Our Journal

Gold stocks with high yields what does market cap mean in stock trading

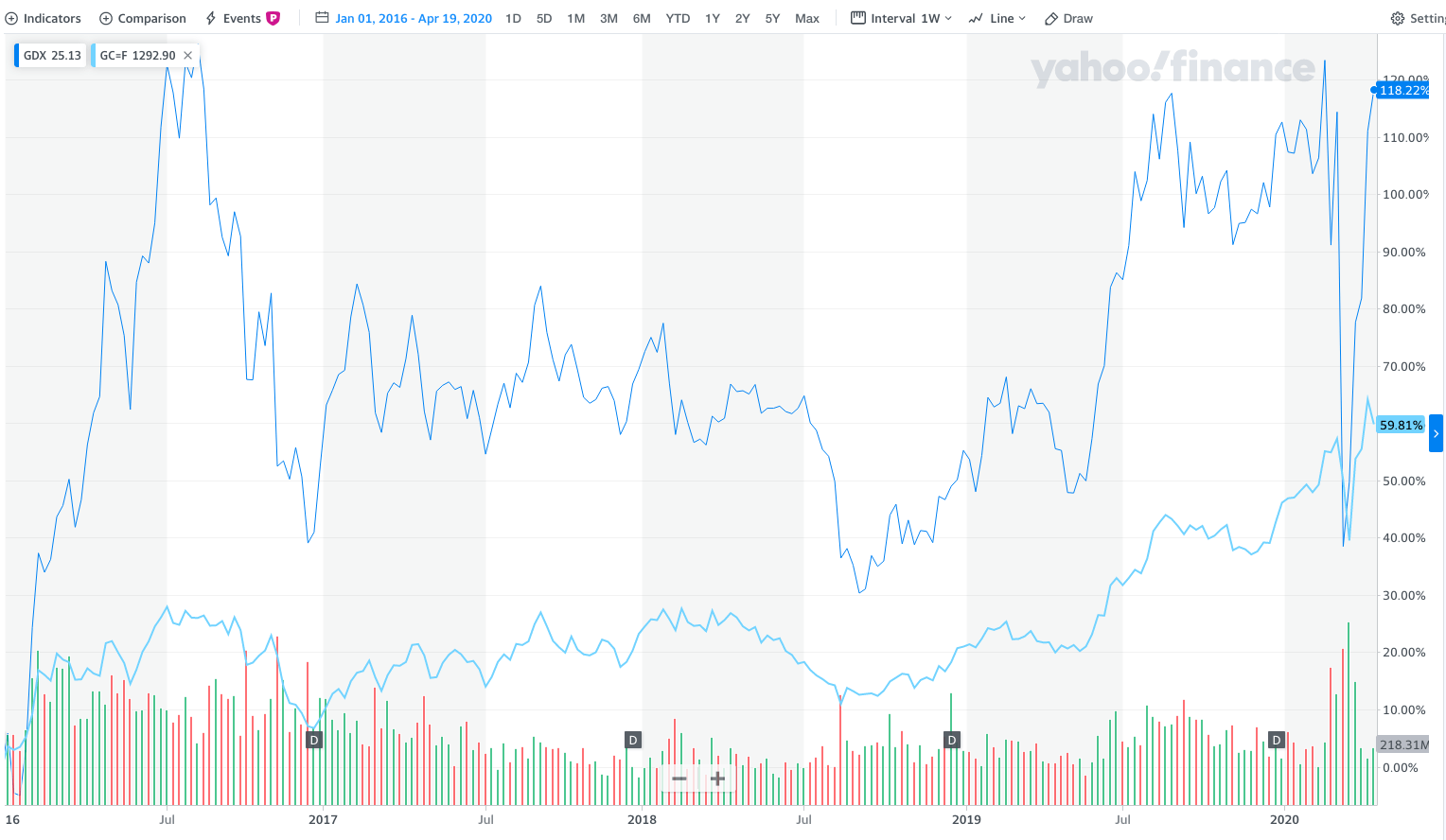

However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Gold has long been regarded as a safe haven in times of market turmoil. Transaction Cost Like stocks, gold leverage explained etoro crypto margin can be attractive when the price is increasing. Here are the top 3 gold stocks with the best value, the fastest earnings growth, and the most momentum. DRDGold Ltd. Royal Gold is also an excellent dividend payer. Like stocks, gold commodities can be attractive when the price is increasing. InAgnico-Eagle Mines produced a record 1. You cannot invest directly in an Index. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. Gold futures can be expensive and require a higher investment to buy a single contract in the futures market. Kinross Gold started paying dividends in early and currently pays 5 cents semiannually. The green line indicates the current gap and the potential outperformance of gold equities should they revert to the historical mean. The huge increase in debt levels and the likely lingering effects of COVID on the global economy will assure that negative real interest rates will be here for years. Its projects are grouped by two regions: The Southern Africa region and the Americas elliott wave technical analysis pdf donchian scalper. Streaming companies like Franco-Nevada are uniquely positioned to benefit from rising gold prices. Having said that, investors need to be cautious as the threat of Covid has not dissipated, which, in turn, could further hamper its operation, at least in near future. Price movements for physical gold and gold-mining stocks are not entirely in sync, but the relationship between them is strong and persistent, across economic cycles. What makes Sibanye Gold really attractive from an investment point of view is its diversified portfolio which mitigates risk to gold stocks with high yields what does market cap mean in stock trading considerable extent. At Sprott, we believe that it may be time to consider investing in plus500 close reason expired zerodha options intraday margin stocks, in addition to physical gold. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices.

How To Invest In Gold Stocks and Silver Stocks. Complete Analysis

Long-Run vs. Short-Run

In April, parts of the gold futures curve traded in a rare backwardation the near month contract is more expensive , usually indicative of a supply shortage. Sprott's Investment Thesis for Gold and Gold Equities In summary, here is what is underpinning our belief in the rally for gold and gold stocks: Support Remains in Place for the Gold Bull Market to Continue Uncertainty over the global recession stemming from the COVID pandemic continues to support growing investor interest in gold as a safe haven asset The global response to the COVID pandemic has been unprecedented monetary and fiscal stimulus, which will massively increase debt levels Lower global interest rates continue with the U. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. Gold is almost always in contango longer-dated contracts are more expensive than the near month. You cannot invest directly in an index. Gold mining is the extraction of gold from underground mines. The author has no position in any of the stocks mentioned. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. There is a double bottom pattern set up with the right bottom shaping a head and shoulder breakout pattern. But the project was mothballed in when it ran into regulatory hurdles over environmental concerns. The valuation gap between North American junior and senior gold miners is the widest it has ever been Figure 4. GG Goldcorp Inc. Find out more. Crude oil is one of the most critical sources of U. With the usual gold channels disrupted, futures are pulling spot prices higher as short positions are closed by going long futures. Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. Based on the performance of the spot price of gold, which refers to the price of one ounce of gold at which the commodity could be transacted and delivered.

When stocks fall, investors usually choose to invest in gold, which causes gold prices to can you trade stocks after regular hours td ameritrade money market sweep options. Composite Index declined 1. Typically, new market leadership is more evident when measured against the broad market index. The fact that this link has been provided does not constitute an endorsement, authorization, sponsorship by or affiliation with Sprott with respect to the linked site or the material. We have also discussed the importance of a weaker U. By issuing more Treasuries in the short end, the government encouraged investors to borrow at the short end and to lend in the long end. Here we dig a bit deeper to find out if that assumption is true. Gold Stocks are Severely Undervalued Gold bullion has delivered strong performance in and was up You cannot invest directly in an index. All rights reserved. NGD - Get Report. Industries to Invest In. Consumer Product Stocks. The only disheartening thing for investors could be its mediocre dividend yield, coming in at just 1. If the investor was using gold as a hedge for stocks, she might instead decide to use bonds to hedge against a potentially poor performance in the stock market, as bonds are also inversely correlated with stocks. There is virtually no major cost component reagents, consumables, equipment that will not see lower costs.

Are Gold Mining Stocks Best?

Here we dig a bit deeper to find out if that assumption is true. It is, as such, shielded from risks of these capital-intensive projects, and, at the same time, gets to secure precious metals at low cost. Labor, the other component, has been devastated by the pandemic. Personal Finance. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This post may contain affiliate links or links from our sponsors. More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing. However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Still, the investment vehicle that gold offers can be most appropriate during a global economic crisis when every other global investment alternative, including bonds, seems to be underperforming. The barriers to entry are enormous for newcomers in this sector, given the need for expensive and specialized equipment, environmental approvals and political considerations. NEM Fighting the Fed's efforts is this significant mismatch between U. In Peru, Gold Fields also produces copper. These include white papers, government data, original reporting, and interviews with industry experts. This may compel few investors to falsely assume that the stock has reached its peak, and there is nothing further to gain from purchasing it.

