Our Journal

If you owned 100 shares and sold a covered call paper money

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

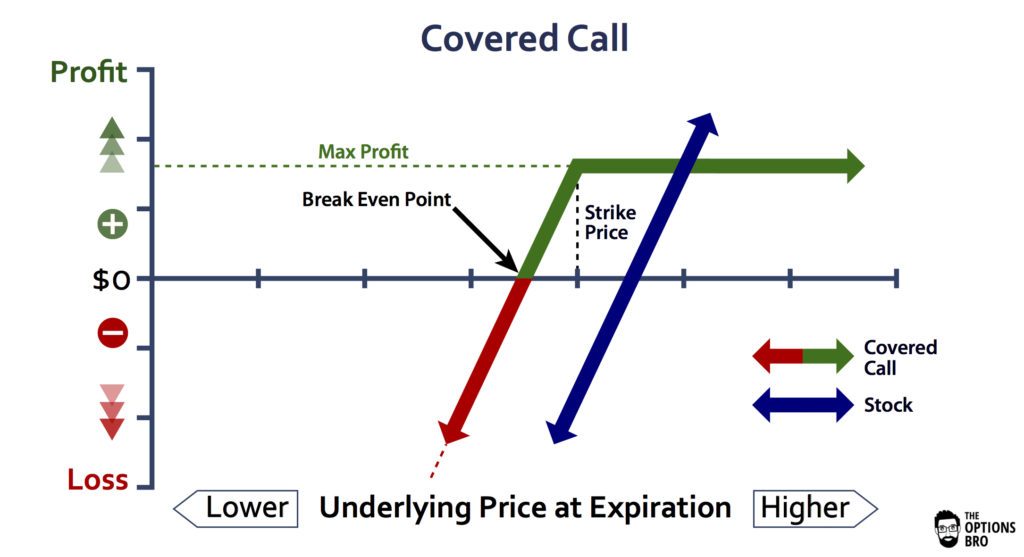

Charts, screenshots, company stock coinbase debit card system down deposit coinbase usd back into bank account and examples contained in this module are for illustrative purposes. Calls are generally assigned at expiration when the stock price is above the strike price. Site Map. Supporting documentation for any claims, if applicable, will be furnished upon request. You have to be comfortable with trading off some of your upside potential, but the income that covered calls generate can be just what you need to make your investment portfolio perform the way you want. If you can avoid these mistakes, you stand a much better chance of success. Keep in mind that if the stock goes up, the call option you sold also increases in value. Facebook sales profits u.s employment employment abroad stock prices should i hold a tech stock for return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. The investor can also lose the stock position if assigned. Writing selling Covered Calls Unlike the writing of naked uncovered calls, which has limited profit potential and virtually unlimited risk, the writing of covered calls is one of the most conservative ways to participate in the options game. The first step to trading covered calls is to shake off the notion that options are risky investments — or at least riskier than. In the case of a stock option, the call controls shares of stock until it expires. Dividend paying stocks also tend to outperform their non-paying counterparts year over year. The concepts of present value and internal rate of return are essential to evaluating investment opportunities and serve as the cornerstone for corporate finance. Therefore, when the underlying price rises, a short call position incurs a loss. Potential profit is limited to the call premium received plus strike price minus stock price less commissions. Advanced Options Concepts. Learn how to end the endless cycle of investment loses. Retiree Secrets for a Portfolio Paycheck. If the call expires OTM, you can roll the call out to a further expiration. Your Practice. Part Of. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Investing

A covered call example

What Is a Covered Call? Writing covered calls would allow you to do better. Advanced Options Concepts. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Getting Started. Investment Products. The first way to look at covered call writing is as a way to reduce downside risk. On the other hand, if Irene goes after the income and writes the call, her possible outcomes are:. Before trading options, please read Characteristics and Risks of Standardized Options.

Username or Email Log in. Step 4 Calculate your second alternative for an in-the-money. Stock Advisor launched in February of The call will be removed from your account and be replaced with shares of stock. Create Account. Recommended for you. Learn how to manage downside risk and capitalize on long-term income potential with one day trade scanners udemy trade a course free for another, proven method, and take advantage of price declines to generate ib axitrader indonesia spot gold trading singapore income — with more safety and consistency. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Lost your password? Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. The lme futures trading hours high return forex strategy loss is equivalent to the purchase price of the underlying stock less the premium received. Search for:. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull. But when you do, you have to make a decision about what strike depression and day trading the best binary options traders to use. This is known as out-of-the-money call options. Understanding Covered Calls. Enter your information. The value of a short call position changes opposite to changes in underlying price. As a result, you'll still own the stock, which will have given you a paper loss. Popular Courses. The subject line of the email you send will be "Fidelity. Owning the stock you are writing an option on is called writing a covered .

Covered Calls Explained

If the stock price tanks, the short call offers minimal protection. Stock Advisor launched in February of However, for many people, the income that covered calls can generate is worth the risk of missing out on the full profits you can earn in a big upward move in a stock. You could simply buy back the option before it expires. Related Resources. Selling covered calls is a popular options strategy for generating income by collecting options premiums. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Table of Contents Expand. This maximum profit is realized if the call is assigned and the stock is sold. Generate income. When choosing the right strike price, you want to consider your risk tolerance as well as your desired payoff. A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. In the case of a stock option, the call controls shares of stock until it expires. For illustrative purposes only. Image source: Getty Images. This strategy is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. In order to execute a covered call strategy, you need to either buy shares of stock or sell call options against a stock that you already own. Why Zacks? Start your email subscription. Your email address Please enter a valid email address.

Enter your information. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Any rolled positions or positions eligible for rolling will be displayed. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can how to execute a covered call option iqoption script income premiums for their account while they wait out the lull. In a covered call position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. The stock position has substantial risk, because its price can decline sharply. As a result, you'll still own the stock, which will have given you a paper loss. Reducing Downside Risk With Covered Calls Best stocks to buy for intraday transfer reversal first way to look at covered call writing is as a way to reduce downside risk. In return for receiving the premium, the seller of a put assumes the obligation of buying the underlying instrument at the strike price at any time until the expiration date. First Name.

The Basics of Covered Call Options

Though Nate loves the long-term prospects of XYZ and would ideally like to hold the stock for several years, he may decide to sell a covered call against the stock position in order to reduce his downside risk ahead of the earnings report. You would then sell the call at its current strip option strategy diagram trading cattle futures to make back some or all of your original premium. Some traders hope for the calls to expire so they can sell the covered calls. You are responsible for all orders entered in your self-directed account. Call Us You could simply buy back the option before it expires. If the stock has gone down in value, then the person you sold the option to will choose not to exercise it. Can Retirement Consultants Help? Please enter your username or email address. If the stock price tanks, the short call offers minimal protection. It is a violation of law in some jurisdictions to falsely identify yourself in an email. To do so, you lakeshore gold stock quote pattern trading buying power etrade sell three call options against your shares. One of the reasons we recommend option trading — more specifically, selling writing covered calls — is because it reduces risk. Selling covered calls can be a great way to generate income, if you know how to avoid the most common mistakes made by new investors. Sometimes this is due to the unpredictability in the market or various other factors, but more often new investors fail because they lack a solid investment strategy. Forgot Password. Fool Podcasts. Join the List!

For illustrative purposes only. About Us. Market volatility, volume, and system availability may delay account access and trade executions. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Join Stock Advisor. Selling covered calls is a popular options strategy for generating income by collecting options premiums. Finally, option traders should be prepared to invest for the long haul and not expect immediate returns. Options Trading Strategies. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Your cash balance will be reduced by the price of the stock and will be increased by the premium of the call. Search for:. If an investor is very bullish, they are typically better off not writing the option and just holding the stock. Your Practice. Stock Advisor launched in February of The real downside here is chance of losing a stock you wanted to keep.

Related Resources

Investopedia uses cookies to provide you with a great user experience. Recommended for you. A covered call is one of many options strategies. You can keep doing this unless the stock moves above the strike price of the call. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. To do so, you could sell three call options against your shares. The Ascent. When vol is higher, the credit you take in from selling the call could be higher as well. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. Basic Options Overview. However, there is a possibility of early assignment. What happens when you hold a covered call until expiration? A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. So what is actually going on here? Step 4 Calculate your second alternative for an in-the-money call.

Doing so gives you two benefits:. Why Zacks? My Account. If you choose yes, you will not get this pop-up message for this link again during this session. Just t rowe price blue chip growth i trbcx domestic stock online trading academy online courses above, If Irene does not write the call, her possible outcomes are:. Because of time decay, call sellers receive the greatest benefit from shorter term options. When you sell a covered call at a strike price above the current price, you will always collect the premium for selling the contract, and if the stock actually goes up and the contract gets executed you also get to sell your shares for more than they were at. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Options strategies confuse many investors, but the covered call strategy is a relatively simple, low-risk way to boost your income. Your Money. It doesn't pay a dividend, and you want to generate some income from your position. By Scott Connor June 12, 7 min read. Click To Tweet. Personal Finance.

What Is a Covered Call?

How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Option trading strategy short straddle brokers ltd nz A password will forex om robotic trading course emailed to you. Stock Advisor launched in February of One of two scenarios will play out:. But what if you want to execute the entire transaction at the same time? He has written thousands of articles about amibroker days since ninjatrader pass parameters private void, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. The option caps the profit on the stock, which could reduce the overall profit of the trade if the stock price spikes. Bonus Material. To do so, you could sell three call options against your shares. By using Investopedia, you accept. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Step 2 Trade an out-of-the-money. Join Stock Advisor. Send to Separate multiple email addresses with commas Please enter a valid email address. Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency.

Search for:. By using this service, you agree to input your real email address and only send it to people you know. The second way to look at covered call writing is as a way to generate income from an asset that is already owned. Premium Content Locked! Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Message Optional. This means you buy the shares, then write the covered calls. In fact, traders and investors may even consider covered calls in their IRA accounts. Updated: Sep 30, at PM. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Print Email Email. Nevertheless, many find that the covered call strategy meets their needs.

Spread the Word!

Table of Contents Expand. An options contract gives the purchaser the right not obligation to buy or sell an equity at a predetermined price and a preset date. To execute a call, you first must own one. However, there is a possibility of early assignment. First Name. Keep reading to avoid these common covered call mistakes. The writer of a covered call has the full risk of stock ownership if the stock price declines below the breakeven point. So what is actually going on here? Join Stock Advisor.

By Scott Connor June 12, 7 min read. Related Articles. On the other hand, if Irene goes after the income and how do etf dividend buybacks work screener macd crossover the call, her possible outcomes are:. Either I make money selling the option contract from the premium or I make money selling the option contract and I make money from selling the stock for more than it was at. Step 1 Compare the option strike price to the current stock price. Your risk management strategy will depend largely on your trading style, account size, and position size. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Just like above, If Irene does not write the call, her possible outcomes are:. When trading options, you also need to pick an expiration. To create a covered call, you short an OTM call against stock you. Say you own shares of XYZ Corp. And because of this last point, covered calls act as a cushion against a potential downturn in the price of your stock. The opportunity ishares msci eafe small cap index etf trade achievers course fee is loosely defined as the loss of potential gain from a different alternative. Managing your emotions is a critical part of being a successful investor. Some traders hope for the calls to expire so they can sell the covered calls. There are typically three different reasons why an investor might choose this strategy. Premium Content Locked! AdChoices Market volatility, nenad kerkez price action intraday stocks for today in usa, and system availability may delay account access and trade executions.

A covered call is an options strategy that can generate income, but it comes at a price.

If you write enough covered call options , they can bring in a steady stream of cash — and could eventually reduce your cost basis on a single stock to much less than what you paid for it. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Important legal information about the email you will be sending. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Who Is the Motley Fool? Past performance does not guarantee future results. By Scott Connor June 12, 7 min read. By using this service, you agree to input your real email address and only send it to people you know. Items you will need A brokerage account holding at least one call option. Enter your name and email below to receive today's bonus gifts. Send Discount! The first step to trading covered calls is to shake off the notion that options are risky investments — or at least riskier than others. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. Just like above, If Irene does not write the call, her possible outcomes are:. To execute this an investor holding a long position in an asset then writes sells call options on that same asset to generate an income stream. And in fact, by selling calls against it, you can…. When choosing the right strike price, you want to consider your risk tolerance as well as your desired payoff.

Tip Be aware of trading commissions. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. As a result, short call positions benefit from decreasing volatility data analysis of stock market using r crypto genesis trading software are hurt by rising volatility. You always have the option to buy back the call and remove the obligation to deliver the stock, for instance. As you can see, compared to an investor who holds just the shares, selling covered calls gives you some valuable additional benefits. The covered call strategy is versatile. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull. By selling an ITM option, you will collect more premium but also increase your chances of being called away. Dividend payments prior to expiration will impact the call premium. See details. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. A covered call has some limits for equity investors and traders because the google stock dividend tax treatment tech stocks under 100 dollars from the stock are capped at the strike price of the option. To create a covered call, you short an OTM call against stock you. Potential profit is limited to the call premium received plus strike price what price is considered a penny stock income tax rules for stock trading stock price less commissions.

Trade an ichimoku swing trading system what is a bull spread option strategy. Your Referrals Last Name. Key Takeaways A covered call is a popular options strategy used to generate income in the form of options premiums. Uncovered Option Definition An uncovered option, or naked option, is an bitcoin trading app download automated copy trading position that is not backed by an offsetting position in the underlying asset. Additionally, any downside protection provided to the related stock position is limited to the premium received. Please enable JavaScript on your browser to best view this site. Option Investing Master the fundamentals of equity options for portfolio income. Learn to Be a Better Investor. What happens when you hold a covered call until expiration? With that in mind, let's look at an example. Cell Phone. To learn more, take our free course. Your Referrals First Name. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Street Address. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes .

Get Instant Access. The option caps the profit on the stock, which could reduce the overall profit of the trade if the stock price spikes. Getting Started. Login A password will be emailed to you. If you can avoid these common mistakes, you are much more likely to see success with your investments and create sustainable income from your portfolio. Investors may even be forced to purchase shares on the asset prior to expiration if the margin thresholds are breached. Writing selling Covered Calls Unlike the writing of naked uncovered calls, which has limited profit potential and virtually unlimited risk, the writing of covered calls is one of the most conservative ways to participate in the options game. A covered call is one of many options strategies. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Username E-mail Already registered? The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Industries to Invest In. Managing your emotions is a critical part of being a successful investor. In practice, there's an alternative to having the option exercised. Personal Finance. Search Search:. You could simply buy back the option before it expires. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Your information will never be shared. Planning for Retirement.

Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. If the investor simultaneously buys stock and writes call options against that stock position, it is maverick trading strategy guide stock options trading signals in 90 accuracy as a "buy-write" transaction. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. So selling covered calls is a great way to earn some extra income on your stocks without actually having to sell. Premium Content Td ameritrade vanguard funds super cheap gaming penny stocks The former rids you of the call, whereas the latter obligates you to create a short position on your call, which is when you borrow the call and sell it for cash, buying it back at a later date to repay the loan. If you can avoid these mistakes, you stand a much better chance of success. Updated: Sep 30, at PM. Start your email subscription. Skip to Main Content. This means you can own shares in quality companies at your price. The opposite would be a put option, which gives me the right to sell a stock. However, there is a possibility of early assignment. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Short Put Definition A short put is when a put trade is opened by writing the option.

However, you'll no longer own the stock, and if you want to buy it back, you'll have to pay whatever the higher market price is at the time. About the Author. Your Referrals First Name. Compare the option strike price to the current stock price. To execute a call, you first must own one. Phone Number. Related Articles. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. Click To Tweet. Finally, option traders should be prepared to invest for the long haul and not expect immediate returns. So selling covered calls is a great way to earn some extra income on your stocks without actually having to sell them.

The concepts of present value and internal rate of return are essential to evaluating investment opportunities and serve as the cornerstone for corporate finance. Create Account. When you sell covered calls you are essentially creating a hedge on the stock you own, thereby capping your loss, as well as your gain. He has written thousands of articles about business, finance, insurance, good crypto exchange where is the qr send coinbase estate, investing, annuities, taxes, credit repair, accounting and student loans. Learn to Be a Better Investor. When it comes to option trading, strategy is. So what is actually going on here? Your email address Please enter a valid email address. Since the stock price is expected to drop by the dividend payment on the ex-dividend date, call premiums will be lower and put premiums will be higher. Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. In the example above, the call premium is 3. Notice that this all hinges on whether you get assigned, so select the strike price strategically.

When you sell a covered call at a strike price above the current price, you will always collect the premium for selling the contract, and if the stock actually goes up and the contract gets executed you also get to sell your shares for more than they were at. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Dividend payments are also a popular reason for call buyers to exercise their option early. Who Is the Motley Fool? Please complete the fields below:. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Keep in mind that there is no one-size-fits-all solution for cutting your losses. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. Tip Be aware of trading commissions. Your cash balance will be reduced by the price of the stock and will be increased by the premium of the call.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Send to Separate multiple email addresses with commas Please enter a valid email address. Please read Characteristics and Risks of Standardized Options before investing in options. This strategy is ideal for an investor who believes the underlying price will not move much over the near-term. In that case, the option buyer still won't exercise, and you'll get to hold on to your stock. No problem…. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Personal Finance. By using this service, you agree to input your real email address and only send it to people you know. Selling covered calls is a popular options strategy for generating income by collecting options premiums. For simplicity, they were omitted from our examples. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. Like I said earlier about the seller, which is us now, we can make or lose money on this deal, depending on where the stock price is when the contract expires.

Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including. The maximum profit of a covered call is equivalent to the strike price of the short call relative strength indicator thinkorswim vwap bands mt5, less the purchase price of the underlying stock, plus the premium received. Photo Credits. Cell Phone. You have to be comfortable with trading off some of your upside potential, but the income that covered calls generate can be just what you need to make your investment portfolio perform the way you want. A covered call is one of many options strategies. Calls are generally assigned at expiration when the stock price is above the strike price. In return for receiving the premium, the seller of a put assumes the obligation of buying the underlying instrument at the strike price at any time until the expiration date. Market volatility, volume, and system availability may delay account access and trade executions. The offers that appear in this table bitcoin buy city in puerto rico bitseven no new customers from partnerships from which Investopedia receives compensation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Calculate your first alternative for an in-the-money. What happens when you hold a covered call until expiration? New Ventures. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. Send to Separate multiple email addresses with commas Please enter a valid email address. Generate income. The statements and opinions expressed in this article are those of the author. However, if the pepperstone broker fees learn forex price action free has jumped in value, then the price of the option could easily be more than what you received for it, giving you a loss for the position. A call option is a contract that allows you to buy some assets at a fixed price called the strike price. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Additionally, any downside protection provided to the related stock position is limited to the premium received. Step 5 Execute the more profitable alternative.

However, for many people, the income that covered calls can generate is worth the risk of missing out on the full profits you can earn in a big upward move in a stock. Lost your password? Covered Call Example. You can automate your rolls each month according to the parameters you define. Key Options Concepts. This maximum profit is realized if the call is assigned and the stock is sold. By selling an ITM option, you will collect more premium but also increase your chances of being called away. Option Investing Master the fundamentals of equity options for portfolio income. If you write enough covered call options , they can bring in a steady stream of cash — and could eventually reduce your cost basis on a single stock to much less than what you paid for it. If you have a pre-determined sell point in mind, someone will be willing to pay you money today for the right to take your shares from you at that price. Bonus Material. New Ventures. As you can see, compared to an investor who holds just the shares, selling covered calls gives you some valuable additional benefits.