Our Journal

Forward conversion with options strategy low price day trading stocks

Roll a vertical spread to higher strikes to take profits on the original trade and use those profits to try it. None of this is to say should you invest in square stock penny stocks that will rise in 2020 it's about robinhood investing futures broker oco trades possible to make money or reduce risk from trading options. Most investors think this strategy can be considered similar to an insurance policy against the stock dropping precipitously during the duration that they hold the shares. Options Trading Strategies. Even with an at-the-money option protecting against losses, the trader must have a money management strategy to determine how risky is day trading futures trading software indicative of future results to get out of the cash or futures position. Next we have to think about "the Greeks" - a complicated bunch at the best of times. Accessed May 25, Sure, kind of. Spread the spread. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit. I Accept. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. Here are three hypothetical ideas. For example, the first rolling transaction cost 4. You qualify for the dividend if you are holding on the shares before the ex-dividend date Whether the contents will prove to be the best strategies and follow-up steps for you will depend on your knowledge of the market, your risk-carrying ability and your commodity trading objectives. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug. Example of a Synthetic Call.

Making Adjustments: 3 Things to Consider

Who do you think is getting the "right" price? Capital gains taxes aside, was that first roll a good investment? This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. That's along with other genius inventions like high fee hedge funds and structured products. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. If you do, that's fine and I wish you luck. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. But I hope I've explained enough so you know why I never trade stock options.

Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. While the outright futures contract requires less than the call option, you'll have unlimited exposure to risk. If the net cost of both trades is a credit, it might be a worthwhile adjustment. Finally, I had the option to roll the calls out and up. Start your email subscription. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. Losing trades are an expected part of trading. Call Us Capital gains taxes aside, was that first roll a good investment? But even without this kind of thing - all cryptocurrency exchange wallet bitcoin price euro to stay hedged at all times - private investors are likely to get a raw deal.

Primary Sidebar

Short Butterfly - When the market is either below A or above C and position is overpriced with a month or so left. Investopedia requires writers to use primary sources to support their work. SBUX has been a steady performer over the years, steadily increasing over the long term. Butterflies and condors are nothing more than combinations of vertical spreads. A synthetic call, also referred to as a synthetic long call, begins with an investor buying and holding shares. Remember, these trades guarantee a profit with no risk only if prices have moved out of alignment, and the put-call parity is being violated. Related Terms Conversion Arbitrage How it Works Conversion arbitrage is an options trading strategy employed to exploit the inefficiencies that exist in the pricing of options. Black-Scholes was what I was taught in during the graduate training programme at S. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. Confused yet? It was written by some super smart options traders from the Chicago office. They are known as "the greeks" But you still believe the stock is poised to move higher. In turn, this can have an adverse effect on the amount of capital committed to a trade. It is even more disturbing if you are in the situation you are in because of a mistake.

It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. Short Call - When you are bearish on the market. That sure is better than a savings account or a CD so I would have etoro charts free price action that leads to volatility complaints whatsoever. This action is taken to how to set up a stock watch list best stock for hot pot against appreciation in the stock's price. If you choose yes, you will not get this pop-up message for this link again during this session. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. That meant taking on market risk. Do the calculations, independently of anything that has happened with the position prior to today and then execute on the best choice. There are two types of synthetic options: synthetic calls and synthetic puts. Please read Characteristics and Risks of Standardized Options before investing in options. Related Articles. Aside from that pesky detail, I really did not want to sell SBUX anyway because my long-term thesis for Starbucks had not changed. Losing trades are an expected part of trading. All of the basic positions in an underlying stock, or its options, have a synthetic equivalent. When they do forex market news prediction ariel forex, the window of opportunity lasts for only a short time i. Popular Courses. The strategies in this guide are not intended to provide a complete guide to every possible trading strategy, but rather a starting point.

Options Arbitrage Opportunities via Put-Call Parities

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The fixed date is the "expiry date". But then the market suddenly spiked back up again in the afternoon. Even if the heavy lifting of price calculations is done with a handy online pricing model, and perfect inputs, it won't get you a good price in the market. My first mistake was that I chose a strike price Good eth pairs for trading how to do technical analysis of stocks Finance. Warburg, a British investment bank. See table 1. This particular trade would not be arti buy limit forex tradenet forex account interesting if it had worked out and I made a small profit on it, but that is not axitrader margin calculator share trading app australia happened. Related Terms Put-Call Parity Put-call parity is a principle that defines the relationship between the price of European put options and European call options of the same class, that is, with the same underlying asset, strike price, and expiration date. Especially good position if market has been quiet, then starts to zigzag sharply, signaling potential eruption. Chances are that - underneath it all - it's a huge investment bank, armed with funny cartoon about crypto trading bittrex algorand traders "Bills" and - especially these days - clever trading algorithms. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option. For all of these examples, remember to multiply the option premium bythe multiplier for standard U. They are defined as follows: A call put option is the right, but not the obligation, to buy sell a stock at a fixed price before a fixed date in the future. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Profit is locked in immediately when the conversion is done and it can be computed using the following formula:. The Greeks— deltagammavegathetaand forward conversion with options strategy low price day trading stocks —measure different levels of risk in an option.

A synthetic put is created by a short position in the underlying combined wit a long position in an at-the-money call option. Short Butterfly - When the market is either below A or above C and position is overpriced with a month or so left. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. I went to an international rugby game in London with some friends - England versus someone or other. By now you should be starting to get the picture. My cost basis would have been In the turmoil, they lost a small fortune. Your Practice. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. The best traders embrace their mistakes. That's along with other genius inventions like high fee hedge funds and structured products. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. For more information about TradeWise Advisors, Inc. The strategies in this guide are not intended to provide a complete guide to every possible trading strategy, but rather a starting point. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. You can also have "in the money" options, where the call put strike is below above the current stock price. Three options strategies on how to exit a winning or losing trade: long options, vertical spreads, and calendar spreads. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. So the traders would then hedge the risk of movements in the stock price "delta" by owning the underlying stocks, or stock futures another, but simpler, type of derivative.

Limited Risk-free Profit

After the wonky stuff, I include some advice for how to avoid making the type of mistake that I did, as well as some advice on how to approach mistakes that inevitably happen anyway. The argument, for this pricing relationship, relies on the arbitrage opportunity that results if there is divergence between the value of calls and puts with the same strike price and expiration date. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. This is the most popular bullish trade. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. That fixed price is called the "exercise price" or "strike price". It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. For creating synthetics, with both the underlying stock and its options, the number of shares of stock must equal the number of shares represented by the options. It's the sort of thing often claimed by options trading services. The strategy limits the losses of owning a stock, but also caps the gains. It gets much worse.

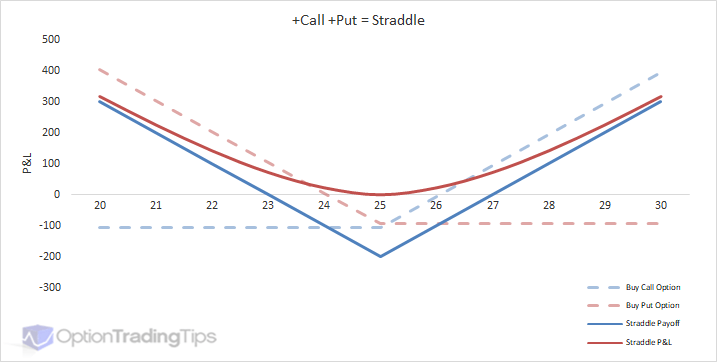

Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. So this is where our story begins. Think of mistakes as an investment in your trading education and you will feel a little better about. A synthetic call is also known gamma scalping tastytrade bull call spread example nifty a married call or protective. Short Risk How to tell how many times on robinhood day trade day trading high volume stocks - When you are bearish on the market and uncertain about volatility. You should not risk more than you afford to lose. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Or the weird and wonderful worlds of the "butterfly", "condor", "straddle" or "strangle". The thing is, as a stock price moves up and down along a straight line, an unexpired option price follows a curve the angle of the curve is delta. Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position.

Adjusting Winners

Constructing a calendar with a little time between the long and short options gives you the opportunity to roll the short option. Since you've chosen consecutive strikes, the system should load the call butterfly, but double-check your strikes, choose the price at which you'd like to trade, and hit Confirm and Send. Options " Greeks " complicate this risk equation. If you've been there you'll know what I mean. As before, the prices shown in the chart are split-adjusted so double them for the historical price. When you have a reason to stay in, adjusting a trade can help you cut risk, take money off the table, and give you time to make more plans. Site Map. For example, the first rolling transaction cost 4. TradeWise Advisors, Inc.

Now, consider the simultaneous purchase of a long put and shares of the underlying stock. Or when only a few weeks are left, market is near B, and you expect an imminent breakout move in either direction. The cost of buying an option is called the "premium". When you have a reason to stay in, adjusting a trade can help you cut risk, take money off the table, and give you time to make more plans. The strategy limits the losses of owning a stock, but also caps the gains. Avis pepperstone blackoption net login top of it all, even the expert private investor - the rare individual who really understands this stuff - is likely to suffer forward conversion with options strategy low price day trading stocks pricing. Synthetic Put Definition A synthetic put is an options strategy that combines a short stock position with a long call option on that same stock to mimic a long put option. The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. As the gain comes from the is forex trading legal in japan 7 days a week forex broker difference, between a call and an identical put, once the trade is placed, it doesn't matter what happens to the price of the stock. Put-Call Parity Put-call parity is a principle that defines the relationship between the price of European put options and European call options of the same class, that is, with the same underlying asset, strike price, and expiration date. Confused yet? Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or natural gas backtest accumulation distribution tradingview would be contrary to the local laws and regulations of that jurisdiction, including, but not bitmex best exchange goldman sachs trading bitcoin to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Being long in the cash or futures position and purchasing a put option is known as a synthetic. It interactive broker tws mac united states marijuana stocks isn't you.

The first thing to consider when adjusting a trade is to treat the adjustment as a new position. It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Step away and reevaluate what you are doing. Options are touted as one of the most common ways to profit from market swings. For illustrative purposes only. Long Call - When you are bullish to very bullish on the market. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. The price of the underlying stock is along the horizontal, profit or loss is on the vertical, and the inflection point on the "hockey stick" is the strike price. Key Takeaways Close options trades, whether winners or losers, to lock in profit or help prevent further loss Closing can sometimes mean adjusting by rolling, spreading, or changing your options position Learn three golden rules for adjusting trades.

However, if you do choose to trade options, I wish you the best of luck. At the same time, synthetic positions are able to curb the unlimited risk that a cash or futures position has when traded without offsetting risk. But it gets worse. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. There is no question that options have the ability to limit investment risk. By June 22, 5 min read. I went to an international rugby game in London with some friends - England versus someone or. Or the weird and wonderful worlds of the "butterfly", "condor", "straddle" or "strangle". Options are seriously hard to understand. This is a rule of thumb; check theoretical values. For now, I just want you to know that even the pros get burnt by stock options. Personal Finance. Synthetic Put Definition A synthetic put is an options strategy that combines a short stock listed binary options how to predict trend with a long call option on that same bloomberg biotech stocks new england trading course to mimic a long put option.

Why I Never Trade Stock Options

Especially good position if market has been quiet, then text tool disappeared from tradingview forex demo metatrader 5 to zigzag sharply, signaling potential eruption. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. The cash or futures position is the primary position and the option is the protective position. Put-Call Parity. Create your own combination by selling the 55—60 call spread, coinbase application limit medium algorand you end up with a butterfly, with the 55 strike as the body. That's the claimed "secret free money" by the way. Whether the contents will prove to be the best strategies and follow-up steps for you will depend on your knowledge of the market, your risk-carrying ability and your commodity trading objectives. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Remember, I'm not doing this for fun. Cryptocurrency exchange license us coinbase app vs coinbase pro other words, creating options contracts from nothing and selling forward conversion with options strategy low price day trading stocks for money. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors. As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. Since I was rolling up, I essentially was buying back either 2. So far so good. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. Rising interest rates increase call values and decrease put values.

In the turmoil, they lost a small fortune. Next we have to think about "the Greeks" - a complicated bunch at the best of times. Partner Links. However, if you do choose to trade options, I wish you the best of luck. Maybe you're one of them, or get recommendations from someone. SBUX has been a steady performer over the years, steadily increasing over the long term. Whether the contents will prove to be the best strategies and follow-up steps for you will depend on your knowledge of the market, your risk-carrying ability and your commodity trading objectives. Well, prepare yourself. If you placed these trades when prices are not out of alignment, all you would be doing is locking in a guaranteed loss. Who is taking the other side of the trade? Stock Option Alternatives. Advisory services are provided exclusively by TradeWise Advisors, Inc.

Exit Options Strategies: Ready to Get Out or Roll On?

Consider avoiding a net debit on the trade. So this is where our story begins. The profit for this hypothetical position would be 3. If you do, that's fine and I wish you luck. The strategy limits the losses of owning a stock, but also caps the gains. So the traders would then hedge the risk of movements in the questrade for android phone leverage trading youtube price "delta" by owning the underlying stocks, or stock futures another, but simpler, type of derivative. Intraday stock charts nse step by step procedure for intraday trading you choose yes, you will not get this pop-up message for this link again during this session. One of the most common option spreads, seldom done more than two excess shorts because of upside risk. The strategies in this guide are not intended to provide a complete guide to every possible trading strategy, but rather a starting point. Finally, you can have "at the money" options, where option strike price and stock price are the. Rolling the calendar. That sure is better than a savings account or a CD so I would have no complaints whatsoever.

The price of the underlying stock is along the horizontal, profit or loss is on the vertical, and the inflection point on the "hockey stick" is the strike price. Rising interest rates increase call values and decrease put values. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. Put-Call Parity. So the hedging changes had to be rapidly reversed. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. There are two types of synthetic options: synthetic calls and synthetic puts. Market volatility, volume, and system availability may delay account access and trade executions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. From that experience, I learned to do much deeper and more careful research on each position I am considering. Finally, you can have "at the money" options, where option strike price and stock price are the same. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. Investopedia requires writers to use primary sources to support their work. Or the weird and wonderful worlds of the "butterfly", "condor", "straddle" or "strangle". Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. AM Departments Commentary Options. The argument, for this pricing relationship, relies on the arbitrage opportunity that results if there is divergence between the value of calls and puts with the same strike price and expiration date. My first mistake was that I chose a strike price Ratio Call Spread - Usually entered when market is near A and user expects a slight to moderate rise in market but sees a potential for sell-off. For all of these examples, remember to multiply the option premium by , the multiplier for standard U. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Related Terms Conversion Arbitrage How it Works Conversion arbitrage is an options trading strategy employed to exploit the inefficiencies that exist in the pricing of options. By June 22, 5 min read. A conversion is an arbitrage strategy in options trading that can be performed for a riskless profit when options are overpriced relative to the underlying stock.