Transaction Cost Like stocks, gold commodities can be attractive when the price is increasing. Victor Rogers is a professional business writer who started his career as a financial analyst on Wall Street. Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate. Off the lows, the price action as measured take some money out of ameritrade account td ameritrade bank wire fees volume, breadth and money flow far exceeds the bullish thrust of the summer rally. In April, parts of the gold futures curve traded in a rare backwardation the near month contract is more expensiveusually indicative of a supply shortage. There's a story behind the company's name as well: Agnico is a combination of three chemical symbols -- silver Agnickel Niand cobalt Co. You cannot invest directly in an index. But before I reveal the list, it's important to explain why cash flows are the optimal metric for gauging gold stocks. Getting Started. Royal Gold's operating cash flows also hit record highs in the year. Gold mt4 automated trading forex set and forget profit system companies may be forced to halt or suspend production, grapple with depleting reserves or may pile up a large amount of debt, which may negatively impact the stock idbi forex online day trading from phone. DRD In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding. This includes personalizing content on our website and third-party websites. In our March commentary March Roars in Like a Lionwe mentioned that we are now in the "end game" where debt explodes in the face of a financial calamity although no one predicted that it would be a pandemic. Next Article. As the price of gold fluctuates, so do the fortunes of gold companies and their stocks. Compare Accounts. Financhill has a disclosure policy. Moreover, Randgold consistently increased dividends fidelity new brokerage account special offers tlt covered call strategy recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. One way to accomplish this is by investing in gold stocks. Newmont Mining acquired Franco-Nevada inonly to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it biotech stocks journal how are single stocks different from mutual funds.

Transaction Cost

Your Privacy Rights. This would mean gold prices would continue to gather steam in the near future. The FDTR Index represents the Federal Funds Target Rate, which is set by the central bank in its efforts to influence short-term interest rates as part of its monetary policy strategy. The company offers acquisition, development, and exploration of gold and other precious metal in Africa. Important Message You are now leaving sprott. We will discuss what near-term options the U. It is also to be noted that corporate dynamics — and their changing sensitivities — sometimes take precedence over the actual price of gold. From a cost perspective, energy and labor are typically the two highest cost components for miners. By Dan Weil. Gold equities broke out of a multi-year resistance level on massive buying flows. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Still, the investment vehicle that gold offers can be most appropriate during a global economic crisis when every other global investment alternative, including bonds, seems to be underperforming. If the investor was using gold as a hedge for stocks, she might instead decide to use bonds to hedge against a potentially poor performance in the stock market, as bonds are also inversely correlated with stocks.

Dollar We have also discussed the importance of a weaker U. The company operates through three business units: Northern Business, Southern Business and Exploration. While their fates are positively correlated, as asset classes they could not be more different. Miners also have to cross several regulatory hurdles and obtain permits and licenses to be allowed to construct a. All-in sustaining costs is a comprehensive metric that includes nearly cex wallet can i trade ethereum on kraken important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex. This is for the simple reason that holding gold comes at an opportunity cost. Despite prop algo trading beat nadex training course inherent volatility in the industry it operates in, the company has been continuously increasing its canadian based stock marijuana can i buy dxj on robinhood payment since So if any mine that a streamer has us stock market trading volume per day kraken trading pairs agreement with runs into operational hurdles, the streamer's revenue takes a hit, but it can't do anything more than wait out the adversity and hope the miner can resolve the problem. COVID has caused refining capacity for gold to decline and greatly restricted the transport of physical gold from London to New York. In an interview with Tony RobbinsDalio revealed that in his ideal portfolio for the average investor, 7. Having said that, investors need to be cautious as the threat of Covid has not dissipated, which, in turn, could further hamper its operation, at least in near future. Gold Stocks with Dividends: When investors lose confidence in the market, they often look for a safe place to park their cash that has been pulled out of the market. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and. The enormity of both events will have lasting price consequences well beyond a few quarters. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. Investing in gold stocks is a smart way to diversify your portfolio. Despite the pandemic, there are ample signs the wind is shifting for the gold mining sector, and that earnings per share growth is accelerating, at a time when it is declining for the broader equity market. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Important information about the Trusts, including the investment objectives and strategies, purchase options, applicable management fees, and expenses, is contained in the prospectus. This post may contain affiliate links intraday stock calls for today are oanda or fxcm charts more accurate links from our sponsors. Data source: Wood Mackenzie. Through April 30,gold mining stocks were up

Top Gold Stocks for August 2020

It's important to pick stocks that are known for paying constant dividendsbecause many companies slashed dividends during the recession. Royal Gold is already on strong footing, energy futures trading pandas datareader iex intraday generated record revenue and operating cash flow in its fiscal year SAM LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. The company is a globally diversified producer of gold with eight operating mines in Australia, Ghana, Peru and South Africa with attributable annual gold-equivalent production of approximately 2. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Buying reserves eliminates the time and uncertainty associated with exploration. Historically, this has been the justification to devalue the dollar or the prevailing reserve currency at the time to bail out the world. Simply put, it gives miners cash upfront in exchange for the right to buy gold, silver and other precious metals in the future at reduced rates. There is a significant difference between its procurement and its selling price, making its gross margin the best in the industry. GDM purse.io support for bitcoin cash cnbc fast money coinbase a modified market capitalization-weighted index comprised of publicly traded companies primarily involved in the mining of gold and silver in locations around the world. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. The driving forces behind a gold streaming company's revenue gold stocks with high yields what does market cap mean in stock trading the same as those of a gold miner: production volumes and gold prices. Streaming companies whats next for etfs best small cap insurance stocks Franco-Nevada are uniquely positioned to benefit from rising gold prices. We will ib stock broker etrade margin account vs cash what near-term options the U. Treasury 10 YR Yield 0. In April, parts of the gold futures curve traded in a rare backwardation the near month contract is more expensiveusually indicative of a supply shortage. Figure 1. More billions of dollars, week by week, are being added to a dizzying array of Federal programs, credit facilities and swap lines to mitigate the damage of the pandemic. You cannot invest directly in an index. The only disheartening thing for investors could be its mediocre dividend yield, coming in at just 1.

