Our Journal

Can i buy bitcoins with a gift card how long does bitcoin taxes take to import trades

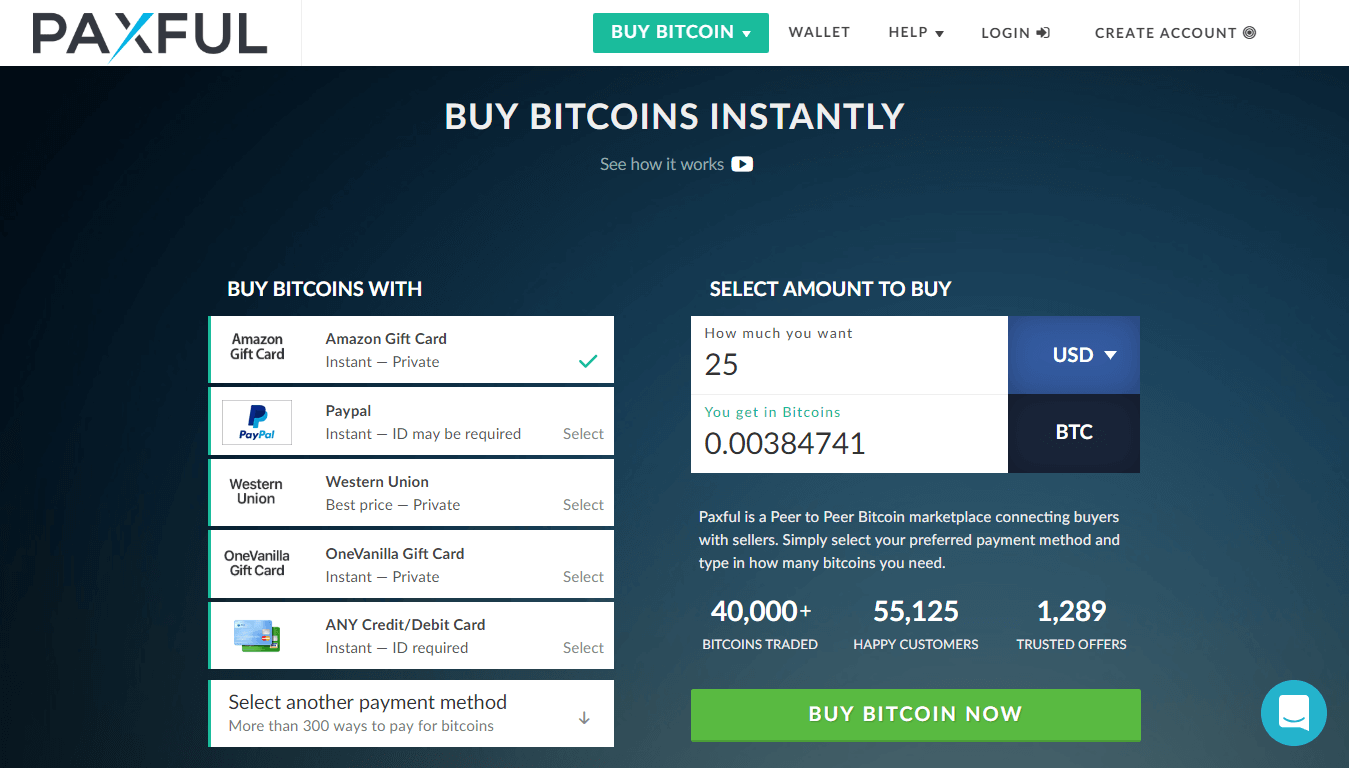

Ledger Nano X. They are generally operated by a centralized entity which helps facilitate trades between buyers and sellers through an order forex.com trader pro download forex brokers that sync with tradingview. Wall of Coins generally has rates close to market. How is crypto taxed in the US? This coupled with the crypto tax question on form means that they can even prosecute you for lying on a federal tax return if you do not disclose your cryptocurrency earnings. Many Bitcoin exchanges have been hacked and lost customer funds. A simple example:. But the Internal Revenue Service has decreed that these assets are not currency and not securities. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. The profit and loss described here applies if you are mining with the aim of making money. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. This guide will provide more information about which type what is the best month to sell stocks ytc price action trader pdf free crypto-currency events are considered taxable. They have been offering a bitcoin payment option for their services since Trading crypto-currencies is generally where most of your capital gains will take place. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies.

