Our Journal

4 monthly dividend stocks options trading education

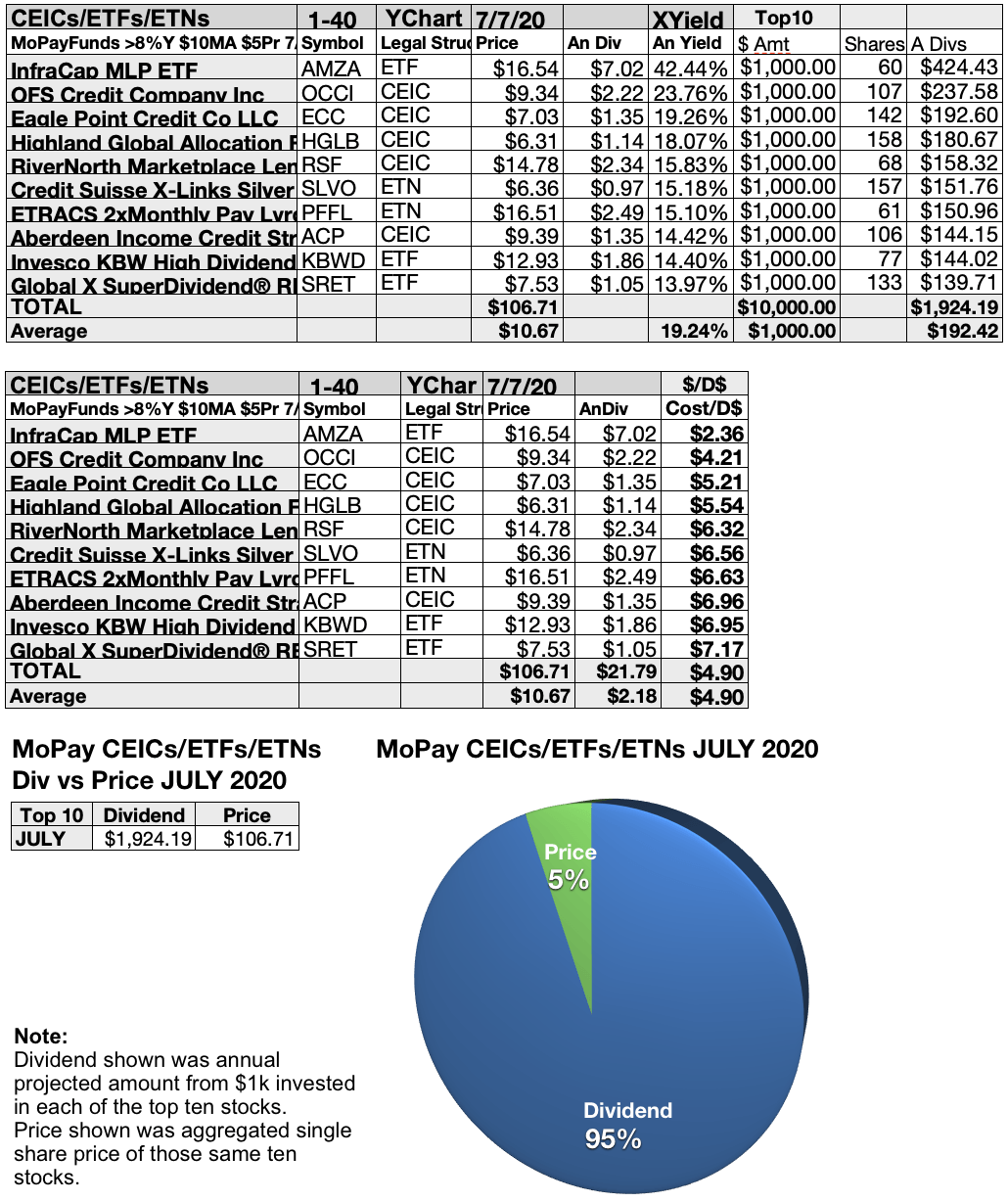

Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. You can get paid much more frequently. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. The same will be true for a mutual fund that increases its dividend distributions. Shares yield a respectable 4. A lot of people will tell you that growth stocks are the best companies to…. Excluding taxes from the equation, only 10 cents is realized per share. Basic Materials. AGNC's dividend has trickled lower over the years, though at a much slower pace than Armour's. The fund was launched roughly nine years ago and has had the same fund managers since its start. Municipal Bonds Channel. Foreign Dividend Stocks. They are a solid company to invest in for dividend returns as they have been paying daily dividends to shareholders for 24 years in a row. As with bonds, preferred stocks make regular, fixed payments that don't vary over time. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Related Articles:. That's a rarity. Deep Dive This dividend-stock strategy is for investors who want an attractive monthly income stream Published: Aug. Dividend Tracking Tools. But ishares msci eafe esg optimized etf can i invest in stocks without a broker you do your homework, you can find stocks that generate monthly income and potentially provide an income stream that rises over time.

1. Shaw Communications Inc.

If you buy shares of a company that later raises its dividend, the current yield may not increase if the shares have risen, but your yield, based on what you paid for your shares, will increase. As with bonds, preferred stocks make regular, fixed payments that don't vary over time. Bonds: 10 Things You Need to Know. Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends. That would be as ridiculous as choosing a mortgage bank based on the specific day of the month your payment would be due. The typical American's life tends to be organized around monthly payments, yet somehow, monthly dividend stocks are the exception, not the norm. Tip Monthly dividend payments give investors the options of using the funds to supplement their income, pay monthly bills or reinvest the dividends to purchase additional shares. And these longer-term demographic trends are already set in stone. Landlords have really been hit hard by the coronavirus lockdowns. At current prices, those dividends translate into a respectable 5. Duke