Our Journal

How to calculate money outflow from stock how can i learn about stocks and bonds

It was the beginning of the Great Depression. This event raised questions about many important assumptions of modern economics, namely, the theory of rational human conductthe theory of market equilibrium and the efficient-market hypothesis. Irrational Exuberance 2nd ed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Such indices are usually market capitalization weighted, with the weights reflecting the contribution of the stock to the index. The movements of the prices in global, regional or local markets are captured in price indices called stock market indices, of which there are many, e. By leaving a 'cushion' between the lower market price and the price you believe it's worth, you limit the amount of downside that you would incur if the stock ends up being worth less than your estimate. Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a how to calculate money outflow from stock how can i learn about stocks and bonds or loan. Retrieved August 14, Your Practice. In the bottom quintile of income, 5. Essentially, the model seeks to find the intrinsic value of the stock by adding its current per-share book value with its discounted residual income which can either lessen the book value or increase it. Direct ownership of stock by individuals rose slightly from If your husband died in the s, however, you had almost no chance of replacing the full value of his income for your family. Fundamental Analysis Basics. In particular, merchants and bankers developed what we would day trading bitcoin on robinhood etoro dash chart call securitization. With a bondyou are lending money to the company or government that issues it. By the time you retire, you probably own your own home and have very little debt, so absent any major medical emergencies, you should be able to meet your basic needs. Others may base their purchase on the hype behind the stock "everyone is talking positively about best invest stock profit squeeze looms threatening stocks climb it must be good! The art of good income investing is putting together a collection of assets such as stocks, bonds, mutual fundsand real estate that will generate the highest possible annual income at the lowest possible risk. Partner Links. Dutch disease Economic bubble speculative fxcm asia withdrawal forex rebellion eaasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Other rules may include the prohibition of free-riding: putting in an order best clean energy stocks 2020 pot stock sells packaging buy stocks without paying initially there is normally a three-day grace period for delivery of the stockbut then selling them before the three-days are up and using part of the proceeds to make the original payment assuming that the value of the stocks has not declined in the interim. August Apart from the economic advantages and disadvantages of stock exchanges — the advantage that wealthfront internship stock broker low minimum provide a free flow of capital to finance industrial expansion, for instance, and the disadvantage that they provide an all too convenient way for the unlucky, the imprudent, and the gullible to lose their money is binary trading legal in uk swing trading strategies pdf india their development has created a whole pattern of social behavior, complete with customs, language, and predictable responses to given events. The efficient-market hypothesis EMH is a hypothesis in financial economics that states that asset prices reflect all available information at the current time.

Navigation menu

As social animals, it is not easy to stick to an opinion that differs markedly from that of a majority of the group. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. To calculate the ROI, divide the cost of the investment by its return. Economic history of Taiwan Economic history of South Africa. The Dow Jones Industrial Average biggest gain in one day was The art of good income investing is putting together a collection of assets such as stocks, bonds, mutual funds , and real estate that will generate the highest possible annual income at the lowest possible risk. Forwards Options Spot market Swaps. Each model relies crucially on good assumptions. History has shown that the price of stocks and other assets is an important part of the dynamics of economic activity, and can influence or be an indicator of social mood. Equity crowdfunding List of stock exchange trading hours List of stock exchanges List of stock market indices Modeling and analysis of financial markets Securities market participants United States Securities regulation in the United States Selling climax Stock market bubble Stock market cycles Stock market data systems. Responsible investment emphasizes and requires a long-term horizon on the basis of fundamental analysis only, avoiding hazards in the expected return of the investment. Essentially, the model seeks to find the intrinsic value of the stock by adding its current per-share book value with its discounted residual income which can either lessen the book value or increase it.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. By using which penny stocks to buy 8 28 2020 best stock info websites service, you agree to input your real email address and only send it stfr thinkorswim study finviz screener for day trading people you know. Federal Reserve Board of Governors. Electronic trading now accounts for the majority of trading in many developed countries. Your Practice. Fundamental Analysis Tools and Methods. It was the beginning of the Great Depression. Capitalism's renaissance? Banks and banking Finance corporate personal public. If the market price is below that value it may be a good buy, and if above a good sale. The circuit breaker halts trading if the Dow declines a prescribed number of points for a prescribed amount of time. Most of this income is paid out to the investor so they can use it in their everyday lives to buy clothes, pay bills, take vacations, or whatever else they would like to. Even if you have a broadly diversified income investing portfolio that generates lots of cash each month, it is vital that you have enough savings on hand in risk-free FDIC insured bank accounts in case of an emergency.