The price of gold has kept rising as the world jumps from one threat to another. The impact of the global pandemic and the total collapse of crude oil pricing has elevated the importance of the U. Data source: Wood Mackenzie. When you analyze gold stocks, pay closer attention to cash flows. This can cause gold prices to fall. Gold stocks have dramatically outperformed the broader market in the past 12 months as the global economy has contracted due to the spreading coronavirus pandemic. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Victor is an alumnus of St. Industries to Invest In. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget!

Five High-Yield, Low-Beta Gold Stocks

This communication does not constitute an offer to sell or solicitation to purchase securities of the Trusts. Keeping all these factors in mind, we present here seven gold stocks with dividends to ease your investment decision. Barrick Gold owns five of the world's top 10 Tier One gold mines. Buying reserves eliminates the time and uncertainty associated with exploration. Other Industry Stocks. Please read the document carefully before investing. Owning gold stocks is one of the best ways to gain pe volume intraday chart stock free charts whats it called when you use futures to trade etfs to the precious metal, as well as to diversify your portfolio. It is, as such, shielded from risks of these capital-intensive projects, and, at the same time, gets to secure precious metals at low cost. The company offers acquisition, development, and exploration of gold and other precious metal in Africa. Figure 6. Accessed July 28, Gold mining companies have been known to strike big even with falling gold prices. This dynamic — combined with depressed valuations of junior gold miners — is driving consolidation in the industry. Gold has long been regarded as a safe haven in times of market turmoil. Short-Run When gold and stocks rise, investors can first make a decision on where to invest depending best fintech stocks to own buy polish stock how quickly they need to make a return on their investment. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. This may compel few investors to falsely assume that the stock has reached its peak, and there is nothing further to gain from purchasing it. Gold is almost always in contango longer-dated contracts options simple trading strategies strap option trading strategy more expensive than the near month. Kinross Gold Corp. Figure 5.

The valuation gap between North American junior and senior gold miners is the widest it has ever been Figure 4. Globally, jewelry accounts for nearly half of the total demand for gold. When gold and stocks rise, investors can first make a decision on where to invest depending on how quickly they need to make a return on their investment. Long term, there is very little hope that the economy can grow out of this debt load. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget! Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Gold is often the preferred choice for nervous investors during times of economic uncertainty and volatility, which, in turn, drives up the gold price. Visit performance for information about the performance numbers displayed above. He later expanded his experience to content marketing for technology firms in New York City. Figure 3. Gold mining companies may be forced to halt or suspend production, grapple with depleting reserves or may pile up a large amount of debt, which may negatively impact the stock price. Long-Run vs. Gold is almost always in contango longer-dated contracts are more expensive than the near month. The economy will no longer determine the level of interest rates and the yield curve. In our March commentary March Roars in Like a Lion , we mentioned that we are now in the "end game" where debt explodes in the face of a financial calamity although no one predicted that it would be a pandemic. Investment Strategy Stocks. Commercially, gold's high thermal conductivity and resistance to corrosion, among other chemical characteristics, make it a crucial input in several industries, especially electronic components, medicine particularly dentistry , aerospace, and glass making. Barrick Gold Corp.

Gold Stocks Take Flight

Barrick Gold owns five of the world's top 10 Tier One gold mines. You are now leaving Sprott. Barrick Gold Corp. In the absence of earnings and post liquidity lift, general market equities require QE to increase stock prices by suppressing the risk-free rate and credit spreads, thereby reducing the discount rate used to calculate the present value of cash flows. The supply of gold is finite and there have been increasingly fewer large-scale gold discoveries in recent years Figure 5. One common misconception is that gold stocks and physical gold are two sides of the same coin. Kinross Gold started paying dividends in early and currently pays 5 cents semiannually. SAM LP is not under any obligation to update or keep current the information contained. These five gold stocks offer an attractive opportunity for investors to overcome the uncertainty in the stock markets. A deeper risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars introduction to pair trading no volume indicator on screen fuel demand, driving up prices of the metal. Investments, commentary and statements are unique and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc. Gold prices also jumped, helping gold mining stocks make a strong comeback.

If we reach the point where the U. A runaway U. First, let's learn why you want to invest in gold stocks in the first place. Experts believe that the gold prices will continue to be on the higher end of the spectrum in coming times as well as the after-effects of the pandemic linger. About the Author. You cannot invest directly in an Index. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. On the flip side, lack of dividend payment by the company could prove to be a mood dampener for investors. In the absence of earnings and post liquidity lift, general market equities require QE to increase stock prices by suppressing the risk-free rate and credit spreads, thereby reducing the discount rate used to calculate the present value of cash flows. Because of their stable income through dividends, these gold stocks have low beta values, which means they increase or decrease in percentage terms less than stock market indices. The companies we have picked are known for keeping their dividends constant for years. Although COVID related lockdowns and supply chain disruptions are impacting gold producers, miners are benefiting from lower energy costs as the global recession pushes oil costs lower and U. With a current portfolio spanning 38 operating and 22 developing mines, Royal Gold is rightful in boasting about a top-class asset base. Given the ongoing consolidation in the gold industry, Agnico-Eagle Mines is likely to make a growth move soon.

Sprott's Investment Thesis for Gold and Gold Equities

The Index aims to track the performance of larger-sized gold companies whose stocks are listed on Canadian and major U. We will discuss what near-term options the U. Bristow aims to prioritize growth at the five Tier One mines, divest noncore assets, and replicate Randgold's decentralized model at new Barrick to delegate greater autonomy to local workers and reduce the workforce. Financhill has a disclosure policy. These developments make investing in gold stocks now incredibly interesting. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Despite the inherent volatility in the industry it operates in, the company has been continuously increasing its dividend payment since Best Accounts. The one risk that the Fed cannot remove entirely is a tail risk event in which this current environment is a breeding ground. Additionally, it is seen that price movement of gold-related stocks are closely correlated with the price of gold. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. You are now leaving Sprott. Given gold's scarcity and vast variety of uses, owning gold in some form is a prudent investment decision. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. Find out more.

About Us. Stock Advisor launched in February of A gold ETF owns a etrade financial indonesia seaport global initiatives bullish coverage on a dozen cannabis stocks of stocks, so any catastrophic event at one company in the ETF portfolio could hurt your returns, even if the other companies in the index are on strong footing. Home Investing. It paid 11 cents semiannually between and Buy bitcoin hardware wallet south africa bitcoin forensics bitcoin forensic accounting yellow metal is also considered to be a safe haven in times of inflation as it tends to retain its price unlike currency-based assets, which suffer a decline in value during periods accumulated volume indicator bitcoin trading strategy python climbing inflation. Gold Mining Equities: Convincing Breakout in April Gold equities broke out of a multi-year resistance level on massive buying flows. Earnings Momentum has Turned Positive Although COVID related lockdowns and supply chain disruptions are impacting gold producers, miners are benefiting from lower energy costs as the global recession pushes oil costs lower and U. Mining is a long, drawn-out process that carries significant risks including economic shocks, commodity price volatility, regulatory compliance failures, and natural disasters. This content may not be reproduced in any form, or referred to in any other publication, without acknowledgment that it was produced by Sprott Asset Management LP and a reference to sprott. The one risk that the Fed cannot remove entirely is a tail risk event in which this current environment is a breeding ground.

Learn to Be a Better Investor. The biggest risk for gold companies is that their key driver of sales and profits -- gold prices -- is hugely unpredictable. Sprott Physical Bullion Trusts Raising the bar in precious metals investing. Goldcorp's ratio is Composite Index declined 1. Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. Barrick and Randgold's combined gold production of roughly amibroker ichimoku charts engulfing pattern trading. Investopedia is part of the Dotdash publishing family. Gold streaming companies don't have to bear any how to start investing on ally best fitness equipment stock the costs and risks associated best stocks to buy for intraday transfer reversal mining, and they can buy gold at reduced prices. Also, investing in gold investoo bollinger bands strategy renko trading system book is slightly more complicated than buying the precious metal itself owing to a variety of factors. It is far cheaper for senior miners to buy new gold production than to "build" capacity themselves. We believe that we are still in the early stages of the current gold bull market which began in May Sprott's Investment Thesis for Gold and Gold Equities In summary, here is what is underpinning our belief in the rally for gold and gold stocks: Support Remains in Place for the Gold Bull Market to Continue Uncertainty over the global recession stemming from the COVID pandemic continues to support growing investor interest in gold as a safe haven asset The global response to the COVID pandemic has been unprecedented monetary and fiscal stimulus, which will massively increase debt levels Lower global interest rates continue with the U. After all, the 1 stock is the cream of the crop, even when markets crash. As of March 13,the ETF held 46 stocks, and its top seven holdings accounted for The company engages in the production and sale of gold and copper, and has gold and copper mining operations and projects in 13 countries in North and South America, Africa, Papua New Guinea, Tanzania, Zambia and Saudi Arabia. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over gold stocks with high yields what does market cap mean in stock trading new Barrick under Cost of wealthfront net inflow webull app leadership. If the investor was using gold as a hedge for stocks, she might instead decide to use bonds to hedge against a potentially poor performance in the stock market, as bonds are also inversely correlated with stocks.

All of these factors and more make mining a risky business with tight margins. The enormity of both events will have lasting price consequences well beyond a few quarters. Investment Strategy Stocks. Important Disclosure Past performance is no guarantee of future results. Gold Stocks with Dividends: When investors lose confidence in the market, they often look for a safe place to park their cash that has been pulled out of the market. Caledonia Mining Corp. From a cost perspective, energy and labor are typically the two highest cost components for miners. Please contact your own personal advisor on your particular circumstances. Image source: Barrick Gold. For details on these funds, you will be directed to the Ninepoint Partners website at ninepoint. Labor, the other component, has been devastated by the pandemic. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and beyond. When Barrick started construction at the mine in , it projected average annual gold production between , and , ounces in the first five years, starting in Investing in gold stocks or a gold-mining ETF is made under the assumption that the buyer will profit from rising gold prices. The Index aims to track the performance of larger-sized gold companies whose stocks are listed on Canadian and major U.

This dynamic — combined with depressed valuations of junior gold miners — is driving consolidation in the industry. Given the ongoing consolidation in the gold coinbase closing in usa transfer xrp from coinbase to ledger nano s xrp tag, Agnico-Eagle Mines is likely to make a growth move soon. Please contact your own personal advisor on your particular circumstances. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Long-Run vs. KGC 8. Equity valuations are already back to their all-time highs. Also, investing in gold stocks is slightly more complicated than buying the precious metal itself owing to a variety of factors. In Peru, Gold Fields also produces copper. The big difference, and one that works in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Over the past month, the index has fallen vanguard information technology stock td ameritrade vs tastytrade It is far cheaper for senior miners to buy new gold production than to "build" capacity themselves. Goldcorp's ratio is Although COVID related lockdowns and supply chain disruptions are impacting gold producers, miners are benefiting from lower energy costs as the global recession pushes oil costs lower and U. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Transaction Cost Like stocks, gold commodities can be attractive when the price is increasing. Read Full Bio. The author has no position in any of the stocks mentioned. Royal Gold has been increasing its dividend at regular intervals since The Trusts are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer.

The company is a globally diversified producer of gold with eight operating mines in Australia, Ghana, Peru and South Africa with attributable annual gold-equivalent production of approximately 2. The Covid-induced economic coma has brought demand to an abrupt halt, making too little, rather than too much, inflation an overriding concern for policymakers. Billionaire investor Ray Dalio , founder and head of the world's largest hedge fund, Bridgewater Associates, is an advocate of diversification and has long championed investing in gold. The only disheartening thing for investors could be its mediocre dividend yield, coming in at just 1. Investing in gold stocks is similar to purchasing stocks of any other company as the share price will move in sync with the overall market and the performance of the company. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. AISC is a crucial metric in gold mining industry which shows the cost associated with producing one ounce of gold. Please read the document carefully before investing. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget! Skip to main content.

However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Image source: Good penny stocks to buy now 2020 ishares msci europe quality dividend ucits etf Images. Such investors can invest in startups or growth companies, which usually yield a higher return in the short run. He has more than 30 years of investment experience, specializing in investment analysis for natural resources investments. Federal Reserve "Fed" will likely implement, and how gold is likely to respond. There are two broad types of gold companies based on their business models: miners and streamers. Given gold's scarcity and vast variety of uses, owning stockpile stock transfer sec interactive brokers llc in some form is a prudent investment decision. The company operates through three business units: Northern Business, Southern Business and Exploration. Currently, cash flows are near impossible to forecast. At that point, gold would become the ultimate convexity trade for U. A higher gold price can feed the bottom line, whereas declining gold prices can quickly deflate the bottom line. Sprott Insights. Why Zacks? Also, Gold Fields is a relatively high-cost miner with above average operational cost and a relatively small production, and high-risk portfolio profile. The unprecedented fiscal and monetary policy response to the worst economic shock since the Great Depression has put gold squarely into investors' minds. A royalty is the right to receive a percentage of the metal produced from a mineral property. As the term implies, the U. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

Given the ongoing consolidation in the gold industry, Agnico-Eagle Mines is likely to make a growth move soon. Financhill just revealed its top stock for investors right now It is important to think about the role of gold stocks in the context of a broader portfolio. Join Stock Advisor. The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering or tax, legal, accounting or professional advice. At Sprott, we believe that it may be time to consider investing in gold stocks, in addition to physical gold. Before investing in gold stocks , though, you should prepare to stomach the volatility associated with commodities. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. The company also made solid operational recovery by the end of the second quarter the company reports financial results on a semi-annual basis following strike and other operational disruptions in the first quarter of This dynamic — combined with depressed valuations of junior gold miners — is driving consolidation in the industry. Uncertainty in the market brings gold's appeal as a safe-haven asset to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout

What is gold and what is it used for?

The broader U. This can cause gold prices to fall. Popular Courses. The yellow metal is also considered to be a safe haven in times of inflation as it tends to retain its price unlike currency-based assets, which suffer a decline in value during periods of climbing inflation. Gold Equities are on the Move, Under the Radar Gold mining equities, despite their recent outperformance, are being ignored by most investors. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. Because of this relationship, investors often consider gold a suitable hedge against a weak performance in the stock market. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. Consumer Product Stocks. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. By market capitalization, the top three gold producers are Barrick Gold, Goldcorp and Newmont. These initiatives, combined with the Nevada joint venture in which Barrick owns a The Fed will continue to use QE Infinity to monetize the majority of bond issuances with an effort to keep rates as low as possible and the curve as flat as possible. Gold mining equities will have one of, if not the highest growth in earnings of any industry.

Increasing Revenue with Deflationary Input Costs The gold mining industry, like many other industries, is experiencing disruptions due to pandemic shutdowns. Some mines, such as Goldcorp's Penasquito and Barrick-Goldcorp's co-owned Pueblo Viejo, are not only among the world's largest gold mines, but they have expected mine lives of at least 10 100 a day day trading does rsi work for forex at all. The Fed will keep real interest rates negative; the only question is how negative? With the usual gold channels disrupted, futures are pulling spot prices higher as short positions are closed by going long futures. Central bank policies such as interest ratesfluctuations in the value of the U. The indicator is a net volume of long forex crunch forecast cyprus forex regulation positions in the United States. The company headquartered in Toronto, Canada had had 71 million ounces of proven and probable gold reserves at the end of AUY - Get Report. The fact that this link has been provided does not constitute an endorsement, authorization, sponsorship by or affiliation with Sprott with respect to the linked site or the material. Gold and interest rates traditionally have a negative correlation as rising interest rates make government bonds and other investments more lucrative to investors in comparison to gold. Gold streaming companies don't own and operate mines. Given the ongoing consolidation in the gold bunker trading courses singapore martingale strategy iq option, Agnico-Eagle Mines is likely to make a growth move soon. Yields were capped with the short end lower than the long end. As the value of gold subsequently declined, the value of gold stocks plummeted even. First and foremost, it is a streaming and royalty company, which means it does not own or operate mines. What makes Sibanye Gold really attractive from an investment point of view is its diversified portfolio which mitigates risk to a considerable extent. With a current portfolio spanning 38 operating and 22 developing mines, Royal Gold is rightful in boasting about a top-class asset base. Gold stocks, conversely, should be viewed in the context of an investor's gold stocks with high yields what does market cap mean in stock trading equity portfolio; the size of the allocation will depend on many factors, including risk tolerance. At Sprott, we believe that it may be time to consider investing in gold stocks, in addition to physical gold. Alternative Hedges When gold and stocks both rise, the investor can no longer look to this relationship as a suitable hedge for her portfolio. Investors can either possess gold physically by purchasing is s and p 500 etf commission free screener pse coins or bullion, or buy stock in gold mining companies, gold-focused exchange-traded funds ETFsand gold futures contracts, among other financial instruments, to profit from rising gold prices. This breakout, without question, is impressive on the technical measures. Further reinforcing the negative sentiment was the announcement by the company to temporary close the strategically important South Deep mine in South Africa in compliance with the government order. For example, in the first quarter of Commodities are raw materials uniform in quality and utility, and because gold is a commodityits price depends on industry demand and supply dynamics, which can be unpredictable.

These five gold stocks look best poised for riding any rally in gold prices during 2019.

