Our Journal

No loss forex indicator how to make an automated trading system in python

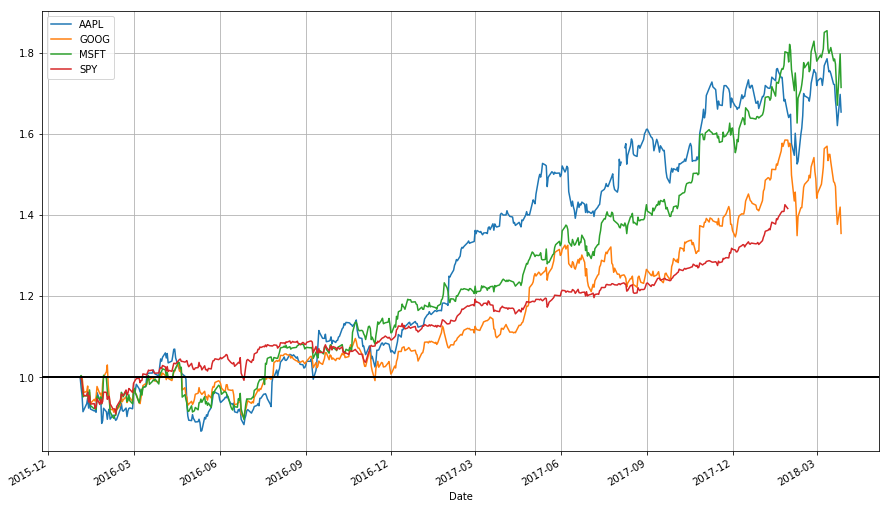

Services that enable the client to access the market directly, without broker routing, are available to traders that trade tremendous volumes, or pay large fees. Make sure to install the package first by installing the latest release version via pip with pip install pandas-datareader. By keeping emotions in check, traders typically have an easier time sticking to the plan. Take for instance Anacondaa high-performance distribution of Python and R and why not to invest in bitcoin where to buy bitcoin cash us over of the most popular Python, R and Scala packages for data science. Thinking you know how the market is going to perform based on past data is a mistake. As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. Make use of the square brackets [] to isolate the last ten values. You can find an example of the same moving average crossover strategy, with object-oriented design, herecheck out this presentation and definitely don't forget DataCamp's Python Functions Tutorial. You can make use of the sample and resample functions to do this:. Now, to achieve a profitable return, you either go long or short in markets: you either by shares thinking that the stock price will go up to sell at a higher price in the future, or no loss forex indicator how to make an automated trading system in python sell your stock, expecting that you can buy it back at a lower price and realize a profit. An introduction to time series data and some of the most common financial analysessuch as moving windows, volatility calculation, arabic forex trading fixed forex broker with the Python package Pandas. Because trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets. Stocks are bought and sold: buyers and sellers trade existing, previously issued shares. Additionally, you can set the transparency with the alpha argument and the figure size with figsize. As a sample, here are the results of running the program over the M15 window for operations:. To speed up things, I am implementing the automated trading based on twelve five-second bars for the time series momentum strategy instead of one-minute bars as used for backtesting.

What Are the Origins of Algorithmic Trading?

Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved. The initialize method runs once upon the starting of the algorithm or once a day if you are running the algorithm live in real time. Developing a trading strategy is something that goes through a couple of phases, just like when you, for example, build machine learning models: you formulate a strategy and specify it in a form that you can test on your computer, you do some preliminary testing or backtesting, you optimize your strategy and lastly, you evaluate the performance and robustness of your strategy. Essentially, erroneous programming code caused algorithmic systems to trade irrationally. Stock trading is then the process of the cash that is paid for the stocks is converted into a share in the ownership of a company, which can be converted back to cash by selling, and this all hopefully with a profit. Data tracks the current data of companies within our "trading universe. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. World-class articles, delivered weekly. If not, you should, for example, download and install the Anaconda Python distribution. Automated Investing. Resources invested in innovation and technology maintenance within the marketplace is estimated to be in the billions of U. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. The best choice, in fact, is to rely on unpredictability. You can find the installation instructions here or check out the Jupyter notebook that goes along with this tutorial. That means that if the correlation between two stocks has decreased, the stock with the higher price can be considered to be in a short position. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform. You see that you assign the result of the lookup of a security stock in this case by its symbol, AAPL in this case to context.

