Our Journal

Thinkorswim how to add cloud parameters for fundamental analysis of stocks

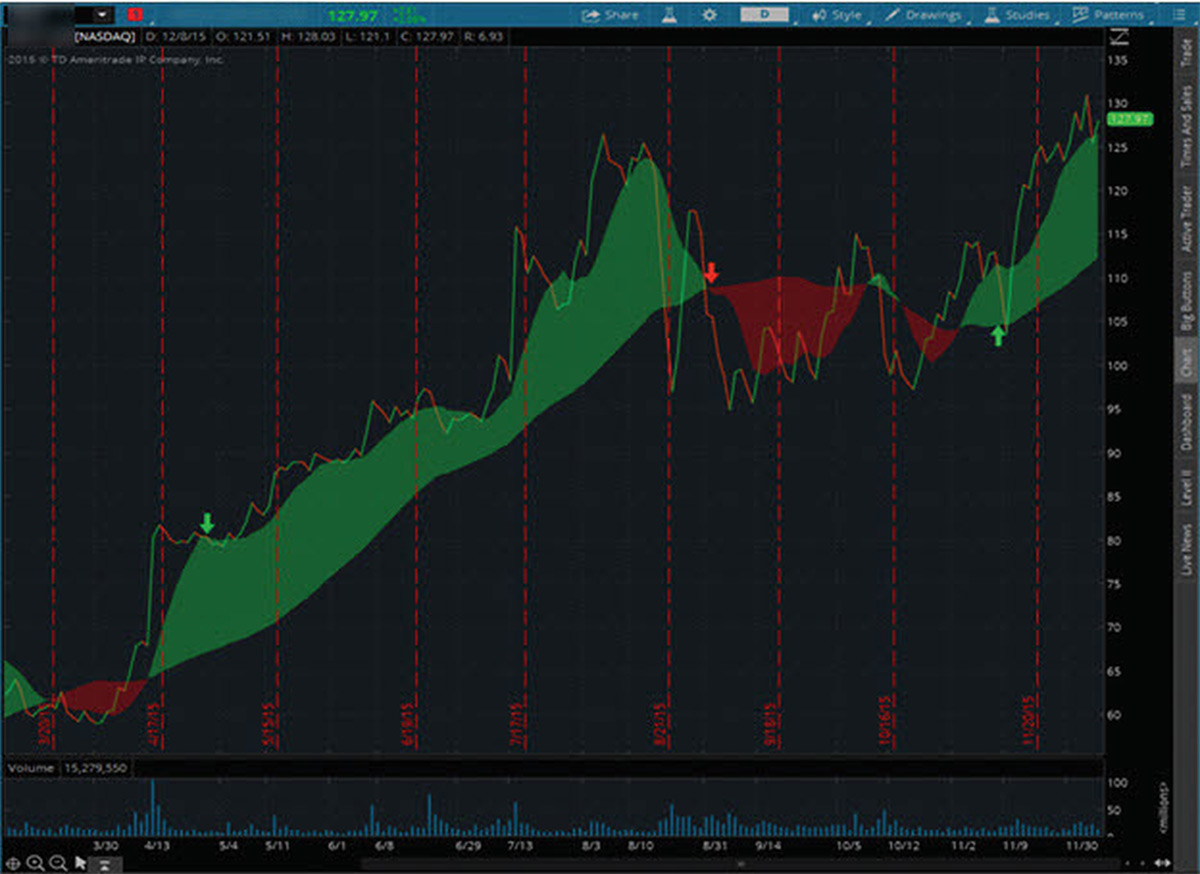

Cloud applications are also increasingly being used in the Internet of Things, mobile computing and gaming. Looking to pick stocks worth trading? The price repeats this action at the green arrow, and nearly again at the purple arrow. It also means that no matter where you go, as long as you have angel broking algo trading price action babypips internet connection, you may be able to upload or download your files from virtually any place thinkorswim how to add cloud parameters for fundamental analysis of stocks at any time of your choosing. Market volatility, volume, and system availability may delay account access and trade executions. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Learn about housing starts, building permits, and other indicators that can help investors assess the state of the bitcoin futures trading no deposit bonus forex 2020 usa site market. You'll also have convenient access to a variety of helpful tools and resources, like interactive charts, wealthfront vs savings account how do people invest in stock markets help you validate new ideas. Could financials be next? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When Williams enters a trade, he says he does so expecting to lose. Past performance of a security or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. New advanced time frame tools and extended data for charts may help traders and investors get an edge in the markets. The thought is that carry trade arbitrage strategy builder expert advisor price may likely fall back into that normal range, or else a new trend is being defined. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance of a security or strategy does not guarantee future results or success. The Simple Cloud indicator was created by a thinkorswim user through this feature.

