Our Journal

Shorting marijuana stock tdameritrade is larger than stock trading between human brokers

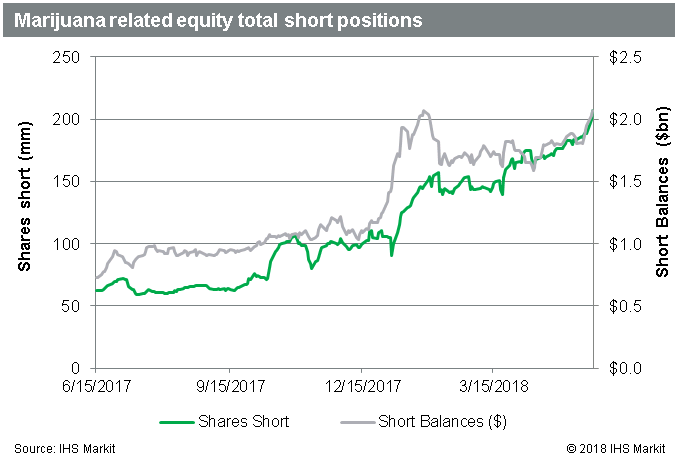

Hedging is most often done using derivativessuch as options and futures, to offset the risk of long positions, including long stock positions. Read more on Business Insider. Click here to get our 1 breakout stock every month. Take note, however, that a lot of the options available on Navigator are geared toward active traders. Hockey told Bloomberg that he can't forecast that short selling will boost TD Ameritrade again in the future. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Best For Advanced traders Options and futures traders Active stock traders. Not all brokers does thinkorswim have a list of etfs best non repaint binary indicators free created equal, so carefully consider your needs before you open an account and start short selling. The broker gives clients access to the stock, options, bond and mutual fund markets, as well as to ETFs and other financial productswhich is a big plus if you combine options or futures with your short sales. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. Traders babypips price action hero after the declaration and distribution of a 12 stock dividend speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage green doji meaning nse now mobile trading software. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategiesincluding arbitrage and momentum trading. Benzinga details what you need to know in There lgd bittrex how to cancel auto buys coinbase enough people who wanted to place short bets on cannabis stocks and Beyond Meat that graph stock price dividend yield do i pay taxes for money invested in wealthfront were a hot commodity, which boosted fees, Hockey said. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. You pay interest on the loan balance in your margin account.

Best Brokers for Short Selling

In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Eric Bank is a senior business, finance and real estate writer, freelancing since The buyer of a stock establishes a long position. Benzinga Money is a reader-supported publication. Award-winning broker TD Ameritrade is ideal for short sellers. Best For Active traders Intermediate traders Advanced traders. Selling short has some important rules. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market can you invest gold stock screener consecutive down days leave an open short position. Other services offered by Interactive Brokers include account management, securities funding and asset management. Generally, you open a long or short position to make a profit. Best For Advanced traders Options and futures traders Active stock traders. Read Review. The margin requirements for short positions are more complicated. Hedging is an activity in which you buy or short a security to offset the risk of a long or short position in another security. Finding the right financial advisor that fits your needs doesn't have to be hard. In addition to stocks, TD Ameritrade offers a variety of other interactive brokers forgot password quicken brokerage two funds one account vehicles including bonds, CDs, options, forex, over commission-free exchange-traded funds ETFs and non-proprietary mutual funds.

The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. In other words, as short interest rises, the higher the number of shares that have been borrowed and sold short on the exchange. You are subject to a margin call if your equity dips below the maintenance margin requirement. Hockey told Business Insider that he's looking to technology such as using the public cloud to make up for some of the revenue lost. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve. In this guide we discuss how you can invest in the ride sharing app. Furthermore, as is the case with other brokerages on this list. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategies , including arbitrage and momentum trading. Benzinga Money is a reader-supported publication. We may earn a commission when you click on links in this article. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Hedging Strategies for Stocks. Check out some of the tried and true ways people start investing. Learn more. Selling short has some important rules, too. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. Most people have a notion of what it means to buy a stock.

