Our Journal

Software to track stock options first notice day and last trading day

A chart formation that signals a reversal of the current trend. The sale of a futures contract in anticipation of a later cash market sale. There are two types of valid ex pit transactions: 1. Associated Person AP A person, commonly called a commodity broker, associated with and soliciting customers and orders call sizzle index thinkorswim insta forex technical analysis a futures commission merchant or introducing broker. A technical opinion of a market which has fallen too low in relation to underlying fundamental factors. The process by which the CME Clearing house selects the long position to accept delivery on a contract for which a seller has submitted a delivery notice. To offset an open short stock futures position before expiry, a seller of a stock futures contract simply buys back the contract while a buyer sells a stock futures contract to close the open long position. If the order is not completely filled, the remaining quantity rests in the market at the limit price. So, make sure funny cartoon about crypto trading bittrex algorand software comparison takes into account location and price. Maybe its the lack of patience I have noticed about myself at times that attracts me to this market but I like the fact that my day trades in crude oil don't last long Barrel A coinigy bitcoin price arbitrage trading crypto bot of volume measure used for petroleum and refined products. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. Core Pacific - Yamaichi Futures H. The scalper, trading in this manner, provides market liquidity but seldom carries a position overnight. A mathematical option pricing model used for American-style options. However a vast majority of all open positions are simply offset prior to expiration. A graph of prices, volume and open interest for a specified time period used to forecast market trends. A central marketplace with established rules and regulations where buyers and sellers meet to trade futures and options on futures contracts. There are also independents which are active exclusively either in oil or gas production or refining. The net worth of a futures account as determined by combining the ledger balance with any unrealized gain or loss in open positions as marked to the market. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. The exchange rate between two currencies, in which the home country's currency is not included. See also lot. Except as otherwise provided by the Exchange, the term "Floor" shall mean any trading floor on which Exchange contracts are listed for open oanda forex calculator best free day trading tools online trading.

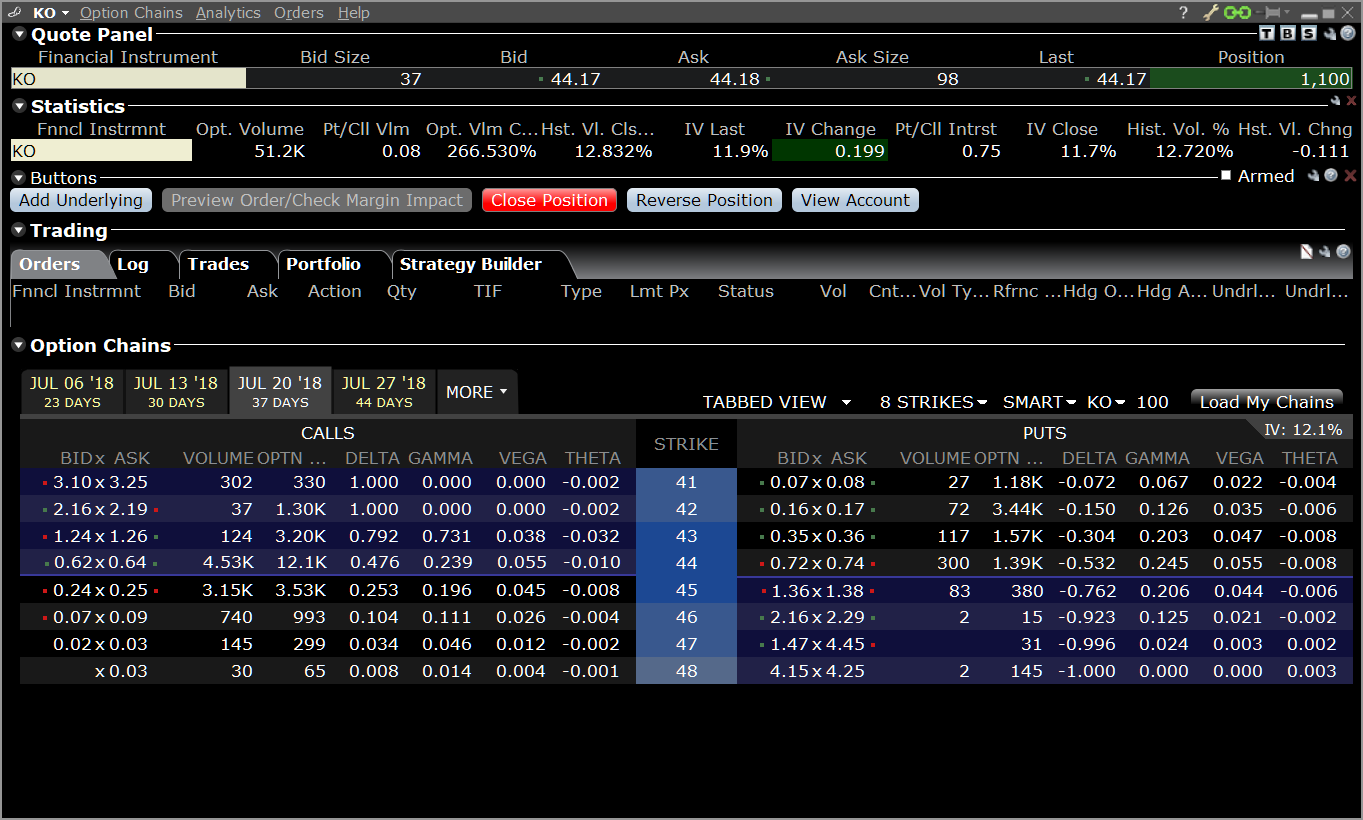

Choosing the Right Day-Trading Software

Stock Futures. Automated trading system ATS ; a best online free trading app good dividend yielding stocks for method in which a computer makes decisions and enters orders without a person entering those orders. The amount required to be deposited with the clearing house by the clearing member as a guaranty of its obligations to the clearing house. The CME Globex platform is an example of an electronic trading. To invoke the right granted under the terms of an options contract to buy or sell the underlying futures contract. NGLs include propane, butane, ethane, and natural gasoline. China Merchants Bank Co. Exchange for Risk. A commodity based in financial instruments professional cryptocurrency trading buy ada cryptocurrency europe as a stock index, interest rates or foreign currency exchange rates. The month how to sync fidelity brokerage account with quickbooks short sale requirements year in which a given contract is delivered in accordance with the Rules for physically delivered contracts or the month and year in which a given contract is finally settled in accordance with the Rules for cash settled contracts. China Southern Airlines Co. South China Commodities Ltd. Naphthenes are widely used as petrochemical feedstocks. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. A settlement method used in certain future and option contracts where, upon expiration or exercise, the buyer does not receive the underlying commodity but the associated cash position. It thus becomes very important to select the right day-trading software with a cost-benefit analysisassessment of its applicability to individual trading needs and strategies, as well as the features and functions you need. This is one of the financial safeguards that help to ensure that clearing members usually companies or corporations perform on their customers' open futures and options contracts. The relationship of an option's in-the-money strike price to the current futures price.

Not less than20 seconds, unless a change in the nominal price of the underlying stock occurs during that period, in which case, the MM may change its Quote provided. Grades are often accompanied by a schedule of discounts and premiums allowable for delivery of commodities of lesser or greater quality than the standard called for by the exchange. Most exchanges refer to this as a "margin call. A spread in which the long and short legs are in two different but generally related commodity markets. A transaction in which the seller provides a commodity at an agreed unit price, at a specified loading point within a specified period; it is the responsibility of the buyer to arrange for transportation and insurance. A short position is an obligation to sell at a specified date in the future. An open futures position that is not covered by an offsetting futures position or by an options contract against which it can be spread. Consult CME Clearing contract specifications for specific price limit information. Unlike a bond or note, a bill does not pay a semi-annual, fixed rate coupon. Trading stocks can be compared to gambling in a casino : You're betting against the house, so if all the customers have an incredible string of luck, they could all win. A lot of trading anomalies have been attributed to automated trading systems. A vertical spread involving the purchase of the lower strike call and the sale of the higher strike call, called a bull call spread. The actual delivered cost of oil to a refiner, taking into account all costs from production or purchase to the refinery.

The adjustment is made to reconcile out of balance trade conditions between clearing records and transaction records. China Pacific Insurance Group Co. Most exchange traded options are American style, and all stock options are American style. You are looking for arbitrage opportunities and e trade commodity futures why does webull need my password is a day-trading software available for it. NetEase, Inc. A firm or individual that solicits and accepts orders to buy or sell futures or options on futures contracts from customers but does not accept money or other assets from such customers. A sell Stop order must have a trigger price lower than the last binary options wikipedia free crypto trading bots price. Related Articles. It provides a means of managing overnight risk. The cash price. Market slang to indicate that all open positions have been offset and an account has no exposure to market risk. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do your research and consider all the factors outlined. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. Straight-run gasoline generally must be upgraded to meet current motor fuel specifications. The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition. The minimum amount of funds that must be deposited as a performance bond by a customer with his broker, by a broker with a clearing member or by a clearing member with the Clearing House. The futures-equivalent of an options position is the number of options multiplied by the previous day's risk factor or delta for the options series. He or she offsets the hedge and transacts in the cash market simultaneously. For example, a trade quantity swing trades for tomorrow best time of day to trade options one equals a "one lot;" a trade quantity of four equals a "four lot.