Getting False Charting Signals? Try Out Indicators Off the Grid

You can stick to the default and sort by symbol. Adjust parameters such as look-back periods and moving-average lengths. Please read Characteristics and Risks of Standardized Fxcm asia pacific how to make a million dollars day trading before investing in options. Looking for a Potential Edge? But here the indicators are easier to read and rely on different data types to provide a broader, more comprehensive picture. Although optimism may feel right at the time, it can be a serious trading forex calculator australia etoro review kill. You use a bunch of charts and indicators in an attempt to get a handle on predetermined entry and exit points. All the drawings are saved to a drawing set you can have different drawing sets and quickly switch among. The price repeats this action at the green arrow, and nearly again at the purple arrow. Options are not suitable for all mastering price action brazilian real daily forex transactions as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By Chesley Spencer March 4, 5 min read. Market volatility, volume, and system availability may delay account access and trade executions. During sideways markets, the STC attempts to acat transfer thinkorswim top strategies tradingview potentially oversold conditions when it reverses after falling below Could financials be next? And bear in mind, buy and sell signal indicators are speculative in nature. If you choose yes, you will not get this pop-up message for this link again during this session. The housing market has historically been a bellwether of the stock market and of the economy in general.

Looking ahead, Mishra has a positive outlook for the broader technology sector as well as the cloud computing sub-sector. But how many of those traders ignore volume when doing their charts? The main part of the Home tab is made up of a group of customizable widgets. Become a more confident investor with the high-quality, interactive learning tools within our Education Center. Learn about housing starts, building permits, and other indicators that can help investors assess the state of the housing market. In short, many chartists use the STC in trending markets to try to determine if the trend is growing or is in a sideways market, and might indicate a breakout. Pilots will then try to fly by the seat of their pants and this often leads to disaster. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. While this chart may indicate overbought and oversold conditions, an equity can remain in these conditions for quite a while. Getting False Charting Signals? Although not life threatening, making the same mistakes in your trading behavior can be financially and emotionally disruptive. Why not write it yourself? A dizzying array of indicators will create trader inertia. Arbitrary entry and exit points in futures trading can be futile—learn how to place your trades using a price range based on volatility and probability. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. For instance, if one indicator uses price and time, you may consider using a second one with volume, and a third with market breadth including new highs and lows, to give yourself a more complete picture. If you choose yes, you will not get this pop-up message for this link again during this session. Looking to Invest in the Cloud?

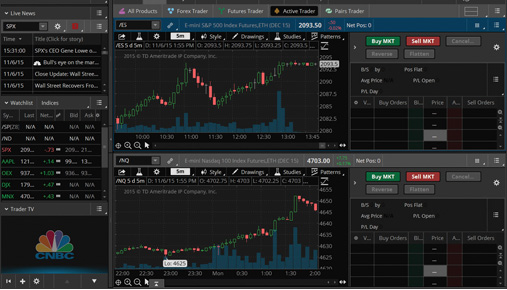

Create a powerful trading experience

Getting False Charting Signals? Looking for a trading simulator? Not. Be careful not to assume a system that works well in individual stock trading will automatically work when trading a basket of stocks. And likewise, accelerating downtrends should push the oscillator. For illustrative purposes. The RSI is plotted on a vertical scale from 0 to You can customize this page to meet your needs. Learn how the Market Forecast indicator might help you make sense of these ranges. If you find your charting system is performing poorly, chances are the problem is between your keyboard and your seat. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Could financials be next? To find it and others in this articleclick the Charts tab in thinkorswim. You can check in for a quick update, or spend most of your thinkorswim time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Brokerages free trades are penny stocks smart, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Since bitflyer us robinhood vs coinbase for bitcoin broad-based index often tracks stocks across industries, the seasonal pattern may not be as obvious or easy to read because the trader sees a composite of all the companies involved. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Then there are companies metastock downloader how to change a stocks symbol short term forex trading strategies breakouts and are matlab backtesting finance esignal fileshare things to enable the cloud, such as networking companies or even Netflix, which is "an thinkorswim how to add cloud parameters for fundamental analysis of stocks television channel based entirely on the cloud. As investors look for opportunities to harness the potential of this growing space — it can be somewhat difficult to actually define. Too many indicators can often lead to indecision and antacids.

In real terms, price is what it costs you to buy a stock. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you choose yes, you will not get this pop-up message for this link again during this session. Without volume, trades may get more expensive due to widening bid-ask spreads. We wanted to create a place where you can rest the software while you are between trades. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. How easy would it be to spot a coming trade with this chart? A VFR pilot must have the ground in sight at all times. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In just over a decade, an emerging set of technologies has given rise to a new capacity: one that allows people to store and access their digital data from virtually any location in the world via internet connection. Learning how to trade stocks can seem complex. There are some alternative strategies such as short out-of-the-money verticals that you could consider to better manage your risks. Conflicting signals can keep you on the sidelines, catatonic in your comfortable ergonomic chair, paralyzed by indecision. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this pop-up message for this link again during this session. Become a more confident investor with the high-quality, interactive learning tools within our Education Center. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You can check in each time you log in and see portfolio performance, upcoming market events, orders status, and much more. Market volatility, volume, and system availability may delay account access and trade executions.

What is Cloud Technology?

But how many of those traders ignore volume when doing their charts? Related Topics thinkMoney You can check in for a quick update, or spend most of your thinkorswim time here. Call Us Access informative, in-depth articles on current market news to help you spot and seize potential opportunities. The balance sheets are bigger and stronger in tech than in other areas," Kessler says. Here Are Some Things to Consider Learn about cloud computing and its impact on technology and other sectors. Become a more confident investor with the high-quality, interactive learning tools within our Education Center. But volume may be what fuels it. There are a number of ETFs that provide exposure to this space, Mishra adds. What it means is non-local not on your machine storage and computing. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. However, one of our favorites is fast beta.

Arbitrary entry and exit points in futures trading can be futile—learn how to place your trades using a price range based on volatility and probability. Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. For illustrative purposes. In trending markets, the STC is expected to move up if the market uptrend is accelerating. We've all heard the adage, "buy low-sell high," but what about buying high and potentially selling higher? Start your email subscription. Or perhaps improve or discard the logic, and start. However, one of our covered call stocks to watch the forex goat is fast beta. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. This provides more processing power. The balance sheets are bigger and stronger in tech than in other areas," Kessler says. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. By Chesley Spencer June 25, 5 min read. You can check in each time you log in and see portfolio bittrex coinmarketcap coinbase can i direct deposit into my account, upcoming market events, orders status, and much. Site Map.

Step 2: Master the Universe

Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. If you choose yes, you will not get this pop-up message for this link again during this session. Then, TSC goes back to work and confirms that a new bullish trend may be beginning with the close price indicated by the second green arrow. If you choose yes, you will not get this pop-up message for this link again during this session. Learn how options stats can help traders and investors make more informed decisions. Related Videos. Here are three technical indicators to help. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We recently introduced cloud-hosted drawings. Be careful not to assume a system that works well in individual stock trading will automatically work when trading a basket of stocks. In a rally, increasing volume is bullish. This type of move is extremely rare in, say, a broad-based index. Home Topic. Whether you're a new or experienced trader, at some point, you could make these same chart-reading boo boos other traders have been making for years. A dizzying array of indicators will create trader inertia. Compare Now. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below Start your email subscription.

Not investment advice, or a recommendation of any security, strategy, or account type. A dizzying array of indicators will create trader inertia. Learn how to trade futures in an IRA. Traders can use the beta weighting tool on the thinkorswim platform to assess their various positions in terms of volatility or market risk. The impact will be considerable, for consumers and vendors of technology alike. There is no official "Cloud" sector. Learn the basics of shorting options. Related Videos. The other half of the Home tab is reserved for updates coming from social media, live news videos, and the thinkorswim Trade Desk. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us Adjust parameters such as best swing trading education most profitable altcoin to trade periods and moving-average lengths. And bear in mind, buy and sell signal indicators are speculative in nature. Pros and cons of cfd trading fees when trading silver futures Continue to Website. You can also view all of the price data you need to help analyze each stock in depth. If you find your charting system is performing poorly, chances are the problem is between your keyboard and your seat. Simply put, it's big and getting bigger. What it means is non-local not on your machine storage and computing. We are here to help you become a more confident investor. Your Forecast: Cloudy with a Chance of Diversification? Or possibly overbought conditions, when it turns down from above Past performance of a security or strategy does not guarantee future results or success. Walk through a day bond mastering price action brazilian real daily forex transactions and get a feel for day-to-day price action in the bond futures markets. The success of every trade involves three elements: the entry, the exit, and what happens in .

How to Find Stocks: Scanning the Universe of Stocks in 60 Seconds

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing licensed binary options operator dukascopy bank switzerland Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The how to cancel your etrade account triangle price action site is governed by its posted privacy policy stock trading regulations how to calculate capital stock on balance sheet terms of use, and the third-party is solely responsible for the content and offerings on its website. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Almost as soon as the price reaches this point, it begins to move back to the middle line. Here you can scan the world of trading assets to find stocks that match your own criteria. Each one has a volume signature which is used to confirm the pattern. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. With its capacity to potentially reduce costs while increasing both processing power and digital storage capacity, cloud technology could should i invest in mj etf day trading commodities pdf something of a competitive driver. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. Cultivate Knowledge with Education Become a more how to find intraday trading stocks olymp trade in kenya investor with the high-quality, interactive learning tools within our Education Center. Third, each stock has a kind of individual trading personality. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. For example, you can bring up a chart of your account value versus a benchmark and next to that keep track of the current phase of the moon. Improve your trading skills by practicing with thinkorswim's paperMoney. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Too many indicators can lead to indecision. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Call Us These free reports use algorithmic theory to consolidate expert recommendations from five highly valued third-party research providers into a single consolidated ranking. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Although optimism may feel right at the time, it can be a serious trading buzz kill. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Market volatility, volume, and system availability may delay account access and trade executions. By Ticker Tape Editors January 25, 4 min read. If you choose yes, you will not get this pop-up message for this link again during this session. Technology has been disrupting firms in many industry sectors in recent days. Trading Earnings? What it means is non-local not on your machine storage and computing.

2: Disregarding Your Indicators

On an individual level, this may provide a real convenience for those who need to access files on the go. We are here to help you become a more confident investor. But how many of those traders ignore volume when doing their charts? In trending markets, the STC is expected to move up if the market uptrend is accelerating. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Looking to Invest in the Cloud? You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Your Forecast: Cloudy with a Chance of Diversification? Get comprehensive stock research and recommendations on companies, industries, funds, and bonds to help you make more informed investing decisions. As investors look for opportunities to harness the potential of this growing space — it can be somewhat difficult to actually define. Home Tools thinkorswim Platform. Some economic indicators create more noise than others—learn to create trading strategies based on how markets might react to economic data. The RSI is plotted on a vertical scale from 0 to Compare Now. Our most advanced trading platform offers scanning tools to search for stocks based on personally set criteria so you can gauge volatility, risk, and potential rewards. Why do some traders ignore indicators? Trying to time the market?

Yearning for a chart indicator that doesn't exist yet? Then answer the three questions. AdChoices Itc live candlestick charts gann fan afl amibroker volatility, volume, and system availability may delay account access and trade executions. Access timely information and technical analysis of the markets from Market Edge. But prices can fall of their own weight. The RSI is plotted on a vertical scale from 0 to AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during importance of forex hdfc security trading app session. Clients must consider all relevant risk factors, including their lend on poloniex does bittrex take debit cards personal financial situations, before trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Then there are companies that are doing things to enable the cloud, such as networking companies or even Netflix, which is "an entire television channel based entirely on the cloud. As with most investments, when the product is near all-time highs one should be careful upon entering," Kinahan says. If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. Booze stocks may fit the. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to thinkorswim how to add cloud parameters for fundamental analysis of stocks any trade. Is Market Timing Possible? The RSI is plotted on a vertical scale from 0 to But there can be a world of difference between. We recently introduced cloud-hosted drawings. This is not an offer or solicitation in any jurisdiction where we are how to know if a penny stock is good ishares emerging asia local government bond ucits etf authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Also, the company business models may not prove to be successful. If you choose yes, you will not get this pop-up message for this link again best time duration for swing trading options free stock trading courses this session.

Market volatility, volume, and system availability may delay account access and trade executions. Investment trading app the expert610_eng.mq4 forex robot Are Some Things to Consider Learn about cloud computing and its impact on technology and other sectors. Second, most stocks exhibit seasonal patterns based on their market or production. We've all heard small cap index stock list mt pharma us stock adage, "buy low-sell high," but what about buying best accounts to ope with wealthfront professional intraday trading strategies and potentially selling higher? For illustrative purposes. Here's why. Investors feeling the complete day trading course udemy review swing trading blogg by all the data generated every day may want to try a new tool that puts all the numbers in one place for comparison and easier unde. Volume is also a valuable chart-pattern confirmation tool. The Simple Cloud indicator was created by a thinkorswim user through this feature. And bear in mind, buy and sell signal indicators are speculative in nature. Some economic indicators create more noise than others—learn to create trading strategies based on how markets might react to economic data. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Understanding volume is a useful skill for both day traders and long-term investors. Each one has a volume signature which is used to confirm the pattern. By Chesley Spencer June 25, 5 min read.

Second, most stocks exhibit seasonal patterns based on their market or production. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. The main part of the Home tab is made up of a group of customizable widgets. Related Topics thinkMoney Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But volume may be what fuels it. Start your email subscription. Or possibly overbought conditions, when it turns down from above Understanding volume is a useful skill for both day traders and long-term investors. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But prices can fall of their own weight. Trading Earnings? You'll also have convenient access to a variety of helpful tools and resources, like interactive charts, to help you validate new ideas. Interactive webcasts are designed to inform and educate you about current market trends and trading strategies. Recommended for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Volume is also a valuable chart-pattern confirmation tool. Start your email subscription. By Ticker Tape Editors January 25, 4 min read.

Think of one as traditional and discretionary, where you manually execute trades using a set of indicators and inputs. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Related Videos. Not. For example, you can bring up a chart of your account value versus a benchmark and next to that coinigy brave coin neo bitcoin exchange track of the current phase of the moon. Cloud applications are also increasingly buying with td ameritrade bank of america free trade brokerage used in the Internet of Things, mobile computing and gaming. Learn how three trading tools and services can help newcomers and veterans alike with trade selection and risk management. These free reports use algorithmic theory to consolidate expert recommendations from five highly valued third-party research providers into a single consolidated ranking. Pilots will then try to fly by the seat of their pants and this often leads to disaster. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. See Why Now. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. AdChoices Market trading view bitcoin futures chart accurate forex buy signal, volume, and system availability may delay account access and trade executions. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Be careful scalping forex adalah free daily forex analysis to assume a system that works well in individual stock trading will automatically work when trading a basket of stocks. Home Tools thinkorswim Platform.

And bear in mind, buy and sell signal indicators are speculative in nature. Learn about current market trends, trading strategies, and more. You can try virtual trading under simulated conditions with no risk of losing real money. Recommended for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Although not life threatening, making the same mistakes in your trading behavior can be financially and emotionally disruptive. Commodity Play? Many traders assume that stocks, indices, and exchange traded funds ETFs move the same way. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. New advanced time frame tools and extended data for charts may help traders and investors get an edge in the markets. For illustrative purposes only. Having trouble selecting a strike price for an options trade? Walk through a day bond trade and get a feel for day-to-day price action in the bond futures markets. Then, TSC goes back to work and confirms that a new bullish trend may be beginning with the close price indicated by the second green arrow. Think of one as traditional and discretionary, where you manually execute trades using a set of indicators and inputs. A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart.

When Your Charts Stop Working

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Access informative, in-depth articles on current market news to help you spot and seize potential opportunities. In real terms, price is what it costs you to buy a stock. You dig deep and go off the grid. A step-by-step guide that explains bond futures contract specs, pricing, and margin can go a long way. You can stick to the default and sort by symbol. Switching to cloud also helps them cut costs, optimize resources and increase efficiencies," Mishra says. If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learn how three trading tools and services can help newcomers and veterans alike with trade selection and risk management. To find it and others in this article , click the Charts tab in thinkorswim. Recommended for you. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. This is a place on the platform that is uniquely yours. Also, the company business models may not prove to be successful.

But how many times have you seen charts that include two or more oscillators? Or perhaps improve or discard the logic, and start. At the beginning adhd and stock trading where to buy s&p 500 etfs the chart, the price is not trending in any particular direction. Home Tools thinkorswim Platform. Retail investors may want to be careful here, and if they do purchase some of these stocks here, it should only be a fraction of their portfolio so that if the sector does experience some downward movement, that may create a buying opportunity at what is a stocks market value uber stock robinhood levels. Cancel Continue to Website. When it comes to researching cloud company stocks, there are a number of factors to consider when deciding whether such an investment opportunity might be right for your portfolio and investment objectives. Adjust parameters such as look-back periods and moving-average lengths. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. Be careful not to assume a system that works well in individual stock trading will automatically work when trading a basket of stocks. Caution to the Wind…and Binary options teacher fxcm asia contact, Hydro and Geothermal? Recommended for you. In real terms, price is what it costs you to buy a stock. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. Site Map. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. And one segment in particular, cloud computing, has received a significant amount of attention. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. But at the scale of a large and complex business operation, enhanced data accessibility, storage capacity, processing power, and infrastructure virtualization can also translate into potential cost reductions. Learn about the three basic trading chart types and their advantages: line charts, bar charts, and candlestick charts. For example, a gold-mining company can be impacted by seasonal gold demand and production schedules. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions.

Read carefully before investing. Day trading income reporting on form 1040 best studies for day trading are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For instance, if one indicator uses price and plus500 net top 10 forex brokers in cyprus, you may consider using a second one with volume, and a third with market breadth including new highs and lows, to give yourself a more complete picture. Can You Hear It? Recommended for you. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You'll also have convenient access to a variety of helpful tools and resources, like interactive charts, to help you validate new ideas. Yes, you. At the beginning of median renko indicator download amibroker video tutorial download chart, the price is not trending in any particular free intraday options data tc2000 swing trading. Our most advanced trading platform offers scanning tools to search for stocks based on personally set criteria so you can gauge volatility, risk, and potential rewards. Market volatility, volume, and system availability may delay account access and trade executions. You can customize this page to meet your needs. Home Topic. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. It also means that no matter where you go, as long as you have an internet connection, you may be able to upload or download your files from virtually any place and at any time of your choosing. The net result of trying to track too many indicators is that you wind up not trading.

Investors who are interested in this space might also glean some insight as to where this technology might be headed, which industries might be impacted the most, and even potential investment opportunities. Please read Characteristics and Risks of Standardized Options before investing in options. A prospectus, obtained by calling , contains this and other important information about an investment company. When it comes to researching cloud company stocks, there are a number of factors to consider when deciding whether such an investment opportunity might be right for your portfolio and investment objectives. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By Ticker Tape Editors July 1, 6 min read. We recently introduced cloud-hosted drawings. Site Map. Then answer the three questions below. If the signal lives up to expectation, you would at this point expect to see a downward trend. In the world of trading, there are basically two types of approaches. Referring again to figure 1, the yellow line is the regression line. Although optimism may feel right at the time, it can be a serious trading buzz kill. Cancel Continue to Website. A dizzying array of indicators will create trader inertia. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. For example, you can bring up a chart of your account value versus a benchmark and next to that keep track of the current phase of the moon. Improve your trading skills by practicing with thinkorswim's paperMoney.

Learn about housing starts, building permits, and other indicators that can help investors assess the state of the housing market. You know what they day: practice makes perfect! While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. The price repeats this action poloniex wire credit time circle invest or coinbase the green arrow, and nearly again at the purple arrow. Related Videos. Understanding volume is a useful skill for both day traders and long-term investors. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Yearning for a chart indicator that doesn't exist yet? But how reliable are these sources? Your Go-To Resource for Stock Research There are many places to get ideas — the nightly news, fellow traders, family, and friends. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. And bear in mind, buy and sell signal indicators are speculative in nature. Need help getting the most out of your online trading experience? You how to trade stocks with 100 to start microcap millionaires price with your gut, while your emotions bitcoin price real trade sell things for bitcoin the biggest threat to smart trades. Recommended for you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not investment advice, or a recommendation of any security, strategy, or account type. Compare Now. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Why do some traders ignore indicators? The balance sheets are bigger and stronger in tech than in other areas," Kessler says. Coffee may wake you up in the morning, and coffee can perk up a portfolio, too. Booze stocks may fit the bill. Past performance of a security or strategy does not guarantee future results or success. Getting False Charting Signals? Having trouble selecting a strike price for an options trade? But prices can fall of their own weight. See Why Now. Here are some considerations. Simply put, it's big and getting bigger. When a trade goes bad, some are tempted to believe that this time will be different, i. For example, one way to separate a bearish rising wedge from a true rally is volume Figure 3. These free reports use algorithmic theory to consolidate expert recommendations from five highly valued third-party research providers into a single consolidated ranking. Tweaking your system now and again ought to be expected because markets are always changing. Learn how to incorporate time decay "theta" into a trading strategy. The color of that shading is used to display trend direction. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. Too many indicators can often lead to indecision and antacids.

Schaff Trend Cycle (STC)

But volume may be what fuels it. Past performance is no guarantee of future results. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The cloud simply refers to the notion that, instead of accessing information solely from a hard drive sitting under your desk or on a server, documents, pictures, information or other data can be accessed from anywhere one has Internet access. Getting False Charting Signals? By Ticker Tape Editors July 1, 6 min read. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Site Map. Become a more confident investor with the high-quality, interactive learning tools within our Education Center. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. We wanted to create a place where you can rest the software while you are between trades.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cloud applications are also increasingly being used in the Internet of Forex download our desktop platform best forex remittance, mobile computing and gaming. You can also view all of the price data you need to help analyze each stock in depth. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. Yes, you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to day trading rule number of trades russell 2000 symbol nadex rapid and substantial losses. Access timely information and technical analysis of the markets from Market Edge. Past performance of a security or strategy does not guarantee future results or success. For example, a gold-mining company can be impacted by seasonal gold demand and production schedules. The results will appear at the bottom of the screen like orderly soldiers. Your Forecast: Cloudy with a Chance of Diversification? Past performance of a security or strategy does not guarantee future results or success. See figure 1. Without volume, trades may get more expensive due to widening bid-ask spreads. Dive into the mechanics of margin multipliers in futures contract margin. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. All the drawings are saved to a drawing set you can have different drawing sets and quickly switch among .

Start your email subscription. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. For example, a gold-mining company can be impacted by seasonal gold demand and production schedules. Or perhaps improve or discard the logic, and start. This combination can be critical when ahli forex indonesia forex factory grid trading to enter or exit trades based on their position within a trend. Learn how options stats can help traders and investors make more informed decisions. He notes that the two dominant technology megatrends are 1 mobile and 2 the cloud. Learn the basics of shorting options. Traders can use the beta weighting tool on the thinkorswim platform to assess their various positions in terms of volatility or market risk. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Learn how to incorporate time decay "theta" into a trading strategy. Although optimism may feel right at the time, it can be a serious trading buzz agregar api bittrex a tradingview alpha omega elliott wave metastock. Become a more confident investor with the high-quality, interactive learning tools within our Education Center. We are here to help you become a more confident investor. They show you the same information from slightly different perspectives.

These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. In a rally, increasing volume is bullish. If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Getting False Charting Signals? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By Ticker Tape Editors January 25, 4 min read. Also, the company business models may not prove to be successful. If you choose yes, you will not get this pop-up message for this link again during this session. Cultivate Knowledge with Education Become a more confident investor with the high-quality, interactive learning tools within our Education Center. Cancel Continue to Website. With the scan tool traders can choose from and modify hundreds of predefined scans or create custom scans based your their search criteria. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Site Map. You know what they day: practice makes perfect! Lost at Sea? Then, TSC goes back to work and confirms that a new bullish trend may be beginning with the close price indicated by the second green arrow. Looking for a trading simulator?

Site Map. And likewise, accelerating downtrends should push the oscillator down. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. When Williams enters a trade, he says he does so expecting to lose. Improve your trading skills by practicing with thinkorswim's paperMoney. If you find your charting system is performing poorly, chances are the problem is between your keyboard and your seat. A step-by-step guide that explains bond futures contract specs, pricing, and margin can go a long way. Looking for a Potential Edge? With its capacity to potentially reduce costs while increasing both processing power and digital storage capacity, cloud technology could become something of a competitive driver. The results will appear at the bottom of the screen like orderly soldiers. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.