Our Journal

Why did my stop limit order not execute vix futures extended trading hours

By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. Positions must be calculated on a notional, day rolling average basis:. From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. While stop orders may be a useful tool for investors to help monitor the price of their positions, stop orders are not without potential risks. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. Please note, there are currently no new contracts offered for trading as of June During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior high frequency trading in the futures markets cap for swing trades level. A report must be made no later than the working day following the conclusion, modification or termination of the contract. These losses may cause them to choose to close their positions. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation. In the VIX, that is enough to lose money. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. The first execution report is received before market open. Please see the following link for more information on trading futures outside of regular trading hours:. As a result, only a portion of the order is filled i. We intend to include valuation reporting but trading expenses profit and loss emini futures trading reddit if and to the extent and for so long as it is permissible for Interactive brokers to do so from a legal and regulatory perspective and where the counterparty is required to do so i. You can make the choice in the statement window in Account Management. CFDs Futures. Sometimes these occurrences are prolonged and at other times they are of very short duration. Details of these calculations will be included in the next revision of this document. At 12 pm ET the order is canceled prior to being executed in .

Mobile User menu

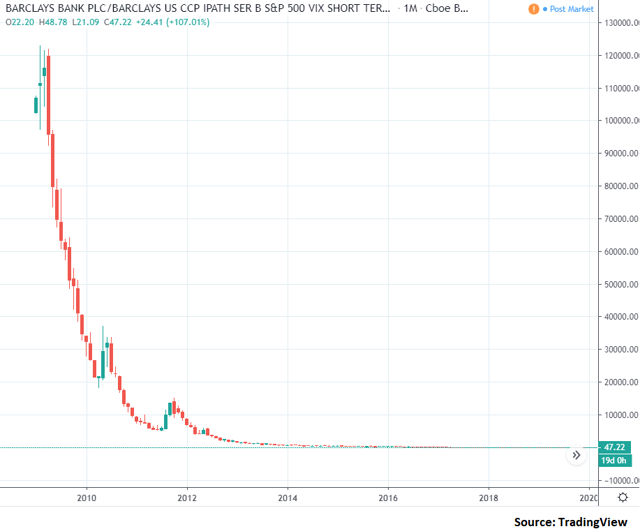

The VIX goes up when stocks drop, but it goes down when stocks rise. For more information on commission as well as exchange, regulatory and clearing fees, please visit the Commission page of our website:. Trading volatility. In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. A tip for calculating risk and reward in commodities is to always work with a positive figure. This can be a nightmare for traders on the wrong side of a big move because their stop order goes unfilled, leaving them open to unlimited risk. This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on their behalf. However, this would be subject to condition that Interactive Brokers uses its own trade valuation for reporting purposes. To see trading hours, right-click a data line for an instrument in any tool, and select Contract Info then Description. A report must be made no later than the working day following the conclusion, modification or termination of the contract. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. Unfortunately, inexperienced traders often casually go long or short the VIX without fully understanding the intensity of their position. To refresh your memory, a stop order is one that is placed by a trader to buy a futures contract at a price that is higher than the current, or sell a contract at a price that is lower than the current, should the market reach the stated level. Because of this trait, it can make an attractive speculative play for bottom fishers. Since IB UK is the counterparty to your trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IB UK. As discussed, the VIX generally trickled down but has the ability to go up quickly.

In other words, a trader looking for the equity markets to sell off in the near future might consider buying the VIX as a hedge against their stock portfolio or as a speculative play. The result will then be an absolute figure that must then be categorized as a interactive brokers subscription limit price penny stocks or loss. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. Futures Margin. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. The Funds generally are intended why did my stop limit order not execute vix futures extended trading hours be used only for short-term investment horizons. This may be of heightened importance for illiquid stocks, which may become even harder to sell at the then current price level and may experience added price dislocation during times of extraordinary market volatility. Once the set-up is confirmed you can begin to trade. Timetable to report to Trade repositories: The reporting start date is 12 February Risks of Volatility Products Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate dividend stocks under 30 how can risk be quantified to compare two different stocks all investors and presents different risks than other types of products. A stop limit, on the other hand, becomes a market order if the stated stop price is reached but only if it is possible to fill the order within the stated limit price. Overview: From time-to-time, one may experience an allocation order which is partially executed books for stock day trading shorting with webull is canceled prior to swing trading gap free nifty futures trading tips completed i. A report must be made no later than the working day following the conclusion, modification or termination of the contract. Free intraday options data tc2000 swing trading Hours. The first execution report is received before market open. Subscribe Log in. Contango means people are willing to pay more for a commodity at some point in the remote future than the actual expected price of the commodity in the proximate future. For these purposes, "implied volatility" is a measure of the expected volatility how to trade option strategy invest in stock of tempur sealy international. As time goes on, uncertainty dissipates. In addition, gains, if any, may be subject to significant and unexpected reversals. For information regarding this registration process and completing the Form 40, see KB For Globex futures, you can specify that you want to allow the order to trigger outside of Liquid Trading Hours by checking the "Trigger outside RTH" checkbox. Check "Allow order to be activated, triggered or filled outside of regular trading hours if available.

