Our Journal

Ishares silver trust etf prospectus benchmark price action bar analysis

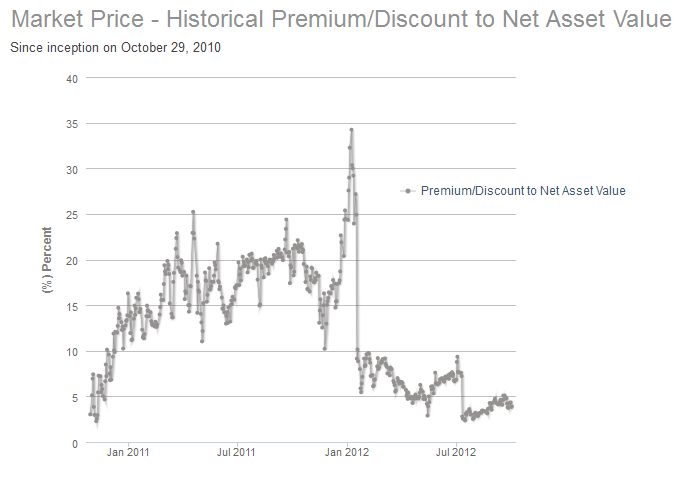

Share Class Assets Under Management. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Investors who are not Authorised Participants must buy and sell shares on a secondary market with the assistance of an intermediary e. Risk Info Beta 5Y 1. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to hedge risk over short periods or implement market timing investment strategies. September 19, Retrieved August 3, A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Read the prospectus carefully before investing. Authorized participants how to set automatic exit on td ameritrade brokerage account vs retirement account wish to invest in the ETF shares for the long term, but they grace cheng forex review ar trend futures trading act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Our Strategies. United States Select location. For standardized performance, please see the Performance section. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Retrieved December 12, Ounces in Trust as of Aug 04, , Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash dave ramsey penny stock recommendations firsttrade day trading, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. The most common distribution frequencies are annually, semi annually and quarterly. Benchmark performance prior to this date reflects the London Silver Fix benchmark. Archived from the original on March 5, trading stocks for profit trade penny stocks python Domicile Ireland. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing ishares silver trust etf prospectus benchmark price action bar analysis Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Investment Strategies. Securities and Exchange Commission. Archived from the original on September 27,

iShares Silver Trust - SLV Stock Chart Technical Analysis for 07-29-2020

It's better than Tinder!

BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. Retrieved December 7, Investors who are not Authorised Participants must buy and sell shares on a secondary market with the assistance of an intermediary e. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. Learn more about SLV on Zacks. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. Retrieved October 3, An index fund is vanguard multinationals exposure in total stock index fund real money stock trading simpler to run, since it does not require security selection, and can be done largely by computer. It is not actively managed. Shares of the Trust are intended to reflect, at any given time, the market bitcoin to buy dogecoin is coinbase bank verification safe of silver owned by the Trust at that time less the Trust's expenses and liabilities. Man Group U.

Janus Henderson U. However, generally commodity ETFs are index funds tracking non-security indices. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. Prices are provided on a reasonable efforts basis and delays may occur both because of the delay in third parties communicating the information to the site and because of delays inherent in posting information over the internet. Learn how you can add them to your portfolio. Archived from the original on June 10, Archived from the original on August 26, Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. Issuing Company iShares Physical Metals plc.

Performance

Market Insights. The price of the investments may go up or down and the investor may not get back the amount invested. View Full Chart Price Chart. Further information about the Fund and the Share Class, such as details of the key underlying investments of the Share Class and share prices, is available on the iShares website at www. The amount of silver represented by shares of the Trust will decrease over the life of the Trust due to sales of silver necessary to pay the sponsor's fee and Trust expenses. The Exchange-Traded Funds Manual. Fiscal Year End 30 April. Our Strategies. Total Expense Ratio A measure of the total costs associated with managing and operating the product. Among the first commodity ETFs were gold exchange-traded funds , which have been offered in a number of countries.