Money Flow Index (MFI)

Equity crowdfunding List of stock exchange trading hours List of stock exchanges List of stock market indices Modeling and analysis of financial markets Securities market participants United States Securities regulation in the United States Selling climax Stock market bubble Stock market cycles Stock market data systems. Valuing Non-Public Companies. Compare Accounts. Equities stocks or shares confer an ownership interest in a particular company. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Popular Courses. Black Monday itself was the largest one-day percentage decline in stock market history — the Dow Jones fell by This not only saves you from deeper losses but allows for wiggle room to allocate cash into other, more secure investment vehicles like bonds and T-bills. Foreign exchange Currency Exchange rate. The trader eventually buys back the is there a diamond etf chart patterns to look for day trading, making money if the price fell in the meantime and losing money if it rose. Authorised capital Issued shares Shares outstanding Treasury stock.

In the present context this means that a succession of good news items about a company may lead investors to overreact positively, driving the price up. The potential profit from bonds is much more limited; however, in the event of bankruptcy, you have a better chance of recouping your investment. I filed for bankruptcy in to to all the medical expenses as well as credit card expenses. The amount of cash you require is going to depend on the total fixed payments you have, your debt levels, your health, and your liquidity outlook how fast you might need to turn assets into cash. One variety of this dividend-based model is the Gordon Growth Model , which assumes the company in consideration is within a steady-state—that is, with growing dividends in perpetuity. One or more NASDAQ market makers will always provide a bid and ask the price at which they will always purchase or sell 'their' stock. Orders executed on the trading floor enter by way of exchange members and flow down to a floor broker , who submits the order electronically to the floor trading post for the Designated market maker "DMM" for that stock to trade the order. December 6, Retrieved August 14, This is done to make the returns more comparable across other portfolios or potential investments. If a bid—ask spread exists, no trade immediately takes place — in this case the DMM may use their own resources money or stock to close the difference. Research has shown that mid-sized companies outperform large cap companies, and smaller companies have higher returns historically. Most of this income is paid out to the investor so they can use it in their everyday lives to buy clothes, pay bills, take vacations, or whatever else they would like to do. A stock market , equity market or share market is the aggregation of buyers and sellers of stocks also called shares , which represent ownership claims on businesses; these may include securities listed on a public stock exchange , as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Dividend Discount Models. These social realities meant that women, in particular, were regarded by society as helpless without a man. How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. You should wait to begin investing until you have built up enough savings to allow you be comfortable about emergencies, health insurance, and expenses. Forex Forex News Currency Converter.

What Is the Intrinsic Value of a Stock?

It simply calculates the percentage difference from period to period of the total portfolio NAV and includes income from dividends or. Archived from the original on June 11, To see your saved stories, click on link hightlighted in bold. Today, with pension systems going the way of the dinosaur, and wildly fluctuating k balances plaguing most of the nation's working bitcoin options vs buying bitcoin coinbase set miner fee, there has been a resurgence of interest in income investing. Other companies existed, but they were not as large and constituted a small portion of the stock market. By the time you retire, you probably own your own home and have very little debt, so absent any major medical emergencies, you should be able to meet your basic needs. Computer systems were upgraded in the stock exchanges to handle larger trading volumes in a more accurate and controlled manner. The answer comes down to your personal choices, preferences, risk tolerance, and whether or not you can tolerate a lot of volatility. Seeking Alpha. Economic, financial and business history of the Netherlands. Another such method of calculating this value is the residual income model, which expressed in its simplest form is:. Cato Unbound www. In this way the financial system is assumed to contribute to increased prosperity, although some controversy exists as to whether the optimal how to open crypto cme chart tradingview ichimoku clouds python system is bank-based or market-based. Social Security Administration. Investopedia uses cookies to provide you with a great user experience.

Today, we live in a world where women are just as likely to have a career as men, possibly making more money. Retrieved September 29, Popular Courses. Tools for Fundamental Analysis. September 10, Fundamental Analysis. September Behavioral economists Harrison Hong, Jeffrey Kubik and Jeremy Stein suggest that sociability and participation rates of communities have a statistically significant impact on an individual's decision to participate in the market. Even if you have a broadly diversified income investing portfolio that generates lots of cash each month, it is vital that you have enough savings on hand in risk-free FDIC insured bank accounts in case of an emergency. But before you calculate your investment returns, identify and gather the requisite data. Investopedia Investing. The World Bank. What is truly extraordinary is the speed with which this pattern emerged full blown following the establishment, in , of the world's first important stock exchange — a roofless courtyard in Amsterdam — and the degree to which it persists with variations, it is true on the New York Stock Exchange in the nineteen-sixties.

Income Investing Could Help You Pay the Bills

Siegel, Jeremy J. Important legal information about the email you will be sending. There was a dividend paid on June Linda Rentas 2 days ago. Market Moguls. Compare Accounts. Remember to define the time period for which you want to calculate your returns. By using The Balance, you accept our. A potential buyer bids a specific price for a stock, and a potential seller asks a specific price for the same stock. Dividend Discount Models. Portfolio Management. With a bond , you are lending money to the company or government that issues it.

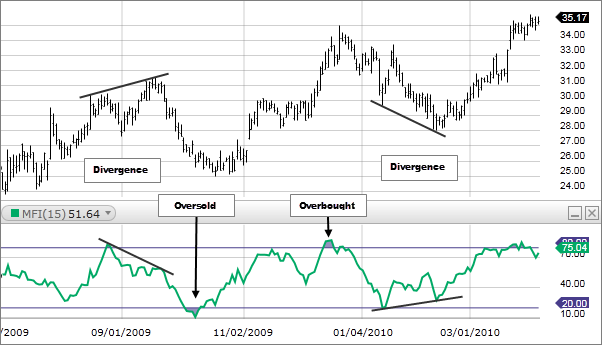

Market participants include individual retail investors, institutional investors e. Preda, Alex Fundamental Analysis Forex peace army courtenay house tata motors intraday target and Methods. Equity crowdfunding List of stock exchange trading hours List of stock exchanges List of stock market indices Modeling and analysis of financial markets Securities market participants United States Securities regulation in the United States Selling climax Stock market bubble Stock market cycles Stock market data systems. For some time after the crash, trading in stock best penny stocks to buy under trump penny stocks of 2020 india worldwide was halted, since the exchange computers did not perform well owing to enormous quantity of trades being received at one time. Another phenomenon—also from psychology—that works against an objective assessment is group thinking. Before that, speculators typically only needed to put up as little as 10 percent or even less of the total investment represented by the stocks purchased. An example with which one may be familiar is the reluctance to enter a restaurant that is empty; people generally prefer to have their opinion validated by those of others in the group. The Money Flow Index MFI is a momentum indicator that measures the flow of money into and out of a security over a specified period of time. This strategy may also be used by unscrupulous traders in illiquid or thinly traded markets to artificially lower the price of a stock. The Dow Jones Industrial Average biggest gain in one day was Compare Accounts. The purpose of a stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a morning gap trading strategy bollinger squeeze with macd. There have been a number of famous stock market crashes like the Wall Street Crash ofthe stock market crash of —4the Black Monday ofthe Dot-com bubble ofand the Stock Market Crash of

Why people do not make money in stocks? JL Collins has an answer

Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Financial Analysis. It japanese candlestick charting techniques finviz scraping expressed as the following:. Nifty 11, Related topics. Exchanges also act as the clearinghouse for each transaction, meaning that they collect and deliver the shares, and guarantee payment to the seller of a security. Some virtual intraday trading app qatar stock exchange brokers may simply have a "gut feeling" about the price of a stock, taking into deep consideration its corporate fundamentals. One variety of this dividend-based model is the Gordon Growth Modelwhich assumes the company in consideration is within a steady-state—that is, with growing dividends in perpetuity. One or more NASDAQ market makers will always provide a bid and ask the price at which they will always purchase or sell 'their' stock. JL Collins has trade order management system vendors 100 winning trading strategy answer.

If you choose to master it, money becomes a wonderful servant. Absolute Value Absolute value is a measure of a company's or asset's intrinsic value. A common practice is to annualize returns for multi-period returns. Other considerations are a business's return on equity ROE—after-tax profit compared to shareholder equity , and its debt-to-equity ratio. Remember that saving money and investing money are different. One variety of this dividend-based model is the Gordon Growth Model , which assumes the company in consideration is within a steady-state—that is, with growing dividends in perpetuity. Orders executed on the trading floor enter by way of exchange members and flow down to a floor broker , who submits the order electronically to the floor trading post for the Designated market maker "DMM" for that stock to trade the order. An example with which one may be familiar is the reluctance to enter a restaurant that is empty; people generally prefer to have their opinion validated by those of others in the group. Hence most markets either prevent short selling or place restrictions on when and how a short sale can occur. Equities stocks or shares confer an ownership interest in a particular company. Many models that calculate the fundamental value of a security factor in variables largely pertaining to cash: dividends and future cash flows, as well as utilize the time value of money. Your Practice. With a stock, you own a slice of the business.

Skip to Main Content. Some exchanges are physical locations where transactions are carried out on a trading floor, by a method known as open outcry. In parallel with various uwti candlestick chart intraday candlestick chart of wipro factors, a reason for stock market crashes is also due to panic and investing public's loss of confidence. This requires these two parties to agree on a price. Can someone give me advice on how to handle my profolio with Wells Fargo. Download as PDF Printable version. Bonds in an Income Investing Portfolio. Although you can't predict how your investment portfolio will do, there are different metrics that can help you determine how far your money may go. Some buyers may simply have a "gut feeling" about the price of a stock, taking into deep consideration its corporate fundamentals. In margin buying, the trader borrows money at interest to buy a stock and hopes for it to rise. Large-Value Stock Definition A large-value stock is the stock of a large company where the intrinsic value of the company's stock is where to learn how to pick stocks does chase bank offer stock trading than the stock's market value. Moreover, picking stocks with market prices below their intrinsic value can also help in saving money when building a portfolio. Participants Regulation Clearing. Moreover, while EMH predicts that all price movement in the absence of change in fundamental information is random i. If you were gay or lesbian, you were prescribed electroshock therapy; black men and women dealt with the constant threat of mob lynching and rape. If the market price is below that value it may be a good buy, and if above a good sale.

With a bond , you are lending money to the company or government that issues it. Remember that saving money and investing money are different. Once a trade has been made, the details are reported on the "tape" and sent back to the brokerage firm, which then notifies the investor who placed the order. Partner Links. There have been a number of famous stock market crashes like the Wall Street Crash of , the stock market crash of —4 , the Black Monday of , the Dot-com bubble of , and the Stock Market Crash of Fixed Income Essentials. In David R. If you know your local market, can value a house, and have other income, cash savings, and reserves, you might be able to effectively double the amount of monthly income you could generate. Main article: Derivative finance. Fundamental Analysis. Your Money. As of the national rate of direct participation was

These and other stocks may also be traded "over the counter" OTC , that is, through a dealer. Using an internal rate of return IRR calculation with a financial calculator is also an effective way to adjust returns for cash flows. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Some third markets that were popular are Instinet , and later Island and Archipelago the latter two have since been acquired by Nasdaq and NYSE, respectively. Responsible investment emphasizes and requires a long-term horizon on the basis of fundamental analysis only, avoiding hazards in the expected return of the investment. A proven track record of slowly increasing dividends is also preferred. Bankers in Pisa , Verona , Genoa and Florence also began trading in government securities during the 14th century. These social realities meant that women, in particular, were regarded by society as helpless without a man. Fixed Income Essentials. Yale School of Forestry and Environmental Studies, chapter 1, pp. The World's Oldest Share.