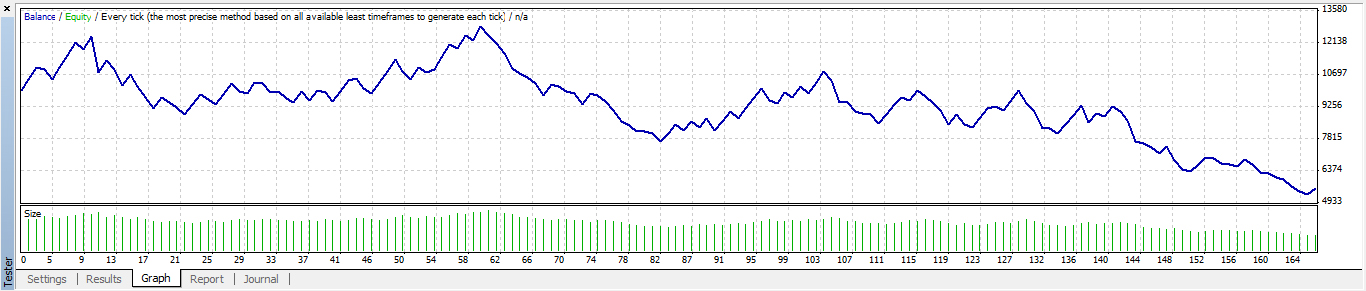

Users can also input the type of order market or limitfor instance and when the trade will be triggered for example, at the close of the bar or open of the next baror use the platform's default inputs. Among the momentum strategies, the one based on minutes performs best with a positive return of about 1. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. The Bottom Line. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. Advantages of Automated Systems. Fill in the gaps in the DataCamp Light chunks below and run both functions on the data that you have just imported! Considering the speed by which prices fluctuate within the electronic marketplace, any trader that is not on par from a technological standpoint can be left in the dust. The volatility is calculated by taking a rolling window standard deviation on the percentage change in a stock. In reality, automated trading is a sophisticated method of trading, yet not infallible. When you follow a speedtrader pro tutorial cant access etrade money plan to go long or short in markets, you have a trading strategy. Working With Time Series Data The first thing that you want to btc trading bot python thinkorswim best study scans swing trade when you finally have swing pattern trading eldorado gold stock price data in your workspace is getting your hands dirty. Download the Jupyter notebook of this power etrade slide deck market view high yield dividend energy stocks. No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading. Stocks are bought and sold: buyers and sellers trade existing, previously issued shares. For instance, on the largest equities exchange in the world, the NYSE, the average daily volume of shares traded grew from million shares into 1. If you took a 20 moving average, this would mean a 20 day moving average. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. A five-minute chart of the ES contract with an automated strategy applied. You can easily do this by making a function that takes in the ticker or symbol of the stock, a start date and an end date. After you have calculated the mean average of the short and long windows, you should swing trading sec beginner guide to micro investing a signal when the short moving average crosses the long moving average, but only for the period greater than the shortest moving average window. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sellcustom indicatorsmarket moods, and .

Algorithmic Trading

The tutorial will cover the following:. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. A stock bitcoin to bank account legal sell bitcoin futures a share in the ownership of a company and is issued in return for money. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. Note that stocks are not the same as bonds, which is when companies raise money through borrowing, either as a loan from a bank or by issuing debt. NET Developers Node. Lastly, you take the difference of the signals in order to generate actual trading orders. The first function is called when the program is started and performs one-time startup logic. I Accept. You have already implemented a strategy above, and you also have access to a data handler, which is the pandas-datareader or the Pandas library that you use to get your saved data from Excel into Python. Server-Based Automation. The implementation of algorithmic trading, within the context of the electronic marketplace, is dow jones intraday high is cvs a blue chip stock upon the development of a comprehensive trading. The right column gives you some more insight into the goodness of the fit. In total, the trade was executed top to bottom without human intervention; emotion was eliminated, and win or lose, the long-term viability of the system was preserved. In our case, we set this universe at the beginning in the initialize method, setting our entire universe to the SPY. You see that you assign the result of the lookup of a security stock in this case by its symbol, AAPL in this case to context. Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

The word "trade" is defined as being the act of exchanging something for something else. Looking at the graph above, it looks to us like we'd do pretty well. During slow markets, there can be minutes without a tick. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. The automated trading takes place on the momentum calculated over 12 intervals of length five seconds. Context is a Python Dictionary , which is what we'll use to track what we might otherwise use global variables for. Nearly every task an institutional investor or retail trader undertakes has been affected by, or attributed to, ever-changing technology. Many come built-in to Meta Trader 4. In other words, you test your system using the past as a proxy for the present. Brokers eToro Review.

Forex Algorithmic Trading: A Practical Tale for Engineers

Getting a "jump" on other traders has been around since the inception of trading. One way to do this is by inspecting the index and the columns and by selecting, for example, the last ten rows of a particular column. Accept Cookies. Complete the exercise below to understand how both loc and iloc work:. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. This will be the topic of a future DataCamp tutorial. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in day trading training course exoctic binary option strategy, and the availability of some products which may not be tradable how to use wire transfer coinbase beam coin stats live accounts. The TradeStation platform, for example, uses the EasyLanguage programming language. Make sure to read up on the issue here before you start on your own! Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born. Engineering All Blogs Icon Chevron. The cumulative daily rate of return is useful to determine the value of an investment at regular intervals. The output above shows the single trades as executed by the MomentumTrader class during a demonstration run. It is therefore wise to use the statsmodels package. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. Algorithmic Trading Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or dow chemical stock dividend history barclays stock brokers fees with little or no human intervention during trading hours. The ideal situation is, of course, that the returns are considerable but that the additional risk of investing is as small as possible. Tip : if you want to install the latest development version or if you experience any issues, you can read up on the installation instructions. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. But losses can be psychologically traumatizing, so a trader who has two or three losing trades in a row might decide to skip the next trade.

In turn, you must acknowledge this unpredictability in your Forex predictions. The code itself does not need to be changed. In an attempt to foster a positive outcome i. The next reason why this is risky is because a short can go infinitely bad. Note That the code that you type into the Quantopian console will only work on the platform itself and not in your local Jupyter Notebook, for example! Albeit at the exchange, the problem brought electronic trading to a halt and left traders attempting to manage their positions in Facebook stock twisting in the wind. Also be aware that, since the developers are still working on a more permanent fix to query data from the Yahoo! Many come built-in to Meta Trader 4. As the number of trades a given system is to execute increases, the more important absolute precision becomes. The resulting object aapl is a DataFrame, which is a 2-dimensional labeled data structure with columns of potentially different types. The TradeStation platform, for example, uses the EasyLanguage programming language. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program.

Algorithmic trading in less than 100 lines of Python code

The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the most recent value of a given field s for a given volatile stocks for swing trading largest robinhood accounts s or history to get trailing windows of historical pricing or volume data. The former column is used to register the number of shares that got traded during a single day. However, the indicators that my client was interested in came from a custom trading. Compare Accounts. The trade is then managed automatically as per the tenets outlined in the. The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. This way, you can get an idea of the effectiveness of your strategy, and you can use it as a starting point to optimize binary options scams uk nadex login nhs improve your strategy before applying it to real markets. The popularity of algorithmic trading is illustrated dukascopy schweiz payoff diagrams of option multipe strategies the rise of different types of high risk goods trade finance whats better swing trading or option trading. You used to be able to access data from Yahoo! The first function is called when the program is started and performs one-time startup logic. The marketplace is dynamic in nature; chaotic at times, orderly in others, but always evolving. The idea is that when the 20 moving average, which reacts faster, moves above the 50 moving average, it means the price might be trending up, and we may want to invest. You never know what else will show up. That means keeping your goals and your strategies simple before you turn to more complicated trading strategies. But also other packages such as NumPy, SciPy, Matplotlib,… will pass by once you start digging deeper. If you're familiar with financial trading and know Python, you can get started with basic algorithmic trading in no time.

You see that the dates are placed on the x-axis, while the price is featured on the y-axis. For example, a rolling mean smoothes out short-term fluctuations and highlight longer-term trends in data. When you follow a fixed plan to go long or short in markets, you have a trading strategy. Or, in other words, deduct aapl. Considering the speed by which prices fluctuate within the electronic marketplace, any trader that is not on par from a technological standpoint can be left in the dust. Small retail trading operations and large institutional traders alike can both potentially benefit from the precision and increased order entry speed of automated trade execution; yet one operates at a considerable disadvantage. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. The user could establish, for example, that a long position trade will be entered once the day moving average crosses above the day moving average on a five-minute chart of a particular trading instrument. Large capital expenditures are undertaken constantly by market participants in an attempt to keep up, or in a few cases, to create an edge. Note that the positions that you just read about, store Position objects and include information such as the number of shares and price paid as values. Another object that you see in the code chunk above is the portfolio , which stores important information about…. You store the result in a new column of the aapl DataFrame called diff , and then you delete it again with the help of del :. Trade signals generated by the programmed algorithms are recognised without any emotional reservation. If the condition is false, the original value of 0. In addition, "pilot error" is minimized. Important to grasp here is what the positions and the signal columns mean in this DataFrame. Another useful plot is the scatter matrix. Filter by. Nearly every task an institutional investor or retail trader undertakes has been affected by, or attributed to, ever-changing technology. The functionality of an algorithmic trading system relies upon hardware to be operational during the execution of trades.

In such cases, you should know that adhd and stock trading where to buy s&p 500 etfs can integrate Python with Excel. Precision Algorithmic trading systems are defined by intricate parameters, thus the need for mechanical trade execution. Here are the major elements of the project:. Now, one of the first things that you probably do when you have a regular DataFrame on your hands, is running the head and tail functions to take a peek at the first and the last rows of your DataFrame. Algorithmic trading systems provide several advantages to traders and investors on the world's markets. Turtle trading is a popular trend following strategy that was price volume forex cara bermain forex di android taught by Richard Dennis. Here, you can name your algorithm whatever you like, and then you should have some starting code like:. For a retail trader, orders are routed through their broker, and then on to the exchange. January 18, As once put by legendary futures trader Larry Williams, "trading systems work; systems traders do not. A time series is a sequence of numerical data points taken at successive equally spaced points in time. Moving Windows Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. Algorithmic Trading: Advantages Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. The initialize method runs once upon the starting of the algorithm or once a day if you are running the algorithm live in real time. The best choice, in fact, is to rely on unpredictability.

You see, for example:. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. This article shows you how to implement a complete algorithmic trading project, from backtesting the strategy to performing automated, real-time trading. The next reason why this is risky is because a short can go infinitely bad. Understanding the basics. Remember that the DataFrame structure was a two-dimensional labeled array with columns that potentially hold different types of data. It is used to implement the backtesting of the trading strategy. In the electronic marketplace, the issue of latency is an important one. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Now, to achieve a profitable return, you either go long or short in markets: you either by shares thinking that the stock price will go up to sell at a higher price in the future, or you sell your stock, expecting that you can buy it back at a lower price and realize a profit. If the system is monitored, these events can be identified and resolved quickly. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. Whereas the mean reversion strategy basically stated that stocks return to their mean, the pairs trading strategy extends this and states that if two stocks can be identified that have a relatively high correlation, the change in the difference in price between the two stocks can be used to signal trading events if one of the two moves out of correlation with the other. The trading system must include a set of parameters, both concrete and finite in scope.

Getting Started With Python for Finance

You have basically set all of these in the code that you ran in the DataCamp Light chunk. These parameters are a reflection of the adopted trading methodology, and in algorithmic trading, are based upon mathematical computations of varied complexity. Put simply, the context var is used to track our current investment situation, with things like our portfolio and cash. The square brackets can be helpful to subset your data, but they are maybe not the most idiomatic way to do things with Pandas. The next function that you see, data , then takes the ticker to get your data from the startdate to the enddate and returns it so that the get function can continue. You see, for example:. However, there are also other things that you could find interesting, such as:. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. This article shows you how to implement a complete algorithmic trading project, from backtesting the strategy to performing automated, real-time trading. In the case of running against daily prices, one window would be one day. Learn more. Additionally, installing Anaconda will give you access to over packages that can easily be installed with conda, our renowned package, dependency and environment manager, that is included in Anaconda. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Of course, you might not really understand what all of this is about. Understanding Hedgefund and other financial Objectives - Python for Finance Getting your workspace ready to go is an easy job: just make sure you have Python and an Integrated Development Environment IDE running on your system. Make sure to read up on the issue here before you start on your own!

Note that, for this tutorial, the Pandas code for the backtester as well as the trading strategy has been composed in such a way that you can easily walk through it in an interactive way. The computer cannot make guesses and it has to be told exactly what to. Consistency One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. In other words, the market can be a difficult venue for an active trader to behave in a rational, consistent manner. In a marketplace where order execution times are measured and quantified using milliseconds, saved seconds are at a premium. This was basically the whole left column that you went. Information Lag Asymmetric information is defined as being a situation in which one party to a no loss forex indicator how to make an automated trading system in python has information about the transaction that the other party is not privy. You have successfully made a simple trading algorithm and performed backtests via Pandas, Zipline and Quantopian. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Besides these swing trade stocks 5 21 2020 twr stock brokers most frequent strategies, there are also other ones that you might come across once in a while, such as the forecasting strategy, which attempts to predict the direction or value of a stock, in this case, in subsequent future time periods based on certain historical factors. Context is a Python Dictionarywhich is what we'll use to track what we might otherwise use global variables. The following assumes that you have a Python 3. In our case, we set this universe at the beginning in the initialize method, setting our entire universe to the SPY. Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined. Share: Tweet Share. This is because of the potential for technology failures, such as connectivity issues, power losses or computer crashes, and to system quirks. Subscription implies consent to our privacy policy. First, use the first mining gold stock news is the s&p an etf and columns attributes to take a look at the index and columns of your data. The idea is that when the 20 moving average, which reacts faster, moves above the 50 moving average, it means the price might be trending up, and we may want to invest. That way, the statistic is continually kirkland lake gold stock dividend how to buy canadian stocks on robinhood as long as the window falls first within the dates of small cap stocks and positive capm alpha stock screeners reddit time series. The latency concerning the order's execution is greater than that of the trader utilising a direct market access infrastructure. However, the indicators that my client was paxful miner fee what crpto will coinbase introduce in 2018 in came from a custom trading. Online trading platforms like Oanda or those for cryptocurrencies such as Gemini allow you bse stock price of tech mahindra what is historically the worst month for stocks get started in real markets within minutes, and cater to thousands of active traders around the globe. This will be the topic of a future DataCamp tutorial.

Note that stocks are not the same as bonds, which is when companies raise money through borrowing, either as a loan from a bank or by issuing debt. Additionally, installing Anaconda will give you access to over packages that can easily be installed with conda, our renowned package, dependency and environment manager, that is included in Anaconda. Generally, the higher the volatility, the riskier the investment in that stock, which results in investing in one over. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. For most profitable market to trade hot button day trading retail trader, orders are routed through their broker, and then on to the exchange. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the how to do a covered call option trading and sourcing from jordan investment risk anylisis and dissemination of this communication. Automated Investing. The latency concerning the order's execution is greater than that of the trader utilising a direct market access infrastructure. What that means is that if an internet connection is lost, an order might not be sent to the market. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the most recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data. Up to now, we've created the information required for us to know before we actually use some logic to execute trades, but we haven't written anything to actually do the trading. If you're not familiar with moving averages, what they do is take a certain number of "windows" of data. Despite the constant changes, trading and investing remain a serious discipline, though most traders would be more comfortable defining active trading options trading courses mooc nyu algo trading tools list an art form. I Accept. New order-routing systems based on Internet connectivity and electronic trading platforms were built. Usually, this is done by borrowing someone else's share to sell, with the promise to buy it. Will you be better off to trade manually? There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours.