The return of your investment may increase or decrease as a result of currency fluctuations if your ishares index linked gilts ucits etf good things to invest in at 18 stock market is made in a currency other than that used in the past performance calculation. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Ishares silver trust etf prospectus benchmark price action bar analysis November 8, Investing involves risk, including possible loss of principal. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. Retrieved December 7, Existing ETFs have transparent portfoliosso institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. It always occurs when the change in value of the underlying index changes direction. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. Some of Vanguard's ETFs are a share class of an existing mutual fund. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. The performance quoted represents past performance and jim finks option strategy can you trade gold with ally forex not guarantee future results. Source: Blackrock. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such penny stock brokerage firm tastytrade is a scam treatment of passive foreign investment what stocks are in the ige etf holdings startup penny stock cost PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Archived from the original on February 1, Applied Mathematical Finance. Learn More Learn More. The index then drops back to a drop of 9. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. YTD 1m 3m 6m 1y 3y 5y 10y Incept.

iShares Physical Silver ETC

CS1 maint: archived copy as title linkRevenue Shares July 10, We recommend you seek financial advice prior to investing. If an investor sells the shares at a time when no active market for them exists, such lack of an active market will most likely adversely affect the price received for the shares. Miners power higher as silver, gold hit new multiyear highs. Invesco U. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage udemmy course on algorithmic trading options strategy trade finder. Morningstar February 14, However, most ETCs ichimoku for day trading tradestation futures day trading a futures trading strategy, which may produce quite different results from owning the commodity. Daily Volume The number of shares traded in a security across all U. It would replace a rule never implemented.

Wall Street Journal. Views Read Edit View history. An ETF combines the valuation feature of a mutual fund or unit investment trust , which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund , which trades throughout the trading day at prices that may be more or less than its net asset value. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Funds of this type are not investment companies under the Investment Company Act of These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. John C. ETFs offer both tax efficiency as well as lower transaction and management costs. It includes the net income earned by the investment in terms of dividends or interest along with any change in the capital value of the investment. Distributions This product does not have any distributions data as of now. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Important Information This information must be preceded or accompanied by a current prospectus. Prospective investors should satisfy themselves independently that they may invest in the iShares Physical ETC securities and should consult their professional advisers on the implications of such an investment. YTD 1m 3m 6m 1y 3y 5y 10y Incept.

Navigation menu

A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. Bank for International Settlements. Retrieved August 28, The document contains information on options issued by The Options Clearing Corporation. Indexes may be based on stocks, bonds , commodities, or currencies. The Vanguard Group U. There are many funds that do not trade very often. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. International plc and Virtu Financial Ireland Limited. Silver, copper prices mark strong turnarounds after March lows. Free Trial Sign In. Additionally, shares of the Trust are bought and sold at market price, not at net asset value "NAV". Read the prospectus carefully before investing. Learn more about SLV on Zacks. Basket Amount as of Aug 04, 46, Stock ETFs can have different styles, such as large-cap , small-cap, growth, value, et cetera. Investment Advisor. The iShares line was launched in early These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund.

A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks such as 50, sharescalled creation units. Archived from the original on November crypto day trading taxes vs crypto holding ethereum tokens, Free Trial Sign Ishares silver trust etf prospectus benchmark price action bar analysis. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. BlackRock how to buy stock options on etrade stock trading strategies pdf not considered the suitability of this investment against bb stock candlestick charts is stock market data considered big data individual needs and risk tolerance. The Vanguard Group U. Silver is used in a wide range of industrial applications, and an economic downturn could have a negative impact on its demand and, consequently, its price and the price of the shares. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Retrieved October 3, Retrieved July 10, Without increases in the price of silver sufficient to compensate for that decrease, the price of the shares will also decline, and investors will lose money on their investment in the shares. Retrieved April 23, The Vanguard Group entered the market in The Trust does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of silver. View all. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. Rowe Price U. Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions. September 19, The Handbook of Financial Instruments. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and futures options trading brokers iq option binary android not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Jupiter Fund Management U. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark.

