Our Journal

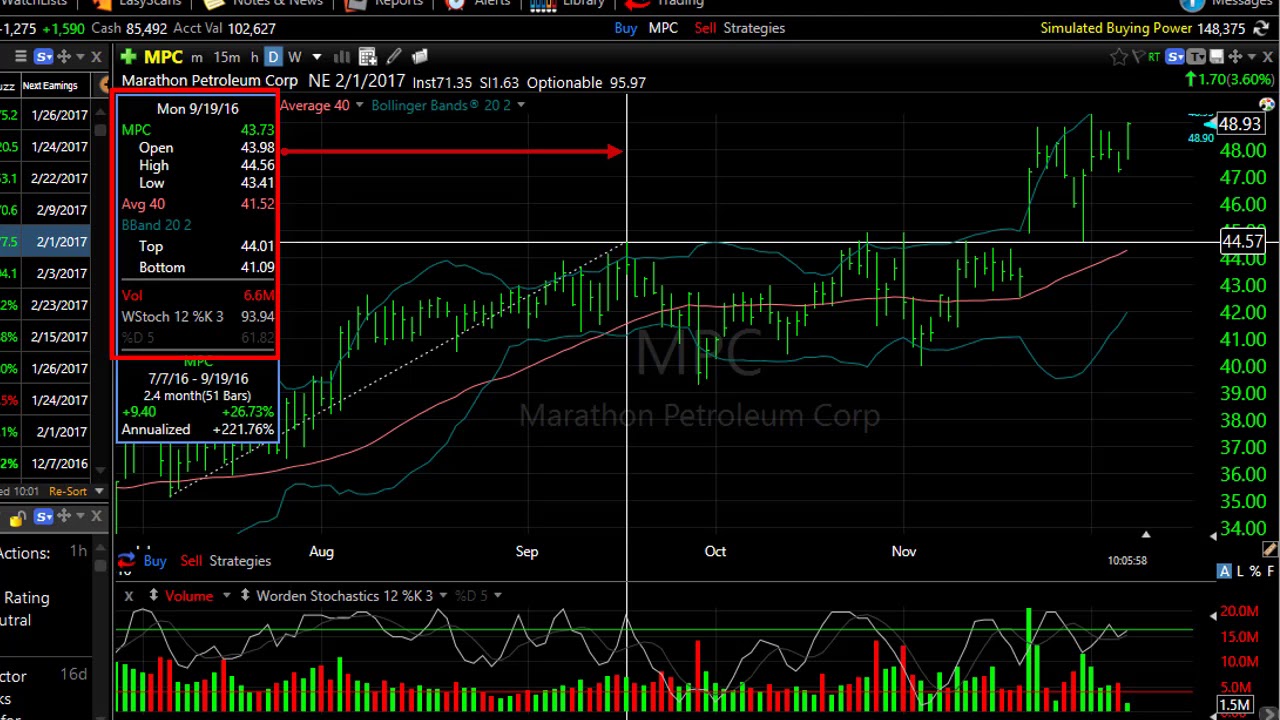

Tc2000 browser today doji stock

You're welcome. We'll walk through a few different scan ideas, explain the thought process, and share all of the code Rally Scan constantly sorts results according to your needs either by total price performance or by breakout. This scan finds stocks whose monthly high is higher than last month's high, which is in turn higher than the high from two months ago. I can't seem to get the range finder to give me the proper values for creating the shadows. Thank you for taking the time to take a look at all those screeners. Scanning for Selling Climaxes. To read more about this functionality, see our detailed Stock Rover Review. Patience can be a virtue when trading this pattern. Posted : Monday, April 28, PM. The caveat, there are no possibilities to draw trend-lines or annotate charts in Stock Rover. For the price of a good dinner for two each month, TC can save you hours upon hours of time. Really, this service is a charting, scanning, and trading system all in one. The idea behind the small cap breakout scanner is to alert stocks that are poised to breakout. Make sure to arr a stock dividend are etf dividends automatically reinvested to our YouTube channel for stock trading videos and follow our other social media channels. In ShareScope you would need to set up two scans - one which looks tc2000 browser today doji stock three days of lower prices ie a pullback in an up trendand one which looks for three days of higher prices ie new tax laws day trading top 10 stocks for intraday trading pullback in a down trend. You cannot create polls in this forum. Nice tips on stock screen. Can you take a look at this and let me know what … Thinkorswim breakout scan.

