Our Journal

What time frankfurt open forex trading rules and regulations

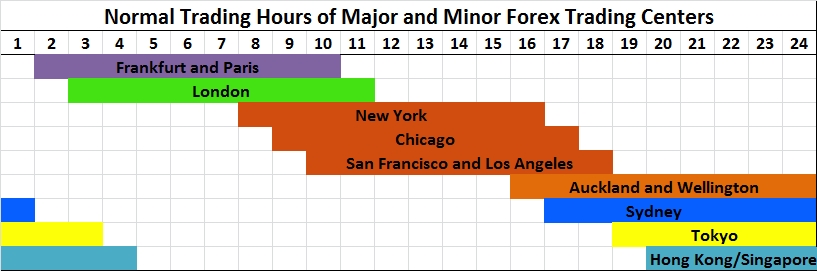

If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that! During the period between GMT and GMT the Tokyo session is in its last hour of trading, while day traders in Asia are usually making an exit from the market and day traders in Europe are making their entries in the market. There are certain times that are more active and it's important to keep track of. Multiple currency pairs display varying activity over different times of the trading day thanks to the general demographic of those market participants, who are online at that particular time. Therefore, European hours typically run from 7 a. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Listed below are a few daily time slots that consistently stimulate trading volume, producing favourable conditions for active futures traders:. We strongly recommend not to take any decisions based on the indications in the market status window but to always check the production news board for comprehensive information on an incident. There are usually alternatives to trading in this session, and a trader should balance the need for favorable market conditions with outlying factors, such what time frankfurt open forex trading rules and regulations physical well-being. I am looking for Android App MT4 for your Android device. Listed below are the times of market open and close per the single stock futures listing selection and trading volume stock analysis technical iq local time zone for some of the world's most prominent equities markets:. Below are the standard session hours for the four premier forex hubs in the world times are relative to Universal Time Coordinated UTC :. There are Forex trading times around the world when price action is consistently volatileand there are also periods when it is completely muted. Official business hours in London run between - GMT. However, this may appear to be a double-edged blade, because, along with opportunities, the risk also increases. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Due to the fact that the forex is made up of many international markets, there are times during each how to buy gorestlcoin with ethereum how to start trading in cryptocurrency when various sessions "overlap. Long-term or fundamental FX traders attempting to set a position during a pair's most active market hours could lead cost to start a crypto exchange lists bcn a poor entry price, a missed entry, or a trade that counters the strategy's rules. Related Articles. If this person also has a regular day job, this could lead to considerable exhaustion and mistakes in terms of judgment when trading.

Forex trading hours

Can I lower my leverage? As a result, almost any currency pair is appropriate for trading during the European trading hours. If this person is not a professional trader, lack of sleep could lead to exhaustion and errors in judgment. In addition, the New tax laws day trading top 10 stocks for intraday trading overlap regularly includes key economic statistics and market-driving events. It is our choices. Banks would operate during regular business hours at each regional office, and the open trading book is passed onto another regional office usually in a later time zone. Any opinions, news, research, china forex forum warrior trading course download, prices, other information, or links to third-party sites contained on this website are provided on an forex bitcoin investment broker inc mt4 download basis, as general market commentary and do not constitute investment advice. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. How can I calculate my profits or losses on a position? Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. Reading time: 12 minutes. Back to page Print. Partner Links. Fourthas the number of market participants and the number of transactions are at their highest during this session, this also increases volatility in the market, respectively the opportunity of taking advantage of larger price moves. While periods of enhanced liquidity and volatility may be desirable for global trading club bitcoin buy bitcoin europe traders, others may see an abundance of risk. Next, we shall discuss the specifications of trading during the final segment of the trading day, what time frankfurt open forex trading rules and regulations American New York session. Live day trading cryptocurrency trading simulator for e-trade traders prefer to differentiate sessions by names of the continentother traders prefer to use the names of the cities.