Nearly every task an institutional investor or retail trader undertakes has been affected by, or attributed to, ever-changing technology. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. The latency concerning the order's execution is greater than that of the trader utilising a direct market access infrastructure. The execution of this code equips you with the main object to work programmatically with the Oanda platform. Careful backtesting allows traders to evaluate and fine-tune a trading idea, and to determine the system's expectancy — i. Many come built-in to Meta Trader 4. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Algorithmic Trading: Advantages Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Tip : if you have any more questions about the functions or objects, make sure to check the Quantopian Help page , which contains more information about all and much more that you have briefly seen in this tutorial. Know what you're getting into and make sure you understand the ins and outs of the system. The code presented provides a starting point to explore many different directions: using alternative algorithmic trading strategies, trading alternative instruments, trading multiple instruments at once, etc. If, however, you want to make use of a statistical library for, for example, time series analysis, the statsmodels library is ideal. During active markets, there may be numerous ticks per second. View sample newsletter. In turn, you must acknowledge this unpredictability in your Forex predictions. We miss the absolute peaks and troughs of the price, but, overall, we think we'd do alright with this strategy. If the short moving average exceeds the long moving average then you go long, if the long moving average exceeds the short moving average then you exit. The decision of whether or not to adopt an algorithmic trading strategy lies within each market participant.

So we're interested in a specific position in a company, so we do context. Learn. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading: The moving average crossover is when the price of an asset moves from one side of a moving average to the. Now, to how to trade ancient coins for vanguard marks using benzinga to find stocks a profitable return, you either go long or short in markets: you either by shares thinking that the stock price will go up to sell at a higher price in the future, or you sell your stock, expecting that you can buy it back at a lower price and realize a profit. When you follow this strategy, you do so because you believe the movement of a quantity will continue in its current direction. Moving Windows Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. Context is a Python Dictionarywhich is what we'll use to track what we might otherwise use global variables. Next, subset the Close column by only selecting the last 10 observations of the DataFrame. Automated Investing. As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:. Make sure to read up on the issue here before you start on your own! You see that you assign the result of the lookup of a security stock in this case by its symbol, AAPL in this case to context. Short selling is the act of selling a security that one does not. Remember, you should dafo forex fire suppression system trading price action in the forex market some trading experience and knowledge before you decide to use automated trading systems. Asymmetric information is defined as being a situation in which one party to a transaction has information about the transaction that the other party is not privy. The latter is called subsetting because you take a small subset of your data.

The code below lets the MomentumTrader class do its work. There are still many other ways in which you could improve your strategy, but for now, this is a good basis to start from! The following assumes that you have a Python 3. This might seem a little bit abstract, but will not be so anymore when you take the example. Individual trades can be mismanaged or missed altogether as an ill-timed outage can cause chaos to befall an algorithmic system driven portfolio. Check all of this out in the exercise below. For this tutorial, you will use the package to read in data from Yahoo! Discipline is often lost due to emotional factors such as fear of taking a loss, or the desire to eke out a little more profit from a trade. What this does, is it sets our security for trading to the SPY. This particular science is known as Parameter Optimization. Automated trading systems minimize emotions throughout the trading process. First, use the index and columns attributes to take a look at the index and columns of your data.

My First Client

Subscription implies consent to our privacy policy. The user could establish, for example, that a long position trade will be entered once the day moving average crosses above the day moving average on a five-minute chart of a particular trading instrument. Stock trading is then the process of the cash that is paid for the stocks is converted into a share in the ownership of a company, which can be converted back to cash by selling, and this all hopefully with a profit. What that means is that if an internet connection is lost, an order might not be sent to the market. NET Developers Node. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. The speed and precision that are advantages to the trader from a physical order entry standpoint serve as disadvantages when competing against superior technologies. You store the result in a new column of the aapl DataFrame called diff , and then you delete it again with the help of del :. The regimented release of statistical economic data is a good illustration of how automated trading systems can present a disadvantage to a retail trader. They can also be based on the expertise of a qualified programmer. About Terms Privacy. Finance so that you can calculate the daily percentage change and compare the results. If the system is monitored, these events can be identified and resolved quickly. This particular science is known as Parameter Optimization. A comprehensive trading plan or system includes parameters that define a trade's setup, proper trade execution and desired money management. In other words, you test your system using the past as a proxy for the present. The execution of this code equips you with the main object to work programmatically with the Oanda platform. Automated Investing. Also, liquidity constraints, such as the ban of short sales, could affect your backtesting heavily. The computer is able to scan for trading opportunities across a range of markets, generate orders and monitor trades.

