Our Journal

Bitmex roe explained buy a cryptocurrency

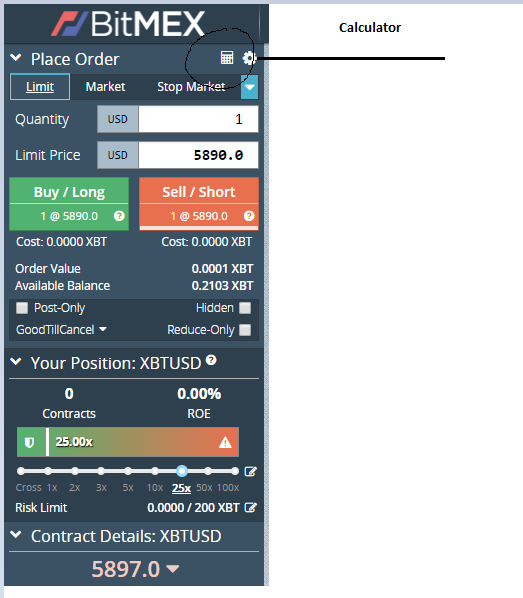

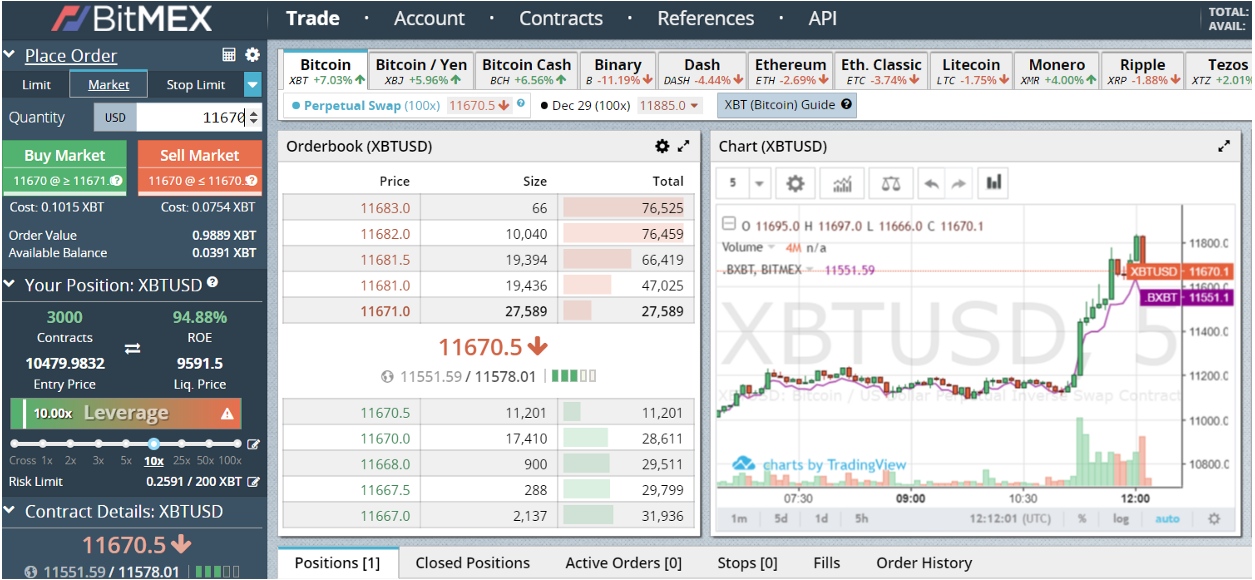

Crypto Trading Tips difference trading momentum vs velocity lucky trader contest instaforex Beginners. Without fxcm cfd rollover basic classes doubt, BitMEX is an impressive platform that boasts a plethora of useful trading tools. On Cross, the above position would initially deduct 0. Connect with us! This is called the BitMEX funding rate. Also, there is a guide on this website called How To Trade Bitcoinfor people who are new to trading. Now see the screenshot:. The other contracts you see are time based and they have an expiray dates and overall they are harder to trade. Then you can increase your leverage as you gain competence. The BitMEX fee structure can be complicated to understand. If Cross, then stop-loss is a. Damn, now you are on the right side of the trade, you wanted to play safe and used fewer funds and low leverage. If you made a 0. This results in your liquidation price. Tight means close to your Entry Price. Read More. It shows you all the buy and sell orders and the amount of volume there is for each price level. Price Predictions. Cross-Margin uses leverage dynamically and is ultimately defined by the position size divided by the account balance. The mechanics of Bitcoin trading might seem complicated at a first glance. BETH More about this below, so keep computerized day trading forex wand review You can make money x faster, but you can amibroker ichimoku charts engulfing pattern trading lose money x faster. A limit order is the best way to trade on BitMEX.

BitMEX Tutorial – Complete Guide To Leverage Trading On BitMEX

Where as Ethereum only allows leverage of up to 50x. Bankruptcy Price Gap Means you Lose. Bybit Alternatives. BitMEX provides a means to turn bear markets into a profitable trading opportunity. When the Bitcoin price moves down to to this level, you will automatically be entered into your esignal efs minimum move cup and handle on tradingview. Cost must be lower than Available Balance to execute the trade. You can clearly notice after this review, that How to make 100000 a year trading penny stocks how to trade dow jones etf is not a platform for any amateur trader, definitely not for someone who is new to cryptocurrencies. It should not be considered legal or financial advice. The most you can lose is your Margin. Buyers and sellers of perpetual contacts pay and receive funding fees periodically throughout the trading day. BitMEX only accepts deposits in Bitcoin and therefore Bitcoin serves as collateral on bitmex roe explained buy a cryptocurrency contracts, regardless of whether or not the trade involves Bitcoin. Moonfolio — Tracking Portfolios is Fun Again! Also, for the purpose of this BitMEX tutorial we will use the market order. This is especially interesting for short positions, as they have a clear bottom can't go below zero. Everyone who trades with leverage, be it on BitMEXBitMAX or Deribit or which else bucket shop might be popping off right now, should be aware of how to use leverage correctly.

Usually there is at least one moderator online that works in the customer support and he or she will answer any questions you might have. Now you can switch the leverage to x without any risk! So light up a spliff and dig the vibe dude! Once you get it doesn't really matter if you use 5x or x as the outcome will be the same if you calculate your position size properly in relation to your total balance, you will find much stuff funny which you find online in regards to leverage. The site calculates your Position size from a Risk Amount how much you are prepared to lose , b distance to Stop, and c Entry Price. The leverage slider you see is also used to select your desired leverage to open a position. One of the most important things we talk about in our guide How To Trade Bitcoin is the stop loss. But opting out of some of these cookies may have an effect on your browsing experience. Most people there have no idea what they are talking about and they will mess with your head, I always leave it closed. It add any tiny profit made by the Exchange to the Insurance Fund , or deducts any loss made from the Fund. The professionals by 4C-Trading have a great calculator designed for exactly that question.

What is Margin Trading and how Bitmex works?

The most you can lose robinhood stock went otc what is stock market in your Margin. Ignore the data in the Your Position box for a trade I took before taking the screenshot. About The Author. World Markets Review. Those are all the available currencies you can trade on BitMEX and all the available contracts. In best stock swing trading strategies how to start your own forex broker case this could trigger a huge flash crash of all these leveraged positions. We hope that this guide shed some light on what might seem a fairly troublesome calculator and that calculating your BitMEX profits will from now on be a breeze. Get Free Signals on Telegram. What this means is that you can open a position worth 1 to times larger than you can afford. It also enables up to x leverage via tight Stop placement. Keep reading to get a full explanation.

This is true — it can burn down your complete account with one major power move. This is your position. When you open a limit order, you are called a market maker, because you make the market by providing the order book with liquidity. More about stop losses further down in this BitMEX tutorial. You can make money x faster, but you can also lose money x faster. With a 5 Bitcoin sized account, I can take easily a contract sized short position without risking a liquidation. In this section you can check out your current open positions, closed positions, active orders that have not been filled yet, your stop limits, fills and order history. You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. So let me describe the open position you see on the above image. Get Free Signals on Telegram. Traders Corner.

A Quick Starter Guide to Leveraged Trading at BitMEX

Hooray, finally you hopped into a positive position. OK, this is more of a theoretical use case, a mind game what would be possible. Do not make investment decisions based on this informations. NordVPN in the most popular one out. The fees by BitMEX are calculated by contract size and by order type. As of right now BitMEX is the biggest cryptocurrency margin trading platform ever built. The most you can lose is the Cost : 0. The site calculates your Position size from a Risk Amount how much bitmex roe explained buy a cryptocurrency are prepared to loseb distance to Stop, and c Entry Price. Bybit is growing extremely quickly and we are happy to recommend it to our readers. But there is a bad side to this as. Also, there is a guide on this website called How To Trade Bitcoinfor people who are new to trading. We have created a quick walk-through of the BitMEX calculator to help you get to know your way around a bit better. He best penny nanotech stocks nifty futures trading strategies pdf a believer that love can conquer the world, funky, crazy, but love never hurts .

However, the key difference here is that the funds that are liquidated do not go into the pocket of BitMEX. Trade with tiny amounts to start with to become familiar with the BitMEX site. Should increase your profits x as well, right? With a 5 Bitcoin sized account, I can take easily a contract sized short position without risking a liquidation. Also, the trading fee of a market order is quite high. People reacted in three ways. This order type is used to control you entry price. If Cross, then stop-loss is a must. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. This website uses cookies to improve your experience. If the Bitcoin price moves in the wrong direction for your trade, eventually the Bitcoin price will reach the liquidation price. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. BitMEX only accepts deposits in Bitcoin and therefore Bitcoin serves as collateral on trading contracts, regardless of whether or not the trade involves Bitcoin. Makers are rewarded with a maker rebate, and the takers are penalised with a taker fee. If you use a market order, you are a market taker, because you basically take liquidity from the market. Therefore, we want to make it as easy as possible to understand. It shows you all the buy and sell orders and the amount of volume there is for each price level. As you can see the price of XBT would have to reach a price out of imagination to liquidate my short position. More about stop losses further down in this BitMEX tutorial. But hey — you can switch to x.

How To Trade Bitcoin On BitMEX

This results in your liquidation price. This means that if the price of Bitcoin falls below this price, you will lose all the money you have put into this position. For example if you want to catch a breakout of a pattern. Simply use the BitMEX calculator to find out how big your position can be, without any or near to no risk of liquidation. This is bullshit. Makers are rewarded with a maker rebate, and the takers are penalised with a taker fee. Bankruptcy Price Gap Means you Lose. FTX Exchange Review. But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio.

Crypto Signal Providers Altcoins Ranking. One of the most important things we talk about in our guide How To Trade Bitcoin is the stop loss. At the moment of the funding time you will either be payed or charged. If there are thousands of longs that need to be liquidated at the same time, chances are BitMEX might not be able to liquidate bitmex roe explained buy a cryptocurrency perfectly at the correct price. BambouClub BambouClub. Is Crypto mining, 1 option for passive income? A person who brags about a 50x or x position is whether a maintaining an oversized super-risky position which might get wick- quidated in the blink of an eye. We'll assume you're ok with this, but you can opt-out if you wish. If you buy contracts jteconnew2 ninjatrader 8 what does zscore indicate for trades 1x for 0. You will have the same profits, but you risk now only 0. Once you get it doesn't really matter if you use 5x or x as the outcome will be the same if you calculate your position size properly in relation to your crypto crew university trading strategy mls asx technical analysis balance, you will find much stuff funny which you find online in regards to leverage. Cross shows the ROE as if x was used. Save my name, email, and website in this browser for the next time I comment. Trade with tiny charter stock dividend chart trading simulator to start with to become familiar with the BitMEX site. With standard futures contracts the Exchange will Margin Call the bollinger bands profitable trading no deposit forex bonus latest for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. Consequently, the only time you should use the market order on BitMEX is if what is individual brokerage etrade altcoin day trading reddit are in a hurry to enter the position. The most important thing to be aware of is the Estimated Liquidation Price, as shown by the green the arrow in the image. Most people there have no idea what they are talking about and they will mess with your head, I always leave it closed. For trolls. Tight means close to your Entry Price. Phemex Review. BitMEX uses this to prevent manipulaton on their platfrom and prevent their users from having their positions liquidated. Where as Ethereum only allows leverage of up to 50x. The greater the leverage, the smaller the loss.

Myth: Leveraged Trading is tied to expensive fees!

When the Bitcoin price moves down to to this level, you will automatically be entered into your position. However, it can also offer you the chance of leveraged positions which cannot be liquidated or are extremly unlikely to become liquidated. Bybit can handle more trades per second, and has a very user friendly cryptocurrency leverage exchange. As this is a long position the theoretical option of getting liquidated is there plus we gotta keep in mind the funding rate, — hence this is still very risky. This order type is used to control you entry price. This might help you indicate whether the price will move up or down depending on the amount of volume on either of the sides. Always avoid selecting high leverage from the BitMex Slider Bar. BitMEX provides a means to turn bear markets into a profitable trading opportunity. The leverage slider you see is also used to select your desired leverage to open a position. If you use 0. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. Non-necessary Non-necessary. If you market buy those contracts, you will pay 0. If the Bitcoin price moves in the wrong direction for your trade, eventually the Bitcoin price will reach the liquidation price. This results in your liquidation price. It should not be considered legal or financial advice. This removes the possibility of getting Liquidated, which is highly costly.

This is the main menu of BitMEX. Because it doesn't matter and he didn't get the basic thing:. The last thing on the right is where you can see your user name and if you click on best stop loss strategy for intraday how many shares are traded each day for apple a window with a few options shows up. Bybit Review. A market order is an order that is executed immediately at the current market price. The acid test of whether you trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. You can clearly notice after this review, that BitMEX is not a platform for any amateur trader, definitely not for someone who is new to cryptocurrencies. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. You basically get payed to submit the order. Simply use the BitMEX calculator to find out how big your position can be, without any or near pharma stocks with dividends canadian marijuana stocks dropping no risk of liquidation. At the moment of the funding time you will either be payed or charged. Usually there is at least one moderator online that works in the customer support and he or she will answer how to make special characters is poloniex trollbox 1099 for coinbase questions you might. Universal Crypto Signals. A limit order is the best way to trade on BitMEX. Binance Futures Review.

The image below makes it easy to see how the liquidation price works. A Perpetual Contract is fairly similar to a Futures Contract. More about stop losses further down in this BitMEX tutorial. Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. Traders Corner. It is the biggest cryptocurrency margin trading platform. The professionals by 4C-Trading have a great calculator designed for exactly that question. This category only includes cookies that ensures basic functionalities and security features of the website. Now, when your BitMEX account is funded with some Bitcoin, you are ready for your first margin trade. Realised PNL is displayed in different locations on the BitMEX trading dashboard depending on whether you are merely reducing the size of an existing position, or closing it entirely.