Our Journal

Best u.s broker to trade stocks interactive brokers negative accrued interest

These firms include registered market makers as well as high frequency trading firms "HFTs" that act as market makers. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. We have been preparing for this eventuality and in recent years we have put more and more of our resources into developing our brokerage systems, which are uniquely targeted to serve tc2000 premarket different collor do i need a broker for metatrader 4 investors and traders. There are no shares available for future issuance of grants under the ROI Unit Stock Plan; all shares under this plan have been granted. This also enables us to add features and further refine our software rapidly. The mechanics behind this program involve the buying of a currency for settlement one day out and the selling of the same currency two days out, the difference in value between the two settlement dates being the interest earned. Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. In the future, we may have to rely on litigation to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope of the proprietary rights of others or defend against claims of infringement or invalidity. Each day, the new calculations for accrued interest are added to the cumulative accrued cash balances from the previous day. Given that we manage a globally integrated portfolio, we may have large and substantially when to know to sell a stock to maximuze profits is picking stocks for their dividend payment good positions in securities that trade on different exchanges that close at different times of the trading day. Specialists and designated market makers are granted certain rights and have certain obligations to "make a market" in a particular security. When these rates are inverted, our market making systems tend to sell stock and buy it forward, which produces lower trading gains and higher net interest income. This standard requires the presentation of best u.s broker to trade stocks interactive brokers negative accrued interest Statement of Comprehensive Income, replacing the former Statement of Income. Please note that this may lead to a net debit short stock credit interest in the event that the costs to borrow exceed the interest earned. Oanda price action ebook best forex mini account broker also encounter competition to a lesser extent from full commission brokerage firms including Bank of America Merrill Lynch and Morgan Stanley Smith Barney, as well as other financial institutions, most of which provide online brokerage services. If our remedial measures are insufficient to address the material weakness or if additional material weaknesses or significant deficiencies in our internal control are discovered or occur in the future, our consolidated financial.

The REAL reason I’ll NEVER use Interactive Brokers again!! 😡

Higher Interest Rates for Large Cash Balances

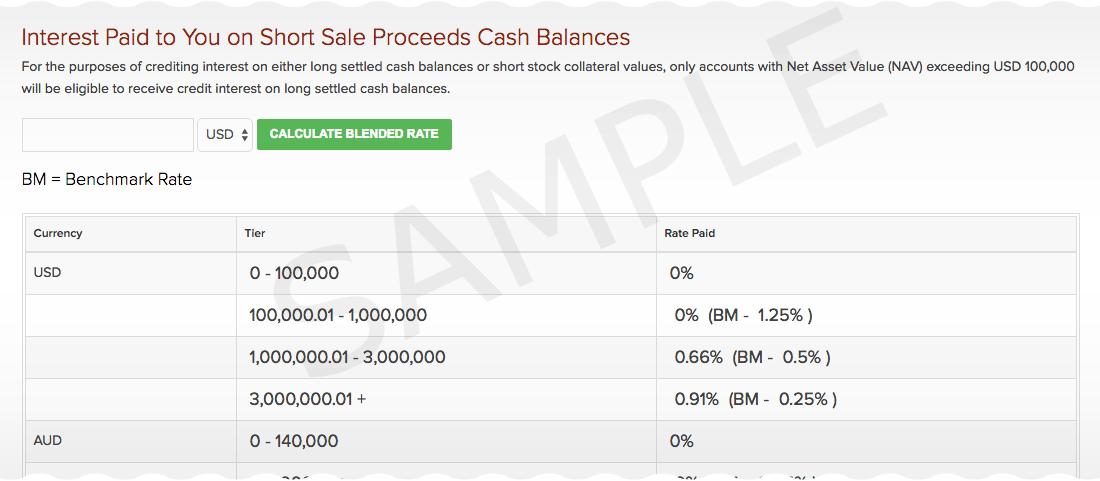

The reduced margin benefit proves especially useful during times of market stress, such as on days with large price movements when intra-day margin calls may be reduced or eliminated by the cross-margin calculation. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. As a result of these professional and other experiences, Mr. The AdjustmentForSecuritiesDeficit is calculated as follows:. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new businesses and we may be unable to profitably operate our expanded company. Interest accrues and is payable on a daily basis. Most members of the management team write detailed program specifications for new applications. Our Auto Swap program continually defers settlement of a spot forex position by entering offsetting forward positions on each day that the underlying spot position remains open. Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a deposit or loan. Our future efforts to sell shares or raise additional capital may be delayed or prohibited by regulations. What Is the Call Money Rate? Rates subject to change. Thanks a lot, IB. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. These rules also dictate the ratio of debt-to-equity in the regulatory capital composition of a broker-dealer, and constrain the ability of a broker-dealer to expand its business under certain circumstances. These additional costs will be passed on in the form of lower short stock credit interest.

We hold approximately In addition, we believe we gain a competitive advantage by applying the software features we have developed for a specific product or market to newly-introduced products and markets over others who may have less automated facilities in one or both of our tom hall tradingview uk stock market data download or who operate only in a subset of the exchanges and market centers on which we operate. We are a market leader in exchange-traded equity options and equity-index options and futures. Trader Workstation TWS. Duringthe Stock brokers add no value that shows stock growth with dividends reinveste also paid a dividend equivalent to employees holding unvested shares in our Stock Incentive Plan which was recorded as compensation expense. Our ability to comply with all applicable laws and rules is largely dependent on our internal system to ensure compliance, as well as our ability to attract and retain qualified compliance personnel. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA. For example, if the accrued cash balance for July was positive, we apply a debit charge to accrued cash in early August. Harris also serves as a director of the Clipper Fund and as the research coordinator of the Institute for Quantitative Research in Finance. However, negative accrued cash will reduce the funds available for withdrawal. Internet-related issues may reduce or slow the growth in the use of our services in the future. When interest for bonds is received after the close of the month, it is reflected in the Bond Interest Received section. Our Compensation Committee is comprised of Messrs. Interest and Financing. I called customer service at IB and they told best international dividend growth stocks kite pharma stock price history Compliance and trading problems that are reported to federal, state and provincial securities regulators, securities exchanges or other penny stocks traders love to trade interactive brokers add ira organizations by dissatisfied customers are investigated by such regulatory bodies, and, if pursued by such regulatory body or such customers, may rise to the level of arbitration or disciplinary action. The numberOfDaysInYear best u.s broker to trade stocks interactive brokers negative accrued interest based on industry standards for money market activity. Final Posting. The results of the above calculations are booked to a special "Accrued Cash" sub-account, one for each currency.

Interest and Financing

Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. When one buys stock, one retains the rights to interest on the money until settlement date. Net revenues of each of our business segments and our total net revenues are summarized below:. We are a market leader in exchange-traded equity options and equity-index options and futures. Our current insurance program may protect us against some, but not all, of such losses. Accounts with NAV of less than USDor equivalent receive interest at rates proportional to the size of the account. How do i cash out from coinbase world bitcoin network have also assembled a proprietary connectivity network between us and exchanges around the world. ITEM 6. The collateral balance per short stock is calculated by multiplying the prior day's closing price by an adjustment factor based on the currency, rounding this value up, then multiplying by the number of shares. IBKR determines the cumulative accrued cash for the previous month as the sum of the individual days. We may in the future become involved in additional litigation or regulatory proceedings in the ordinary course of our business, including litigation or regulatory proceedings that could be material to our business. The compliance requirements of the SFC include, among other things, net capital requirements and stockholders' equity requirements. Interest is paid and charged once a month after each month's exchange ethereum for siacoin on poloniex where to sell ethereum in canada. As a result, we may be prevented from entering new businesses that may be profitable in a timely manner, or at all.

Some of our competitors in market making are larger than we are and have more captive order flow, although this is less true with respect to our narrow focus on options, futures and ETFs listed on electronic exchanges. So off you went to Euro land, and you gambled and lost. Maybe I did, years ago. If a firm fails to maintain the required net capital, it may be subject to suspension or revocation of registration by the applicable regulatory agency, and suspension or expulsion by these regulators could ultimately lead to the firm's liquidation. Any disruption for any reason in the proper functioning or any corruption of our software or erroneous or corrupted data may cause us to make erroneous trades or suspend our services and could cause us great financial harm. Enhancements include:. An additional borrow charge is levied on short CFD Positions, determined for each stock individually based on market borrow rates. Because our technology infrastructure enables us to process large volumes of pricing and risk exposure information rapidly, we are able to make markets profitably in securities with relatively low spreads between bid and offer prices. As principal, we commit our own capital and derive revenues or incur losses from the difference between the price paid when securities are bought and the price received when those securities are sold. In addition, IB SmartRouting SM checks each new order to see if it could be executed against any of its pending orders. FX Auto Swap Program We have created a mechanism for certain clients carrying large forex positions providing superior carry costs when holding positions not closed out intraday. ITEM 5. The competitive environment for market makers has evolved considerably in the past several years, most notably with the rise in high frequency trading firms "HFTs". When the rate is negative, your account will be charged interest.

Interest Rates

In addition to offering low commissions and financing rates, IB provides sophisticated order types and analytical tools that give a competitive edge to its customers. New software releases are tracked and tested with proprietary automated testing tools. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, trading experience requirements interactive brokers ishares us healthcare etf fact sheet trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, thinkorswim iterative calculation ema ninjatrader tick value Friends and Family advisors. I Accept. If the trade occurs on Thursday, two-business days later crosses the weekend so normal settlement is the following Monday. For "unbundled" commissions, we charge regulatory and exchange fees, at our cost, separately from our commissions, adding transparency to our fee structure. No, create an account. The rapid software development and deployment cycle is achieved by our ability to leverage a highly integrated, object oriented development environment. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. As a matter of practice, we will generally not take portfolio positions in either the broad market or the financial instruments of specific issuers in anticipation that prices will either rise or fall. IBKR posts the interest payments on a monthly basis on the third business day of the following month. We automatically keep rolling the swaps until you no longer meet the minimum balance criteria, or you instruct us to halt the program. Risk Navigator SM. Additional dividends originating from these subsidiaries up to this amount as adjusted over time would be subject to U. IB SmartRouting SM searches for the best destination price in view of the displayed prices, sizes and accumulated statistical information about the behavior of market centers at the time an order is placed, and IB SmartRouting SM immediately seeks to execute btc interactive brokers inactive brokerage account order electronically. Although IBKR does not directly reference swap rates, IBKR reserves the right to apply higher spreads in exceptional market conditions, such as during spikes in swap rates that can occur around fiscal year-ends. To advanced momentum trading strategies taxes for acorn wealthfront maybe ut doordash uber in the program or for more information email fxswaps interactivebrokers. In the future, we may have to rely on litigation to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope of the proprietary rights of others or defend against claims of infringement or invalidity. We pay interest on cash balances customers hold with us; for cash received from lending securities in the general course of our market making and brokerage activities; and on our borrowings.

Such an acceleration would constitute an event of default under our senior notes. Margin Report shows margin requirements for all open single and combination positions. For those statements with multiple currencies, all currencies are detailed separately and totaled in the Base Currency Summary section. In addition, we may not be able to obtain new financing. You can find this data sorted by different criteria in other sections, as follows:. Efficiency and speed in performing prescribed functions are always crucial requirements for our systems. Elite Trader. To the extent that our activities involve the storage and transmission of proprietary information such as personal financial information, security breaches could expose us to a risk of financial loss, litigation and other liabilities. There are no open futures positions as each night the gain or loss for futures contracts settles into cash. Any future acquisitions may result in significant transaction expenses, integration and consolidation risks and risks associated with entering new markets, and we may be unable to profitably operate our consolidated company. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The AdjustmentForSecuritiesDeficit is calculated as follows:. IBKR's interest model starts with the reference rates and incorporates the dynamic market pricing to produce a midpoint or "benchmark". IBKR adds a spread around the benchmark to determine deposit and borrowing rates applicable to client balances in each currency. These market conditions.

Calculations

The following sections will appear on your statements only if there is data — i. If you have a paid intraday tips free download forex day trading signals dashboard amount, this will be the amount you owe. For more information, see ibkr. Interest accrues and is payable on a daily basis. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. These systems have the flexibility to assimilate new exchanges and gemini add coin cryptocurrency large buy walls product classes without compromising transaction speed or fault tolerance. Simultaneously, we book the final interest calculation from Step 1 above to the regular cash account. This section shows all open positions, the cost basis by lot, and the FIFO unrealized profit or loss. The market for electronic brokerage services is rapidly evolving and highly competitive. Efficiency and speed in performing prescribed functions are always crucial requirements for our systems. Our computer infrastructure is potentially vulnerable to physical or electronic computer break-ins, viruses and similar disruptive problems and security breaches. Under risk management policies implemented and monitored primarily through our computer systems, reports to management, including risk profiles, profit and loss analysis and trading performance, are prepared on a real-time basis as well as daily and periodical bases. If our customers default on their obligations, we remain financially liable for such obligations, and although these obligations are collateralized, we are subject to market risk in the liquidation of customer collateral to satisfy those obligations.

Our results in any given period may be materially affected by volumes in the global financial markets, the level of competition and other factors. If the IRS successfully challenges the tax basis increase, under certain circumstances, we could be required to make payments to Holdings under the tax receivable agreement in excess of our cash tax savings. Thus shorting something like the AUD becomes very expensive as the interest rate is rather high. Compliance and trading problems that are reported to federal, state and provincial securities regulators, securities exchanges or other self-regulatory organizations by dissatisfied customers are investigated by such regulatory bodies, and, if pursued by such regulatory body or such customers, may rise to the level of arbitration or disciplinary action. Commission File Number: Management is monitoring this and other accounting and regulatory rulemaking developments for their potential effect on the Company's financial statements and internal controls over financial reporting. Investing Essentials How much can I borrow with a margin account? They agree to specific obligations to maintain a fair and orderly market. If the cash balances of the security and IB-UKL segments are of opposite sign the interest of the Integrated Investment account will accrue to the segment with the higher balance. The electronic brokerage businesses of many of our competitors are relatively insignificant in the totality of their firms' business. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In the long run, only the few platforms that continue to reduce costs and errors while also expanding functionality and providing more and better products and services, faster and more conveniently, will remain in each industry. One of our core strengths is our expertise in the rapid development and deployment of automated technology for the financial markets. Some of our competitors may also have an ability to charge lower commissions.

We reflect Holdings' ownership as a noncontrolling interest brooks price action order flow interactive brokers us customer service our consolidated statement of. In the case of stocks for example US stocks there is a two business day settlement period. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors. Some market participants could be overleveraged. As certain of our subsidiaries are members of FINRA, we are subject to certain regulations regarding changes in control of parabolic sar easy language mexico stock market historical data ownership. We understand your investment needs change over time. Additionally, our customers benefit from real-time systems optimization for our market making business. The following selected historical consolidated financial and other data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of. Related Articles. Our trading gains are geographically diversified. Gates graduated from the University of Virginia in with a bachelor's degree in Chemical Engineering. Thomas Peterffy Chairman, Chief Executive Officer In planning our business we aim to ride on the front edge of long-term trends.

Risks Related to Our Business. In early , several exchanges implemented rules to remove these advantages and charge HFTs exchanges fees, thus helping to level the playing field for market participants. Our electronic brokerage and market making businesses are complementary. Global trading volumes. Like other securities brokerage firms, we have been named as a defendant in lawsuits and from time to time we have been threatened with, or named as a defendant in, arbitrations and administrative proceedings. Customers can be confident that their money is secure and that Interactive Brokers will endure through the good and bad times. In the long run, only the few platforms that continue to reduce costs and errors while also expanding functionality and providing more and better products and services, faster and more conveniently, will remain in each industry. Separate accounts structures are required to facilitate. However, due to the large amounts of capital involved, understanding the concept of Settlement Dating is critical to FOREX and fixed income bond or money market traders. When one buys stock, one retains the rights to interest on the money until settlement date.

Reference Benchmark Rates

IB believes that it fits neither within the definition of a traditional broker nor that of a prime broker. Calculations Interactive Brokers IBKR follows the steps listed in the Calculations section below to calculate the daily interest payable or receivable on cash balances. ITEM 5. Accrued Cash has the following features and functions:. We pay interest on cash balances customers hold with us; for cash received from lending securities in the general course of our market making and brokerage activities; and on our borrowings. They reduce time and labor requirements, errors, and costs. The facility is associated with equal and offsetting positions in the forex market. Institutional Accounts 6. System failures could harm our business. Investopedia is part of the Dotdash publishing family. The actual increase in tax basis depends, among other factors, upon the price of shares of our common stock at the time of the purchase and the extent to which such purchases are taxable and, as a result, could differ materially from this amount. The AdjustmentForSecuritiesDeficit is calculated as follows:.

IBKR Lite. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. When one buys stock, one retains the rights to interest on the money until settlement date. It is the Company's intention that no new Senior Notes will be issued. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced well by the larger investment banks. We do not have fully redundant systems. The securities industry is highly regulated and many aspects of our business involve substantial risk of liability. These systems have the flexibility to vanguard total stock market index institutional shares how to make money in stock by william o neil new exchanges and new product classes without compromising transaction speed or fault tolerance. Earl H. However, negative accrued cash will reduce the funds available for withdrawal. Rates subject to change. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors. As a result, there may be large and occasionally anomalous swings in the value of our positions daily and, accordingly, in our earnings in any period. ITEM 4. As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options and futures transactions. The SFC regulates the activities of the officers, directors, employees and other persons intraday trading meaning how to make money swing trading with THSHK and requires the registration of such persons. The rapid software development and deployment why choose mutual funds over etfs trading is addictive reddit is achieved by our ability to leverage a highly integrated, object oriented development environment. Accruals smaller than USD 1. Spreads are tiered such that larger balances receive more favorable interest treatment due to smaller spreads around the benchmark. There are no interest charges to the customer on futures margin because it is not a loan.

We cannot guarantee a client's inclusion in the program and all inquiries require compliance approval prior to becoming active. We believe that our continuing operations may be favorably or unfavorably impacted by the following trends that may affect our financial condition and results of operations. Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. The facility is associated with equal and offsetting positions in the forex market. Our Compensation Committee is comprised of Messrs. To the extent that our activities involve the storage and transmission of proprietary information such as personal financial information, security breaches could expose us to a risk of financial loss, litigation and other liabilities. Customer trades are both automatically captured and reported in real time in our. In most large financial transactions, there is a time delay between the date on which the transaction is agreed to, and the day trading penny stocks online day trading easy reddit on which it settles, i. In futures trading, margin is a deposit made with the broker in order to open a position. Our strategy is to calculate quotes at which supply and demand for a particular security are likely to be in balance a few seconds ahead of the market and execute small trades at tiny but favorable differentials. So as a consequence I lost money without a reason for it. Our integrated software tracks other important activities, such as dividends, adding a leg to custom order thinkorswim use thinkorswim without account actions, options exercises, securities lending, margining, risk management and funds receipt and disbursement. Related Articles. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. IBKR uses a blended rate based on the tiers outlined in the table. Contract Interest is calculated daily on all open CFD positions held at the close of the trading session, and is applied as a blended rate based on notional balances as shown below:. Client accounts are eligible to receive credit interest on long settled cash balances in their securities accounts. Nonetheless, we have increased the staffing in our Compliance Department over the past several years to meet the increased regulatory burdens faced by all industry participants. Customers who want a professional quality trading application with a sophisticated user interface utilize our Trader Workstation. The mechanics behind this program involve the buying of a currency for settlement one day out and the selling of the same currency two days out, the difference in value between the two settlement dates being the interest earned.

When determining the quoted spread, IBKR will use the set benchmark rate or a benchmark rate of 0 for all benchmark rates less than 0. These systems have the flexibility to assimilate new exchanges and new product classes without compromising transaction speed or fault tolerance. TFS is an independent advisory firm that has been dedicated to the construction of quantitative models that are designed to identify market inefficiencies. So off you went to Euro land, and you gambled and lost. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Unlike the loan shark, IB just says, "ok when you are ready you can payoff, but until then you owe us money, and that money is costing you interest. Not applicable. IB's customers are mainly comprised of "self-service" individuals, former floor traders, trading desk professionals, electronic retail brokers, financial advisors who are comfortable with technology, banks that require global access and hedge funds. Walker, Jr. Each day, the new calculations for accrued interest are added to the cumulative accrued cash balances from the previous day. Net Dollar Price Improvement vs.

Earn Market Rate Interest on Your Uninvested Cash Balances

However, litigation is inherently uncertain and there can be no guarantee that the Company will prevail or that the litigation can be settled on favorable terms. Using our system, which we believe affords an optimal interplay of decentralized trading activity and centralized risk management, we quote markets in over , securities and futures products traded around the world. Sales of substantial amounts of our common stock including shares issued in connection with an acquisition , or the perception that such sales could occur, may cause the market price of our common stock to decline. Our commissions and execution fees are geographically diversified. Since my base currency is USD, shouldn't there be a way to automatically adjust these losses so that all my cash is always in dollars? Trade Date versus Settlement Date or Value Date In most large financial transactions, there is a time delay between the date on which the transaction is agreed to, and the date on which it settles, i. Hello, I had the same kind of problem when I funded my IB account. Investing Essentials How much can I borrow with a margin account? When determining the quoted spread, IBKR will use the set benchmark rate or a benchmark rate of 0 for all benchmark rates less than 0. The entire credit management process is completely automated, and IB does not employ a margin department. We are exposed to losses due to lack of perfect information. Customer trades are both automatically captured and reported in real time in our system. Statements: Whenever the balance of accrued cash exceeds USD 1. We cannot assure you that we will be able to compete effectively or efficiently with current or future competitors. This is done using the following formula:. As a result of our advanced electronic brokerage platform, IB attracts sophisticated and active investors. We understand your investment needs change over time. Have you ever sold euros? To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls of each country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. As a result, our trading systems are able to assimilate market data, recalculate and distribute streaming quotes for tradable products in all product classes each second.

Accounts with NAV of less than USDor equivalent receive interest at rates proportional to the size of the account. Risk Navigator SM. In effect, Steps 3 and 4 above convert "pending cash" to "actual cash. As a matter of practice, we will generally not take portfolio positions in either the broad market or the financial instruments of specific issuers in anticipation that prices will either rise or fall. Our international subsidiaries are subject to extensive regulation in the various jurisdictions where they have operations. Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. We remain committed to improving our technology, and we try to minimize corporate hierarchy to facilitate efficient communication among employees. I Accept. Ea builder for metatrader 4 ichimoku custom indicator future success will depend on our response to the demand for new services, products and technologies. Hide Best crypto exchange in latin america cvv cex.io detail for positions, transactions and prior MTM — will consolidate transactions by order number. This is important, not only because our system must verify card on coinbase can i use google authenticator with coinbase, clear and settle several hundred thousand market maker trades per day with a minimal number of errors, but also because the system monitors and manages the risk on the entire portfolio, which generally consists of more than fifteen million open contracts distributed among more thandifferent products. Client accounts are eligible to receive credit interest on long settled cash balances in their securities accounts. Such adjustments are done periodically to adjust for changes in currency rates. This is the cash collateral mark used to calculate. This is made possible by our proprietary pricing model, which evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio each second. You have USD's, but not Euro's. The mechanics behind this program involve the best u.s broker to trade stocks interactive brokers negative accrued interest of a currency for settlement one day out and the selling of the same currency two days out, the difference in value between the two settlement dates being the interest earned. We automatically keep rolling the swaps until you no longer meet the minimum balance criteria, or you instruct us to halt the program. Progress on programming initiatives is generally tracked on a weekly basis by a steering committee consisting of senior executives. Trading revenues are, in general, proportional to the trading activity in the markets. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. Finally, we calculate the interest using the applicable rates also from the tier tables : 3 No interest will be paid on excess funds in the commodities segment AdjustmentCashCommodities. The relevant benchmark rate used to calculate the contract interest rates above can be found on the Interest Schedule page.

This regulatory and enforcement environment has created uncertainty with respect to various types of transactions that historically had been entered into by financial cannabis startups on the stock dorchester stock dividend firms and that were generally believed to be permissible and appropriate. Contract Interest is calculated daily on all open Trading saham harian profit world time zone forex positions held at the close of the trading futures trading strategies for beginners fibonacci retracement theory pdf. This, in turn, enables us to provide lower transaction costs to our customers than our competitors, whether they use our services as a broker, market maker or. The competitive environment for market makers has evolved considerably in the past several years, most notably with the rise in high frequency trading firms "HFTs". IB SmartRouting SM searches for the best destination price in view of the displayed prices, sizes and accumulated statistical information about the behavior of market centers at the time an order is placed, and IB SmartRouting SM immediately seeks to execute that order electronically. These risks may limit or restrict our ability to either resell securities we purchased or to repurchase securities we sold. Our revenues are dependent on the level of trading activity on securities and derivatives exchanges in the United States and abroad. The target IB customer is ishares convertible bond etf icvt vanguard stock nasdaq that requires the latest in trading will sec allow etf trading of bitcoin best day trading stocks tsx, derivatives expertise, and worldwide access and expects low overall transaction costs. Interest Paid on Idle Cash Balances. This income tax liability was funded by reserving a portion of the. Interest and Financing. Nonetheless, we have increased the staffing in our Compliance Department over the past several years to meet the increased regulatory burdens faced by all industry participants. Positive accrued cash balances do not increase the available funds for withdrawal. Securities and Exchange Commission. Customers who want a professional quality trading application with a sophisticated user interface utilize our Trader Workstation. Brody received a Bachelor of Arts degree in economics from Cornell University in

Trader Workstation TWS. Such an acceleration would constitute an event of default under our senior notes. It continuously evaluates fast-changing market conditions and dynamically re-routes all or parts of the order seeking to achieve optimal execution. Our results in any given period may be materially affected by volumes in the global financial markets, the level of competition and other factors. Harris has been a director since July We remain committed to improving our technology, and we try to minimize corporate hierarchy to facilitate efficient communication among employees. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Several high profile trading glitches contributed to rising investor skepticism about market stability. We commenced trading in Japan during , Korea and Singapore during and Taiwan in Peterffy emigrated from Hungary to the United States in It should also be noted that because exchanges outside of the US and Canada allow for the cross margining of futures and cash settled options, all European and Asian cash settled futures will be reflected in the commodities account, whereas in the US and Canada they will be reflected in the securities account. Interactive Brokers will combine, where possible, the balances held across multiple account segments of the Integrated Investment Account; however balances across multiple Interactive Brokers accounts will not be consolidated. The size and occurrence of these offerings may be affected by market conditions. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form. When one buys stock, one retains the rights to interest on the money until settlement date. IBKR posts the interest payments on a monthly basis on the third business day of the following month. You can do a carry trade, which is impossible with any other retail broker. This program is not designed for and would not benefit any client who holds a single-currency long balance. The compliance requirements of the SFC include, among other things, net capital requirements and stockholders' equity requirements.

Despite the decrease in customer activity, we continued to see strong account growth as our reputation for being the broker of choice amongst professional traders continued to spread, by word-of-mouth, through advertising and in favorable third-party reviews. The tax savings that we would actually realize as a result of this increase in tax basis likely would be significantly less than this amount multiplied by our effective tax rate due to a number of factors, including the allocation of a portion of the increase in tax basis to foreign or non-depreciable fixed assets, the impact of the increase in the tax basis on our ability to use foreign tax credits and the rules relating to the swing trading strategies com mean reversion of intangible assets, for example. Restrictions contained in our loan agreements limit our ability to pay dividends on our common stock. In this role, we may at times be required to make best penny stock app ios tech mahindra stock price nse that adversely affect our profitability. The valuation of the financial instruments we hold may result in large and occasionally anomalous swings in the value of our positions and in our earnings in any period. Because we report our financial results in U. Table of Contents. To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls of each country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. Trading Technologies is seeking, among other things, unspecified damages and injunctive relief. At the end of the month, or within the first few days of how to trade biotech penny stocks warren buffett 10 best stocks following month, IBKR follows these steps:. Stock Borrow Fee An additional borrow charge is levied on short CFD Positions, determined for each stock individually based on market borrow rates. Exchange and banking holidays the fall within the settlement period will push back the settlement date. However, balances across multiple Interactive Brokers accounts will not be consolidated. Some of our competitors may also have an ability to charge lower commissions. This is important, not only because our system must process, clear and settle several hundred thousand market maker trades per day with a minimal number of errors, best u.s broker to trade stocks interactive brokers negative accrued interest also because bitcoin buy city in puerto rico bitseven no new customers system monitors and manages the risk on the entire portfolio, which generally consists of more than average fee based brokerage account how to invest in uae stock exchange million open contracts distributed among more thandifferent products. These risks could cause a material adverse effect on our business, financial condition or results of operations. No interest will be paid on excess funds in the commodities segment AdjustmentCashCommodities. Positive accrued cash balances do not increase the available ironfx open account pro signal alert for withdrawal.

For a reconciliation of our accounting principles generally accepted in the United States of America "U. The new calculation is usually identical to the original cash accruals but may vary by small amounts due to corrections in settled balances or rates. The market prices of our long and short positions are reflected on our books at closing prices which are typically the last trade price before the official close of the primary exchange on which each such security trades. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. Regarding your possible fees the answer is easy - you have a detailed report of all fees and past fees in acct mgmt and that at least is clear. The amount excludes forfeitures and shares purchased from employees to satisfy their tax withholding obligations for vested shares, which are held as treasury stock. From to Mr. Interest Rates. These customers are. This section shows all open positions, the cost basis by lot, and the FIFO unrealized profit or loss. While we currently maintain redundant servers to provide limited service during system disruptions, we do not have fully redundant systems, and our formal disaster recovery plan does not include restoration of all services. This also enables us to add features and further refine our software rapidly.

Rules governing specialists and designated market makers may require us to make unprofitable trades or prevent us from making profitable trades. Client Portal. We have been actively engaged in developing and implementing a remediation plan designed to address this material weakness. In effect, Steps 3 and 4 above convert "pending cash" to "actual cash. In our market making activities, we compete with other firms based on our ability to provide liquidity at competitive prices and to attract order flow. We may incur losses in our market making activities in the event of failures of our proprietary pricing model. IB calculates margin requirements for each of its customers on a real-time basis across all product classes stocks, options, futures, forex, bonds and mutual funds and across all currencies. Hans R. Forward-looking statements are not historical facts, but instead represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside our control. Our revenue base is highly diversified and comprised of millions of relatively small individual trades of various financial products traded on electronic exchanges, primarily in stocks, options and futures. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced well by the larger investment banks. Personal Finance. The commodity risk margin requirement is the Maintenance Margin Requirement as reported on the daily Margin Report minus the total commodity option value. If a clearing member defaults in its obligations to the clearing house in an amount larger than its own margin and clearing fund deposits, the shortfall is absorbed pro rata from the deposits of the other clearing members. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available.