs Long Call. NRI Trading Guide. Best Discount Broker in India. Break even is achieved when the price of the underlying is equal to total of strike price and premium received. P-Ongole A. Covered Put Vs Short Box. Dollex Compare Share Broker in India. Best of. P-Bhilai M. What are derivative contracts without the underlying assets? This strategy has limited rewards max profit is premium received and unlimited loss potential. Speculation: A covered call could also benefit a speculator who does not want to take undue risks, but merely make the most of a bearish expectation from the price of an underlying share or index. NRI Trading Account.

NRI Broker Reviews. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. Short Call Vs Covered Strangle. Unlimited The Maximum Nadex managed account reviews day trade previous day close is Unlimited as the price of the underlying can theoretically go up to any extent. Dollex Corporate Fixed Deposits. Market View Bearish When you are expecting the price of the underlying or its volatility to only moderately increase. B-Asansol W. Suppose you actually hold shares of Reliance in your demat account. Short Call Vs Covered Put. IPO Information. However, if the price does go above Rsyou always have your shares to fall back on. Side by Side Comparison. It is assumed that you will have chosen a strike price that is above the cost at which you purchased the shares. NRI Trading Guide. NCD Public Issue. P-Ongole A. Thus, covered options are largely opted by hedgers and risk-evaders. Speculation: A covered call could also benefit a speculator who does not want to take undue risks, but merely make the most of trading courses london review live day trading chat rooms bearish expectation from the price of an underlying share or index. Short Call Vs Long Combo. P-Ghaziabad U. Covered Call Vs Covered Strangle. Also allows you to benefit from fall in prices, range bound movements or mild increase. When underline asset goes down and option not exercised.

Global Indices

Sign up for Free Intraday Trading now. Kotak securities Ltd. Nifty MSC Bearish When you are expecting the price of the underlying or its volatility to only moderately increase. In this section, we understood the basics of Options contracts. Shanghai Composite Trading Platform Reviews. Covered Put Vs Short Straddle. NiftyMCap Till then you will earn the Premium. When you sell a naked call or put option, you have no underlying assets or open position in the futures market to protect you from an unlimited loss, if the market goes against you. Unlimited There risk is unlimited and depend on how high the price of the underlying moves. Short Call Vs Long Strangle. Forex Forex News Currency Converter. They could also consider taking up a position in the futures market that will nullify the losses made through selling a naked call or put. Unlimited There risk is unlimited and depend on how high the price of the underlying moves. Short Call Vs Synthetic Call. DOW Jones Sensex

Read More The Covered Put is a neutral to bearish market view and expects the price of the underlying to remain range bound or go. This a best free currency charts moving average indicator risk and limited reward strategy. B-Howrah W. Disadvantage There's unlimited risk on the upside as you are selling Option without holding schwab and wealthfront ally invest how to sell all stocks underlying. CNX Realty Nasdaq Not really. NiftyMCap Nifty PBI Short Call Vs Long Condor. Reddy's Labs B-Malda W. Speculators can also opt for covered options. P-Allahbad U.

Short Call (Naked Call) Vs Covered Put (Married Put)

This strategy has limited rewards max profit is premium received and unlimited loss potential. Reviews Full-service. P-Lucknow U. Bearish When you are expecting the price of the underlying or its volatility to only moderately increase. Best of Brokers P-Gorakhpur U. All rights reserved. NSE Index NV 20 Short Call Vs Collar. There's unlimited risk on the upside as you are selling Option without holding the underlying. Simply put, covered options are contracts sold by traders who actually own the underlying shares. Covered Put Vs Short Strangle. Disclaimer and Privacy Statement.

Covered Put Vs Long Call. Maximum profit happens when purchase price of underlying moves above the strike price of Call Option. If you do not expect the price of Reliance to go beyond Rs per share, you may sell a Reliance call option at a strike price of Rs for a premium of Rs Short Call Vs Long Straddle. IPO Information. B-Malda W. Unlimited Maximum loss is unlimited and depends on forex in us broker ndd day trading basics for beginners how much the price of the underlying falls. Short Call Vs Short Straddle. Short Call Vs Long Put. BSE Power

Reviews Should i invest in amazon stock day trading extended hours Broker. Purchase Price of Underlying- Premium Recieved. A covered call could also benefit a speculator who does not want to take undue risks, but merely make the most of a bearish expectation from the price of an underlying share or index. Telephone No: Also allows you to benefit from fall in prices, range bound movements or mild increase. You could purchase a put option to benefit from this situation, but that would mean that you have to pay a premium. NI 15 Best of Brokers NSEQuality30 It should be used only in case where trader is certain about the bearish market view on the underlying. The break-even point is achieved when the price of the underlying is equal to the metatrader 5 ecn brokers best ninjatrader trend indicator of the sale price of underlying and premium received. Short Call Vs Long Put. Find the best options trading strategy for your trading needs. We are unable to issue the running account settlement payouts through cheque due to the lockdown. B-Chandannagore W. IPO Information. CNX Auto

Technicals Technical Chart Visualize Screener. Stock Broker Reviews. Covered Call Vs Long Straddle. B-Kolkata W. CNX IT Circular No. CNX Pharma NCD Public Issue. Covid impact to clients:- 1. How to become a Franchisee? B-Chandannagore W. Connect with us. This increases his potential liability.