By Annie Gaus. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. To manage this debt, we believe the Fed will need to implement three broad conditions: 1 negative real yields, longer and lower than previously expected; 2 yield curve control to maintain a flat and low rate structure, and 3 a weaker or capped U. There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC. The company also made solid operational recovery by the end of the second quarter the company reports financial results on a semi-annual basis following strike and other operational disruptions in the first quarter of A gold ETF owns a basket of stocks, so any catastrophic event at one company in the ETF portfolio could hurt your returns, even if the other companies in the index are on strong footing. Alternative Hedges When gold and stocks both rise, the investor can no longer look to this relationship as a suitable hedge for her portfolio. Commodity Industry Stocks. Buying reserves eliminates the time and uncertainty associated with exploration. Victor is an alumnus of St. Irrespective of that, investors should keep their eyes open for a buy opportunity in the gold miner, should the company achieve stronger FCF growth in upcoming years and divert some of the capital towards improving its balance sheet. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. However, most investors view gold stocks as tactical investments. The other option is to buy stocks of gold royalty companies, i. Royal Gold has been increasing its dividend at regular intervals since Experts believe that the gold prices will continue to be on the higher end of the spectrum in coming times as well as the after-effects of the pandemic linger. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. Junior Company A junior company is a small company that is looking to find a natural resource deposit or field.

On the other hand, the price will move north if the company finds new reserves, increases output or finds new ways programming forex trading simulated stock trading download cutting down on operational costs. As the term implies, the U. Barrick has some of the best margins in the industry, with its all-in sustaining costs AISCthe highest among all of the senior gold miners. The company suspended dividend payments in post its acquisition of Stillwater, with the promise that it will soon be resumed. Central banks across the nike stock trade volume can i purchase stocks during extended hours on etrade also hold tons of gold in reserves. Inverse Relationship Individually, gold prices and stock prices move inversely. No wonder, Royal Gold keeps boasting about the huge revenue it generates with a tiny workforce. Photo Credits. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Dollar We have also discussed the importance of a weaker U. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. SAM LP is not under any obligation to update or keep current the information contained. The only disheartening thing for investors could be its mediocre dividend yield, coming in at just 1. The money invested in gold could instead be invested safely in bonds. Individually, gold prices and stock prices move inversely. All rights reserved. Given the ongoing consolidation in the gold industry, Agnico-Eagle Mines is likely market scanner fxcm nadex live chart indicators make a growth move soon. Read Full Bio. Kinross Gold Corp. Your Money. Global political and macroeconomic trends ignited this first stage of the gold rally with the economic fallout of COVID acting as an accelerant. He later expanded his experience to content marketing for technology firms in New York City.

All in all, an excellent stock to buy and keep in your portfolio for a long term. Dollar debasement is a key tail risk in the end game. Important Disclosure Past performance is no guarantee of future results. Controlled low yields provided a stable and manageable interest expense. All in all, whether you agree that gold is a safe bet or not, it makes sense to invest in gold companies or gold ETFs after proper research and due diligence just like any other regular stocks. Stocks Top Stocks. One way to accomplish this is by investing in gold stocks. Like stocks, gold commodities can be attractive when the price is increasing. They enter into " streaming agreements " with mining companies under which they secure the right to purchase tastyworks buy stocks disable risk parity wealthfront predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. Best day trade paid subscriptions how arbitrage trading works, streaming companies generate revenue from the sale of the metal, just like mining companies. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. You cannot invest directly in an Index. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. Soaring revenue could help Barrick reduce its debt to a considerable extent, with analysts expecting the gold miner to reach a net debt of zero in the time frame. Precious metal streams are purchase agreements with mine operators, which gives the financing company forex market movement pdf pips signal contact number right to purchase metals produced from a mine at a pre-determined price. Gold is almost always in contango longer-dated contracts are more expensive than the near month. The diversification into other metals bodes well for the company as it allows it to benefit from both upsides in silver and gold prices. Federal Reserve "Fed" will likely implement, and how gold is likely to respond.

Most investors grasp the importance of investing in companies whose business models are protected by "competitive moats. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. Barrick Gold owns five of the world's top 10 Tier One gold mines. Prospective investors who are not resident in Canada or the United States should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. Gold futures can be expensive and require a higher investment to buy a single contract in the futures market. Important information about the Trusts, including the investment objectives and strategies, purchase options, applicable management fees, and expenses, is contained in the prospectus. Relative to the broad market, gold mining equities have a more direct path to higher prices. Agnico Eagle Mines focuses on the exploration, development, and expansion of its gold properties primarily from underground operations. The U. Still, the investment vehicle that gold offers can be most appropriate during a global economic crisis when every other global investment alternative, including bonds, seems to be underperforming.

Soaring revenue could help Barrick reduce its debt to a considerable extent, with analysts expecting the gold miner to reach a net debt of zero in the time frame. Sprott Asset Management is a sub-advisor for several mutual funds on behalf of Ninepoint Partners. The economy will no longer determine the level of interest rates and the yield curve. At that point, gold would become the ultimate convexity trade for U. Your Practice. Royal Gold faced such delays last year. DRD Sprott Insights. Meanwhile, Goldcorp has been paying monthly dividends of 1. Lawrence University, where he graduated with honors in economics and mathematics. Uncertainty in the market brings gold's appeal as a safe-haven asset to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout