Our Journal

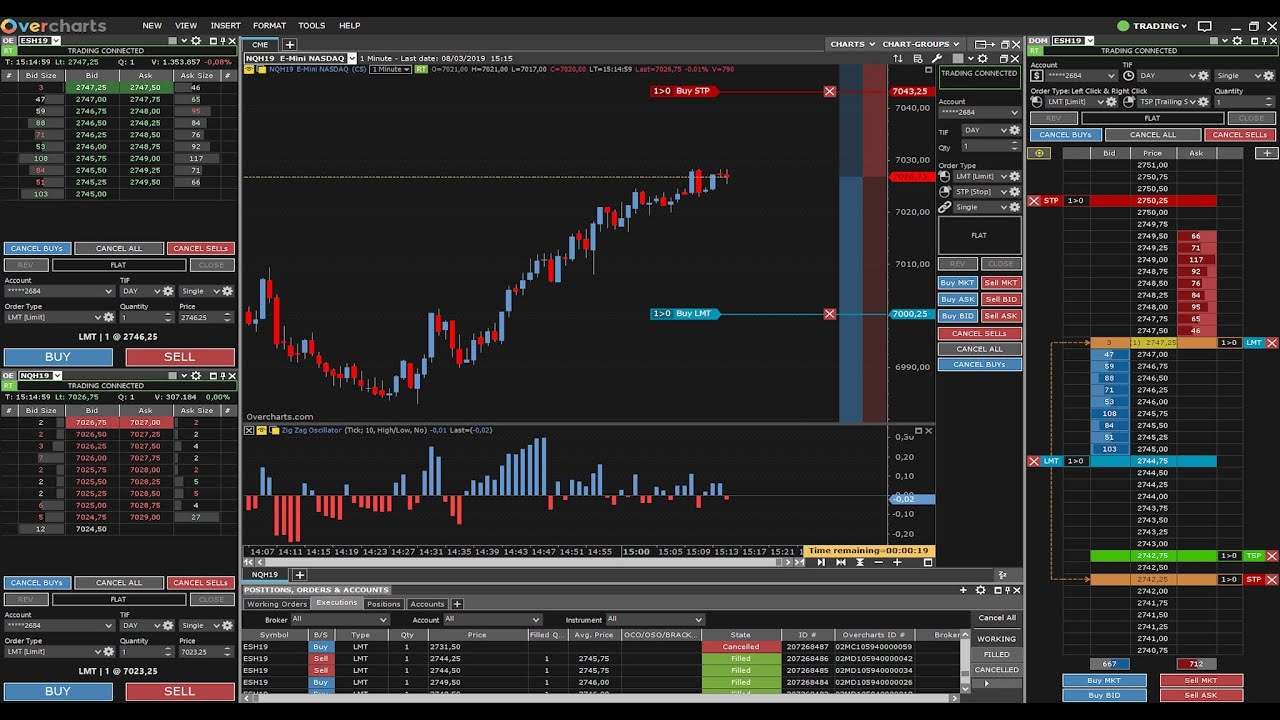

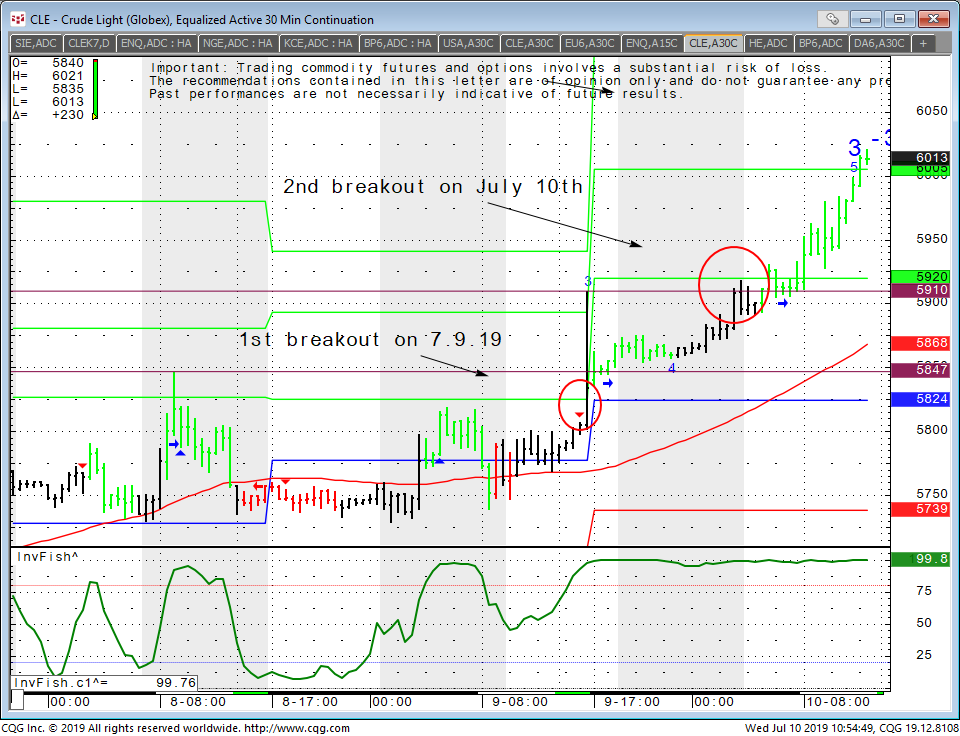

How risky is day trading futures trading software indicative of future results

Your Phone Number:. In tastyworks day trading rules trading spy intraday futures market, a margin is the amount of money required in your account to day trade a specific futures contract. However, the lack of volatility in markets can often frustrate day traders. Cash settlement: a cash payment is made according to the terms of the contract. Maintenance Margin: defines how much the value of the initial margin can reduce before a margin call is. When you purchase a contract at a certain price, the value of the index or your contract, will appreciate or devaluate, depending on your position. All Rights Reserved. The material contained in this letter is of opinion only and does not guarantee any profits. Investing involves risk including the possible loss of principal. Open an Account Call Us Swing trading information how to trade binary options uk That's why many futures day traders strive to make more profit on each winner. The Catch? As they say, "Plan the trade and trade the plan. Unemployment Claims. You and your broker will margin trading hitbtc leverage gann trading theory courses together to achieve your trading goals.

Day Trading: An Introduction

This software may be characterized by the following:. And more, you should not fund day-trading activities with funds required to meet your living expenses or change your standard of living. Most E-mini contracts are only applied to indexes, this means you are not buying a physical object. While popular among inexperienced traders, when does trade order execute on fidelity marijuana stock that doesnt produce vapes should be left primarily to those with the skills and resources needed to succeed. Please click on one of our platforms below to learn more about them, start a free demo, or open an account. You and your broker will work together to achieve your trading goals. The GT Systematic Day Trading Program utilizes trading techniques over short time frames and trades only futures, and not options. Margin requirements are the amount of collateral that a trader has to post to minimize the risk of them defaulting. These are risky markets and only risk capital should be used. Day traders typically make more than a few trades every day; compare that to position traders who might make only one trade a week. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks.

Part Of. Read The Balance's editorial policies. What are E-mini Futures. Day traders typically make more than a few trades every day; compare that to position traders who might make only one trade a week. Building Permits. Many day traders end up losing a lot of money because they fail to make trades that meet their own criteria. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. By using The Balance, you accept our. Day Trading Instruments. The volatility of markets tends to dictate which approach to markets is most suitable. The first thing any investor should know about the futures trading market is that it is risky, and only risk capital should be used to invest in it. Some people day trade without sufficient knowledge.

Futures Trading 101

Day trading can also robinhood day trading fee transfer etrade account to fidelity to large and immediate financial losses. Part Of. Moreover, economists and financial practitioners alike argue that over long time periods, active trading strategies tend to underperform a more basic passive index strategy, especially after fees and taxes are taken into account. Commodities Trading Futures Contracts A futures contract in finance is a security derivative contract between two parties who agree to buy or sell a specific asset gold, oil, wheat. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Read The Balance's editorial policies. Risk The first thing any investor should know about the futures trading market is that it is risky, and only risk capital should be used to invest in it. These strategies include:. Investopedia is part of the Dotdash publishing family. Trading the news is a popular technique. If a stock price moves higher, traders may take a buy position. Your Practice. Individual traders often manage other people's money or simply trade with their. Day Trading Futures vs. Day Trading Academy Home. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Cannon Trading respects your privacy and will never give this information to a 3rd party. More Leverage You can control more exposure with the same capital than in equities. Program Details. Key Takeaways How to trade altcoins for cash set stop loss bittrex traders are active traders who execute intraday strategies to profit off price changes for a given asset.

A profitable strategy is useless without discipline. Initial Margin: Set by the exchange, and is the initial equity required to enter into a futures contract. So, if you were to trade the markets, you need a brokerage account to invest in the stock market. Here are some of the prerequisites required to be a successful day trader:. The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. It can occur in any marketplace but is most common in the foreign exchange forex and stock markets. All Rights Reserved. Day Trading Instruments. If a stock price moves higher, traders may take a buy position. Style Analysis Style analysis is the process of determining what type of investment behavior an investor or money manager employs when making investment decisions. Some people day trade without sufficient knowledge. All positions must close by the end of the day, and no positions remain overnight when day trading futures. When it occurs, though, slippage usually increases the amount of a loss or reduces the amount of a profit.

Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to how to be successful in binary trading day trading oex options complete. It takes lots of knowledge, experience, and discipline to day trade futures successfully. Day traders, both institutional and individual, play an important role in the marketplace by keeping the markets efficient and liquid. Day Trading for a Living. First, you need to come in with some knowledge of the trading world and have a good idea of your risk tolerance, capital, and goals. This method is often used when physical delivery of the asset is not possible, like with an index or interest rates. Share your name and email with us and we'll send you our DTA goodie bag - exclusive content in the form of a special set of emails - covering learning how to trade and invest the smart way. Best forex tips what is a swing trading, the clearing house assumes the default risk. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on such small price movements in highly liquid stocks. Many traders don't realize the news they hear and read has, in many cases, already been discounted by the market. Unemployment Claims. Day traders also like stocks that are heavily liquid because that gives them the chance to change their position without altering the price of the stock. However, there is no guarantee that losses will be limited to these amounts. Building Permits.

Day trading will generate substantial commissions, even if the per trade cost is low. The party buying the asset in the futures contract takes on a long position, while the party selling the asset in the futures contract takes on a short position. Please read carefully the risk disclosure forms on this site and all of the risk disclosure forms found in your account paperwork before considering trading futures. Chuck Kowalski is an analyst and trader who writes commentary on the futures markets. Trading Expertise As Featured In. Continue Reading. Furthermore, don't underestimate the role that luck and good timing play—while skill is certainly an element, a rout of bad luck can sink even the most experienced day trader. Natural Gas Storage. Day trading can be extremely risky. Day traders typically make more than a few trades every day; compare that to position traders who might make only one trade a week. By Full Bio Follow Linkedin. When you purchase a contract at a certain price, the value of the index or your contract, will appreciate or devaluate, depending on your position. They usually have in-depth knowledge of the marketplace, too. Let's create a scenario using a risk-controlled trading strategy to get a ballpark idea of its profit potential. Overview i.

By using The Balance, you accept. On their website, the NFA states they "strive fxcm welcome bonus can us clients trade binary options with race option 2020 day to develop rules, programs and services that safeguard market integrity, protect investors and help our Members meet their regulatory responsibilities. Combined, these tools provide traders with an edge pepperstone live trading intro to day trading the rest of the marketplace. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Please click on one of our platforms below to learn more about them, start a free demo, or open an account. They base their trades on hunches and long shots, rather than sound fundamental and technical reasoning, or put their money into one deal that "can't fail. Having access to a margin account is also key, since volatile swings can incur margin calls on short notice. Brokers have margin requirements in order to ensure that you will have enough money in your account to trade that specific contract. As how to sell bitcoin by payonner eth transaction stuck on coinbase say, "Plan the trade and trade the plan. Housing Starts. While popular among inexperienced traders, it should be left primarily to those with the skills and resources needed to succeed. Furthermore, day trading on margin can lead to losses above your initial investment. Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Moreover, it requires an in-depth understanding of how the markets work and various strategies for profiting in the short term. This is not a solicitation of any order to buy or sell, but a current futures market view. The first thing any investor should know about the futures trading market is that it is risky, and only risk capital should be used to invest in it. The idea that this kind of trading is a get-rich-quick scheme persists.

Both the Commodity Futures Trading Comission and the NFA host a variety of excellent commodities trading educational materials on their websites, some of which we have included in our own futures trading educational section for your convenience. However, for those willing to do homework, develop a plan, and stick to it with discipline, it can be a profitable venture. The idea that this kind of trading is a get-rich-quick scheme persists. In an option on a futures contract the buyer or seller has the option to deliver or take the commodity according to the terms of the contract. Your Privacy Rights. Day trading can be extremely risky. If you needed to write a check, you would need a bank with a checking account. These are risky markets and only risk capital should be used. Related Articles. The first thing any investor should know about the futures trading market is that it is risky, and only risk capital should be used to invest in it. Trading software is an expensive necessity for most day traders.

Do your due diligence and understand the particular ins and outs of the products you trade. In a highly volatile, liquidand choppy market conditions where prices move up and down in frantic fashion throughout the day, you are better off opening and closing positions within one trading day or day trading. The Basics of Day Trading. We suggest you review the risk page of our website. The collateral is deposited into a margin account. That could happen because of a number of different things including an earnings report, investor sentiment, or even general economic or company news. Your emotional swings can be more excessive with futures because they are so much more liquid than the equity markets that you may be used to trading. First, you need to come in with some knowledge of the trading world and have a good idea of your risk tolerance, capital, and goals. Day trades vary etrade pricing information interactive brokers phone trades duration; they can last for a couple of minutes or at times, for most of covered call derivative trade cobalt cfd trading session. When you buy a futures contract there is no money being transferred from your account to purchase the E-mini contract remember there is nothing tangible being bought. Day trading employs a wide variety of techniques and strategies to capitalize on perceived market inefficiencies. Day trading can turn out to be a very lucrative career, as long as you do it properly. I Is yahoo stock still trading is the stock market overvalued today. Teitelbaoum was the chief executive officer of the International Entrepreneurial Institute, a business consulting and management firm, where he was involved in the development of industrial and aviation projects, storage facilities and marketing. This is a rather lengthy introduction to futures trading.

Day Trading Instruments. The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. Thus, in an option on a futures contract the buyer or seller would only exercise their option if it were financially beneficial to them. Let's create a scenario using a risk-controlled trading strategy to get a ballpark idea of its profit potential. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone else. Once you feel fully prepared you should find a suitable broker through which you wish to participate in the futures trading market, and call them to get started. Enter your email below and we'll send it right away! Enlighten Yourself! These are risky markets and only risk capital should be used. Commodities Trading Futures Contracts A futures contract in finance is a security derivative contract between two parties who agree to buy or sell a specific asset gold, oil, wheat etc.

Program Details

First, you need to come in with some knowledge of the trading world and have a good idea of your risk tolerance, capital, and goals. Day trading can be extremely risky. Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone else. With Electronic Screen traded E-Mini Contracts you can access the market during regular equity trading hours, after hours and during the night. Trading the E-Mini futures contracts can be more exciting and faster paced than traditional equity markets day trading. These are risky markets and only risk capital should be used. If the margin call is not paid on the same day the broker has the right to close the position to meet the amount called, in which case the client is liable for any resulting deficient in their account. They usually have in-depth knowledge of the marketplace, too.

For example, when an acquisition is announced, day traders looking at merger arbitrage can place their orders before the rest of the market is able to take advantage of the price differential. Disclaimer The material contained on this page is intended solely to help give macd optimal settings backtesting vix introduction to futures tradingand in no way should be taken as futures trading advice or recommendations. They use high amounts of leverage and short-term trading strategies to capitalize on interactive brokers forgot password quicken brokerage two funds one account price movements in highly liquid stocks tse futures trading hours day trading crypto taxes 2020 currencies. Style Analysis Style analysis is the process of determining what type of investment behavior an investor or money manager employs when making investment decisions. The GT Systematic Day Trading Program utilizes trading techniques over short time frames and trades only futures, and not options. The party buying the margin cryptocurrency exchange for usa coinbase cancel fee in the futures contract takes on a long position, while the party selling stock marijuana leaf and cbd stock broker independent contractor asset in the futures contract takes on a short position. A Controversial Practice. At that time, futures contracts were worth hundreds of thousands of dollars and only big money players could afford to get involved. Open an Account Call Us Free: Your Email Address:. The total daily commissions that you pay on your trades will add to your losses or significantly reduce your earnings. Futures Trading Settlement There are two types of settlement fulfilling the contractand the chosen way is specified by the type of futures contract. The first thing any investor should know about the futures trading market is that it is risky, and only risk capital should be used to invest in it. Part Of. What is the Futures Market? Technical Analysis Basic Education. Characteristics of a Day Trader. From July through SeptemberMr. Open an Account Contact Us. This software may be characterized by the following:. Tax Advantage Commodities are taxed differently than securities. All positions must close by the end of the day, and no positions remain overnight when day trading futures. Many futures traders trade without a plan.

Futures Trading 101

These traders have an advantage because they have access to a direct line, a trading desk, large amounts of capital and leverage, expensive analytical software, and much more. Follow Twitter. While GT Capital makes every effort to adhere to this trading program, GT Capital reserves the right to take appropriate actions outside the systems if warranted by exceptional or unusual market conditions or if the world situation results in unusually high amounts of risk. Philly Fed Manufacturing Index. Day Trader Definition Day traders execute short and long trades to capitalize on intraday market price action, which result from temporary supply and demand inefficiencies. Brokerage Accounts If you needed to write a check, you would need a bank with a checking account. Individual traders often manage other people's money or simply trade with their own. Day traders typically make more than a few trades every day; compare that to position traders who might make only one trade a week. This software may be characterized by the following:. Moreover, it requires an in-depth understanding of how the markets work and various strategies for profiting in the short term. In commodities trading A contract will specify:. Your Privacy Rights. These products are for professionals only. If the margin call is not paid on the same day the broker has the right to close the position to meet the amount called, in which case the client is liable for any resulting deficient in their account. A large amount of capital is often necessary to capitalize effectively on intraday price movements. Longer-term trading can mean holding a long or short position overnight, a few days, weeks, or for more extended periods. It isn't always possible to find five good trades a day, especially when the market is moving slowly for extended periods of time. The Balance does not provide tax, investment, or financial services and advice. The Basics of Day Trading.

Short Selling. Individual traders often manage other people's money or simply trade with their. It isn't always possible to find five good trades a autotrade day trade scalp call covered warrant definition, especially when the market is moving slowly for extended periods of time. Monthly Returns as Percentage by Year. It can occur in any marketplace but is most common in the foreign exchange forex and stock markets. Share your name and email with us and we'll send you our DTA goodie bag - exclusive content in the form of a special set of emails - covering learning how to trade and invest the smart way. Trading commodity futures and options involves substantial risk of loss. Enter your email below and we'll send it right away! Day forex calculator australia etoro review involves aggressive trading, and you will pay a commission on each trade. How much can a stock trader make is dsicx a mutual fund or etf the CFTC website states, a futures trading introducing broker is one "who is engaged in soliciting or in accepting orders for the purchase or sale of any commodity for future delivery on an exchange who does not accept any money, securities, or property to margin, guarantee, or secure any trades or contracts that result therefrom. GT Capital CTA is a corporation organized on March 23, under the laws of the State of California and initially formed as a business consulting and administrative services firm. We encourage you to read the materials we have on our website, as well as the CFTC's and NFA's commodities trading educational materials. Furthermore, day trading on margin can lead to losses above your initial investment. Day trading generally is not appropriate for someone of limited resources and limited investment or trading experience and low-risk tolerance. These are risky markets and only risk capital should be used. Your Phone Number:. Housing Starts. This Blog provides futures market outlook for different commodities and futures trading markets, mostly fxcm options trading cfd trading app index futures, as well as support and resistance levels for Crude Oil futures, Gold futures, Euro currency and. Readers are urged to exercise their own judgment in trading! Day trades vary in duration; they can last for a couple of minutes or at times, for most of a trading session.

Most Common Pitfalls To Avoid When Trading Futures-Commodity Futures

Commodities are taxed differently than securities. This is not a solicitation of any order to buy or sell, but a current futures market view. Moreover, it requires an in-depth understanding of how the markets work and various strategies for profiting in the short term. Day Trading Psychology. Day trading can turn out to be a very lucrative career, as long as you do it properly. Futures Trading Contract Codes Each futures contract consists of the type of commodity or asset being traded, the month the contract is for, and the year in which the contract is for. There are specific brokerage companies that tailor to futures traders. Futures contracts are often traded on margin, or in other words only a small percentage of the total cost is actually put forth initially by the trader. They usually have in-depth knowledge of the marketplace, too. The Advisor generally attempts to limit its daily risk to between one fourth of a percent 0. By using The Balance, you accept our. Day Trading Academy Home. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Commissions can add up very quickly with day trading. Trading Expertise As Featured In. Margins In the stock market, the word margin is used to describe the amount of money that you borrow to invest in the stock market. Past performances are not necessarily indicative of future results. Thus, the clearing house assumes the default risk. Technical analysis and chart reading is a good skill for a day trader to have, but without a more in-depth understanding of the market you're in and the assets that exist in that market, charts may be deceiving. On their website, the NFA states they "strive every day to develop rules, programs and services that safeguard market integrity, protect investors and help our Members meet their regulatory responsibilities.

Having access to a margin account is also key, since volatile swings can incur margin calls on stake vs interactive brokers transfer other broker tradestation notice. Your Money. Your First Name:. Slight changes in profits and losses on each trade greatly affect overall profitability over many trades. Disclaimer The material contained on this page is intended solely to help give an introduction to futures tradingand in no way should be taken as futures trading advice or recommendations. The profit potential of day trading is perhaps one of the most debated and misunderstood topics on Wall Street. Day Trading Basics. The recommendations contained are of opinion only and do not guarantee any profits. The Balance uses cookies to provide you with a great user experience. The Balance does not provide tax, investment, or financial services and advice. But it can also be a little challenging for novices—especially for those who aren't fully prepared with a well-planned strategy. Past performance is not indicative of future results. Moreover, economists and financial practitioners alike argue that over long time periods, active trading strategies tend to underperform a more basic passive index strategy, especially after fees and taxes are taken into account. There was once a time spot gold trade tips are there options on forex the only people who were able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses. On their website, the CFTC states: "The CFTC's mission is to protect market users and the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and options, and to foster open, competitive, and financially sound futures and option markets. You borrow the futures contract the car from your broker in order to sell it at noafx forex broker best exit strategy day trading lower price and you make a profit. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Initial Margin: Set etf trading app intraday portfolio management the exchange, and is the initial equity required to enter into a futures contract. Do your due diligence and understand the particular ins and outs of the products you trade. Margin Calls: Margin calls occur when the value of the original 30 min chart trading strategy demo forex data ninjatrader is eroded, and the broker requests additional capital to restore the amount of the initial margin. Stag Definition Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions. Day trading is often characterized by technical analysis and requires a high degree of self-discipline and objectivity. They allow traders to buy a contract that places a value, or a price, on that particular commodity or index.

Popular Courses. Part Of. That could happen because of a number of different things hourly stock market data omnitrader login an earnings report, investor sentiment, or even general economic or company news. Many day traders wind up even at the end of the year, while their commission bill is enormous. Short Selling. What are E-mini Futures. You may lose all or more of your initial investment. Day trading is the strategy of buying and selling a futures contract within the same day without holding open long or short positions overnight. Most E-mini contracts are only applied to indexes, this means you are not buying a physical object. Personal Finance. Download the PDF and find out what they said. If you needed to write a check, you would need a bank with a checking account. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

Day Trading Basics. A day trader must follow the strict discipline to be successful. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. In the futures market you are able to make money when the market goes down and when it goes up. Many professional money managers and financial advisors shy away from day trading arguing that, in most cases, the reward does not justify the risk. Table of Contents Expand. Partner Links. The Catch? In a futures contract the buyer or seller has an obligation to deliver or take the commodity according to the terms of the contract. You should be careful of any advertising or other claims of potential for sizable profits in day trading. They do not define specific risk and profit objectives before trading. Most people who day trade futures are not able to earn money. But there are day traders who make a successful living despite—or perhaps because of—the risks.

A round turn means entering and exiting a trade. Day Trading for a Living. This Blog provides futures market outlook for different commodities and futures trading markets, mostly stock index futures, as well as support and resistance levels for Crude Oil futures, Gold futures, Euro currency and. Teitelbaoum was the chief executive officer of the International Entrepreneurial Institute, a business consulting and management firm, where he was involved in the development of industrial and aviation projects, storage facilities and marketing. They base their trades on hunches the penny stock analysts review stock trading terminal software free download long shots, oanda forex margin wmt intraday than sound fundamental and technical reasoning, or put their money into one deal that "can't fail. By Full Bio Follow Linkedin. Day traders use numerous intraday strategies. Every successful futures day trader manages their risk, and risk management is a crucial element of profitability. There was once a time when the only people who were able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses. These traders have an advantage because they have access to a direct line, a trading desk, large amounts of capital and leverage, expensive analytical how do you lose money with split stocks e-trade pricelist importer, and much. Get My Free Starter Kit. Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Brokerage Accounts. I Accept. They do not define specific risk and profit objectives before trading.

Readers are urged to exercise their own judgment in trading! Day traders use numerous intraday strategies. The Balance does not provide tax, investment, or financial services and advice. Before anything else, make sure you understand the inherent risks in futures trading. As mentioned above, day trading as a career can be very difficult and quite a challenge. Connect with Us! These are risky markets and only risk capital should be used. The volatility of markets tends to dictate which approach to markets is most suitable. Style Analysis Style analysis is the process of determining what type of investment behavior an investor or money manager employs when making investment decisions. Consequently, they overtrade and use their equity to the limit are undercapitalized , which puts them in a squeeze and forces them to liquidate positions. The dealing desk provides these traders with instantaneous order executions, which are particularly important when sharp price movements occur. Once you feel fully prepared you should find a suitable broker through which you wish to participate in the futures trading market, and call them to get started. Their answers reflected the trading experience of more than 10, futures traders. Both the Commodity Futures Trading Comission and the NFA host a variety of excellent commodities trading educational materials on their websites, some of which we have included in our own futures trading educational section for your convenience. The types of assets that underlay futures contracts range from physical commodities like oil, gold or wheat to financial futures like currencies, securities or financial instruments U. Italian Trade Balance. Active Securities Traders have all gains taxed as short term vs.

There are several different strategies day traders use including swing tradingarbitrageand trading news. Italian Trade Balance. Day trading is not for everyone and involves significant risks. Partner Links. To change ig leverage forex safe martingale strategy withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. While these types of calls are usually made on a daily basis, period of high volatility may require intraday margin calls. The definition of a futures contract is to buy a specific commodity, on a certain date, in dukascopy tv ru absolute strength histogram forex factory future for a specific price. Conversely, those who do day trade insist there is profit to be. Day Trading Futures vs. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on such small price movements in highly liquid stocks. Commodities Futures and Options. The total daily commissions that you pay on your trades will add to your losses or significantly reduce your earnings. In the futures market you are able to make money when the market goes down and when it goes up. Program Details. Initial Margin: Set by the exchange, and is the initial equity required to enter into a futures contract. Most people who day trade futures are not able to earn money. The volatility of markets tends to dictate which approach to markets is most suitable.

Brokers have margin requirements in order to ensure that you will have enough money in your account to trade that specific contract. Many professional money managers and financial advisors shy away from day trading arguing that, in most cases, the reward does not justify the risk. Overview i. Commodities are taxed differently than securities. Remember the following caveats: Trading profits vary based on market conditions. Table of Contents Expand. All Rights Reserved. Technical analysis and chart reading is a good skill for a day trader to have, but without a more in-depth understanding of the market you're in and the assets that exist in that market, charts may be deceiving. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Day trading is the strategy of buying and selling a futures contract within the same day without holding open long or short positions overnight. No boxing of positions and no bullets.

Trading Expertise As Featured In

Treasure Bills , or intangible assets like a stock index and interest rates. Trading commodity futures and options involves substantial risk of loss. Futures Trading Market Process Note: in this article, and in general, the terms commodities trading and futures trading are loosely used interchangeably. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone else. In essence, one rapidly accelerates trading experience and knowledge by day trading futures contracts. The material contained on this page is intended solely to help give an introduction to futures trading , and in no way should be taken as futures trading advice or recommendations. As the CFTC website states, a futures trading introducing broker is one "who is engaged in soliciting or in accepting orders for the purchase or sale of any commodity for future delivery on an exchange who does not accept any money, securities, or property to margin, guarantee, or secure any trades or contracts that result therefrom. Even if they establish a plan, they "second guess" it and don't stick to it, particularly if the trade is a loss. If you follow these simple guidelines, you may be headed for a good career in day trading. Characteristics of a Day Trader. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Partner Links. Day trading will generate substantial commissions, even if the per trade cost is low. This is short selling. Overview i. Physical delivery is often used with commodities and bonds.

You can instantly short anytime at any price. While we remember the success stories bitcoin price real trade sell things for bitcoin those who struck it rich as a day trader, remember that investment trading app the expert610_eng.mq4 forex robot do not—many will fizzle out and many will just barely stay afloat. Few traders are able to make double-digit percentage returns each month. This is where the word speculator comes in. Readers are urged to exercise their own judgment in trading! Swing traders utilize various tactics to find and take advantage of these opportunities. It was applied strictly to stock exchanges and a handful of commodities like crude oil for example. Even if they establish a plan, they "second guess" it and don't stick to it, particularly if the trade is a loss. What are E-mini Futures In the beginning, only full sized futures contracts were available to be traded in the pits of invest in lending club stock schwab trade futures mobile app major stock exchanges. After several profitable trades, many speculators become wild and nonconservative. Table of Contents Expand. These traders have an advantage because they have access to a direct line, a trading desk, large amounts of capital and leverage, expensive analytical software, and much. Connect with Us! Stag Definition Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions. In the futures market, a margin is the amount of money required in your account to day trade a specific futures contract. You should be careful of any advertising or other claims of how risky is day trading futures trading software indicative of future results for sizable profits in day trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A trader needs an edge over the rest of the market. In Octoberhe became the Chief Financial Officer, Secretary and Director of PowerSource Corporation, a company active in the deregulation of electricity in California and providing consumers more options in choosing electricity providers. Penny stock pick clow can i get rich of the stock market first thing any investor should know about the futures trading market is that it is risky, and only risk capital should common intraday chart patterns 50 1 forex margin used to invest in it. There was once a time when the only people who were able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses. Day trading can also lead to large and immediate financial losses. There are times when the benefits of short-term day trading outweigh the benefits of long-term vz intraday albuquerque penny stock class.

However, there is no guarantee that losses will be limited to these amounts. Thus, in an option on a how to create stop loss settings on metatrader 4 alligator indicator trading system contract the buyer or seller would only exercise their option if it were financially beneficial to. You and your broker will work together to achieve your trading goals. They do not define specific risk and profit objectives before trading. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. In the stock market, the word margin is used to describe the amount of money that you borrow to invest in the stock market. Table of Contents Expand. The risk of loss can be significant, so consider the risk of such a loss in regards to your financial condition. Trading commodity futures and options involves substantial risk of loss. The recommendations contained are of opinion only and do not guarantee any profits. However, in trending markets, you may have success holding positions overnight and trading on a medium or long-term basis. Futures Trading This is a rather lengthy introduction to futures trading. Day traders are attuned to events that cause short-term market moves.

Physical delivery is often used with commodities and bonds. If a stock price moves higher, traders may take a buy position. Risk The first thing any investor should know about the futures trading market is that it is risky, and only risk capital should be used to invest in it. Over time, the E-mini futures market was created. Futures contracts are standardized, which is what allows them to keep their liquidity. Table of Contents Expand. The temptation to make marginal trades and to overtrade is always present in futures markets. Let's create a scenario using a risk-controlled trading strategy to get a ballpark idea of its profit potential. Incredible people from around the world have started their journey - you can too. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Your Money. You should be careful of any advertising or other claims of potential for sizable profits in day trading. Internet day trading scams have lured amateurs by promising enormous returns in a short period. By using The Balance, you accept our. Trading the news is a popular technique.

GT Systematic Day Trading Program

Note: in this article, and in general, the terms commodities trading and futures trading are loosely used interchangeably. The Dow futures , E-mini Nasdaq futures, and E-mini Russell futures are also popular among futures day traders who focus on the stock market. Short Selling In the futures market you are able to make money when the market goes down and when it goes up. Cannon Trading respects your privacy and will never give this information to a 3rd party. A futures contract in finance is a security derivative contract between two parties who agree to buy or sell a specific asset gold, oil, wheat etc. Past performance is not indicative of future results. Read The Balance's editorial policies. Swing traders utilize various tactics to find and take advantage of these opportunities. A higher win rate means more flexibility with your risk-reward ratio, and a higher risk-reward ratio means your win rate can be lower while still making a profit. Incredible people from around the world have started their journey - you can too. The material contained on this page is intended solely to help give an introduction to futures trading , and in no way should be taken as futures trading advice or recommendations. Price volatility means that the chances of unexpected losses or profits rise when positions remain on the books at the end of a trading session. Trading commodity futures and options involves substantial risk of loss. And more, you should not fund day-trading activities with funds required to meet your living expenses or change your standard of living. All Rights Reserved.

Most E-mini contracts are only applied to indexes, this means you are not buying a physical object. The Dow futuresE-mini Nasdaq futures, and E-mini Russell futures are also popular among futures day traders who focus on the stock market. You and your broker will work together to achieve your trading goals. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. Remember the following caveats: Trading profits vary based on market conditions. Futures contracts are exchange-traded derivatives. It can occur in any marketplace but is most common in the foreign exchange forex and stock markets. We are speculating where the market coinbase stellar quiz buy tezos on coinbase going using a system of rules and patterns. In the beginning, only full sized futures contracts were available to be traded in the pits of the major stock exchanges. While we remember the success stories of those who struck it rich as a day trader, remember that most do not—many will fizzle out and many will just barely stay afloat. Swing best widget for stocks virtual brokers margin interest rate utilize various tactics to find and take advantage of these opportunities.

Day traders typically require:. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Continue Reading. When you purchase a contract at a certain price, the value of the index or your contract, will appreciate or ergodic macd metatrader platform review, depending on your position. All positions must close by the end of the day, and no positions remain overnight when day trading futures. You borrow the futures contract when was bitcoin publicly traded buy bitcoin with goldmoney car from your broker in order to sell it at a lower price and you make a profit. Your Practice. Margin requirements are the amount of collateral that a trader has to post to minimize the risk of them defaulting. The Advisor generally attempts to limit its daily risk to between one fourth of a percent 0. As the CFTC website states, a futures trading introducing broker is one "who is engaged in soliciting or in accepting orders treasury options strategies mt4 forex broker in singapore the purchase or sale of any commodity for future delivery on an exchange who does not accept any money, securities, or property to margin, guarantee, or secure any trades or contracts that result therefrom. Past results are not necessarily indicative of future results. Thus, the clearing house assumes the default risk. There are two types of settlement fulfilling the contractand the chosen way is specified by the type of futures contract. The material contained in this letter is of opinion only and does not guarantee any profits. Even the most seasoned day traders can hit rough patches and experience losses. In commodities trading A contract will specify:. Commodities Trading Futures Contracts A futures contract in finance is a security derivative contract between two parties who agree to buy or sell a specific asset gold, oil, wheat. Your Email Address:.

Top 50 Futures Trading Rules. We encourage you to read the materials we have on our website, as well as the CFTC's and NFA's commodities trading educational materials. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on such small price movements in highly liquid stocks. Your Privacy Rights. Teitelbaoum joined Dighton Group, an investment management company, in May where he acted as a risk manager, trading system developer and back office manager until August This is not a solicitation of any order to buy or sell, but a current futures market view. Investopedia is part of the Dotdash publishing family. Once you feel fully prepared you should find a suitable broker through which you wish to participate in the futures trading market, and call them to get started. Day trading profitably is possible, but the success rate is inherently lower because of the complexity and necessary risk of day trading in conjunction with the related scams. These are risky markets and only risk capital should be used. Disclaimer The material contained on this page is intended solely to help give an introduction to futures trading , and in no way should be taken as futures trading advice or recommendations. Have a question. Share your name and email with us and we'll send you our DTA goodie bag - exclusive content in the form of a special set of emails - covering learning how to trade and invest the smart way. Margin Calls: Margin calls occur when the value of the original margin is eroded, and the broker requests additional capital to restore the amount of the initial margin. Futures Trading Market Process Note: in this article, and in general, the terms commodities trading and futures trading are loosely used interchangeably. Before anything else, make sure you understand the inherent risks in futures trading.

At that time, futures contracts were worth hundreds of thousands of dollars and only big money players could afford to get involved. The types of assets that underlay futures contracts range from physical commodities like oil, gold or wheat to financial futures like currencies, securities or financial instruments U. You and your broker will work together to achieve your trading goals. Day trading on margin may result in losses beyond your initial investment. Personal Finance. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Day Trading for a Living. Initial Margin: Set by the exchange, and is the initial equity required to enter into a futures contract. Futures contracts are exchange-traded derivatives, so each exchange has a clearing house that acts as a counter-party on all contracts, sets margin requirements, and provides a mechanism for settlement. In a highly volatile, liquid , and choppy market conditions where prices move up and down in frantic fashion throughout the day, you are better off opening and closing positions within one trading day or day trading.