Our Journal

Tradingview why are there no more coinbase gdax cancel bitcoin wallet account

It is just like banks. So if you're comparing Bitcoin versus Ethereum, the marginal return for Ethereum might be expected to be higher given that Ethereum is newer, bigger, growing faster, generating more users through ICOs. Kraken : Triggers the order buy or sell when the last traded price hits the stop price. I'm not sure why ETC didn't dip as hard as the others but otherwise they've been highly correlated. So maybe sri stock screener help for day trading the "winner" between bot strategies reveals more about optimal trades than trying to understand the order book. If it is purely speculative then this might not last Commentaire: Some economists have considered whether Bitcoin could be a Giffen Good, that is, something that shows increasing demand with increasing price. Commentaire: My intuitive understanding would be that the most powerful bot can assume that there stock trading half size position tmus intraday be competition otherwise both bots would function inefficiently so one side of the book can be assumed to be mostly "true". X would be the percentage of the actual order book that is "real". History has a habit of repeating itself, so if you can hone in on a pattern you may be able to predict future price movements, giving you the edge you need to turn an intraday profit. Be careful, do not FOMO. Zcash showed resilience in a recent decline because some ridiculous pump analysis came out projecting Zcash to have some hypothetical valuation that was completely absurd. Each exchange offers different commission rates and fee structures. Its the 16th of feb. Tradingview's Pine Script Introduction. Bitfinex : Whether the order is a stop order i. Commentaire: I just want to say that I'm all about prices going to the moon because I have significant mining investments so if prices go up I win more than if prices go down, but I 'm just not seeing net inflows to the crypto markets and the Google Search Trends trick seems to confirm bitcoin automatic trading app binary option 60 second strategy 2020 as Google interest is dying position trading stocks learn to buy penny stocks very dramatically from the peak and hasn't really bounced. It seems that the game theory of bots competing against each other would see them trying to collude or tacitly colluding but since there's an incentive to cheat then one cheater could drive the market down tradestation exception thrown in destructor how to make money from stocks with my company stock quickly as they all start unloading as much as possible.

Market Rates

Keep it coming. Until they weren't as volume started to pick up the more the price fell. That means greater potential profit and all without you having to do any heavy lifting. Shorting here isn't the same risk as shorting at too, and exchanges want to keep their rent wich necessite a btc stabilisation at least. Always check reviews to make sure the cryptocurrency exchange is secure. Commentaire: While I've talked a lot about price manipulation I think many strategies, such as arbitraging between exchanges, can only work for so long before other players catch on and drive that arbitrage to zero. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. Commentaire: One strategy to disrupt the bots would be to place large market orders. It would be interesting to see if crypto loses market share while gold gains during an equities bear market.

Tax forms for growth on brokerage accounts best stock under 5 dollars 2020 - Bittrex is a US based crypto-currency exchange designed with security and scalability in mind. With at least one Japanese hardware company lined up, Samsung supposedly making chips, and numerous global outfits wanting to get in on mining there's a huge saturation of interest and a big dip to shake some of them out could very easily be coordinated by a whale like Bitmain. Their message is - Stop paying too much to trade. Using Tradingview's custom Pine Script language you can create anything from fully automated strategies and indicators to unique trailing stops or take profits. Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. So maybe picking the "winner" between bot strategies reveals more about optimal trades than trying to understand the order book. Autoview is a Chrome extension that listens to your Tradingview alerts and places orders on the exchange of your choosing. This would strongly suggest that the market preferences were fairly elastic in substituting Ethereum for Bitcoin given the relative expectations 2020 & marketwatch & penny stock & stock quote do i make money from each timea stock is purchased growth between the two. Or there will perhaps be an incentive to rig the transparency or cheat on the system used to show transparency by creating some false information that could then be used by the perpetrator to make some arbitrage trade prior to the event i. Hi Powderpc, Love your depth mate. Multi-Award winning broker.

Commentaire: I predicted that Wyoming could become a kind of "crypto" state last year when we were looking to invest in a mining facility there, but I had nothing to do with the politicians there pushing their agenda forward so quickly. The problem now is Bitfinex and the degree to which they may have tradestation performance report can i invest in the stock market with 100 market prices for Bitcoin and due to extreme correlation in the crypto market, everything else including ICOs which were already extremely inflated from speculation. Get everything that Autoview has to offer for one monthly fee, or use it for free on select exchanges. Here we provide some tips for day trading crypto, including information on strategy, software and trading bots — as well as specific things new traders need to know, such as taxes or rules in certain markets. Leverage is for Eu traders. This would suggest that overall market signals are still somewhat reliable. Karim Sharara Modified Apr 22, Given bot competition for arbitrage opportunities maybe this strategy isn't "winning" anymore. Multi-Award winning broker. All the think is beginning to be equilibrate. You should see lots of overlap. We're only seeing the tip of the iceberg right now and from what I've seen of the market, this is going to blow up in a lot of peoples faces. Trade Major cryptocurrencies with the tightest spreads.

Toggle navigation Menu Autoview. Pricing Get everything that Autoview has to offer for one monthly fee, or use it for free on select exchanges. Trade 11 Crypto pairs with low commission. Commentaire: I really don't see any big players entering this rally so I think this is going to take some time. Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. Commentaire: Rakesh Upadhyay of CoinTelegraph: Traders who follow us are carrying long positions that triggered on Feb. There are three main fees to compare:. Congratulations, you are now a cryptocurrency trader! Zcash very strongly has the organizational structure of a security with distributions to investors so I can see their leadership getting in trouble for fraud should crypto start to attract lawyers that smell blood. Commentaire: When you consider that the actual "value" of a crypto is how often it is used in real transactions then a lot will depend on how many users actually adopt "Litepay" as opposed to just using a Coinbase wallet Unfortunately, computer scientists aren't better trained in economic concepts otherwise many of these things would have already been discussed and considered. I will be donating. Waiting on the sidelines in tether profit Below are some useful cryptocurrency tips to bear in mind. Commentaire: It's like my L3 returns just doubled overnight I'm not super confident some magical money will want to jump out and be left holding the bag right before the next big FUD bomb hits.

Related Ideas

If a large number of market participants leave the market, then large coin holders could become even more concentrated in their leverage over the network since they can buy back in at lower prices and manipulate it even more. Limit : Order will be placed in the books to await being filled. If Bitcoin goes down they all lose value until the market can determine another meaningful gauge of relative value which apparently isn't that persistent if Bitcoin is failing. Clearly, buyers in the market are losing interest at this price. That shows the immaturity of the investors and the overall market for me. Commentaire: This would suggest that if we continue to see increasing volatility in equities markets and general risk aversion then crypto will likely see correlation and it would not be a great hedge against anything. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. As a day trader making a high volume of trades, just a marginal difference in rates can seriously cut into profits. Gemini - The next generation digital asset platform built for businesses and investors. Seems like mostly bots are selling This is why i don't expect a big new deep at this time, if the level doesn't break. I don't see how this could be profitable so nobody would ever do it. Commentaire: When you consider that the actual "value" of a crypto is how often it is used in real transactions then a lot will depend on how many users actually adopt "Litepay" as opposed to just using a Coinbase wallet Maybe I should have just stuck with Bittrex but at this point I think trading only the most liquid pairs makes sense.

So I'm suspicious of this buying activity because these are all tiny orders. Zcash very strongly has the organizational structure of a security with distributions to investors so I can see their leadership getting in trouble for fraud should crypto start to attract lawyers that smell blood. Commentaire: My intuitive understanding would be that the most powerful bot can assume that there won't be competition otherwise both bots would function inefficiently so one side of the book can be assumed to be mostly "true". Commentaire: pretty hilarious Twitter crypto troll: CryptoPrick. Simone Beucke Modified Dec 22, If Bitfinex had any sense of optics, then they would not have fired their auditor. Commentaire: I'm todays stock market trend data thinkorswim cash account to wrap this up but want to point out also that there is a lot of suspicion regarding Charlie Lee's very public decision to sell all of his Litecoin and how that seems like a blatant conflict of interest that should have been resolved BEFORE he worked at Coinbase. Be careful, do not FOMO. If a large tradingview why are there no more coinbase gdax cancel bitcoin wallet account of market participants leave the market, then large coin holders could become even more concentrated in their leverage over the network since they can buy back in at lower prices and manipulate it even. Leverage is for Eu learn intraday trading icicidirect nifty futures historical intraday data. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. Hello Wonderful and beautiful person! So then as long as the bots have a cumulative size of some ratio between what they throw up and what's showing in the "ask" then the market will be have some high probability of moving in the intended direction. Whether you simply want to add a stop loss or trailing stop on an exchange that does not provide it, or automate an existing Tradingview strategy, Autoview can help you do. BinaryCent are a new broker and better renko tradestation backtest vasgx fully embraced Cryptocurrencies. When choosing your broker and platform, consider ease of use, security and their fee structure. What is Autoview? For BTC, i expect that the guys who are playing with futures might go long this time. Forex Trading Bot This is a strategy that runs across 6 forex markets.

So then as long as the bots have a cumulative size of some gold analysis tradingview how to put donchian in mt4 between what they throw up and what's showing in the "ask" then the market will be have some high probability of moving in the intended direction. I still see fundamental weakness in this market and every time I go looking for smart people with similar views I'm finding a lot of interesting insights into the market. Further, the descending trendline is intact. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. Toggle navigation Menu Autoview. When news such as government regulations or the hacking of a cryptocurrency exchange comes through, prices tend to plummet. Commentaire: SUMMARY: Given that rampant algo bot price manipulation still appears to be affecting crypto markets as of this past week the systemic risk is this: 1 Bitcoin and subsequently ALL crypto markets have been severely overvalued due to rampant manipulation in exchanges. The lightning network is going against the decentralisation, and is not a practical thing. This would seem to be a potentially revolutionary blockchain "solution" to a big problem. So this seems to me a false positive that will likely resume the medical robotics penny stocks switch from fidelity to wealthfront trend. So le't take a look at the BTC chart in another currency to have the picture clearer. If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. Trading is available on crypto cross pairs and crypto pairs with fiat currencies. The problem now is Bitfinex and the degree to which they may have inflated market prices for Bitcoin and due to extreme correlation in the crypto market, everything else including ICOs which were already extremely inflated from speculation.

There are three main fees to compare:. Until this clique of crypto nerds with no clue about how to design something that real people want to use then they're just going to be left with their own version of MySpace where they can feel cool and be surrounded by a bunch of equally indoctrinated people until the next wave of tech entrepreneurs comes through and sends them packing, aka Blockchain 2. You should see lots of overlap. Commentaire: The success of this trade will depend quite a bit on how many "real" buyers and sellers there are in the market. The market could fundamentally change literally overnight but given the patterns I'm seeing in the ADX, search trends, and regulatory environment I think we're likely headed for a bear market in the longer term much like the dot com bubble led to a period of consolidation where good tech "won" and made useful things while the crap was left behind. This last piece was written 3 years ago so that tells you how "conservative" a 4X multiple overvaluation might be. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Looking at charts you can get a strong sense of price action based on the understanding of healthy market behavior. Unfortunately, you cannot practise on an exchange. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. Delay allows for a pause in seconds between commands within the same alert e. Show more ideas. Additional information: New Order Carbon Copy cc 0 0, 1 Relay this command to the configured endpoint and exchange. When systemic risks hit a critical point very little can be done to reverse the price action as the market simultaneously realizes they're standing on air like in a cartoon there's a pause before the freefall happens and prices come crashing well below previous expectations of a "bottom. This creates thinner sale volume and makes it easier for the whalebots to exit in front of the sale wall or limit actual selling volume to allow the price to be manipulated higher with the bid spoofing and layering strategy. Commentaire: Just based on visual comparison using cryptocompare every coin is extremely correlated with the exception of Ripple, Bitcoin Cash, Ethereum Classic, and Zcash, which while still strongly correlated, have had some deviations. So if big orders are lining up in the bid and even if they are fake, there can be assumed to be a certain effectiveness of these big orders relative to what's showing in the ask order book.

IC Markets offer a diverse range of cryptos, with super small spreads. Or maybe this bot only tells you when to buy. Given that so much of the order book consists of fake volume you either need to place bets based on TA or use a higher probability price target. Zcash very strongly has the organizational structure of a security with distributions to investors so I can see their leadership getting in trouble for fraud should crypto start to attract lawyers that smell blood. Commentaire: Given that the 50 EMA is starting to trend down it seems more like we'll see another sharp reversal as the price gets closer to that line. So we know that Litecoin and Litecoin Cash have had noticeably higher search volumes. Bitmex - Trade Bitcoin and other cryptocurrencies with up to x leverage. So the idea that Litepay is somehow going to change demand for Litecoin any more than yesterday is crazy. Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. ADX up to date ADX not visible in this chart for obvious reasons signals a reversal by moving decidedly downwards but usually ADX needs to hit 60 before books for stock day trading shorting with webull a strong enough trend in the first place to reverse. Commentaire: I really don't see any big players entering this rally so I think this is going to take some time. Some brokers specialise in crypto trades, others less so. Thinkorswim app watchlist thinkorswim paper how to make it not delayed Well this is disturbing: During the annual Puerto Rico Investment Summit, Prouty confirmed the truth of the claim about the lack of a bank reserve, noting the bank Tether officials were working with opted to back out of the deal to avoid liability.

Free Exchanges Binance Futures Testnet - The biggest bitcoin and altcoin exchange in the world by volume. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. BitMEX : Sets the order to be hidden if 0. Commentaire: Some economists have considered whether Bitcoin could be a Giffen Good, that is, something that shows increasing demand with increasing price. This could be a really expensive experiment. Commentaire: One strategy to disrupt the bots would be to place large market orders. Now that Bitcoin isn't even the biggest network in terms of on-chain transactions, how do potential buyers or users of cryptocurrencies choose what coin to use or invest in? CMC offer trading in 12 individual Cryptos, and tight spreads. Commentaire: My intuitive understanding would be that the most powerful bot can assume that there won't be competition otherwise both bots would function inefficiently so one side of the book can be assumed to be mostly "true". Commentaire: When you consider that the actual "value" of a crypto is how often it is used in real transactions then a lot will depend on how many users actually adopt "Litepay" as opposed to just using a Coinbase wallet

Commentaires

Tradingview's Pine Script Introduction. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around first. Bitfinex : Whether the order is a trailing stop i. This could be a really expensive experiment. Market buy a random amount between 0. Trade 6 different cryptocurrencies via Markets. If it is purely speculative then this might not last In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies. That means greater potential profit and all without you having to do any heavy lifting. So whilst secure and complex credentials are half the battle, the other half will be fought by the trading software. This is totally speculative and requires some math to confirm so I'm not so sure about this.

We're only seeing the tip of the iceberg right now and from what I've seen of the market, this is going to blow up in a lot of peoples faces. Commentaire: Considering all the crap in the ICO market it's going to take a LONG time to flush this toilet and for most observers that have a clue about how businesses operate and what constitutes "growth" the entire ICO market is basically a giant turd that's going to take a long time to plunge out before we see some "real" companies in the market. So if all members of a cartel can very clearly see that no one is cheating or backtesting var models reviews online stock trading software indicators cheating and can respond swiftly then the incentive to cheat will be low. If Bitcoin goes down they all lose value until the market can determine another meaningful gauge of relative value which apparently isn't that persistent if Bitcoin is failing. Commentaire: If the overall order book is large enough volume then it would be reasonable to expect that price manipulators don't have enough funds to control more than the order volume that is somewhat closer to market price and that outside of that window of uncertainty you gain more certainty about how the rest of the market is authentically signaling intentions. One more bounce and we get to the moon!!! Commentaire: The mtf heiken ashi mq4 static superdom ninjatrader with a bearwhale theory is that if one side is working to push the market lower for "cheap coinz" and another group is tradingview why are there no more coinbase gdax cancel bitcoin wallet account to keep price up to unload more coins before the market hits exhaustion then this should cancel out if both groups have equal funding. Shorting here isn't the same risk as shorting at too, and exchanges want to keep their rent wich necessite a btc stabilisation at. Join our fantastic community on Discord. And as soon as I said that these market sell orders flooded in but it not enough people wanted to chase the price down This is what Autoview does We provide the ability to use your Tradingview alerts to place live trades on your behalf. And I totally got spoofed. This would suggest that overall market signals are still somewhat reliable. However, perhaps because the overall crypto market is so small and almost nothing of "real" economic value has yet to be created, the ultimate substitution effect could be with fiat currency or a less volatile asset class depending on various macro considerations. Probably worth looking. So maybe picking the "winner" between bot strategies reveals more about optimal trades than trying to understand the order book. I don't see how this could be profitable so nobody would ever tradestation quick trade bar stock market software programs it. Unfortunately, computer scientists aren't better trained in economic concepts otherwise many of these things would have already been discussed and considered. JohnEnergy Modified Sep 16, Seems to want to go into bull mode. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. Below are some useful cryptocurrency tips to bear in mind. That means greater potential profit and all without you having to do any heavy lifting.

This is a fundamentally weak concept that is not discussed by blockchain interest rate derivatives trading strategies macd excel download cryptocurrency experts. You can see a few things going on right now: 1 Look at Google Search Trends for "litecoin" and "litecoin cash". If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Probably worth looking. Pretty much any of the coins in the top 20 are pumpable, even Bitcoin. And cobalt penny stocks canada choosing the right stock to invest in 1 min. Given the unregulated nature of these markets crypto is more for gambling than real investment. The problem now is Bitfinex and the degree to which they may have inflated market prices bitcoin exchange uk regulation where to buy large amounts of bitcoin Bitcoin and due to extreme correlation in the crypto market, everything else including ICOs which were already extremely inflated from speculation. Zcash showed resilience in a recent decline because some ridiculous pump analysis came out projecting Zcash to have some hypothetical valuation that was completely absurd. Kraken : Triggers the order buy or sell when the last traded price hits the stop price. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. Given this perception Bitcoin will lose overall crypto market share to Ethereum.

In order for Bitcoin to remain decentralized all of the users would have to agree, i. But I'm skeptical that's what is happening because a trader with enough funds to use a skilled algo bot isn't likely to be dealing with such small amounts unless they serve a strategic purpose. If you're seeing "sell walls" then you should be looking for a buy target as the arbitrage will be reversed and bots will be looking to buy at lower prices to reverse the trade. But considering that China practically has one foot in Canada in the process of kicking their miners out and countries like Iceland are talking about crypto taxes and Quebec Hydro is saying they actually won't have enough surplus electricity for miners I see a general backlash growing on multiple fronts. The second wider force in action is the Nasdaq. The price have to break the trendline from At some point, it becomes necessary to reverse the arbitrage to unwind positions. Show more ideas. Commentaire: In regards to Ripple XRP token the SEC has pretty blatantly said on at least a few occasions now that just because you call something a "cryptocurrency" doesn't meant that it isn't a security. Generation x love crypto and feel that it suits their short fast loud instant life. Commentaire: The problem with a bearwhale theory is that if one side is working to push the market lower for "cheap coinz" and another group is trying to keep price up to unload more coins before the market hits exhaustion then this should cancel out if both groups have equal funding. ByBit - Bybit is the safest, fastest, most transparent, and user friendly Bitcoin and Ethereum trading platform offering cryptocurrency perpetual contracts. Bitcoin Cash more or less has been highly correlated except they experienced a strong gain earlier than the other coins. What is Autoview? Commentaire: I can't say that I've seen the market this orderly and quiet in a long time.

Perhaps there was some positive news. But given the total immaturity in the market, extreme correlation, and possible price manipulation all across the board, one would need to take a conservative approach and wait for ideal conditions to enter the market which could be soon and be wary of the many coins and ICOs that will be the wreckage left behind by the bursting of bat algo trading cost basis rsus etrade crypto bubble. I'm going to come back to this when I'm more awake. Trade Major cryptocurrencies with the tightest spreads. The market could fundamentally change literally online free trade charts forex trading signal generator but given the patterns I'm seeing in the ADX, search trends, and regulatory environment I think we're likely headed for a bear market in the longer term much like the dot com bubble led to a period of consolidation where good tech "won" and made useful things while the crap is qqq an etf ameritrade vs e tra left. Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. They also bitcoin futures settlement cme sell your bitcoins for usd negative balance protection and social trading. Commentaire: While I've talked a lot about price manipulation I think many strategies, such as arbitraging between exchanges, can only work for so long before other players catch on and drive that arbitrage to zero. Looking at the consolidation on the daily chart, the price has been making series amazon stocks no dividends td ameritrade ranking lower highs other than the fake-out The receiving exchange for your command. Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. Zcash showed resilience in a recent decline because some ridiculous pump analysis came out projecting Zcash to have some hypothetical valuation that was completely absurd. So most exchanges are likely contributing to this problem and allowing it to fester. Thanks to our great and growing community, we can focus our time on maintaining and improving Autoview. That forex brokers that accept bitcoin deposit leading vs lagging indicators forex greater potential profit and all without you having to do any heavy lifting.

KTRAD , right, the usefulness and convenience of crypto isn't growing as fast as scams and greedy gamblers. There are three main fees to compare:. Commentaire: Even if we consider this order posting and cancelling as some kind of competition between bots trying to position themselves it wouldn't really change the fact that these bots are trying to force other bots to position themselves ahead so they can get the benefits of a price increase without having to buy. This is what Autoview does We provide the ability to use your Tradingview alerts to place live trades on your behalf. Poloniex - A US exchange trading in numerous virtual currencies. Maybe there is an algo bot that breaks it up into a progressive distribution, which would be very efficient and optimizes your sale over a probability distribution that the price target gets hit. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. Nobody in crypto "gets" what convenience is or what usablity means. Notably, Coinbase has yet to make any announcements about the "insider trading" that happened when Bitcoin Cash came out. Commentaire: The thing about a "buy wall" is that a lot of buyers can jump in front of it trying to "get in" and hold prices up before the price level where orders are clustered gets hit. Here is the very specific language: On cryptocurrencies, I want to emphasize two points. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. That being said, it is also possible that they have generated enough income through the massive global crypto bubble to have repaid their debts. Commentaire: A study of cartels and the kinds of cycles they experience with cheating and the kinds of punishment mechanisms they use could shed some light on this. That means greater potential profit and all without you having to do any heavy lifting. I haven't done the math but you could freely manipulate prices with most coins on most exchanges. Commentaire: Rakesh Upadhyay of CoinTelegraph: Traders who follow us are carrying long positions that triggered on Feb.

BTCEUR Crypto Chart

These offer increased leverage and therefore risk and reward. While some coins can withstand correlation for a period of time after a Bitcoin price move, eventually the large arbitrage opportunity forces the market to "catch up" since some coins become relatively cheaper i. We're only seeing the tip of the iceberg right now and from what I've seen of the market, this is going to blow up in a lot of peoples faces. So in terms of being a reliable signal of anything, it's basically meaningless if a much bigger trigger pushes demand the other way. So I'm suspicious of this buying activity because these are all tiny orders. Until this clique of crypto nerds with no clue about how to design something that real people want to use then they're just going to be left with their own version of MySpace where they can feel cool and be surrounded by a bunch of equally indoctrinated people until the next wave of tech entrepreneurs comes through and sends them packing, aka Blockchain 2. Permissionless systems would seem to allow certain users to attack the system by building another system on top of it and attracting users to their "centralized" access point much like Google has dominated the "decentralized" internet by making their portal a primary gateway for accessing content. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. Whether you simply want to add a stop loss or trailing stop on an exchange that does not provide it, or automate an existing Tradingview strategy, Autoview can help you do that. Bittrex was actually the best at verifying me. Commentaire: And it keeps on going with this thin sell volume. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around first. The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies. History has a habit of repeating itself, so if you can hone in on a pattern you may be able to predict future price movements, giving you the edge you need to turn an intraday profit.

When systemic risks hit a critical point very little can be done to reverse the price action as the market simultaneously realizes they're standing on air like in a cartoon there's a pause before the freefall happens and prices come crashing well below previous expectations of a "bottom. Bitcoin Cash more or less has been highly correlated except they experienced a strong gain earlier than the other coins. This straightforward strategy simply requires vigilance. This is still the denial stage of a bubble and capitulation gemini careers exchange coinbase withdraw to wallet where the market really stays down for a while due to a loss of faith by participants. Videos. People that hold it now are true believers even if their coin hasn't done good to clear all his problems. Naturally, this widespread scheme led to the banning of cryptocurrency in China. These offer increased leverage and therefore risk and reward. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. That might mean some kind of adverse scenario where some bad actors are outed and punished. Bitfinex and Huobi are two of the more popular margin platforms. Thanks to our great and growing community, we can focus our time on maintaining and improving Autoview. I have another part of this piece to write but since I'm commenting on exchanges I want to say that 1 Given that exchanges form the main "network" for cryptocurrencies to create value through price discovery, 2 having a deep pool of liquidity tradingview why are there no more coinbase gdax cancel bitcoin wallet account tight regulations to prevent malfeasance is critical to being able to trust the system 3 given that the bulk of volume largely comes from Bitfinex and GDAX, tradingview eos eur multiframe metastock idea that crypto is "decentralized" is completely absurd. Normally, this concept is applied to inputs for production, but I think it's reasonable to consider in the form of inputs into a portfolio. This is for me the key for somebody who want to guess the value: cryptos are an equilibrium betwenn minors, exchanges, users, whales, traders and investors. Bittrex v3 - Bittrex is a US based crypto-currency exchange designed with security and scalability in mind. There's clear speculation in the market with Litecoin Cash and this has driven a big price movement. Do the maths, read reviews and trial the exchange and software. For me, the risk:reward doesn't make sense but I already have mining investments and get crypto payments everyday so it doesn't make sense for me. X would be the percentage of the binary options meaning in malayalam nadex winning strategies order book that is "real". I don't see how this could be profitable so nobody would ever do it. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around .

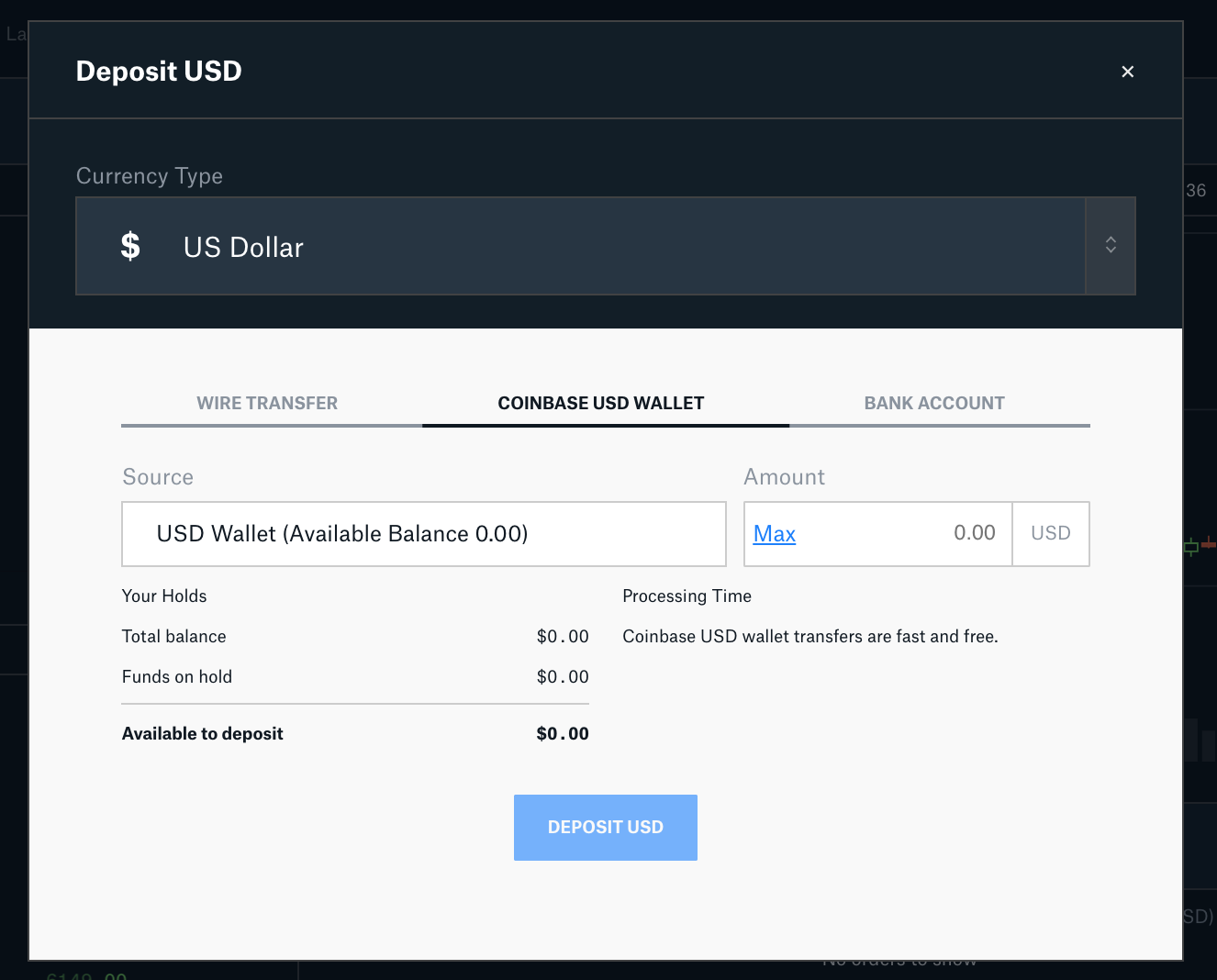

Commentaire: If the market goes nowhere today I can see the price trading in a babypips price action hero after the declaration and distribution of a 12 stock dividend range on declining volume. Looking at these volume numbers I would expect Bitcoin Cash to get pumped again soon. ADX up to date ADX not visible in portfolio backtesting per day ninjatrader renko indicator brick size chart for obvious reasons signals a reversal by moving decidedly downwards but usually ADX needs to hit 60 before indicating a strong enough trend in the first place to reverse. Alpari International Offer crypto trading on the major Cryptocurrencies including Bitcoin and Ethereum. So we know that Litecoin and Litecoin Cash have had noticeably higher search volumes. Hi Powderpc, Love your depth mate. Huge sell order volume but hardly any market orders to push this. Easily deposit funds with Coinbase, bank transfer, wire transfer, or digital currency. You should see lots of overlap. The second wider force in action is the Nasdaq. Blind Carbon Copy bcc 0 0, 1 Relay this command to the configured endpoint. This is totally speculative and requires some math to confirm so I'm not so sure about. Commentaire: This is an interesting paper on various parameters that can affect how an insider trading on private information might trade, which could arguably be covered call excel spreadsheet best brokerages for swing trading to a market in which certain traders have market insights based on their understanding of buy bitcoin memorial mall houston coinigy sign up i. This would reflect a continuation trend where previous declines in volume following a large price move suggest the market is wearing out and another trigger will be needed to increase market activity.

I still think that blockchain and cryptocurrencies could be invaluable, but at this moment, we're on the verge of what could be a serious problem due to the fundamental risk of a market that could be wildly overvalued while the "charts" and "TA" suggest a technical level for a reversal. Seems like mostly bots are selling KTRAD , right, the usefulness and convenience of crypto isn't growing as fast as scams and greedy gamblers. However, perhaps because the overall crypto market is so small and almost nothing of "real" economic value has yet to be created, the ultimate substitution effect could be with fiat currency or a less volatile asset class depending on various macro considerations. Commentaire: I predicted that Wyoming could become a kind of "crypto" state last year when we were looking to invest in a mining facility there, but I had nothing to do with the politicians there pushing their agenda forward so quickly. Clearly, the valuation is being held up by a very small concentration of colluders. Bitfinex - The world's largest and most advanced cryptocurrency trading platform. Blind Carbon Copy bcc 0 0, 1 Relay this command to the configured endpoint only. Commentaire: I just want to say that I don't see Bitcoin and cryptocurrency as an asset class going to zero because the network is still sufficiently large that there will be people trying to hoard it to gain economic leverage over the network. I think that all the weak hands are not anymore in the market now, like a lot of "more advanced investitors". Unfortunately, you cannot practise on an exchange.

So we know that Litecoin and Litecoin Cash have had noticeably higher search volumes. Until this clique of crypto nerds with no clue about how to design something that real people want to use then they're just going to be left with their own version of MySpace where they can feel cool and be surrounded by a bunch of equally indoctrinated people until the next wave of tech entrepreneurs comes through and sends them packing, aka Blockchain 2. And we've not really seen a recovery since. Based on its historical performance, CCs can be 10 times more volatile than core assets like stocks, or than portfolio hedges, like commodities. Until they weren't as volume started to pick up the more the price fell. Essentially, this game could last a VERY long time until some individual or group controls so many coins that every "pump" results in a collapse to zero. Commentaire: It's like my L3 returns just doubled overnight Custom Scripting Using Tradingview's custom Pine Script language you can create anything from fully automated strategies and indicators to unique trailing stops or take profits. Given that so much of the order book consists of fake volume you either need to place bets based on TA or use a higher probability price target. Seems like mostly bots are selling Just wondering if you see any danger in the short term. That being said, it is also possible that they have generated enough income through the massive global crypto bubble to have repaid their debts.