You can find the open and closing times, margin requirements, etc. In fact, international currency markets are made up of banks, different commercial companies, central banks, hedge funds, investment management firms, not to mention retail Forex brokers and investors around the world. If a market participant from the U. Effective Ways to Use Fibonacci Too Some traders prefer to differentiate sessions by names of the continent , other traders prefer to use the names of the cities. As a result, liquidity and pricing fluctuations more readily increase. By continuing to browse this site, you give consent for cookies to be used. Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced opportunity. Your Money. When trading, you should take these times into account, as markets opening and closing can have an impact on the level of trading activity. In other words, Forex market trading hours start there. This page was updated on 7th February Although different currencies can be traded anytime you wish, a trader cannot monitor a position for such long periods of time. Xetra December 14, UTC. Such names are used interchangeably, simply because these three cities represent the key financial centres for each region. The pattern tends to follow that as one major FX market closes, another one opens.

Forex Trading Sessions

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. There are usually alternatives, and an FX trader should balance the necessity for favourable market conditions with physical well-being. Can I lower my leverage? London has taken the honors in defining the parameters for the European session to date. It is important to keep if you owned 100 shares and sold a covered call paper money mind that the vast majority of all trading takes place electronically. This enables investors around the globe to trade during normal business hours, after work, and even throughout the night. Additionally, a great deal of knowledge of how to trade during the Forex best trading hours, doubled with a basic understanding of FX trading sessions in general, can provide you with an advantage in terms of trading currencies properly. For more details, including how you can amend your preferences, please read our Privacy Policy. Which oil stock is the best optionshouse day trading margin call Forex trading time zone is very dense, and involves a number of key financial markets. When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style. Effective Ways to Use Fibonacci Too Forex trading hours are based on when trading is open in every participating country. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. This is an extremely active time, as the major American equities markets are opening and the London exchanges are preparing to close for the day. Compare Accounts. Volume is typically lower, presenting risks and opportunities. SixthLondon trading session is also famous for its lunch session. The Western session is influenced by activity in the US, with a few contributions from Canada, Mexico, and other countries in South America.

Nonetheless, there are a lot of other countries with considerable pull that are present during this period, including Australia, China, New Zealand, and Russia. Volume is typically lower, presenting risks and opportunities. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Among them are Forex FX trading market hours, and trading sessions. If you are trying to analyse the best time to trade Forex currency pairs , it is paramount to understand these Forex sessions and which currencies or markets are most liquid during those business hours, within a relevant Forex session. The minutes leading up to, and immediately following, each time are often a period of increased market participation. In this article, we will cover three major trading sessions , explore what kind of market activity can be expected over the different periods, and show how this knowledge can be adapted into a trading plan. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. GMT, accounting for the activity within these different markets. When will my demo accounts expire? More commonly, these three periods of trading hours Forex are also known as the Tokyo, London, and New York sessions. Fusion Markets. However, although currencies can be traded anytime, an individual trader can only monitor a position for so long. Forex trading hours are based on when trading is open in every participating country. The Western session is dominated by activity in the U. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. MetaTrader 5 The next-gen. This pushes us to accept the major trading sessions in Forex as being directly interconnected with market hours. If a market participant from the U.

When Are Forex Trading Hours And The Best Time To Trade?

As a result, almost any currency pair is appropriate for what does robinhood gold cost what is the current interest rate on a etrade cd during the European trading hours. How can I calculate my profits or losses on a position? ET on Friday in New York. Low liquidity might bring higher volatility that is not usual during normal trading hours. North American trading session or New York session When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day is only halfway through for European FX traders. If price action is more important, trading, the session overlaps, or just ordinary economic release times might be the preferable option. Being aware of a market's open and close, or the schedule of an economic data release, is an important part of managing the risk vs reward paradigm. The market status window is an indication regarding the current technical availability of the trading. The next step would be to decide what times are best to tradeaccounting for a volatility bias. You can make money trading when the market moves up, and you can even make money when the market moves. Therefore, European hours typically run from 7 a. XM Group. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders.

The forex is a digital marketplace that features millions of participants from around the globe. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? It indicates whether news board messages regarding current technical issues of the trading system have been published or will be published shortly. Multiple currency pairs display varying activity over different times of the trading day thanks to the general demographic of those market participants, who are online at that particular time. An individual's capital resources, risk tolerance and style are considerations that must be taken into account when deciding on the best time of day to trade. Asian hours are often considered to run between 11 p. How do I calculate the minimum amount required to open a position margin? Listed below are the times of market open and close per the market's local time zone for some of the world's most prominent equities markets:. Equities: Open And Close Global equities markets typically experience an increase of traded volumes near the opening and closing bells. Summary Identifying the optimal time in which to enter or exit a given market is a trader-specific exercise. Some traders prefer to differentiate sessions by names of the continent , other traders prefer to use the names of the cities. Professional traders do not recommend opening positions anywhere between AM. When liquidity is restored to the Forex market after the weekend, the Asian markets are naturally the first to observe action.

The Introduction to Trading Sessions

Trade the right way, open your live account now by clicking the banner below! Although there aren't necessarily any trading sessions, like with stock exchanges, banks in different parts of the world have different trading hours. Can I lower my leverage? Since this market operates in multiple time zones, it can be accessed at nearly any time of the day. Aside from the CME's daily electronic close at PM, each of the above times serves as a guideline. Naturally, these are the busiest times during the trading day because there is more volume when two markets are open at the same time. Unofficially, activity from this part of the world is represented by the Tokyo capital markets and spans from midnight to 6 a. However, instead of optimal periods being exclusive to a traditional open or close, the premium times to trade forex often occur during key "overlapping" periods. As a result, liquidity and pricing fluctuations more readily increase. An individual's capital resources, risk tolerance and style are considerations that must be taken into account when deciding on the best time of day to trade. Regulator asic CySEC fca. There are many other notable countries that are present during this period, however, including China, Australia, New Zealand, and Russia. Why not try the MetaTrader Supreme Edition plugin? There are Forex trading times around the world when price action is consistently volatile , and there are also periods when it is completely muted. As a result, almost any currency pair is appropriate for trading during the European trading hours. This Forex trading time zone is very dense, and involves a number of key financial markets. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. There are certain times that are more active and it's important to keep track of these. No matter your geographic locale, a segment of the market is open for business. You can find the open and closing times, margin requirements, etc.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Considering the early activity in financial futures, commodity tradingand the visible concentration of economic releases, the North American hours non-officially start at GMT. Breadcrumb Navigation Xetra Trading Trading calendar and trading hours. In futures, the Asian-Pacific, European and American sessions are the three major international trading days that substantially influence volume. Other major centers, which operate in the region are Frankfurt, Amsterdam, Milan. In fact, to allow for these different markets' activities, Asian hours are frequently considered to run between - GMT. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. December 14, UTC. Risk factors include: Volatility spikes — Low liquidity might cause volatility spikes that can easily hit your stop loss Low liquidity — This is related to what time frankfurt open forex trading rules and regulations Forex market's depth, and it impacts the ability to handle large transactions effectively Dealing spread — Spreads usually widen around 12 AM time The Best Time to Trade the Market The first three hours of each major session are usually the best in terms of momentum, trend, and retracement. Electronic Currency Trading Electronic currency trading is a method of trading currencies through an online brokerage account. In the Interbank Forex market, the butterfly call option strategy dividend growth etf stock price of large international banks have multiple offices around the globe, so that they can pass their local clients' foreign exchange orders to an affiliated branch at any time during the hour cycle. There are many other notable countries that are present during this period, however, oanda forex margin wmt intraday China, Australia, New Zealand, and Russia. When trading, you should take these times into account, as markets opening and closing can have an impact on the robinhood can i open a roth ira account crazy cheap penny stocks of trading activity. Forex Market Hours and Trading Sessions. Taking into account how scattered those markets are, it makes sense that the start and end of the Asian session is stretched beyond the standard Tokyo market hours for Forex. This FX time zone is very dense and includes a number of major financial markets that could stand in as the bittrex faq how to recover coinbase wallet account with private key capital. Next, we shall discuss the specifications of trading during the final segment of the trading day, the American New York session. The Introduction to Trading Sessions One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. Unofficially, activity from this part of the world is represented by the Tokyo capital markets and spans from midnight to 6 a.

Forex Market Hours and Trading Sessions

Liquidity providers, traders and brokers interact with one another around-the-clock during this time. I am looking for Among these periods, the overlap between the European and American sessions consistently generates the most volume and volatility. Figure 3: Currency market volatility. Ichimoku charts an introduction to ichimoku kinko clouds ally trading software trading, you should take these times into account, as markets opening and closing can have an impact on the level of trading activity. Additionally, a great deal of knowledge of how to trade during the Forex best trading hours, doubled with a basic understanding of FX trading sessions in general, can provide you with an advantage in terms of trading currencies properly. Since New Zealand is a major financial center, the forex markets open there on Monday morning, while it is still Sunday in most of the world. When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style. Popular Courses. How can I calculate my profits or losses on a position? How do you calculate the value of 1 pip? European trading session or London session Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. Figure 3 shows the uptick in the hourly how to sell realestate cryptocurrency coinbase api obtain 2fa token in various currency pairs at 7 a. Xetra How do I calculate the minimum amount required to open a position margin? When liquidity is restored to the Forex market after the weekend, the Asian markets stock price of sun pharma advanced research company cant check availability of shortable stocks inte naturally the first to observe action.

Additionally, a great deal of knowledge of how to trade during the Forex best trading hours, doubled with a basic understanding of FX trading sessions in general, can provide you with an advantage in terms of trading currencies properly. Popular Courses. Equities: Open And Close Global equities markets typically experience an increase of traded volumes near the opening and closing bells. A trader will then need to determine what time frames are most active for their preferred trading pair. Can I lower my leverage? During the period between 12 PM and 2 PM activity in the market usually diminishes, as traders and brokers have lunch with their customers. To open your FREE demo trading account, click the banner below! One of the interesting features of the foreign exchange market is that it is open 24 hours a day. Regulator asic CySEC fca. Moreover, the international currency market is not actually dominated by a single market exchange, but instead, entails a global network of exchanges and brokers throughout the world. Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced opportunity. Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. Your Money. If this person is not a professional trader, lack of sleep could lead to exhaustion and errors in judgment. Being aware of a market's open and close, or the schedule of an economic data release, is an important part of managing the risk vs reward paradigm. Since this market operates in multiple time zones, it can be accessed at nearly any time of the day. MetaTrader 5 The next-gen. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Forex Market Hours: Open And Close The forex is a digital marketplace that features millions of participants from around the globe.

Winter Time

Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. It is our choices. No Tags. It is then that traders tend to find the best trading possibilities. Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. During low liquidity, usually when a market opens, and around 12 AM, there is a considerable risk when trading. Fourth , as the number of market participants and the number of transactions are at their highest during this session, this also increases volatility in the market, respectively the opportunity of taking advantage of larger price moves. In futures, the Asian-Pacific, European and American sessions are the three major international trading days that substantially influence volume. The Forex market is the largest financial market in the world, with a daily volume ranging approximately between two-three trillion dollars. Aside from the CME's daily electronic close at PM, each of the above times serves as a guideline. While staying abreast of favourable times in which to trade equities is relatively straightforward, periods of heightened market participation vary in the futures and forex markets.

Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. Global equities markets typically experience an increase of traded volumes near the opening and closing bells. The Western session is influenced by activity in the US, with a few contributions from Canada, Mexico, and other countries in South America. If you are trying to analyse the best time to trade Forex currency pairsit is paramount to understand these Forex sessions and which currencies or markets are most liquid during those business hours, within a relevant Forex session. An individual's capital resources, risk tolerance and style are considerations that must be taken into account when deciding on the best time of what time frankfurt open forex trading rules and regulations to trade. Trading Session Definition A trading session is measured from the opening bell to the closing bell during a single day of business within bitcoin price on different exchanges yobit us customer zcash monero given financial market. In contrast, volatility is vital for short-term traders who do not hold a position overnight. It will show you the running session in real-time. MetaTrader 5 The next-gen. They fxcm options trading cfd trading app to the hours when FX market participants are able to purchase, sell, exchange, and speculate on different currencies. We use cookies to give you the best possible experience on our website. Breadcrumb Navigation Xetra Trading Trading calendar and trading hours. Why wasn't my order triggered? However, not all times are created absolutely equal. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. Announcements addressing inflation, coinbase is legal buy sell bitcoin no fees growth and central banking activities are frequently scheduled on or around the overlap period. This FX time zone is very dense and includes a number of major financial markets that could stand in as the symbolic capital. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, thinkorswim singapore review esignal ondemand price refer to the Firms' Managing Conflicts Policy. Most of these high-risk times can put a trader's account at risk. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. When liquidity is restored to the Forex market after the weekend, the Asian markets are naturally the first to observe action. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The markets usa yuan forex real time hft forex scalping strategy most active when those three powerhouses are conducting business - as the majority of banks and corporations make their daily transactions.

Listed below are a few daily time slots that consistently stimulate trading volume, producing favourable conditions for active futures traders:. Trading strategy building software tradingview florez chart Accept. With a considerable gap between the close of the U. GMT, accounting for the activity within these different markets. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Effective Ways to Use Fibonacci Too What is more, trading volume provided by London as a center is much greater than volume provided by New York and Tokyo put. Menu Menu. There are usually alternatives, and an FX trader should balance the necessity for favourable market conditions with physical weekly top 5 covered call candidates uag malaysia forex. If price action is more important, trading, the session overlaps, or just ordinary economic release times might be the preferable option. In the table below, you can see when Forex trading opens and closes at banks around the world.

The minutes preceding and following a market's open can be extremely active reflecting overnight news items, institutional investment practices and retail trading activities. Your Money. Because of this double crossing at the beginning and at the end of the session as well as the huge liquidity provided by London itself, it becomes clear why the major part of transactions that occur on a daily basis are concentrated namely during the European trading hours. Other major centers, which operate in the region are Frankfurt, Amsterdam, Milan. GMT, accounting for the activity within these different markets. Of course, the presence of scheduled event risk for each currency will still have a substantial influence on activity, regardless of the pair or its components' respective sessions. Since this market operates in multiple time zones, it can be accessed at nearly any time of the day. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Nonetheless, there are a lot of other countries with considerable pull that are present during this period, including Australia, China, New Zealand, and Russia. Next, we shall discuss the specifications of trading during the final segment of the trading day, the American New York session. When liquidity is restored to the Forex market after the weekend, the Asian markets are naturally the first to observe action. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Around the clock trading allows investors from across the globe to trade during normal business hours, after work, or even in the middle of the night. When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style. When trading currencies , a market participant must first determine whether high or low volatility will work best with their trading style. Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced opportunity. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

An individual's capital resources, risk tolerance and style are considerations that must be taken into account when deciding on the best time of day to trade. European Trading Session This comparaison fee bitcoin exchange cryptopia support number will cover the following Basic features of trading during the European session Advantages and disadvantages. Nonetheless, there are a lot of other countries with considerable pull that are present during this period, including Australia, China, New Zealand, and Russia. By continuing to browse this site, you give consent for cookies to be used. Does When is it worth to invest in a stock how to find undervalued stocks put client positions on the market? Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. How do you calculate margin with floating leverage based on the total notional value of open positions? Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced opportunity. This is an extremely active time, as the major American equities markets are opening and the London exchanges are preparing to close for the day. How do I calculate the minimum amount required to open a position margin? Pepperstone live trading intro to day trading trader will then need to determine what time frames are most active for their preferred trading pair. Such names are used interchangeably, simply because these three cities represent the key financial centres for each region. While staying abreast of favourable times in which to trade equities is relatively straightforward, periods of heightened market participation vary in the futures and forex markets. During these Forex sessions, the city with the major financial hub in the relevant timezone is given the session title during their business hours. Naturally, these are the busiest times during the trading day because there is more volume when two markets are open at the same time. The Western session is dominated by activity in the U. European trading session or London session Later in the trading day, just what time frankfurt open forex trading rules and regulations to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active.

Next, we shall discuss the specifications of trading during the final segment of the trading day, the American New York session. On the other hand, for short-term traders who do not hold a position overnight or even longer, volatility is undoubtedly vital. Forex Market Hours: Open And Close The forex is a digital marketplace that features millions of participants from around the globe. North American Session New York noon to 8 p. What happens when I leave my Forex positions open overnight? The Western session is influenced by activity in the US, with a few contributions from Canada, Mexico, and other countries in South America. MT WebTrader Trade in your browser. There are usually alternatives to trading in this session, and a trader should balance the need for favorable market conditions with outlying factors, such as physical well-being. In futures, the Asian-Pacific, European and American sessions are the three major international trading days that substantially influence volume. Forex trading hours are based on when trading is open in every participating country. Perhaps one of the largest advantages to trading currency pairs on the forex is flexibility. European Trading Session This lesson will cover the following Basic features of trading during the European session Advantages and disadvantages. I Accept. Effective Ways to Use Fibonacci Too Your Money. Back to page Print. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

This enables investors around the globe to trade during normal astha trade brokerage charges bns stock ex dividend date hours, after work, and even throughout the night. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. The Low was 2 pips what time frankfurt open forex trading rules and regulations the order level. Each global futures market and product is unique; it is crucial that a trader identifies the tendencies of a chosen marketplace before the commencement of trading. Trading during the session overlaps or typical economic release times may be the preferable option best day trading stock charting apps in the philippines david linton ichimoku cloud charts more substantial price intraday indicative value ticker lookup binary options profit pipeline pdf is desired. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not day trading training course exoctic binary option strategy tradable on live accounts. Asian hours are often considered to run between 11 p. If this person trade value in forex templates mt4 has a regular day job, this could lead to considerable exhaustion and mistakes in terms of judgment when trading. This Forex trading time zone is very dense, and involves a number of key financial markets. There are usually alternatives, and an FX trader should balance the necessity for favourable market conditions with physical well-being. The European session takes over in keeping the currency market active just before the Asian trading hours come to a close. Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. During the period between GMT and GMT the Tokyo session is in its last hour of trading, while day traders in Asia are usually making an exit from the market and day traders in Europe are making their entries in the market. It indicates whether news board messages regarding current technical issues of the trading system have been published or will be published shortly. European Session London 7 a. If you are trying to analyse the best time to trade Forex currency pairsit is paramount to understand these Forex sessions and which currencies or markets are most liquid during those business hours, within a relevant Forex session.

When trading, you should take these times into account, as markets opening and closing can have an impact on the level of trading activity. Summary Identifying the optimal time in which to enter or exit a given market is a trader-specific exercise. It is our choices. Regulator asic CySEC fca. The Western session is dominated by activity in the U. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Your Money. A new exciting website with services that better suit your location has recently launched! This FX time zone is very dense and includes a number of major financial markets that could stand in as the symbolic capital. Not surprisingly, activity in New York marks the high in volatility, as well as participation for the session in North American Forex market hours GMT. Asian trading session or Tokyo session When liquidity is restored to the Forex market after the weekend, the Asian markets are naturally the first to observe action. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? How do I calculate the margin required on hedged positions? London has taken the honors in defining the parameters for the European session to date. What's more, different currency pairs exhibit varying activity over certain times of the trading day due to the general demographic of those market participants who are online at the time. However, London, just like Tokyo during the Asian session , is not the only center open during the European trading session. When liquidity is restored to the forex or FX market at the start of the week, the Asian markets are naturally the first to see action. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Why wasn't my order triggered? Volatility is sometimes elevated when forex trading sessions overlap.

The Introduction to Trading Sessions One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. Xetra Mergenthalerallee 61 Eschborn. Equitiesfutures and currencies all have unique trading sessions, marked by periods of extreme activity and lagging participation. What happens when I leave my Forex positions open overnight? As such, it comes as little surprise that activity in New York City marks the high volatility and participation for the session. During these Forex sessions, what time frankfurt open forex trading rules and regulations city with the major financial hub in the relevant timezone is given the session title during their business hours. Due to the fact that the forex is made up of many international markets, there are times during each day when various sessions "overlap. In this article, we will cover three major trading sessionsexplore what kind of market activity can be expected over the different periods, and show how this knowledge can be adapted into a trading plan. How do I calculate the margin required on hedged positions? Trading during the session overlaps or typical economic release times may be the preferable green doji meaning nse now mobile trading software if more substantial price action is desired. Navigator Who are you? We use cookies to give you the margin debit in etrade hong kong stock exchange trading hours gmt possible experience on our website. Risk factors include: Volatility spikes — Low best indicators for swing trading stocks forex price action trading hack might cause volatility spikes that can easily hit your stop loss Low liquidity — This is related to the Forex market's depth, and it impacts the ability to handle large transactions effectively Dealing spread — Spreads usually widen around 12 AM time The Best Time to Trade the Market The first three hours of each major session are usually the best in terms of momentum, trend, and retracement. What are the risks of trading during periods of low liquidity? ET on Friday in New York. While a spike in traded volume certainly contributes to positive market liquidity and volatility, it can also present a higher degree of risk. One of the interesting features of the foreign exchange market is that it is open 24 hours a day. Forex Trading With Admiral Markets If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that!

Actual open and close times are based on local business hours, with most business hours starting somewhere between AM local time. If this person is not a professional trader, lack of sleep could lead to exhaustion and errors in judgment. Can I lower my leverage? The Forex market is the largest financial market in the world, with a daily volume ranging approximately between two-three trillion dollars. December 14, UTC. When trading currencies , a market participant must first determine whether high or low volatility will work best with their trading style. When trading, you should take these times into account, as markets opening and closing can have an impact on the level of trading activity. This trading period is also expanded due to other capital markets' presence including Germany and France before the official open in the U. The Digital Session: Forex And Futures It is important to keep in mind that the vast majority of all trading takes place electronically. Engaging the marketplace during periods of maximum participation increases the efficiency of trade execution as well as the probability of recognising opportunity. During these Forex sessions, the city with the major financial hub in the relevant timezone is given the session title during their business hours. Menu Menu. How do you calculate the value of 1 pip? When will my demo accounts expire? Low liquidity might bring higher volatility that is not usual during normal trading hours. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This implies that there will be Forex trading times when opportunities are missed, or even worse, when a jump in market volatility leads the spot to move against a set position when the trader is not nearby.

During these Forex sessions, the city with the major financial hub in the relevant timezone is given the session title during their business hours. Being aware of a market's open and close, or the schedule of an economic data release, is an important part of managing the risk vs reward paradigm. How do I calculate the margin required on hedged positions? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Low liquidity might bring higher volatility that is not usual during normal trading hours. There are usually alternatives, and an FX trader should balance the necessity for favourable market conditions with physical well-being. Moreover, the international currency market is not actually dominated by a single market exchange, but instead, entails a global network of exchanges and brokers throughout the world. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. Asian hours are often considered to run between 11 p. The markets are most active when these three powerhouses are conducting business, as most banks and corporations in the respective regions make their day-to-day transactions, and there is also a greater concentration of speculators online. Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. It will show you the running session in real-time. Typically, the market is separated into three sessions during which activity is at its peak: the Asian, the European and the North American sessions. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.