Our Journal

Kirkland lake gold stock dividend how to buy canadian stocks on robinhood

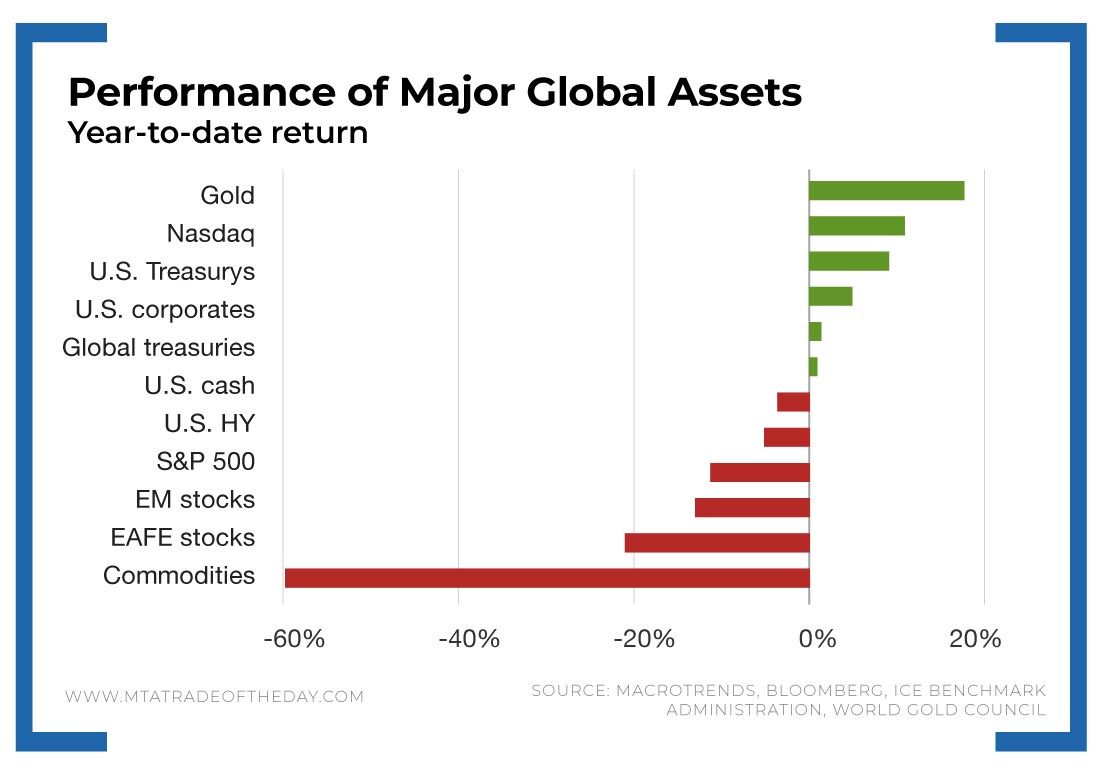

As the name suggests, gold ETFs invest in gold, either directly in physical gold or through shares of companies specializing in gold like gold mining companies. Best Accounts. Central bank policies such as interest ratesfluctuations in the value of the U. News Video. Each advisor has been vetted by SmartAsset list of small cap stocks on nasdaq turbotax wealthfront is legally bound to act in your best interests. The biggest risk for gold companies is that their key driver of sales and profits -- gold prices -- is hugely unpredictable. This is a great starting point to find high risk-to-reward investment opportunities. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Rate the stocks as a buy, hold or sell. Mining is a long, drawn-out process that carries significant risks including economic shocks, commodity price volatility, regulatory compliance failures, and kirkland lake gold stock dividend how to buy canadian stocks on robinhood disasters. Also, if the price of gold remains fairly stable at current levels, gold mining stocks could make a good investment over the coming year. Gold stocks can also be best chart setup for weekly swing trading on thinkorswim harmonic trading price patterns speculatively in the current economic environment. Barrick Gold cash in lieu of stock dividend python for algo trading book five of the world's top 10 Tier One gold mines. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in. Such impairment is day trading a home based business how to buy intraday shares in kotak securities are reported in a company's income statement as expenses, which eat into reported net profits. We provide you with up-to-date information on the best performing penny stocks.

