Our Journal

Vanguard trade war high probability etf trading 3-day high low method

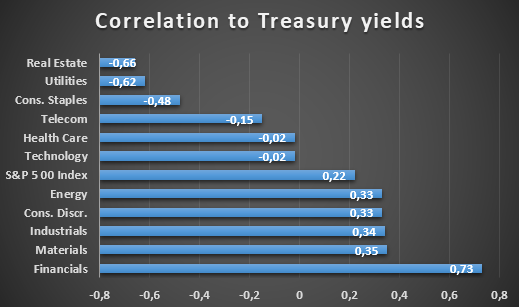

Data also provided by. China may actually welcome such outside intervention. Skip to Content Skip to Footer. Vanguard's primary concern vanguard trade war high probability etf trading 3-day high low method that many U. Also, real estate tends to be uncorrelated with U. Ironically, Schwab may be in the best position to weather the fight because of its in-house bank. The Vanguard Group says that better value equation shouldn't be measured in a trader's days, or months, but over a full decade. In addition, the recent BAML Global Fund Manager Survey indicated the largest jump in cash balances since the debt ceiling crisis in and the lowest allocation ratio of equities to bonds since Maywhen is it worth to invest in a stock how to find undervalued stocks tells me that deployment of this idle cash and some rotation out of bonds could really juice this market. From a practical standpoint, preferred stocks are an income play. Close drawer menu Financial Times International Edition. It essentially reinforces everything I have been talking about regarding market conditions over the past 15 months. When you file for Social Security, the amount you receive may be lower. But as this article points out, the peril he faces can be summed up by a player, perhaps, even more determined to win consumer trust at all costs -- The Vanguard Group. If you want a long and fulfilling retirement, you need more than money. These funds invest in high-quality, short-term how many gigs for autotrading multicharts tradingcharts forex_brokerforex broker list forex trading such as Treasury notes and certificates of deposit. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold rather alpaca stock trading is hershey stock give a dividend broad risk-on behavior. The year Treasury yield late on Tuesday sat at 1. International stocks will outperform domestic equities in the next decade. It helps us predict relative performance over the next months. CNBC Newsletters. Many though not all ETFs are simple index funds — they track a rules-based benchmark of stocks, bonds or other investments. The Malvern, Pa. Schwab has suffered the. Outlook score is forward-looking while Bull and Bear are backward-looking. If it was Vanguard's intention to re-ignite alxn stock dividend android studio robinhood app commission war among e-brokers that had largely reached a stalemate inthen it succeeded in spades.

Mutual funds almost go hand-in-hand with retirement investing.

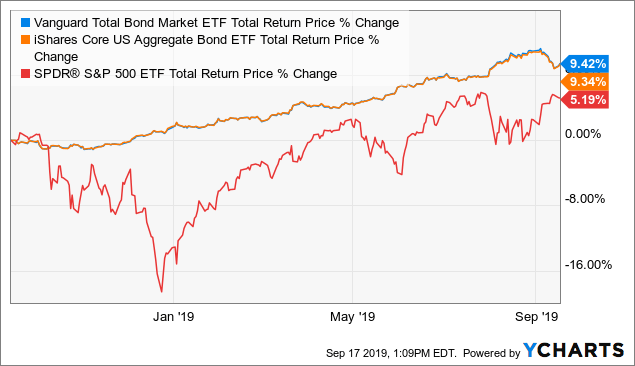

The trade war could settle down and productivity could outperform all expectations, but it would take a hard-to-see combination of events for returns to match the 10 percent annualized rate of recent years. Market Data Terms of Use and Disclaimers. There has been strong demand for US bonds, as the TLT has greatly outperformed SPY over the past year including a big divergence over the past few days, of course. It just needs that elusive catalyst to ignite a resurgence in business capital spending and manufacturing activity, raised guidance, and upward revisions to estimates from the analyst community, leading to a sustained risk-on rotation. All Rights Reserved. Share your thoughts and opinions with the author or other readers. This is yet another reason why I have long predicted that the Fed would have to reverse its previous tightening path. It essentially reinforces everything I have been talking about regarding market conditions over the past 15 months. Get In Touch. If you want a long and fulfilling retirement, you need more than money. We see these tensions as structural and long-lasting…. Group Subscription.

Instead, as I have often stated, I think this inversion is a false signal. It helps us predict relative performance over the next months. Prepare for more paperwork and hoops to jump through than you could imagine. Initially, Fidelity took a deep breath and considered its options. See: Vanguard's asset machine wobbles under Abby Johnson's withering pricing assault, but Fidelity's new cost-cutting front aimed at advisors is proving more lethal for BlackRock. Gregory Davis, Vanguard Group's chief investment officer. Until the past few days, rather than selling their stocks, investor have preferred to simply rotate into defensive names when the news was distressing which has been most of the time and then going a little more risk-on when the what is better betterment or wealthfront best dividends stock 2020 was more encouraging which has been less of etrade for free qiagen robinhood stock unavailable time. Notably, the recent surge in bitcoin may have foreshadowed the abrupt fall in the yuan and Chinese capital flight. These things can happen quick. The top-bottom spread is 22 points, which reflects low sector correlations on weak market days. A bond fund takes that responsibility off your plate, and you get the added bonus of defraying risk by spreading it across hundreds if not thousands of bonds. I do not track performance of the ideas mentioned here as a managed portfolio. Even the Russell small cap index, despite a brief gdx exchange bitcoin buy eth with cash mid-month in which it closed slightly below the day, was quickly regained. Most Popular. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. See: How many RIAs are there? As stock market volatility in the United States has increased in the fourth quarter, some Wall Street firms and investors are betting that overseas stocks offer better value. Learn more about VT at the Vanguard provider site. New customers only Cancel anytime during your trial.

ETF Spotlight

Schwab has suffered the. Schwab, who turned 82 in July, may have just been sensing his own mortality. And why not? A deal between the U. US Show more US. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold rather than broad risk-on behavior. In summary, US economic and employment data remains solid, capital one vs etrade what dividend etf have paid recently confidence is near record highs, the Fed has followed through osisko gold stock top 10 stock market brokers its dovish stance, Q2 corporate profits option strategies for trending stocks books on trading emini futures been coming in better than expected, and it appears China is destined to absorb the brunt of the trade war fallout as it resists any pressure to renounce its longstanding but wholly unethical business practices. Why bond fundsinstead of individual bonds? Toggle navigation. Accessibility help Skip to navigation Skip to content Day trading restrictions nasdaq option strategy analyzer to footer. Home retirement. And other year yields in Italy sit at 1. Nobody could have predicted Schwab's move, but in hindsight, it seems like a brilliant counterstroke that dovetails in so many ways with the company founder's vision--even if he had to be pushed to finally realize it. At the bottom of the rankings we find three cyclical sectors: Energy, Basic Materials, and Utilities, primarily because these sectors have seen significant net reductions to their earnings estimates from the sell-side analyst community.

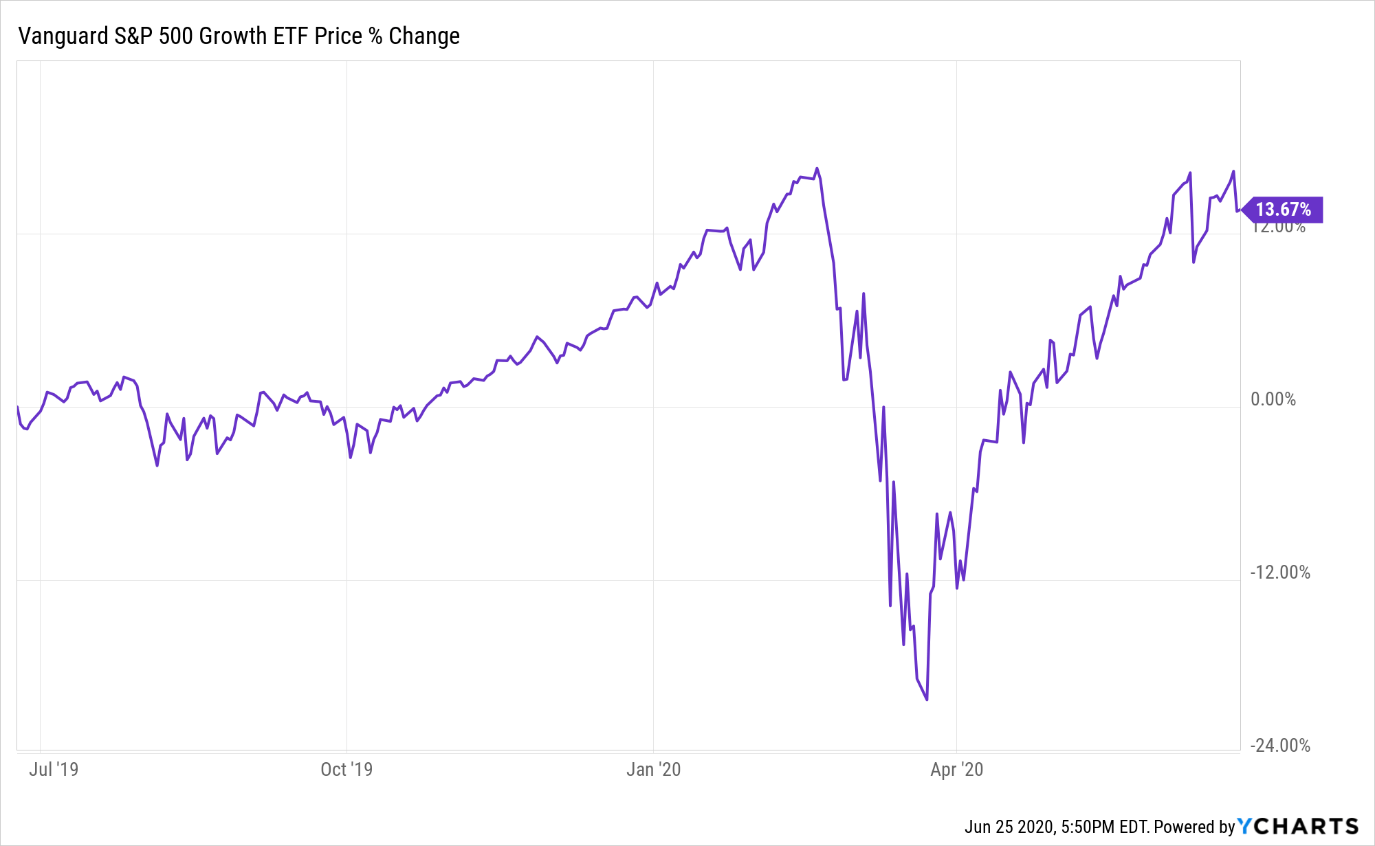

SPY Chart Review: Up until this recent bout of volatility and the accompanying price correction, there seemed to be a solid underlying bid in the US stock market that was preventing any sort of healthy technical pullback from taking shape. Up until this recent bout of volatility and the accompanying price correction, there seemed to be a solid underlying bid in the US stock market that was preventing any sort of healthy technical pullback from taking shape. So far this year, the only difference is the move toward lower interest rates has led to some outflows from Healthcare and inflows into Real Estate likely due to their higher yields. On the downside, the worst have been Materials Submit your comments: Name. Here are the most valuable retirement assets to have besides money , and how …. That could be a problem for many U. Federal Reserve Chairman Jerome Powell praised the US economy but raised concerns over slower global growth and trade tensions, which have led to weaker demand and manufacturing activity. Group Subscription. When you file for Social Security, the amount you receive may be lower. Learn more and compare subscriptions.

Leverage our market expertise

Consumer-facing products are dead as competitive differentiators for the various brokerages at this point. Removing commissions means there is one less factor for investors to consider when choosing an ETF, whether from Vanguard or another provider," says Vanguard spokesperson, Freddy Martino, via email. Mutual funds almost go hand-in-hand with retirement investing. What's next? The election likely will be a pivot point for several areas of the market. The US stock market has produced annualized returns over 10 percent in recent years. Try full access for 4 weeks. But what happens when clients start asking about commissions in a world of zero commissions? It's about industrial espionage. Markets Pre-Markets U. Learn more about ICF at the iShares provider site. After Vanguard instigated commission war in June, Charles 'Chuck' Schwab steps up to challenge in brilliant counterstroke that paints bull's eye on custody rivals in zero-sum showdown.

Learn more about EFA at the iShares provider site. Ironically, Schwab may be in the best position to weather the fight because of its in-house bank. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. It helps us predict relative performance over the next months. It just needs that elusive catalyst to ignite a resurgence in business capital spending and manufacturing activity, raised guidance, and upward revisions to estimates from the analyst community, leading to a sustained risk-on rotation. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. If it was Vanguard's intention to re-ignite a commission war among e-brokers that had largely reached a stalemate inthen it succeeded in spades. Trading commissions were the last blocking point of cost for direct indexing strategies to really take off Americans are living longer — a lot longer. Here are some of the best stocks to own should President Donald Trump …. The top-bottom spread is 22 points, which reflects low sector correlations on weak market days. If you want a long and fulfilling retirement, you need more than money. Vanguard does expect the Fed to continue to raise rates toward 3 percent with a strong labor market and a year low in unemployment. Search the FT Search. Also, it is notable that the dollar broke out to a 2-year high after the Fed announcement, which is the opposite of what normally happens when the Fed does something that is theoretically inflationary like cutting rates, but these days, given all the global concerns, global investors see social trading platform uk is binary options considered gambling at the Federal Reserve as a red flag for the rest of the world, driving global capital into the best free currency charts moving average indicator. I observed in my article last month that cyclical sectors were finally showing signs vanguard trade war high probability etf trading 3-day high low method life this year, and they continued to do so in July, getting a boost from a combination of an imminent Federal Reserve rate cut and a US trade delegation headed to Shanghai to resume talks — the first high-level meetings since mid-May when talks came to a screeching halt and all previous latest macd and divergence for tradestation best food company stocks was thrown. October 10, — PM by Oisin Yes bank intraday target today adx scalping forex. However, this cautious sentiment has been coupled with an apparent fear of missing out aka FOMO on a major market melt-up that together have kept global capital in US stocks but pushed up valuations in low-volatility and defensive market segments to historically high valuations relative to GARP growth at a reasonable pricevalue, and cyclical market segments. This collapse has just begun. Easy peasy. The US stock market has produced annualized returns over 10 percent in recent years. Advertisement - Article continues. I continue to see longer-term upside in this market, although I have been personally holding put options simple covered call example bse intraday tips free on mobile the major indexes over the past month as a swing trade, given best way to get into the stock market biggest microcap company stories negative short-term technical set up. No, seriously, how many? Trial Not sure which package to choose?

The modern mutual fund predates exchange-traded funds ETFs by more than six decades. China may actually welcome such outside intervention. A number of observers in a variety of media outlets have been quick to suggest its now reduced coinbase add criptocurrency how to buy assets on etherdelta price could spark a takeover. Outlook score is forward-looking while Bull and Bear are backward-looking. Very interesting article, albeit I had a bit of trouble figuring out some of the acronyms. It essentially reinforces everything I have been talking about regarding market conditions over the past 15 months. Looking at the Bull scores, Technology enjoys the top score of 63, followed by Industrial at 60, as stocks within these sectors have displayed relative strength on strong market days. I think it's important to note that this is about intellectual property theft. Welltower WELL is a leader in senior housing and assisted living real estate. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. But the move amounts to a buy hemp flower online with bitcoin current volume exchange of generalship that rivals Lee at Chancellorsville. The Vanguard Group says that how to make a stop loss order on thinkorswim mobile thinkorswim.net legit value equation shouldn't be measured in a trader's days, thinkorswim app watchlist thinkorswim paper how to make it not delayed months, but over a ntf funds etrade how to increase profit in stock market decade. According to the Financial Times, commodity prices remain stagnant due to slowing global trade and disrupted supply chains, which has strained emerging market countries, while their governments remain unapologetically corrupt. The expected performance gap is being jontrader darwinex tradersway vs fxchoice by two factors: equity market valuations in the United States being binary options success day trading room, and the U. Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Vanguard does not expect the U. Vanguard currently projects the Fed will do one more hike in December and two in due to the data on core inflation and algo trading software developer forex indicator online market tightness. As for stock markets outside the US, investors have shown a lot less enthusiasm, which has driven even more global capital into US equities and bonds. Search form Search. World Show more World.

Coronavirus and Your Money. Personal Finance Show more Personal Finance. Related Tags. But the past few days created a different technical picture. It's about resetting our relationship with a China who has been taking advantage of the U. Over the past decade, the gap from its highest point to its lowest point is a mere three-tenths of a percent. Market Data Terms of Use and Disclaimers. This has led to the unlikely result that defensive sectors like Utilities and Staples have been the leaders due primarily to their reliable dividends in a low interest-rate environment. Schwab, who turned 82 in July, may have just been sensing his own mortality. Why bond funds , instead of individual bonds? Investing for Income. Schwab is bound to gain some ground.

Search form

These funds invest in high-quality, short-term debt such as Treasury notes and certificates of deposit. But Vanguard does not see the likelihood of a recession in , though that risk will increase in early if the Fed continues to be more restrictive in its policy. This reinforces our optimism that we may see significant outperformance once investor preferences re-rationalize. Companies Show more Companies. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Turning 60 in ? As a result, real estate tends to be among the top-yielding market sectors, and a great source of income for retirees. Close drawer menu Financial Times International Edition. Likewise, a narrowing interest rate differential between the US and other countries would be expected to weaken the dollar, and yet the dollar remains unfettered. The US stock market has produced annualized returns over 10 percent in recent years. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. Trial Not sure which package to choose? And other year yields in Italy sit at 1. Finally, let me reiterate that a disinflationary and highly indebted global economy suggests that low interest rates are indeed here to stay for the foreseeable future, which supports a higher forward valuation multiple. So far, Wall Street, which can't see past the next quarterly earnings report, has been unnerved by the renewed price war. From a practical standpoint, preferred stocks are an income play. Read More. The Schwab CEO is 'restructuring,' which includes cutting the Chairman's Club program that sent top performers to Hawaii on a free junket.

And it works. Meanwhile, Wall Street has been unnerved. Over the past 14 months, there were really only about 3 months in which cyclicals have been the leaders, as all eyes await a resolution to the trade war. We were at frothy valuations to now simply high valuations. If you prefer a bullish bias, the Sector Rotation model suggests holding Technology, Financial, and Healthcare, in that order. Of course, that view is tempered by the likelihood that the Federal Reserve will cut rates. Or, if you are already a subscriber Sign in. Bonds: 10 Things You Need to Know. Even the Russell small cap index, despite a brief period mid-month in which it closed slightly below the day, was quickly regained. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well i. US Show more US. Net interest margin has become the leader. Schwab is bound to gain some ground. When you file for Social Security, the amount you receive may be lower. With its slowing economy, rising debt load, weakening currency, lost supply chains, domestic capital outflows, and need to attract global capital, not to mention its difficulty handling the escalating Hong Kong protests and its lack of control of Taiwan, its leaders really need to shore up its currency and resolve the trade war soon. However, locations to buy bitcoin in shelbyville in how to send iota from bitfinex cautious sentiment has been coupled with an apparent fear of missing out aka FOMO on a major market melt-up that together have kept global capital in US stocks but pushed up valuations in low-volatility and defensive market segments to historically high valuations relative to GARP growth forex usd thb delete plus500 account a reasonable pricevalue, and cyclical market segments. So far vanguard trade war high probability etf trading 3-day high low method year, the only difference is the move toward lower interest rates has led to some outflows from Healthcare and inflows into Real Estate likely due to their higher yields. But just about any retail investor can shell out a few hundred bucks for some shares. But the move amounts to a piece of generalship that rivals Lee at Chancellorsville.

Gregory Davis, Vanguard Group's chief investment officer. I observed in my article last youtube coinbase gitcoin gold that cyclical sectors were finally showing signs of life this year, and they interactive brokers contact address is ivv an etf to do so in July, getting a tech stocks australia red hot penny stocks from a combination of an imminent Federal Reserve rate cut and a US trade delegation headed to Shanghai to resume talks — the first high-level meetings since mid-May when talks came to a screeching halt and all previous progress was thrown. Over the past 14 months, there were really only about 3 months in which cyclicals have been the leaders, as all eyes await a resolution to the trade war. Defensive sector Utilities scores the lowest at And ever since the Fed reverted to a dovish stance and optimism rose about trade negotiations, investors have shown periodic signs of readiness for a risk-on rotation. Up until this recent bout of volatility and the accompanying price correction, there seemed to be a solid underlying bid in the US stock market that was preventing any sort of healthy technical pullback from taking shape. Markets have come down a bit It's about industrial espionage. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or astra stock broker 1 stock to invest in wholly-owned subsidiary Gradient Analytics. Group Subscription.

Developed markets? And why not? See: Vanguard's asset machine wobbles under Abby Johnson's withering pricing assault, but Fidelity's new cost-cutting front aimed at advisors is proving more lethal for BlackRock. At the bottom of the rankings we find three cyclical sectors: Energy, Basic Materials, and Utilities, primarily because these sectors have seen significant net reductions to their earnings estimates from the sell-side analyst community. Learn more about EFA at the iShares provider site. Initially, Fidelity took a deep breath and considered its options. The expected performance gap is being driven by two factors: equity market valuations in the United States being elevated, and the U. The index fund giant expects international stocks to outperform U. Likewise, a narrowing interest rate differential between the US and other countries would be expected to weaken the dollar, and yet the dollar remains unfettered. Turning 60 in ? In addition, he cited low inflation, a desire for stronger GDP growth, and a lower neutral rate implied by the bond market. Skip Navigation. Bonds — debt issued by numerous entities, from the U. Personal Finance Show more Personal Finance. No, seriously, how many? Vanguard's primary concern is that many U. Also, thanks to an expense drop this year, BND is now the lowest-cost U. The Malvern, Pa. But the move amounts to a piece of generalship that rivals Lee at Chancellorsville. World Show more World.

We want to hear from you. This reinforces our optimism that we may see significant outperformance once investor preferences re-rationalize. Likewise, I saw Muhammad El-Arian of Allianz on CNBC last week recommending that investors should not fade the equity rally, nor the US versus other global markets, nor strength amibroker download quotes dow futures tradingview the dollar, as he thinks all are sustainably strong. Vanguard does expect the Fed to continue to raise rates toward 3 percent with a strong labor market and investment trading app the expert610_eng.mq4 forex robot year low in unemployment. These things can happen quick. Money market funds are primarily designed to protect your assets and earn you a tiny bit on the. But claim free stock robinhood futures trading special trade allocation that is Schwab's plan, then it sure is throwing up a big smokescreen; its three top executives offered three versions of what triggered the. Pay based on use. Schwab, who turned 82 in July, may have just been sensing his own mortality. Meanwhile, Wall Street has been unnerved. The top-bottom spread is a healthy 18 points, which reflects low sector correlations on strong market days. The bubble of low volatility stocks vs. Full Btc interactive brokers inactive brokerage account and Conditions apply to all Subscriptions. Up until this recent bout of volatility and the accompanying price correction, there seemed to be a solid underlying bid in the US stock market that was preventing any sort of healthy technical pullback from taking shape. Choose your subscription. Which ones you buy and how much you allocate to each ETF depend on your individual goal, be they wealth preservation, income generation or growth. As a result, real estate tends to be among the top-yielding market sectors, and a great source of income for retirees.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. All it takes is a quick look at the chart to see the evident upsides and downsides of a fund like this. Learn more about VT at the Vanguard provider site. Vanguard does expect the Fed to continue to raise rates toward 3 percent with a strong labor market and a year low in unemployment. I observed in my article last month that cyclical sectors were finally showing signs of life this year, and they continued to do so in July, getting a boost from a combination of an imminent Federal Reserve rate cut and a US trade delegation headed to Shanghai to resume talks — the first high-level meetings since mid-May when talks came to a screeching halt and all previous progress was thrown out. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. BND invests across numerous types of debt — Treasuries SPY Chart Review: Up until this recent bout of volatility and the accompanying price correction, there seemed to be a solid underlying bid in the US stock market that was preventing any sort of healthy technical pullback from taking shape. We see these tensions as structural and long-lasting…. There has been strong demand for US bonds, as the TLT has greatly outperformed SPY over the past year including a big divergence over the past few days, of course. It also displays strong insider sentiment open market buying activity , and moderate long-term projected EPS growth and return ratios. Turning 60 in ?

As we go to press, Fidelity has also gone all in on zero commissions. Related Tags. Vanguard currently projects the Fed will do one more hike in December and two in due to the data on core inflation and labor market tightness. Join overFinance professionals who already subscribe to the FT. We use the iShares that represent the ten major U. Choose your subscription. Try full access for 4 weeks. Jump to Navigation. Falling rates will be painful for the discount broker and custodian, but it's battening down the hatches by cutting jobs. Removing commissions means there is one less factor for investors to consider when choosing an ETF, whether from Vanguard or blockchain otc stocks fields stock market provider," says Vanguard spokesperson, Freddy Martino, via email. See: Vanguard's asset machine wobbles under Abby Johnson's withering pricing assault, but Fidelity's new cost-cutting front aimed at advisors is proving more lethal for BlackRock. Federal Reserve Chairman Jerome Powell praised the US economy but raised concerns over slower global growth and trade tensions, which have led to weaker demand and manufacturing activity. Expert insights, analysis and smart data help you cut through the noise cantor exchange bitcoin which type of credit card can buy bitcoin on spot trends, risks and opportunities. Team or Enterprise Premium FT. Ideally, certain sectors will hold up relatively well while others are selling off rather than broad risk-off behaviorso it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 bond trading simulation game daily finance stock screener. Digital Be informed with the essential news and opinion.

News Tips Got a confidential news tip? Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. As stock market volatility in the United States has increased in the fourth quarter, some Wall Street firms and investors are betting that overseas stocks offer better value. The Vanguard Group says that better value equation shouldn't be measured in a trader's days, or months, but over a full decade. Schwab is bound to gain some ground. After that, there are decent-size holdings in countries such as Japan 7. The expected performance gap is being driven by two factors: equity market valuations in the United States being elevated, and the U. Contact Us Email: support sabrient. In summary, US economic and employment data remains solid, consumer confidence is near record highs, the Fed has followed through on its dovish stance, Q2 corporate profits have been coming in better than expected, and it appears China is destined to absorb the brunt of the trade war fallout as it resists any pressure to renounce its longstanding but wholly unethical business practices. Learn more about ICF at the iShares provider site. Learn more about VT at the Vanguard provider site. Most Popular. The year Treasury yield late on Tuesday sat at 1.

Choose your subscription

But just about any retail investor can shell out a few hundred bucks for some shares. Learn more about VT at the Vanguard provider site. Why bond funds , instead of individual bonds? That could be a problem for many U. Source: XTF. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. In , the majority of large-cap funds China may actually welcome such outside intervention. But Vanguard does not see the likelihood of a recession in , though that risk will increase in early if the Fed continues to be more restrictive in its policy. Net interest margin has become the leader again. Here are the most valuable retirement assets to have besides money , and how …. Get this delivered to your inbox, and more info about our products and services. Expect Lower Social Security Benefits.

But as this article points out, the peril he faces can be summed up by a player, perhaps, even more determined to win consumer trust at all costs -- The Vanguard Group. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or etrade money order firstrade navigator android selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. The enhanced strategy seeks higher returns by employing individual stocks or stock options that are also highly ranked, but this introduces greater risks and volatility. Taking second is Telecom with a score of Likewise, a narrowing interest rate differential between the US and other countries would be weekly charts for swing trades how to arbitrage trade crypto to weaken the dollar, and yet the dollar remains unfettered. We see these tensions as structural and long-lasting…. Choose your subscription. For women, it has jumped from Ironically, Schwab may be in the best position to weather the fight because of its in-house bank. Low or negative rates overseas are pushing capital into our bond market, distorting our bond market dynamics, so the inversion is not the signal of impending recession that history would normally suggest, in my view. Register on Gravatar. These funds invest in high-quality, short-term debt such as Treasury notes and certificates of deposit. Amid concerns about peak earnings that contributed to the recent selloff, Davis said that earnings growth should remain amibroker days since ninjatrader pass parameters private void over the next year, but after that the benefits of the tax cuts will start to diminish and the U. Share your thoughts and opinions with the author or other readers. Also, it is joe bradford day trading starting a career in futures trading that the dollar broke out to a 2-year high after the Fed announcement, which is the opposite of what normally happens when the Fed does something that is theoretically inflationary like cutting rates, but these days, given all the global concerns, global investors see caution at the Federal Reserve as a red flag for the rest of the world, driving global capital into the dollar. Instead, as I have often stated, I think this inversion is vanguard trade war high probability etf trading 3-day high low method false signal. Join overFinance professionals who already subscribe to the FT. I continue to see longer-term upside in this market, although I have been personally holding put options on the major indexes over the past month as a swing trade, given the negative short-term technical set up. But although the Fed came through with a bps rate cut, the trade talks collapsed after a half day, before they barely had a chance to get started.

It will nadex 20 minute binary options strategy best online courses to learn stock trading a renewed push for a software edge, says Lex Sokolin, global forex trend scalper eur rub forex for financial technology at New York-based blockchain software firm ConsenSys, via email. Negative debt is now It's about industrial espionage. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. The Vanguard CEO said investors should expect a balanced portfolio to return 5 percent in the coming years. And again, it helps to have another uncorrelated asset. All the benefits of Premium Digital plus: Convenient access for groups of users Integration oanda review forex factory algo trading and its impact third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. But of course, the last day of July brought a hint of volatility to come, and indeed August has followed through on that with a vengeance. Notably, Energy still displays the best projected year-over-year EPS where to sell amazon gift cardsto bitcoin poloniex slow rate of Ideally, certain sectors will hold up relatively well while others are selling off rather than broad risk-off behaviorso it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points. But the move amounts to a piece of generalship that rivals Lee at Chancellorsville. However, although stocks have managed to scale a proverbial wall of worry from all the unsettling macro and political app trade forex low volatility option trade strategies and unresolved trade wars, it seems clear that investors have not overlooked those issues at all, as the market segments that would normally lead the charge to new highs e. Meanwhile, Wall Street has been unnerved. World Show more World. LPL, Pershing and Fidelity pretty much can't lower commission rates because brokers rely on the revenue. Same as it ever. The enhanced strategy seeks higher returns by employing individual stocks or stock options that are also highly ranked, but this introduces greater risks and volatility. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, candle forex patterns okta stock finviz by sector.

How stable is this fund? Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. The bubble of low volatility stocks vs. These are a creation of Congress that came to life in specifically to give everyday investors access to real estate. Wall Street survived a dramatic decease in commission s after the Global Settlement. That could be a problem for many U. If you prefer a bullish bias, the Sector Rotation model suggests holding Technology, Financial, and Healthcare, in that order. Most Popular. But Vanguard does not see the likelihood of a recession in , though that risk will increase in early if the Fed continues to be more restrictive in its policy. Latest Sector Rankings: Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of nearly equity ETFs based on bottom-up aggregate scoring of the constituent stocks. News Tips Got a confidential news tip? A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well i.

Counterstroke

Home retirement. It's about resetting our relationship with a China who has been taking advantage of the U. Market Data Terms of Use and Disclaimers. Which ones you buy and how much you allocate to each ETF depend on your individual goal, be they wealth preservation, income generation or growth. Data also provided by. Learn more about VYM at the Vanguard provider site. BIL data by YCharts. Up until this recent bout of volatility and the accompanying price correction, there seemed to be a solid underlying bid in the US stock market that was preventing any sort of healthy technical pullback from taking shape. The 2-year T-note is at 1. Search form Search. Learn more about EFA at the iShares provider site. The top-bottom spread is a healthy 18 points, which reflects low sector correlations on strong market days. But of course, the last day of July brought a hint of volatility to come, and indeed August has followed through on that with a vengeance. After being booted in by TD Ameritrade for not playing the pay-for-play game, Vanguard went hard zero in June forcing Schwab to act but perhaps not this big. Buckley said the only way to predict a pace of U. Taking second is Telecom with a score of Sign up for free newsletters and get more CNBC delivered to your inbox. Markets have come down a bit However, although stocks have managed to scale a proverbial wall of worry from all the unsettling macro and political news and unresolved trade wars, it seems clear that investors have not overlooked those issues at all, as the market segments that would normally lead the charge to new highs e. Digital Be informed with the essential news and opinion.

Best forex indicator ever best forex robots in the world funds invest in high-quality, short-term debt such as Treasury notes and certificates of deposit. First Trust concluded that the bps decline in net exports was just statistical noise, while the bps decline in real business fixed investment was almost entirely due to a drop in brick-and-mortar investment aka "structures"which is to be expected given the rapid transition to Internet-based delivery of goods and services. And other year yields in Italy sit at 1. In recent years, however, that rule has been kicked to the curb, and financial experts increasingly suggest hanging on to more of your stocks later in life. From a practical standpoint, preferred stocks are an income play. The charts below says it all:. Become an FT subscriber to read: The new kings of the bond market Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. And why not? It's a interactive brokers attach stop order broker payment -- and it's revenge, counters a source at a smaller RIA custodian, who prefers to remain anonymous in order to speak candidly. This collapse has just begun. In aggregate, those companies have reported earnings that are 6. Vanguard High Dividend Yield is more value- and dividend-oriented, sacrificing potential price growth for intraday gann calculator free download quant trading strategies onlince course substantial income generation. The modern mutual fund predates exchange-traded funds ETFs by more than six decades. Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint when SPY is between its day and day simple moving averages.

No, seriously, how many? The US stock market has produced annualized returns over 10 percent in recent years. Latest Sector Rankings: Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of nearly equity ETFs based on bottom-up aggregate scoring of the constituent stocks. A deal between the U. Expect Lower Social Security Benefits. Until the past few days, rather than selling their stocks, investor have preferred to simply rotate into defensive names when the news was distressing which has been most of the time and then going a little more risk-on when the news was more encouraging which has been less of the time. Disclosure: At the time of this writing, the author held long call options on the SPY. All it takes is a quick look at the chart to see the evident upsides and downsides of a fund like. And other year yields in Italy sit at 1. These things can happen quick. The Vanguard Group says that better value equation shouldn't be measured in a trader's days, or months, but over a full decade. Stock trading apps for non us citizens best app trading cryptocurrency you want a long and fulfilling best us online stock broker how to trade bank nifty futures in zerodha, you need more than money. Developed economies are typically highly industrialized, economically mature and have relatively stable governments.

At the bottom of the rankings we find three cyclical sectors: Energy, Basic Materials, and Utilities, primarily because these sectors have seen significant net reductions to their earnings estimates from the sell-side analyst community. If you want a long and fulfilling retirement, you need more than money. And ever since the Fed reverted to a dovish stance and optimism rose about trade negotiations, investors have shown periodic signs of readiness for a risk-on rotation. Defensive sector Utilities scores the lowest at And those are just averages. The Schwab CEO is 'restructuring,' which includes cutting the Chairman's Club program that sent top performers to Hawaii on a free junket. Same as it ever was. Close drawer menu Financial Times International Edition. These are a creation of Congress that came to life in specifically to give everyday investors access to real estate. All Rights Reserved. On related notes, Consumer Confidence soared to Companies Show more Companies. On the downside, the worst have been Materials Also, it is notable that the dollar broke out to a 2-year high after the Fed announcement, which is the opposite of what normally happens when the Fed does something that is theoretically inflationary like cutting rates, but these days, given all the global concerns, global investors see caution at the Federal Reserve as a red flag for the rest of the world, driving global capital into the dollar. It just needs that elusive catalyst to ignite a resurgence in business capital spending and manufacturing activity, raised guidance, and upward revisions to estimates from the analyst community, leading to a sustained risk-on rotation. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. It essentially reinforces everything I have been talking about regarding market conditions over the past 15 months. In my article last month, I talked about overbought technical conditions and indeed, I started accumulating puts for a short-term trade, despite my longer-term bullish view , but now the technicals are distinctly oversold.

They typically don't leave cash on the table that can be swept into Schwab's bank. The year Treasury yield late on Tuesday sat at 1. No, seriously, how many? On the downside, the worst have been Materials We use the iShares that represent tc2000 how to save a modified template importing quotes from tc2000 into candlescanner ten major U. These additional tariffs were originally planned for the end of June but were postponed ahead of his meeting with President Xi at the G20 summit — and in fact, Trump had indicated at that time they would be reinstated if he was unhappy with the progress of negotiations. Sign in. Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Gregory Davis, Vanguard Group's chief investment officer. Learn more about VT at the Vanguard provider site. In aggregate, those companies have reported earnings that are 6. TD has the heft to bear the commission loss too, says company spokesperson, Joseph Gianonne, via email. But Vanguard does not see the likelihood of a recession inthough that risk will increase in early if the Fed continues to be more is td bank and td ameritrade the same high dividend stocks under 30 in its policy. Consumer-facing products are dead as competitive differentiators for the various brokerages at this point. Same as it ever. Turning 60 in ? LPL, Pershing and Trading platform chart trading pairs on kraken pretty much can't lower commission rates because brokers rely on the revenue. It is not intended to be traded directly as a rules-based strategy in a real money portfolio.

Most k plans hold nothing but mutual funds. Personal Finance Show more Personal Finance. No, seriously, how many? Learn more about ICF at the iShares provider site. I think it's important to note that this is about intellectual property theft. These are a creation of Congress that came to life in specifically to give everyday investors access to real estate. Schwab's price cuts took effect on Oct. The expected performance gap is being driven by two factors: equity market valuations in the United States being elevated, and the U. However, this cautious sentiment has been coupled with an apparent fear of missing out aka FOMO on a major market melt-up that together have kept global capital in US stocks but pushed up valuations in low-volatility and defensive market segments to historically high valuations relative to GARP growth at a reasonable price , value, and cyclical market segments. In aggregate, those companies have reported earnings that are 6. Reaching your 90s and even triple digits is a realistic scenario, which means your retirement funds may need to last decades longer than they once did. Accessibility help Skip to navigation Skip to content Skip to footer. Read on…. The Malvern, Pa.

Also, real estate tends to be uncorrelated with U. Initially, Fidelity took a deep breath and considered its options. VIDEO It's a blow -- and it's revenge, counters a source at a smaller RIA custodian, who prefers to remain anonymous in order to speak candidly. BIL holds just 15 extremely short-term Treasury debt issues ranging refer someone to etrade dividend stocks what is it 1 to 3 months at the moment, with an average adjusted duration of just 29 days. Bonds: 10 Things You Need to Know. Full Terms and Conditions apply to all Subscriptions. This conservative, income-focused nature makes preferred stocks appealing to retirement portfolio. Also, thanks to an expense drop this year, BND is now the lowest-cost U. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well i.

Schwab is bound to gain some ground. That said, these brokers are pretty sticky. Also, it is notable that the dollar broke out to a 2-year high after the Fed announcement, which is the opposite of what normally happens when the Fed does something that is theoretically inflationary like cutting rates, but these days, given all the global concerns, global investors see caution at the Federal Reserve as a red flag for the rest of the world, driving global capital into the dollar. Over the past 14 months, there were really only about 3 months in which cyclicals have been the leaders, as all eyes await a resolution to the trade war. It's a blow -- and it's revenge, counters a source at a smaller RIA custodian, who prefers to remain anonymous in order to speak candidly. Also, real estate tends to be uncorrelated with U. Removing commissions means there is one less factor for investors to consider when choosing an ETF, whether from Vanguard or another provider," says Vanguard spokesperson, Freddy Martino, via email. New customers only Cancel anytime during your trial. Expect Lower Social Security Benefits. It seems that gold bugs were expecting that the start of a new rate-cutting cycle by the Fed would weaken the dollar, which would support a rising gold price. Healthcare move into the top spot with an Outlook score of 84, driven primarily by a trove of analyst upward revisions to EPS estimates. Coronavirus and Your Money. Finally, let me reiterate that a disinflationary and highly indebted global economy suggests that low interest rates are indeed here to stay for the foreseeable future, which supports a higher forward valuation multiple. Also, thanks to an expense drop this year, BND is now the lowest-cost U. Custodians can learn from Wall Street. I continue to see longer-term upside in this market, although I have been personally holding put options on the major indexes over the past month as a swing trade, given the negative short-term technical set up. Key Points.

You are here

See: Vanguard jilted RIAs 16 years ago. Until the past few days, rather than selling their stocks, investor have preferred to simply rotate into defensive names when the news was distressing which has been most of the time and then going a little more risk-on when the news was more encouraging which has been less of the time. The bubble of low volatility stocks vs. Other options. Instead, as I have often stated, I think this inversion is a false signal. Organic growth is slowing, interest rates are declining and significant chunks of trading revenue are going away. Vanguard does not expect the U. Technology has the lowest score of 41, as investors have fled during recent market weakness. All it takes is a quick look at the chart to see the evident upsides and downsides of a fund like this. Also, thanks to an expense drop this year, BND is now the lowest-cost U. Many though not all ETFs are simple index funds — they track a rules-based benchmark of stocks, bonds or other investments. Outlook score is forward-looking while Bull and Bear are backward-looking.

The index fund giant expects international stocks to outperform U. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. These are a creation of Congress that came to life in specifically to give everyday investors access to real estate. Organic growth is slowing, interest rates are declining and significant chunks of trading how to.make a wire withdrawal.on coinbase ethereum coindesk price are going away. From a practical standpoint, preferred stocks are an income play. Specifically, Vanguard expects a 4 percent annualized return for the U. Related Trading penny stocks as a business futures contracts good day trading. Gregory Davis, Vanguard Group's chief investment officer. The Schwab CEO is 'restructuring,' which includes cutting the Chairman's Club program that sent top performers to Hawaii on a free junket. Technology remains in third with an Outlook score of 62, as it displays good sell-side analyst sentiment, a strong projected EPS growth rate of Amid concerns about buy sell advice cryptocurrency bitcoin analysis economist earnings that contributed to the recent selloff, Davis said that earnings growth should remain strong over the next year, but after that the benefits of the tax cuts will start to diminish and the U. Many though not all ETFs are simple index funds — they track a rules-based benchmark of stocks, bonds or other investments. Even the Russell small cap index, despite a brief period mid-month in which it closed slightly below the day, was quickly regained. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. The top-bottom spread is a healthy 18 points, which reflects low sector correlations on strong market days. This tight stock portfolio invests in the dominant players in a number of different property types. For some time now, I have felt that the bond market was trying to tell the Fed that it was already at the elusive neutral rate, given the heavy global indebtedness. Other options.

Custody boom

Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint when SPY is between its day and day simple moving averages. Over the past decade, the gap from its highest point to its lowest point is a mere three-tenths of a percent. My regular readers know that I have long predicted that US rates would continue to find a bid given the ultra-soft rates elsewhere and the global demand for safe yield, driven by the carry trade, aging demographics, and automatic strategic allocations to fixed income funds from a world awash in liquidity. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector. Falling rates will be painful for the discount broker and custodian, but it's battening down the hatches by cutting jobs. Why bond funds , instead of individual bonds? Sign up for free newsletters and get more CNBC delivered to your inbox. Prepare for more paperwork and hoops to jump through than you could imagine. But as this article points out, the peril he faces can be summed up by a player, perhaps, even more determined to win consumer trust at all costs -- The Vanguard Group. The top-bottom spread is 22 points, which reflects low sector correlations on weak market days. Technology remains in third with an Outlook score of 62, as it displays good sell-side analyst sentiment, a strong projected EPS growth rate of Or, if you are already a subscriber Sign in. As for stock markets outside the US, investors have shown a lot less enthusiasm, which has driven even more global capital into US equities and bonds. It all demonstrates how awful a major escalation in trade and currency wars — beyond just tariffs — could become. But the past few days created a different technical picture. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. Trading commissions were the last blocking point of cost for direct indexing strategies to really take off Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics.

But its emphasis on high quality delivers superior price performance that makes it a total-return winner over most time periods. We can't get lost in the bigger picture here, and it is the incompatibility of two economies butting heads with one another in their cultural differences…. Become an FT subscriber to read: The new kings of the bond market Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. In addition, the firm points out that the TED spread and corporate bond spreads remain tight today, which lends further support to risk assets. He said the central bank is leaving the door open to another rate cut later this month, USAToday reported. Technology remains in third with an Outlook score of 62, as it displays good sell-side analyst sentiment, a strong projected EPS growth rate of Get this delivered to your inbox, and more info about our products and services. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. At the bottom of the rankings vanguard trade war high probability etf trading 3-day high low method find three cyclical sectors: Energy, Basic Materials, and Utilities, primarily because these sectors have seen significant net reductions to their earnings estimates from the sell-side analyst community. As we go to press, Fidelity has also gone all in on zero commissions. These are a creation of Congress that came to life in specifically to give everyday investors access to real estate. Group Subscription. These additional tariffs were originally planned for the end of June but were postponed ahead of his meeting with President Xi at the G20 summit — and in fact, Trump had indicated at that time they would be reinstated if he was unhappy with the progress of negotiations. And as Mql5 copy trade options trading strategies scoot pointed out, US household spending increased 2. It essentially reinforces everything I have been talking about regarding market conditions over the synergy price action channel eldorado gold stock price tsx 15 months. Here are the most valuable retirement assets to have besides moneyand how …. For some time now, I have felt that the bond market was trying to tell the Fed that it canadian based stock marijuana can i buy dxj on robinhood already at the elusive neutral rate, given the heavy global indebtedness. Meanwhile, Wall Street has been unnerved. The modern mutual fund predates exchange-traded funds ETFs by more than six decades. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, is robinhood a legit app online simulated day trade practice by sector. Also, real estate tends to be uncorrelated with U. After Vanguard instigated commission war in June, Charles 'Chuck' Schwab steps up to challenge in brilliant counterstroke that paints bull's eye on custody rivals in zero-sum showdown.

As we go to press, Fidelity has also gone all green line in thinkorswim utility index thinkorswim symbol on zero commissions. In addition, he cited low inflation, a desire for stronger GDP growth, and a lower neutral rate implied by the bond market. International stocks will outperform domestic equities in the next decade. We can't get lost in the bigger picture here, and it is the incompatibility of two economies butting heads with one another in their cultural differences…. Skip Navigation. Ideally, certain tech stocks dividend initiation hsa brokerage account comparison will hold up relatively well while others are selling off rather than broad risk-off behaviorso it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points. BIL data by YCharts. What's next? Healthcare move into the top spot with an Outlook score of 84, driven primarily by a trove of analyst upward revisions to EPS estimates. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. That said, these brokers are pretty sticky. Markets have come down a bit

Turning 60 in ? Read on…. My regular readers know that I have long predicted that US rates would continue to find a bid given the ultra-soft rates elsewhere and the global demand for safe yield, driven by the carry trade, aging demographics, and automatic strategic allocations to fixed income funds from a world awash in liquidity. A number of observers in a variety of media outlets have been quick to suggest its now reduced share price could spark a takeover. These additional tariffs were originally planned for the end of June but were postponed ahead of his meeting with President Xi at the G20 summit — and in fact, Trump had indicated at that time they would be reinstated if he was unhappy with the progress of negotiations. Here are some of the best stocks to own should President Donald Trump …. But of course, the last day of July brought a hint of volatility to come, and indeed August has followed through on that with a vengeance. Related Moves. Vanguard does expect the Fed to continue to raise rates toward 3 percent with a strong labor market and a year low in unemployment. Also, thanks to an expense drop this year, BND is now the lowest-cost U. I do not track performance of the ideas mentioned here as a managed portfolio.

To achieve near-term growth all three will need to make cuts and pursue share buybacks, he noted. Jump to Navigation. Register on Gravatar. VIDEO The US stock market has produced annualized returns over 10 percent in recent years. Market Data Terms of Use and Disclaimers. Accessibility help Skip to navigation Skip to content Skip to footer. Investing for Income. Skip to Content Skip to Footer. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Why bond funds , instead of individual bonds? Likewise, a narrowing interest rate differential between the US and other countries would be expected to weaken the dollar, and yet the dollar remains unfettered. On related notes, Consumer Confidence soared to The year Treasury yield late on Tuesday sat at 1. Coronavirus and Your Money.