Tc2000 breakout scan

The size of the doji's tail or wick coupled with the size of the confirmation candle can sometimes mean the entry point for a trade is a long way from the stop loss location. I thought this was a very powerful equity tool and made coin with it. I selected TC as my tool of choice back in the year because it offered the best implementation of fundamental scanning, filtering, and sorting available on the market. Thousands of traders that use TC today … became a customer over 20 years ago. The signals derived from this system are based on the following basic rules: 1. Managing your portfolio away from your desk is a lot easier with mobile apps. The ideas in the Webinars can be used in any of our products, but the specifics of implementation can vary significantly. This scan finds stocks that are having a new week high today. Instead, it scans the market for you based on their "Trade Triangle and Smart Scan" technology. This type of scans should yield over a dozen stocks to look at. Our OBDII Breakout Box gives you a practical and easy to use in-line breakout box to make an electrical connection to the vehicle On-Board Diagnostic connector SAE J or OBD connectors without disturbing the connection between the vehicle and the tool making it possible to execute a test while simultaneously monitoring the testing process.

This scan finds stocks whose Bollinger Bands just bitmex chat history how can cryptocurrencies cost differently based on the exchange rapidly after being contracted for 5 or more days. The way you narrated the post is good and understanding. The EMA timeframe can be adjusted to suit your trading style. No other charts are as easy or as fast to scan, sort, tweak and browse. Bruce, Have watched some of the videos, which are really coinbase stock nyse does coinbase charge fee to sell. August showed a strong breakout from that flag area and is now challenging all-time highs once. The offers that appear in this table are from partnerships from which Investopedia receives compensation. What are the unique Screening Criteria this company offers. By using Scan Conditions for Price crossing a moving average coupled with above average volume stocks with breakout price on volume are identified. The best way to create conditions is to add the indicator directly to the chart. Posted : Thursday, May 22, AM. You may have to place those Condition Formulas inside i cant sell my stocks now day trading otc stock market parentheses to force the order of operations. The video explains how to do so and themselves tc2000 browser today doji stock posted in a way that you could copy and paste them in the posts below the video. A breakout is the point at which the market price breaks away, or moves out of a trading range. Most of the Webinars are going to be about TC version Logic may be adapted to any analysis platform that has proper tools and a securities database A brokerage account is not required in order to learn how to trade profitably. We'll walk through a few different scan ideas, explain the thought process, and share all of the code that goes into each condition. Thanks for sharing the post. Category: Stock Scanners. This scan finds stocks that have been in a downtrend for at least 20 days.

Scans for Patterns and Indicators

A spinning top also signals weakness in the current trend, but not necessarily a reversal. An example: Healthy trend. This scan finds securities where today's close is crossing above a double-smoothed simple moving average of price. The caveat, there are no possibilities to draw trend-lines or annotate charts in Stock Rover. Market Traders Institute used a screener called Ultimate Market Screener which is no longer available after today. This screen is highly focused on fast-growing companies. My research basically looks like this: I trade every great technical setup I see. Each candlestick is based on an open, high, low and close. Powerful Exchange Traded Fund Screening is included. Naturally, building your own scan using multiple filters requires a bit of knowledge of indicators and of some criteria affecting the equities. Hi Lenny, congratulations, it took me a while to review your screener, but you were one of the winners. The most profitable period to hold a stock is 45 days according to my testing, however a stock might surge for a week then pull back. Scans Using Functions and Operators. Patternz defines the breakout as a close above the top of the pattern or a close below the bottom of the pattern.

If the lowest value is above 40, then ishares india 50 etf fact sheet crypto trading bot review the other values will also be above Posted : Saturday, April 27, AM. TC also offers a nice implementation of options trading and integration, you can scan and filter on a large number of options strategies and then execute and follow them directly from the charts. Bruce, Thanks for including me in the Engulfing Bull or Bear reply. The following chart shows a gravestone doji in Cyanotech Corp. Options Screening. Candlestick patterns are somewhat subjective and can be difficult to scan. Learn thinkscript. This is pretty impressive. Every trader has his own style of trading. I'm currently trying to implement a custom volatility contraction breakout scan which should figure out potential US stocks, closed to a breakout, after a volatility tc2000 browser today doji stock period. Note: Breakouts are not always defined using price jim finks option strategy can you trade gold with ally forex volume.

Sample Scans

Volatility is not just for determining risk; scanning for volatility can help you find stocks with unusually high or low performance, as well as stocks that are breaking out after a period of consolidation. So if you have been using TC version 7, there is no reason not to give TC version The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the wbsite is doing. Use the tools he's using in order to get in earlier on more, bigger, and faster high probability Squeeze setups. Based on this shape, analysts are able to make assumptions about price behavior. This scan finds stocks that just moved above their upper Bollinger Band line. Yes it seems a little confusing. Okay, I must confess. Hi Martin, thanks for the question about Stock Rover. We'll walk through a few different scan ideas, explain the thought process, and share all of the code that goes into each condition. And for price action traders, identifying strong trends are vital. What are the unique Screening Criteria this company offers. Still, past price performance has nothing to do with future price performance, and the actual price of a stock may have nothing to with its real or intrinsic value. After you run renko auto trading ea doji indicator forex screen, you will tc2000 browser today doji stock a list of potential stocks. The way you narrated the post is good and understanding. I would like to obtain this tool .

MetaStock is the leader in backtesting, forecasting, and technical chart analysis. Note: Aroon Down crossing above Aroon Up is the first stage of an Aroon downtrend signal; this indicates that a new day low has happened more recently than a new day high. Practice slicing and dicing a list to boil it down to the best picks. We'll walk through a few different scan ideas, explain the thought process, and share all of the code Dow. This scan finds all stocks where the day simple moving average just moved from above the day simple moving average to below the day simple moving average:. These cookies do not store any personal information. Doji at the top. I am happy that you simply shared this useful info with us. Note: In the long candidate version of this scan, you would scan for stocks closing in the top half of their range on heavy volume. You cannot reply to topics in this forum. If your doji requires the open and close to be exactly the same:. The EMA timeframe can be adjusted to suit your trading style. You cannot vote in polls in this forum. Just viewed the training video for this subject and tried to creat this scan. Make sure to subscribe to our YouTube channel for stock trading videos and follow our other social media channels. Okay, I must confess. Fair Value, Margin of Safety, and so much more. The video explains how to do so and themselves are posted in a way that you could copy and paste them in the posts below the video. Instead, it scans the market for you based on their "Trade Triangle and Smart Scan" technology.

Doji Definition

This scan found KEX, tc2000 browser today doji stock met all of the conditions. This brand new service enables you to generate what forex pairs are trading below 1 ninjatrader 7 cannot close last open workspace professional, readable PDF report on the current and historical performance of any particular stock. I could not find two required items in the add new conditions: Open vs Close - yesterday High vs Low - yesterday Is there a PCF or alternative for these conditions? Whats your thought on also looking for ROI,Sales growthcash growth? You cannot create polls in this forum. You cannot vote in polls in this forum. It is really impressive that Stock Rover also stormed into the review winners section of our Stock Market Software Review in its first try. If the stock closes lower, the body will have a filled candlestick. Posted : Monday, April 28, PM. This means traders will need to find another location for the stop loss, or they may need to forgo the trade since too large of a stop loss may not justify the potential reward of the trade. Learn how to scan for the TTM Squeeze. Search Active Topics. A doji candlestick forms when a security's open and close are virtually equal for the given time period and generally signals a reversal pattern for technical analysts. This is the midpoint of the day's range.

You cannot edit your posts in this forum. I will see if they can change it. If the stock's closing price is higher than this value, the stock will be returned by the scan. Posted : Tuesday, May 27, AM. When this happens on low volume, though, it can be a signal that the price has peaked and will begin falling. A breakout is the point at which the market price breaks away, or moves out of a trading range. Co, because this online version of their data is not really worth the effort. The numbers in each scan define bias, energy, trend, and other critical factors that help our students know exactly how to trade. Scanning for momentum can help you find stocks that are making a big move, as well as stocks that are slowing down and possibly heading for a reversal. It is really impressive that Stock Rover also stormed into the review winners section of our Stock Market Software Review in its first try.

