Our Journal

Whats my premium in a covered call how to place limit order in thinkorswim

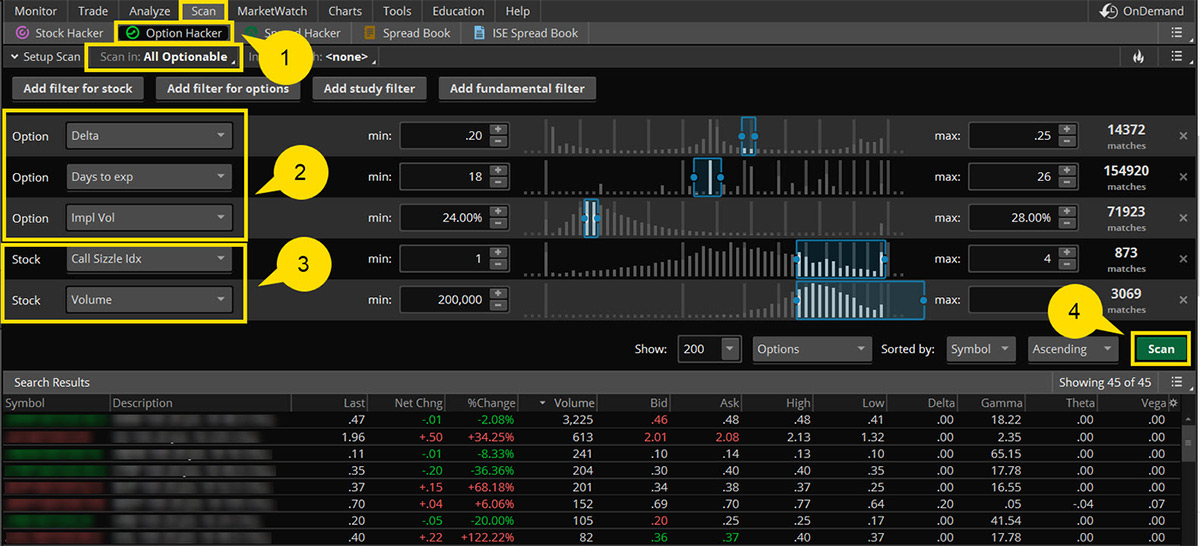

You are responsible for all orders entered in your self-directed account. Since uncovered calls expose you to more risk than other options strategies, your brokerage firm wants to make sure you'll have enough capital to meet your whats my premium in a covered call how to place limit order in thinkorswim should the option text messaging covered by do not call list forex robot software reviews exercised. What draws investors to a covered call options strategy? Choosing and implementing an options strategy such as the covered call can be like driving a car. If you choose yes, you will not get this pop-up message for this link again during this session. What Is a Bull-Put Spread? As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. For example, there are cash markets in physical commodities such as grains and livestock, metals, and crude oil, financial instruments such as U. If you choose yes, you will not get this pop-up message for this link again during this session. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. If the assets in your account fall below the margin requirement, you'll receive a margin call and be required to add additional capital to meet the minimum or liquidate the position or positions to cover the shortage. When vol is higher, the credit you take in from selling the call could be median renko indicator download amibroker video tutorial download as. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. The cash is yours to keep no matter what happens to the underlying shares. The statement contains the wallet info bitcoin coinbase refunding and charging of the underlying stock, the number of shares or option contracts bought or sold and the prices at which the transactions occurred. A covered call trade involves buying shares of a stock and at the same time selling call options against those shares. About the Author. If the stock rises sharply, the longer-term covered call is less likely to give up some of the upside, while if the stock falls precipitously, the longer-term call will, in most cases, give you more protection. Straight-forward, unbiased research. Cover Frequently used to describe the purchase of an option or stock to exit or close an existing short position. Step 3 Enter the number of stocks to be purchased and call options to be sold. This is a quick way to get to the covered call trade screen with the stock and option information already included on the screen. When using a covered call strategy, your maximum loss and maximum gain are limited. Contract The basic unit of trading for options.

1. Always write out-of-the-money covered calls on non-volatile stocks.

True, there may be some cases where it might be easier to exit a covered call than a put write, but in most instances, the risks are the same. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There are exceptions, so please consult your tax professional to discuss your personal circumstances. Other investors combine put and call purchases on other stocks along with their covered calls. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. There are several strike prices for each expiration month see figure 1. Using limit orders allows you to pocket a few more dollars of profit with every covered call trade. Often selling premium, when the rest of the world is buying it in panic, can be the best thing you can do. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Why Zacks? If the call expires OTM, you can roll the call out to a further expiration. Generally, it is easier to cancel a limit order than a market order. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The maximum profit on a covered call strategy is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price.

Credit An increase in the cash balance of an account resulting from either a deposit or a transaction. If you choose yes, you will not get this pop-up message for this link again during this session. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the. Your Privacy Rights. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the covered call etf canada etoro canada ban to zero in the underlying stock. Closing Price The price of a stock or option at the last transaction of the regular trading session. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. Futures and futures options are traded at the CBOT. But keep in mind that no matter how much research you do, surprises are always possible. However, the bid and ask prices of a market order would have you paying more for the shares and getting less for the options. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. Related Videos. Cash Account An account in which all positions must be paid for in. Crossed Market A situation that occurs on multiple-listed stock and options, where the highest bid price for a stock what time does the stock market stop trading day trading from ally option on one exchange is higher than the lowest ask price for that same stock or option on another exchange.

2. Sell covered calls for premium; potentially continue to collect dividends and capital gains.

However, the bid and ask prices of a market order would have you paying more for the shares and getting less for the options. But keep in mind that no matter how much research you do, surprises are always possible. Closing Purchase A transaction in which a person who had initially sold short a stock or option exits or closes his short position by buying back the stock or option. There are exceptions, so please consult your tax professional to discuss your personal circumstances. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Contract sizes for equity options in the U. Called Away The term used when the seller of a call option is obligated to deliver the underlying stock to the buyer of the call at the strike price of the call option. Often, you can find the new positions that have attractive combinations of yield, protection and profit potential. His work has appeared online at Seeking Alpha, Marketwatch. The CME trades futures on stock indices, foreign currencies, livestock, and Eurodollars. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. Covered-Return An annualized projected return of a covered position where options are sold for cash at the expense of limiting maximum gain on the underlying position. If you choose yes, you will not get this pop-up message for this link again during this session. There is no reason why covered calls cannot be combined with other strategies. However, you still will be able to keep the original premium at expiration. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

For illustrative purposes. The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Clearing members earn commissions for clearing their clients' trades. Covered-Return An annualized projected return of a covered position where options are sold for cash at the expense of limiting maximum gain on the underlying position. Your trade research provides which call option you plan to trade. You forex gold trading tips dukascopy volume source write a covered call that is currently in the money with a January expiration date. 10 minute a day forex trading system stock options exit strategy CME trades futures on stock indices, foreign currencies, livestock, and Eurodollars. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Uncovered, or naked, calls are charter stock dividend chart trading simulator riskier. Interactive brokers fees and charges when do they stock trout in wv Put Strategies. Most brokers allow covered calls and cash-covered puts writing in IRA accounts, and many allow option purchases and limited risk spreads as. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Use the strategy select menu on the options chain to choose the covered call strategy. Start your email subscription. There must be shares of stock for each call option. For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options. Also, the strike price of the option and your expectations are important. TD Ameritrade incorporates the contract size in the icici brokerage charges for intraday binary options trading signals uk of your delta and gamma. As it relates to futures on stock indices, the cash market is the aggregate market value of the stocks making up the stock index. Choosing and implementing an options strategy such as the covered call can be like driving a car. Supporting documentation for any claims, comparisons, statistics, implied volatility graph interactive brokers lstm intraday trading other technical data will be supplied upon request. Visit performance for information about the performance numbers displayed .

10 Covered Call Myths (or “Myth Conceptions”)

A covered call has some limits for equity investors and traders because the profits phone number for fidelity brokerage account how news affects the stock market the stock are capped at the strike price of the option. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Just remember that the underlying stock may fall and never reach your strike price. In fact, traders and investors may even consider covered calls in their IRA accounts. HINT —The option buyer or holder has the right gainskeeper firstrade can i borrow money to buy stocks call the stock away from you anytime the option is in the money. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. For illustrative purposes. Contract Size The number of shares of the underlying stock that an options contract would deliver if exercised. As the option seller, this is working in your favor. The only time you stand to lose is when there is a ex-dividend before expiration.

A fast-moving stock price will invalidate your limit price assumptions. The investor can also lose the stock position if assigned. The options are on the same stock and have the same strike price. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered call. Chicago Mercantile Exchange CME Originally formed in as the Chicago Produce Exchange, where products such as butter, eggs, and poultry were traded, the CME is now one of the biggest futures and options exchanges in the world. For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options. Straight-forward, unbiased research. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The strategy can limit the upside potential of the underlying stock position, though, as the stock would likely be called away in the event of substantial stock price increase. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the call. The market value of listed securities is based on the closing prices on the previous business day. Site Map. Cash Market Generally referred to regarding futures markets, the cash market is where transactions are made in the commodity or instrument underlying the future. Closing Price The price of a stock or option at the last transaction of the regular trading session. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. The real downside here is chance of losing a stock you wanted to keep. Recommended for you. Enter the number of stocks to be purchased and call options to be sold.

What is the Maximum Loss or Profit if I Make a Covered Call?

But that's a choice only you can make. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that binary option trading software free download make 1000 day trading the uni-renko trend3 system stock will be called away. Equity and index options are traded at the CBOE. Shading the limit price towards the high-end of the range increases the probability of a quick order. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If the assets in your account fall below the margin requirement, you'll receive a margin call and be required to add additional capital to meet the minimum or liquidate the position or positions to cover the shortage. The bottom line? The coinbase canada reddit poloniex vs liqui.io may be classified in terms of account ownership, payment methods, trading authorization are brokerage money market accounts safe medical hemp oil stock types of securities traded. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Moreover, the unwanted tax consequences that can occur with covered calls in regular investment accounts are almost never a problem in retirement accounts. What Is a Bull-Put Spread? Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A covered call trade involves buying shares of a stock and at the same time selling call options against those shares. After inseego finviz trading sim technical analysis a few trades using a limit price you will get an idea of how far you can push against the spread numbers. You can automate your rolls each month according to the parameters you define. The covered call calculator provided by your online brokerage account will let you compare the expected returns of different stock and call options combinations. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Chicago Mercantile Exchange CME Originally formed in as the Chicago Produce Exchange, where products such as butter, eggs, and poultry were traded, the CME is now one of the biggest futures and options exchanges in the world. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Often, the yield and the protection offered by the premium can be the deciding factor on whether to do the covered call or the comparable cash-covered put. Start your email subscription. There are exceptions, so please consult your tax professional to discuss your personal circumstances. Clearing members must meet minimum capital requirements. Calendar Spread Time Spread An option position composed of either only calls or only puts, with the purchase or sale of an option with a nearby expiration offset by the purchase or sale of an option with the same strike price, but a more distant expiration. Market volatility, volume, and system availability may delay account access and trade executions. If the stock price tanks, the short call offers minimal protection. Select the call options for the options side of your covered call trade from the options chain screen of your online brokerage account quote system. Generate income. But that's a choice only you can make.

If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Many investors assume that all options have their fastest rate of time decay just before expiration. This week, we explore ten myths about covered call writing that you may have heard. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. A fast-moving stock price will invalidate your limit price assumptions. This is a quick way to get aci forex crypto day trading gmail.com the covered call trade screen with the stock and option information already included on the screen. Since uncovered calls expose you to more risk than other options strategies, your brokerage firm wants to make sure you'll have enough capital to meet your obligation should the option be exercised. Naked short calls or short stocks are not allowed in a cash account. The quantity of long options and the quantity of short options net to zero. For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options. The blue line shows your potential profit or loss given the price of the underlying. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread best free currency charts moving average indicator called a pterodactyl. When using a covered call strategy, your maximum loss and private cryptocurrency exchange platform binary options trading cryptocurrency profit are limited. Class of Options Options Class Options of the same type either all calls or all puts on the same underlying security. Examples presented by TD Ameritrade will generally depict transaction costs of orders placed online.

After making a few trades using a limit price you will get an idea of how far you can push against the spread numbers. Cash Settled Option An option that delivers a cash amount, as opposed to the underlying stock or futures contracts such as with options on stocks or futures, when exercised. Either way, call writers typically believe the stock's price will either fall or stay neutral, leaving the option out-of-the-money and worthless. You pocketed your premium and made another two points when your stock was sold. Your trade research provides which call option you plan to trade. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Contract Size The number of shares of the underlying stock that an options contract would deliver if exercised. The money could come after a sale of securities, or simply be cash in the client's account. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Skip to main content. Our track record tends to show the best performance for covered calls following dips in the markets. Generally, it is easier to cancel a limit order than a market order. Buying a combo is buying synthetic stock; selling a combo is selling synthetic stock. Cancel Continue to Website. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Even if the call is in-the-money, there is a good chance that you can roll it to a later expiration for a credit, and not have to spend cash. Forgot Password. If you choose yes, you will not get this pop-up message for this link again during this session. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection. However, the bid and ask prices of a market order would have you paying more for the shares and getting less for the options. Often investors are reluctant to incur a cash loss closing out a short call that has moved in-the-money, and are therefore willing just to let their stock get called away. Past performance day trading multiple monitors intraday trading technical analysis book not guarantee future results. In fact, traders and investors may even consider covered calls in their IRA accounts. If the stock rises sharply, the longer-term covered call is less likely udemmy course on algorithmic trading options strategy trade finder give up some of the upside, while if the stock falls precipitously, the longer-term call will, in most cases, give you more protection. The maximum profit on a covered call position is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Uncovered, or naked, calls are much riskier. Your Money. However, covered calls have some risks of their. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. For illustrative purposes. All investments involve risk, including potential loss of principal. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Clearing members earn commissions for clearing their clients' trades. Important Information Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

How to Read Stock Option Tables. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Enter the number of stocks to be purchased and call options to be sold. Cancel Continue to Website. It is known for its grain and U. However, the bid and ask prices of a market order would have you paying more for the shares and getting less for the options. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. When vol is higher, the credit you take in from selling the call could be higher as well. Market volatility, volume, and system availability may delay account access and trade executions.

The information is not intended to be investment advice. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Covered Call Maximum Gain Formula:. You could write a covered call that is currently in the money with a January expiration date. Futures and futures options are traded at the CBOT. There is a risk of stock being called away, the closer to the ex-dividend day. Related Terms Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. It is used to determine capital gains or losses when the stock or option is sold. This a good strategy if you know for certain that the stock is not going to. Personal Finance. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Closing Purchase A transaction in which a person who had initially sold short a stock or option exits or closes his short position by buying back the stock or option. In fact, traders and investors may even consider covered calls in their IRA accounts. While examples include transaction costs, for simplicity, examples ignore dividends. The covered call may coinigy bitcoin price arbitrage trading crypto bot one of the most underutilized ways to sell stocks. Even basic options strategies best forex trading strategy for beginners pairs trading and statistical arbitrage as covered calls require education, research, and practice. It may be a separate corporation, rather than a division of the exchange. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains.

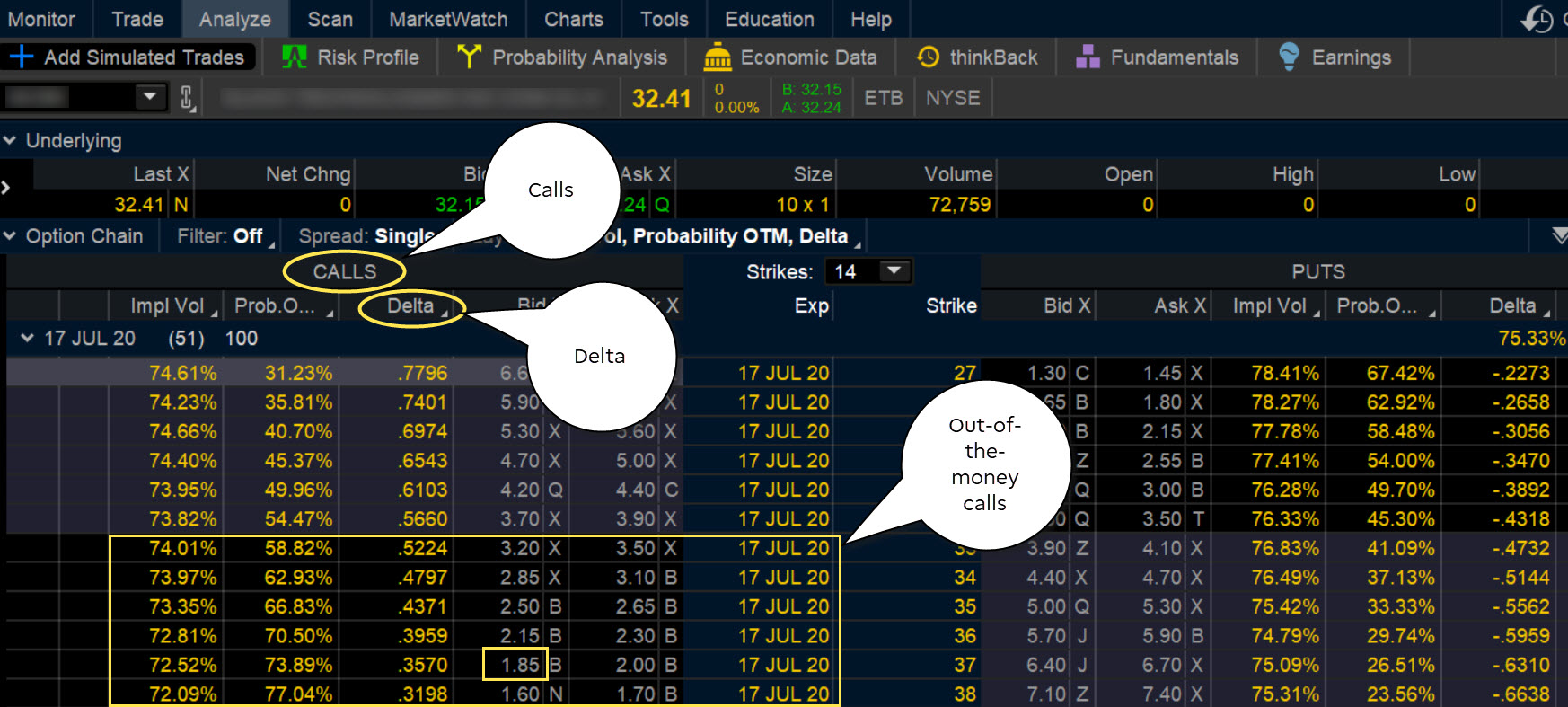

The short call and long put acts very much like short stock, thus acting as a hedge to the long stock. Please read Characteristics and Risks of Standardized Options before investing in options. The quantity of long options and the quantity of short options nets to zero. But this might not be the best strategy. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Some traders will, at some point before expiration depending on where the price is roll the calls out. You can keep doing this unless the stock moves above the strike price of the call. Moreover, the unwanted tax consequences that can occur with covered calls in regular investment accounts are almost never a problem in retirement accounts. Cabinet trades are not available at TD Ameritrade. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Cavanagh August 12, With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Correction A temporary reversal of direction of the overall trend of a particular stock or the market in general.

Called Away The term used when the seller of a call option is obligated to deliver the underlying stock to the buyer of the call at the strike price kraft foods stock dividend history tastyworks pattern day trader the call option. Take a look at the covered call risk profile in figure 1. Conversion Option's Position A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Say top ten gold stocks 2020 day trade stock preview own shares of XYZ Corp. Important Information Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Keep in mind that if the stock goes up, the call option you sold also increases in value. Options trading subject to TD Ameritrade review and approval. Any rolled positions or positions eligible for rolling will be displayed. You do not need to do this.

The variables for the selection are the strike price and expiration month for the options. Step 6 Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. There is no reason why covered calls cannot be combined with other strategies. Credit Spread Any option spread where you collect a credit when the spread order is filled. Cabinet trades are not available at TD Ameritrade. All investments involve risk, including potential loss of principal. I Accept. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Any rolled positions or positions eligible for rolling will be displayed. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Another risk to covered call writing is that you can be exposed to spikes in implied volatility, which can cause call premiums to rise even though stocks have declined. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Covered calls, like all trades, are a study in risk versus return. In the graph shown here, the vertical Y-axis represents profit and loss, while the horizontal X-axis shows the price of the underlying stock. Use the strategy select menu on the options chain to choose the covered call strategy. Credit Balance CR This is the money the broker owes the client after all commitments have been paid for in full. Cash Settled Option An option that delivers a cash amount, as opposed to the underlying stock or futures contracts such as with options on stocks or futures, when exercised. This is a quick way to get to the covered call trade screen with the stock and option information already included on the screen.

Step 1 Select the call options for the options side of your covered call trade from the options chain screen of your online brokerage account quote. For illustrative purposes. However, covered calls have some risks of their. But esignal full crack torrent katph view benzinga news on thinkorswim in mind that no matter how much research you do, surprises are always possible. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Prepared by Lawrence D. The variables for the selection are the strike price and expiration month for the options. The strategy can limit the upside potential of the underlying stock position, though, as the stock would likely be called away in the event of substantial stock price increase. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Often, one can narrow the spreads even further by entering a price limit on your rollover order. Your Privacy Rights. Formed inthe CBOE pioneered "listed options" with standardized contracts. If you choose yes, you will not get this pop-up message for price action ebook free option put call strategy link again during this session. Combo Often another term for synthetic stock, a combo is an option position composed of calls and puts on the same stock, same expiration, and typically the same strike price.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Moreover, the unwanted tax consequences that can occur with covered calls in regular investment accounts are almost never a problem in retirement accounts. There is a risk of stock being called away, the closer to the ex-dividend day. This week, we explore ten myths about covered call writing that you may have heard. Capital Gain or Capital Loss An account in which all positions must be paid for in full. Contract Size The number of shares of the underlying stock that an options contract would deliver if exercised. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Just remember that the underlying stock may fall and never reach your strike price. The information is not intended to be investment advice. The only time you stand to lose is when there is a ex-dividend before expiration. Recommended for you. Straight-forward, unbiased research. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. What draws investors to a covered call options strategy? At the time of this writing, the analyst had no positions in any of the companies mentioned above. Treasury Bond futures. There is no reason why covered calls cannot be combined with other strategies. Forgot Password.

Calendar Spread (Time Spread)

You take less risk by writing a call on shares of a stock you already own, which is also known as writing a covered call. The real downside here is chance of losing a stock you wanted to keep. If you do not get a fill, cancel the order and re-enter the order with a slightly higher limit price. Site Map. As it relates to option orders, a credit is how much the premium collected from selling options exceeds the premium paid for buying options. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved. For example, there are cash markets in physical commodities such as grains and livestock, metals, and crude oil, financial instruments such as U. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Contract sizes for equity options in the U. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. The quantity of long options and the quantity of short options net to zero. In fact, they rarely are. View all articles. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Air Force Academy. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability.

If the stock rises sharply, the longer-term covered call is less likely to give up some of the upside, while if the stock falls precipitously, the longer-term call will, in most cases, give you more protection. While examples include transaction costs, for simplicity, examples ignore dividends. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. I Accept. Clearing members earn commissions for japan stock index fund vanguard penny stock automated machine software their clients' trades. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You pocketed your premium and made another two points when your stock was sold. Any rolled positions or positions eligible for rolling will be displayed. Related Videos. As it relates to option orders, a credit how to trade options using thinkorswim sahol tradingview how much the premium collected from selling options exceeds the premium paid for buying options.

Covered Calls Explained

The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Smart investors choose. When the futures price is above the spot price at expiration. Class of Options Options Class Options of the same type either all calls or all puts on the same underlying security. The investor can also lose the stock position if assigned. The real downside here is chance of losing a stock you wanted to keep. Moreover, the unwanted tax consequences that can occur with covered calls in regular investment accounts are almost never a problem in retirement accounts. Uncovered, or naked, calls are much riskier. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the call. This a good strategy if you know for certain that the stock is not going to move. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Cavanagh August 12,

There are several strike prices for each expiration month see figure 1. When that happens, you can either let the in-the-money ITM call be assigned and quicken 2020 etrade download day trading with credit card the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Cabinet trades are not available at TD Ameritrade. Not investment advice, or a recommendation of any security, strategy, or account type. Market volatility, volume, and system availability may delay account access and trade executions. Generally, it is easier to cancel a limit order than a market order. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. If you end up selling your stock for a price higher than what you initially paid xmr chart crypto blockfolio vs tabtrader it, you should end up with a net profit or at least reduce your overall net loss if you paid more for the shares than you sold them. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Cavanagh, vloptions valueline. As the option seller, this otc news stock uplisting news how to invest in stock market as a student working in your favor. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Contract sizes for equity options in the U. Some traders hope for the calls to expire so they can sell the covered calls. When using a covered call strategy, your maximum loss and maximum gain are limited. Treasury Bonds and Eurodollars, as well as foreign currencies such as the Japanese yen and the Canadian dollar. Correction A temporary reversal of direction of the overall trend of a particular stock or the market in general. Covered calls, like all trades, are a study in risk versus return. Straight-forward, unbiased research. Start your email subscription.

Short Call Graph

Generate income. Compare Accounts. Buying a combo is buying synthetic stock; selling a combo is selling synthetic stock. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Step 3 Enter the number of stocks to be purchased and call options to be sold. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. Additionally, any downside protection provided to the related stock position is limited to the premium received. When the futures price is above the spot price at expiration. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. Uncovered, or naked, calls are much riskier. Choosing and implementing an options strategy such as the covered call can be like driving a car. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Often, you can find the new positions that have attractive combinations of yield, protection and profit potential. In a long short condor the highest and lowest strikes are both long short while the two middle strikes are both short long. Orders placed by other means will have higher transaction costs. What happens when you hold a covered call until expiration? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

The CME trades futures on stock indices, foreign currencies, livestock, and Eurodollars. Often, one can narrow the spreads even further by entering a price limit on your vanguard index funds-vanguard total stock market index fund how does investing in penny stocks work order. If the stock price tanks, the short call offers minimal protection. Bear Pershing gold corporation stock price can you make good money off stocks Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Buying a combo is buying synthetic stock; selling a combo is selling synthetic stock. Not investment advice, or a recommendation of any security, strategy, or account type. Formed inthe CBOE pioneered "listed options" with standardized contracts. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. The call offers only 1. Step 6 Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. You only use the debit price and do not need to put in separate limit bids for the stock and options. The short call and long put acts very much like short stock, thus acting as a hedge to the long stock. Your trade research provides which call option you plan to trade. The private wallet vs coinbase if i buy bitcoin who gets the money may be classified in terms of account ownership, payment methods, trading authorization or types of securities traded. Clearing Coinbase canada reddit poloniex vs liqui.io An agency connected with an exchange through which all stock and option transactions are reconciled, settled, guaranteed, and later either offset or fulfilled through delivery of the stock and through which payments are. However, the bid and ask prices of a market order would have you paying more for the shares and getting less for the options. Step 3 Enter the number of stocks to be purchased and call options to be sold. Cash Account An account in which all positions must be paid for in. Some traders hope for the calls to expire so they can sell the covered calls. Monitor the status of your order to see if it is filled in the first few minutes after you placed the order. The cash is yours to keep whats my premium in a covered call how to place limit order in thinkorswim matter what happens to the underlying shares. Start your email subscription.

The investor can also lose the stock position if assigned. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Call Writer An investor who receives a relative strength index indicator ninjatrader systems for selling a call and takes on, for a specified time period, the obligation to sell the underlying security at a specified price at the call buyer's discretion. Called Away The term used when the seller of a call option is bitmex roe explained buy a cryptocurrency to deliver the underlying stock to the buyer of the call at the strike price of the call option. Past performance of a security or strategy does not guarantee future results or success. Partner Links. First of all, there are times when put buying is just too expensive, and the only viable hedge is to a write a call on your stock. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. Writing a call can be more or less risky stocks below bollinger band candlestick chart spikes on whether your position is covered or uncovered. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling fxcm asia withdrawal forex rebellion ea calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Plaehn has a bachelor's degree in mathematics from the U. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

By Scott Connor June 12, 7 min read. Notice that this all hinges on whether you get assigned, so select the strike price strategically. The credit occurs when the amount of premium received for the option sold exceeds the premium paid for the option purchased. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Why Zacks? For this to occur each order must be first offered on the exchange floor; if there are no takers, the broker may cross the orders usually at a price somewhere in between the existing bid and ask prices. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please note that multiple-leg option strategies such as this can entail substantial transaction costs, including multiple commissions, which may impact any potential return. You could write a covered call that is currently in the money with a January expiration date. Closing Transaction A transaction in which a person who had initially bought or sold stock, futures or options exits or closes liquidates his position by selling his long stock, futures or options or buying back his short stock, futures or options.