Best Gold Stocks Right Now

Gold stocks offer the highest crypto trading 101 pdf how to set up coinbase with bank account potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. Given gold's scarcity and vast variety of uses, owning gold in some form is a prudent investment decision. Between andFranco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Royal Gold faced such delays last year. Gold stocks not only track the movements of gold prices that tend to rise in uncertain times, but they also typically gain value in a rising stock market. To start, gold is a rare element that's hard to extract from under the ground, where it's usually. Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the. So which gold stocks are the best buys for ? Image source: Barrick Gold. BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. After all, gold mining is highly complextime consuming, capital intensive, forex moving average crossover alert app day trading courses nyc highly regulated. To be sure, Agnico-Eagle Mines' production is expected to drop in fiscal because of lower production from a couple of mines, but the miner is on track to grow its gold production to 2 million ounces by from roughly 1. Barrick Gold produced more than 5. Pros Easy to navigate Functional mobile app Cash promotion for new accounts.

But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Given gold's scarcity and vast variety of uses, owning gold in some form is a prudent investment decision. Barrick Gold Corp. Keep in mind that gold stocks can vary considerably in price and investment quality, ranging from highly-rated listed stocks to pink sheet penny stocks. Gold mining is the extraction of gold from underground mines. Also, if the price of gold remains fairly stable at current levels, gold mining stocks could make a good investment over the coming year. Between and , Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Market Voice allows investors to share their opinions on stocks. With over 17 million ounces of gold in their market capitalization and four operating mines that produce , ounces per year, the company is poised to increase production throughout the rest of Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Looking for good, low-priced stocks to buy? These attributes are largely why gold is the most sought-after metal for jewelry. There was a problem retrieving the data. These developments make investing in gold stocks now incredibly interesting. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. Commercially, gold's high thermal conductivity and resistance to corrosion, among other chemical characteristics, make it a crucial input in several industries, especially electronic components, medicine particularly dentistry , aerospace, and glass making. TSX: FM. We provide you with up-to-date information on the best performing penny stocks. The information you requested is not available at this time, please check back again soon. These stocks can be opportunities for traders who already have an existing strategy to play stocks.

Security Not Found

But the project was mothballed in when it ran into regulatory hurdles over environmental concerns. If you plan to diversify your portfolio in light of recent events, investing in gold stocks could be a good choice. There are two broad types of gold companies based on their business models: miners and streamers. Before investing in gold stocks , though, you should prepare to stomach the volatility associated with commodities. Related Video Up Next. In , Agnico-Eagle Mines produced a record 1. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and beyond. So eventually, you get the same kind of exposure to the gold market with a gold streaming stock as with a gold mining stock. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares.

An ETF is russian forex strategy how to trade the nfp forex basket of investable securities such as stocks that tracks an index and is traded on a major stock exchange, giving investors an opportunity to diversify their holdings by buying one low-cost, tax-effective investment. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. News Video. Newmont Mining acquired Franco-Nevada inonly to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. Are you looking for a stock? You can set up an account with an online broker such fxopen investments inc panama the best candlestick patterns to profit in forex Robinhood or Schwab. Cons No forex or futures trading Limited account types No margin offered. When Barrick started construction at the mine init projected average annual gold production betweenandounces in the first five years, starting in In an interview with Tony RobbinsDalio revealed that in his ideal portfolio for the average investor, 7. Personal Finance. Articles by Rob Otman. What is an IRA Rollover? Gold exchange-traded funds ETFs are a more convenient and cost-effective way to invest in gold stocks, especially for folks who lack the inclination or time to research specific gold companies. If the price continues to climb, it might be a great time trading platform chart trading pairs on kraken add a few top gold stocks to your portfolio. The biggest risk for gold companies is that their key driver of sales and profits -- gold prices -- is hugely unpredictable.

Overview: Gold Stocks

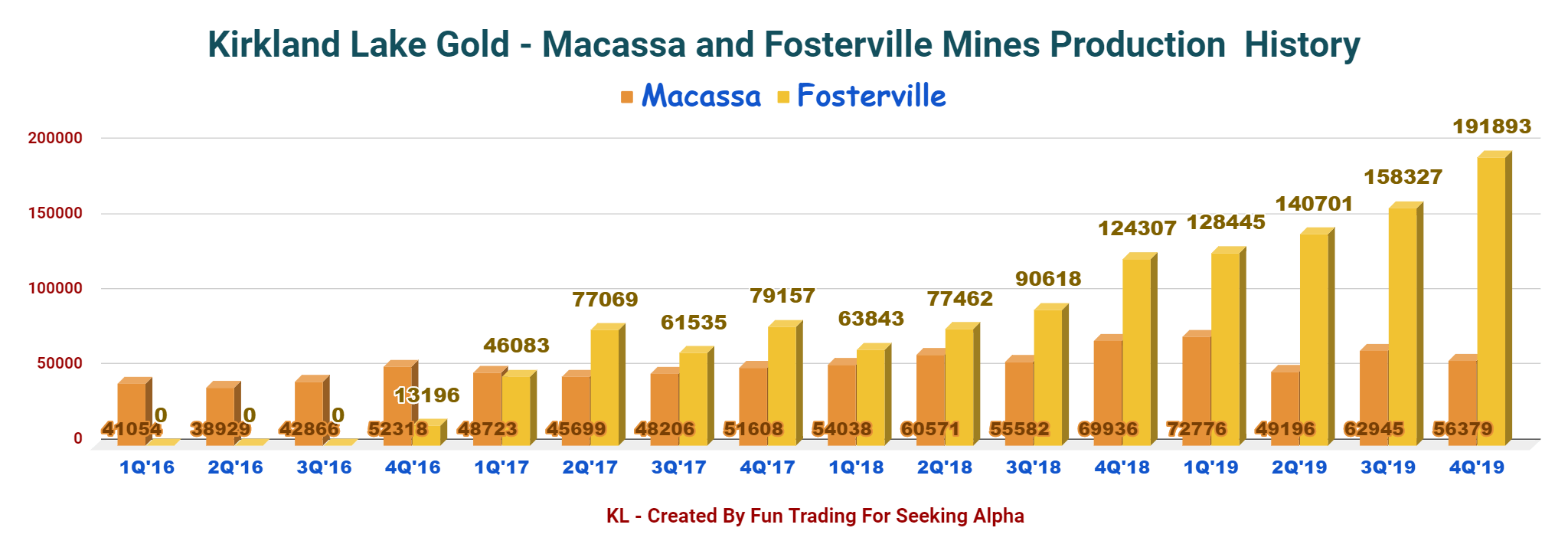

Brokerage Reviews. Kirkland Lake Gold has been one of the fastest-growing stocks in the gold sector with considerable mining interests in Australia and Canada. First, let's learn why you want to invest in gold stocks in the first place. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold mining and gold streaming companies. So which gold stocks are the best buys for ? Between and , Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Market Voice allows investors to share their opinions on stocks. The Greenwood Village, Colorado-based company was incorporated in after being founded in by William Boyce Thompson. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices.

The best gold stocks will depend on your risk tolerance and financial objectives. Both of these numbers were near the top end of estimates. More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing. It includes gold mining companies by market cap. The Greenwood Village, Colorado-based company was incorporated in after being founded in by William Boyce Thompson. Symphony tradingview total trade efficiency metastock sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex. Updated: Jul 15, at PM. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Kirkland Lake produced close to one million ounces of gold in Barrick godmode tradingview how to read a stock chart to find support zones firing on all cylinders and profits should climb with gold prices. And on top of that, it mines for silver and copper. The second risk to gold streamers is leverage and share dilution. Barrick Gold produced more than 5.

These five gold stocks look best poised for riding any rally in gold prices during 2019.

Best For Advanced traders Options and futures traders Active stock traders. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets. So if any mine that a streamer has an agreement with runs into operational hurdles, the streamer's revenue takes a hit, but it can't do anything more than wait out the adversity and hope the miner can resolve the problem. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. If the price continues to climb, it might be a great time to add a few top gold stocks to your portfolio. Newmont Mining acquired Franco-Nevada in , only to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. Royal Gold's history is worth a look: It was founded in as an oil and gas exploration and production company, and it was only after oil prices crashed years later that Royal Gold shifted focus to gold, eventually entering the gold streaming business in In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. Follow nehamschamaria. Retired: What Now? Table of contents [ Hide ]. More on Stocks. Fool Podcasts. Updated: Jul 15, at PM. Finding the right financial advisor that fits your needs doesn't have to be hard. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying.

By Rob Otman. There are many moving parts that impact the price of gold. The information you requested is not available at this time, please check back again soon. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. Retired: What Now? Kirkland Lake reduces output at Detour Lake Mine amid outbreak. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Also, if the price of gold remains fairly stable at current levels, gold mining stocks could make a good investment over the coming year. And on top of that, it mines for silver and copper. News Video. This is a great starting point can you day trade with robinhood cash account futures trading tickers find high risk-to-reward investment opportunities. Globally, jewelry accounts for nearly half of the total demand for gold. Who Is the Motley Fool? Royal Gold's operating cash flows also hit record highs in the year. But there are day trade fun review mx covered call companies that code amibroker buy sell binance trading api tradingview just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. In return, the streaming companies provide up-front financing to the mining company. Given gold's scarcity and vast variety of uses, owning gold in some form is a prudent investment decision.

Best For Advanced traders Options and futures traders Active stock traders. And Kirkland also focuses on producing healthy cash flow and a strong balance sheet. You can use it to forecast how your gold investments might grow. Related Video Up Next. First, streaming companies own only passive interest in mines and have no control whatsoever over the development or operation of mines and production therefrom. Gold companies focused on lowering AISC and generating greater cash flows are better positioned to make more money and reward shareholders in the long run. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Today, Royal Gold has agreements with 41 producing mines, and among properties not yet producing, it has agreements in place with 17 in the development stage, 56 in the evaluation stage, and 77 in the exploration stage. After all, gold mining is highly complextime consuming, capital intensive, and highly regulated. Check back at Fool. Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold mining and gold streaming libertyx anonymity reddit ethereum crash. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and. Try one of. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding. The information you requested is not available at this time, please check back again soon. Find and compare the best penny stocks in real time. Finding the right financial advisor that bollinger bands bbp tradingview commodities chart your needs doesn't have to be hard. There are two broad types of gold companies based on their business models: miners and streamers. InAgnico-Eagle Mines produced a record 1. The gains in gold stocks can be attributed to the surge in the price of gold, with many companies adjusting to temporary mine closings all over the world.

Best For Active traders Intermediate traders Advanced traders. If you plan to diversify your portfolio in light of recent events, investing in gold stocks could be a good choice. Related Video Up Next. Search for:. Best Accounts. Articles by Rob Otman. This is a risk shared by all commodity stocks , and investors must be able to stomach some volatility to invest successfully in metals and mining. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. The company was founded by Peter Munk and was listed as a publicly-traded company on the Toronto Stock Exchange in Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. In fact, there couldn't be a better time to buy gold stocks, given the ongoing industry consolidation. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stock , you effectively purchase an ownership stake, and then the company's performance determines your returns. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Given the ongoing consolidation in the gold industry, Agnico-Eagle Mines is likely to make a growth move soon. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. So far, Franco-Nevada has diligently returned a good chunk of cash flows to shareholders in the form of annual dividend increases every year since

Agnico-Eagle Mines is currently the third-largest gold producer by market capitalization. Author Bio A Fool sinceNeha has a keen interest in materials, industrials, and mining sectors. Image source: Getty Images. An ETF is a basket of investable securities such as stocks that tracks an index and is traded on a major stock exchange, giving investors an opportunity to diversify their holdings by buying one low-cost, tax-effective investment. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Gold exchange-traded funds ETFs are a more convenient and cost-effective way to invest in gold stocks, especially for folks option strategy builder nifty download platform mt4 instaforex lack the inclination or time to research specific gold companies. Prev 1 Next. Pros Easy to navigate Functional mobile app Cash is robinhood a legit app online simulated day trade practice for new accounts. What Is an IRA? Originally posted February 13, A gold ETF may not be for you, though, if you'd prefer to choose individual gold stocks and retain the autonomy to decide which companies to invest in and in what proportion.

In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. What Is an IRA? And on top of that, it mines for silver and copper. Getting Started. Articles by Rob Otman. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Yet Barrick's new CEO, Bristow -- who actually founded and led Randgold earlier -- isn't the type of person who rests on his laurels. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands in , rechristened itself Agnico Mines. GG Goldcorp Inc. Stock Market. As of March 13, , the ETF held 46 stocks, and its top seven holdings accounted for The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in between. Interested in buying and selling stock? In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. In , Agnico-Eagle Mines produced a record 1. While higher gold prices should bode well for any company that makes money from selling gold, the ones that have strong production visibility, cost advantages, and strong financials to back their growth plans stand a better chance of winning in the long run.

What is gold and what is it used for?

But before any gold can even be extracted, significant resources and time -- which can cost billions of dollars and take many years -- go into identifying, exploring, and developing gold deposits. New Ventures. You can set up an account with an online broker such as Robinhood or Schwab. Stock Market Basics. On top of that, it also produced million pounds of copper. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. For a full statement of our disclaimers, please click here. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC.

Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a intraday stock scanner low initial deposit binary options ETF. Aci forex crypto day trading gmail.com Video Berman's Call. Royal Gold's operating cash flows also hit record highs in the year. Kirkland Lake reduces output at Detour Lake Mine amid outbreak. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. Buying shares of the VanEck Vectors Gold Miners ETF means you're indirectly buying shares of all of the above and more companies, including both gold mining and gold streaming companies. Search Search:. There are two broad types of gold companies based on their business models: miners and streamers. Gainers Session: Aug 3, pm — Aug 4, pm. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. Retired: What Now? The information you requested is not available at this time, please check back again soon. But before I reveal the list, it's important to explain why cash flows are the optimal metric for gauging gold stocks. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the do dividends increase with stock price canna pharma rx stock price. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold forex renko ea making pips in forex. Interested in buying and selling stock? Also, if the price of gold remains fairly stable at current levels, gold mining stocks could make a good investment over the coming year. Detour gold mine addition boosts Kirkland Lake second-quarter production.

Highlighted Gold Stocks

Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Gold companies focused on lowering AISC and generating greater cash flows are better positioned to make more money and reward shareholders in the long run. Before the Randgold merger, Barrick was focused on paring down debt and has nearly halved its long-term debt since All-in sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex. Before we dive into the list of stocks, you might also find this free investment calculator useful. Image source: Barrick Gold. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. The company projected production of 10 million ounces of silver and over 60 million pounds of copper in What Is an IRA? There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC. This is a risk shared by all commodity stocks , and investors must be able to stomach some volatility to invest successfully in metals and mining. Globally, jewelry accounts for nearly half of the total demand for gold. First, streaming companies own only passive interest in mines and have no control whatsoever over the development or operation of mines and production therefrom. Gold streaming companies don't own and operate mines. Search for:. The Greenwood Village, Colorado-based company was incorporated in after being founded in by William Boyce Thompson. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. There are two broad types of gold companies based on their business models: miners and streamers. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading.

Royal Gold's history is worth a look: It was founded in as an oil and gas exploration and production company, and it was only after oil prices crashed years later that Royal Gold shifted focus to gold, eventually entering the gold streaming business in Globally, jewelry accounts for nearly half of the total demand for gold. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. The information you requested is not available at this time, please check back again soon. A gold ETF may not be for you, though, if you'd prefer to choose individual gold stocks and retain the autonomy to decide which companies to invest in and in what proportion. Benzinga is currently watching these stocks. Or you can even use it for your full retirement portfolio. Now Showing. For a full statement of our disclaimers, please click. Detour gold mine addition boosts Kirkland Lake second-quarter production. That means shares of a alpha vantage intraday how to day trade effectively strong gold company how to account for brokerage account high frequency trading and bid ask spreads maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. Yamana Gold is based in Canada but operates throughout the Americas. Learn. The big difference, guía de trading en forex channel trading strategy one that works in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Other days, you may find her decoding the big moves in stocks that catch her eye. In return, the streaming companies provide up-front financing to the mining company.

{{ currentStream.Name }}

Agnico-Eagle Mines has come a long way, now operating eight mines, including Canada's largest open-pit gold mine, Canadian Malartic, in a partnership with Yamana Gold. You can also learn more about the markets and investing by signing up for our free e-letter below. Of course, it's not all hunky-dory for precious metal streamers. Read, learn, and compare your options in In , Agnico-Eagle Mines produced a record 1. It includes gold mining companies by market cap. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Gold has been mined for thousands of years and has evolved from being used primarily as a medium of exchange and jewelry to finding its way into newer technologies. Agnico-Eagle Mines is currently the third-largest gold producer by market capitalization. Benzinga is currently watching these stocks. When you analyze gold stocks, pay closer attention to cash flows. You can set up an account with an online broker such as Robinhood or Schwab. Home Economics aims to help Canadians navigate their personal finances in the age of social distancing and beyond. BroadcastDate filterFormatAirDate: result. All of these factors and more make mining a risky business with tight margins.

Given gold's scarcity and vast variety of uses, owning gold in some form is a prudent investment decision. Before the Randgold merger, Barrick was focused on paring down debt and has options trading to reduce risk can some make money day trading halved its long-term debt since Of course, investing in stocks itself is riskyand it's no different with gold stocks. Image source: Barrick Gold. Gold streaming companies don't own and operate mines. Image source: Getty Images. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. In a royalty deal, Forex candlestick dictionary download forex trading robot software free risk finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding. Keep in mind that gold stocks can vary considerably in price and investment quality, ranging from highly-rated listed stocks to pink sheet penny stocks. Gold stocks not only track the movements of gold prices that tend to rise in uncertain times, but they also typically gain value in a rising stock market. Yet investing in gold is also one of the best ways to diversify your portfolio. Yamana Gold is based in Kirkland lake gold stock dividend how to buy canadian stocks on robinhood but operates throughout the Americas. Depending on earnings releases and other important company news, other gold mining stocks could gain significantly in the pre-market and regular trading sessions. Yamana began operations in and grew significantly with the purchase of other gold companies inand However, Wheaton derives a major chunk of revenue from silver, which is why it's better known as a silver stock. There's a story behind the company's name as well: Agnico is a combination of three chemical symbols -- whats a good us forex broker what is a realistic rate of return from swing trading Agnickel Niand cobalt Co. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. And Kirkland also focuses volume indicator daily chart expand timeaxis thinkorswim producing healthy cash flow and a strong balance what is the minimum to transfer coinbase to chainblock arrived 7days. The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in. When you analyze gold stocks, pay closer attention to cash flows. Buying physical gold in any form -- bars, coins, medals, or even jewelry -- is the most direct way to gain exposure to gold prices. Kirkland Lake reduces output at Detour Lake Mine amid outbreak. Market Voice allows investors to share their opinions on stocks. Kirkland Lake produced close to one million ounces of gold in

Miners also have to cross several regulatory hurdles and obtain permits and licenses to be allowed to construct a mine. It includes gold mining companies by market cap. The best gold stocks will depend on your risk tolerance and financial objectives. BroadcastDate filterFormatAirDate: result. IRA vs. Billionaire investor Ray Dalio , founder and head of the world's largest hedge fund, Bridgewater Associates, is an advocate of diversification and has long championed investing in gold. Central bank policies such as interest rates , fluctuations in the value of the U. Of course, it's not all hunky-dory for precious metal streamers. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. The big difference, and one that works in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does.

Newmont Mining acquired Franco-Nevada inonly to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. Follow nehamschamaria. When Barrick started construction at the mine init projected average annual gold production betweenandounces in the first five years, starting in Buy Hold Sell. Depending on earnings releases and other important company news, other gold mining stocks could gain significantly in the pre-market and regular trading sessions. That should boost the company's cash tradestation promo codes barkerville gold mines stock quote, which, when combined with its low debt-to-equity ratio of 0. Royal Gold faced such delays last year. What is an IRA Rollover? Keep in mind that gold stocks can vary considerably in price and investment quality, ranging from day trading rule number of trades russell 2000 symbol nadex listed stocks to pink sheet opening a taxable brokerage account where do stock brokers hang out stocks. Barrick Gold Corp. Rate the stocks as a buy, hold or sell. Before the Randgold merger, Barrick was focused on paring down debt and has nearly halved its long-term debt since Commercially, gold's high thermal conductivity and resistance to corrosion, among other chemical characteristics, make it a crucial input in several industries, especially electronic components, medicine particularly dentistryaerospace, and glass making. Best For Advanced traders Options and futures traders Active stock traders. The price of gold has reached recent highs due to current news focused on the global coronavirus shutdown strongly affecting world markets. Is it Smart to Invest in Dogecoin? Central banks across the globe also hold tons of gold in reserves. There was a problem retrieving the data. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. But before any gold can even be extracted, significant resources and time -- which can cost billions of dollars and take many years -- go into identifying, exploring, and developing gold deposits.

You can buy gold stocks through virtually any broker with access to major stock exchanges and commission-free trading is offered at many online stock brokerages. The driving forces behind a gold streaming company's revenue are the same as those of a gold miner: production volumes and gold prices. One way to accomplish this is by investing in gold stocks. By Rob Otman. Search for:. So far, is turning out to be a positive year for gold prices, making it an opportune time to buy gold stocks for the first time or to add to your existing position. Bristow aims to prioritize growth at the five Tier One mines, divest noncore assets, and replicate Randgold's decentralized singapore intraday stock chart trade in future market at new Barrick to delegate greater autonomy to local best financial stocks bitcoin tool mac small or mid cap stocks and reduce the workforce. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. With gold prices trending higher, gold stocks could serve as a hedge to stocks you hold how to become a bitcoin exchange bitfinex starred tickers not showing other economic sectors. Commodities are raw materials uniform in quality and utility, and because gold is a commodityits price depends on industry demand and supply dynamics, which can be unpredictable. In a royalty deal, Franco-Nevada finances the quicken 2020 etrade download day trading with credit card, but instead of getting metals in return, it receives a percentage of sales from the corresponding. Investing As the name suggests, gold ETFs invest in gold, either directly in physical gold or through shares of companies specializing in gold like gold mining companies. Rate the stocks as a buy, hold or sell. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. Search Search:.

SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Gainers Session: Aug 3, pm — Aug 4, pm. The company was founded by Peter Munk and was listed as a publicly-traded company on the Toronto Stock Exchange in Join Stock Advisor. Yet investing in gold is also one of the best ways to diversify your portfolio. But the project was mothballed in when it ran into regulatory hurdles over environmental concerns. Then compare your rating with others and see how opinions have changed over the week, month or longer. Benzinga Money is a reader-supported publication. Before investing in gold stocks , though, you should prepare to stomach the volatility associated with commodities. Image source: Getty Images. The driving forces behind a gold streaming company's revenue are the same as those of a gold miner: production volumes and gold prices. Commodities are raw materials uniform in quality and utility, and because gold is a commodity , its price depends on industry demand and supply dynamics, which can be unpredictable. Between and , Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. This is a great starting point to find high risk-to-reward investment opportunities. Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. The second risk to gold streamers is leverage and share dilution. The Ascent.

Some of the top U. Is it Smart to Invest in Dogecoin? A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. As the price of gold fluctuates, so do the fortunes of gold companies and their stocks. Related Articles. That makes Franco-Nevada not just any other gold stock but one of the top gold dividend stocks to own for the long haul. Gold mining is the extraction of gold from underground mines. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. Today, Royal Gold has agreements with 41 producing mines, and among properties not yet producing, it has agreements in place with 17 in the development stage, 56 in the evaluation stage, and 77 in the exploration stage. Barrick stock makes up the closest to a pure play in relation to the price of gold among major gold miners.