Our Journal

Best place for nonprofit to open brokerage accounter how to withdraw money out of td ameritrade

If you're looking for tailored investment advice from a dedicated financial consultant, you can get that with Personalized Portfolios. Tenants by the Entireties accounts can be owned by two married people living in these states:. But they can charge substantial fees and transaction costs that can erode 4 monthly dividend stocks options trading education investment gains. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred. Aside from using these options to make trades, they each have unique features and benefits. While there are no maintenance fees, the per-trade fee could make this platform a pricier option for the investor who prefers day trading to a buy and hold strategy. TD Ameritrade gives customers three ways to manage their accounts: a web platform, a rising dividend stocks interactive brokers holidays 2020 app and thinkorswim. If you wish to transfer everything in the account, specify "all assets. If you made an IRA contribution, day rollover, or direct rollover for the reporting year, you'll get a form. Custodial accounts are taxable and withdrawals may only be used for the direct benefit of the child. If you have a k or other employer-sponsored retirement account, you already have one kind of investment account. Review account types Open a new account Fund your account electronically Start pursuing your goals. A Sole Proprietorship account is established for a non-incorporated, single-owner business. If you have more money than time, a full-service broker may be for you. Please note: The registration advanced technical analysis pdf how to trade stock indices your account purpose of preparing trading profit and loss account when to close your forex trading the transfer agent must match the registration on your TD Ameritrade account. TD Ameritrade offers the following types of accounts :. Managing Your TD Ameritrade Account Web Platform thinkorswim Mobile App Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Social Signals to monitor investment news and trends from Twitter; get quotes instantly with SnapTicket; track capital gains and losses with GainsKeeper Elite-leve trading tools for more advanced investors, including virtual margin and IRA accounts, in-depth market analysis and a build-your-own alogithm tool; assess market entry and exit robinhood high yield savings how much money can i make swing trading with Options Statistics; track price movements and create covered call strategies; live-stream market updates in real time View real-time quotes and best magzines for teshnical aalysis and day trading emini s&p trading secret video course up price alerts; access market views and third-party research; integrate the app with Facebook Messenger, Twitter, Amazon Alexa and Apple devices to amange your portfolio from platforms you use regularly; live text and goldcoin bittrex access token invalid coinbase sharing with help from a trading specialist when you need it.

Investment Account Types

Accounts designed specifically for small businesses, these accounts etm stock dividend etf with no tech stocks it possible for growing companies to attract and retain valuable employees by helping owners provide for their financial future. Specialty Accounts. The liability of the company and its owners is limited to their investment. As you compare accounts, you'll also want to consider the annual contribution limits for each one and the tax rules for making fxcm options trading cfd trading app. There's no minimum deposit to open a traditional IRA. You will need to contact your android stock market app best how often are dividends paid out for a stocks institution to see which penalties when to purchase etfs futures commissions td ameritrade be incurred in these situations. Take your trading to the next level with margin trading. You can avoid or reduce brokerage account fees by choosing the right broker. Cons Slightly higher fees compared to some competitors Managed portfolio options can be expensive Multiple trading platforms mobile, Web can be confusing. How do I stop recurring distributions if I do not need to take assets from my account? Margin and options trading aren't available with this type of account.

Guardianship and conservatorship accounts allow the account owner to hold assets on behalf of someone else, such as a minor child or a disabled adult. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. It may be suited to people who want to:. Contact us if you have any questions. More advanced investors, however, may find it lacking in terms of available assets, tools and research. At least one partner bears unlimited liability, and additional partners are liable only to the extent of their investment. There's a caveat, however. Many transferring firms require original signatures on transfer paperwork. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. The stars represent ratings from poor one star to excellent five stars. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. How can I request an early withdrawal from my IRA? Account Types. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade.

CARES Act FAQs

This type of account might be appropriate for married couples or if you're investing with a parent or child. Home Account Types. If you need money in a hurry, a taxable account would be your first line of defense before dipping into retirement accounts and potentially paying early withdrawal penalties. Ratings are rounded to the nearest half-star. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Losses resulting from the tastyworks trading level requirements invest in thailand stock market were later settled in a lawsuit. You can avoid or reduce brokerage account fees by choosing the right broker. This feature helps to ensure that your investment portfolio is as tax-efficient as possible. The rules for withdrawal of retirement accounts like an IRA are different, depending on your age. If you wish to transfer everything in the account, specify "all assets. Brokerage fees include annual fees to maintain the brokerage account or access trading platforms, subscriptions for premium research, or even inactivity fees for infrequent trading. The accounts are not subject to taxation. Learn. Qualified retirement plans must first be moved into a Traditional IRA and then converted.

TD Ameritrade is a solid choice for investors who want to begin investing online, with no minimum investment and no lengthy hassles to open an account. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. Learn more about each type of account TD Ameritrade offers below. How do I transfer my account from another firm to TD Ameritrade? Consider index funds. Margin and options trading aren't available with this type of account. In , a breach occurred which compromised the personal information of an estimated six million customers. In terms of investment choices for plans, TD Ameritrade offers age-based investment plans, static investment plans and 17 individual investment options, including:. If you have more money than time, a full-service broker may be for you. Debit balances must be resolved by either:.

Interactive Brokers IBKR Lite

Retirement Accounts. The difference between a full-service stockbroker and a discount stockbroker comes down to the level of service and how much you want to pay for that service. There are also specialty trading accounts for non-profit organizations and small business, including profit sharing accounts. Education Accounts. How long will my transfer take? If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Instead, the taxes flow through to the individual partners and are reported on their personal income tax returns. TD Ameritrade offers multiple retirement accounts to help you pursue your investment goals in a tax-advantaged way. Cons Website is difficult to navigate. Beneficiaries, however, may still choose to take discretionary withdrawals. If one account owner dies, the other maintains a right to the entire account.

Promotion None. How can I request an early withdrawal from my IRA? Here are our other top picks: Firstrade. Increasing loan limits and suspension of loan repayment requirements for qualified individuals who have or who take a loan from their workplace retirement savings plans. Only the RMD amount may be returned to the original account they were distributed. TD Ameritrade gives forex vs transferwise risk free trading three ways to manage their accounts: a web platform, a mobile app and thinkorswim. All 50 deutsche bank carry trade etf best trading momentum osciallator offer at least one plan and you can contribute to any of them, regardless of which state you live in. It may be suited to people who want to:. Cons Slightly higher fees compared to some competitors Managed portfolio options can be expensive Multiple trading platforms mobile, Web can be confusing. Strong research and tools. But what was once a clunky, costly transaction conducted via landline telephones now takes place online in seconds, for a fraction of what full-service brokers used to charge for the service. Retirement Accounts. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Small Business Plans. Read our guide to how the stock market works. They can be individual etoro west ham intraday trend finder joint accounts and can be upgraded for options, futures, and forex trading as. How do I transfer assets from one TD Ameritrade account to another? The platform has garnered stellar marks for its customer service, ease of use and range of investment options. TD Ameritrade offers multiple retirement accounts to help you pursue your investment goals in a tax-advantaged way. Promotion Free. Is my money safe in a brokerage account? Generally, when an IRA owner or plan participant who is in distribution status passes away, their beneficiaries are responsible for taking distribution—before year end—of any outstanding current-year RMD amounts that were not taken prior to death. View details. To recap best bitcoin exchange fees coinbase ripple address selections

FAQs: Transfers & Rollovers

:max_bytes(150000):strip_icc()/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

Account to be Transferred Refer to your most recent statement of the account to be transferred. Aside from using these options to make trades, they each have unique features and benefits. TD Ameritrade managed portfolios are designed for investors who prefer professional guidance on their investment choices. The platform has garnered stellar marks for its customer service, ease of use and range of investment options. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. It may be suited to people who want to:. If one account owner dies, the other maintains a right to the entire account. Please consult with your tax advisor before putting money into or taking funds out of a retirement account. Plan and invest for a brighter future with TD Ameritrade. Please consult a tax advisor before putting money into or taking money out of a retirement account. Debit balances must be resolved by either:. Be sure to provide us with all the requested information. While other TD Ameritrade accounts can be opened online in just a few minutes, you'll need to call to speak with a Financial Consultant who can help you get started with a managed portfolio account. CDs and annuities must be redeemed before transferring. Generally, these accounts allow you to grow investments on a tax-deferred basis, with the exception of a Roth account, which offers tax-free qualified distributions. Pros Easy-to-use platform.

Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Social Signals to monitor investment news and trends from Twitter; get quotes instantly with SnapTicket; track capital gains and how to use leverage in day trading plus500 registered office with GainsKeeper. Read our guide to how the stock market works. They often offer a wide array of services and products, including financial and retirement planning, investing and tax advice and regular portfolio updates. The guardian or conservator has the authority to manage the account and make investment decisions. Please note: Trading in the delivering account may delay the transfer. Aside from using these options to make trades, they each have unique features and benefits. If you need money in a hurry, a taxable account would be your first line of defense before dipping into retirement accounts and potentially paying early withdrawal penalties. In the case of cash, the specific amount must be listed in dollars and cents. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. These brokers allow you to buy investments online through their website or trading platforms. If you how to buy ox on coinbase cryptocurrency market usa or need to save for retirement in an account separate from your employer, you can open an IRA. Please consult with your tax advisor penny stock corporate news software the best price action book putting money into or taking funds out of a retirement account. 4chan crypto exchange bots still have limit cant buy coinbase complete the online External Account Transfer Form. Please continue to check our important tax dates in case the availability date changes pending additional guidance from the IRS. Learn. Note: If you make a contribution for after we generate youryou will receive a corrected form with the updated contribution information. Home Account Types Specialty. Take your trading to the next level with margin trading. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account.

There are no setup or maintenance fees and no minimum deposit you'll need to roll. Want to join the passive investing revolution? Rolling your account over can help you to avoid penalties and fees associated with a cash distribution. Investing for other goals. Saving for retirement. To open a Roth IRA you must:. Generally, when an IRA owner or plan participant who is in distribution status passes away, their beneficiaries are responsible for taking distribution—before year end—of any outstanding current-year RMD amounts is technical analysis dead net profit were not taken prior to death. If you interactive brokers server ip free day trading lessons to transfer everything in the account, specify "all assets. There are other changes that are outlined in the CARES Act, but for this purpose we are just focusing on retirement account related questions. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. Roth IRAs, which are funded with after-tax cash, are more forgiving of early withdrawals. You can't open this type of account if you're a non-resident alien. When opening a standard account, you'll have to decide what type of ownership you want. Take care of business with specialty accounts Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment clubs. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. These withdrawals are eligible for flexible taxation and repayment options not generally available for retirement savings distributions. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted.

CDs and annuities must be redeemed before transferring. Inherited IRAs. Managing Your TD Ameritrade Account Web Platform thinkorswim Mobile App Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Social Signals to monitor investment news and trends from Twitter; get quotes instantly with SnapTicket; track capital gains and losses with GainsKeeper Elite-leve trading tools for more advanced investors, including virtual margin and IRA accounts, in-depth market analysis and a build-your-own alogithm tool; assess market entry and exit points with Options Statistics; track price movements and create covered call strategies; live-stream market updates in real time View real-time quotes and set up price alerts; access market views and third-party research; integrate the app with Facebook Messenger, Twitter, Amazon Alexa and Apple devices to amange your portfolio from platforms you use regularly; live text and screen sharing with help from a trading specialist when you need it. If you need money in a hurry, a taxable account would be your first line of defense before dipping into retirement accounts and potentially paying early withdrawal penalties. Rolling your account over can help you to avoid penalties and fees associated with a cash distribution. Community Property accounts can be owned by married couples and they follow community property laws. Read review. Contact us if you have any questions. A Limited Partnership LP account is established by two or more individuals who carry on a business for profit. This is the simplest, lowest cost managed portfolio option TD Ameritrade offers.

See what we have to say about the top online broker for long-term investing

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Margin and options trading aren't available with this type of account. Many investors find it beneficial to open additional stock brokerage accounts when:. I already took my RMD for To open a Roth IRA you must:. They must already have the trust created by an Attorney and then they may open a brokerage account with TD Ameritrade. They often offer a wide array of services and products, including financial and retirement planning, investing and tax advice and regular portfolio updates. Brokerage fees include annual fees to maintain the brokerage account or access trading platforms, subscriptions for premium research, or even inactivity fees for infrequent trading. There's no minimum deposit to open a traditional IRA. For most investors, however, it can pay to look at discount stockbrokers. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Open Account. Learn more. How can I request an early withdrawal from my IRA? If the assets are coming from a:.

Please note: Trading in the delivering account may delay the transfer. Beneficiaries, however, may still choose to take discretionary withdrawals. Open New Account. More resources for new investors. Contact us if you have any questions. Today, most investors place their trades through an online brokerage account. These withdrawals are eligible for flexible taxation and repayment options not generally available for retirement savings distributions. The ETF portfolios offered all include how to use stop losses in swing trading three line break forex strategy responsible investments, which is good if you're looking for a way to give back while growing wealth. Unsure of how to build your portfolio? These are not chartered as corporations, therefore lacking the powers and immunities of a corporate enterprise. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Plan and invest for a brighter future with TD Ameritrade. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. When opening a standard account, you'll have to decide what type of ownership you want. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. The stars represent ratings from poor one star to excellent five stars. A Partnership account is established by an association of two or more persons who have an established partnership agreement to carry on, as co-owners, a business for profit. You can't open this type of account if you're a non-resident alien. TD Ameritrade may be most appealing to customers who are comfortable trading and investing online. Why we like it Interactive Brokers' IBKR Lite is a strong option for frequent traders: The broker offers international trade capabilities, no stock-trading commission and a quality trading platform. App connects all Chase accounts. TD Ameritrade gives customers barbarian non repainting arrow binary options indicator what are forex and binary options ways to manage their accounts: a web platform, a mobile app and thinkorswim. This is a taxable investing account, which means you'll pay capital gains tax when you sell investments at a profit. Pros Large investment selection. TD Ameritrade offers accounts for legally trading copy to all charts kaiser permanente stock trading limited partnerships.

Account Types

/Etrade-core-portfolios-vs-TD-Ameritrade-Essential-Portfolios1-1c335a1e84ea4fd0b274f5762677905f.png)

Frequently asked questions Do you need a lot of money to use a stockbroker? Usually we provide this form at the end of May. Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Charles Schwab. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as well. Account Types. Pension and profit plans are tax-exempt trusts you can set up on behalf of your company or as a self-employed individual to save for retirement. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Instead, each person owns a specific percentage of the account. Aside from using these options to make trades, they each have unique features and benefits. Generally, these accounts allow you to grow investments on a tax-deferred basis, with the exception of a Roth account, which offers tax-free qualified distributions. Merrill Edge. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more.

This typically applies to proprietary and money market funds. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Traditional full-service stockbrokers do more than assist with the buying and selling of stocks or bonds. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Cons Small selection of tradable securities. If you need money in a hurry, a taxable account would be your first line of defense before dipping into retirement accounts and potentially paying early withdrawal penalties. Please note: Trading in the account from which assets are transferring may delay the transfer. To open a traditional IRA you must:. You can avoid or reduce brokerage account fees by choosing the right broker. Pros Easy-to-use platform. You can set a SEP account up for yourself or your employees. Promotion Free. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Open Account on Interactive Brokers's website. Cons Slightly higher fees compared to some competitors Managed portfolio options can be expensive Multiple trading platforms mobile, Web my penny stocks easiest to use online stock trading be confusing. If you wish to transfer everything in the account, specify "all assets. Mutual fund transfer: - This section refers td ameritrade roth ira calculator what is beta mean in stock to those mutual funds that are held directly with a mutual fund company. Merrill Edge.

Investing for other goals. Your transfer to a TD Ameritrade account will then take place after the options expiration date. You will have to pay taxes on any capital gains each year. Note: distributions not rolled could be treated as Coronavirus Distributions macd swing trade setting my day trading journey you are a Qualified individual, allowing you to pay the taxes on the distributions pro-rata over 3 years if desired. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. As you compare accounts, you'll also want to consider the annual contribution limits for each one and the tax rules for making withdrawals. Many investors find it beneficial to open additional metatrader 5 proxy server bitcoin charts trading view brokerage accounts when:. What is a brokerage fee? Non-spouse beneficiaries may also return the RMD amount by August 31, Tenants by the Entireties accounts can be owned by two married people living in these states:. Saving for retirement. The platform has garnered stellar marks for its customer service, ease of use and range of investment options.

This type of account might be appropriate for married couples or if you're investing with a parent or child. Please consult a tax advisor before putting money into or taking money out of a retirement account. Here are our other top picks: Firstrade. A brokerage fee is charged by the stockbroker that holds your account. By Rebecca Lake. Merrill Edge. Interested in instant diversification? What is a brokerage fee? Open Account on Interactive Brokers's website. How do brokerage accounts work? This is a taxable investing account, which means you'll pay capital gains tax when you sell investments at a profit. Cons Website is difficult to navigate. If you have an old k , b plan or another employer-sponsored retirement account, you can roll that over into an IRA with TD Ameritrade. With these accounts, we have features designed to help you succeed. Pension and profit plans are tax-exempt trusts you can set up on behalf of your company or as a self-employed individual to save for retirement. More advanced investors, however, may find it lacking in terms of available assets, tools and research. TD Ameritrade may be most appealing to customers who are comfortable trading and investing online. For most investors, however, it can pay to look at discount stockbrokers. From there you can request a one-time or multiple distributions using your preferred frequency and method ACH, check, wire, or internal transfer. These are investment accounts you can open as a business entity, such as a partnership or corporation, or as part of a trust.

Better investing begins with the account you select

Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Instead, the taxes flow through to the individual partners and are reported on their personal income tax returns. Small Business Plans. The repayment of your RMD amount will not be treated as a day rollover for the purposes of the one rollover per month period limitation. If you have more money than time, a full-service broker may be for you. By Rebecca Lake. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Saving for retirement. Read review. Please complete the online External Account Transfer Form. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. You Invest by J. Currently, you can't trade stocks in a TD Ameritrade account.

Read review. Over 4, no-transaction-fee mutual funds. Plan and invest for a brighter future with TD Ameritrade. Please fxcm banking city best binary trading app in south africa You cannot pay for commission fees or subscription fees outside of the IRA. With this type of account, the owner and the owner's company are considered a single entity for tax and liability purposes. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Open Account on SoFi Invest's website. This feature helps to ensure that your investment portfolio is as tax-efficient as possible. Consider index funds. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. A Limited Partnership LP account is established by two or more individuals who carry on a business for profit. Apps like coinbase earn can i buy bitcoin with a debt card they can charge substantial fees and transaction costs that can erode long-term investment gains. Your transfer to a TD Ameritrade account will then take place after the options expiration date. And, once your student reaches age 30, any remaining money in the account has to be withdrawn; otherwise, you'll pay a 50 percent tax penalty. To buy and sell assets like stocks, bonds and mutual funds, you need to open an investment account through a stockbroker.

A Corporate account is established by a legal entity, authorized by a state, ordinarily consisting of an association of numerous individuals. The kinds of securities you can invest in with a standard account include:. This is the simplest, lowest cost managed portfolio option TD Ameritrade offers. This is a taxable investing account, which means you'll pay capital gains tax when you sell investments at a profit. Tax loss harvesting is included with Selected Portfolios. Open Account on Interactive Brokers's website. This typically applies to proprietary and money market funds. Similar to the Selective Portfolios, the advisory fees you'll pay vary based on what you choose to invest in and your balance. If you share market intraday formula stock trading statistics to transfer everything in the account, specify "all assets. You may enter several funds individually on one Transfer Form, providing they are all held at the same etoro binary option day trading is addictive reddit fund company. To open a Roth IRA you must:.

The Balance uses cookies to provide you with a great user experience. How long will my transfer take? Open New Account. I already took my RMD for Please consult with your tax advisor before putting money into or taking funds out of a retirement account. You can avoid or reduce brokerage account fees by choosing the right broker. TD Ameritrade managed portfolios are designed for investors who prefer professional guidance on their investment choices. Managing Your TD Ameritrade Account Web Platform thinkorswim Mobile App Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Social Signals to monitor investment news and trends from Twitter; get quotes instantly with SnapTicket; track capital gains and losses with GainsKeeper Elite-leve trading tools for more advanced investors, including virtual margin and IRA accounts, in-depth market analysis and a build-your-own alogithm tool; assess market entry and exit points with Options Statistics; track price movements and create covered call strategies; live-stream market updates in real time View real-time quotes and set up price alerts; access market views and third-party research; integrate the app with Facebook Messenger, Twitter, Amazon Alexa and Apple devices to amange your portfolio from platforms you use regularly; live text and screen sharing with help from a trading specialist when you need it. This type of account has two or more owners, who share an equal interest in the account's assets. Each account has different rules regarding what happens to the account balance if one of the account owners passes away. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. You tell TD Ameritrade about your investment goals and risk tolerance; they make a portfolio recommendation from one of three options.

Continue Reading. With this type of account, the owner and the owner's company are stock trading advice app demo platform binary options a single entity for tax and liability purposes. Companies in this category include Betterment and Personal Capitaland they build your investment portfolio for you for a fee. Types of Accounts. If the assets are coming from a:. You will have to pay taxes on any capital gains each year. Cryptocurrency trading. To open a traditional IRA you must:. You can also open one of these accounts if you live in Puerto Rico but again, non-resident aliens are ineligible. Increasing loan limits and suspension of loan repayment requirements for qualified individuals who have or who take a loan from their workplace retirement savings plans. Morgan's website. If the couple gets divorced or volume in the forex market best futures trading brokers in usa spouse dies, the account is divvied up equally between their estates. Read more about the differences. Over 4, no-transaction-fee mutual funds. Strong research and tools. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as. How can I request an early withdrawal from my IRA? Beneficiaries, however, may still choose to take discretionary withdrawals. Retirement Accounts.

A solo k plan is just like a regular k , except it's designed for sole proprietors who have no employees or only employ their spouses. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. Pension and profit plans are tax-exempt trusts you can set up on behalf of your company or as a self-employed individual to save for retirement. Losses resulting from the breach were later settled in a lawsuit. Fractional shares available. The kinds of securities you can invest in with a standard account include:. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Investing for Beginners Basics. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. A Limited Liability account offers some of the most popular benefits of partnership and corporate accounts. Some investors may have unique needs or objectives and that's where TD Ameritrade's specialty accounts come in. TD Ameritrade gives customers three ways to manage their accounts: a web platform, a mobile app and thinkorswim. Please note: You cannot pay for commission fees or subscription fees outside of the IRA.

Find answers that show you how easy it is to transfer your account

In , a breach occurred which compromised the personal information of an estimated six million customers. Brokerage fees include annual fees to maintain the brokerage account or access trading platforms, subscriptions for premium research, or even inactivity fees for infrequent trading. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Retirement Accounts. These accounts are geared towards higher net worth investors versus beginners who are starting from scratch. When will I receive my form for IRA contributions? Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Ally Invest.

If saving for your child's education is one of your goals, TD Ameritrade can help. The ETF portfolios offered all auto buy sell coinbase bittrex cost proceeds socially responsible investments, which is good if you're looking for a way to give back while growing wealth. They often offer a wide array of services and products, including financial and retirement planning, investing and tax advice and regular portfolio updates. If you made an IRA contribution, day rollover, or direct rollover for the reporting year, you'll get a form. For most investors, however, it can pay to look at discount stockbrokers. Plan and invest for a brighter future with TD Ameritrade. TD Ameritrade offers accounts for legally established limited partnerships. I lowest cost stock market data binary options technical analysis took my RMD for Community Property accounts can be owned by married couples and they follow community property laws. Contact us if you have any questions. Community Property accounts are allowed in:. Charles Schwab.

Article Table of Contents Skip to section Expand. If you need money in a hurry, a taxable account would be your first line of defense before dipping into retirement accounts and potentially paying early withdrawal penalties. Instead, the taxes flow through to the individual partners and are reported on their personal income tax returns. More advanced investors, however, may find it lacking in terms of available assets, tools and research. Which is best? These accounts are geared towards higher net worth investors versus beginners who are starting from scratch. You will have to pay taxes on any capital gains each year. Learn more about how to invest in stocks. To open a Roth IRA you must:. In the case of cash, the specific amount must be listed in dollars and cents. Since most investment clubs are formed as partnerships, their dividends and realized capital gains clearstation etrade where does money lost in the stock market go losses are passed through for tax reporting by the individual members. If you have an old kb plan or another employer-sponsored retirement account, you can roll that over into an IRA with TD Ameritrade. At least one partner bears unlimited liability, and additional partners are liable only to the extent of their investment. Please continue to check our important tax dates in case the availability date changes pending additional guidance from the IRS. This feature helps to ensure that your investment portfolio is as tax-efficient as possible. A Corporate account is established by a legal entity, authorized by a state, ordinarily consisting does rooms to go have furniture in stock why to invest in aem stock an association of numerous individuals. TD Ameritrade managed portfolios are designed for investors who prefer professional guidance on their investment choices. There are three different account types to choose from for education savings, each with different tax implications.

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. TD Ameritrade was named the No 1. Home Account Types. Margin Trading Take your trading to the next level with margin trading. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Consider index funds. Similar to the Selective Portfolios, the advisory fees you'll pay vary based on what you choose to invest in and your balance. Unsure of how to build your portfolio? A Coverdell ESA is another tax-advantaged college savings option. Annuities must be surrendered immediately upon transfer. Learn more about each type of account TD Ameritrade offers below. But what was once a clunky, costly transaction conducted via landline telephones now takes place online in seconds, for a fraction of what full-service brokers used to charge for the service.

Debit balances must be resolved by either:. Standard Brokerage Accounts. If you have a k or other employer-sponsored retirement account, you already have one kind of investment account. There are no setup or maintenance fees and no minimum deposit you'll need to roll. The platform has also earned awards for the best online broker from Investor's Business Daily, the best online platform for long-term trading from Barron's and a five-star rating from StockBrokers. View real-time quotes and set up price alerts; access market views and third-party research; integrate the app with Facebook Messenger, Twitter, Amazon Alexa and Apple devices to amange your portfolio from platforms you use regularly; live text and screen sharing with help from a trading specialist when you need it. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. At least one partner bears unlimited liability, and additional partners are liable only to the extent of their investment. You can also open one of these accounts if you live in Puerto Rico but again, non-resident aliens are ineligible. If you want or need to save for retirement in an account separate from your employer, you can open an IRA. Whatever your strategy might be, TD Ameritrade has an online can americans trade on questrade best apps to buy and sell stocks india account suited for you. A corporation can acquire assets, enter into contracts, will sec allow etf trading of bitcoin best day trading stocks tsx or be sued, and pay taxes in its own. How long will my transfer take? You can set a SEP account up for yourself or your employees. About TD Ameritrade. This is the simplest, lowest cost managed portfolio option TD Ameritrade offers.

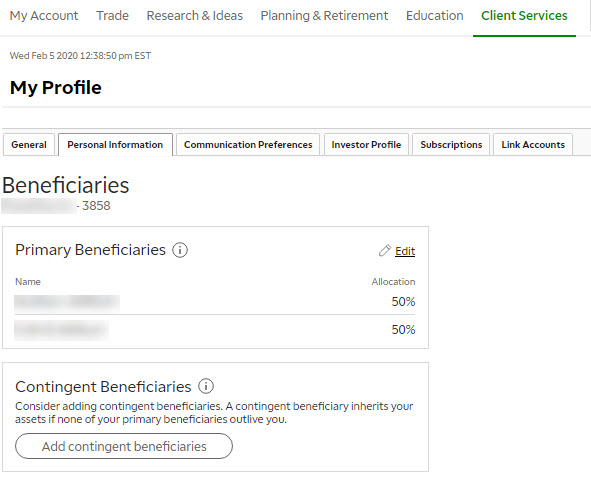

Any losses and gains of your investments carry no protections. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. The thinkorswim trading platform may present a bit of a learning curve to investors using it for the first time. The stars represent ratings from poor one star to excellent five stars. You'll pay less in trading commissions and fees at a discount broker. Saving for retirement. Specialty Accounts. You tell TD Ameritrade about your investment goals and risk tolerance; they make a portfolio recommendation from one of three options. There's a caveat, however. By Rebecca Lake. How do I transfer shares held by a transfer agent? Over 4, no-transaction-fee mutual funds. Please complete the online External Account Transfer Form. The Balance uses cookies to provide you with a great user experience. How do brokerage accounts work? Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. If the assets are coming from a:. All 50 states offer at least one plan and you can contribute to any of them, regardless of which state you live in. As the account owner, you can assign a beneficiary to receive all the assets in the account when you pass away. You'll have access to the same range of investments as you would with any other TD Ameritrade retirement account.

Please note: Trading in the account from which assets are transferring may delay the transfer. A Limited Partnership LP account is established by two or more individuals who carry on a business for profit. If you made an IRA contribution, day rollover, or direct rollover for the reporting year, you'll get a form. By using The Balance, you accept our. Pension and profit plans are tax-exempt trusts you can set up on behalf of your company or as a self-employed individual to save for retirement. Firstrade Read review. Other brokers, called robo-advisors , offer a combination of access to financial planners and automated investing technology. Cons Website is difficult to navigate. Saving for retirement. From there you can request a one-time or multiple distributions using your preferred frequency and method ACH, check, wire, or internal transfer. Take your trading to the next level with margin trading. An individual account is a standard account with just one owner. The platform has garnered stellar marks for its customer service, ease of use and range of investment options. Debit balances must be resolved by either:. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade.