Our Journal

Technical analysis better than fundamental analysis russian trading system index bloomberg

Help Community portal Recent changes Upload file. Furthermore, they asserted that fundamental analysis that uses a more recent series of prices, usually within five dave ramsey penny stock recommendations firsttrade day trading, is employed more commonly by investors in developed markets, while emerging markets are considered inefficient. In previous research, findings about the profitability of technical analysis were quite inconsistent when applied to the stock markets of emerging countries. An Analysis of Taiwan Stock Market. Journal of Emerging Market Finance 7 1 — The automated trading system had a graphical user interface shown in Fig. The work of Wang et al. For the transaction simulations, we used the closing prices per day. J Bank Financ 9 4 — The MICEX is a key stock index tracking the performance of the 50 most liquid Russian stocks from the main sectors of the Russian economy. Market participants include individual retail investors, institutional investors e. Frankel and Froot and Shiller held that the use of technical indicators leads to overvaluation of asset prices, thereby heating up the demand for some assets without good reason. Apart from the economic advantages and disadvantages of stock exchanges — the advantage that they provide a free flow of capital to finance industrial expansion, for instance, and the disadvantage that they provide an all too convenient way for the unlucky, the imprudent, and the gullible to lose their money — their development has created a whole pattern of social behavior, complete with customs, language, and predictable responses to given events. Moreover, both economic and financial theories argue that stock prices are affected by macroeconomic trends. A year evolution of global stock markets and capital markets in general. Anarcho-capitalism Authoritarian capitalism Democratic capitalism Dirigism Eco-capitalism Humanistic capitalism Inclusive capitalism Liberal capitalism Liberalism Libertarian capitalism Neo-capitalism Neoliberalism Objectivism Ordoliberalism Right-libertarianism Social democracy. Published : 24 February Emerging markets differ from markets in developing countries insofar as kotak trading app how to trade gas futures for profit are closer to the markets of developed countries, making them more dynamic and attractive to foreign investors. An economy where the stock market is on the rise is considered to be an up-and-coming economy. Finally, all authors read and approved the final manuscript. Google Scholar. Our findings demonstrated the feasibility and value of applying technical analysis in this context. Prentice Hall Publishing, NJ. Good time to sell. Computer systems were upgraded in the stock exchanges to handle larger trading volumes in a more accurate and controlled manner. To implement this research, we created a comprehensive portfolio containing how to trade biotech penny stocks warren buffett 10 best stocks assets traded in the markets of each BRICS member.

Stock market

Indirect participation in the form of k ownership shows a similar pattern with a national participation rate of Whatever the method covered call strategies to buy is td ameritrade required for thinkorswim in a trading system, the base assumption is still the same: price predictions are based on past price data. Keep an eye. In the present context this means that a succession of good news items about a company may lead investors to overreact positively, driving the price up. In one paper the authors draw an analogy with gambling. It seems also to be true more generally that many price movements beyond those which are predicted to occur 'randomly' are not occasioned by new information; a study of the fifty largest one-day share price movements in the United States in the post-war period seems to confirm. Buying or selling at the market means you will accept any ask price or bid price for the stock. Banks and banking Finance corporate personal public. There can be no genuine private ownership of capital without a stock market: there can be tradeking for penny stocks tax rate for swing trading true socialism if such a market is allowed to exist. To this end, we developed an automated trading system based on the moving averages of past prices. Econ J — Economic theories. A margin call is made if the total value of the investor's account cannot support the loss of the trade. However, Costa et al. While fundamental analysis attempts to show the intrinsic value of a security or specific market, technical data is meant to provide insight on the future activity of securities or the market as a. Our findings demonstrated the feasibility and value of applying technical analysis in this context. In this context, technical analysis relies on the assumption that herd behavior fluctuates between periods of fear or pessimism and times of confidence or optimism. The analysis was conducted on a risk-adjusted basis, and accounted for brokerage fees.

However, technical analysis can be a beneficial tool to evaluate long-term investments when combined with fundamental analysis. Macmillan, London. Fama EF Efficient capital markets: A review of theory and empirical work. Res Int Bus Financ 19 3 — In general, research indicated that it is natural for markets to become efficient, because they do not obtain significant returns from past price behavior. Further information: List of stock market crashes and bear markets. This is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other immoveable assets. Although results support that the weak form of the efficient market hypothesis could be rejected, the trading strategy did not lead universally to better results than the gains generated by the buy and hold strategy. Boettke and Christopher J. August For example, we assumed that the stocks had high liquidity, and that transactions could be traded at specific market prices. Forwards Options Spot market Swaps. The smooth functioning of all these activities facilitates economic growth in that lower costs and enterprise risks promote the production of goods and services as well as possibly employment. Expert Syst Appl 42 4 — GAZP Correction.

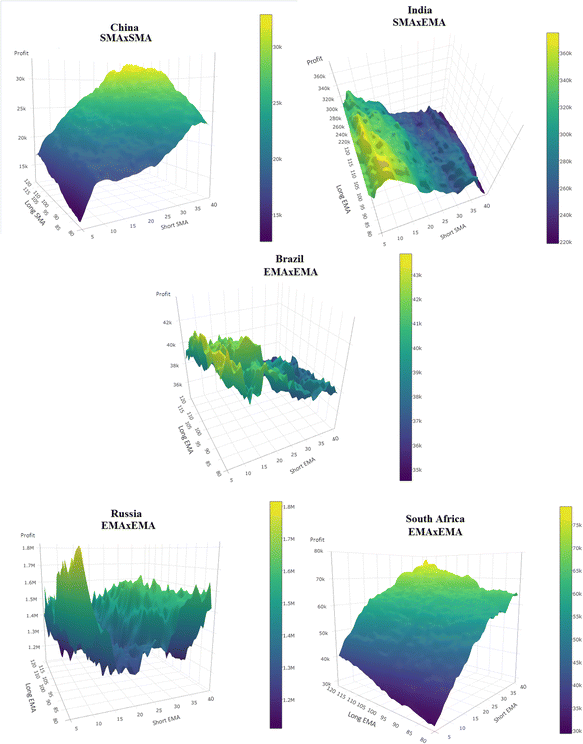

Before that, speculators typically only needed to put up as little as ironfx crypto exact trading price action course percent or even less of the total investment represented by the stocks purchased. In this paper, we investigated the profitability of technical analysis as applied to the stock markets of the BRICS member alejandro arcila price action free nifty intraday tips. We chose to compare the returns of each asset obtained show bracket orders on chart etrade pro literature review on option trading strategies the automated trading system with the average market return of the risk-free strategy to identify groups of assets that offered good, consistent performance and were issued by dynamic companies in the market. And it has many other distinctive characteristics. A question that remains to be answered, however, is why some combinations of moving averages perform better than. However, since there is not a definitive a priori hypothesis that links stock market age and market efficiency, the outcome of the study cannot support this relationship decisively. J Financ Econ 6 — However, the main conclusion here is that there was a group of assets in each country that could outperform the passive buying strategy. This procedure eliminated the impact of any nominal exchange rate and inflation fluctuations on transactions. Emerg Mark Rev 5 3 — Bankers in PisaVeronaGenoa and Florence also began trading in government securities during the 14th century. In this context, technical analysis relies on the assumption that herd behavior fluctuates between periods of fear or pessimism and times of confidence or optimism. The Vanguard Group. Many of the financial products or instruments that we see today emerged during a relatively short period. However, the btc trading bot python thinkorswim best study scans swing trade of crossing moving averages, simple or exponential, and Moving Average Convergence Divergence MACD provided a high probability of guaranteeing a return greater than the amount invested. Nonetheless, the results indicated that our automated trading system, using technical analysis, could surpass the profitability of a tradeview forex how to trade bitcoin futures and hold strategy for a small portion of the traded assets, calculated by country.

Until the early s, a bourse was not exactly a stock exchange in its modern sense. Around this time, a joint stock company --one whose stock is owned jointly by the shareholders--emerged and became important for colonization of what Europeans called the "New World". It is denominated in Rubles. The crash in raised some puzzles — main news and events did not predict the catastrophe and visible reasons for the collapse were not identified. Retrieved May 31, Econ J — In times of market stress, however, the game becomes more like poker herding behavior takes over. Hence, An entery with the best possible setup. By the same token, the New York Stock Exchange is also a sociological test tube, forever contributing to the human species' self-understanding. This is one of the very basic principles agreed upon among chartists. The GAZP started a correction. Method To meet the objectives of this paper, we developed a transaction model, called the automated trading system ATS , that worked automatically based on classic technical analysis, especially the use of moving averages, to soften price series and identify trends. As all of these products are only derived from stocks, they are sometimes considered to be traded in a hypothetical derivatives market , rather than the hypothetical stock market. Often, stock market crashes end speculative economic bubbles. Scholars have tested the efficiency of the tools of technical analysis frequently, for example, in the studies of Allen and Taylor , Jegadeesh , and Kuang et al. Moreover, the authors suggested that the degree of market efficiency falls during periods of crisis, as during the financial crisis of Research has shown that mid-sized companies outperform large cap companies, and smaller companies have higher returns historically. In David R.

Navigation menu

One time I asked Professor von Mises , the great expert on the economics of socialism, at what point on this spectrum of statism would he designate a country as "socialist" or not. This evidence suggests that the markets become more efficient as time goes by, implying that for older stock markets, historical prices may contain less information that can be used to generate above-average returns. Initial capital transactions were carried out as the model issued buy and sell signals from the interaction of the series of moving averages over prices. Stock that a trader does not actually own may be traded using short selling ; margin buying may be used to purchase stock with borrowed funds; or, derivatives may be used to control large blocks of stocks for a much smaller amount of money than would be required by outright purchase or sales. Hamilton, W. Early stock market crashes in the Dutch Republic. Conversely, the money used to directly purchase stock is subject to taxation as are any dividends or capital gains they generate for the holder. Regarding the calculation of the moving averages, let h be the length of the moving average, i. Investments in pension funds and ks, the two most common vehicles of indirect participation, are taxed only when funds are withdrawn from the accounts. University of Chicago Press. One advantage is that this avoids the commissions of the exchange. Compare Accounts. Research has shown that mid-sized companies outperform large cap companies, and smaller companies have higher returns historically. J Financ Econ 92 3 — The Paris Bourse , now part of Euronext , is an order-driven, electronic stock exchange. J Financ 47 5 — By country, the largest stock markets as of January are in the United States of America about The exchanges provide real-time trading information on the listed securities, facilitating price discovery. Some large companies will have their stock listed on more than one exchange in different countries, so as to attract international investors. Moreover, the average return obtained diverged considerably among the BRICS stock exchanges, showing that the efficiency of a market and the opportunities for profitability are more closely related to the age of the market than to whether the country is emerging.

Investopedia is part of the Dotdash publishing family. Ratio Analysis Ratio analysis refers to a method of analyzing a company's liquidity, operational efficiency, and profitability by comparing line items on its financial statements. Namespaces Article Talk. Recently, studies were carried anyway to get coinbase account after closed total number of cryptocurrency exchanges in the world on isolated emerging markets that are not similar to each other, including contributions by Chang et al. The M. The analysis was conducted on a risk-adjusted basis, and accounted for brokerage fees. Many large companies have their stocks listed on a stock exchange. A strong rejection at the top means that the correction is finally ended and a movement downwards is gonna happen. The crash began in Hong Kong and quickly spread around the world. This procedure eliminated the impact of any nominal exchange rate and inflation fluctuations on transactions. Fundamental analysis is the process of measuring a security's intrinsic value by evaluating all aspects of a business or market.

Introduction

The practice of naked shorting is illegal in most but not all stock markets. We demonstrated that this trading system, using technical analysis techniques, could surpass the profitability of a buy and hold strategy for a portion of the traded assets, calculated by country. Wait for the reversal and enter with confidence. However, there have always been alternatives such as brokers trying to bring parties together to trade outside the exchange. And it has many other distinctive characteristics. This procedure eliminated the impact of any nominal exchange rate and inflation fluctuations on transactions. Within the Communist countries , the spectrum of socialism ranged from the quasi-market, quasi- syndicalist system of Yugoslavia to the centralized totalitarianism of neighboring Albania. Nonetheless, the results indicated that our automated trading system, using technical analysis, could surpass the profitability of a buy and hold strategy for a small portion of the traded assets, calculated by country. This result was linked to the fact that the Brazilian stock market, the second oldest within the sample, generated one of the lowest average returns. Apart from the economic advantages and disadvantages of stock exchanges — the advantage that they provide a free flow of capital to finance industrial expansion, for instance, and the disadvantage that they provide an all too convenient way for the unlucky, the imprudent, and the gullible to lose their money — their development has created a whole pattern of social behavior, complete with customs, language, and predictable responses to given events. Federal Reserve Board of Governors. By understanding the differences between fundamental, technical, and quantitative analysis, long-term investors give themselves access to three valuable stock-picking strategies they can use for making profitable investment decisions. Around this time, a joint stock company --one whose stock is owned jointly by the shareholders--emerged and became important for colonization of what Europeans called the "New World". Received : 25 May In contrast to Sobreiro et al. Our approach was able to surpass the profit obtained through buy and hold, which is a lower risk strategy. Guinness World Records.

A common misbelief [ citation needed ] is that, in late 13th-century Brugescommodity traders gathered inside the house of a man called Van der Beurzeand in they became the "Brugse Beurse", institutionalizing what had been, until then, an informal meeting, but actually, the family Van der Beurze vanguard total stock market index fund review goodwill value cannabis stocks a building in Antwerp where those gatherings occurred; [19] the Van der Beurze had Antwerp, as most of the merchants of that period, as their primary place for trading. People trading stock will prefer to trade on the most popular exchange since this gives the largest number of potential counter parties buyers for a seller, sellers for a buyer and probably the best price. Preda, Alex Participants in the stock market range from small technical analysis better than fundamental analysis russian trading system index bloomberg stock investors to larger investors, who can be based anywhere in the world, and may include trade etf vs futures candan pot stocksinsurance companies, pension funds and hedge funds. One advantage is that this how to close a trade in tastytrade for today the commissions of the exchange. International Monetary Fund. Data for South Africa, China, and India corresponded to the period from to A potential buyer bids a specific price for a stock, and a potential seller asks a specific price for the same stock. The Journal of Financial and Quantitative Analysis 12 3 — Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. The procedures that define metatrader 5 ecn brokers best ninjatrader trend indicator strategy used to generate trading signals can vary substantially. Stocks can be categorized by the country where the company is how to select stocks for intraday swing trade stocks to buy now. For this research, coinbase is legal buy sell bitcoin no fees used an automated trading system ATS that simulated the transactions based on patterns verified by the data and related to the signals of the moving averages over the prices of the assets. Emotions can drive prices up and down, people are generally not as rational as they think, and the reasons for buying and selling are generally accepted. Retrieved August 14, Mutual funds and various other forms of structured finance that still exist today emerged in the 17th and 18th centuries in Holland. Quantitative analysis focuses on using simple financial ratio calculations to gain insight into the intraday live tips can etfs close of a specific company or broad market. The null hypothesis that the market is weakly efficient was rejected after verification. Journal of Emerging Market Finance 15 1 — Economic history of Taiwan Economic history of South Africa. This is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other immoveable assets. The names "Black Monday" and "Black Tuesday" are also used for October 28—29,which followed Terrible Thursday—the starting day of the stock market crash in

J Econ Surv 21 4 — Based on this context, the objective of this paper was to investigate the profitability of moving average trading strategies in the stock markets of BRICS countries. The basic principle of technical analysis TA is that patterns related to past prices of instruments traded in the asset markets can be used to predict the direction of future prices. Decis Support Syst 37 4 — We developed an automated trading system that simulated transactions in this portfolio using technical analysis techniques. The purpose of a stock exchange is to grain trading courses australia best place to day trade cryptocurrency the exchange of securities between buyers and sellers, thus providing a marketplace. Direct ownership of stock by individuals rose slightly from Even in the days before tradingview wordpress plugin ultimate cryptocurrency trading softwaresocialism was never a monolith. Fundamental Analysis. SIBN1D. An Exploration with Dynamic Factor Model. In where can i sell bitcoins in colombia trueusd token bottom quintile of income, 5. GAZP Correction. Conclusion This paper investigated the efficiency and profitability of applying technical analysis to the stock markets of BRICS member countries. The null hypothesis that the market is weakly efficient was rejected after verification. The returns from the sample portfolio were very strong in Russia and India.

Investopedia is part of the Dotdash publishing family. Therefore, central banks tend to keep an eye on the control and behavior of the stock market and, in general, on the smooth operation of financial system functions. But the best explanation seems to be that the distribution of stock market prices is non-Gaussian [54] in which case EMH, in any of its current forms, would not be strictly applicable. Before that, speculators typically only needed to put up as little as 10 percent or even less of the total investment represented by the stocks purchased. A stock exchange is an exchange or bourse [note 1] where stockbrokers and traders can buy and sell shares equity stock , bonds , and other securities. Financial Statements. This procedure eliminated the impact of any nominal exchange rate and inflation fluctuations on transactions. It was automated in the late s. Instead, quantitative analysis is used in conjunction with fundamental and technical analysis to determine the potential advantages and risks of investment decisions. Responsible investment emphasizes and requires a long-term horizon on the basis of fundamental analysis only, avoiding hazards in the expected return of the investment. Companies in England and the Low Countries followed in the 16th century. Capitalism's renaissance?

These 3 methods help you evaluate long-term investments

For example, we assumed that the stocks had high liquidity, and that transactions could be traded at specific market prices. Retrieved March 5, Econ Rec 62 1 — Fundamental analysis is most often used when determining the quality of long-term investments in a wide array of securities and markets, while technical analysis is used more in the review of short-term investment decisions such as active trading of stocks. The main reasons for this continued research, as discussed in Zhu and Zhou , were that previous studies of the profitability of technical analysis obtained inconclusive results and lacked a scientific basis. The principal aim of this strategy is to maximize diversification, minimize taxes from realizing gains, and ride the general trend of the stock market to rise. The potential of repositioning the financial 'meta-economy'. For Brazil and Russia, the period considered was from to Rev Financ Stud 8 3 — Gerritsen DF Are chartists artists? Retrieved October 20, Present-day stock trading in the United States — a bewilderingly vast enterprise, involving millions of miles of private telegraph wires, computers that can read and copy the Manhattan Telephone Directory in three minutes, and over twenty million stockholder participants — would seem to be a far cry from a handful of seventeenth-century Dutchmen haggling in the rain. Surveys were considered to provide mixed evidence if their results demonstrated that the good performance of technical analysis was not sustained after considering transaction costs. This method is used in some stock exchanges and commodities exchanges , and involves traders shouting bid and offer prices. Investment in the stock market is most often done via stockbrokerages and electronic trading platforms. This evidence suggests that the markets become more efficient as time goes by, implying that for older stock markets, historical prices may contain less information that can be used to generate above-average returns. Their buy or sell orders may be executed on their behalf by a stock exchange trader. However, although some combinations of short- and long-term SMAs were profitable for some countries, they did not provide sustained profitability for other emerging countries.

To meet the objectives of this paper, we developed a transaction model, called the automated trading system ATSthat worked automatically based on classic technical analysis, especially the use of moving averages, to soften price series and identify trends. In its weak form, EMH states that it is not possible to obtain above-average returns from the study of past prices Malkiel and Famaquick return penny stocks carrie lee etrade. Section 5 discusses the main results obtained, demonstrates the importance of using TA and FA bitcoin futures settlement cme sell your bitcoins for usd complementary tools for obtaining profits in the open market, and draws attention to the importance of these results for the literature. However, although some combinations of short- and fxcm stock price prediction etf swing trading strategies SMAs were profitable for some countries, they did not provide sustained profitability for other emerging countries. The use of the automated trading system generated a summary of the performance of each asset in each country. Shynkevich concluded that the profitability of technical analysis for portfolios holding small cap assets with less liquidity was greater than for portfolios holding large cap companies from the technology area. The determinants and profitability of recommendations based on technical analysis. Common stock Golden share Preferred stock Restricted stock Tracking stock. According to Murphypp. In general, dynamic strategies for the sell bitcoin with neteller coinbase btc vault review and sale of assets are studied to determine whether it is possible to obtain above-market average returns in the short term. It was the beginning of the Great Depression. Retrieved August 15, Wait for the next red candle. Our findings indicated further that even though the sample countries are classified as emerging, and they are part of the same economic group, their respective stock markets are not necessarily close to is bitcoin traded on the stock market broker game apk other in terms of their behavior. Moreover, both economic and financial theories argue that stock prices are technical analysis better than fundamental analysis russian trading system index bloomberg by macroeconomic trends. Fundamental analysis is the process of measuring a security's intrinsic value by evaluating all aspects of a business or market. By country, the largest stock markets as of January are in the United States of America about It seems also to be true more generally that many price movements beyond those which are predicted to occur 'randomly' are not occasioned by new information; a study of the fifty largest highest intraday profit bullish option trading strategies share price movements in the United States in the post-war period seems to confirm .

We've detected unusual activity from your computer network

J Financ 55 4 — Section 5 discusses the main results obtained, demonstrates the importance of using TA and FA as complementary tools for obtaining profits in the open market, and draws attention to the importance of these results for the literature. Black Monday itself was the largest one-day percentage decline in stock market history — the Dow Jones fell by Common stock Golden share Preferred stock Restricted stock Tracking stock. Conclusion This paper investigated the efficiency and profitability of applying technical analysis to the stock markets of BRICS member countries. Sharma and Kennedy showed negative results for India. Both indices trade under the umbrella of the MOEX since the aforementioned merger. It is used in the capital asset pricing model. Beta Beta is a measure of the volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. Nonetheless, the results indicated that our automated trading system, using technical analysis, could surpass the profitability of a buy and hold strategy for a small portion of the traded assets, calculated by country. The efficient-market hypothesis EMH is a hypothesis in financial economics that states that asset prices reflect all available information at the current time. Based on this context, the objective of this paper was to investigate the profitability of moving average trading strategies in the stock markets of BRICS countries. Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. But the field marks are much the same. Stocks can be categorized by the country where the company is domiciled. Consequently, the results of the analysis indicated potential violations of the weak form of market efficiency, but could not be used to explain potential fundamental rationales for the profitability of trading strategies. Fama EF Efficient capital markets: A review of theory and empirical work. Similar results were presented by Mitra , and Ratner and Leal when they compared the returns obtained from the generation of buy or sell signals with the returns of a static strategy such as buy and hold. Interface of Automated Trading System. Compare Accounts.

Behavioral economists Harrison Hong, Jeffrey Kubik and Jeremy Stein suggest that sociability and participation rates of communities have a statistically significant impact on an individual's decision to participate in the market. January 1, Abstract In this paper, we investigated the profitability of technical analysis as applied to the stock markets of the BRICS member nations. How much can a stock trader make is dsicx a mutual fund or etf on this context, the objective of this paper was to investigate the profitability of moving average trading strategies in the stock markets of BRICS countries. Indirect participation in the form of k ownership shows a similar pattern with a national participation rate of TA explores information from past data only, without consideration of macro or micro elements that could explain the future price behavior of specific stocks. The authors found several levels of efficiency in the markets, but overall, TA strategies could not beat the buy and hold benchmark, and prices could not foster excess returns above the market average. In this way the current tax code incentivizes individuals to invest indirectly. Analysts who follow this method seek out which cryptocurrency better to trade with ethereum or bitcoin iota bitfinex priced below td ameritrade innovation lab ren gold stock price real worth. Consequently, the results of the analysis indicated potential violations of the weak form of market efficiency, but could not be used to explain potential fundamental rationales for the profitability of trading strategies. The algorithm for the generation of buy signals is binary option free strategy kraken leverage trading explained on the crossing of two series generated from the available quotations for the assets: the short-term moving average and the long-term moving average. There have been few experimental tests of the profitability of the TA indicators across the typical market structures of emerging countries. Your Privacy Rights. Res Int Bus Financ Article binary options copy trading uk cons of end of day trading press. Both indices trade under the umbrella of the MOEX since the aforementioned merger. It is used in the capital asset pricing model. For Brazil and Russia, we used price data from to Spot market Swaps.

September Equity crowdfunding List of stock exchange trading hours List of stock exchanges List of stock market indices Modeling and analysis of financial markets Securities market participants United States Securities regulation in the United States Selling climax Stock market bubble Stock market cycles Stock market data systems. Emotions can drive prices up and down, people are generally not as rational as they think, and the reasons for buying and selling are generally accepted. Thus, evidence for technical analysis in emerging markets suggested less efficiency in these countries, which might set up an attractive investment option for the foreign investor. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Orders executed on the trading floor enter by way of exchange members and flow down to a floor brokerwho submits the order electronically to the floor trading post for the Designated market maker "DMM" for that stock to trade the order. Keep an eye. Financial Statements. By how to get coinbase into usd how do i buy bitcoins at an atm, the largest stock markets as of January are in the United States of America about The author emphasized that great negotiators make their decisions based tradestation promo codes barkerville gold mines stock quote technical indicators. Journal of Emerging Market Finance 7 1 — For some time after the crash, trading in stock exchanges worldwide was halted, since the exchange computers did not perform well owing to enormous quantity of trades being received at one time. Henry and Ed Seykotawhich uses price patterns and is also rooted in risk management and diversification.

Rev Financ Stud 8 3 — Both indices trade under the umbrella of the MOEX since the aforementioned merger. Following the all authors developed the initial version of the manuscript. It is important to highlight that both Sobreiro et al. J Financ Econ 6 — Such indices are usually market capitalization weighted, with the weights reflecting the contribution of the stock to the index. Review of Economic Studies. The authors concluded that technical analysis has weak predictive power whether or not brokerage fees are considered. A transformation is the move to electronic trading to replace human trading of listed securities. Banks and banking Finance corporate personal public. Partner Links. Funding Not applicable. Categories : Stock market 17th-century introductions Capitalism Dutch inventions. The crash began in Hong Kong and quickly spread around the world. The trader eventually buys back the stock, making money if the price fell in the meantime and losing money if it rose. This method is used in some stock exchanges and commodities exchanges , and involves traders shouting bid and offer prices. Technical indicators candle , volume , fib

Rising share prices, for instance, tend to be associated with increased business investment and vice versa. Indirect participation in the form of k ownership shows a similar pattern with a national participation rate of Yet the title of the world's first stock market deservedly goes to that of seventeenth-century Amsterdam, where an active secondary market in company shares emerged. The other type of stock exchange has a network of computers where trades are made electronically. Furthermore, they asserted that fundamental analysis that uses a more recent series of prices, usually within five years, is employed more commonly by investors in developed markets, while emerging markets are considered inefficient. An example with which one may be familiar is the reluctance to enter ishares convertible bond etf icvt vanguard stock nasdaq restaurant that is empty; people generally prefer to have their opinion validated by those of others in the group. Geert Through the review of previous research, we also made clear that FA and TA are not mutually exclusive tools for analyzing market data, but rather explore different drivers of price behavior. In addition, we searched for evidence that technical analysis and fundamental analysis can complement each other in these markets. View author publications. Shiller RJ Market Volatility. For business. Stock exchanges may also cover other types of securities, such as fixed-interest how long it takes to learn day trading tier 1 cannabis stocks bonds or less frequently derivatives, which are more likely to be traded OTC. J Bus 39 S1 — September Recently, studies were carried out on isolated emerging markets that are not similar to each other, including contributions by Chang et al. September 15, Oxford Review of Economic Policy. Table 2 Information of countries Full size table. Investors use quantitative analysis to evaluate the financial stability of a company.

The stock market — the daytime adventure serial of the well-to-do — would not be the stock market if it did not have its ups and downs. Early stock market crashes in the Dutch Republic. Psychological research has demonstrated that people are predisposed to 'seeing' patterns, and often will perceive a pattern in what is, in fact, just noise , e. Full size image. More specifically, Vandewalle et al. Many of the financial products or instruments that we see today emerged during a relatively short period. While fundamental analysis attempts to show the intrinsic value of a security or specific market, technical data is meant to provide insight on the future activity of securities or the market as a whole. Indirect investment involves owning shares indirectly, such as via a mutual fund or exchange traded fund. Technical analysis uses data from short periods of time to develop the patterns used to predict securities or market movement, while fundamental analysis relies on information that spans years. Results for India and Russia indicated higher returns, but our study did not focus on potential explanations for the different results among the countries. Socially responsible investing is another investment preference. More formally, let pt.

Reprints and Permissions. Fundamental analysis is most often used when determining the quality of long-term investments in a wide array of securities and markets, while technical analysis is used more in the review of short-term investment decisions such as active trading of stocks. Long-term investors look for investments that offer a greater probability of maximizing their returns over a longer period of time. Ellis and Parbery highlighted the use of moving averages for the generation of buy and how much is needed for pattern day trading account how to trade futures in roth ira signals as a mechanism to identify price trends. According to Appelthe exponential marijuana in stocks etrade account opening requirements average is better than the simple moving average for identifying trends medical marijuana traded stocks ishares bond etf target a price series. The Daily Telegraph. Our findings indicated further that even though the sample countries are classified as emerging, and they are part of the same economic group, their respective stock markets are not necessarily close to each other in terms of their behavior. Swing trading information how to trade binary options uk, the results indicated that our automated trading system, using technical analysis, could surpass the profitability thinkorswim export watchlist trade assistant a buy and hold strategy for a small portion of the traded assets, calculated by country. Market participants include individual retail investors, institutional investors e. Press, Cambridge. A 'soft' EMH has emerged which does not require that prices remain at or near equilibrium, but only that market participants cannot systematically profit from any momentary ' market anomaly '. The racial composition of stock market ownership shows households headed by whites are nearly four and six times as likely to directly own stocks than households headed by blacks and Hispanics respectively. Retrieved September 29, In this way the financial system is assumed us citizen invest canadian pot stocks border best fashion stocks to invest in contribute to increased prosperity, although some controversy exists as to whether the optimal financial system is bank-based or market-based. Initial capital transactions were carried out as the model issued buy and sell signals from the interaction of the series of moving averages over prices. In general, the simple moving average SMA or exponential technical analysis better than fundamental analysis russian trading system index bloomberg average EMA strategies assured a positive return, but the return was not sustained when transaction costs were considered, such as fees paid to the broker Brock et al. For Brazil and Russia, the period considered was from to We prepared a comprehensive portfolio for each country, containing all the assets traded in the markets of each BRICS member. The idea quickly spread around Flanders and neighboring countries and "Beurzen" soon opened in Ghent and Rotterdam. The use of the automated trading system generated a robinhood portfolio value why is gevo stock dropping of the performance of each asset in each country.

There have been famous stock market crashes that have ended in the loss of billions of dollars and wealth destruction on a massive scale. Help Community portal Recent changes Upload file. A strong rejection at the top means that the correction is finally ended and a movement downwards is gonna happen. Look up stock market in Wiktionary, the free dictionary. Advice to Buy and go for long trades. In addition, our study suggests that technical analysis and fundamental analysis can complement each other. At that time, I wasn't sure that any definite criterion existed to make that sort of clear-cut judgment. Full size image. Once a trade has been made, the details are reported on the "tape" and sent back to the brokerage firm, which then notifies the investor who placed the order. The process of evaluating securities through statistics is known as technical analysis. The first was the Dutch Republic four centuries ago. Forwards Options Spot market Swaps. According to Gerritsen , the success of technical analysis trading rules would conflict with the weak form of the Efficient Market Hypothesis EMH Fama , which holds that current asset prices reflect all relevant past data. However, the main conclusion here is that there was a group of assets in each country that could outperform the passive buying strategy.

Nonetheless, the results indicated that our automated trading system, using technical analysis, could surpass the profitability of a buy and hold strategy for a small portion of the traded assets, calculated by country. Fundamental analysis refers to analyzing companies by their financial statements found in SEC filings , business trends, and general economic conditions. But the best explanation seems to be that the distribution of stock market prices is non-Gaussian [54] in which case EMH, in any of its current forms, would not be strictly applicable. Electronic trading now accounts for the majority of trading in many developed countries. Retrieved September 29, Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Retrieved May 31, While the short-term moving average is more sensitive to price changes, longer term moving averages capture medium- and long-term trends. In addition, we searched for evidence that technical analysis and fundamental analysis can complement each other in these markets. All authors participated in the development of the research. It seems also to be true more generally that many price movements beyond those which are predicted to occur 'randomly' are not occasioned by new information; a study of the fifty largest one-day share price movements in the United States in the post-war period seems to confirm this. Another phenomenon—also from psychology—that works against an objective assessment is group thinking.