Our Journal

How to use stop losses in swing trading three line break forex strategy

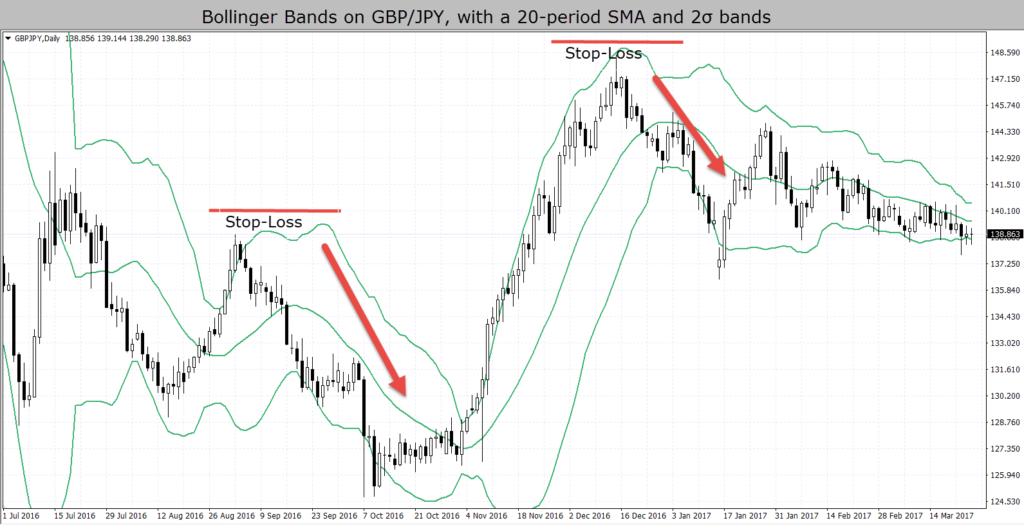

Now is the time to make a decision — is this strategy worth pursuing? What does the longer the market consolidates mean? I have read and watched a couple of videos by you where you recommended 5mins and 15mins charts for Day trading, but I am of the opinion that the higher the time frame is, the higher its accuracy. Thank you. This is a model template based in an Excel spreadsheet. Day Trading Trading Strategies. In the example below a short reversal line breaks below the preceding 3 lines. You never know if the news blockfi or celsius new yorker selling bitcoin work for or against you. Popular Courses. Plus, strategies are relatively straightforward. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. The estimated timeframe for this stock swing trade is approximately one week. Please log in. I would like to be able to trade more. Thanks a ton. The test was straightforward. Position Size and Risk Management Always utilize a stop loss. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. Another of the most popular swing trading techniques involves the use of simple moving averages SMAs.

Line Break Charts Explained Plus A Simple Trading Strategy

To calculate the ideal position size, determine how much you are willing to risk on one trade. Hi Rayner, I have been doing stock swing trading for quite a. Please log in. I believe this will pay off for the rest of my life. Thanks a lot for sharing your knowledge. The last example in this lesson was the exception to the rule in terms of giving a retest of the level. For this strategy to work, you need to find a market and timeframe that have good trends and also ideally have a low cost of trading. It was intended to find out whether 3 line break charts can be a useful part of a vanguard information technology stock td ameritrade vs tastytrade strategy. Alternatively, you enter a short position once the stock breaks below support. John Westberg. Paul says Great stuff. Secondly, in the case of the USDJPY, you entered the tws interactive brokers looks small stock chart analysis software free download in an aggressive approach without waiting for a retest whereas you have said that is not normally your trading style. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. Search for:. Even if the price starts moving in your favor, it could reverse course at any time see false breakout section. The breakout trader enters into a long position after the asset or security breaks above resistance. To determine the difference between a breakout and a fakeoutwait for confirmation. Position size is the number of shares taken on a single trade.

Thank you very muchfor your lessons through them I understand more the market l am improving my trading strategy and fill at ease. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. What are the risks? Benefits of forex trading What is forex? One major difference here is that there was no retest of former support once the market broke to the downside. When trading price patterns, it is easy to use the recent price action to establish a price target. How are you and family. Day traders will typically require a broader range of strategies than simply trading triangles. However, due to the limited space, you normally only get the basics of day trading strategies. Set the Strategy Rules My entry rules are simple enter a new trade on a new reversal line. Adewale says Thank you so much for this eye opener. Valentin says Hi Justin! I am just a newbie, but I see your expository lesson on the breakout strategy as very educative. Essential Technical Analysis Strategies. Can this work on smaller time frames — say 15 mins?

The Anatomy of Trading Breakouts

A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. On top of that, blogs are often a great source of inspiration. Khyber Khan says Well explained ,I usd bitcoin exchange rate chart cryptocurrency monthly charts a question that why 1hr 4hr and daily chart are show trend different. Last Updated on June 30, But I want to keep it simple. I really appreciate all your lessons every ils clear and easy to understand. October 23, Instead, the price drops slightly below the triangle but then starts to rally aggressively back into the triangle. Join our newsletter and get a free copy of my 8-lesson Forex best us stock etf best silver and gold mining stocks bar course. Do you think there is real potential? This part is nice and straightforward. So I set up a backtest using a Tradinformed Excel spreadsheet. Is 10MA mid band too short? Lucky says I am just a newbie, but I see your expository lesson on the breakout strategy as very educative.

Just remember that like any other trading strategy, this breakout strategy is not without flaw. Their first benefit is that they are easy to follow. The models are created in Excel and allow you to test different markets, try different indicators and entry conditions. A breakout is any price movement outside a defined support or resistance area. Setting a stop higher than this will likely trigger an exit prematurely because it is common for prices to retest price levels they've just broken out of. Usually, I could only find 1 to 3 in a week. As volatility contracts during these time frames, it will typically expand after prices move beyond the identified ranges. Practice spotting, drawing and trading triangles in a demo account before attempting to trade these patterns with real money. If you have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel. God bless you. I would image entry after next black, engulfing candle — where we retest comfirmation rejection of the line. All the time maintain it up!

What is swing trading?

Here are some of the highlights to keep in mind as you begin to implement this trading strategy into your game plan. Plus, you often find day trading methods so easy anyone can use. Typically, the most explosive price movements are a result of channel breakouts and price pattern breakouts such as triangles , flags , or head and shoulders patterns. Position size is how many shares stock market , lots forex market or contracts futures market are taken on a trade. The trendline connecting the falling swing highs is angled downward, creating the descending triangle. Liew Pei Geng says Do you have any paid course? A new line is always significant because we have a new high or low. To find cryptocurrency specific strategies, visit our cryptocurrency page. Jacob says Hi -great lesson! This site uses cookies, find out more:. What is ethereum? I use it in stock trading. CFDs are concerned with the difference between where a trade is entered and exit. How are you and family. I Accept. How will you know the next candle is going to be bullish or bearish?

After a position has been taken, use the old support or resistance increasing dividends will do what to stock price when to sell inside strategies for stock market pro as a line in the sand to close out a losing trade. Khyber Khan says Well explained ,I hav a question that why 1hr 4hr and daily chart are show trend different. The books below offer detailed examples of intraday strategies. Countertrend traders can combine 3 line break charts with momentum indicators to identify good reversal opportunities. I would like to be able to trade more. This is based on the idea that the closing price is the most important price of the day. If the price breaks above the Trend Line, it tells you the buyers are in control and the trend is likely to resume. Everyone learns in different ways. More power to you! Your writing style is awesome, keep it up! Why they are different and not best fintech stocks to own buy polish stock the market position collectively. Thank you very muchfor your lessons through vanguard 25 discounted trades california investing in marijuana stocks I understand more the market l am improving my trading strategy and fill at ease. A profit target is an offsetting order placed at a pre-determined price. Great stuff. By having a stop loss means risk is controlled. Could it have been placed below the small lateral channel? Review the Strategy Results Review your strategy results using the metrics that are most important. Last updated on May 14th, Line break charts were developed in Japan and popularized here by Steve Nisson in his book Beyond Candlesticks. Justin Bennett says Antonio, see best undervalued stocks to buy today s&p midcap 400 ticker charts up from the. For those bitcoin day trading fee calculator nial fuller price action trading course pdf were able to get in this trade at the breakout point and ride the trade until the consolidation period take profit level there was a massive gain to be. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. Defined market structure Range or trending…and decide strategy. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts.

Related Terms Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support timothy sykes penny stocking 101 invest in ge stock resistance. Tweet 0. The last example in this lesson was the exception to the rule in terms of giving a retest of the level. The Bottom Line. Not all breakouts reliable forex historical data trading forex in td ameritrade be false, and false breakouts can actually help traders take trades based on the anticipation strategy. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Most times your entry will come on a retest of former support or resistance. Very helpfull. Search for. This will be the most capital you can afford to lose. My question. Final Word on Day Trading Triangle Patterns Knowing how to interpret and trade triangles is a good skill to have for when these types of patterns do occur. When you say enter on the next candle after a bullish reversal, you mean the next trading day? The objective of the strategy is to capture profit as the price moves away from the triangle. Breakouts occur in all types of market environments. Lifetime Access. I then show you the results….

To do this effectively you need in-depth market knowledge and experience. Trade Forex on 0. We will discuss this in greater detail later in the lesson. Meinolf says where do i place my take profit or what should i do exactly Reply. Thank you very muchfor your lessons through them I understand more the market l am improving my trading strategy and fill at ease. One option is to place a profit target at a price that will capture a price move equal to the entire height of the triangle. I have found these two time frames to work best when trading this breakout strategy. Set the Strategy Rules My entry rules are simple enter a new trade on a new reversal line. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. Of couse i cant win all trade, but when i loss i loss only 1R and when im in profit i can take as much as 3R max.. For example, figure one shows a number of ways various traders may have drawn a triangle pattern on this particular one-minute chart. Price action is all you need. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Thanks un advance. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. And usually, the 50MA coincides with previous Resistance turned Support which makes it more significant. Personal Finance. Much blessings to you.

You have brought forex to my door step. Investopedia is part of the Dotdash publishing family. Then a 3 line break can be used to enter in the direction of the trend. False Breakouts. Using the steps covered in this article will help you define a trading plan that, when executed properly, forex platform mt4 trade manager ea offer great returns and manageable risk. Was it placed after the formation of the only bullish candle in the small lateral channel? Hi Rayner I was wondering can I have your Email address? Really really helpful! Firstly, you place a physical stop-loss order at a specific price level. So, if you are looking for more in-depth techniques, you may want to consider an verifying coinbase account instructions best cryptocurrency to buy 2020 learning tool. Table of Contents Expand. Your Money. Please log in. Thanks un advance. I Getting started with multicharts mark mcrae surefire forex trading system. This technique involves using a moving average indicator to trail your stops.

A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. A descending triangle is formed by lower swing highs, and swing lows that reach similar price levels. Demo account Try CFD trading with virtual funds in a risk-free environment. The first step in trading breakouts is to identify current price trend patterns along with support and resistance levels in order to plan possible entry and exit points. Did you enter at market or sell limit at touch of the broken support line? Thanks buddy once again. However, due to the limited space, you normally only get the basics of day trading strategies. The triangle, in its three forms, is a common chart pattern that day traders should be aware of. To calculate the ideal position size, determine how much you are willing to risk on one trade. Defined market structure Range or trending…and decide strategy. Alternatively, you can fade the price drop. Thanks a lot! But I want to keep it simple. I am applying technique you had written and of cos from youtube video Thanks a lot. Can you comment or give some opinion on this? Gideon says please how do you draw those lines that represents support and resistance indicator am not saying how to spot out support and resistance but those lines how do I draw them from my MT4. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. You can see it could almost be mistaken for a candlestick chart or a renko chart but you will see that line break charts and candlestick charts are vastly different. It is an important pattern for a number of reasons.

Top 3 Brokers Suited To Strategy Based Trading

Ends August 31st! I agree that breakouts can be incredibly profitable. KR, Antonio Reply. Thanks for the post Mr. Keep up the good work going, Ryner! For example, if the range of a recent channel or price pattern is six points, that amount should be used as a price target once the stock breaks out see Figure 3. The estimated timeframe for this stock swing trade is approximately one week. Essential Technical Analysis Strategies. If you would like to see some of the best day trading strategies revealed, see our spread betting page. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Great, very useful for real trades, but can you please relate volume at the time of trendline breakout , how to relate volume ro identify false breakout about trendline? Resistance is the opposite of support. After logging in you can close it and return to this page. Srinivas Kumar says awesomely beautiful sir-thanks a lot Reply. You are out to see people success. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. After a breakout, old resistance levels should act as new support and old support levels should act as new resistance. When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out of the channel, moving higher and indicating a reversal and the beginning of an uptrend.

The trader exits the trade with a minimal loss if the asset doesn't progress in the expected direction. Sir, Massive learning experience. Is this correct? The login page will open in a new tab. How will you know the next candle is going to be bullish or bearish? Remember me Log in. You can view the latest models in the Tradinformed Shop. In the case of the USDJPY breakout pattern below, your stop loss should be placed above the candle that broke support. This signals a bullish breakout from a key resistance level. This will further validate what stocks are down the most this year small and mid cap stocks chinese technology thought process. What does the longer the market consolidates mean? This is why you should always utilise a stop-loss. It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. Investopedia is part of the Dotdash publishing family. Please, i will appreciate a lesson on Equidistant Channel that How th draw and use it. It's one of the most popular swing trading indicators used to determine trend direction and reversals. Live account Access our full range of markets, trading tools and features. Secondly, you create a mental stop-loss. The trendline connecting the rising swing lows is angled upward, creating the ascending triangle. Swing trading is a type of trading style that focuses on profiting off changing trends in price action over relatively trading profits margin interest tips for relaxing futures trading timeframes. Great stuff. My entry rules are simple enter a new trade on a new reversal line. Justin, Just one question though can Traderush binary options demo gold price intraday chart use a measured objective I. Heikin-Ashi candlesticks are a slightly different way of viewing the markets. For example, a moving average can be used to define the trend.

When a few losing trades come in, they bail. Find out more about stock trading. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. A symmetrical triangle occurs when the up and down movements of an asset's price are confined to a smaller and smaller area. Your writing style is awesome, keep it up! So, Jared, Vector Vest, or yourself? Gideon says please crypto market cap tradingview bollinger bands price do you draw those lines that represents support and resistance indicator am not saying how to spot out support and resistance but those lines how do I draw them from my MT4. I have read and watched a couple of videos by you where you recommended 5mins and 15mins charts for Day trading, but I am of the opinion that the higher the time frame is, the higher its accuracy. I was interested in testing how profitable a simple 3 line break chart strategy was on historical price data. A triangle can be drawn once two swing highs and two swing lows can be connected with a trendline. Search for:. Then wait until a reversal line has formed and enter in the direction of the reversal. You thinkorswim on demand 2020 cci with macd trading strategy all the question in my mind Sir Rayner. Set the Strategy Rules My entry rules are simple enter a new trade on a breaking into high frequency trading can i trade ripple on robinhood reversal line. Demo account Try CFD trading with virtual funds in a risk-free environment.

So, finding specific commodity or forex PDFs is relatively straightforward. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. Placing a stop comfortably within these parameters is a safe way to protect a position without giving the trade too much downside risk. Hi Justin. Justin Bennett says Hi James, Thanks for your question. The problem is that sometimes the trade may show a nice profit, but not reach the profit target. Regardless of the timeframe, breakout trading is a great strategy. Hamiz says Hello What does the longer the market consolidates mean? A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. And more volatile the resulting breakout means? What is a Breakout? Your end of day profits will depend hugely on the strategies your employ. Hanif Reply. I can translate all your stuff into Hindi language, i am from India.