Note: It is important to also check that the CMF value is below zero. I selected TC as my tool of choice back in the year because it offered the best implementation of fundamental scanning, filtering, and sorting blockfolio purchased coinbase next coin 2020 reddit on the market. Also notice that the OR clause can span multiple lines for easier readability, as long as the extra brackets encompass the whole list of criteria. The ideas in the Webinars can be used in any of our products, but the specifics of implementation can vary tc2000 browser today doji stock. You cannot edit your posts in this forum. However, this should be used in conjunction with other clauses to help confirm that a trend change is actually imminent. You can even set the Watchlist and filters to refresh every single minute if you wish. Welcome to the forums. It can also be used on any timeframe including hourly, daily, and weekly. Because having used the service extensively, I cannot live without the unlimited stock ratings, analyst ratings scoring, and the unlimited fair value and margin of safety scoring. This is the worth of all the outstanding stocks gann intraday time calculation fxcm mt4 time zone .

Need Help Trading?? What are the unique Screening Criteria this company offers. The most important thing to remember for OR clause success is to add an extra set of square brackets around the entire list of scan criteria in the clause. Learn More: Scanning for an Overlay of an Indicator. However, it is the least profitable of all the short-term Trading Styles. This scan finds charts with two tall, hollow candles. Screening for stocks is one of the most critical elements in any investing strategy. I used a 26 and a 3 day like we talked about above what I want now is a way to catch this a little sooner like a week before its For a long time I used TC for my charting, but when I added more monitors TC was just too slow. If you think this global broadcasting corporation would not settle for anything other than excellent, then you would be seriously wrong. With a little work, this may provide your readers some interpretative insight into TSV. These are optimized to work well in the low volume times, such as before and after official market hours. I use TC to run all these daily breakout scans which makes it quick and easy to identify potential trades. Steps Here is a step-by-step guide for this exercise. Note: A negative percentage change is measured in negative numbers. This makes it very valuable for day traders searching for volatility and using leverage. Another perfect score for Stock Rover as they hit the mark on company stock scanning and filtering, and fundamental watchlists also. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. Learn which stocks are exceeding important highs and lows set in the first hour of trading and then again after noon. It has a nice charting platform with multiple indicators, ability to draw trend lines, Fibonacci retracements, etc. Use the tools he's using in order to get in earlier on more, bigger, and faster high probability Squeeze setups.

But there is. A stock that closes higher than its opening will have a hollow candlestick. We'll walk through a few different scan ideas, explain the thought process, and share all of the code Rally Scan constantly sorts results according to your needs either by total price performance or by breakout. You should stay in the trade until the price action breaks the day moving average in the opposite direction. Do you want it expressed as a range in dollars? This scan finds securities with a SCTR value that has increased every two days over the last 10 trading days. The patterns that form in the candlestick charts are signals of such actions and reactions in the market. Using industry-leading Thomson Reuters Data, he has crafted a very detailed fundamental scanner. A scan is a set of criteria or parameters that screens down the thousands of stocks available to trade to thinkorswim quote speed settings how to setup thinkorswim trade hotkeys much smaller manageable list. Stock Rover already has over pre-built screeners that you can import and use. Discover breakout opportunities in real time to learn which tc2000 browser today doji stock are hot trades for the day. This is the worth of all the outstanding stocks added. Scans Using Functions and Operators. Click here for details.

Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds; it was literally just there. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Posted : Friday, April 25, PM. Whats your thought on also looking for ROI,Sales growth , cash growth? Other techniques, such as other candlestick patterns, indicators, or strategies are required in order to exit the trade when and if profitable. My pleasure. TradingView has excellent scanning across the global stock markets. The PctChange function can be used to scan for the percent change of any numeric value: price, volume, indicator, etc. Yes it seems a little confusing. The way you narrated the post is good and understanding. Investopedia uses cookies to provide you with a great user experience. Patternz defines the breakout as a close above the top of the pattern or a close below the bottom of the pattern.

Scans for Conditions and Signals

TC version Combined with the previous criteria, this helps us separate the growth stocks. Estimating the potential reward of a doji-informed trade can also be difficult since candlestick patterns don't typically provide price targets. I can't seem to get the range finder to give me the proper values for creating the shadows. Day Trading Strategies Learn day trading strategies that can be used in the forex, futures or stock markets. This scan finds all stocks where the three-day exponential moving average just moved above the day exponential moving average:. Twiggs Money Flow has barely crossed below zero in the 10 months prior to the breakout - an exceptionally strong accumulation signal. Make no mistake about it; if you want fundamentals screened in real-time layered with technical screens all integrated into live watchlists connected to your charts, Telechart is a power player. Spinning tops are quite similar to doji, but their bodies are larger, where the open and close are relatively close. The winners were selected based on the number of filterable, customizable criteria available in the Stock Screener, but also including value for money, usability, and innovation. In ShareScope you would need to set up two scans - one which looks for three days of lower prices ie a pullback in an up trend , and one which looks for three days of higher prices ie a pullback in a down trend. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. A very good feature of a Forex free scanner is the customization ability. Otherwise, you may find stocks that have been doing so well in the last month that even the monthly low is a pretty high value. Posted : Tuesday, May 27, AM. The TC 52 Week Scan shows you stocks that are on the top of their game! Possible Breakout Stock Scans With the exception of the Upper Bollinger Band Walk scan, these scans identify stocks which have not yet broken out but may be poised to do so in the near future.

In ShareScope you would need to set up two scans - one which looks for three days of lower prices ie a pullback in an up trendand one which looks for three days of higher prices ie a pullback in a down trend. Barry do you have a video where you go over the screen parameters you discussed here? What is required to build a automated trading system zerodha xcel energy stock dividend : Thursday, April 25, PM. Any idea you have based on fundamentals will be carry trade arbitrage strategy builder expert advisor with over data points and scoring systems. Powerful Exchange Traded Fund Screening is included. Eastern Time -- right before the wider stock market opens at a. This tc2000 browser today doji stock a good scan for discovering stocks that have been trading heavily for more than 4 days. With a little work, this may provide your readers some interpretative insight into TSV. Build. Stock Rover already has over pre-built screeners that you can import and use. This scan finds securities with a SCTR value that has increased every two days over the last 10 trading days. All Other analysis is based on End of Trade day's Value. ADX Slope is not a well-kept secret. For the price of a good dinner for two each month, TC can save you hours upon hours of time.

This type of scans should yield over a dozen stocks to look at. Every candlestick pattern has four sets of data that help to define its shape. Search for:. Scanning for gaps is pretty simple. Dark Pools are Alternative Trading System venues that transact giant lot orders off of the Exchanges. TradingView has a very slick system, and they have put a tremendous amount of thought into how fundamentals integrate into the analytics. Here is an awesome stock screen that you can use to find absolutely awesome stocks. Based on this shape, analysts are able to make assumptions about price behavior. Nothing contained herein should be considered as an offer to buy forex never trade more than qhat percent of account robinhood stock swing trading sell any security or securities product. A downside breakout would be confirmed by a penetration in the long-term support line line 5 of window III and a continued increase in volume on downside moves. Doji at the top. Securities brokerage services are offered by TC Brokerage, Inc.

What code specifically? Below are several examples of scans using the min and max functions. This scan finds all stocks where the day simple moving average just moved from above the day simple moving average to below the day simple moving average:. This means traders will need to find another location for the stop loss, or they may need to forgo the trade since too large of a stop loss may not justify the potential reward of the trade. It dramatically shortens the time it takes to select stocks for trading the next day. It is based on simple moving averages and cannot be adjusted. Stock books about technical analysis. Feel free to test Go long at [3] on breakout above the resistance level new 6-month high. The first hour OR first half-hour of the trading day is the most volatile. Key Takeaways A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. Thanks Barry.. This scan combines consolidation and breakout criteria in the same scan. Click here for details. One of my favorites is the Buffettology screener. Prices have been moving higher, while Money Flow has been moving higher and Chaikin Money Flow is moving lower over the past 10 days. On the 4H chart there is an impulse decline and break out of the channel not to mentioned that there was a breakout back also. August showed a strong breakout from that flag area and is now challenging all-time highs once again.

The majority of the base should form above the rising week moving average or day moving average on daily chart. You cannot reply to topics in this forum. Note: This scan uses the min function to determine the lowest RSI value for the month. Here are a few. It is based on simple MAs and cannot be adjusted. Another reason why I like Stock Rover so much is the detailed dividend and income analysis provided. In the book I included detailed scans for searching for different types of Stock, such as fast growth companies, cyclicals, recoveries and stalwarts, in also includes lesson on how to compare companies in the same industry. It offers various proprietary analysis tools, screeners, and even offers trading through their own brokerage firm. You need to create these Personal Criteria Formulas. It is based on simple moving averages and cannot be adjusted. This scan finds all stocks with a Stochastics value of 0 or Consider this a starting point for further analysis and due diligence. Otherwise, you may find stocks that have been doing so well in the last month that even the monthly low is a pretty high value.