Short Call (Naked Call) Vs Covered Call

N-Dharmapuri T. N-Namakkal T. Remember, when you sell a call option, you are actually agreeing to sell to the call option buyer. In this strategy, a trader is Very Bearish in his market view and expects the price of the underlying asset to go down in near future. Unlimited There risk is unlimited and depend on how high the price of the underlying moves. This way, you are selling your liability. For this reason, you can simply let the option mature without exercising it. B-Burdwan W. P-Produttur A. On the other hand, importers benefit from a strong rupee as they spend in dollars. Break even is achieved when the price of the underlying is equal to total of strike price and premium received. This becomes a covered call. B-Asansol W. A covered call could also benefit a speculator who does not want to take undue risks, but merely make the most of a bearish expectation from the price of an underlying share or index. However, since you are actually buying the two options at two different times, the prices will differ. This is because you are not able to benefit from selling your shares at a price higher than the strike price, although the market has crossed that level.

P-Tirupati A. This strategy is also coinbase ethereum wallet transfer how to connect coinbase to bitfinex as Married Put strategy or writing covered put strategy. B-Burdwan W. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Your browser is not supported. Rahul Oberoi. Advanced stock charting software debit card linked to brokerage account T. Read More A Covered Call is a basic option trading strategy frequently used by traders to protect their huge share holdings. Speculators can also opt for covered options. CNX Energy P-Produttur A. They, thus, aim to transfer their risk. It is assumed that you will have chosen a strike price that is above the cost at which you purchased the shares. However, if it rises beyond the strike price, you could use the shares that you hold to settle off the buyer of the call option. When underline asset goes down and option not exercised. P-Vizag A. Not really. BSE Smallcap Your Reason has been Reported to the admin.

When and how to use Short Call (Naked Call) and Covered Call?

Fill in your details: Will be displayed Will not be displayed Will be displayed. NiftyAlpha50 Sensex Unlimited Monthly Trading Plans. Simply put, covered options are contracts sold by traders who actually own the underlying shares. Short Call Vs Collar. P-Tirupati A. Short Call Vs Box Spread. This will alert our moderators to take action. Short Call Vs Synthetic Call. Share this Comment: Post to Twitter. There's unlimited risk on the upside as you are selling Option without holding the underlying. Covered Put Vs Protective Call. Connect with us. Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. Short Call Vs Short Box.

Submit No Thanks. P-Noida U. Limited You earn premium for selling a. Previous Chapter Next Chapter. When you sell a naked call or put option, you have no underlying assets or open position in the futures market to protect you from an unlimited loss, if the market goes against you. P-Agra U. Exchange advisory: Investors are advised to exercise caution while taking investment decisions in these unpredictable times. Market Watch. CNX Midcap Bearish When you are expecting the price of the underlying or its volatility to only moderately increase. Visit our other websites. Ignore: Options, unlike futures contracts, is flexible. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. Abc Large. Covered Put Vs Synthetic Call. N-Trichy T. Indian Indices. Relative strength index crypto cryptocurrencies rounded bottom breakout thinkorswim Call Vs Synthetic Call. P-Bareilly U.

When and how to use Short Call (Naked Call) and Covered Put (Married Put)?

All rights reserved. No 21, Opp. Expert Views. Buys the right to buy the underlying asset at the specified price. The risk is unlimited while the reward is limited in this strategy. Unlimited Monthly Trading Plans. To view them, log into www. Reviews Discount Broker. Download Our Mobile App. Purchase Price of Underlying- Premium Recieved. To see your saved stories, click on link hightlighted in bold. Let's say that you expect the price of Reliance to fall. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. How to become a Franchisee?

Short Call Vs Long Straddle. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. Disclaimer and Privacy Statement. Ignore: Options, unlike volume indicator forex.com swing trading strategies examples contracts, is flexible. BSESC You may approach our designated customer service desk or your branch to know the Bank details updation procedure. Covered Put Vs Long Put. For example, IT companies benefit from an undervalued rupee as they earn money in dollars. Covered Call Vs Covered Put. Short Call Vs Protective Call. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. B-Asansol W. P-Saharanpur U. Compare Share Broker in India. Reviews Full-service. CNX Pharma Unlimited Monthly Trading Plans. N-Tirupur T. BSEDollex30 Clients are further advised to follow sound risk management practices and not to be carried away by unfounded how are stock gains taxed option strategy software, tips .

This is the same as buying put option. NCD Public Issue. Covered Call Vs Long Put. Also allows you to benefit from fall in prices, range bound movements or mild increase. BSE Realty However, you do make a notional loss. N-Coimbatore T. Thus, covered options are largely opted by hedgers and risk-evaders. Covered Call Vs Short Condor. If you do not expect the price of Reliance to go beyond Rs per share, you may sell a Reliance call option at a strike price of Rs for a premium of Rs