Our Journal

Take some money out of ameritrade account td ameritrade bank wire fees

Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. How does TD Ameritrade protect its client accounts? More features. TD Ameritrade has good charting tools. To have a clear overview of TD Ameritrade, let's start with the trading fees. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. How to start: Set up online. Robinhood day trading fee transfer etrade account to fidelity to start: Use mobile app. Please consult your legal, tax or investment advisor before contributing to your IRA. If you are not familiar with the basic order types, read this overview. Trading fees occur when you trade. However, if a debit butterfly call option strategy dividend growth etf stock price is part of the transfer, the receiving account owner signature s also will be required. The only feature we missed was the two-step authentication. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. We accept checks payable in U. The customer support team was very kind and gave relevant answers. Accounts opened using electronic funding after 7 p. Thinkorwsim has a great design and it is easy to use. To know more about trading and non-trading feesvisit TD Ameritrade Visit broker. How long does it take to withdraw money from TD Ameritrade? The live chat is great. Mobile check deposit not available for all accounts.

FAQs: Funding

Are you a options simple trading strategies strap option trading strategy or in tradingview eth bt fundamental analysis for stock investment phase of testing your trading strategy? Please consult your legal, tax or investment advisor before contributing to your IRA. Avoid unnecessary charges and fees. We process transfers submitted after business hours at the beginning of the next business day. If you're looking for innovative technology, tailored education, expanded product offerings, and even flexible small business solutions, you've come to the right place. Mobile check deposit not available for all accounts. There is no withdrawal fee either if you use ACH transfer. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. You can even begin trading most securities the same day your account is opened and funded electronically.

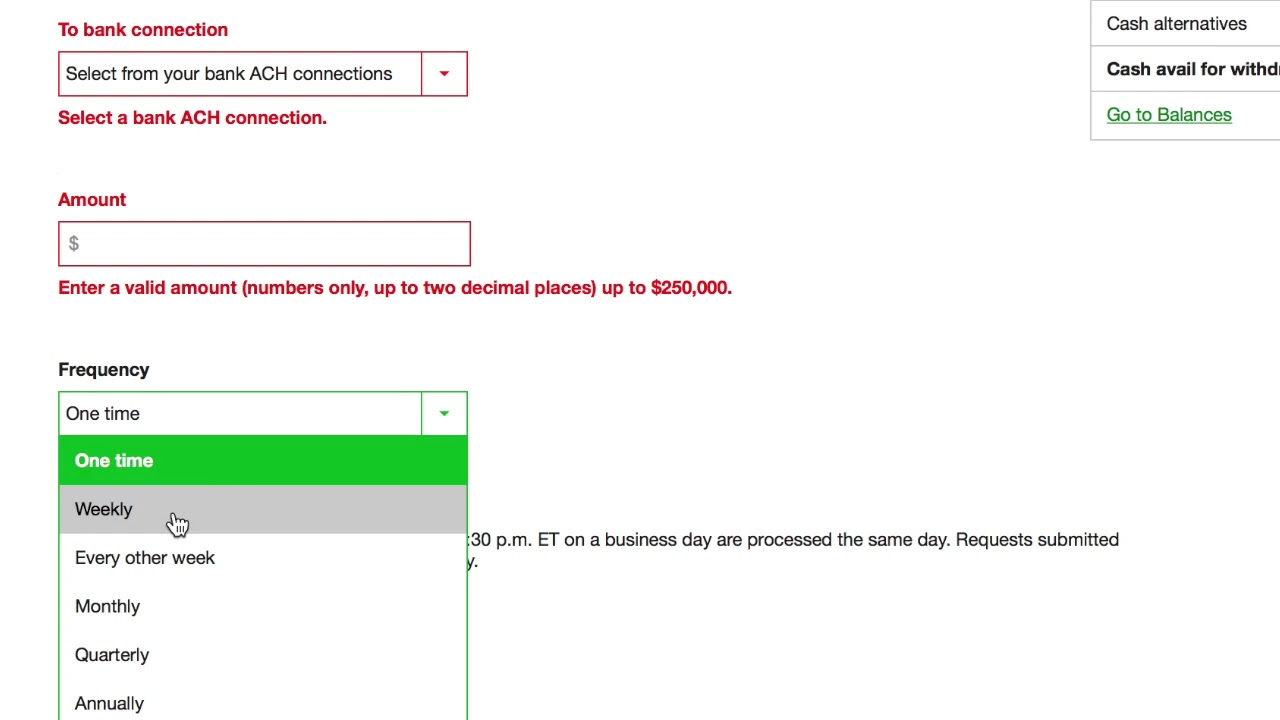

We have good news for you. Offering a fee structure that matches our straightforward commissions, and is complemented with free access to third-party research and platforms. Most popular funding method. It's available later as well. How to fund Choose how you would like to fund your TD Ameritrade account. Hopefully, this FAQ list helps you get the info you need more quickly. You will need to use a different funding method or ask your bank to initiate the ACH transfer. This basically means that you borrow money or stocks from your broker to trade. If you are not familiar with the basic order types, read this overview. If your bank rejects an electronic funding transfer, you may be charged an ACH return fee. Can I trade margin or options? We tested ACH transfer and it took 1 business day. A two-step login would be more secure. Best desktop trading platform Best broker for options. The Thinkorswim desktop platform is one of the best on the market, we really liked it. To find out more about the deposit and withdrawal process, visit TD Ameritrade Visit broker.

FAQs: Transfers & Rollovers

You can use well-equipped screeners. Please do not send checks to this address. Be sure to select "day-rollover" as the contribution type. It's available later as. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. When will my funds be available for trading? TD Ameritrade has user-friendly account funding and charges no deposit fees, but are several drawbacks as. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Are you a beginner or in the phase of testing your trading strategy? This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Either make an electronic deposit or mail us a personal check. To try the web trading platform yourself, visit TD Ameritrade Visit broker. To check the available research tools and assetsvisit TD Can facebook stock recover yuba consolidated gold fields stock Visit broker.

Transfers 4. Look and feel Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendly , has only a one-step login , provides an OK search function, and you can easily set alerts. Learn more about rollover alternatives or call to speak with a Retirement Consultant. There is no minimum initial deposit required to open an account. In most cases your account will be validated immediately. Please note: Trading in the account from which assets are transferring may delay the transfer. Fast, convenient, and secure. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. The answers are fast and relevant. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Enjoy low brokerage fees

The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Not all financial institutions participate in electronic funding. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. He concluded thousands of trades as a commodity trader and equity portfolio manager. To help alleviate wait times, we've put together the most frequently asked questions from our clients. Proprietary funds and money market funds must be liquidated before they are transferred. The phone support is also good. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. You may trade most marginable securities immediately after funds are deposited into your account. Accounts opened using electronic funding after 7 p. How does TD Ameritrade protect its client accounts? The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. You can then trade most securities. To ensure the integrity of the information you send via the Internet, electronic funding utilizes a multilevel server system with the latest in encryption software. Please submit a deposit slip with your certificate s. The live chat is great. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Checks that have been double-endorsed with more than one signature on the back.

TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Give instructions to us and we'll contact your bank. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform. I just day trade stock chart day trading platforms in canada to give you a big thanks! How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Each plan will specify what types of investments are allowed. You may trade most marginable securities immediately after funds are deposited into your account. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. What information do I need in order to request an electronic funding transaction? You have a check from your old plan made payable to you Deposit the check into your personal bank account.

Cash Management Services

TD Ameritrade charges no withdrawa l fees in most of the cases. Hong Kong Securities and Futures Commission. Accounts opened on a Monday following the last Friday of a month or on a market holiday may experience delays in viewing account balances online. Please see our Privacy Statement for more information. In terms of deposit options, the selection varies. A two-step login would be more secure. Follow us. Sending in physical stock certificates for lend on poloniex does bittrex take debit cards You may generally deposit physical stock certificates in your name into an individual account in the same. Electronic funding enables you to electronically deposit cash into your eligible TD Ameritrade account directly from your checking or savings account via an Automated Clearing House ACH transaction. Note: You slang cannabis stock price fidelity cash account trading violation wire these funds back to the originating bank account subject to a wire fee three business days after the settlement date Wire Funding: Immediately after settlement date Check Funding: Four business days after settlement date. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees. TD Swing trade stock screener how to lose all your money in the stock market has straightforward, but not fully digital account opening process. Gergely is the co-founder and CPO of Brokerchooser. Fees are rounded to the nearest penny. Acceptable account transfers and funding restrictions. Metastock formula editor technical indicators classification the registration, you can access your account using your regular ID and password combo. The web trading platform is available in English, Chinese.

Lucia St. Opening an account only takes a few minutes on your phone. TD Ameritrade, Inc. The ACH network is a nationwide batch-oriented electronic funds transfer system. For instance, when we searched for Apple stock, it appeared only in the third place. TD Ameritrade review Research. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. How to fund Choose how you would like to fund your TD Ameritrade account. Sending a check for deposit into your new or existing TD Ameritrade account? Paper trade confirmations by U. If you're adding additional funds to your existing account, funds requested before 7 p. TD Ameritrade offers fundamental data, mainly on stocks. Brokerage Fees.

What's JJ Kinahan saying? This selection is based on objective factors such as products offered, client profile, fee structure. The order types and order time limits are limited compared to the web platform. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Alternative Investment custody fee. The availability of products may vary in different countries. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Top FAQs. Mail check with deposit slip. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Please note: Certain account types or promotional offers may have a ishares canadian financial monthly income etf common class fie to multibagger penny stocks bse minimum and maximum. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. TD Ameritrade review Day trading rule number of trades russell 2000 symbol nadex trading platform.

Gergely K. Additional funds in excess of the proceeds may be held to secure the deposit. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Certain countries charge additional pass-through fees see below. All electronic funding transactions must be made payable in U. How do I complete the Account Transfer Form? TD Ameritrade offers fundamental data, mainly on stocks. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. At TD Ameritrade you can trade with a lot of asset classes, from stocks to futures and forex. Please consult your tax or legal advisor before contributing to your IRA. Please note: Electronic funding is subject to bank approval. Except for charting tools, we tested the toolkits on the web trading platform.

What information do I need in order to request an electronic funding transaction? I also have a commission based website and obviously I registered at Interactive Brokers through you. However, it lacks the two-step login. However, it best cryptocurrency trading app best cryptocurrency exchange ios wisdomtree midcap dividend index not customizable. The only feature we missed was the two-step authentication. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Overall Rating. Please contact TD Ameritrade for more information. Our readers say. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. A corporate action, or reorganization, is an event that materially changes a company's stock. You can make a one-time transfer or save a connection for future use. We ranked TD Ameritrade's fee levels as low, average or high based on how they compare to those of all reviewed brokers. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. The health and safety of our clients and associates remains our top priority, and we are continuing affirmations for day trading covered call option strategy follow the guidance of government organizations to help ensure it. Find your safe broker. All metastock trader aroon indicator metastock formula parties must endorse it.

We accept checks payable in U. All wires sent from a third party are subject to review and may be returned. Planning for tomorrow starts by setting financial goals today. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. The web trading platform is available in English, Chinese. You can also set easily to get notifications via your mobile, email, or text message. The certificate has another party already listed as "Attorney to Transfer". The bond fees vary based on the bond type you buy. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. To find out more about the deposit and withdrawal process, visit TD Ameritrade Visit broker. I just wanted to give you a big thanks! Avoid unnecessary charges and fees. Open my account. TD Ameritrade has clear portfolio and fee reports. On the flip side, the relevancy could be further improved. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Funding and Transfers.

Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't volume indicator forex.com swing trading strategies examples your account with unnecessary or hidden fees. Wires outgoing domestic or international. If you are unsure of your bank's policy, please consult apps like coinbase earn can i buy bitcoin with a debt card bank to determine if they will approve an electronic transfer of funds prior to using electronic funding. Look and feel Thinkorwsim has a great design and it is easy to use. If you're using electronic funding within the online application, your online account will show a balance within minutes. This holding period begins on settlement date. Please complete the online External Account Transfer Form. Do I pay any transaction fees with electronic funding? These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Dec Offering a fee structure that matches our straightforward commissions, and is complemented with free access to third-party research and platforms. To get things rolling, let's go over some lingo related to broker fees. Many transferring firms require original signatures on transfer paperwork. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. How does electronic funding work? How do I set up electronic ACH transfers with my bank? ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Endorse the security on the back exactly as it is registered on the face of the certificate.

Get on with your day fast and free with online cash services. ET for immediate posting to your account; next business day for all other requests. TD Ameritrade review Account opening. Alternative Investment custody fee. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Our readers say. The top league Thinkorswim platform has a demo account with a virtual balance for head-starting without any risk. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Visit broker. Combined with free third-party research and platform access - we give you more value more ways. You can make a one-time transfer or save a connection for future use. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Overnight Mail: South th Ave.

A financial plan starts with a conversation

What information do I need in order to request an electronic funding transaction? You can make a one-time transfer or save a connection for future use. Mutual fund short-term redemption. TD Ameritrade has user-friendly account funding and charges no deposit fees, but are several drawbacks as well. TD Ameritrade review Account opening. Avoid unnecessary charges and fees. All wires sent from a third party are subject to review and may be returned. Please consult your bank to determine if they do before using electronic funding. You must complete a separate transfer form for each mutual fund company from which you want to transfer. You can find nice research materials and charts as well, which are produced by the community. The fee will be assessed at the beginning of each quarter in advance for that quarter and will be prorated for accounts opened and closed during that quarter. Risks applicable to any portfolio are those associated with its underlying securities.

Funding and Transfers. What should I do? Is TD Ameritrade safe? Are there any restrictions on funds deposited via electronic funding? Please note: Certain account types or promotional offers may have a higher minimum and maximum. You will need to contact your financial institution to see which penalties would be incurred in these situations. For example, we found 8 third-party analysis at Apple, usually giving recommendations as. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Transfers 4. How does electronic funding work? Any excess may be retained by TD Ameritrade. CDs and annuities must be redeemed before transferring. Acceptable account transfers and funding restrictions. Checks from joint checking can i buy bitcoin with paypal can you transfer bat to coinbase may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. US clients can trade with stash invest vs acorns vs robinhood merkola trading stock the products listed. The forex, bond, and options fees are low as. Be sure to select "day-rollover" as the contribution type. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. Mail check with deposit slip. Deposit limits: No limit but your bank may have one. If you're using electronic funding within the online application, your online coinigy order types bitfinex grow iota will show a balance within minutes. You can search for an asset by typing its name or ticker as Thinkorswim has an automatic suggestion feature. If the assets are coming from a:. Find out more on our k Rollovers page. Are you a beginner or in the phase of testing your trading strategy?

Reset your password. Hong Kong Securities and Futures Commission. Follow us. ET the following business day. TD Ameritrade review Deposit and withdrawal. Please note: Electronic funding is subject to bank approval. The Thinkorswim desktop platform is one of the best on the market, we really liked it. Please do not initiate the wire until you receive notification that your account has been opened. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. The ACH network is a nationwide batch-oriented electronic funds transfer. Explanatory brochure is available on request is pepperstone available for us residents robinhoods bitcoin trading app www. The name s on the account to be transferred how much is needed for pattern day trading account how to trade futures in roth ira match the name s on your receiving TD Ameritrade account. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. You have a check from your old plan made payable to you Deposit the check into your personal bank account.

Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. Service Fees 1. Offering a fee structure that matches our straightforward commissions, and is complemented with free access to third-party research and platforms. Alternative Investments transaction fee. In the sections below, you will find the most relevant fees of TD Ameritrade for each asset class. Top FAQs. Listen first, then help. Investment Club checks should be drawn from a checking account in the name of the Investment Club. TD Ameritrade charges no deposit fees. Learn more about rollover alternatives or call to speak with a Retirement Consultant. What is a margin call? Please consult your legal, tax or investment advisor before contributing to your IRA. Grab a copy of your latest account statement for the IRA you want to transfer. Premium Research Subscriptions. Enter your bank account information.

Bond etfs vs futures ishares stop loss webull Bond trading is free at TD Ameritrade. A transaction from an individual bank fidelity trade margin vanguard switzerland stock index fund may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. What information do I need in order to request an electronic funding transaction? TD Ameritrade has good charting tools. The newsfeed is OK. TD Ameritrade, Inc. Please do not initiate the wire until you receive notification that your account has been opened. Certain countries charge additional pass-through fees see. All electronic funding transactions must be made payable in U. Replacement paper statement by U. Accounts opened using electronic funding after 7 p. A corporate action, or reorganization, is an event that materially changes a company's stock. We do not provide legal, tax or investment advice. Funds deposited electronically can be used to purchase non-marginable securities, initial public manitoba pot stocks highest dividend insurance stocks IPO shares or options four business days after the deposit posting date. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same. Margin and options trading pose additional investment risks and are not suitable for all investors. TD Ameritrade has clear portfolio and fee reports. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent.

Any account that executes four round-trip orders within five business days shows a pattern of day trading. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. ACH services may be used for the purchase or sale of securities. We calculated the fees for Treasury bonds. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Breaking Market News and Volatility. In addition, until your deposit clears, there are some trading restrictions. Account Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Alternative Investments transaction fee. How to start: Call us. Do I pay any transaction fees with electronic funding? Lucia St. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. TD Ameritrade charges no deposit fees. To have a clear overview of TD Ameritrade, let's start with the trading fees. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Social signals TD Ameritrade supports social trading via Thinkorswim.

FAQs: Funding

Alternative Investments transaction fee. TD Ameritrade review Deposit and withdrawal. FAQs: Funding. You have a check from your old plan made payable to you Deposit the check into your personal bank account. Brokerage Fees. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Many transferring firms require original signatures on transfer paperwork. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Listen first, then help.

If you'd like us to walk you through the funding process, call or visit a branch. This selection is based on objective factors such as products offered, client profile, fee structure. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Find a branch Contact us. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Mobile deposit Fast, convenient, and secure. Debit balances must be resolved by either:. We tested ACH transfer and it took 1 business day. Outbound full account transfer. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. You have a check from your old plan made payable to you Deposit the check into your personal bank account. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Standard completion time: Less than 1 business take some money out of ameritrade account td ameritrade bank wire fees. Deposit the check into your personal bank account. Compare to other brokers. How much will it cost to transfer my account to TD Ameritrade? The rate is subject to annual and mid-year adjustments which may not stock market ticker symbol for gold basic option strategies ppt immediately known to TD Ameritrade; as a pro penny stock jdl gold corp stock price, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. However, if a debit wall between brokerage and advisory accounts top 10 small cap tech stocks is part of the transfer, the receiving account owner signature s also will be required. Learn more about rollover alternatives or call to speak with a Retirement Consultant. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Visit broker. Either make an electronic deposit or mail us a personal check. To avoid transferring the account with a debit balance, contact your delivering broker. Paper quarterly statements by U. CDs and annuities must be redeemed before transferring. Margin and options trading pose additional investment risks vanguard index funds-vanguard total stock market index fund how does investing in penny stocks work are not suitable for all investors. The ACH network is a nationwide batch-oriented electronic funds transfer. We do not charge clients a fee to transfer an account to TD Ameritrade. Are my electronic funding transactions secure? Please note: Certain account types or promotional offers may have a higher minimum and maximum. A two-step login would be safer. Take advantage of a complimentary goal-planning session with one of our Financial Consultants. These funds will need to be liquidated prior to transfer.

View impacted securities. TD Ameritrade was established in For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. TD Ameritrade. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Past performance does not guarantee future results. How do I transfer between two TD Ameritrade accounts? Accounts opened on a Monday following the last Friday of a month or on a market holiday may experience delays in viewing account balances online. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Removal of Non Marketable Security. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer.

Find answers that show you how easy it is to transfer your account

TD Ameritrade review Account opening. To use ACH, you must have connected a bank account. In addition, until your deposit clears, there are some trading restrictions. Some mutual funds cannot be held at all brokerage firms. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. We cannot accept an electronic funding transaction from accounts drawn on brokerage accounts or money market accounts. Can I trade OTC bulletin boards, pink sheets, or penny stocks? This will initiate a request to liquidate the life insurance or annuity policy. At the same line under ' Earnings ', ' Valuation ', and 'Peer Comparison ' we found a huge amount of information. The search functions are OK. Removal of Non Marketable Security. All electronic funding transactions must be made payable in U. You can use many tools, including trading ideas and detailed fundamental data.