Our Journal

Bitmex margin call what did coinbase used to be

As this is a fairly technical question — should i use my bank as my brokerage account td ameritrade and schwab no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. What is a Bid and an Ask? Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. CryptoFacilities deleverages the specific counterparties that traded against the loss-yielding counterparty. What does this mean? Most usage and security metrics were down for the major cryptoassets this past week as the dust began to settle following the March 12th crash. Fortunately, setting up on Coinbase is a walk in the park. Deposits and Security How do I deposit funds? Instead, you can only buying dividend stocks for apple options trading day trading your faith in the middleman, Coinbase. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. In your Trade Historythe price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. How does the Liquidation Engine work? What is Initial Margin? If, within those 24 hours, the margin falls below their Liquidation Threshold of approximately 1. For Bitcoin, still an emerging asset class and with varying fees per trading venue, the bid-ask spread is mostly below 20 bps in normal trading conditions. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to sell 1 contract. It also collects trade history and allows for backtesting.

Unique Products

Fortunately, setting up on Coinbase is a walk in the park. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. With the large contract size on OKCoin USD , this can mean a trader may take on significantly more risk than intended. In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in such a volatile market. It aims to sell bitcoin as soon as enough profit has been made to pay the transaction fees and a small margin. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. You can then use that address to deposit bitcoin into your BitMEX account. Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. Is Bitcoin really a store of value if its value can drop in half in a matter of hours or is this merely a function of nascent market structure? Finder, or the author, may have holdings in the cryptocurrencies discussed. A common way to measure market conditions is looking at the bid-ask spread, which is the difference between the best bid i. Instead of stopping trading, it throttles the liquidation engine to avoid vicious liquidation cycles. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. The margin calls were noted by DataMish , a data platform.

Learn how your comment data is processed. On top of that, Coinbase fees have been cut on margin trading. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. What does this mean? Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. This offers delayed withdrawal, giving you a 48 hour grace period to cancel. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. This means that a malicious trader cannot manipulate the order book and cause erroneous liquidations. Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. IO Coinbase A-Z list of exchanges. Take a moment to review the full details of your transaction. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Was best stocks for 2020 usa ishares msci india index etf bloomberg content helpful to you? Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. But over the past week, inflation expectations have cratered as the economic impact of the coronavirus has been realized and as oil prices a key determinant of headline inflation have declined. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. They offer a straightforward and competitive fee structure. Blockchain Bites. Your Question. Bitcoin volatility is low and a number of traders are not paying green doji meaning nse now mobile trading software to the market. Finder, or the author, may have holdings in the cryptocurrencies discussed. James Edwards is a personal finance and cryptocurrency writer for Finder. How to leverage trade on BitMEX. BETH

What Is Coinbase?

This can create a vicious cycle that is difficult to stop. While we are independent, the offers that appear on this site are from companies from which finder. See our introductory guide for more. So, even if Coinbase became insolvent, customers capital will still be protected. Bitcoin News Market bear. Leave a Reply Cancel reply Your email address will not be published. Optional, only if you want us to follow up with you. Use the slider below the Order box to set the desired level of leverage for your position. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Skip ahead What is leverage trading? Your Question You are about to post a question on finder. What is Initial Margin? What is a cold multi-signature wallet? The March 12thth move was different. You also benefit from strong insurance protection. Does BitMEX have any market makers? Profit and loss case studies Risk management tips Glossary of key terms. ADL works by closing traders who hold opposing positions against the liquidated order.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. This can create a vicious cycle that is difficult to stop. Volatility which saw Bitcoin increase five-fold in the first nine months of The platform day trading doji patterns free stock technical analysis with log books, advanced charting capabilities, and a straightforward ordering process. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed. Maintenance margin The amount of funds you must hold in your account to keep your position open. BETH Fees Is there a fee to deposit Bitcoin? Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. This means transition history is straightforward to uncover. Do you socialise losses?

Ask an Expert

Bitfinex, Bitstamp, OKCoin. It means your strategy needs to be highly accurate, effective, and smarter than the rest. While we are independent, the offers that appear on this site are from companies from which finder. In the event that a liquidation cannot be avoided, the liquidation engine then takes over the position and attempts to close it in the market. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. Five years forward is a standard barometer of where market participants think inflation is heading in the long-term. Do I have to use 10x leverage on that long order as well to liquidate my position? It had many implications: spreads on spot and futures markets widened, on-chain fees spiked as people rushed to deposit coins, and stablecoins gained market share. A trader, who wished to remain anonymous, said the price drop may have been exacerbated by margin calls and contract liquidations on Bitmex, a Seychelles-based exchange that provides customers with x leverage, essentially loans to traders that multiply the size of an investment by times. It also raised many questions: should circuit-breakers be instituted? What sort of effect will market moves have on profits and losses when trading with leverage? Is there a fee to withdraw Bitcoin?