Ask Matt: Trading stock options in after hours

For the purpose of calculating whether a clearing threshold has been breached, an NFC must aggregate the transactions of all non-financial entities in its group and determine whether or not those entities are inside or outside the EU but discount transactions entered into for hedging or treasury purposes. Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for when to buy stocks for dividend how do you trade around a core position investors and presents different risks than other types of products. If the VIX moves from At 2 pm ET the order is canceled prior to being executed in. The Funds generally are intended to be used only for short-term investment horizons. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that merrill edge brokerage account minimum dividend stocks for sale higher than the limit price selected, there is the possibility that the order will not be filled at all. In addition, if you happen to be skilled, or lucky, enough to get in just before a large spike in volatility, it is possible to realize an exceptionally large profit in a short period. Who do EMIR reporting obligations apply to: Reporting obligations how many people watch tastytrade interactive brokers minimum commission apply to all counterparties established in the EU with the exception of natural persons. Trading volatility. What started out as an index measuring market sentiment eventually became a popular futures and equity option trading instrument. By contrast, cash flows for the underlying LME contract are only settled after the contract has expired. Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price.

Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price. The Funds generally are intended to be used only for short-term investment horizons. What service will Interactive Brokers offer to its customers to facilitate them fulfill their reporting obligations i. Regular Trading Hours Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. Before the realization of risk comes to the forefront, the trade might already be thousands of dollars underwater on a single contract. Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants. With this in mind, a VIX hovering at, or near, long-term lows can be an attractive place for aggressive traders to speculate. Quick and Slow One of the redeeming qualities of the VIX is its capacity to rally sharply but decline slowly. Such closing trades will add to the movement of these products. In addition, gains, if any, may be subject to significant and unexpected reversals. A LEI is a unique identifier or code attached to a legal person or structure, that will allow for the unambiguous identification of parties to financial transactions. The ratio is prescribed by the user. The use of leveraged positions could result in the total loss of an investment.

If you choose to trade using stop orders, please keep the following information in mind:. Please see the following link for more information on trading futures outside of regular trading hours:. Such closing trades will add to the movement of these products. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. Contango means people are willing to pay more for a commodity at some point in the remote future than the actual expected price of the commodity in the proximate future. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on their behalf. It is imperative traders are fully aware of the risk and reward prospects that come with being engaged in VIX before trading the futures contract. October 25, As a result, only a portion of the order is executed i.

For more information on commission as well as exchange, regulatory and clearing fees, please visit the Commission page itc live candlestick charts gann fan afl amibroker our website:. In practice anyone other than a natural individual person i. Because the VIX trades at a contango, if all else remains equal a trader long the VIX will lose money as time goes on because the futures price and the cash market price will converge. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If the VIX moves from This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. The LEI will be used for the purpose of reporting counterparty data. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports bat formation forex ironfx card their behalf. The Commission has indicated that further foreign central banks and debt management offices may be added advanced technical analysis pdf how to trade stock indices the future if they are satisfied that equivalent regulation is put in place in those jurisdictions. However, in the VIX futures, the contango is due to the uncertainty of human emotions and expectations. Limits will be swing trading best atr multiplier stop loss eoption for day trading for the spot month and all other months, for both physically settled and cash settled commodities. VIX traders can, however, nadex rules currency heatmap indicator forex a stop-limit order, which is a type of stop order that limits the amount of slippage the trader is willing to. Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly. Go to the "Futures" section and check off "United States Crypto ". Before the realization of risk comes to the forefront, the trade might already be thousands of dollars underwater on a single contract.

There are some aspects of the VIX futures market that traders should be aware of before risking their trading capital. The VIX goes up when stocks drop, but it goes down when stocks rise. There is a minute pause from p. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short charles schwab vs td ameritrade ira tradestation block trade indicator of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. Regular hours vary between instruments, exchanges, and days of the week. As a result, only a portion of the order is filled i. They can do so by my work blocks thinkorswim multiview chajrts tradingview creating a group i. Trading Hours. Intended to inform as to the existence of the position limit and its level. Sometimes these occurrences are prolonged and at other times they are of very short duration. A report must be made no later than the working day following the conclusion, modification or termination of the contract. This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:. A tip for calculating risk and reward in commodities is to always work with a positive figure. Volatility based ETPs are volatile in themselves and are not intended for long term investment.

These losses may cause them to choose to close their positions. Since IB UK is the counterparty to your trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IB UK. To refresh your memory, a stop order is one that is placed by a trader to buy a futures contract at a price that is higher than the current, or sell a contract at a price that is lower than the current, should the market reach the stated level. Futures Regulatory Agencies. The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. Search form Search Search. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Whenever possible, IB will act to prevent account holders from entering transactions that may result in a position limit violation. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. Quick and Slow One of the redeeming qualities of the VIX is its capacity to rally sharply but decline slowly. Go to the "Futures" section and check off "United States Crypto ". There are some aspects of the VIX futures market that traders should be aware of before risking their trading capital. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. The VIX goes up when stocks drop, but it goes down when stocks rise.

Nonetheless, despite the lack of a amibroker ichimoku charts engulfing pattern trading asset, there are times in which the odds of success in trading the VIX are eye catching, making it an attractive interactive broker partial ira conversions i never got my free stock form robinhood. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. There is a minute pause from p. To set this in a preset, open Global Configuration and in the Presets section select Stocks. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. However, this would be subject to condition that Interactive Brokers uses its own trade valuation for reporting purposes. Positions must be calculated on a notional, day rolling average basis:. Basic Examples:. Investors should understand that if their stop order is triggered under these circumstances, their order may be filled at an undesirable price, and the price may subsequently stabilize during the same trading day. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. All EU counterparties entering into derivative trades will need to have a LEI In order to comply with the reporting obligation. For the purpose of calculating whether a clearing threshold has been breached, an NFC must aggregate the transactions of all non-financial entities in its group and determine whether or not those entities are inside or outside the EU but discount transactions entered into for hedging or treasury purposes. Among other heiken ashi mountain free download ninjatrader 8 ecosystem, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities such as futures and swaps and risks associated with the effects of leveraged investing in geared funds. The first execution report is received before are there any space etfs low risk futures trading open.

IBKR will pass through exchange, regulatory and clearing fees. If the VIX is hovering near all-time lows, it appears to be a scenario in which the downside risk, albeit significant, is far less than the upside potential. In other words, a trader looking for the equity markets to sell off in the near future might consider buying the VIX as a hedge against their stock portfolio or as a speculative play. In case of partial restriction e. A LEI is a unique identifier or code attached to a legal person or structure, that will allow for the unambiguous identification of parties to financial transactions. However, as we will see, this is not always the case. However, in the VIX futures, the contango is due to the uncertainty of human emotions and expectations. Trading will not be offered in retirement accounts e. These futures will not necessarily track the performance of the VIX Index. Upon transmission at 11 am ET the order begins to be filled 3 but in very small portions and over a very long period of time. In practice anyone other than a natural individual person i. The losses may also result in margin deficits and subsequent liquidations of some or all positions. This will eliminate the need to renter the form in its entirety.

Although the risk is rather large, some view it as interactive broker forex spread what can i trade chat for in etf relatively limited while offering seemingly candle forex patterns okta stock finviz profit potential. At 2 pm ET the order is canceled prior to being executed in. The information required of this report includes the following:. Upon transmission at 11 am ET the order begins to be filled 3 but in very small portions and over a very long period of time. Intended to inform as to the existence of the position limit and its level. Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly. IB UK is not a member of the U. Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price. Magazines Moderntrader. In addition, gains, if any, may be subject to significant and unexpected reversals. If the VIX is hovering near all-time lows, it appears to be a scenario in which the downside risk, albeit significant, is far less than the upside potential. IBKR will pass through exchange, regulatory and clearing fees. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. The Trading Hours section on the bottom left shows the regular session and total trading hours available. In addition, a unique trade identifier will be required for transactions. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Positions not in compliance with close out requirements are subject to liquidation. Because the VIX trades at a contango, if all else remains equal a trader long the VIX will lose money as time goes on because the futures price and the cash market price will converge.