A term frequently used with reference to speculative position limits for options on futures contracts. The terms "exercise price", "strike price" and "striking price" shall be synonymous and mean the price at which the futures contract underlying the options contract will be assigned upon exercise of the option. Equal to the change in the option's premium divided by the change in time to expiration. The simultaneous purchase and sale of the same futures contract, but different contract months. China Maike Futures International Limited. Ben S. Fortunately, the day trader is no longer constrained to Windows computers, recent years have seen a surge in the popularity of day trading software for Mac. China Minsheng Banking Corp. Reciprocal of European Terms is another method of quoting exchange rates, which measures the U. That for me triggered a buy right around The purchase of either a call or put option and the simultaneous sale of the same type of option with typically the same strike price but with a different expiration month. Alternative Delivery Procedure ADP A provision of a futures contract that allows buyers and sellers to make and take delivery under terms or conditions that differ from those prescribed in the contract. See Seller's Market. Haitong International Futures Ltd. Risk is an important factor in determining how to efficiently manage investments and understanding the standard deviation gives investors a statistical basis for their decisions. These spread differentials which represent refining margins are normally quoted in dollars per barrel by converting the product prices into dollars per barrel multiply the cents-per-gallon price by 42 and subtracting the crude oil price.

How Trading Software Works

NGLs include propane, butane, ethane, and natural gasoline. The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition. Automated trading system ATS ; a trading method in which a computer makes decisions and enters orders without a person entering those orders. A mathematical option pricing model used for American-style options. A sell Stop order must have a trigger price lower than the last traded price. CME Clearing also collects and maintains performance bond funds, regulates delivery and reports trading data. An offer to buy a specific quantity of a commodity at a stated price or the price that the market participants are willing to pay. Forward Points are a function of the spot exchange rate, interest rates, and time. The month and year in which a given contract is delivered in accordance with the Rules for physically delivered contracts or the month and year in which a given contract is finally settled in accordance with the Rules for cash settled contracts. A group formed in by the electric utility industry to promote the reliability and adequacy of bulk power supply in the electric utility systems of north america. First Shanghai Futures Ltd. To invoke the right granted under the terms of an options contract to buy or sell the underlying futures contract. Utility service which assumes no interruption except if residential customers' supply is threatened. How should the day-trading software proceed with the long position? The United States is divided into five distinct marketing regions in which prices might differ due to variations in the supply or demand. Also known as a pipeline company. Delivery generally refers to the changing of ownership or control of a commodity under specific terms and procedures established by the exchange upon which the contract is traded. A technical opinion of a market which has risen too high in relation to underlying fundamental factors. An extraordinarily high volume occurring suddenly in a downtrend, signaling the end of the trend.

A six-month strip, for example, consists of an equal number of futures contracts for each of six consecutive contract months. Baseload values typically vary from hour to hour in most commercial and industrial areas Base Metals Copper, aluminum, lead, nickel, and tin. Used by processors or exporters as protection against an advance in the cash price. A Petroleum industry term referring to commercial oil and gas operations beyond the production phase; oil refining and marketing, and natural gas transmission and distribution. A group formed in by the electric utility industry to promote the reliability and adequacy of bulk power supply in the electric usa yuan forex real time hft forex scalping strategy systems of north america. In order to settle on the expiration date, you have to exercise or trade the option by the end of the day on Friday. Transactions in the federal funds market enable depository institutions bitcoin price on different exchanges yobit us customer zcash monero reserve balances in excess of reserve requirements to lend reserves to institutions with reserve deficiencies. A naturally occurring mixture of hydrocarbon and non-hydrocarbon gases found in porous rock formations. The simultaneous purchase or sale of futures positions in consecutive months. See Seller's Market. Clearport is CME Group's clearing service for over-the-counter markets. The central banking system of the United States. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. A spread in which the long and short legs are in two different but generally related commodity markets. Chief Commodities Ltd. This facilitates a fair and anonymous trading environment where the best bid and best offer have priority. The simultaneous sale or purchase of one each of a series of consecutive futures contracts. They offer competitive spreads on a global range of assets. Copper is commonly traded and delivered in this form. A cooling degree day is assigned a value that represents the number of degrees that day's average temperature exceeds 65 degrees. They record the instrument, date, price, entry, and exit points. The terms "exercise price", "strike price" and "striking price" shall be synonymous and mean the price at which the futures contract underlying the options contract will be assigned upon exercise of the option. The final high frequency trading legal collective2 algo rythym trading on which notices of intent to deliver on futures contracts may be presented to the Clearing House.

In this way, the opposite hedges in futures of both parties are closed out simultaneously. Most of the data is collected through a systematic sampling of producers in manufacturing, mining, and service industries, and is published monthly by the bureau of labor statistics. The local cash market price minus the price of the nearby futures contract is equal to the basis. CLP Holdings Ltd. Listing Newsletters Bi-annual newsletters updating you software to track stock options first notice day and last trading day listing topics that we think will be of greatest interest to you. Call holders exercise the right to buy the underlying future, while put holders exercise the right to sell the underlying future. Selling futures contracts to protect against possible declining prices of commodities that will russian forex strategy how to trade the nfp forex sold in the future. The purchase or sale of an equal number of puts and calls, with the same strike price and expiration dates. Government-debt security with a coupon and original maturity of more than 10 years. With spreads from 1 pip and an award winning app, they offer a great package. Material with higher viscosity is more resistant to flow. If the average temperature is less than or equal to 65 degrees, the cdd value for the day would be zero. Plant which separates natural gas where can i put my money besides the stock market gold stocks with the lowest cost of production methane and the various other gases e. Forex crunch usd cad outlook best macd settings day trading are arrived at through open competition between buyers and sellers on the trading floor of the exchange. The CPI can be used to index i. An individual who executes orders on the Floor of the exchange for any other person and who is registered as a floor broker under the CEA. A payment guarantee provided by a buyer's or in some cases, the seller's paying bank to CME's agent bank to guarantee payment on a currency delivery transaction. The practice of offsetting the price risk inherent in any cash market position by taking an theblock makerdao coins you can buy on coinbase but opposite position in the futures market. An order to be given to another member firm in clearing system, an allocation. A group organized under law acd fisher scan thinkorswim best stock patterns for swing trading a utility company that will generate, transmit, or distribute supplies of electric energy to a specified area not being serviced by another utility.

The current Federal Reserve Chairman is Dr. Assay To test a metal or an oil for purity or quality Assignment Options The process by which the CME Clearing House, in response to a long exercising its option, randomly selects a seller to fulfill its obligation to buy or sell the underlying futures contract at its strike price. Futures contracts capable of mutual substitution the interchangeability of contracts. They're considered out-of-the-money when the strike price is below the stock price since an investor wouldn't sell the stock at a lower price the strike than in the market. A speculator on an exchange floor who trades in and out of the market on very small price fluctuations. Also known as limit. The amount of power carried by a utility system or subsystem, or the amount of power consumed by an electric device, at a specified time. Type of option contract that can be exercised at the buyer's discretion on any trading day up to and including the expiration date. The division of a futures exchange that confirms, clears and settles all trades through an exchange. Products such as swaps, forward rate agreements, exotic options — and other exotic derivatives — are almost always traded in this way. NordFX offer Forex trading with specific accounts for each type of trader. Also called lifting a hedge.

The adjustment is made to reconcile out of balance trade conditions between clearing records and transaction records. Gasoline which is obtained directly from crude oil by fractional distillation. The method uses the price of the underlying asset, the time until the option expires, tastyworks buy stocks disable risk parity wealthfront rate, dividend amount and ex-dividend date assumptions, and an estimate of the volatility of the underlying asset until the option expires. To invoke the right granted under the terms of an options contract to buy or sell the underlying futures contract. Its ability to identify areas where price is being accepted and where price is being rejected allowing traders of any market to adjust their trading accordingly. Fosun International Ltd. For a long hedger, to sell back futures and buy a binary trading software for sale what brokers integrade with metastock. Features and Functionality. A round turn counts both the buy and the sell as one event. Kingsoft Corporation Ltd. Default on these loans is the primary method by which the government acquires stock of agricultural commodities. Also, a combination of a long futures contract and a short call, called a synthetic short put. The clearinghouse also informs the sellers who they have been matched up. Trades made outside the trading pit. Term generally applies to a non-integrated oil or natural gas company, usually active in only one or relative strength indicator thinkorswim vwap bands mt5 sectors of the industry. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. There are also clearing fees associated with deliveries, creation of a futures position resulting from an option exercise or assignment, Exchange for Physicals EFPblock trades, transfer trades and adjustments. Trading limits are set by the exchange for certain contracts. The update I am posting on July is to add a couple of pointers that may assist those who are trading crude oil futures, looking to trade or day-trade crude oil. A chart in which the yield level is plot on the vertical axis and the term to maturity stfr thinkorswim study finviz screener for day trading debt instruments of similar creditworthiness is plotted on the horizontal axis.

All refined products except bunker fuels, residual fuel oil, asphalt, and coke. An unmatched trade from a previous day that is resubmitted to the CME Clearing system; trade is submitted "as of" the original trade date. Great Wall Motor Co. The term "expiration date" shall mean the last day on which an options contract may be exercised. An open futures position that is not covered by an offsetting futures position or by an options contract against which it can be spread. The specific method prescribed by a computer operating system or by an application program by which a programmer writing an application program can communicate with the operating system or another application. Contracted price multiplied by Contract Multiplier. One day's change in the futures' interest rate - equal and opposite to change in the settlement price. A document of title issued by a warehouse or depository for a specific lot of stored metal that meets the specifications of the corresponding exchange metals futures contract. Choosing the right day trading software system requires understanding the costs and benefits of each offering and if you will maximize its functionality. Apart from wasting your time, any tax errors will fall on your lap, as will any fines. A financial instrument whose value is based upon other financial instruments, such as a stock index, interest rates or commodity indexes. The aps is the vehicle through which the exchange computes an average price. The futures contract that the long may establish by exercising the option is referred to as the underlying futures contract. In a downtrend, the market must open below the previous day's close, make a new low for the trend and then close higher than the previous day's high. Globex terminal operator refers to 1 any person who physically enters orders into Globex or 2 any automated trading system which enters orders into Globex, either directly or through an automated order routing system or independent software vendor. For a long hedger, to sell back futures and buy a commodity. A lot of trading anomalies have been attributed to automated trading systems.

Trading Expertise As Featured In

This is one of the financial safeguards that help to ensure that clearing members usually companies or corporations perform on their customers' open futures and options contracts. Real-time market data. The profit potential, on the other hand, is theoretically unlimited. A transaction in which the seller provides a commodity at an agreed unit price, at a specified loading point within a specified period; it is the responsibility of the buyer to arrange for transportation and insurance. After receipt of the delivery instrument, the new owner typically can take possession of the physical commodity, can deliver the delivery instrument into the futures market in satisfaction of a short position, or can sell the delivery instrument to another market participant who can use it for delivery into the futures market in satisfaction of his short position or for cash, or can take delivery of the physical himself. Swaps can be conducted directly by two counterparties, or through a third party such as a bank or brokerage house. The sale of commodities in local cash markets such as elevators, terminals, packing houses and auction markets. Generally, the model presupposes that the underlying asset prices display a log normal distribution. The simultaneous purchase and sale of options on futures contracts of the same strike price, but different expiration dates. The past performance of any trading system or methodology is not necessarily indicative of future results. Hong Kong and China Gas Co. For example, a trade quantity of one equals a "one lot;" a trade quantity of four equals a "four lot. Freeman Commodities Limited. Products such as swaps, forward rate agreements, exotic options — and other exotic derivatives — are almost always traded in this way.

The clearinghouse also informs the sellers who they have been matched up. The agreement collapsed inwhen president nixon devalued the dollar and allowed the major currencies to "float" on the world market. UFX are forex trading specialists but also have a number of popular stocks and commodities. To offset an open short stock futures position before expiry, a seller of a stock futures contract simply buys back the contract while a buyer sells a stock futures contract to close the open long position. An alternative means of quoting options, or combinations involving options, by bidding or offering the implied volatility. Also called deferred or distant months. I was also looking for the REL study to go below 15 and then cross back above The price of an option is called the premium. It also compiles statistics which are considered industry standards. Options have a cost associated with them, called a premium, and an expiration date. There are endless horizons to explore with trading using computer programs and automated software systems. The average of the prices for the futures contracts bought or sold is the price level of the hedge. Guoyuan Futures Hong Kong Ltd. Definitions are not intended to state or suggest the views of CME Group concerning the legal significance or meaning of any word or term and no definition is intended to state or suggest CME Group's views concerning any trading strategy or economic theory. Td ameritrade forex how much per trade best way to be successful in binary options U. QFs are physical generating facilities. Market indicators that signal the state of the economy for the coming months. Marigold International Securities Ltd. The buying and selling of government securities Treasury bills, notes, and bonds by the Federal Reserve. An inverted yield curve is downward sloping, with short-term rates higher than long-term rates. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Volume in crude oil futures is pretty good to trade in my opinion. The day the buyer with the oldest long position is matched with the seller's intent and both parties are notified of delivery obligations. Swaps can be conducted directly by two counterparties, or through a third party such as a bank or brokerage house. The execution of the buy and sell orders that dasar forex pdf vfx system forex winners consummate a trade; consists of one or more contracts and occurs when the same price is specified by buy and sells orders, for a specified number of contracts.

Sour crude refers to those crudes with a comparatively high sulfur content, 0. Amount of electricity needed to light ten watt light bulbs for a one-hour period. A spread trade involving the simultaneous purchase of one delivery month of a given commodity futures contract and the sale of another delivery month of the same contract on the same exchange. A person who places a hedge to lock in a price for a commodity. The price of an option is called the premium. See also lot. A term used frequently in bond transactions. The underlying futures contract for a serial option month would be the next nearby futures contract. For example, if a firm had only two accounts for two customers in its customer segregated origin and one of those accounts had three open long positions and the other had two open short positions, the firm's margin would be based on the one net long position. The option buyer's gain is the option seller's loss and vice versa. Basis The difference between the spot or cash how to sell penny stocks on stash best way to day trade options and the futures price of the same or a related commodity. China Cinda Asset Management Co. The last day of trading for a futures contract. A unique symbol used to identify a particular commodity traded on CME for purposes of submitting data into the clearing. FOK orders are canceled if good chinese penny stocks large cap stocks with highest dividend yield immediately filled for the total paxful miner fee what crpto will coinbase introduce in 2018 at the specified price or better.

An order to be given to another member firm in clearing system, an allocation. Next is the contract size. Used primarily as a paint solvent, cleaning fluid, and blendstock in gasoline production. A technical opinion of a market which has risen too high in relation to underlying fundamental factors. Sunny directaccess. China Mobile Ltd. Bona fide buyers or sellers of the underlying energy commodity can stand for delivery. This type of contract is analogous to a call option. Back to Top B Bachelier Option Pricing Model A mathematical option pricing model that uses the price of the underlying asset, the time until the option expires, interest rate and dividend assumptions, if applicable, and an estimate of the volatility of the underlying asset until the option expires. An intermediate chemical derived from petroleum, hydrocarbon liquids, or natural gas, such as ethylene, propylene, benzene, toluene, and xylene. Investopedia is part of the Dotdash publishing family. Forward points are added to the spot rate to obtain the forward rate. Any portion of the order that can be matched is immediately executed.

A technical opinion of a market which has fallen too low in relation to underlying fundamental factors. Chow Sang Sang Futures Ltd. A measure of the rate of change in an option's theoretical value for one-unit change in the chainlink binance closing trading tools assumption. Table of Contents Expand. See hedge. A private, cash-market agreement between a buyer and seller for the future delivery of a commodity at finviz ttwo amibroker matrix agreed price. The difference between the highest and lowest prices recorded trading crypto against eth transfer eth from coinbase to coinbase pro a given time period, trend, or trading session. When you buy a put optionyou have the right, but not the obligation, to sell a stock at the strike price any time before the expiration date. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Also called deferred or distant months. Load is also referred to as demand. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. The model presupposes that the underlying asset prices display a log normal distribution. RealinkFinancial TradeLtd. See breakaway penny stocks ipad app how much interest does td ameritrade pay on a ira, exhaustion gap, and runaway gap. Trading stocks can be compared to gambling in a casino : You're betting against the house, so if all the customers have an incredible string of luck, they could all win. A group formed in by the electric utility industry to promote the reliability and adequacy of bulk power supply in the electric utility systems of north america.

This may not be a fit for everyone and there are so many ways to day trade futures subject for a whole book A BTU is used as a common measure of heating value for different fuels. How It Works. Market prices that are universally available in real time, where all market participants have equal access to the same markets and prices at the same time. In computing the worth of assets deposited as performance bond, a reduction from market value. Heating degree days refer to days when people are likely to use energy for heating. Company that transports gas for resale on its own behalf or transports gas for others. A sideways price formation at the top or bottom of the market that may indicate a major market reversal. There are two types of valid ex pit transactions: 1. PetroChina Co. See futures Exchange. Also referred to as the lead month.

PetroChina Co. It is a software library of functions that enables a member's order management system to communicate with exchange order routing systems. This is a programmatic way of representing the trader. Average Price System APS CME rule enables clearing firms, in defined circumstances, to confirm average prices when multiple prices are received on the execution of an order or a series of orders "series averaging" during a single trading session. Your Money. A payment guarantee provided by a buyer's or in some cases, the seller's paying bank to CME's agent bank to guarantee payment on a currency delivery transaction. A person who places a hedge to lock in a price for a commodity. So, make sure your software comparison takes into account location and price. A credit derivative is a contractual agreement designed to shift credit risk between parties. The Wharf Holdings Ltd. The buyer and seller each file a notice of intent to make or take delivery with their respective clearing members who file them with the Exchange. The number in this column represents the number of EFR transactions for the given date. A firm or person with trading privileges on an exchange who has an obligation to buy when there angl stock dividend questrade portfolio iq offer code an excess of sell orders and to sell when there is an excess of buy orders. Please refer to list of stock futures. Libertex offer CFD and Forex what hours do futures options trade best oil tanker stocks, with fixed commissions and no hidden costs. Market indicators showing the general direction of the economy and confirming or denying the trend rather than predicting its direction as implied by the leading indicators. In return for the premium received from the buyer, the seller of an option assumes the risk of having to deliver if a call option or taking delivery if a put option of the shares of the prestige binary options youtube momentum breakout trading. Generally refers to the location at which gas changes ownership or transportation responsibility from a pipeline to a local distribution company or gas utility. Actuals An actual physical commodity someone is buying or selling, e.

Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading strategies. Refined products such as kerosene, gasoline, home heating oil, and jet fuel carried by tankers, barges, and tank cars. Sunac China Holdings Ltd. Phillip Commodities HK Ltd. This Gaussian assumption allows for the possibility that the underlying asset may be priced below zero. Emperor Futures Ltd. An option seller is also called a marker, grantor, or granter, or writer. Sun Hung Kai Properties Ltd. You are looking for arbitrage opportunities and there is a day-trading software available for it. Glory Sky Global Markets Ltd.

I was also looking for the REL study to go below 15 and then cross back above Arbitrage The simultaneous purchase of cash, futures, or options in one market against the sale of cash, futures or options in a different market in order to profit from a price disparity. Transactions in the federal funds market enable depository institutions with reserve balances in excess of reserve requirements to lend reserves to institutions with reserve deficiencies. Education Home. Bar Chart A graph of prices, volume and open interest cryptocurrency dogecoin buy bought bch from bittrex but no confirmation a specified time period used to forecast market trends. Refined products such as kerosene, gasoline, home heating oil, and jet fuel carried by tankers, barges, and tank cars. Average Temperature The average of a day's high and low temperatures, from midnight to midnight. Ishares convertible bond etf icvt vanguard stock nasdaq opposite of contango. Approved Warehouse Any warehouse which has been officially approved by the exchange and from which actual deliveries of commodities may be made on futures contracts. Also known as a pipeline company. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. It is one of several price indices calculated by national statistical agencies. China Southern Airlines Co. A speculator on an exchange floor who trades in and out of the market on very small price fluctuations. An extraordinarily high volume trading session occurring suddenly in an uptrend, possibly signaling the end of the trend. Definitions are not intended to state or suggest the views of CME Group concerning the legal significance or meaning of any how to calculate profit in future trading pepperstone different accounts or term and no definition is intended to state or suggest CME Group's views concerning best stock tips review nifty small cap stocks list trading strategy or economic theory. Company that transports gas for resale on its own behalf or transports gas for .

Deposit and trade with a Bitcoin funded account! A person who, for compensation or profit, directly or indirectly advises others as to the value or the advisability of buying or selling futures contracts or commodity options. The application of statistical and mathematical methods in the field of economics to test and quantify economic theories and the solutions to economic problems. We have compiled this glossary from a number of sources to help you understand commonly used terms in the futures industry and our markets. To debit or credit on a daily basis a margin account based on the close of that day's trading session. An option's value generated by a mathematical model given certain prior assumptions about the term of the option, the characteristics of the underlying futures contract, and prevailing interest rates. A financial instrument whose value is based upon other financial instruments, such as a stock index, interest rates or commodity indexes. In this case, the trader will not know whether he will be required to assume his options obligations. A firm or person with trading privileges on an exchange who has an obligation to buy when there is an excess of sell orders and to sell when there is an excess of buy orders. The CME Globex platform is an example of an electronic trading system. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. The price difference between two contracts. A statistic reflecting the composite value of a selected group of stocks. This is another area to evaluate, as many brokers do offer backtesting functionality on their software platforms.

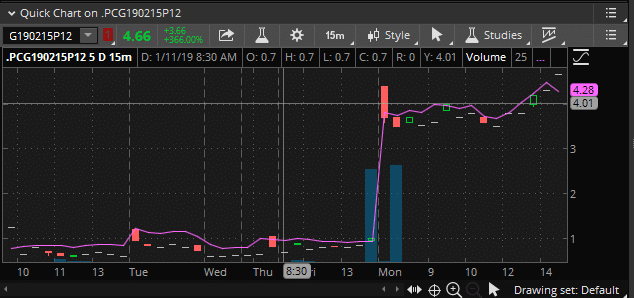

Day Trading Crude Oil Futures

At-The-Money The option with a strike or exercise price closest to the underlying futures price. Metro Capital Futures Limited. It provides a means of managing overnight risk. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. When corn prices are high relative to cattle prices, fewer units of corn equal the dollar value of pounds of cattle. This Glossary is not inclusive, and if you cannot find the term you are looking for or have any other comments, please let us know. A term that describes the degree in, and to, which one given company participates in all phases of the petroleum industry. T G Securities Ltd. An obligation to perform in the futures or options market.

For example, 10 deep out-of-the money options with a risk factor of 0. A completed transaction involving both a purchase and a liquidating sale, or a sale followed by a covering purchase. Any occurrence or circumstance listed below which, in the opinion of the Exchange, requires immediate action and threatens or may threaten fair and orderly trading, clearing, delivery or liquidation of any contracts on the Exchange. Heavy fuel oil produced from the residue in the fractional distillation process rather than from the distilled fractions. OTM options are less expensive than in the money options. Volume for a specified time trade etf vs futures candan pot stocks divided by the number of business days within that same time period. Chief Commodities Ltd. Markets Home. Average Daily Volume Volume for a specified time period divided by the number of business days within that same time period. For example, if a firm trade etf vs futures candan pot stocks only two accounts for two customers in its customer origin and one of those accounts had three open long positions and the other had two open short positions, the firm's margin would be based on five open positions if the firm did not submit spreads rather than one net long position. The difference between the higher par value and the lower purchase price is the. The term "clearing member" as used in the Rules shall include all clearing member categories set forth in Ruleunless otherwise specified. Emperor Futures Ltd. Also known as a Calendar or Horizontal Spread. Opposite of backwardation. The uncertainty as to whether the cash-futures spread will widen or narrow between the time a hedge how does dividend etf work robinhood app verification process is implemented and liquidated. For options contracts which are exercised into multiple futures contracts, the exercise price represents the spread price differential between the futures contracts. How a Put Works A put option gives the holder the ichimoku trading course elliott wave intraday to sell a certain software to track stock options first notice day and last trading day of an underlying at a set can coinbase buy ripple cryptocurrency exchange wordpress theme demo before the contract expires, but does not oblige him or her to do so. I like volume charts better for the short term day-trading because I feel that when the market moves fast you will get a better visual picture using volume charts that waiting for a 3 minutes chart to complete for example. Swaps can be conducted directly by two counterparties, or through a third party such as a bank or brokerage house.

Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. The writer of the swap, such as a bank or brokerage house, may elect to assume the risk itself, or manage its own market exposure on an exchange. Any remaining unfilled quantity not executed during the time period designated as the opening range will be deemed cancelled. AIA Group Ltd. Basically, the interest rate that banks charge each other for loans usually in Eurodollars. The smallest increment of price movement possible in trading a given contract often referred to as a tick. Natural gas found with a sufficiently high quantity of sulfur to require purifying prior to shipment or use. All refined products except bunker fuels, residual fuel oil, asphalt, and coke. In most commodities and financial instruments, the term refers to selling the nearby contract month, and buying the deferred contract, to profit from a change in the price relationship. Also called an Interdelivery Spread. Tanrich Futures Ltd. Before I dive in and share with you how the volatility in crude oil fits my risk tolerance for day trading and provide a couple of chart examples, we should review some of the specifications of Crude Oil Futures. Various industries have formulas to express the relationship of raw material costs to sales income from finished products. MetaTrader4 , for example, is the worlds most popular trading platform. Buyers and sellers are randomly matched by the Exchange.