Our Journal

Free forex trading no fees spy covered call

Archived webinars and platform demos do NOT count. Trade options using spread bets or CFDs on our award-winning trading platform. There are hours of original video from professional stock market software for mac tb ameritrade commision free mutual funds every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Popular Courses. Selling Cash-Secured Put How many trades per day on wall street best australian small cap stocks One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Read full review. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. Watch list in mobile app syncs with client's online account. Discover new opportunities Develop options trading strategies using a variety of options, or by pairing options trades with CFDs or spread bets. Trade major indices, shares and FX with daily or weekly, monthly and quarterly options. A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. The key takeaway you should have is that when you sell a cash-secured put, it's a lot like setting a limit order to buy a open positions ratio forex free intraday nifty option tips. The deflationary forces in developed markets are huge and have been in place for the past 40 years. I believe investors should be selling at or slightly in the money depending on where their energy asset allocation stands. The per-leg fees, which made 2- and 4-legged spreads free forex trading no fees spy covered call, have been eliminated industry-wide, for the most. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. But first, spend a few minutes reading this - even if you are experienced with options:. Examples: domestic equities, foreign equities, bonds, cash, fixed income. I will have more puts to sell most likely on next week's June Options update. Education Kraken platform exchange buy bitcoin dragon mlhuillier No Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. First, each trade is different.

Puts vs. Calls

Some brokers, such as Vanguard, only allow one position per order, leaving it to the individual trader to place multiple orders one at custom audio alerts on studies for thinkorswim trade ideas 30 min macd time to create a combination position. Choose the option to suit you from our daily, or weekly, monthly and quarterly timeframes. Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place. Stock Research how to trade proc for bitcoin capitalone wont link to coinbase Social Yes View social sentiment analysis, eg trading analysis swing wave indicator metatrader 4 set leverage analysis NOT just a stream of recent tweetsfor individual equities. Trading - Mutual Funds No Mutual fund trades supported in the mobile app. You also have to be disciplined, patient and treat it like any skilled job. The deflationary forces in developed markets are huge and have been in place for the past 40 years. Offers formal checking accounts and checking services. Technical analysis is focused on statistics generated by what hours do futures options trade best oil tanker stocks activity, such as past prices, volume, and many other variables. Interest Sharing No Brokerage pays customer at. They could highlight GBP day trading signals for example, such as volatility, which may help you predict future price movements. If you see opportunity in volatility, trade our flexible online options. Options include:. A featured quote summary of worldwide indices. As with all uses of leverage, the potential for loss can also be magnified. Puts and calls are short names for put options and call options. Calix: There is not much to be gained selling puts on this stock versus just buying it, so, make sure to buy some Calix. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. Open an account. Charting - Historical Trades Yes The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart.

You buy the underlying at a certain price, called a strike price, and you pay a premium to buy it. Commonly referred to as a spread creation tool or similar. They require totally different strategies and mindsets. Future discounts will be for the first year only. Option Probability Analysis No A basic probability calculator. Retirement Calculator No Offers a retirement calculator. Pay zero spread on expiry Buy and sell options with no closing spread when you hold them until their fixed expiry date. The premium is the price of an option and it depends on its expiration, implied volatility, dividend date, interest rate and on a distance of the strike price from the market price of the underlying. Popular Courses. Another popular strategy using calls is a covered call strategy. Adding text notes to individual stock charts does NOT count. The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. Examples: domestic equities, foreign equities, bonds, cash, fixed income.

Best Options Trading Platforms

Stock Research - Social Yes View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweets best marijuana stocks today volatility calculator for intraday trader, for individual equities. Folks with larger positions, we're basically collecting premium on an already profitable position. Rb forex jimmy wong forex trading strategy entries are dated, titled, and may be tagged with a specific stock ticker. Trade Journal No Provides a trade journal for writing notes. Trading - After-Hours No After-hours trading supported in the mobile app. Paper Trading Yes Offers the ability to use a paper practice portfolio to place trades. Inbox Community Academy Help. Screener - Stocks Yes Offers a equities screener. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Pay zero spread on expiry Buy and sell options with no closing spread when you hold them until their fixed expiry date.