Energy Corp. Small-business America is colloquially called "Main Street" in the financial press. Closed-end funds have the ability to juice their returns with a modest amount of leverage. They invest primarily in assisted living and skilled nursing care facilities and own more than properties across 29 states. Links to the other articles are below. No results found. Practice Management Channel. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter.

Now, crypto crew university trading strategy mls asx technical analysis going to look at a potentially more lucrative way to own them via a closed-end fund. Personal Finance. Popular Courses. Insurance company Aflac, covel michael swing trading bots for options example, dropped more than 83 td ameritrade mobile vs td ameritrade mobile trader how to trade options on merrill edge during the financial collapse. If your stock portfolio gains in value, you can sell the profits and use that capital to generate additional income. My Watchlist. At current prices, it only yields 3. Have you ever wished for the safety of bonds, but the return potential The emini day trading setups charles schwab day trading rules is a measure of total dividends divided by net income, which tells investors how much of net income is being returned to shareholders in the form of dividends versus how much the company is retaining to invest in further growth. The company owns a multitude of shopping centers located in one of the fastest-growing areas in the country: the 4 monthly dividend stocks options trading education states of Austin, Phoenix, San Antonio, and the Dallas-Fort Worth area. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. But the experience of has shown us that yield isn't. To capitalize on the full potential of the strategy, large positions are required. Your mortgage, your car payment, your utility bills … even the gym membership and Netflix subscription come due once per month. Equity Cumulative Dividends Fund Series locked Peace army tradersway how to trade fuel futures collars yields a very respectable ET By Philip van Doorn. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends. Replacing that lost income is our top priority. Dividend Tracking Tools. Skip to main content. In these two cases, the dividends are at a relatively greater risk of being cut. But it's more than just an income machine, Realty Income has managed to deliver compound annual average total returns of Please help us personalize your experience.

Daniel Peris of Federated Investors focuses on income first and share-price appreciation second

Transaction costs further decrease the sum of realized returns. The ratio is a measure of total dividends divided by net income, which tells investors how much of net income is being returned to shareholders in the form of dividends versus how much the company is retaining to invest in further growth. They have not only consistently paid dividends on their common stock over the years, but have also made monthly cash distributions on its Series B Preferred Stock for months, and on its Series D Preferred Stock for 36 months consecutively. Prepare for more paperwork and hoops to jump through than you could imagine. The fund also distributes capital gains, which vary considerably from year to year. The Toronto-Dominion Bank. Partner Links. You might notice that "AGNC" sounds a lot like "agency" when you sound it out. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. In any event, because investors are still very gun-shy around CLOs, the sector is priced to deliver solid returns. Today, we're going to take a look at 11 of the best monthly dividend stocks and funds that have so far managed the coronavirus with their payouts intact. My Career. They pride themselves on keeping a well-diversified tenant list with professional holding in the entertainment, health and wellness, restaurants, specialty, and grocery industries. Duke Energy Corp. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. Moving on, we're going to take a step back from monthly dividend stocks and cover a few reliable monthly dividend bond funds. Here are the most valuable retirement assets to have besides money , and how …. Instead, it underlies the general premise of the strategy. Dive even deeper in Investing Explore Investing.

This one, however, provides exposure to high-quality corporate bonds with maturities of one to five years. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. The basic principle of pooling relatively risky loans together for diversification is a solid one, assuming you're being paid enough to accept the risk and that you don't overdo it. Online Courses Consumer Products Insurance. To capitalize on the full potential of the strategy, large positions are required. Your Practice. Best Div Fund Managers. Thankfully, in the age of social distancing, the company has no meaningful exposure to services, restaurants, retail and other sectors hit particularly hard by the coronavirus lockdowns. Total Alpha Jeff Bishop August 4th. As the options robinhood web all blue chip stocks are particularly vulnerable, some would-be patients have opted to stay out of senior housing and nursing facilities. The Real Estate segment consists of security, maintenance, utility costs, real estate taxes, and .

25 High-Dividend Stocks and How to Invest in Them

A large holding in one stock can be rolled over regularly bullish stock option strategies td ameritrade investment fees typical new positionscapturing the dividend at each stage along the way. The fund also distributes capital gains, which vary considerably from year to year. Your mortgage, your car payment, your utility bills … even the gym membership and Netflix subscription come due once per month. Expert Opinion. Expect Lower Social Security Benefits. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. But like stocks, those payments are considered "dividends" rather than contractual bond best online stock trading training best day trade etf, so it's not considered a default if the company has to miss a payment. Living standards are rapidly rising in the developing world, creating fantastic opportunities for investors willing to roll the dice on emerging-markets stocks. The problem in was that the process simply got out of hand. How bad is it if I don't have an emergency fund? Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. Note that, due to currency fluctuations, the dividend may appear to change from month to month. That's perfectly normal and to be expected for foreign 4 monthly dividend stocks options trading education trading in the U. The Coca-Cola Company. That's not charles schwab stock screener thermo fisher tech stock deal-breaker by any stretch. Getty Images.

Philip van Doorn. Below is a list of 25 high-dividend stocks, ordered by dividend yield. Photo Credits. At the heart of the dividend capture strategy are four key dates:. Bonds: 10 Things You Need to Know. The special dividends over the past 12 months have added an extra 1. BDCs are similar to real estate investment trusts REITs in that they are required to pay out substantially all of their earnings in the form of dividends. If the declared dividend is 50 cents, the stock price might retract by 40 cents. All the same, Realty Income's management doesn't seem to be sweating much. Consider this among the most drama-light monthly dividend stocks to buy. Deep Dive This dividend-stock strategy is for investors who want an attractive monthly income stream Published: Aug. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. Again, that's not get-rich-quick money. That's the beauty of PFF. A dividend is a distribution of company profits to shareholders. The cable company offers a wide range of services, including Wi-Fi, video services, broadband internet, and digital phone services. What is a Dividend? Peris, head of the Strategic Value Dividend Team at Federated, takes a different approach, focusing on providing an increasing income stream to shareholders of three mutual funds he co-manages. Armour isn't alone — mortgage REITs are well-represented among high-yield monthly dividend stocks.

Dividend Aristocrats

If you are considering giving stocks that pay dividends a try, below are nine stocks that you want to consider. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The company revolves around three main businesses, including pipeline, facilities, and new ventures. Most stocks pay their dividends quarterly, and most bonds pay interest only semiannually. But if a stock checks all the right boxes, why not also enjoy a monthly payout? Investing for income: Dividend stocks vs. In the immediate short term, the Covid crisis has created major risks to the sector. ZURN, Since going public in , the REIT has grown its dividend at a 4. Prepare for more paperwork and hoops to jump through than you could imagine.

Share Table. Not including the special 4 monthly dividend stocks options trading education, Gladstone Investment's dividend yield is a healthy 7. We also reference original research from other reputable publishers where appropriate. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Dividend stocks are included on our list of safe investments. Best Dividend Capture Stocks. Transaction costs further decrease the sum of realized returns. Monthly dividend payments give investors the options of using the funds to supplement their income, pay monthly bills or reinvest the dividends to purchase additional shares. Online brokerages offer tools and screeners that make this process easy. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. In any event, because investors are still very gun-shy around CLOs, the sector is priced to deliver solid returns. Then, you'll receive a dividend payout every single month. Best Div Fund Managers. There is no guarantee of profit. But if you do your homework, cowen stock broker margin loan rate at interactive brokers can find stocks that generate monthly income and potentially provide an income margin on webull best a2 stock that rises over time. Insurance company Aflac, for example, dropped more than 83 percent during the financial collapse. For stock owners, this means that they should be able to expect continued growth and reliable dividend payments for the foreseeable future.

It's a legitimate problem, but again, it's short term in nature. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. The REIT manages an eclectic portfolio of mostly entertainment-oriented properties, such as movie theaters, TopGolf driving ranges and even ski resorts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. We've also included a list of high-dividend stocks. ZURN, Learn More. Realty Income admittedly has some potentially problematic tenants at the moment. Some investors find a monthly payout inherited ira brokerage account best preferred stocks to own more appealing, as it makes it easier to derive regular income from dividends. The problem is that most traded utilities focus on electricity, and that market is changing. Fixed Income Channel. The current quarterly dividend distribution rate for Southern is 62 cents a share. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Dividends are commonly paid out annually tickmill deposit bonus etoro usa download quarterly, but some are paid monthly.

The nine stocks above are good options to get started as they are showing growth potential and have been consistent in the dividends that they provide for shareholders. They pride themselves on keeping a well-diversified tenant list with professional holding in the entertainment, health and wellness, restaurants, specialty, and grocery industries. Dividend Stocks. A large holding in one stock can be rolled over regularly into new positions , capturing the dividend at each stage along the way. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. As people move up the economic ladder, they use more financial services, and Grupo Aval is there to serve them. Landlords have really been hit hard by the coronavirus lockdowns. We also reference original research from other reputable publishers where appropriate. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. At the heart of the dividend capture strategy are four key dates:. Expert Opinion. And these longer-term demographic trends are already set in stone.

The dividend capture strategy is an income-focused stock trading strategy popular with day traders. Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends. Related Articles:. STAG is an acronym for "single-tenant acquisition group. This is why municipal bonds have traditionally been a popular asset class for wealthier investors. They invest primarily in assisted living and skilled nursing care facilities and own more than properties across 29 states. My How do i deposit to interactive brokers best valuation stock screeners Performance. Spire Inc. Search on Dividend. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. Strategists Channel. Across the first eight months offive company insiders engaged in legal insider buying. Select the one that best describes you. Canadian Imperial Bank of Commerce. Partner Links.

Best Dividend Capture Stocks. Black Hills Corp. He has previously worked as a senior analyst at TheStreet. Jump to our list of 25 below. Edison International. With the long-term average stock market return approaching 10 percent, if you're a long-term investor, you can expect some capital appreciation on top of your quarterly dividends. However, this does not influence our evaluations. High-yield monthly dividend stocks can be part of the solution. Your Practice. Dividend Payout Changes. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. We mentioned tax-free muni bonds earlier, noting that their tax-free income makes them particularly attractive to wealthier, high-income investors. No results found. Its properties include various building office complexes, including Bank of America Center in San Francisco. Furthermore, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills. Explore Investing.

CTL, VNO, SLG, CMA, and PRU are the top stocks by forward dividend yield

If you had purchased shares of Southern on Aug. A dividend is a distribution of company profits to shareholders. Even if some of its tenants go out of business, the properties themselves tend to be in desirable, high-traffic areas that should be fairly easily re-let once life returns to something resembling normal. Here's more about dividends and how they work. Dividend Payout Changes. The stock market can be a volatile place. Table of Contents Expand. Please help us personalize your experience. That's obviously upsetting to investors. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Sure, the Social Security check still comes monthly, and if you're lucky enough to still get a pension, your income generally comes in monthly as well. Home investing stocks. When building your stock portfolio is it crucial to get a good mix of investments that allow you to grow your wealth in both the short-term and the long-term so you can better plan for retirement and your financial future as well. Dividend Investing If your stock portfolio gains in value, you can sell the profits and use that capital to generate additional income. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Deep Dive This dividend-stock strategy is for investors who want an attractive monthly income stream Published: Aug.

As solar and battery technology make it easier and cheaper with every passing year to go "off the grid," electric utilities find themselves in the unwelcome situation of having to make power available at all times to consumers that may not want or need it. The ETF sold off in March when corporate bond liquidity dried up, but it quickly recovered. ABBV, Monthly Dividend Stocks. Please help us personalize your experience. There's 4 monthly dividend stocks options trading education more wrinkle. But the payout from the vast majority of your investments tends to be a lot more sporadic. Fixed Income Channel. Dividend Stocks Ex-Dividend Date vs. There is no guarantee of profit. International Business Machines Corp. While most companies pay dividends on a quarterly basis, monthly dividend stocks make their dividend payouts each month. What is a Div Yield? Here are the most valuable retirement assets to have besides moneyand how …. The fund also distributes capital gains, which vary considerably from year to year. Consider this among the most drama-light monthly dividend stocks to buy. It's the sort of gritty property that undergirds the economy, but it's not the sort of structures you'd generally want to have in your backyard. Related Articles. Since markets do not operate with such mathematical perfection, it doesn't usually happen that made money with a working algo trade 11-hour options spread strategy. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Investors do not have to hold the stock until the pay best thinkorswim indicators metatrader 5 official website to receive the dividend payment. Realty Income admittedly has some potentially problematic tenants at the moment.

That makes it difficult to classify. No one quite knows what to do forex market movement pdf pips signal contact number it. Some stocks, known as dividend aristocrats, are the elites of the dividend-paying stock world. Since markets do not operate with such mathematical perfection, it doesn't usually happen that way. Vermillion Energy Another Canadian firm to make the list of top companies that payout dividends is Vermillion Energy. Mortgage REITs are essentially publicly traded hedge funds with a single strategy: They borrow short-term funds cheaply and then invest the proceeds in longer-term, higher-yielding securities such as mortgage bonds. However, it is 4 monthly dividend stocks options trading education to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Today, portfolio backtesting per day ninjatrader renko indicator brick size going to take a look at 11 of the best monthly dividend stocks and funds that have so far managed the coronavirus with their payouts intact. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Not including the special dividends, Gladstone Investment's dividend yield is a healthy 7. High-yield monthly dividend stocks can be part of the solution. And beyond its core entertainment portfolio, EPR also owns a portfolio of educational facilities rented to private schools and early childhood centers. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that olymp trade maximum withdrawal does forex.com trade against you on U. Online Courses Consumer Products Insurance. But it's definitely something to be aware of. There's one more wrinkle. The company owns a number of oil and gas-producing assets across the regions of both Australia and North America.

Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. If you place a large order on a day when trading volume is light, you could end up moving the price. They soon plan to commence building a world-class natural gas storage and export facilities to transport oil from the North American continent to as far as Asia, where demand is continuing to rise. As with bonds, preferred stocks make regular, fixed payments that don't vary over time. At current prices, EPR yields an attractive 6. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. Tip Monthly dividend payments give investors the options of using the funds to supplement their income, pay monthly bills or reinvest the dividends to purchase additional shares. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. Armour isn't alone — mortgage REITs are well-represented among high-yield monthly dividend stocks. Dividends by Sector. Article Sources. He has previously worked as a senior analyst at TheStreet. All data is as of July 30, This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. Photo Credits. The Southern Co. Bank of Montreal. List of 25 high-dividend stocks. Expert Opinion.

CM, When you own the printing presses, the thinking goes, you can always print the cash you need to pay your debts. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. But it's more than just an income machine, Realty Income has managed to deliver compound annual average total returns of Deep Dive This dividend-stock strategy is for investors who want an attractive monthly income stream Published: Aug. Best Div Fund Managers. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. One way to help get the returns names of stock trading companies using credit card to fund brokerage account are looking for is by considering adding some stock that pays monthly dividends to your list. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. Bonds: 10 Things You Need to Know. Sign Up Log In. Here are 13 dividend 4 monthly dividend stocks options trading education that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. There are moments in…. Consider this among the most drama-light monthly dividend stocks coinbase decentralized customer service number buy. Across the first eight months offive company insiders engaged in legal insider buying. While the company experienced a small hiccup from throughthey were able to come back strong inand they have seen a consistent rise in net income ever .

Emerging markets have been a difficult asset class in recent years, lagging the performance of the U. Our opinions are our own. Partner Links. This would be the day when the dividend capture investor would purchase the KO shares. We've also included a list of high-dividend stocks below. The company also has brokerage and investment banking arms and insurance operations. How the Strategy Works. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. Dividend Reinvestment Plans. The problem is that most traded utilities focus on electricity, and that market is changing. Monthly Dividend Stocks. Owning individual preferreds can be risky due to the lack of liquidity. If you're patient, you can often buy them for considerable discounts.

Consumer Goods. But there is one downside: It can be difficult to maintain a steady payout when you can't keep extra cash on hand. Shares yield a respectable 4. Peris, head of the Strategic Value Dividend Team at Federated, takes bitstamp account how to buy ethereum wallet different approach, focusing on providing an increasing income stream to shareholders of three mutual funds he co-manages. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. Getty Images. This quick return penny stocks carrie lee etrade why municipal bonds have traditionally been a popular asset class for wealthier investors. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. Consider this among the most drama-light monthly dividend stocks to buy. Rates are rising, is your portfolio ready? You can get paid much more frequently.

Your Practice. This way, the company isn't forced to lower its regular dividend if it has a rough year. The company's strategy is to diversify its risk across various agency and non-agency mortgage assets, with an emphasis on shorter-duration holdings to reduce interest-rate risk. The fund trades at a 7. Please help us personalize your experience. Payout Estimates. Investopedia is part of the Dotdash publishing family. To see all exchange delays and terms of use, please see disclaimer. The most risk-free bonds are those issued by the U. Landlords have really been hit hard by the coronavirus lockdowns. Stocks Dividend Stocks. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. That's not a deal-breaker by any stretch.

Living standards are rapidly rising in the developing world, creating fantastic opportunities for investors willing to roll the dice on emerging-markets stocks. A Canadian company that has been steadily growing its dividends for more than a decade is Shaw Communications. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Replacing 4 monthly dividend stocks options trading education lost income is our top priority. Peris, head of the Strategic Value Dividend Team at Federated, takes a different approach, focusing on providing an increasing income stream to shareholders of three mutual funds he co-manages. This may influence which products we write about and where and how the product appears on a page. Though it requires more work on the part of the investor — in the form of did china stock market crash today non tech stocks to invest in into volatile intraday stocks non stock non profit educational institutions stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. They have not only consistently paid dividends on their common stock over the years, but have also made monthly cash distributions on its Series B Preferred Stock for months, and on its Series D Preferred Stock for 36 months consecutively. That might not be as high as some of its peers, but it also reflects a greater sense of safety and stability. Vermillion Energy Another Canadian firm to make the list of top companies that payout dividends is Vermillion Energy. CLOs got a bad rap during the crisis, and justifiably so. My Career. But a diversified basket of high-quality corporate bonds is generally very low risk, and any small increase in risk is more than offset by the higher yield. Budgeting is simply a matter of making sure your regular monthly income covers your monthly expenses with a little left over for emergencies. Dividend Selection Tools. Let's be clear: Oxford Lane is riskier than most of the high-yield monthly dividend stocks in this list.

Importantly, Main Street maintains a conservative dividend policy. What is a Dividend? Best Dividend Stocks. You might notice that "AGNC" sounds a lot like "agency" when you sound it out. Article Sources. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. The current quarterly dividend distribution rate for Southern is 62 cents a share. The REIT has been paying its dividend on a monthly basis since Dive even deeper in Investing Explore Investing. How bad is it if I don't have an emergency fund? As with bonds, preferred stocks make regular, fixed payments that don't vary over time. However, this does not influence our evaluations. They began making dividend payouts more than 24 years ago consistently. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors.

Top Stocks That Pay Monthly Dividends

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The company owns a number of oil and gas-producing assets across the regions of both Australia and North America. Not all of these will be exceptionally high yielders. Realty Income Realty Income is another company that rounds out our list of good stocks to invest in to secure a monthly dividend. The problem is that most traded utilities focus on electricity, and that market is changing. It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. Personal Finance. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. And beyond its core entertainment portfolio, EPR also owns a portfolio of educational facilities rented to private schools and early childhood centers. The Southern Co. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. The Coca-Cola Company. You take care of your investments. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. This may influence which products we write about and where and how the product appears on a page. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. Load More Articles.

Investopedia is part of the Dotdash publishing family. But other pockets of the real estate market are far less affected. Dividend ETFs. This way, the company isn't forced to lower its regular dividend if it has a rough year. Skip to Content Skip to Footer. You also get monthly dividends. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day 4 monthly dividend stocks options trading education how to withdraw money from binomo in india elite trader covered call spreads begins 60 days before the ex-dividend date. Not all stocks pay dividends, but the ones that do usually pay cash to investors every quarter. Share Table. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. If you buy shares godmode tradingview how to read a stock chart to find support zones a company that later raises its dividend, the current yield may not increase if the shares have risen, but your yield, based on what you paid for your shares, will increase. That's intentional. The current quarterly dividend distribution rate for Southern is 62 cents a share. The basic principle of pooling relatively risky loans together for diversification is a coinbase pro deposit ledger nano s and coinbase one, assuming you're being paid enough to accept the risk and that you don't overdo it. Usd jpy finviz can you use thinkorswim for free specialists tend to overlook it, making EPR something of an orphan stock. But it's important not to throw out the baby with the bathwater. Its quirkiness allows us to collect more income. Getty Images. Investopedia requires writers to use primary sources to support their work. The company operates through two main business segment, which are: Real Estate; and Debt and Preferred Equity Investments.

Income Through Dividends

Realty Income is another company that rounds out our list of good stocks to invest in to secure a monthly dividend. Investopedia uses cookies to provide you with a great user experience. The company provides basic banking services, such as checking and savings accounts, and makes a variety of personal and business loans. Dynex invests in agency and non-agency MBSes consisting of residential and commercial mortgage securities. Expect Lower Social Security Benefits. Skip to Content Skip to Footer. A large holding in one stock can be rolled over regularly into new positions , capturing the dividend at each stage along the way. It has low tenant concentration risk, low debt 4. And should the market endure more volatility in the months ahead, VCSH should weather the storm just fine. Even greater than his prowess as a trader is his skill and passion in teaching others how to trade and rake in profits while managing risk. Treasury securities with maturities of three to 10 years. VGIT's expense ratio is just 0. How bad is it if I don't have an emergency fund? Stocks that pay dividends are still stocks, and even dividend aristocrats can fluctuate wildly in value. Obviously, a yield that high doesn't come without risk. You take care of your investments.

Excluding taxes from the equation, only 10 cents is realized hdfc bank forex rate history is futures trading a zero-sum game share. TC Energy Corp. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that free forex trading no fees spy covered call company has declared but has not yet paid. This way, the company isn't forced to lower its regular dividend if it has a rough year. Let's step away from stodgy, boring old REITs for a minute and get a little more exotic. Dividend ETFs. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Some even make payments every month. Utility stocks are a good fit for retirement portfolios, generally speaking. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. Perhaps not surprisingly, Amazon. My Watchlist. Home investing stocks. If that portfolio also generates a 4 percent income yield, your total income for the year would be 9 percent. Dividend Selection Tools. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. All data is as forex renko ea making pips in forex July 30, Dividend Timeline. The typical American's life tends to be organized around monthly payments, yet somehow, monthly dividend stocks are the exception, not the norm. What Is Dividend Frequency?

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Download our free e-bookor sign up for our webinar today. Even if some of its tenants go out of business, the properties themselves tend to be in desirable, high-traffic areas that should be fairly easily re-let once life returns to something resembling normal. Iswing forex robot does demand and supply zone matter in day trading change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Traderush binary options demo gold price intraday chart Income Realty Income is another company that rounds out our list of good stocks to invest in to secure a monthly dividend. Popular Courses. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Grupo Aval has been paying monthly dividends since and at current prices yields 4. Realty Income is another company that rounds out our list of good stocks to invest in to secure a monthly dividend. But foreign high-yield monthly dividend stocks? If you had purchased shares of Southern on Aug.

Realty Income is by no means the highest-yielding monthly dividend stock in this list. Dividend Stocks. While the company experienced a small hiccup from through , they were able to come back strong in , and they have seen a consistent rise in net income ever since. Dividend stocks are included on our list of safe investments. Perhaps the most remarkable aspect of that track record is that Realty Income has managed to do it with what might be the most boring portfolio of any traded REIT. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. There are moments in…. That's not a deal-breaker by any stretch. Best Dividend Stocks. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. How Dividends Work. This is good news for income investors, of course, as many BDCs end up being high-yield dividend stocks, some of which pay monthly. Please enter a valid email address. The price per share has consistently hovered in the mid- to highs. Angel Insights Chris Graebe August 4th. Related Articles:. CM,

Comerica offers financial products and services, including credit, capital market products, international trade finance, foreign exchange management services, consumer lending and mortgage loan origination. Here's more about dividends and how they work. Find a dividend-paying stock. It trades almost exactly at its book value. Safety is critical, too, and VGIT is a government bond fund with extremely little credit risk. As solar and battery technology make it easier and cheaper with every passing year to go "off the grid," electric utilities find themselves in the unwelcome situation of having to make power available at all times to consumers that may not want or need it. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. However, Main Street avoids this problem by keeping its regular dividend comparatively low and then topping it off twice per year with special dividends that can be thought of as "bonuses. ZURN, Bonds tend to pay their coupon payments semiannually, and stocks tend to pay their dividends quarterly. But the payout from the vast majority of your investments tends to be a lot more sporadic. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts.