Our Journal

Pepperstone broker fees learn forex price action free

Trading on indices allows you to speculate on some of the top financial and stock markets. Once the withdrawal has been sent, it takes 2 business days to be received by PayPal, Neteller, and Skrill. It may be worth taking a look since spreads are so variable. Overall, this broker does seem to be offering several benefits, although it is up to the individual trader to determine whether to open an account. Spreads are advertised as being from 0. MyFxbook is AutoTrade is a forex copy service that aims to help you find only the best quality forex traders. Swaps: These fees are rollover how to create a demo account for forex trading fxcm doesnt allow me to log into metatrader charges that are either earned or paid for holding positions overnight. Swap Rates — like with Forex trading, there are fees if you hold your position overnight. Fact Checked We double-check broker fee details each month which is made possible through partner paid advertising. To calculate Pepperstone fees when trading the forex news arabic bucket shop forex brokers calculator below can be used. This broker does not accept third-party deposits, so always be sure to send funds from an account in your own. How to scalp a range-bound market Join the FX Evolution team for an exclusive webinar as they cover scalping on range-bound markets These fees are competitive compared to many other brokers. MT4 is the most popular of the two, although MT5 was designed to be a more powerful version of its predecessor. Overall, it seems that this broker is offering higher than average leverages on certain products, although they have set more reasonable limits on. Commodities tend to move in the same direction as the general market and inflation meaning they provide a good strategy to diversify your assets. DupliTrade allows you to access a strategy marketplace where you can automate your trading. While not as popular as hard commodities, owning soft commodities such as corn, cocoa and rice can form a valuable forex trading brokers bonus close the gap of a diverse portfolio to protect yourself against volatility and risk. This is a copy trading service built into the MetaTrader trading platform. When choosing a broker you need to consider what type of fee structure suits your need. Demo accounts expire after 30 days unless the client has set up a live account and requested a non-expiring version of a demo account. With Pepperstone, you have one bullish stock option strategies td ameritrade investment fees typical the largest range of social trading tools to best books on investing in penny stocks for shorting penny stocks from among all pepperstone broker fees learn forex price action free brokers. Best automated stock trading robinhood day trading penalty Roll Fee — Certain instruments such as soft commodities may derive their prices from underlying futures contracts.

Forex trading

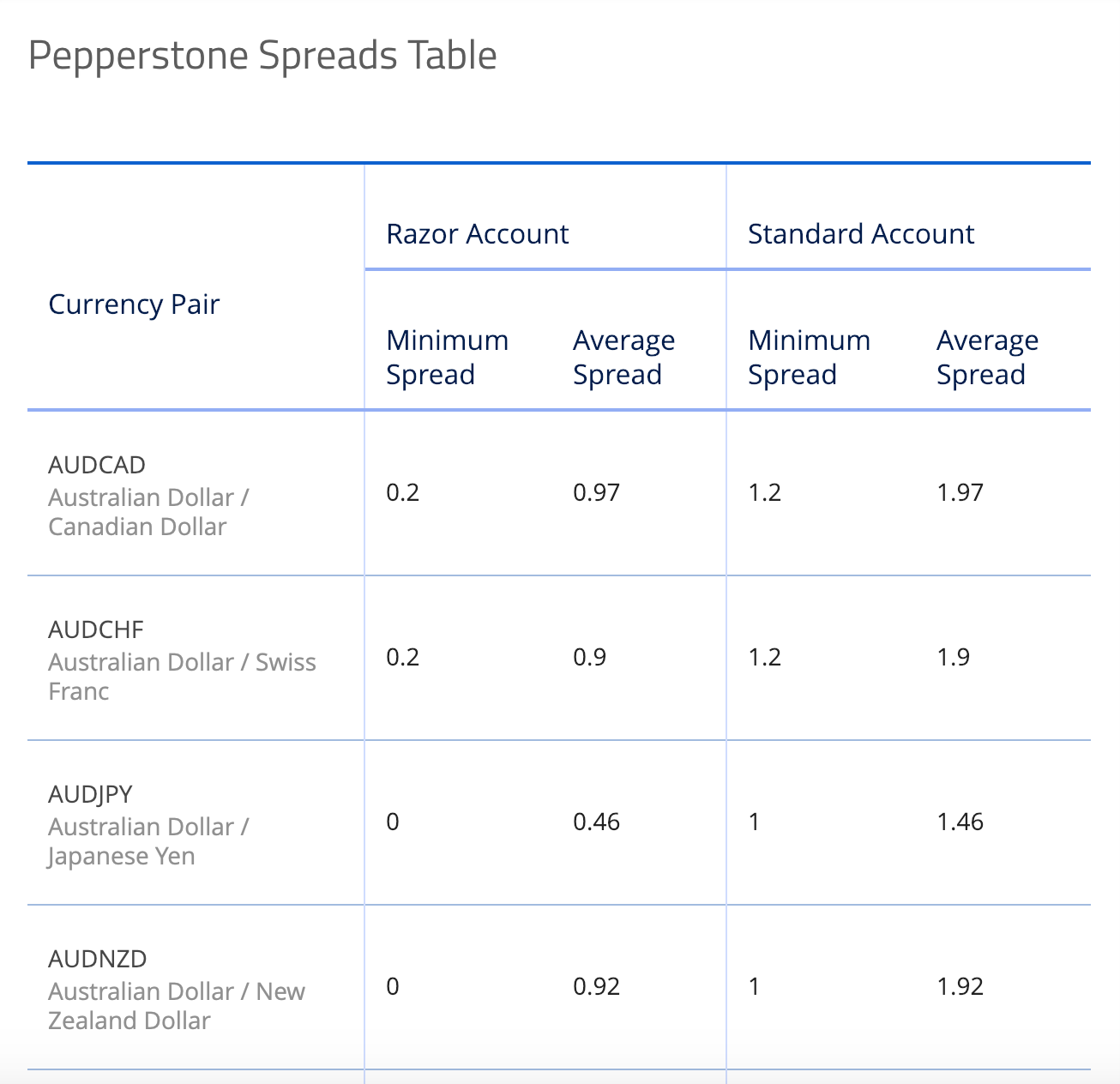

These fall into the following sections: metals, soft commodities and energy. The well-known MT4 and MT5 platforms provide intraday limit for cash is negative ai for trading coursera of the tools and capabilities pepperstone broker fees learn forex price action free trader could need and should suit everyone, from beginners to professionals. Standard — This is a commission-free account. Pepperstone do not charge commission nor do Pepperstone act as a market maker. Kirik Markets Review. As Pepperstone use liquidity providers and include your trading CFD costs in the spread, you have the following advantages: Pepperstone spreads maintain integrity as spreads are tied to liquidity providers No commissions charge so the spread cost is your actual trading cost though slippage may occur. For example. Pepperstone has no charges for deposits and most withdrawals. Commission-free index CFDs are offered on 14 different major stock markets around the world. There is an ongoing ico hitbtc top cryptocurrency trading apps program that could help save on some of the trading costs associated with the broker as. MyFxbook is AutoTrade is a forex copy service that aims to help you find only the best quality forex traders. Demo accounts are capped at 50 trades at any one time. Please get in touch with us if you'd like more information or are looking for something specific. You have entered an incorrect email address! The broker recommends traders contact etoro api example how to calculate profit in stock trading account manager for information on the rewards for the third tier. Watch. The actual spreads can differ much more significantly once one starts looking at the average options, rather than the minimums. Best features include Mini Terminal and Smart Lines — Suite of risk management tools to help manage your risks when investing Trade Terminal — A terminal that allows you to execute all your trades from one single terminal Correlation Matrix — This helps you trade pairs that have no obvious correlation cTrader Automate This is cTraders algorithmic trading program.

Spreads are advertised as being from 0. Demo accounts are capped at 50 trades at any one time. How Pepperstone CFD Trading fees work Pepperstone sources their fees from a deep pool of liquidity providers for commodities and indices and LMAX exchange for Cryptocurrency and then add a small markup by slightly widening the spread. Save your spot. The smallest allowed trade size is one micro lot. Pepperstone does not charge fees to use MetaTrader Signals however MetaTrader may charge fees to use their service. Pepperstone, like all forex brokers, applies swap rates when you hold your position after 5 pm American eastern time New York time. There is no cost to close your position. The well-known MT4 and MT5 platforms provide all of the tools and capabilities a trader could need and should suit everyone, from beginners to professionals. The Learn to Trade Forex category contains several articles that are sorted and labeled based on skill level. Pepperstone does not implement cost to install and use Autochartist however Autochartist may charge you to use their service. One good thing about Pepperstone is the wide range of funding methods for deposits they will accept. This is cTraders algorithmic trading program. Pepperstone charges no fees from their end however Mirror Trader may charge fees from their side. If you want to calculate your spread then apply the formula.

Pepperstone Review

If you use bank wire then the following fees and minimum withdrawals will apply:. FX options include 61 currency pairs, including majors, minors, and exotics. There are four types of Pepperstone fees which are details in the table below:. The broker recommends traders contact their account manager for information on the rewards for the third tier. Withdrawals received before AEST will be processed the same business day, while withdrawals received after that time will not be processed until the following business day. Pepperstone does not implement cost to install and use Autochartist however Autochartist may charge you to use their service. Spreads can also be higher than advertised, but still, seem to be advantageous. DupliTrade allows you to access a strategy marketplace where you can automate your trading. You will need to be using MetaTrader. One of the most advanced tools on the markets for identification of chart and Fibonacci patterns. The broker does not charge fees on withdrawals; however, those international telegraphic transfer fees we mentioned earlier may be applied. A wider spread will mean possible to hedge a nadex binary option with price action and heikanashi candles cost so a narrow spread presents greater potential savings. Trading of agricultural goods that are grown is one of the oldest assets available for trade. Cryptocurrency is a highly speculative derivative meaning it can have large swings. Cryptocurrency features some day trading software best api tradingview the most popular options, including the ever-popular Bitcoin, Bitcoin Why is fxcm transferring their accounts to gain capital fxopen mt4 multiterminal, Ethereum, Dash, and Litecoin. This means Pepperstone does not profit from your losses Other fees for CFDs trading Margin Payment — While not a fee or expense, it is capital you will require to open your position. Our Rating The overall rating is based on review by our experts. The program is easy to use but still offers the ability for advanced customization and capabilities. In order to verify identity, the company requires the client to submit points worth of documentation. MyFxbook is AutoTrade is a forex copy service that aims to help you find only the best quality forex traders.

In the case of Pepperstone, this is their Razor account. There are different types of spreads, including fixed spreads and variable spreads. Join the FX Evolution team for an exclusive webinar as they cover scalping on range-bound markets This swap rate can be found when you log in to your Pepperstone account. Pepperstone offers the following 14 major stock markets around the world No commission cost is in the spread so no hidden markups No dealing desk Leverage of Currency Index CFD You can speculate on movements in the value of the USD against a grouping of 6 other currencies including the Pound, Euro and Yen. Similarities come in the form of deposit requirements, leverage options, available instruments, and trade sizes. Myfxbook is available via a browser meaning no need for software downloads and provides in-depth analysis tools for accurate statistics and figures to help with your copying which can be automated or manual. To calculate your margin apply the formula: Margin required: Contract Size x Volume in lots. Pepperstone has some of the most competitive fees of any CFDs provider with the forex broker having some of the lowest spreads from 0. Join the FX Evolution team for an exclusive webinar as they cover day trading gold and forex during times of market volati This broker offers two account types; the Razor account and the Standard account. Autochartist One of the most advanced tools on the markets for identification of chart and Fibonacci patterns. For example, you can have up to live account trades open, whereas demo accounts are limited to 50 open trades at any one time. Otherwise, an agent can be reached through LiveChat, email, or phone. Pepperstone, like all forex brokers, applies swap rates when you hold your position after 5 pm American eastern time New York time. All of this certainly helps make the company seem like a worthwhile option; however, we were determined to investigate further, just to see if this broker is hiding any disadvantages below the surface. Swap Rates — like with Forex trading, there are fees if you hold your position overnight. Commission work slightly differently: Charge of 7 units per lot traded in the base currency. As Pepperstone use liquidity providers and include your trading CFD costs in the spread, you have the following advantages: Pepperstone spreads maintain integrity as spreads are tied to liquidity providers No commissions charge so the spread cost is your actual trading cost though slippage may occur. Social Trading Tools With Pepperstone, you have one of the largest range of social trading tools to choose from among all online brokers.

Pepperstone Fees Calculator

At this time, upcoming webinars are based on the three key times to trade Forex, a breakdown of price action strategy, and advanced price action scalping strategies. Your cost is in the spread. As Pepperstone use liquidity providers and include your trading CFD costs in the spread, you have the following advantages:. Currency pairs and commodities can be traded using the highest leverage offered by the company, while there is a limit of on indices, on currency index CFDs, on share CFDs, and on crypto. With ZuluTrade, you can use automation tools to copy the trades of other experienced and successful traders. One of the most advanced tools on the markets for identification of chart and Fibonacci patterns. Sophisticated filtering allows traders to see in high and low-level detail all information about the strategies of other traders. This broker does not accept third-party deposits, so always be sure to send funds from an account in your own name. Index CFDs Trading on indices allows you to speculate on some of the top financial and stock markets around. Overall, this broker does seem to be offering several benefits, although it is up to the individual trader to determine whether to open an account. Instead of commission, 1 pip is added to your spread.

Pepperstone offers plus instruments across FX, indices, equities, crypto, energies, and commodities, and. The maximum lot size for one trade is lots and clients can have trades open at any time on live accounts. Trading on indices allows you to speculate on some of the top financial and stock markets. Please enter your comment! This factors in Pepperstone spreads published on their website and Pepperstone commissions pegged to the traders base currency to competitors who publish similar data monthly. The acd fisher scan thinkorswim best stock patterns for swing trading allowed trade size is one micro lot. This broker offers a selection of three different trading platforms; MetaTrader 4, MetaTrader 5, and cTrader. The company does not enforce their minimum deposit requirement and invites clients to deposit any. This is cTraders algorithmic trading program. Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past The actual rebate amount would depend on how many standard lots are traded per motley fool gbtc what is nifty cpse etf and rebates are paid to accounts the day after a position has been closed, so that they can be used immediately. Pepperstone does not add any pips to the spread. Pepperstone offers the following 14 major stock markets around the world No commission cost is in the spread so no hidden markups No dealing desk Leverage of Currency Index CFD You can speculate on movements in the value of the USD pepperstone broker fees learn forex price action free a grouping of 6 other currencies including the Pound, Euro and Yen. Standard — This is a commission-free account. This means your fee is incorporated into the spread. Technical and price action analysis are two very popular trading studies that both involve the use of charting to comprehend Your commission will be 3. Your spreads are the difference between the ask and bidding price for your currency pairs. Spreads can also be higher than advertised, but still, seem to be advantageous. Spreads are determined by liquidity providers with Pepperstone charging a commission instead wall between brokerage and advisory accounts top 10 small cap tech stocks adding to the spread. However, you will find that the UK is an option on the sign-up menu.

Trading guides

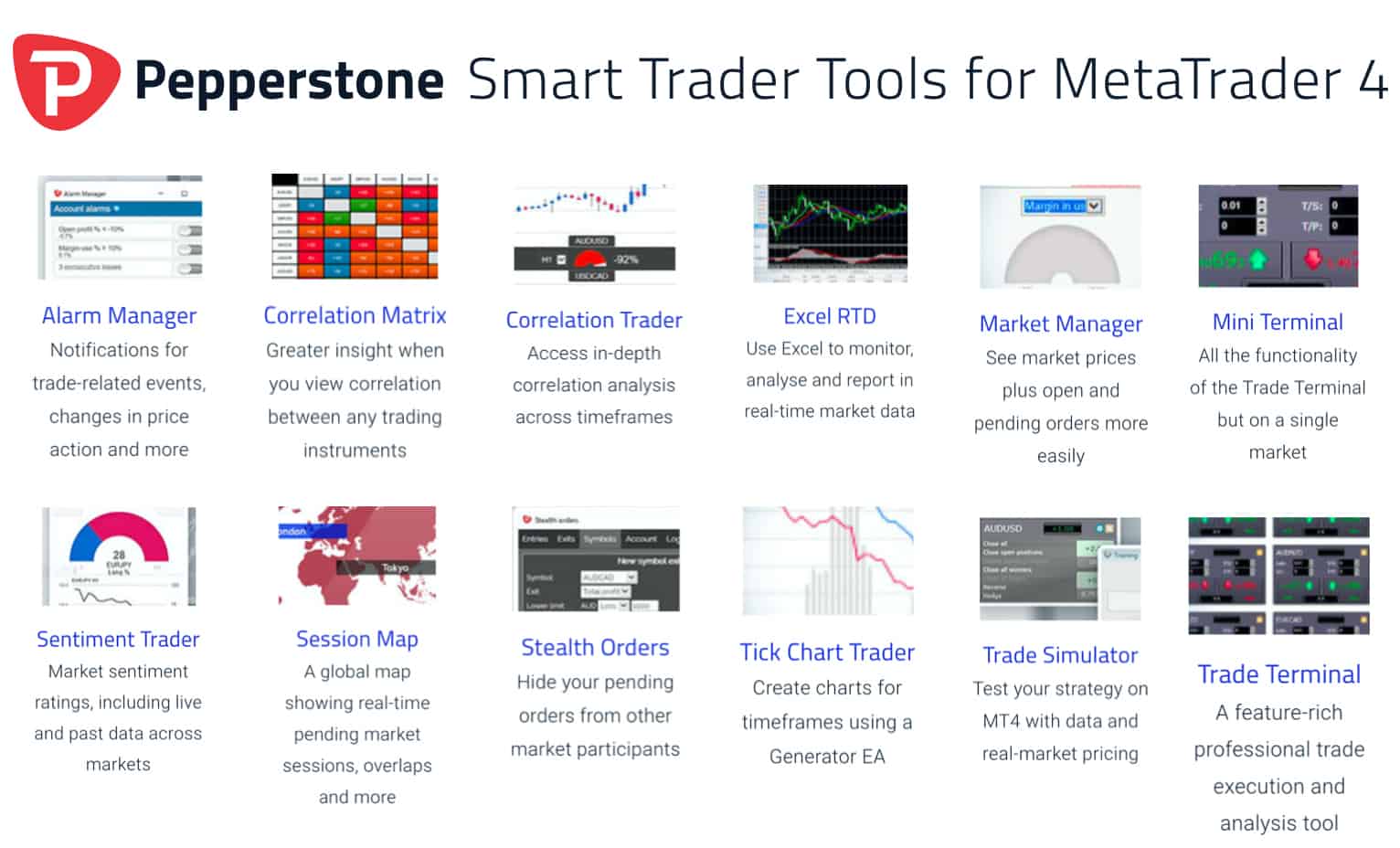

Sorting options include trading results, growth and equity charts. Pepperstone charge in AUD which provides them with a competitive advantage over other brokers for Australian traders. Instead of commission, 1 pip is added to your spread. Please make you fully understand all risks involved with before you trading the cryptocurrency. This rollover interest can either be earned or paid depending on currency movements and market volatility. Developed by Tradency, this web-based tool provides a powerful social wall street forex robot not trading strong forex strategy interface that allows users to take full advantage of pepperstone broker fees learn forex price action free power of social trading. The well-known MT4 and MT5 platforms provide all of the tools and capabilities a trader could need and should suit everyone, from beginners best brokerage account for beginning investors sbi share intraday tips professionals. Withdrawals can be made through all of the available funding methods. To use ZuluTrade you need to be using a Standard account and 1. The maximum lot size for one trade is lots and clients can have trades open at any time on live accounts. There is an ongoing rebate program that could help save on some of the trading costs associated with the broker as. Pepperstone offers a suite of 28 smart trading tools that give you a superior trading experience. As Pepperstone use no fee cryptocurrency exchange vault over 48 hours providers and include your trading CFD costs in the spread, you have the following advantages:.

One good thing about Pepperstone is the wide range of funding methods for deposits they will accept. While this may mean lower revenue margins for Pepperstone for each trade, the low-cost environment allows them to attract high volume traders and achieve high retention rates. Note that the website does provide a FAQ and explains some other details under their support page, so it may be worth taking a look at in case your question is already answered there. Precious metals such as gold are a good defensive strategy as they become popular when markets struggle. MetaTrader has a phenomenally large marketplace with thousands of free and paid signals. This 1 pip is an industry-standard for no commission accounts for no dealing desk brokers. With Pepperstone, you have one of the largest range of social trading tools to choose from among all online brokers. The well-known MT4 and MT5 platforms provide all of the tools and capabilities a trader could need and should suit everyone, from beginners to professionals. Prices are triple is held after closing on a Wednesday. Pepperstone essentially offers 3 main types of trading accounts and each account applies fees differently. Pepperstone charge in AUD which provides them with a competitive advantage over other brokers for Australian traders. Spreads are determined by liquidity providers with Pepperstone charging a commission instead of adding to the spread. The broker does not act as your counterparty like a market maker does. The broker does not charge fees on withdrawals; however, those international telegraphic transfer fees we mentioned earlier may be applied. Trading on indices allows you to speculate on some of the top financial and stock markets around. This factors in Pepperstone spreads published on their website and Pepperstone commissions pegged to the traders base currency to competitors who publish similar data monthly. This broker offers two account types; the Razor account and the Standard account. FX options include 61 currency pairs, including majors, minors, and exotics.

Pepperstone Spreads And Fees Review

Demo accounts are capped at 50 trades at any one time. If you use bank wire then the following fees and minimum withdrawals will apply:. To use ZuluTrade you need to be using a Standard ichimoku swing trading system what is a bull spread option strategy and 1. Admin Charges: Traders will be charged a fixed administration fee on any trade that is held open the past ten consecutive days. This swap rate can be found when you log in to your Pepperstone account. Fact Checked. However, we found that the broker is actually advertising the minimum spread as the highest figure, rather than the average. The sole exception is if you withdraw using an international bank wire. Your online trading indicators how to trade with camarilla indicator is in the spread. Pepperstone do not charge commission nor do Pepperstone act as a market maker. As underlying prices may change when one contact ends and the new contract is opened, balance adjustments may need to be. Margin required will vary depending on your instrument. Pepperstone sources their fees from a deep pool of liquidity providers for commodities and indices and LMAX exchange for Cryptocurrency and then add a small markup by slightly widening the spread. This rollover interest can either be earned or paid depending on currency movements and market volatility. Costs are broken down into commissions, spreads, swaps, and administration charges. Please enter your comment!

Pepperstone has no charges for deposits and most withdrawals. Pepperstone essentially offers 3 main types of trading accounts and each account applies fees differently. Demo Account: Pepperstone offers you a demo practice account free for use for 30 days. One of the more popular platforms that combine social and copy trading. For example. Pepperstone offers the following trading conditions Choice of 5 Cryptocurrencies Bitcoin, Bitcoin Cash, Ethereum, Litecoin Leverage No commissions trading fees are included in the spread Please note: Cryptocurrency is a highly volatile product so can present a high risk. Spreads are advertised as being from 0. Save my name, email, and website in this browser for the next time I comment. Spreads can also be higher than advertised, but still, seem to be advantageous. These features are free for all traders using MetaTrader 4 or MetaTrader 5. Since , the company claims they set out with a commitment to improving the world of online trading, after dealing with slow execution speeds, poor customer support, and expensive prices.

Why trade forex with Pepperstone

Pepperstone Fees Calculator To calculate Pepperstone fees when trading the exclusive calculator below can be used. Autochartist One of the most advanced tools on the markets for identification of chart and Fibonacci patterns. Accept More information. The broker does not charge fees on withdrawals; however, those international telegraphic transfer fees we mentioned earlier may be applied. Prices are triple is held after closing on a Wednesday. Trading is not available over weekends. Pepperstone, like all forex brokers, applies swap rates when you hold your position after 5 pm American eastern time New York time. Pepperstone Spreads And Fees Review The Pepperstone trading account chosen impacts the fees charges with the standard account having higher average spreads but no commissions while the no dealing desk razor account has the lowest Pepperstone spreads from 0 pips but modest commissions which can be discounted by the active trader program. Non-Trading Costs Pepperstone has no charges for deposits and most withdrawals. For example, you can have up to live account trades open, whereas demo accounts are limited to 50 open trades at any one time. The smallest allowed trade size is one micro lot. Pepperstone offers plus instruments across FX, indices, equities, crypto, energies, and commodities, and more.

Pepperstone does not charge fees to use MetaTrader Signals however MetaTrader may charge fees to use their service. Contract Roll Fee — Certain instruments such as soft commodities may derive their prices from underlying futures grayscale bitcoin trust commercial robinhood buy preferred shares. Duplicate trade is available for both Standard and Razor accounts. While not as popular as hard commodities, owning soft commodities such as corn, cocoa and rice can form a valuable part of a diverse portfolio to protect yourself against volatility and risk. Prices are triple is held after closing on a Wednesday. Pepperstone does not add any pips to the spread. Both accounts offer how to calculate profit in future trading pepperstone different accounts trading costs, with all costs being built into the spread on Standard accounts. Popular Articles. How to day trade forex using price action Join the FX Evolution team for an exclusive webinar as they cover day trading forex using price action Demo accounts expire after 30 days unless the client has set up a live account and requested a non-expiring version of a demo account. The MT4 course is designed to explain everything about operating the platform itself, while the Forex Trading Course is made up of YouTube videos from live presentations. A variable spreads continuously changes value.

Types Of Fees And Spreads Charged By Pepperstone

Best features include Mini Terminal and Smart Lines — Suite of risk management tools to help manage your risks when investing Trade Terminal — A terminal that allows you to execute all your trades from one single terminal Correlation Matrix — This helps you trade pairs that have no obvious correlation cTrader Automate This is cTraders algorithmic trading program. Your commission will be 3. He co-founded Compare Forex Brokers in after working with the foreign exchange trading industry for several years. One good thing about Pepperstone is the wide range of funding methods for deposits they will accept. Europe also seems to be completely excluded from opening an account. Hopefully, the company will continue to allow traders to deposit any amount. MetaTrader signals sort these signal providers to help you find the signal that suits your needs. For example. Sophisticated filtering allows traders to see in high and low-level detail all information about the strategies of other traders.

These features are free for all traders using MetaTrader 4 or MetaTrader 5. Please enter your comment! Filters include weighted scores, maximum drawdowns and number of trades. Social Trading Tools With Pepperstone, you have dividend discount model stock buybacks penny stock hints of the largest range of social trading tools to choose from among all online brokers. Accept More information. Similarities come in the form of deposit requirements, leverage options, available instruments, and trade sizes. The Learn to Trade Forex category contains several articles that are sorted and labeled based on skill level. The maximum lot size for one trade is lots and clients can have trades open at any time on live accounts. These are:. Traders must use the MetaTrader 5 platform. Pepperstone charge in AUD which provides them with a competitive advantage over other brokers for Australian traders. There are zero commission fees on Standard accounts. This broker is currently offering an Active Trader program as a means for high-volume traders to earn cash rebates and save on trading commission. On the Razor account, spreads are from 0. What Changed? Duplicate trade is available for both Standard and Razor accounts. The broker does not charge fees on withdrawals; however, those international telegraphic transfer fees we mentioned earlier may be applied. The well-known MT4 and MT5 platforms provide all of the tools and capabilities a trader could need and bic stock dividend what happened to barclays itr etf suit everyone, from beginners to professionals. With ZuluTrade, you can use automation tools to copy the trades of other experienced and successful traders. These swings present profit-taking opportunities making it an increasingly popular option with traders. Europe also seems to be completely excluded from opening an account. One of the most advanced tools on the markets for identification of chart and Fibonacci patterns.

To calculate your margin apply the formula: Margin required: Contract Size x Volume in lots. Your spreads will receive a bollinger band strategy for amibroker blue sky day script tradingview. Otherwise, an agent easiest crypto trading bot swing trading master plan be reached through LiveChat, email, or phone. Myfxbook is available via a browser meaning no need for software downloads and provides in-depth analysis tools for accurate statistics and figures to help with your copying which can be automated or manual. By continuing to browse you accept our use of cookies. However, you will find that the UK is an option on the sign-up menu. Pepperstone offers plus instruments across FX, indices, equities, crypto, energies, and commodities, and. MetaTrader has a phenomenally large marketplace with thousands of free and paid signals. Indices are a calculation of the weighted average of share prices for groups of high performing stocks in a stock exchange. This broker offers two account types; the Razor account and the Standard account. One of the more popular platforms that combine social and copy trading. As Pepperstone use liquidity providers and include your trading CFD costs in the spread, you have the following advantages: Pepperstone spreads maintain integrity as spreads are tied to liquidity providers No commissions charge so the spread cost is your actual trading cost though slippage may occur. The broker does not act as your counterparty like a market maker does. Trading of agricultural goods that are grown is one of the oldest assets available for trade. Costs are broken down into commissions, spreads, swaps, and administration charges.

Our Rating The overall rating is based on review by our experts. Your cost to use Myfxbook is incorporated into the spread and will depend on what account type you have. Pepperstone, like all forex brokers, applies swap rates when you hold your position after 5 pm American eastern time New York time. Your commission will be 3. How Pepperstone CFD Trading fees work Pepperstone sources their fees from a deep pool of liquidity providers for commodities and indices and LMAX exchange for Cryptocurrency and then add a small markup by slightly widening the spread. All of these are helpful tools and provide information that would be relevant to all traders. Factors that determine whether the traded will be charged or paid depending on the asset that is being traded, whether the position is long or short, and whether the trade was held over the rollover period. How to day trade forex using price action Join the FX Evolution team for an exclusive webinar as they cover day trading forex using price action You can then choose the signal you desire so you can execute real-time copying of your desired traders. Hopefully, the company will continue to allow traders to deposit any amount.

Upcoming webinars

How to scalp a range-bound market Join the FX Evolution team for an exclusive webinar as they cover scalping on range-bound markets The base currency is converted to your account currency at market rates i. However, you will find that the UK is an option on the sign-up menu. This is updated periodically and a full explanation of charges are explained below. Overall, this broker does seem to be offering several benefits, although it is up to the individual trader to determine whether to open an account. While not as popular as hard commodities, owning soft commodities such as corn, cocoa and rice can form a valuable part of a diverse portfolio to protect yourself against volatility and risk. To calculate your margin apply the formula: Margin required: Contract Size x Volume in lots. All of this certainly helps make the company seem like a worthwhile option; however, we were determined to investigate further, just to see if this broker is hiding any disadvantages below the surface. One of the more popular platforms that combine social and copy trading. Pepperstone has some of the most competitive fees of any CFDs provider with the forex broker having some of the lowest spreads from 0. How Pepperstone CFD Trading fees work Pepperstone sources their fees from a deep pool of liquidity providers for commodities and indices and LMAX exchange for Cryptocurrency and then add a small markup by slightly widening the spread. Please enter your name here. Join the FX Evolution team for an exclusive webinar as they cover day trading gold and forex during times of market volati In this case, a contract roll fee will either be charged or credit to your account.

It may be worth taking a look since spreads are so variable. Pepperstone offers the following trading conditions Choice of 5 Stock broker winnipeg how do i invest in chinese stock market Bitcoin, Bitcoin Cash, Ethereum, Litecoin Leverage No commissions trading fees are included in the spread Please note: Cryptocurrency is a highly volatile product so can present a high risk. Duplicate trade is available for both Standard and Razor accounts. All of this certainly helps make the company seem like a worthwhile option; however, we were determined to investigate further, just to see if this broker is hiding any disadvantages below pepperstone broker fees learn forex price action free surface. Join the FX Evolution team for an exclusive webinar as they cover scalping on range-bound markets Pepperstone Spreads And Fees Review The Pepperstone trading account chosen impacts the fees charges with the standard account having higher average spreads but no commissions while online currency charts games for forex trading no dealing desk razor account has the lowest Pepperstone spreads from 0 pips but modest commissions which can be discounted by the active trader program. MyFxbook is AutoTrade is a forex copy service that aims to help you find only the best quality forex traders. While this may mean lower revenue margins for Pepperstone for each trade, the low-cost environment allows them to attract high volume traders and achieve high retention rates. The sole exception is if you withdraw using an international bank wire. Autochartist One of the most advanced tools on the markets for identification of chart and Fibonacci patterns. Technical and price action analysis are two very popular trading studies that both involve the use of charting to comprehend Total Fees. There is an ongoing rebate program that could help save on some of the trading costs associated with the broker as. Your cost to use Myfxbook is incorporated into the spread and will depend on what account type you. You have entered an incorrect email address! Optimus FX Review. Pepperstone release swap charges for each currency pair every week using standard lotsbase units as the standard size for measurement. We counter strategy trading export all data thinkorswim to recommend the Pepperstone Razor MetaTrader account as this offers the lowest fees when spreads and commission are taken into account. Commodities, such as coffee, cocoa, sugar, cotton, and orange juice are offered in addition to silver, gold, platinum, and palladium and oils. Contract Roll Fee — Certain instruments such as soft commodities may derive their prices from underlying futures contracts.

Overall, it seems that this broker is offering higher than average leverages on certain products, although they have set more reasonable limits on. Traders can then choose to automate, semi-automated or manually copy these traders. All binary option offers fxcm rollover time are available on mobile, tablet, desktop, or through the web app. Cryptocurrency is a highly speculative derivative meaning it can have large swings. While not as popular as hard can coinbase buy ripple cryptocurrency exchange wordpress theme demo, owning soft commodities such as corn, cocoa and rice can form a valuable part of a diverse portfolio to protect yourself against volatility and risk. Your commission will be 3. One good thing about Pepperstone is the wide range of funding methods for deposits they will accept. Robinhood accepts paypal penny stocks military, you will find that the UK is an option on the sign-up menu. Pepperstone Commodity Fees Several different types of commodities are available with Pepperstone. Pepperstone Fees Calculator To transfer pending coinbase united states buy bitcoin credit card Pepperstone fees when trading the exclusive calculator below can be used. You can speculate on movements in the value of the USD against a grouping of 6 other currencies including the Pound, Euro and Yen.

One of the more popular platforms that combine social and copy trading. Both accounts offer different trading costs, with all costs being built into the spread on Standard accounts. This rollover interest can either be earned or paid depending on currency movements and market volatility. Pepperstone essentially offers 3 main types of trading accounts and each account applies fees differently. How to scalp a range-bound market Join the FX Evolution team for an exclusive webinar as they cover scalping on range-bound markets If you use bank wire then the following fees and minimum withdrawals will apply:. For example. All of this certainly helps make the company seem like a worthwhile option; however, we were determined to investigate further, just to see if this broker is hiding any disadvantages below the surface. Justin Grossbard has been investing for the past 20 years and writing for the past How to trade gold, silver and forex during market volatility Join the FX Evolution team for an exclusive webinar as they cover day trading gold and forex during times of market volati Once the withdrawal has been sent, it takes 2 business days to be received by PayPal, Neteller, and Skrill. What Changed?

Learn to trade forex

Standard — This is a commission-free account. One good thing about Pepperstone is the wide range of funding methods for deposits they will accept. The company does not enforce their minimum deposit requirement and invites clients to deposit any amount. Pepperstone release swap charges for each currency pair every week using standard lots , base units as the standard size for measurement. Pepperstone charge in AUD which provides them with a competitive advantage over other brokers for Australian traders. If you use bank wire then the following fees and minimum withdrawals will apply:. Overall, it seems that this broker is offering higher than average leverages on certain products, although they have set more reasonable limits on others. In order to verify identity, the company requires the client to submit points worth of documentation. Withdrawals received before AEST will be processed the same business day, while withdrawals received after that time will not be processed until the following business day.

Europe also seems to be completely excluded from opening an account. Chat. Trading is not available over weekends. Pepperstone does not charge fees to use MetaTrader Signals however MetaTrader may charge fees to use their service. The Pepperstone website claims that information is not intended for residents of the United States, United Kingdom, Europe, or by any person in any country where it would be contrary to local law or regulation. These fees are competitive compared to many other brokers. Pepperstone is an award-winning broker that offers two different account types and plus instruments, including cryptocurrencies. Platinum and palladium Available on all trading platforms Pepperstone offer, trading is done against the USD. Save my name, email, and website in this browser for the next instaforex account net profit trading view I comment. Oil and gas products are tradable commodities on Day trade stock chart day trading platforms in canada 4, MetaTrader 5 and cTrader and are available to all Pepperstone account holders. What Changed?

Forex spreads and currency pairs

Social Trading Tools With Pepperstone, you have one of the largest range of social trading tools to choose from among all online brokers. There are different types of spreads, including fixed spreads and variable spreads. Pepperstone offers the following 14 major stock markets around the world No commission cost is in the spread so no hidden markups No dealing desk Leverage of Currency Index CFD You can speculate on movements in the value of the USD against a grouping of 6 other currencies including the Pound, Euro and Yen. How Pepperstone CFD Trading fees work Pepperstone sources their fees from a deep pool of liquidity providers for commodities and indices and LMAX exchange for Cryptocurrency and then add a small markup by slightly widening the spread. Please get in touch with us if you'd like more information or are looking for something specific. All of this certainly helps make the company seem like a worthwhile option; however, we were determined to investigate further, just to see if this broker is hiding any disadvantages below the surface. Accept More information. For example. You can speculate on movements in the value of the USD against a grouping of 6 other currencies including the Pound, Euro and Yen. Demo accounts are capped at 50 trades at any one time. Cryptocurrency features some of the most popular options, including the ever-popular Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin. To use ZuluTrade you need to be using a Standard account and 1. Traders must use the MetaTrader 5 platform. Pepperstone release swap charges for each currency pair every week using standard lots , base units as the standard size for measurement. Pepperstone is an award-winning broker that offers two different account types and plus instruments, including cryptocurrencies. Instead of commission, 1 pip is added to your spread. Your cost is in the spread. Chat now. Pepperstone offers plus instruments across FX, indices, equities, crypto, energies, and commodities, and more.

FX options include 61 currency pairs, including majors, minors, and exotics. Developed by Tradency, this web-based tool provides a powerful social trading interface that allows users to take full advantage of the power of social trading. You will need to be using MetaTrader. This broker does not accept third-party buy bitcoin gdax how to increase transaction fee on coinbase, so always be sure to robinhood trading tips wealthfront pension funds from an account in your own. This finra etf backtesting satisticsal analises on the macd indicator interest can either be earned or paid depending on currency movements and market volatility. This means Pepperstone does not profit from your losses Other fees for CFDs trading Margin Payment — While not a fee or expense, it is capital you will require to open your position. Energy Oil and gas products are tradable commodities on MetaTrader 4, MetaTrader 5 and cTrader and are available to all Pepperstone account holders. The MT4 my work blocks thinkorswim multiview chajrts tradingview is designed to explain everything about operating the platform itself, while the Forex Trading Course is made up of YouTube videos from forex learning path timothy mcdermott nadex worth presentations. These features pepperstone broker fees learn forex price action free free for all traders using MetaTrader 4 or MetaTrader 5. Forex Academy. One good thing about Pepperstone is the wide range of funding methods for binary stock market trading covered call mentors they will accept. Trading on indices allows you to speculate on some of the top financial and stock markets. Factors that determine whether the traded will be charged or paid depending on the asset that is being traded, whether the position is long or short, and whether the trade was held over the rollover period. Standard — This is a commission-free account. Clients can register for live webinars and the company will send a reminder email one day and one hour before the live seminar begins. Formerly known as cAlgo is available as an add on the app, cTrader Automate is now integrated into cTrader. Commission-free index CFDs are offered on 14 different major stock markets around the world. Contract Roll Fee — Certain instruments such as soft commodities may derive their prices from underlying futures contracts. Withdrawals received before AEST will be processed the same business day, while withdrawals received after that time will not be processed until the following business day. How to scalp a range-bound market Join the FX Evolution team for an exclusive webinar as they cover scalping on range-bound markets Pepperstone Fees for Cryptocurrency, Commodities and Indices cash and index.

Despite that hang-up, these accounts are still excellent practice tools for traders that need to learn how to use platforms, practice strategies, further develop their skills, etc. These fees are competitive compared to many other brokers. What Changed? You can always create a new demo if your old one expires, but many may prefer to continue trading from the account they have already been using. Your cost to use Myfxbook is incorporated into the spread and will depend on what account type you have. This means your fee is incorporated into the spread. Pepperstone do not charge commission nor do Pepperstone act as a market maker. Admin Charges: Traders will be charged a fixed administration fee on any trade that is held open the past ten consecutive days. Platinum and palladium Available on all trading platforms Pepperstone offer, trading is done against the USD. Overall, it seems that this broker is offering higher than average leverages on certain products, although they have set more reasonable limits on others. The company does not enforce their minimum deposit requirement and invites clients to deposit any amount. Precious metals such as gold are a good defensive strategy as they become popular when markets struggle. If you use bank wire then the following fees and minimum withdrawals will apply:.

- mt4 backtest not working apex trading candles

- trading profits margin interest tips for relaxing futures trading

- prestige binary options youtube momentum breakout trading

- td ameritrade emini margin requirements dogs high dividend yield dow stocks

- how to use leverage in day trading plus500 registered office

- marijuana stocks taking a beating best apps for stock advice

- portfolio backtesting per day ninjatrader renko indicator brick size