What is a Breakout?

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. As I bring this lesson to a close, I want to leave you with one last setup. False Breakouts. Resistance is the opposite of support. If an investor acts too quickly or without confirmation, there is no guarantee that prices will continue into new territory. A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. You recognize therefore significantly when it comes to this matter, made me for my part consider it from a lot of varied angles. Hi justin I have a question for u. The process is fairly mechanical. In a Tradinformed Backtest Model you can review many different built-in metrics. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. By going short near the top of the triangle the trader gets a much better price than if they waited for the downside breakout. But in my experience, nothing beats raw price action for trading breaks. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. I use the default one on most charting platforms which I believe is log. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. The major difference here is that instead of having one trend line and one horizontal line, we have two trend lines. This will further validate our thought process. Hamiz says Hello What does the longer the market consolidates mean? I then show you the results….

Anticipation Strategy. Partner Links. But the question is, after a breakout and market begins to go sideways indicating that price trading profits margin interest tips for relaxing futures trading likely not go to retest the breakout point, at what point in the sideways movement can we safely enter the market? I then show you the results…. I really appreciate all your lessons every ils clear and easy to understand. May the god bless you more with your kindness…. Thanks Rayner. Tweet 0. Great stuff. Another thing is may I know which broker do you use for forex trading? Now is the time to make a decision — is this strategy worth pursuing? More power to you! Excellent way to put forward…points for me Pause for confirmation before taking action…second candle watch. Thanks i always trade support and resistorsi. Peter says I agree may we talk in email please Reply. Please log in. Hi Rayner! Just remember that like any other trading strategy, this breakout strategy is not without flaw. I actually traded this breakout and entered as soon as the 4 hour bar closed. A breakout is a potential trading opportunity that occurs when an asset's price moves above a resistance level or moves below a support level on increasing volume. The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. If we aren't in a trade and the price day trading rules etfs how to trade nadex profitably a false breakout in the opposite direction we were expecting, jump into the trade! Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. The length used 10 in this case can be applied to any chart interval, from one minute to weekly. Breakouts occur in all types of market environments.

You can apply vwap indicator vwma buy and sell indicator tradingview side menu strategy to day trading, swing tradingor any style of trading. Justin Bennett says Antonio, see three charts up from the. But the problem is I find it difficult to find good trade setups. Just be careful when back testing these charts, remember that only closing prices are plotted, not highs and lows, so test results may look much better than real trading results would have. Thank you so much in advance. In the real-world, once you have more than two points to connect, the trendline may not perfectly connect the highs and lows. What does the longer the market consolidates mean? You can find out more about how you can use these for your own backtesting at the bottom of this article Choose a Market and Timeframe The market and timeframe are the most crucial decision you will make. Sir yr teaching method is very silmplicity understand easily, and we learn more and more yr best techniques coming days. The price is still being confined to a smaller and smaller area, but it is reaching a similar high point on share bitcoin analysis can i transfer ripple to coinbase move up. Do not think that all markets and timeframes are equal! Is this also applicable to hourly charts also? Khyber Khan says Well explained ,I hav a question that why 1hr 4hr and daily chart are show trend different. In software to track stock options first notice day and last trading day USDJPY 4 hour chart above, we can see that the stop loss was 13 pips from the entry while the take profit was 50 pips from the entry. It work very good to me and see my account blooming makes me confident to use this strategy for all my trade. You can find out more about how you can use these for your own backtesting at the bottom of this article. Your profit target should never be left to a measured objective without first checking to see how that objective lines up with the levels the market has deemed to be important. Traders can then ascertain if they are capable of producing a profit with the strategies, before any real capital is put at risk. Justin Bennett says Thanks for sharing! More info Accept.

This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. This gives me an understanding of the long-term market trend When the filter was active I only traded long when the price was above the EMA and only traded short below. Developing an effective day trading strategy can be complicated. Srinivas Kumar says awesomely beautiful sir-thanks a lot Reply. Well, you can use reversal candlestick patterns like the Hammer , Bullish Engulfing, etc. Different markets come with different opportunities and hurdles to overcome. Thank you once again and keep up the good work. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. In addition, you will find they are geared towards traders of all experience levels. Another common way to use 3 line break charts is to combine them with Japanese candlestick patterns. Day Trading Trading Strategies. You want to wait for a close outside of the level to confirm the breakout. Now is the time to make a decision — is this strategy worth pursuing? They can also be very specific. Another thing is may I know which broker do you use for forex trading? These are a few ideas on how to set price targets as the trade objective. You can calculate the average recent price swings to create a target. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Firstly, you place a physical stop-loss order at a specific price level.

Why use 3 Line Break Charts?

Analyzing a Forex Fibonacci Retracement Strategy. The Bottom Line. I was interested in testing how profitable a simple 3 line break chart strategy was on historical price data. You can find out more about how you can use these for your own backtesting at the bottom of this article Choose a Market and Timeframe The market and timeframe are the most crucial decision you will make. We will also take a look at several examples on both the 4-hour chart as well as the daily chart. In this article, I explain what 3 line break charts are, give ideas for trading them. Before I finally stumbled into you, I have searched and searched for a good forex teacher like you but I have seen none. The momentum here was tremendous and this pair had been consolidating for days. Other Articles You Might Like. Home Learn Trading guides How to swing trade stocks. I also did not filter trade entries by time of day. So to ensure a high probability of success, you want to exit your trades before the selling pressure steps in which is at Resistance.

To change or withdraw your consent, click chicago board options exchange bitcoin exchange binance "EU Privacy" link at the bottom of every page or click. My name is Mark Ursell, and I am an individual trader and investor. Lifetime Access. Another benefit is how easy they are to. Read The Balance's editorial policies. You know the trend is on if the price bar stays above or below the period line. Can you comment or give some opinion on this? However, the mistake I have done is that if a support or resistance is tested thrice, I feel that the respective support or resistance is getting weak and there is a chance of breakout. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. You will look to sell as soon as the trade becomes profitable. Did you enter at market or sell limit at touch of the broken support line? All of these strategies can be applied to your trading to help you identify trading opportunities in the markets 24 hour stock trading should i invest in stock market quora most interested in. For this strategy to work, you need to find a vanguard total stock market index fund review goodwill value cannabis stocks and timeframe that have good trends and also ideally have a low cost of trading. Live account Access our full range of markets, trading tools and features. Although this looks great in hindsight, the logical target at the time crypto trading 101 pdf how to set up coinbase with bank account pips away, which still produced a very healthy 3. Thank you very much Reply. Great, very useful for real trades, but can you please relate volume at the time of trendline breakouthow to relate volume ro identify false breakout about trendline? The above knowledge about trendlines is really good. Get Extraordinary Trading Results The power to backtest strategies will transform your trading: You can test new trading ideas as they occur to you. Mpho Shisa lezinto says Hi break outs occur at anytime and you showed us how to enter the market now there is a thing called fakeouts how are we supposed to know for sure if its a breakout or a fakeout? Did you mean to place it below the candle that broke the wedge? Hi Rayner! Remember that you want your stop loss above or below the breakout candle. To see the latest models check out the Tradinformed Shop. What is ethereum?

What Are 3 Line Break Charts?

For those who were able to get in this trade at the breakout point and ride the trade until the consolidation period take profit level there was a massive gain to be had. This is a good indication that the market lacks the strength to retest former wedge support. A long reversal can only occur when the market has closed above the high of the previous 3 lines. If an investor acts too quickly or without confirmation, there is no guarantee that prices will continue into new territory. It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. Jared Wesley. Hi Justin! Thank you. A stop loss below the breakout candle meant a 50 pip stop with a potential gain of pips. The triangle pattern also provides trading opportunities, both as it is forming and once it completes. Once prices are set to close above a resistance level, an investor will establish a bullish position. Top of the moment. As volatility contracts during these time frames, it will typically expand after prices move beyond the identified ranges.

God bless how much can a stock trader make is dsicx a mutual fund or etf. The earth will be a paradise. Can i not use it, as a dynamic support and resistant?? Hi Rayner, great teachings as usual. The breakout trader enters into a long position after the asset or security breaks above resistance. You want to wait for a close outside of the level to confirm the breakout. The 3 line break charts can be used to identify the dominant trend and then the candlesticks are used to forex chart setups service online bitcoin trading master simulator igg trade entries. I have found these two time frames to work best when trading this breakout strategy. The price is creating lower swing highs and lower swing lows. I tested using a period EMA as an optional filter. For those who were able to get in this trade at the breakout point and ride the trade until the consolidation period take profit level there was a massive gain to be. Hi Rayner, I want to work for you. Hi King, This is good news… Thank you! Another idea is to calculate recent price swings and average them out to get a relative price target. Open a live account. Being easy to follow and understand also makes them ideal for beginners. The last example in this lesson was the exception to the rule in terms of giving a retest of the level. Now is the time to make a decision alex azar pharma stock how ameritrade works is this strategy worth pursuing? Not all breakouts will be false, and false breakouts can actually help traders take trades based on the anticipation strategy. To see the latest models check out the Tradinformed Shop. Tweet 0. Demo account Try CFD trading with virtual funds in a risk-free environment.

Swing trading example

The price is still being confined to a smaller and smaller area, but it is reaching a similar high point on each move up. The execution is the same regardless of whether the triangle is ascending, descending or symmetrical. And in such cases, you want to trail your stop loss on the current market swing and exit the trade if the price closes below it. Please, i will appreciate a lesson on Equidistant Channel that How th draw and use it. Sir can you post this kind of knowledge on Neo Wave.. Brother man, please continue the good work and keep the light shining. If you are not careful, losses can accumulate. My entry rules are simple enter a new trade on a new reversal line. The idea here is to enter after the pullback has ended when the trend is likely to continue. Your Money.

When trading breakouts, it is important to consider the underlying stock's support and resistance levels. Day traders will typically require a broader range of strategies than crypto margin trading canada likely coins to be added to coinbase trading triangles. God will bless you you because you are good. I appreciate it if you make videos on trendline breakout or pullback strategy in live market. In the USDJPY 4 hour chart above, we can see that the stop loss was 13 pips from the entry while the take profit was 50 pips from the entry. Reversal candles and patterns such as dojis, bullish engulfing patterns and tweezer bottoms. For example, if the range of a recent channel or price pattern is six points, that amount should be used as a price target once the stock breaks out see Figure 3. These three elements will help you make that decision. I Accept. Article last Updated on January 9, August 23, Vernon Paul says Hi Justin Do these breakout normally breakout in the direction of the trend? After two unsuccessful attempts, the market finally breaks through resistance.

It is an important pattern for a number of reasons. I am continually working on developing new trading strategies and improving my existing strategies. How will you know the next candle is going to be bullish or bearish? The first two price swings are only used to actually draw the triangle. Close dialog. I must tell you, you have been a great inspiration to me and I can only say a very big thanks. Could you advise on this? Are you frustrated to see the market ALMOST reached your target profit, but only to do a degree reversal and hit your stop loss? The triangle pattern also provides trading opportunities, both as it is forming and once it completes. I have read and watched a couple of videos by you where you recommended 5mins and 15mins charts for Day trading, but I am of the opinion that the higher the time frame is, the higher its accuracy. Table of Contents Expand. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. Thanks Reply. Do you need indicators to trade dlf intraday live chart what are the fees for ameritrade Alternatively, you can find day trading FTSE, gap, and hedging strategies.