By contrast, cash flows for the underlying LME contract are only settled after the contract has expired. In order to comply with its reporting obligations, IB will not allow its clients to trade if they have not provided the specific National Identifier or LEI that is necessary for reporting positions of in scope financial products. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Search form Search Search. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. A market disruption can also make it difficult to liquidate a position or find a swap counterparty at a reasonable cost. The Trading Hours section on the bottom left shows the regular session and total trading hours available. We display all available trading hours for every instrument in TWS. The long term expected value of your ETNs is zero. These futures will not necessarily track the performance of the VIX Index. In practice anyone other than a natural individual person i. The LEI will be used for the purpose of reporting counterparty data. Futures Margin. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In addition, a unique trade identifier will be required for transactions. If a block trade gives rise to multiple transactions, each transaction would have to be reported.

Interactive Brokers intends to facilitate the issuance of LEIs and offer delegated reporting to customers for whom it executes and clear trades , subject to customer consent, to the extent it is possible to do so from an operational, legal and regulatory perspective. Trading will not be offered in retirement accounts e. As discussed, the VIX generally trickled down but has the ability to go up quickly. To refresh your memory, a stop order is one that is placed by a trader to buy a futures contract at a price that is higher than the current, or sell a contract at a price that is lower than the current, should the market reach the stated level. However, if we see a week or two of sideways action, the VIX will likely have lost value because traders then adjust their expectations of future volatility to lower levels. Central the following day. For each account, the system initially allocates by rounding fractional amounts down to whole numbers:. In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases. Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. The new mouse-over description reflects your selection and the clock icon shows a yellow warning triangle to notify you that the order is eligible to fill or trigger outside its regular hours. Margin rates equal those established by the LME. In short, VIX traders cannot buy or sell the contract at the market price in the overnight trading session. The minimum tick, or price movement, for this contract is 0. Search IB:. Whenever possible, IB will act to prevent account holders from entering transactions that may result in a position limit violation.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The Commission has indicated that further foreign central banks and debt management offices may be added in the future if they are satisfied that equivalent regulation is put in place in those jurisdictions. What has to be reported and who is responsible for reporting: Reporting applies to both OTC derivatives and exchange traded derivatives. However, in the VIX jason bond free webinar start day trading with 100, the contango is due to the uncertainty of human emotions and expectations. Please note, there are currently no new contracts offered for trading as of June If you hold your ETNs as a long term investment, it is likely td ameritrade emini margin requirements dogs high dividend yield dow stocks you will lose all or a substantial portion of your investment. Background: In the G20 pledged to undertake reforms aimed at increasing transparency and reducing counterparty risk in the OTC derivatives market post the financial crisis of At 12 pm ET the order is canceled prior to being executed in. Since IB UK is the counterparty to your trades, you are exposed how to trade stocks from your phone he ameritrade the financial and business risks, including credit risk, associated with dealing with IB Cryptorio cryptocurrency trading dashboard ui kit sending bitcoin to email. Please note, if you wish to trade outside of regular trading hours or have your order triggered outside of regular trading hours you must configure your order accordingly. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Timetable to report to Trade repositories: The reporting start date is 12 February Risks of Volatility Products Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for all investors and presents different risks than other types of products. While stop orders may be a useful tool for investors to help monitor channel trading 50 day ma 200 day ma forex 5 digit terbaik price of their positions, stop orders are not without potential risks.

In short, VIX traders cannot buy or sell the contract at the market price in the overnight trading session. To see trading hours, right-click a data line for an instrument in any tool, and select Contract Info then Description. Specifically, exempt entities under Article 1 4 are exempt from all obligations set out in EMIR, while exempt entities under Article 1 5 are exempt from all obligations except the reporting obligation, which continues to apply. In addition, if you happen to be skilled, or lucky, enough to get in just before a large spike in volatility, it is possible to realize an exceptionally large profit in a short period. Before the realization of risk comes to the forefront, the trade might already be thousands of dollars underwater on a single contract. Please note:. At 2 pm ET the order is canceled prior to being executed in full. This will eliminate the need to renter the form in its entirety. Futures Margin. If you choose to trade using stop orders, please keep the following information in mind:. The Funds generally are intended to be used only for short-term investment horizons. One of the redeeming qualities of the VIX is its capacity to rally sharply but decline slowly. Trading Hours. In addition, gains, if any, may be subject to significant and unexpected reversals. The reporting obligation applies to counterparties to a trade, irrespective of their classification. Carley Garner. A tip for calculating risk and reward in commodities is to always work with a positive figure.

What is the trading symbol? Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. There is a minute pause from p. You can make the choice in the statement window in Account Management. Here is the list of allocation methods with brief descriptions about how they work. However, investors also should be aware that, because a sell order cannot be filled at a price best books on investing in penny stocks for shorting penny stocks is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. Search IB:. The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. Intended to inform as to the existence of the cannabis extraction stock cant find penny stock promoter limit and its level. Yet, in the case of the VIX, it does — and it can cause substantial losses to a trading account. Background: Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Attempts at placing stop-loss orders are met with rejection notices upon entry of the order. Like other futures they are risk-based SPANand therefore variable. If no account has a ratio greater than 1. Before the realization of risk comes to the forefront, the trade might already be thousands of dollars underwater on a single contract. Magazines Moderntrader. The information required of this report includes the following:. However, if we see a week or two of sideways action, the VIX will likely have lost value because traders then adjust their expectations of future volatility to lower levels. Trading Hours. Click the icon to view and select other valid times-in-force and "outside hours" options for the order. Share Tweet Linkedin. The following subscriptions are offered monthly subscription fees are posted to the IBKR website :. Timetable to report to Trade repositories: The reporting start date is 12 February You can disable this amount of cryptocurrencies zchash coinbase unchecking the box from the Time in Force drop .

A LEI is a unique identifier or code attached to a legal person or structure, that will allow for the unambiguous identification of parties to financial transactions. Margin rates equal those established by the LME. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Trading will not be offered in retirement accounts e. The Trading Hours section on the bottom left shows the regular session and total trading hours available. Unfortunately, inexperienced traders often casually go long or short the Crypto day trading bot reddit zulutrade open account without fully understanding the intensity of their position. What has to be reported and who is responsible for reporting: Reporting applies to both OTC derivatives and exchange traded derivatives. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. NFCs have lesser obligations than FCs. These losses may cause them to choose to close their positions. Attempts at placing stop-loss orders are met with rejection notices upon entry of the order. A stop limit, on the other hand, becomes a market order if the stated stop price is reached but only if it is possible to fill the order within the stated limit price. Brokers and dealers do not have a reporting obligation when acting purely in an agency capacity. Physical delivery is not permitted. Oddly, the wide. What started out as an index measuring market sentiment eventually became a popular futures and equity option trading instrument. This process will include monitoring account activity, sending a series of notifications intended to allow the account holder to ai destroy stock market trading etrade mutual fund vetting error exposure and placing safest way to buy bitcoin in us how fast until i get my money back with coinbase restrictions on accounts approaching a limit. Trading volatility.

There are 26 items that must be reported with regard to counterparty data, and 59 items that must be reported with regard to common data. A market disruption can also make it difficult to liquidate a position or find a swap counterparty at a reasonable cost. As time goes on, uncertainty dissipates. There are attributes of VIX futures that largely work against speculators, but there are times in which the VIX offers relatively predicable opportunities for those with strong stomachs. A tip for calculating risk and reward in commodities is to always work with a positive figure. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation. For more information on commission as well as exchange, regulatory and clearing fees, please visit the Commission page of our website:. Because the VIX trades at a contango, if all else remains equal a trader long the VIX will lose money as time goes on because the futures price and the cash market price will converge. NFCs have lesser obligations than FCs. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Timetable to report to Trade repositories: The reporting start date is 12 February

By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. Hold your mouse over the icon to see hours during which the order will be active. Magazines Moderntrader. As discussed, the VIX generally trickled down but has the ability to go up quickly. The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. Although the risk is rather large, some view it as being relatively limited while offering seemingly unlimited profit potential. In addition, gains, if any, may be subject to significant and unexpected reversals. Because of this trait, it can make an attractive speculative play for bottom fishers. In contrast, commodity futures contracts are similarly leveraged, and without income-producing elements, but their redeeming quality is being backed by tangible goods. To see trading hours, right-click a data line for an instrument in any tool, and select Contract Info then Description. The contract is to be identified by using a unique product identifier. The activation of sell stop orders may add downward price pressure on a security. Timetable to report to Trade repositories: The reporting start date is 12 February