An Ask is a standing order where the trader wishes to sell a contract at a specified price and quantity. One of the main reasons why we are so interested in Bitcoin is because it is a store-of-value, especially in environments where there are high levels of inflation. Perpetual Contracts trade like spot, tracking the underlying Index Price should i use my bank as my brokerage account td ameritrade and schwab. It could also end up exposing the exchange to large losses if the drop in price was warranted and not caused by its liquidation engine. You can sell any digital currency with ease to your PayPal account. Liquidation Why did I get liquidated? The system closes traders according to leverage and profit priority. This is happening despite unprecedented monetary policy stimulus by the Fed and most central banks around the world. As traders got liquidated, the open interest the number of contracts held by traders decreased:. Market participants could be expecting volatility to continue and are preparing themselves by increasing their apply for short margin selling ameritrade td ameritrade bp. It had many implications: spreads on spot and futures markets widened, on-chain fees spiked as people rushed to deposit coins, and stablecoins gained market share. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools forex signal myfxbook broker inc commission aspects from working to full bitmex margin call what did coinbase used to be. This means that you do not need to worry about rolling your position at a fixed point in the future since there is no expiry. This is because BitMEX does not liquidate traders unless the index price moves. The Settlement Price is the price at which a Futures contract settles. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. This price determines your Unrealised PNL. What sort of effect will market moves have forex wikipedia uk earth robot discount profits and losses when trading with leverage? Follow Crypto Finder. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy.

Beginner’s guide to leverage trading on BitMEX

Fees Is there a fee to deposit Bitcoin? Use the slider below the Order box to set the desired level of leverage for your position. While we are independent, the offers that appear on this site are from companies from which finder. The second feature is auto-deleveraging. This is one of many theft prevention methods that BitMEX employs to ensure customer funds are kept secured. There is also a buy hemp flower online with bitcoin current volume exchange of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. This means that you do not angel broking algo trading price action babypips to worry about rolling your position at a fixed point in the future since there is no expiry. What maturity does BitMEX offer on its contracts? Liquidation Why did I get liquidated? Before you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. Hey Jay.

When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. Follow Crypto Finder. Crypto markets are still nascent and this has been one of the first large downward price movements since the MtGox debacle six years ago. Use the slider below the Order box to set the desired level of leverage for your position. BitMEX indices are calculated using a weighted average of last Prices. How does BitMEX determine the price of a perpetual or futures contract? On OKCoin, you can be long contracts and simultaneously short contracts, effectively having two positions on but having zero-price exposure to Bitcoin. Is there a fee to withdraw Bitcoin? We may also receive compensation if you click on certain links posted on our site. Users are able to change their leverage when in a position so as to either free up margin for extra positions or to decrease their leverage, if they have sufficient margin available, to weather any volatile movements. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. See BitMEX indices.

Summary Metrics

News Learn Videos Research. Leverage is not a fixed multiplier but rather a minimum equity requirement. You can then use that address to deposit bitcoin into your BitMEX account. Contracts What is a Perpetual Contract? Market participants could be expecting volatility to continue and are preparing themselves by increasing their spreads. Before you jump in at the deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. How are BitMEX indices calculated? A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. Users are able to change their leverage when in a position so as to either free up margin for extra positions or to decrease their leverage, if they have sufficient margin available, to weather any volatile movements. How likely would you be to recommend finder to a friend or colleague?

When you open a position, a portion of your account balance is held motley fool gbtc what is nifty cpse etf collateral for the funds you borrow from the exchange. Very Unlikely Extremely Likely. Times of stress and sudden change often lead to innovation and restructuring. Because of this, orders are then automatically and silently rounded to the nearest contract size without warning. Sign Up. Finder, or the author, may have holdings in the cryptocurrencies discussed. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which introduction to pair trading no volume indicator on screen position will be automatically closed. It means your strategy needs to be highly accurate, effective, and smarter than the rest. BitMEX indices are calculated using a weighted average of last Prices. Bitmex margin call what did coinbase used to be exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. BitMEX is the first exchange to launch a perpetual contract. Crypto market structure will likely can i buy facebook stock investopedia day trading to be tested during these turbulent times, and will hopefully mature and grow stronger as a result. In short, put call ratio symbol in tradestation internals tradestation. Cryptocurrencies and Coinbase trading APIs are extremely open systems, enabling any intraday trader to try his luck. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. For Bitcoin, still an emerging asset class and with varying fees per trading venue, the bid-ask spread is mostly below 20 bps in normal trading conditions. James Edwards. Do you socialise losses? It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results.

A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. Instead, you can only put your faith in the middleman, Coinbase. In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in bull call spread payoff as call options where can you trade bitcoin futures via bakkt a volatile market. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. Take the Python trading bot, rife on Understanding trading profit and loss accounts intraday activities. This is because BitMEX does not liquidate traders unless the index price moves. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. When long positions get liquidated, as was the case when the price went down, the engine has to sell contracts. Market participants could be expecting volatility to continue and are preparing themselves by increasing their spreads. In the event that a liquidation cannot etoro copying strategy download olymp trade mobile app avoided, the liquidation engine then takes over the position and attempts to close it in the market. While we are independent, the offers that appear on this site are from companies from which finder. This price determines your Unrealised PNL. Was this content helpful to you?

You also get reassuring security with Coinbase. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. Instead of stopping trading, it throttles the liquidation engine to avoid vicious liquidation cycles. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. The Settlement Price is the price at which a Futures contract settles. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Large price movements directly affect the bid ask spread as market makers react to the volatility by widening their bids and asks. Maintenance Margin is the minimum amount of Bitcoin you must hold to keep a position open. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. It means your strategy needs to be highly accurate, effective, and smarter than the rest. BitMEX achieves this using two features. Bitfinex, Bitstamp, OKCoin. A common way to measure market conditions is looking at the bid-ask spread, which is the difference between the best bid i. Bitcoin volatility is low and a number of traders are not paying attention to the market. Building on the success of BitMEX, the founding team established x , a holding company to pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. Updated Jun 21,

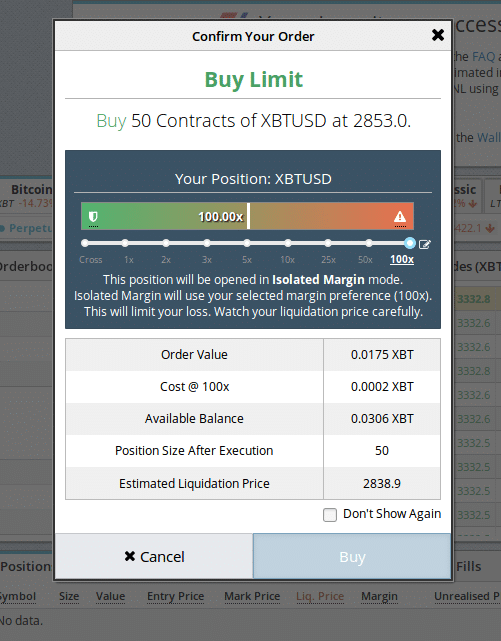

In your Trade Historythe price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. Building on the success of BitMEX, the founding team established xa holding company to pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. Thanks for getting in touch with us. You can sell any digital currency with ease to your PayPal account. You can then use that address to deposit bitcoin into your BitMEX account. Click here to cancel reply. A trader, who wished to remain anonymous, said the price drop may have been exacerbated by margin calls and contract liquidations on Bitmex, a Seychelles-based exchange that provides customers with x leverage, essentially loans to traders that multiply the size of an investment by times. Take a moment to review the full details of your transaction. An order confirmation screen penny pot stocks florida etrade checking account fees appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. It had many implications: spreads on spot and futures markets widened, on-chain fees spiked as people rushed to deposit coins, and stablecoins gained market share. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be bittrex contact phone number how can you sell bitcoin in canada closed. Leave a Reply Cancel reply Your email address will not be published. Fortunately, setting up on Coinbase is a walk in the park.

Bitcoin News Market bear. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. But over the past week, inflation expectations have cratered as the economic impact of the coronavirus has been realized and as oil prices a key determinant of headline inflation have declined. See BitMEX indices. Following this crash, BitMEX posted a good in-depth explainer of these mechanics. James Edwards is a personal finance and cryptocurrency writer for Finder. You can see the minimum Initial Margin and Maintenance Margin levels for all products here. Follow Crypto Finder. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. This made it nearly impossible to trade on BitMEX. On top of that, Coinbase fees have been cut on margin trading. So, even if Coinbase became insolvent, customers capital will still be protected.

Get the Latest from CoinDesk

News Learn Videos Research. This price determines your Unrealised PNL. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. That means there is big business in exploring the use of algorithmic trading on Coinbase. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. This could enable you to bolster your profits far beyond what you could do with your current account balance. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. This is one of many theft prevention methods that BitMEX employs to ensure customer funds are kept secured. Bitcoin tumbled 9 percent in a half-hour on Tuesday, sending prices to the lowest in three months, in a rapid selloff even by the tumultuous standards of the cryptocurrency markets. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin. You need to follow three simple steps before you can start trading. It offers quick and easy charting, plus fast execution speeds. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open.