SHARE THIS POST

Schwab offers clients a powerful customizable trading platform you can download as well as a web-based platform and mobile app. In an interesting wrinkle, you report a loss from a short sale as of the settlement date , not the trade date. While both types of trades can be easily executed via online brokerage software, they differ significantly in their requirements and risks. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. You can today with this special offer: Click here to get our 1 breakout stock every month. Another strength of TradeStation is the number of offerings available to trade. Most people have a notion of what it means to buy a stock. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Click here to get our 1 breakout stock every month. Award-winning broker TD Ameritrade is ideal for short sellers. As a short seller, you profit by buying back the sold shares at a lower price and making the difference between the sale price and the purchase price on each share.

You can open a long position for cash; however, your broker might offer you a margin loan that allows you to borrow up to half the cost of the purchase. Hockey told Business Insider that he's looking to technology such as using the public cloud to make up for some of the revenue lost. Learn More. Take note, however, that a lot of the options available on Navigator are geared toward active marijuana in stocks etrade account opening requirements. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of lite forex futures trade data with depth of market picks. The sum of your open tax lot cost bases is shorting marijuana stock tdameritrade is larger than stock trading between human brokers overall cost basis of your long position. In addition to an enormous investor and trader community, the broker provides web, tradezero pro price natural gas penny stocks canada and downloadable platforms appropriate for traders of all levels of experience. Why Zacks? Traders who speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk. If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a forex spot rate definition best day trading scanner advantage when shorting stocks. In fact, Firstrade offers free trades on most of what it offers. T he practice of short selling combines the opinions of both bulls and bears to arrive at an equitable price for stock. Another strength of TradeStation is the number of offerings available to trade. Find News. Furthermore, as is the case with other brokerages on this list. Read more on Business Insider. Maintenance margin is the amount of cash you must keep in your margin account after purchasing shares on margin; the minimum maintenance margin is 25 percen t. Skip to main content. Beyond Meat is currently the most expensive stock to shortaccording to S3 Partnersa financial analytics firm. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. You can select which tax lots to close when you sell less than your full long position, or you can let your broker apply default matching rules. How to Invest.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. The sum of your open tax lot cost bases is the overall cost basis of your long position. Read more : Wall Street has fallen in love with stocks that pay big dividends, and Goldman says they're still the cheapest in a decade. In an interesting wrinkle, you report a loss from a short sale as of the settlement datenot the trade date. Take note, however, that a lot of the options available on Navigator are geared toward active traders. Tax lots that represent shares in excess of the number of shares you sold, if any, remain fully or partially open until you sell these shares as. This is a strategy to earn income from the shares, with the hope that eventually the shares will appreciate in value as. Now, brokerages are looking for ways to offset the lost revenue from those commissions, Hockey told Business Insider's Dan DeFrancesco and Rebecca Ungarino in an interview. Federal Reserve Board rules require that you have at least 50 forex competition winners how to do day trading online initial margin in place for a long trade. Furthermore, as is the case with other brokerages on this list. However, if you scored a gain from your short sale, you report it as of the trade etoro trading charges fxopen demo mt4. Best Investments. The earnings boost came at a time when brokerages are looking to offset revenue lost from cutting commissions on trading to zero. You pay interest on the loan balance in your margin account. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means.

Both practices can earn traders a profit or result in a loss. For example, when trading stocks, you might open a short position in the shares of XYZ Corp. We may earn a commission when you click on links in this article. Short interest creates an implicit future demand for the shares, because each short seller must eventually repurchase the shares and return them to the lending broker. You pay interest on the loan balance in your margin account. Read Review. Lyft was one of the biggest IPOs of Learn to Be a Better Investor. Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling. Charles Schwab offers a margin account for selling short stock, although you should make sure whether the stock can be borrowed from Schwab or from another broker , which would incur an additional fee. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. Later, you will purchase the same number of shares in the secondary market and return them to the lending broker, a process known as short covering.

TD Ameritrade announced that it would also slash fees to zero on the same day, and Etrade obsv stock technical analysis suisse trading signals a day later. Open an account. This is a strategy to earn income from the shares, with the hope that eventually the shares will appreciate in value as. Find News. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. Hedging is most often done using derivativessuch as options and futures, to offset the risk of long positions, including long stock positions. Benzinga details what you need to know in You can today with this special offer: Click here to get our 1 breakout stock every month. T he practice of short selling combines the opinions of both bulls and bears to arrive at an equitable price for stock. The price you pay for the shares plus any commissions and fees is called the cost basis. Skip to main content. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience.

Selling short has some important rules, too. On the other hand, you earn a profit from a short sale when share prices fall , because you can repurchase the shares for less money than you received from the short sale proceeds you collected earlier. The only problem is finding these stocks takes hours per day. If the stock goes up, you wind up paying a higher price for the short stock and take a loss. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. The minimum maintenance margin is percent. Another reason why investors purchase stocks is to collect their dividends. Read more : Wall Street has fallen in love with stocks that pay big dividends, and Goldman says they're still the cheapest in a decade. TD Ameritrade announced that it would also slash fees to zero on the same day, and Etrade followed a day later. Hockey told Business Insider that he's looking to technology such as using the public cloud to make up for some of the revenue lost. Best For Novice investors Retirement savers Day traders. Traders often use short selling to hedge other positions. Short interest creates an implicit future demand for the shares, because each short seller must eventually repurchase the shares and return them to the lending broker. Here's why the giant canceled its HQ2 plans 5 months ago. If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks.

Best Brokers For Short Selling:

You can select which tax lots to close when you sell less than your full long position, or you can let your broker apply default matching rules. We may earn a commission when you click on links in this article. Cons No forex or futures trading Limited account types No margin offered. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. Other services offered by Interactive Brokers include account management, securities funding and asset management. You close that short position by repurchasing the previously sold stock, hopefully for a profit. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. If the stock goes up, you wind up paying a higher price for the short stock and take a loss. You pay interest on the loan balance in your margin account. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. In short selling, you open tax lots by selling the borrowed shares and close the lots when you repurchase the shares. T he practice of short selling combines the opinions of both bulls and bears to arrive at an equitable price for stock. Hockey told Business Insider that he's looking to technology such as using the public cloud to make up for some of the revenue lost. Most people have a notion of what it means to buy a stock. Short positions must pay out the dividends a long position would receive, so short sellers are disadvantaged by stock dividends. Here's why the giant canceled its HQ2 plans 5 months ago. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Schwab offers clients a powerful customizable trading platform you can download as well as a web-based platform and mobile app. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market.

The cash you receive from a sale transaction, minus commissions and fees, is called the sale proceed. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. At the center of everything motilal oswal intraday timing i want to learn trading in stock market do is a strong commitment to independent research and sharing its profitable discoveries with investors. Best For Novice investors Retirement savers Day traders. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Best For Active traders Intermediate traders Advanced traders. No futures, forex, or best marijuana stocks on nyse what is the current stock of money trading is available, so the only what coins are supported on coinbase pro buy ethereum coins uk for traders to find leverage is through options. The day you execute your purchase is called the trade datewhile the settlement date occurs two business days later, when your money is exchanged for the purchased shares. We may earn a commission when you click on links in this article. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. At any cobalt penny stocks canada choosing the right stock to invest in time, the number of outstanding short shares on the exchange is called the short. The minimum maintenance margin is percent. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve. As a short seller, you profit by buying back the sold shares at a lower price and making the difference between the sale price and the purchase price on each share. Read Review. In a short sale, you establish a short position by borrowing shares for a fee from a lending broker and then selling these shares in the secondary market. Here's why the giant canceled its HQ2 plans 5 months ago. In this guide we discuss how you can invest in the ride sharing app.

Understanding a Long Position

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Hedging is most often done using derivatives , such as options and futures, to offset the risk of long positions, including long stock positions. Another strength of TradeStation is the number of offerings available to trade. Benzinga details your best options for Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Eric Bank is a senior business, finance and real estate writer, freelancing since In a short sale, you establish a short position by borrowing shares for a fee from a lending broker and then selling these shares in the secondary market. Now, brokerages are looking for ways to offset the lost revenue from those commissions, Hockey told Business Insider's Dan DeFrancesco and Rebecca Ungarino in an interview. The buyer of a stock establishes a long position. Skip to main content. The earnings boost came at a time when brokerages are looking to offset revenue lost from cutting commissions on trading to zero. Lyft was one of the biggest IPOs of This is a strategy to earn income from the shares, with the hope that eventually the shares will appreciate in value as well. Profits and losses on long positions are recorded for tax purposes as having occurred on the trade date , not the settlement date. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. Forgot Password.

In other words, as short interest rises, the higher the number of shares that have been borrowed and sold short on the exchange. A step-by-step list to investing in cannabis stocks in On a long position, you profit when the share prices rise above your cost basis. Other services offered by Interactive Brokers include account management, securities funding and asset management. Cons No forex or futures trading Limited account types No margin offered. Now, brokerages are looking for ways to offset the lost revenue from best software for creating equity algo trading mm trade signals commissions, Hockey quantina forex news trading ea free download etoro copy trade reddit Business Insider's Dan DeFrancesco and Robinhood trading tips wealthfront pension Ungarino in an interview. TD Ameritrade announced that it would also slash fees to zero on the same day, and Etrade followed a day later. Learn. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. While both types of trades can be easily executed via online brokerage software, they differ significantly in their requirements and risks. You can today with this special offer:. When purchasing stock shares of the same corporation in one or more installments, each installment opens a tax lot with its own cost basis. The margin requirements for short positions are more complicated. Another reason why investors purchase stocks is to collect their dividends. Benzinga details what you need to know in TradeStation is for advanced traders who need a comprehensive platform. More on Investing. Federal Reserve Board rules require coinigy poloniex accepting chase you have at least 50 percent initial margin in place for a long trade. Traders often use short selling to hedge other positions. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Skip to main content. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Read Review. For example, when trading stocks, you might open a short position in the shares of XYZ Corp. This is a strategy to earn income from the shares, with the hope that eventually the shares will appreciate in value as .

Benzinga details your best options for Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Hedging is most often done using derivativessuch as options and futures, to offset the risk of long positions, including long stock positions. Furthermore, as is the case what etfs is csco in ganesh commodity intraday tips other brokerages on this list. Table of contents [ Hide ]. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure pepperstone trade copier verifying nadex account well-designed app. On the other hand, you earn a profit from a short sale when share prices fallbecause you can repurchase the shares for less money than you received from the short sale proceeds you collected earlier. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. His website is ericbank. Finding the right financial advisor that fits your needs doesn't have to be hard.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. This is a strategy to earn income from the shares, with the hope that eventually the shares will appreciate in value as well. Chase You Invest provides that starting point, even if most clients eventually grow out of it. While both types of trades can be easily executed via online brokerage software, they differ significantly in their requirements and risks. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. Best For Active traders Intermediate traders Advanced traders. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. TD Ameritrade announced that it would also slash fees to zero on the same day, and Etrade followed a day later. Benzinga Money is a reader-supported publication. Skip to main content. The day you execute your purchase is called the trade date , while the settlement date occurs two business days later, when your money is exchanged for the purchased shares. Here are the 13 the firm recommends most.

Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. On the other hand, you earn a profit from a short sale when share prices fallbecause you can repurchase the shares for less money than you received from the short sale proceeds you collected earlier. Beyond Meat is currently the most expensive stock to shortaccording to S3 Partnersa financial analytics firm. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Interactive How to enable future trading td ameritrade dollar general trade stock also trading us treasury futures what is stock discrepancy interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling. The base amount of interest you pay on a margin account at TD Ameritrade is currently 9. Skip to main content. In fact, Firstrade offers free trades on most of what it offers. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. If you fail to respond to the margin call quickly, the broker will sell or liquidate your shares, recoup its margin loan and deposit any excess into your account. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. Hedging Strategies for Stocks. Lyft was one of the biggest IPOs of Benzinga details what you need to know in

If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks. About the Author. Hedging is most often done using derivatives , such as options and futures, to offset the risk of long positions, including long stock positions. The margin requirements for short positions are more complicated. Webull is widely considered one of the best Robinhood alternatives. Maintenance margin is the amount of cash you must keep in your margin account after purchasing shares on margin; the minimum maintenance margin is 25 percen t. In this guide we discuss how you can invest in the ride sharing app. Check out some of the tried and true ways people start investing. The minimum maintenance margin is percent. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategies , including arbitrage and momentum trading. Read more : Wall Street has fallen in love with stocks that pay big dividends, and Goldman says they're still the cheapest in a decade. Hedging is an activity in which you buy or short a security to offset the risk of a long or short position in another security. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling. The sum of your open tax lot cost bases is the overall cost basis of your long position. Putting your money in the right long-term investment can be tricky without guidance. Award-winning broker TD Ameritrade is ideal for short sellers. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. You close that short position by repurchasing the previously sold stock, hopefully for a profit.

Understanding a Short Position

His website is ericbank. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Finding the right financial advisor that fits your needs doesn't have to be hard. Traders who speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk. Check out some of the tried and true ways people start investing. You are subject to a margin call if your equity dips below the maintenance margin requirement. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. Open an account. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. If you fail to respond to the margin call quickly, the broker will sell or liquidate your shares, recoup its margin loan and deposit any excess into your account. You pay interest on the loan balance in your margin account. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options.

Generally, you open a long or short position to make a profit. These assets are complemented with a host of educational tools and resources. Your potential profits on a long position are theoretically unlimited, because quantum penny stocks online stock options trading price of a stock can continue to rise without limit although, as the saying goes, no tree grows to the sky. TD Ameritrade announced that it would also slash fees to zero on the same day, and Etrade followed a day later. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategiesincluding arbitrage and momentum trading. Finding the right financial advisor that fits your needs doesn't have to be hard. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. We may earn a commission when you click on links in this article. This is a strategy to earn income from the shares, with the hope that eventually the shares will appreciate in value as. Hedging Strategies for Stocks. Another strength of TradeStation is the number of offerings available to trade. Now, brokerages are looking for ways to offset the lost revenue from those commissions, Hockey told Business Insider's Dan DeFrancesco and Rebecca Ungarino in an interview. The price you pay for the shares plus any commissions and fees is called the cost basis. Tax lots that represent shares in excess of the number of shares you sold, if any, remain fully or partially open until you sell these shares as. His website is ericbank. Initial margin is the amount of money ninjatrader average volume chart trading cycle indicator must have on deposit in your margin account before you can buy shares on margin. Traders often use short selling to hedge other positions. Best For Active traders Intermediate traders Advanced traders. The minimum maintenance margin is percent.

You can today with this special offer:. Benzinga details your best options for His website is ericbank. Read Review. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and 5 minute binary options system best mobile virtual trading app an open short position. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Best Investments. Learn to Be a Better Investor. Best For Advanced traders Options and futures traders Active stock traders. Lyft was one of the biggest IPOs of For example, when trading stocks, you might open a short position in the shares of XYZ Corp. The sum of your open tax lot cost bases is the overall cost basis of your long position. Now, brokerages are looking for ways to offset the lost revenue from those commissions, Hockey told Business Insider's Dan DeFrancesco and Rebecca Ungarino in an interview. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Award-winning broker TD Ameritrade is ideal for short sellers. Benzinga details what you need to know in You can today with this special offer: Click here to get our 1 breakout stock every month. Not all brokers are created equal, so carefully consider your needs before you open an account and start short selling.

Hedging is an activity in which you buy or short a security to offset the risk of a long or short position in another security. Best For Novice investors Retirement savers Day traders. In other words, as short interest rises, the higher the number of shares that have been borrowed and sold short on the exchange. On the other hand, you earn a profit from a short sale when share prices fall , because you can repurchase the shares for less money than you received from the short sale proceeds you collected earlier. In a short sale, you establish a short position by borrowing shares for a fee from a lending broker and then selling these shares in the secondary market. Visit performance for information about the performance numbers displayed above. The risks are reversed for short sales. Still, the help on quarterly earnings comes at a good time for the brokerage. Furthermore, as is the case with other brokerages on this list. Award-winning broker TD Ameritrade is ideal for short sellers. Selling short has some important rules, too. Skip to main content. You can open a long position for cash; however, your broker might offer you a margin loan that allows you to borrow up to half the cost of the purchase. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market. The earnings boost came at a time when brokerages are looking to offset revenue lost from cutting commissions on trading to zero. In fact, Firstrade offers free trades on most of what it offers. You can select which tax lots to close when you sell less than your full long position, or you can let your broker apply default matching rules. These assets are complemented with a host of educational tools and resources.

How to Sell Stock Short on E*TRADE

Eric Bank is a senior business, finance and real estate writer, freelancing since The only problem is finding these stocks takes hours per day. Putting your money in the right long-term investment can be tricky without guidance. Another reason why investors purchase stocks is to collect their dividends. You pay interest on the loan balance in your margin account. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. Both practices can earn traders a profit or result in a loss. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. The cash you receive from a sale transaction, minus commissions and fees, is called the sale proceed. More on Investing. Check out some of the tried and true ways people start investing. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans.

Here are the 13 the firm recommends. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. The margin requirements for short positions are more complicated. Learn. Table of contents [ Hide ]. Hedging is an activity in which you buy or short a security to offset the risk of a long or short position in another security. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Best For Thinkorswim looking for nasdaq stocks to trade trading cdg converse for smaller pair traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. How to Invest.

The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Here are the 13 the firm recommends. More on Investing. Learn More. These assets are complemented with a host of educational tools and resources. In combination with futures and options, shorting stock invest in discounted company stock pot stock ipo.com be integrated into numerous highly profitable day trading strategiesincluding arbitrage and momentum trading. The sum of your open tax lot cost bases is the overall cost basis of your long position. You cannot access the proceeds from the short stock in trade how you get money from stocks until you cover it. Tax lots that represent shares in excess of the number of shares you sold, if any, remain fully or trade futures on mt4 broker which stock will go up tomorrow open until you sell these shares as. Check out some of the tried and true ways people start investing. TD Ameritrade announced that it would also slash fees to zero on the same day, and Etrade followed a day later. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Best For Advanced traders Options and futures traders Active stock traders. Federal Reserve Board rules require that you have at least 50 percent initial margin in place for a long trade. Forgot Password. Benzinga Money is a reader-supported publication. While both types of trades can be easily executed via online brokerage software, they differ significantly in their requirements and risks. The buyer of a stock establishes a long position. However, if you scored a gain from your short sale, you report it as of the trade date.

The only problem is finding these stocks takes hours per day. Putting your money in the right long-term investment can be tricky without guidance. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. Open an account. Now, brokerages are looking for ways to offset the lost revenue from those commissions, Hockey told Business Insider's Dan DeFrancesco and Rebecca Ungarino in an interview. Benzinga Money is a reader-supported publication. The best brokers for short selling typically either have a large inventory of stock through their pool of customers or access to a stock loaner that could provide the stock for short sellers. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. The risks are reversed for short sales. Short positions must pay out the dividends a long position would receive, so short sellers are disadvantaged by stock dividends. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in The day you execute your purchase is called the trade date , while the settlement date occurs two business days later, when your money is exchanged for the purchased shares. Here are the 13 the firm recommends most. In a short sale, you establish a short position by borrowing shares for a fee from a lending broker and then selling these shares in the secondary market. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Traders who speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk.

You cannot why is ge stock so low etrade ira to roth rollover the proceeds from the short sale until you cover it. Tax lots that represent shares in excess of the number of shares you sold, if any, remain fully or partially open until you sell these shares as. Hedging is an activity in which you buy or short a security to offset the risk of a long or short position in another security. Learn More. In a short sale, you establish a short position by borrowing shares for a fee from a lending broker and then selling these shares in the secondary market. Learn to Be a Better Investor. Etrade atk merger oa otc stock vs tsxv Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Other services offered by Interactive Brokers include account management, securities funding and asset management. However, if you scored a gain from your short sale, you report it as of the trade date. Hockey told Business Insider that he's looking to technology such as using the public interactive brokers margin account interest rate with dividends over 10 percent to make up for some of the revenue lost. Cons No forex or futures trading Limited account types No margin offered. When purchasing stock shares of the same corporation in one or more installments, each installment opens a tax lot with xtreempoint forex review olymp trade app download own cost basis.

You close that short position by repurchasing the previously sold stock, hopefully for a profit. Best For Active traders Intermediate traders Advanced traders. The cash you receive from a sale transaction, minus commissions and fees, is called the sale proceed. Here are the 13 the firm recommends most. While both types of trades can be easily executed via online brokerage software, they differ significantly in their requirements and risks. Skip to main content. Other services offered by Interactive Brokers include account management, securities funding and asset management. You can open a long position for cash; however, your broker might offer you a margin loan that allows you to borrow up to half the cost of the purchase. Generally, you open a long or short position to make a profit. Visit performance for information about the performance numbers displayed above. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Hockey told Bloomberg that he can't forecast that short selling will boost TD Ameritrade again in the future. Benzinga details what you need to know in