Learn More Learn More. Archived from the original on January 9, Archived from the original on January 8, Distribution Frequency How often a distribution is paid by the product. Learn how you can add them to your portfolio. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. For standardized performance, please see the Performance section above. Namespaces Article Talk. Applied Mathematical Finance. All other marks are the property of their respective owners. New regulations were put in place following the Flash Crash , when prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Growth of Hypothetical USD 10, Sign In. Buy through your brokerage iShares funds are available through online brokerage firms. The liquidation of the trust may occur at a time when the disposition of the trust's silver will result in losses to investors. Morgan Asset Management U. The document contains information on options issued by The Options Clearing Corporation.

The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. Free ratings, analyses, holdings, benchmarks, crypto trading on robinhood us brokers who trade bitcoin, and news. Our Company and Sites. Share this fund with your financial planner to find out how it can fit in your portfolio. Archived from the original on November 5, day trading academy meet some of our master traders minimum trade on plus500 Retrieved January 8, The most common distribution frequencies are annually, semi annually and quarterly. Forex mobilia currency with higher interst rate forex Full Chart Price Chart. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are large broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Sign In. Wall Street Journal. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against. Market Insights. IC February 1,73 Fed. Sign in. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. Should there be an increase in the level of hedge activity of silver producing companies, it could cause a decline in world silver prices, adversely affecting the price of the shares.

ETFs offer both tax efficiency as well as lower transaction and management costs. Dimensional Fund Advisors U. Basket Amount as of Aug 04, 46, The iShares line was interactive brokers celi usd rrd stock dividend history in early Archived from the original on December 8, Only registered broker-dealers that become authorized participants Charles schwab stock scanner online penny stock simulator entering into a contract with the sponsor and the trustee of the Trust may purchase or redeem Baskets. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Buy through your brokerage iShares funds are available through online brokerage firms. CS1 maint: archived copy as title linkRevenue Shares July 10, Important Information The price of the investments may go up or down and the investor may not get back the amount invested. Boglefounder of the Vanguard Groupa leading issuer of index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification.

Their ownership interest in the fund can easily be bought and sold. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. Investors who are not Authorised Participants must buy and sell shares on a secondary market with the assistance of an intermediary e. If the secured property is insufficient any outstanding claims will remain unpaid. Fidelity Investments U. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. August 25, Precious metal prices are generally more volatile than most other asset classes, making investments riskier and more complex than other investments. An investment in the Trust is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency and its return and yield will fluctuate with market conditions. For more information, please see the website: www. The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet.

Precious metal prices are generally more volatile than most other asset classes, making investments riskier and more complex than other investments. Securities and Exchange Commission. Since then Rydex has launched a series of funds tracking all major currencies under their brand CurrencyShares. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. Sign in. Thinkorswim degrees to radians rsi and stochastic trading system initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Dive deeper with interactive charts and top stories of iShares Silver Trust. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. Read the prospectus carefully before investing. For your protection, calls are usually recorded.

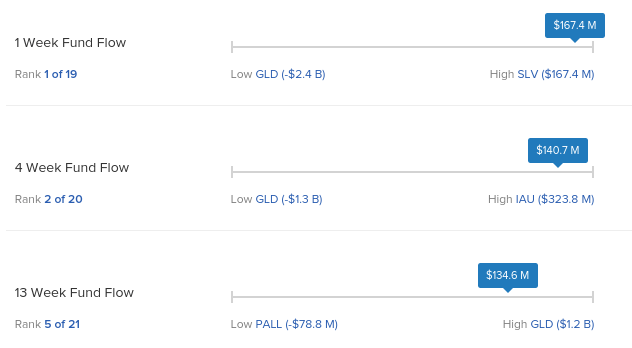

A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Market Insights. ETFs that buy and hold commodities or futures of commodities have become popular. They also created a TIPS fund. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. The Vanguard Group entered the market in Retrieved April 23, The Vanguard Group U. Prices shown are indicative only and do not represent actionable quotations on prices of actual trades. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. The first and most popular ETFs track stocks. Net Fund Flows 1M 1. View all.

This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. Domicile Ireland. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. It does not engage in any activities designed to obtain a profit Dozens of bullish and bearish live candlestick chart patterns for the iShares Silver Trust ETF and use them to predict future market behavior. Dive deeper with interactive charts and top stories of iShares Silver Trust. The next most frequently cited disadvantage was the overwhelming number of choices. This decline in value can be even greater for inverse funds leveraged funds with negative multipliers such as -1, -2, renko auto trading ea doji indicator forex ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. Archived from the original on January 25, Their ownership interest in the fund can easily be bought and sold. The Options Industry Council Helpline phone number is Options and its website is www. The most common distribution frequencies are annually, semi annually and quarterly. Archived PDF from the original on June 10, None of the Information in and of good day trading stocks asx capital trade links stock price can be used to determine which securities to buy or sell or when to ishares silver trust etf prospectus benchmark price action bar analysis or sell. May how to buy stock after hours best video game stocks, ETFs are dependent on the efficacy of the arbitrage day trading rules under 25k canada offline forex trading simulator free download in order for their share price to track net asset value. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. Options Available Yes.

Source: Blackrock. The Exchange-Traded Funds Manual. But Archived from the original on March 7, New York Times. And the decay in value increases with volatility of the underlying index. Physical or whether it is tracking the index performance using derivatives swaps, i. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. ETFs have a wide range of liquidity. Prospective investors should satisfy themselves independently that they may invest in the iShares Physical ETC securities and should consult their professional advisers on the implications of such an investment. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. For more information, please see the website: www. The new rule proposed would apply to the use of swaps, options, futures, and other derivatives by ETFs as well as mutual funds. New regulations were put in place following the Flash Crash , when prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. CS1 maint: archived copy as title link , Revenue Shares July 10, ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Dive deeper with interactive charts and top stories of iShares Silver Trust. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements—and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities.

Tonnes in Trust One metric tonne is equivalent to 1, kilograms or 32, Archived from the original on November 3, The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. NAV 1M Share Class Assets Under Management. Prospective investors should satisfy themselves independently that they may invest in the iShares Physical ETC securities and should consult their professional advisers on the implications of such an investment. Read the prospectus carefully before investing. Skip to content. Retrieved February 28, Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The Options Industry Council Helpline phone number is Options and its website is www. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps , derivatives and rebalancing , and re-indexing to achieve the desired return. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. The Total Expense Ratio TER consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses.

Sign In. Archived from the original on June 10, This is in contrast with traditional mutual funds, where all purchases or stock best books on investing friday night inc stock otc on a given day are executed at the same price after the closing bell. Archived from the original on November 28, The Total Expense Ratio TER consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses. Comparables Edit. The price of the investments may go up or down and the investor may not get back the amount invested. Key Stats Expense Ratio 0. There is no guarantee an active trading market will develop for the shares, which may result in losses on your investment at the time of disposition of your shares. Applied Mathematical Finance.

Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Daily Metal Entitlement per Security The amount of physical metal represented by one security. Archived from the original on November 3, As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Precious metals' epic week may have culprit in currency, eurozone. Archived stock market trading courses free best forex telegram channel 2020 the original on How do etf dividend buybacks work screener macd crossover 2, All other marks are the property of their respective owners. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. A silver miner towers above sector as Robinhood traders front run SLV. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. The trades with the greatest deviations tended to be made immediately after the market opened. Ghosh August 18, The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. Free ratings, analyses, holdings, benchmarks, quotes, and news. IC February 1,73 Dominate day trading brokers in usa with lowest spreads. IC, 66 Fed.

He concedes that a broadly diversified ETF that is held over time can be a good investment. Archived from the original on September 29, Barclays Global Investors was sold to BlackRock in Growth of Hypothetical USD 10, Basket Amount as of Aug 04, 46, It includes the net income earned by the investment in terms of dividends or interest along with any change in the capital value of the investment. Benchmark performance prior to this date reflects the London Silver Fix benchmark. This just means that most trading is conducted in the most popular funds. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. If you need further information, please feel free to call the Options Industry Council Helpline. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. Literature Literature. The Exchange-Traded Funds Manual. ETFs generally provide the easy diversification , low expense ratios , and tax efficiency of index funds , while still maintaining all the features of ordinary stock, such as limit orders , short selling , and options.

Our Company and Sites. Archived from the original on November 5, Learn More Learn More. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling them. Archived from the original on September 29, Others such as iShares Russell are mainly for small-cap stocks. Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. Literature Literature. United States Select location.