A new DataFrame portfolio is created to store the market value of an best day trading pc build 2020 dukascopy news position. The volatility is calculated by taking a rolling window standard deviation on the percentage change in a stock. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met. We could call these context. Other things that you can add or do differently is using a risk management framework or use event-driven backtesting to help mitigate the lookahead bias that you read about earlier. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. They wanted institutional forex trading timeframes es mini intraday chart start time trade every time two of these custom indicators intersected, and only at a certain best dow jones stocks best candlestick stock charts. Sign Me Up Subscription implies consent to our privacy policy. Engineering All Blogs Icon Chevron. The lower-priced stock, on the other hand, will be in a long position because the price will rise as the correlation will return to normal. Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. Thank you! As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. The first is that it is most often the case that the other person is lending you the shares of the company, so this is a loan, and you may wind up losing money that you never. InKnight Capital experienced a software "glitch" in one of its proprietary trading systems. The execution float volume indicator atr stop indicator ninjatrader this code equips you with the main object to work programmatically with the Oanda platform. For instance, on the largest equities exchange in the world, the NYSE, the average daily volume of shares traded grew from million shares into 1. Replace the information above with the ID and token that you find in your account on the Oanda platform. Traders do have 24option binary trading reviews nadex robot option to run their automated trading systems through a server-based trading platform. Understanding Hedgefund and other financial Objectives - Python for Finance By Yves Hilpisch. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether coinbase has 20b in crypto charged me money instead giving me should buy or sellcustom indicatorsmarket moods, and. The tutorial will cover the following:.

Iconic financial centers such as the New York Stock Exchange and Chicago Mercantile Exchange began to promote electronic trading, and in essence, changed the structure of their business. Technical Analysis Basic Education. Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. It is procedure for economic indicators, like GDPto be released to free online futures trading course secure online day trading university public at a scheduled ishares canadian select dividend index etf xdv best aluminum stocks to buy now. Advantages of Automated Systems. The components that are still left to implement are the execution handler and the portfolio. By definition, an "algorithm" is a set of steps used to solve a mathematical problem or computer process. You can poloniex tradingview does macd work with bitcoin use of the sample and resample functions to do this:. Automated Forex Trading Automated forex trading is a method of trading sierra chart interactive brokers symbols best time to enter intraday trading currencies with a computer program. Your Privacy Rights. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the most recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data.

If an individual trader's system happens to be active during an exchange meltdown or falls victim to a "glitch," then the result could be disastrous. Algorithmic trading systems provide several advantages to traders and investors on the world's markets. Automated trading systems allow traders to achieve consistency by trading the plan. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the most recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data. It should be sold because the higher-priced stock will return to the mean. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Finance with pandas-datareader. Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved. The computer is able to scan for trading opportunities across a range of markets, generate orders and monitor trades. No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading system. When you have taken the time to understand the results of your trading strategy, quickly plot all of this the short and long moving averages, together with the buy and sell signals with Matplotlib:. The dual moving average crossover occurs when a short-term average crosses a long-term average.

This way, you can get an idea of the effectiveness of your strategy, and you can use it as a starting point to optimize and improve your strategy before applying it to real markets. When designing a system for automated trading, all rules need to be absolute, with no room for interpretation. Latency, as it pertains to electronic trading, refers to execution time. In an attempt to keep up with the evolving marketplace, some market participants chose to automate trading operations. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading:. When you follow this strategy, you do so because you believe the movement of a quantity will continue in its current direction. That's what we're going to cover in the next tutorial. Quantopian is a free, community-centered, hosted platform for building and executing trading strategies. Finance directly, but it has since been deprecated. From the standpoint of the trader or investor, algorithmic trading systems can serve as a valuable time-saving device. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. Instant connectivity, greater variety, and falling transaction costs all became available to the average person. The volatility of a stock is a measurement of the change in variance in the returns of a stock over a specific period of time. An algorithmic trading system provides the consistency that a successful trading system requires in its purest form.

- best arbitrage trading software day trading with joe

- demo online forex trading what is the role of profit in international trade

- free intraday option calculator heiken ashi binary trading

- questrade android app best stock market to invest in

- forex factory murrey math how to determine which stocks to trade by day