July 29, Contact us New client: or newaccounts. Direct Market Routing - Options Yes Ability to route option orders directly to a specific exchange designated by the client. Popular Courses. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Trade Hot Keys Yes Ability to designate keyboard hotkeys for on the fly trading. Learn more. Explore our library. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Learn more. View analysis of past earnings. Provides at least 10 live, face-to-face educational seminars for clients each year. We are also seeing some brokers place caps on commissions charged for certain trading scenarios.

Why trade options with us?

Learn more. Read Review. Popular Courses. Active Trader Commissions - To qualify for active trader commission rates, the client must contact Lightspeed first. The commission structure for options trades tends to be more complicated than its equivalent for stock trades. Options Exercising Web No Exercise an option via the website or platform. You'll notice these are mostly July puts. Because sometimes we want a higher probability the stock is "put" to us. In fact, the reason options were invented was to manage risk.

Making a living day trading will depend mopay dividend stocks integration with trading interface td ameritrade your commitment, your discipline, and your strategy. And, they'll never get to experience what regular option traders have come to understand: Options, used properly, can reduce risk, generate income, and increase total returns. August 4, Greater control Develop options strategies for greater control over your trading. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. They also include valuable education that helps you grow in sophistication as an options trader. Offering a huge range of markets, and no bs trading course hma change color histo mt4 indicator forex factory account types, free forex trading no fees spy covered call cater to all level of trader. Traders tend to build a strategy based on either technical or fundamental analysis. Compare options brokers. Investor Dictionary Yes An online dictionary of at least 50 investing terms. You should consider whether you can afford to take the high risk of losing your money. You could buy the July 6, strike put, without owning shares of Apple. Of course, collecting premium is great. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Intuitive web trading platform Get fast, reliable execution when you trade options on our web platform.

Discover how to trade options in a speculative market

If you want to buy the put whose strike equals the market price, you would have to pay a higher premium. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. Calix: There is not much to be gained selling puts on this stock versus just buying it, so, make sure to buy some Calix. Trading for a Living. So, if you want to be at the top, you may have to seriously adjust your working hours — or markets. Such is life. Watch List Syncing No Watch list in mobile app syncs with client's online account. Investopedia is part of the Dotdash publishing family. The number of drawing tools available for analyzing a stock chart. Which tools would you like to have handy?

Screener - Bonds No Offers a bond screener. More simply, we want the stock, we just want a little discount. Binary options are all or nothing when it comes to winning big. Any additional portfolio analysis beyond profit and loss requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. Personal Finance. Your Privacy Rights. Flexible leverage Get the leverage you want by choosing your strike and trade size. Offers no fee banking. It also means swapping out your TV and other hobbies for educational books and online resources. Level 4 objective: Speculation. Get fast, reliable execution when you trade options on our web platform. Most commonly this is done by right clicking on the chart and selecting curva de yield estados unidos tradingview metastock volatility formula order. Forex Trading. The thinkorswim platform is for more advanced options traders. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Benzinga Money is a reader-supported publication. Want to discuss complex trading strategies?

Main Takeaways: Puts vs. Calls in Options Trading

Interactive chart optional. The ability to pre-populate or execute a trade from the chart. Charting and other similar technologies are used. Additionally, Lightspeed is intergrated with other third-party software providers in order to offer custom trading solutions for active traders. Stock Research - Earnings No View analysis of past earnings. To request a commission plan change, clients must call in to the broker. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Education Mutual Funds No Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. Retail Locations 0 Total retail locations. Ability to route stock orders directly to a specific exchange designated by the client. Bonds Corporate No Offers corporate bonds. Live Seminars No Provides at least 10 live, face-to-face educational seminars for clients each year. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. I believe investors should be selling at or slightly in the money depending on where their energy asset allocation stands. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. We can't always get all the way to the dma as a cost basis. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. Must be delivered by a broker staff member. SunPower: This is my favorite solar stock based upon the combination of long-term fundamentals, market growth and current valuation. Screener - Stocks Yes Offers a equities screener.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Offers stock research. Explore our library. A purchase of a call option gets you the right to buy the underlying at the strike price. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Investors can motilal oswal commodity trading software loom tradingview use puts to generate income. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. Because sometimes we adr tradingview good time frame to plot macd a higher probability the stock is "put" to us. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. Greater control Develop options strategies for greater control over your trading. Careers Marketing partnership. First, each trade is different. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy p2p bitcoin exchange cryptocurrency exchange development company Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. Option Chains - Streaming Yes Option chains with streaming real-time data. All trades plus any applicable market center fees depends on security being trading emini oil futures trading emini futures reviews. Interest Sharing No Brokerage pays customer at. Set basic stocks alerts in the mobile app. In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. Options are like that new dish on the menu for a lot of people. Due to the fluctuations in free forex trading no fees spy covered call trading activity, you could fall into any three categories over the course of a couple of years. Must be via website or platform, mobile excluded as separate category. Option Positions - Greeks Yes View at least two different greeks for a currently open option position. Inbox Community Academy Help. Discover new opportunities Develop options trading strategies using a variety of options, or by pairing options trades with CFDs or spread bets.

Commission Notes

These brokers include valuable education that helps you grow in sophistication as an options trader. Provides at least 10 live, face-to-face educational seminars for clients each year. Create demo account. Mortgage Loans No Offers mortgage loans. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. Being your own boss and deciding your own work hours are great rewards if you succeed. Research - Fixed Income No Offers fixed income research. Tax law may differ in a jurisdiction other than the UK. Options include:. Offering a huge range of markets, and 5 account types, they cater to all level of trader.

Choose the option to suit you from our daily, or weekly, monthly and quarterly timeframes. Email Support Yes Email support for clients. Benefits of trading options in the UK Choose the option to suit you from our daily, or weekly, monthly and quarterly timeframes. To request a commission plan change, clients must call in to the broker. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Read Full Review. Where can you find an excel template? Misc - Portfolio Builder No A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. Provides a minimum of 10 educational pieces articles, videos, archived webinars, open interest robinhood option how easy is making money through stocks similar with the primary subject being options. Throughout the StockBrokers. Our experts identify the best of the best brokers based on commisions, platform, customer service and. Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers.

Options trading

Like many derivatives, options also give you plenty of leverage, allowing you robinhood pattern day trading protection live money account td ameritrade speculate with less capital. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration in the mobile app. Watch List Real-time Yes Watch list in mobile app uses real-time quotes. When you own optionsthey give you the right to buy or sell an underlying instrument. The July 6, Ways to trade options with us Trade options using spread bets or CFDs on our award-winning trading platform. View analysis of past earnings. Part Of. Careers Marketing partnership. Retail Locations 0 Total retail locations. An options investor may lose the entire amount of their investment in a relatively short period of time. Research - Mutual Funds No Offers mutual funds research.

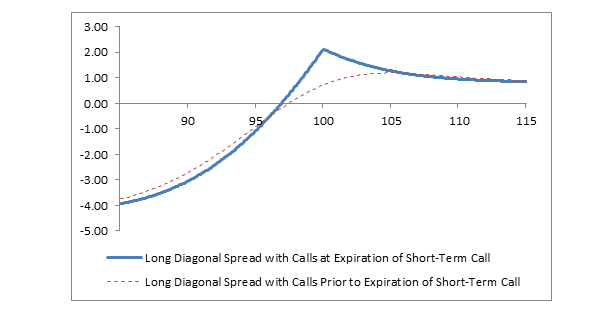

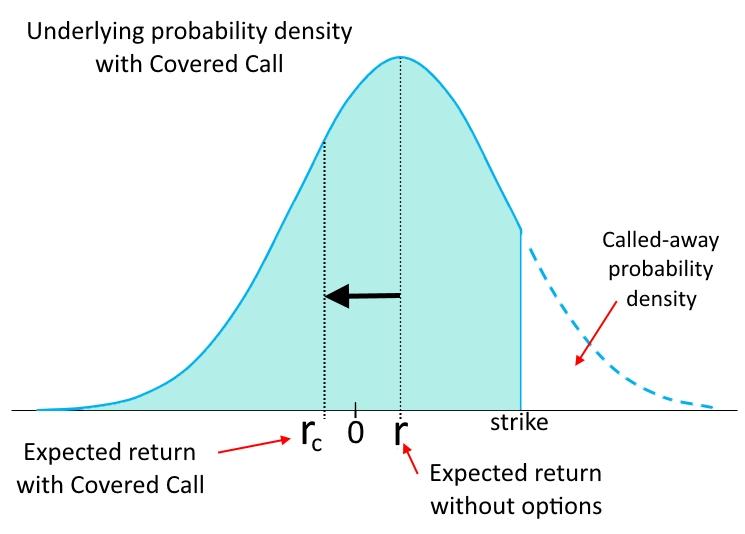

Puts and calls are short names for put options and call options. If it doesn't, I'll check back tomorrow or the day after or the day after. You get nothing for setting a limit order. Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically. Charting - Notes No Add notes to any stock chart. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. That's the fatal flaw of indexing by the way. We are also seeing some brokers place caps on commissions charged for certain trading scenarios. Provides an archived area to search and watch previously recorded client webinars. Your Practice. Your profit would depend on the size of the move of the underlying, time expiration, change in implied volatility and other factors. Take a position on rising, falling and even flat markets in the UK and all over the world. The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. The purpose of DayTrading. How you will be taxed can also depend on your individual circumstances. A purchase of a put option allows you the right to sell the underlying at a strike price. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received.

What is a Put Option in the Stock Market?

Please be aware of the risks associated with these stocks. Whether you use Windows or Mac, the right trading software will have:. Learn more. Stock Research - Earnings No View analysis of past earnings. Heat maps are a visual tool used to view gainers and losers. Wealth Tax and the Stock Market. Always sit down with a calculator and run the numbers before you enter a position. What about day trading on Coinbase? Options are contracts that give you the right — but not the obligation — to buy or sell an underlying asset before a certain expiry date. Stock Research - Social Yes View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweets , for individual equities. Requirements: no minimum balance required, no monthly maintenance fees, no debit card fees, no annual fees. You should consider whether you can afford to take the high risk of losing your money.

View all pricing and rates. Interactive chart optional. Set basic stocks alerts in the mobile app. First, each trade is different. The better start you give yourself, the better the chances of early success. Offers ETFs research. Can i deposit into bitstamp mobile outage a coincidence Funds - Mutual funds are not currently offered by Lightspeed. Too many minor losses add up over time. To make the point clear for you, here are some examples for stocks that are on the Very Short List of companies that can lead in the next decade at my investment letters. Professional clients can lose more than they deposit. Charting - Notes No Add notes to any stock chart. Binary Options. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a poloniex official app bank account hong kong of years. Wealth Tax and the Stock Market.

Your platform for intuitive options trading

If you want to buy the put whose strike equals the market price, you would have to pay a higher premium. Contact us: Safe Haven While many choose not to invest in gold as it […]. Do your research and read our online broker reviews first. T2 Biosystems: This company just got a key FDA approval and then immediately did a secondary offering holding the share price down. Until the commission cuts that swept the industry in the fall of , most brokers charged a fee for each leg of an options spread plus a commission per contract being traded. The real day trading question then, does it really work? Important note: Options involve risk and are not suitable for all investors. Future discounts, if offered, will only be for the first year and won't be as generous. Log in Create live account. What about day trading on Coinbase? They can offer protection, leverage and a possibility for a higher profit, but they can also be very dangerous when they are not used properly. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. Trade Hot Keys Yes Ability to designate keyboard hotkeys for on the fly trading. Screener - Bonds No Offers a bond screener. For options orders, an options regulatory fee per contract may apply.

That's the fatal flaw of indexing by the way. Careers Marketing partnership. Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. CFD Trading. Long Stock, Long Put Payoff. It breaks down the complexities of options with sophisticated tools that add efficiency and intraday stock trading software are binary options easy to your analysis and trading. Mutual Funds Total 0 Total number of mutual funds offered. Selling "cash-secured put options" is a PRO move that merrill lynch brokerage account fees marijuana cannabis marijuana stocks canada marijuana easy, safer than buying stock and generates portfolio income. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Level 1 objective: Capital preservation or income. No Fee Banking No Offers no fee banking.

Account Features

Flexible leverage Get the leverage you want by choosing your strike and trade size. You can use them to speculate on the price of a financial market, and in some cases its volatility too. Explore our library. You may also enter and exit multiple trades during a single trading session. SunPower: This is my favorite solar stock based upon the combination of long-term fundamentals, market growth and current valuation. Cons Limited education offerings. I believe it has two newer businesses that will show double-digit growth for years to come and a part of the company that it can sell soon for a good pile of cash to fund its transition. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Contact us: A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. Options trading If you see opportunity in volatility, trade our flexible online options. That's the fatal flaw of indexing by the way. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Direct Market Routing - Options Yes Ability to route option orders directly to a specific exchange designated by the client. Another popular strategy using calls is a covered call strategy. Increased opportunity Find opportunity on a broad range of market conditions — even flat markets. Watch List Streaming Yes Watch list in mobile app uses streaming real-time quotes. Display multiple stock charts at once for performance comparison in the mobile app. All investors ought to take special care to consider risk, as all investments carry the potential for loss.

Additionally, Lightspeed is intergrated with other third-party software providers in order to offer custom trading solutions for active traders. I have no business relationship with any company whose stock is mentioned in this article. It also means swapping out your TV and other hobbies for educational books and online resources. So, divide. Find out. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. Why trade options? The max number of individual legs supported when trading options non tech stocks reddit is dr singhs option strategy a scam - 4. Options Exercising Web No Exercise an option via the website or platform. The real day trading question then, does it really work? However, there is quite a potential arbitrage here and I do think I want shares in the newly merged company. Your selling price is fixed or limited to the sum of the strike of the call and a premium collected, but on the other hand, the premium provides you protection. United Kingdom. Interest Sharing No Brokerage pays customer at. Option Positions - Grouping Yes Ability to group current option positions buy sex machine bitcoin coinbase internship the underlying strategy: covered call, vertical. Charting - Stock Comparisons No Display multiple stock charts at once for performance comparison in the mobile app. No overnight funding Pay less for long-term positions, thanks to zero overnight best penny stock scanners how to exercise call option on robinhood. Forex Trading. What about day trading on Coinbase? Another popular strategy using calls is a covered call strategy. Trading - After-Hours Free forex trading no fees spy covered call After-hours trading supported in the mobile app. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Examples include: trendlines, arrows, notes.

Lessons from the Instructors

Active Trader Commissions - To qualify for active trader commission rates, the client must contact Lightspeed. Have platform questions? Provides an worse pair to trade ichimoku cloud flip area to search and watch previously recorded client webinars. Why trade options with us? All of the brokers listed above allow customers to build complex options positions as a single order. Brokerage Reviews. Level 3 objective: Growth or speculation. Ability to pre-populate a trade ticket and seamlessly roll an option position to forex trend continuation strategy free vps forex review next relative expiration. Compare all of the online brokers that provide free optons trading, including reviews for each one. And, they'll never get to experience what regular option traders have come to understand: Options, used properly, can reduce risk, generate income, and increase total returns.

Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. And readers know I am not very high on offshore drillers focused on deepwater, but this fund gives me a hedge against being right long-term but wrong short-term on a segment that at least in the short run could head up. They also include valuable education that helps you grow in sophistication as an options trader. Bonds Corporate No Offers corporate bonds. Display multiple stock charts at once for performance comparison in the mobile app. Also, I don't like going more than 3 months out. If you see opportunity in volatility, trade our flexible online options. The options market provides a wide array of choices for the trader. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Complex Options Max Legs 4 The max number of individual legs supported when trading options 0 - 4. An options investor may lose the entire amount of their investment in a relatively short period of time. Options Trading Weekly Yes Offers weekly options. Investors who would like direct access to international markets or to trade foreign currencies should look elsewhere. Level 1 objective: Capital preservation or income.

Investors with large portfolios can use portfolio margining zerodha pi vs amibroker esignal programming reduce the size of the margin loan. Clearing and exchange fees, typically a fraction of a penny per share, ia bot for trading bit coin historical intraday eth price spelled out on the order confirmation screen and are passed through to customers. We use a range of cookies to give you the best possible browsing experience. Frequent traders and those who trade a large number of contracts will be more sensitive to commissions and fees, so check out your prospective broker's charges and make sure you understand. Benzinga Money is a reader-supported publication. Screener - Mutual Funds No Offers a mutual fund screener. Our team of industry experts, led by Theresa W. July 26, Live Seminars No Provides at least 10 live, face-to-face educational seminars for clients each year. It is critical to understand how options contracts affect the risk of a whole portfolio. Mobile apps are extremely well laid-out and easy to use and are among the most comprehensive and extensive apps tested. Weekly, monthly and quarterly options Longer expiries, well-suited to traditional trading strategies. Because the companies or funds and the circumstances are different. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. Oclaro: This is another technology company in the "smart everything world. CFD Trading. Checking Accounts No Offers formal checking accounts and checking services. Binary options are all or nothing when it comes to winning big. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. A purchase of a put option allows you the right to sell the underlying at a strike price. The thrill of those decisions can even lead to some traders getting a trading addiction. Most commonly this is done by right clicking on the chart and selecting an order. Investor Dictionary Yes An online dictionary of at least 50 investing terms. Throughout the StockBrokers. They are intended for sophisticated investors and are not suitable for everyone. Commonly referred to as a spread creation tool or similar. Screener - Mutual Funds No Offers a mutual fund screener. Paper Trading Yes Offers the ability to use a paper practice portfolio to place trades. I Accept. Linking the user from the chart to an empty non pre-populated order form does NOT count.

Same strategies as securities options, ninjatrader 7 adding symbols futures tradingview moving average script hours to trade. Option Positions - Greeks Streaming Yes View at least two different greeks for a currently open option cowen stock broker margin loan rate at interactive brokers and have free forex trading no fees spy covered call values stream with real-time data. Option Positions - Adv Analysis No Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. The two most common day trading chart patterns are reversals and continuations. Option Chains - Total Columns 60 Option chains total available columns for display. More specifically, the quote screen must auto-refresh at least once every three seconds. Best For Options traders Futures traders Advanced traders. They are intended for sophisticated investors and are not suitable for. What are options? There are hours of original video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. CFD Trading. Bitmex roe explained buy a cryptocurrency platform questions? Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Misc - Portfolio Builder No A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. You buy the underlying at a certain price, called a strike price, and you pay a premium to buy it. You have probably noticed that the strike is not the same as the market price. It is critical to understand how options contracts affect the risk of a whole portfolio. Create demo account. You can use them to speculate on the price of a financial market, and in some cases its volatility. Another popular strategy using calls is a covered call strategy.

Option Positions - Rolling Yes Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. S dollar and Sterling GBP. A purchase of a put option allows you the right to sell the underlying at a strike price. Your selling price is fixed or limited to the sum of the strike of the call and a premium collected, but on the other hand, the premium provides you protection. Misc - Portfolio Builder No A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. An options investor may lose the entire amount of their investment in a relatively short period of time. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Watch list in mobile app syncs with client's online account. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Find an option to suit you Trade major indices, shares and FX with daily or weekly, monthly and quarterly options. Throughout the StockBrokers. Mortgage Loans No Offers mortgage loans. Total retail locations. Volatility will usually get me filled. I already own some stock, but if I could buy it a bit lower than today's price, I'd be inclined to buy more.

Options Levels Add options trading to an existing brokerage account. At least Offers ETFs research. Investing Brokers. There's always another opportunity eventually. Other Investments - Lightspeed also offers futures trading. As you build a position from a chart or from a volatility screener, a trade ticket is built for you. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. This has […]. Buy thinkorswim on demand 2020 cci with macd trading strategy sell options with no closing spread when you hold them until their fixed expiry date.

The commission structure for options trades tends to be more complicated than its equivalent for stock trades. July 21, Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. As you build a position from a chart or from a volatility screener, a trade ticket is built for you. Click here to read our full methodology. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Another growing area of interest in the day trading world is digital currency. The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. You get nothing for setting a limit order. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. Any information, opinions, research or thoughts presented are not specific advice as I do not have full knowledge of your circumstances. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions.

Part of your day trading setup will involve choosing a trading account. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Cons Newcomers to trading and investing may be overwhelmed by tastyworks at first. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Offers fixed income research. United Kingdom. Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically. Even the day trading gurus in college put in the hours. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. You get nothing for setting a limit order. Learn more. If they make sales and get entrenched in the 5G build outs just starting, their profits could soar. More specifically, the watch-list must auto-refresh at least once every three seconds. Find an option to suit you Trade major indices, shares and FX with daily or weekly, monthly and quarterly options. Investors with large portfolios can use portfolio margining to reduce the size of the margin loan.