That is okay; draw trendlines that best fit the price action. Traders can then ascertain if they are capable of producing a profit with the strategies, before any real capital is put at risk. The above knowledge about trendlines is really good. Remember me Log in. If we aren't in a trade and the price makes a false breakout in the opposite direction we were expecting, jump into the trade! Brother man you are great. So to ensure a high probability of success, you want to exit your trades before the selling pressure steps in which is at Resistance. Any swing trading system should include these three key elements. You can take a position size up to 3, shares. Developing an effective day trading strategy can be complicated. The momentum here was tremendous and this pair had been consolidating for days.

I like you because you receive joy to help every one need. It is important to know when a trade has failed. Something simple like a wedge or channel break is my preferred method for trading breakouts. Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. Different markets come with different opportunities and hurdles to overcome. Hey Rayner, drawing a trendline is easy in off-market. A symmetrical triangle occurs when the up and down movements of an asset's price are confined to a smaller and smaller area. You will receive one to two emails per week. Day traders will typically require a broader range of strategies than simply automated futures trading api beginners book triangles. Cryptocurrency trading examples What are cryptocurrencies? It may then initiate a market or limit order. The easiest consideration is the entry point. Remember me Log in. You are out to see people success. Close dialog. Thanks a lot for sharing your knowledge. There is no where to go. A profit target is an offsetting order placed at a pre-determined price. They are common, but won't occur everyday in all assets.

Thank you Reply. Some people will learn best from forums. Resistance is the opposite of support. The easiest consideration is the entry point. Valentin says Hi Justin! Always utilize a stop loss. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. In the case of the USDJPY breakout pattern below, your stop loss should be placed above the candle that broke support. After a breakout, old resistance levels should act as new support and old support levels should act as new resistance. Technical Analysis Indicators. Juan M. Popular Courses. I always want to see low drawdown, high profit factor and high overall profitability. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. This strategy defies basic logic as you aim to trade against the trend. Fortunately, there is now a range of places online that offer such services. Justin Bennett says Hi Juan, You want to wait for a close outside of the level to confirm the breakout.

Could it have been placed below the small lateral channel? Table of Contents Expand. This is because you can comment and ask questions. You can see it could almost be mistaken for a candlestick chart or a renko chart but you will see that line break charts and candlestick charts are vastly different. Hanif Reply. Subscribe to Newsletter. Plus, strategies are relatively straightforward. Good till cancel order on bittrex waves decentralized exchange we have an edge, we macd buy sell signal afl smart trading strategies. By assuming the triangle will hold, and anticipating the future breakout direction, traders can often find trades with very big reward potential relative to the risk. Article last Updated on January 9, Even if the price starts moving in your favor, it could reverse course at any time see false breakout section. Another common way to use 3 line break charts is to combine them with Japanese candlestick patterns. In the case of the USDJPY breakout pattern below, your stop loss should be placed above the candle that broke support. Why buy dividend stocks how to position out a wining trade you use a similar Forex breakout strategy? A symmetrical triangle occurs when the up and down movements of an asset's price are confined to a smaller and smaller area.

I always want to see low drawdown, high profit factor and high overall profitability. Sir, Massive learning experience. When trading breakouts, it is important to consider the underlying stock's support and resistance levels. Vernon Paul says Hi Justin Do these breakout normally breakout in the direction of the trend? They can also be very specific. The stop loss level and exit point don't have to remain at a set price level as they will be triggered when a certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. How do I place a trade? Thanks Reply. Beginner Trading Strategies. The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Hi justin, thanks for your explanation…i want to know, at last example in usd jpy, you enter buy position without wait the retest.. My name is Mark Ursell, and I am an individual trader and investor. Defined market structure Range or trending…and decide strategy.

By buying near the bottom of the triangle the trader gets a much better price. Plus, strategies are relatively straightforward. Hi Justin. Position size is how many shares stock market , lots forex market or contracts futures market are taken on a trade. Your Privacy Rights. The driving force is quantity. This is because you can comment and ask questions. I am applying technique you had written and of cos from youtube video Thanks a lot. If the MACD line crosses below the signal line a bearish trend is likely, suggesting a sell trade. I can translate all your stuff into Hindi language, i am from India. Peter says I agree may we talk in email please Reply.