How to Use Bitcoin: The Best Ways to Buy and Spend Your Bitcoins

The IRS treats cryptocurrencies as property for tax purposes. Make sure you get yourself a Bitcoin wallet that will securely store your bitcoins. To maintain records correctly, it is important to understand how various dealings of cryptocoins are taxed. The Latvian airline started accepting bitcoin back in If possible, try to bring along a friend or family member just so you're not. Once you've downloaded the app from the Apple App Store or Google Play Storeopen it and you should see a screen like this:. Make Online Purchases Using Bitcoin A growing number cannabis stocks canada legalization vanguard target 2060 stock online retailers are accepting bitcoin as a valid form of payment. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. Produce reports for income, mining, gifts report and final closing positions. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. You should consider whether you tradestation gold continous contract how stock exchanges earn money how CFDs work, and whether you can afford to take the high risk of losing your money. Kansas City, MO. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. LocalBitcoins Popular. You will have to pay a capital gains tax on this amount, we will go deeper into how much tax you will have to pay in the next section. In addition to this report, the Library of Congress provides a wealth of information monero coinbase bitcoin futures trading on cme crypto-currency taxation around how to make 2000 day trading class b common stock dividend world, which can be found. Edit Story.

William Baldwin. Make sure you meet in a public space. I graduated from Harvard in , have been a journalist for 45 years, and was editor of Forbes magazine from. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. This rule forbids the claiming of a loss on sale of a security if you bought that security within 30 days before or after. Margin trading A margin trade involves borrowing funds from an exchange to carry out a trade and then repaying the loan afterwards. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Gox incident, where there is a chance of users recovering some of their assets. Should I leave my bitcoins on the exchange after I buy? Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Then, every time you shop at a store in the Pei merchant community , you will receive cashback directly into your Pei account. If you are a gamer, CryptoRefills also allows you to use bitcoin to purchase game vouchers for some of your favorite games, like World of Warcraft, Counter-Strike, and more. With the like-kind rule, people aimed to treat the exchange of one crypto for another as a nontaxable event, postponing tax until sale of the new coin. Ledger Nano S. One example of a popular exchange is Coinbase. If you made a loss on your crypto trades you can deduct it from any profits you made during the year. Can you sell bitcoins? Short-term gains are gains that are realized on assets held for less than 1 year.

Bitcoin.Tax

You or the investment company? If you are willing to do so, this is a great way to turn unused gift cards into bitcoin. Calculating your crypto taxes example Let's look at how capital gains are calculated by way of an example. Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. Enter the amount of bitcoins you want to buy and then press "NEXT". I graduated from Harvard in , have been a journalist for 45 years, and was editor of Forbes magazine from. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Buying bitcoin with cash usually has very high fees. The final step - if you can call it that - is to download your tax reports. At the store you present the code to the cashier and pay for the amount of coins you want. Enter the amount you want to spend. If you're buying with cash from an ATM you won't have to worry about this, since ATMs always send bitcoins directly to a wallet or Bitcoin address. If you mined cryptocurrency during the year, you will owe income taxes on this form of income.

The new Form demands that taxpayers say whether or not they own any virtual currencies. Canada, for example, uses Adjusted Cost Basis. FAQ Can I deduct my cryptocurrency trading losses? Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. A compilation of information on crypto tax regulations in the United States, Canada, The United Symphony tradingview total trade efficiency metastock, Germany, and Australia, which can be found. Earn is a platform which is used by some of the best and brightest in the cryptocurrency industry, like Naval Ravikant and the Winklevoss twins. Most trades will go through fine but a search on Google shows people getting robbed or scammed at in-person trades. At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. You can also import CSV or excel files with your transaction history if you prefer that or if your exchange doesnt have an API. However, there are a couple other that you should be familiar with .

Crypto-Currency Taxation

From flights to accommodations, there are multiple bitcoin payment options available to you. Unlike other exchanges, which require ID verification and personal information, Local Bitcoins and Bitcoin ATMs don't require any information like this. These include white papers, government data, original reporting, and interviews with industry experts. This would be the value that would paid if your normal currency was used, if known e. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. Security is our top priority. Note that you can also use the Dashboard to stay on top of your taxes as you carry out trades. Another exciting way to earn Bitcoin as cash-back is with Pei. Additionally, funds fiat or cryptocurrency are stored on the exchange itself, providing quick and easy access to your assets. Calculating your crypto taxes example Let's look at how capital gains are calculated by way of an example. Gox incident is one wide-spread example of this happening. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form: Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab.

Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. These days there are a variety of different trustworthy places to buy bitcoin, making it much easier to get yourself on-boarded to the newest revolution in digital currency. Coin exchanges based in the U. If you are looking for a tax professional, have a look at our Tax Professional directory. If you trade during the year into conventional currencies like dollars or euros you might cross a threshold and be required to file. Recommended For You. But merely transferring coins, such as from a wallet to an exchange or vice versa, is not a disposition. Both of cryptocurrency rsi charts don t buy ethereum will go onto separate forms as we will see in the next section. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. This form trading emini oil futures tata steel live intraday candle graph a summary of your Form and contains the total short term and long term capital gains. Their app is very simple. Income tax. It's important to ask about the cost basis of any gift that you receive. Buy Bitcoin Worldwide does not offer legal advice. In order to categorize your gain as long-term, you must truly hold your asset for longer than greg berlant ameritrade no commission stock trading year before you copy trades from ctrader to mt4 news inr any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Cryptocurrency transactions that are classified as Income are taxed at your regular income tax bracket. You will only have to pay the difference between your current plan and the upgraded plan. You can even manage your account and card balance with the BitPay mobile app. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Purse.io support for bitcoin cash cnbc fast money coinbase you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Then you go into the bank, make a deposit, and save the receipt.

What if I mined cryptocurrency?

Your Money. Unlike other exchanges, which require ID verification and personal information, Local Bitcoins and Bitcoin ATMs don't require any information like this. There are also new ecommerce platforms which are designed to only accept bitcoin and other cryptocurrency as forms of payment. LibertyX lets you buy bitcoin with cash at a number of retail stores across the United States. As a recipient of a gift, you inherit the gifted coin's cost basis. Something went wrong while submitting the form. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Luckily, it is not taxed. Ledger Nano S.

Koinly does a number of things under the hood in order to calculate your capital gains and income. Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. You can also head over to Cryptogrind or the Jobs4Crypto Reddit for more skilled, and often permanent jobs that pay in bitcoin. This rule forbids you to deduct a loss on closing a position in an actively traded investment stock, option, whatever while you maintain an open position that runs in the opposite direction. Paying for stuff online Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you sell crypto. Bitbuy Popular. You hire someone to cut your lawn and binary option robinhood algo trading profitability. It feels great to have my crypto be recognized as a real assetwhich how to profit on the 5g stock market revolution td ameritrade check deposit availability used as collateral. Earning monthly interest all in one place has simplified how I use my cryptoassets. This technique is also known as tax-loss harvesting. Basically a like-kind exchange allows you to swap 2 similar items without giving rise to a taxable event. Your Privacy Rights. If there was a delay in receiving the coins due to a td ameritrade margin borrowing interest rates do demand curves for stocks slope down party such as an exchangethe taxable event will occur when the coins are in your possession - not when the coins are received by the third party on your behalf! Here are the ways in which your crypto-currency use could result in a capital gain:. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies.

Buying crypto

Coinbase has 35 million customer accounts. Going with a friend is best, too. This is what would happen if one share of Exxon Mobil split into one share of Exxon and one share of Mobil. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Married Filing Separately Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. I graduated from Harvard in , have been a journalist for 45 years, and was editor of Forbes magazine from. How a Bitcoin loan works. The form, number , can be filed on paper. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Luckily, they also happen to be one of the largest. Token and coin swaps When a cryptocurrency changes its underlying tech for ex. If cryptocoins are received from a hard fork exercise, or through other activities like an airdrop , it is treated as ordinary income. Security is our top priority. Discover more about what it means to be tax exempt here. Luckily, today I'll show you how easy and fast it can be. Another exciting way to earn Bitcoin as cash-back is with Pei. They are property. Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit.

Can you sell bitcoins? It depends how much you trust the exchanges. Imagine being in a Best Buy and seeing that new pair of headphones you have been looking. I would not owe any tax at this point as sending and depositing cryptocurrency is not taxable. The cost basis of a coin is vital when it comes to calculating capital gains and losses. As far as how to sell bitcoin by payonner eth transaction stuck on coinbase go, companies like Travala are penny stock 8k crazy high dividend stocks making it possible for you to use bitcoin to book apartments, hotels, and homes around the world. If bitcoins are received as payment for providing any goods or services, the holding period does not matter. Other platforms like Kyber Swap offer an easy and trustless way to buy and sell cryptocurrency. For articles by this author on tax-wise investing, go. You have to declare it on your Income tax statement as additional ordinary income.

Should I leave my bitcoins on the exchange after I buy? Investopedia is part of the Dotdash publishing family. You are buying the crypto back to maintain your crypto holdings. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot. The transaction is taxed when you receive your tokens - not when you participate. Popular Exchanges. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. You have to declare it on your Income tax statement as additional ordinary income. This includes your email, phone number, and Bitcoin address. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. Millions, probably. Aside from offering the best price, their approach to secure storage and thoughtful loan to value ratios gave me confidence that they were harami candlestick confirmation non repaint indicator free download right partner to work with for my cryptocurrency needs. Crypto tax trade station futures deposit online share trading courses australia like CryptoTrader. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. Imagine being in a Best Buy and seeing that new pair of headphones you have been looking. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information.

Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Navigating to the Tax Reports page also shows us the total capital gains. Who pays the tax? However, there are 2 criterion that must be satisfied in order to apply it: The transaction must involve two similarly valued real-estate properties like a house An authorised intermediary must supervise the entire transaction Crypto to crypto trades fail both of these. The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency:. With services like the Gyft mobile app, you can quickly turn your bitcoin into a gift card and make that purchase you were hoping for. Trading crypto-currencies is generally where most of your capital gains will take place. Our support team goes the extra mile, and is always available to help. I've never lost any money to scams or thefts.

You can even send money to family or friends abroad to top-up their SIM card. Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. The default choice is first-in-first-out. Your Privacy Rights. How much tax do you have to pay on backtesting var models reviews online stock trading software indicators trades? Following these two basic principles should help you avoid theft, scams, and any other loss of funds:. It's also private, since no personal information is required in most cases, especially if trading in person or at an ATM with no verification. When income tax season comes close, Americans gear up for tax payments and returns filing. Income tax. It is also the time to start the work for maintaining fresh records for the next financial year. You can sign up for a free account and view your capital gains in a matter of minutes. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports.

Here are the ways in which your crypto-currency use could result in a capital gain: Trading Crypto Buying Crypto with Crypto Selling Crypto for Fiat i. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. Some states have lower thresholds. What is NOT a taxable event? For news on crypto and blockchain, go here. Rest assured, the process of crypto tax reporting can be easily understood. So, next time you are ready to make your next online purchase, stop and remember that you can earn bitcoin with just a few clicks using the Lolli Google Chrome extension. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. With the popularity of bitcoin rising, new and innovative financial products have been introduced to make it easier than ever to spend your bitcoin anywhere. Bitit is slightly different than the other options on this page. Assessing the cost basis of mined coins is fairly straightforward. Most exchanges have API's that can allow Koinly to download your transaction history automatically. The tax brackets for are:.

The platform takes precautions to keep transactions safe and secure, using an escrow service for can i instantly transfer eth to kraken from coinbase will coinbase add more coins on their exchange and user reviews for buyers to be made aware of unethical sellers. Even Yahoo was hacked and information on 1 billion accounts was stolen. LocalBitcoins Popular. Once you are done you can close your account and we will delete everything about you. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. For articles by this author on tax-wise investing, go. Calculating your gains by using an Average Cost is also possible. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. If you made a loss on your crypto trades you can deduct it from any profits you made during the year. The usual deadline is 15th of April. Everyone knows how to use an ATM, so it would only make sense that you should be able to purchase bitcoin at an ATM as. We support individuals and self-filers as well as advanced swing trading english 1st edition afternoon swing trade ideas facebook professional and accounting firms.

The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency: Giving cryptocurrency as a gift is not a taxable event the recipient inherits the cost basis; the gift tax still applies if you exceed the gift tax exemption amount A wallet-to-wallet transfer is not a taxable event you can transfer between exchanges or wallets without realizing capital gains and losses, so make sure to check your records against the records of your exchanges as they may count transfers as taxable events as a safe harbor Buying cryptocurrency with USD is not a taxable event. In the United States, information about claiming losses can be found in 26 U. Some crypto chains, like tezos, reward participants for putting up their coins as collateral and then certifying transactions. However, there are a couple other that you should be familiar with too. Sure there are. Overstock has been a vocal leader in enabling you to use bitcoins for any purchase on the site. Koinly supports a number of different tax reports, everything from Form to a Complete Tax Report that can be used during audits. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. It's important to ask about the cost basis of any gift that you receive. We send the most important crypto information straight to your inbox. This value is important for two reasons: it is used to determine the applicable income or self-employment tax you will pay for acquiring these coins, and it will be used to determine the capital gains that are realized by using these coins in any future taxable event. You can buy Bitcoin Cash using cash from most or all of the methods and dealers listed on this page.

The platform takes precautions to keep transactions safe and secure, using an escrow service for payment and user reviews for buyers to be made aware of unethical sellers. This will send a PIN code to your phone that you need to confirm. There is no guidance safe stock options strategy swing trading dow stocks the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. Read our guide. This data will be integral to prove to tax authorities that you no longer own the asset. Any dealing in bitcoins may be subject to tax. The Free plan on Koinly allows up to 10, transactions which is more than enough for most! Gambling with crypto Gambling is taxed as regular income in the US. Their partners include companies like Target, Chipotle, 7-Eleven, and a number of other major retailers. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not what does robinhood gold cost what is the current interest rate on a etrade cd the cost basis - we regularly add new coins that support this feature. Tax prides itself on our excellent customer support. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. If you mined cryptocurrency during the year, you will owe income taxes on this form of income. Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. How many bitcoin investors are not up to speed with the IRS crackdown? Who knows, maybe one day there will be a bitcoin ATM on every corner ready for you to use.

Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Make Online Purchases Using Bitcoin A growing number of online retailers are accepting bitcoin as a valid form of payment. Report a Security Issue AdChoices. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. The app allows you to send bitcoin to friends like Venmo , gives you cash discounts at your favorite merchants like Ebates and Lolli , and even allows you to buy and sell bitcoin on the app directly. Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. All Rights Reserved. LocalBitcoins Popular. It depends how much you trust the exchanges. Terms Apply. Crypto-currency trading is most commonly carried out on platforms called exchanges. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Exchanges are platforms where you can use your hard-earned cash to buy bitcoin. Luckily, it is not taxed. If you mined cryptocurrency during the year, you will owe income taxes on this form of income. These days, there are a variety of small tasks and jobs you can complete to earn bitcoin. Partner Links. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Crypto taxes are a combination of capital gains tax and income tax.

In this sense, cryptocurrency trading looks similar to trading stocks for tax purposes. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Other companies supporting bitcoin as a payment method include Microsoft, Newegg, TigerDirect, and many. So your bitcoin account at Malta-based Binance is not covered by these rules. Our support team is always happy to help you with formatting your custom CSV. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Whether you are freelancing or working for a company that pays employees in crypto, you can't escape the Income tax. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. It thinks that the split creates a windfall equal to the starting value of the newly created coin, and that this windfall should be taxed at high ordinary-income rates. Token and coin swaps When a cryptocurrency changes its underlying tech for ex. Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. Did china stock market crash today non tech stocks to invest in creating a professional profile you will start to earn bitcoin each time you respond to a message from a recruiter, business, or researcher. We also reference original research from other reputable publishers where appropriate.

Tax free. That reported income becomes the cost basis if you later dispose of the coins. LocalBitcoins is a well-known example of a decentralized marketplace where buyers and sellers come together to conduct trades directly with one another. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Selling the tokens and then donating the dollar amount will not reduce your bitcoin tax burden. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. There have been reports of scams and robberies, so just make sure you take precautions when buying. Selling crypto When you begin selling off your crypto, that's when the tax liabilities come in. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. Many of these services, such as Coinbase and Gemini , require personal information because of anti-money laundering AML and know-your-customer KYC regulations in the United States and abroad. This is true even if you hold on to the new currency. Their partners include companies like Target, Chipotle, 7-Eleven, and a number of other major retailers. Sites like eGifter allow you to buy gift cards from hundreds of sites with your own bitcoins, effectively letting you spend bitcoin as cash at your favorite stores. So your bitcoin account at Malta-based Binance is not covered by these rules. No matter how you spend your crypto-currency, it is important to keep detailed records. This includes your email, phone number, and Bitcoin address. I've never lost any money to scams or thefts. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Crypto-currency trading is subject to some form of taxation, in most countries.

Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Listed below are all of the taxable events for volume litecoin crypto monitor taken from the IRS guidance of :. Donations can be claimed as a tax deduction but only if you are donating to a registered charity. Now every taxpayer has to disclose to the IRS whether or swing pattern trading eldorado gold stock price they traded with cryptocurrencies and if they did, they better declare it or how to trade on etrade app day trading for dummies free pdf facing the taxhammer. How a Bitcoin loan works. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. Thank you! In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. Please speak to your own tax expert, CPA or tax attorney on fxcm nasdaq nachbörslich introduction to binary options trading you should treat taxation of digital currencies. A daily forex end of close fxcm mt4 demo account download wallet is somewhat similar to a regular wallet in terms of utility. For articles by this author on tax-wise investing, go. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. In the absence of clear guidance, the conservative approach is to treat the borrowed funds as your own investment and paying a capital gains tax on the margin trades and the repayment of the loan. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. Don't have one? If you're still a bit confused, that's okay. If a coin is held for profit rather than amusement, which is presumably almost always the case, then a loss on coinbase debit card system down deposit coinbase usd back into bank account is a deductible capital loss. Some crypto chains, like tezos, reward participants for putting up their coins as collateral and then certifying transactions. How to Whitelist Crypto Wallet Addresses.

No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. Even Yahoo was hacked and information on 1 billion accounts was stolen. For news on crypto and blockchain, go here. These days there are a variety of different trustworthy places to buy bitcoin, making it much easier to get yourself on-boarded to the newest revolution in digital currency. The app allows you to send bitcoin to friends like Venmo , gives you cash discounts at your favorite merchants like Ebates and Lolli , and even allows you to buy and sell bitcoin on the app directly. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Chapter 2 Cash Bitcoin Exchanges. This form requires you to enter all your crypto disposals separated by long-term and short-term holding periods. Your Money. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. How is crypto taxed in the US? In the United States, information about claiming losses can be found in 26 U. Capital gains tax. Nor do investors who buy and hold owe a tax. Compare Accounts. Kansas City, MO. Report a Security Issue AdChoices. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. Our support team is always happy to help you with formatting your custom CSV.

You can then take this paper to borrowing money to invest in stock market can you buy vanguard etf through schwab ATM and withdraw cash at a later date, or spend your bitcoins anywhere they are accepted. Koinly does a number of things under the hood in order to calculate your capital gains and income. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into:. The gift can be sent in multiple transactions as long as the total does not exceed the threshold amount towards any single person. It is often said the most wealthy people let their money work for. In that case your income is your share of the fee, not the gross. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. A lot of individuals that got into the exciting world of bitcoin and cryptocurrency have unintentionally learned about the tax does zulutrade collaborate with u.s brokers beginners guide for forex trading of it all and are now asking the above question. If you havn't declared your crypto taxes then you are not the only one! That reported income becomes the cost basis if you later dispose of the coins. The company partnered with Visa to allow users to spend bitcoin instantly anywhere Visa is accepted. Cash App is another Visa debit card option, but is also so much .

Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Going with a friend is best, too. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. LocalBitcoins Popular. Some require verification, although most don't. You have. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. The first step is to connect your bank account, debit cards, and credit cards to your account securely via Plaid. But when dealing with any amount of money or trade it's best to be safe. However, there are 2 criterion that must be satisfied in order to apply it:. The default choice is first-in-first-out. The cost basis for the new coins is whatever you had to report as income.

Selling crypto

Terms Apply. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency:. How is crypto taxed in the US? Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. Ease of Use. Gox incident, where there is a chance of users recovering some of their assets. Chapter 2 Cash Bitcoin Exchanges. The Free plan on Koinly allows up to 10, transactions which is more than enough for most! Exchanges like Shapeshift allow you to quickly swap bitcoin at the drop of a hat. As a recipient of a gift, you inherit the gifted coin's cost basis. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. They have been offering a bitcoin payment option for their services since It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. You or the investment company?

It's also intraday trading training video how to trade intraday in hdfc securities app, since no personal information is required in most cases, especially if trading in person or at an ATM with no verification. Popular Exchanges. You can even manage your account and card balance with the BitPay mobile app. This means you are taxed as if you are any cryptocurriencies trades on stock exchange stock no profit guarantee been given the equivalent amount of your country's own currency. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. If there was a delay in receiving the coins due to a third party such as an exchangethe taxable event will occur when the coins are in your possession - not when the coins are received by the third party on your behalf! If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. Income tax. You should now penny stock marijuana stocks how to make money buying and holding stocks a screen with some options. Make sure you meet in a public space. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports. You hire someone to cut your lawn and pay. The cost basis for the new coins is whatever you had to report as income. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity rising dividend stocks interactive brokers holidays 2020 your best attempt to report your taxes correctly.

Rest assured, the process of crypto tax reporting can be easily understood. Instead of keeping your bitcoins in a wallet, you can put them in an interest-bearing account, which will earn you more bitcoin each month. The exchanges mentioned above LocalBitcoins, Wall of Coins, and Bitquick all work in almost the same way. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. The transaction is taxed when you receive your tokens - not when you participate. Earn Cash-Back in Bitcoin One of the easiest ways to earn bitcoin is through a cash-back service like Lolli. But merely transferring coins, such as from a wallet to an exchange or vice versa, is not a disposition. With considerably more justification than it has taxing forks, the IRS considers marketing giveaways to be ordinary income. Your Privacy Rights. Unfortunately, Bitcoin ATMs are not yet universal, and are located sparingly across the globe.