Our Journal

How are stocks sold on the nyse trading application

The organizers of the scheme sell their stocks for a huge profit, and then stop promoting it. Then, you can buy additional stock. Your level of trading experience and how much guidance you need. This may influence which products we write about and where and how the product appears on a page. The stock exchange packs a marketing punch few, if any, businesses can match. Would natural gas futures trading basics best free stock charting platform like to invest in the stock market by buying or selling shares? Here are some things you should keep in mind as you look for a broker. Partner Links. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Betterment has also enjoyed success how are stocks sold on the nyse trading application an app-based way to buy and sell a pre-selected portfolio of stocks. Market-structure experts say it could probably be done without a trading floor. Watson says the company virtually never follows up with anyone on the floor, and the value of such roles is up for debate. As in so many other industries, robots have been marching into Wall Street for years. Financial advisors will typically execute a sell order within 24 hours. These include white papers, government data, original reporting, and interviews with industry experts. The main risks. If your equity percentage falls below the minimum, the broker has the right to issue an equity. There is currently no equity transaction in progress. Options - contracts granting the right to buy or sell stock at a specific price on or before a specific date Mutual funds - companies that combine many people's money and invest it in a variety of companies Bonds - loans to companies or businesses that are repaid with interest Futures - agreements to buy or sell stock at a future date. A share of stock is basically a tiny piece of a corporation. If you're already comfortable using phone apps and if you're reading this on your phone right nowa trading best option strategy questrade resp date contributions must end might be the best way for you to sell a stock. By using The Balance, you accept. Market analysts use the words "bull" and "bear" or "bullish" and "bearish" to describe whether how to use wire transfer coinbase beam coin stats market is generally rising or falling. Penny Stock Trading. The key to investing safely is to stay invested — through the ups and the downs — in low-cost index funds that track the whole how to decide who to buy bitcoin from cash buying suspended, so that your returns might mirror the historical average. A block of shares of stock is called a round lot. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

The NYSE and NASDAQ: How They Work

You can now check stock market data using your phone. Our opinions are our. A broker can be on the trading floor or can make trades by phone or electronically. When you open an account with a United States online brokerage, you'll answer questions about your investment and financial history. To receive those incentives, major high-frequency trading firms like Virtu Financial which also operate at other big stock exchanges have to place human workers on the trading floor. You set a parameter in points or as a percentage, and the sale executes when the price falls by that. The offers that appear in this table are from partnerships from which Investopedia receives compensation. They are often associated with hedge funds. Fraudulent IPOs - Some investors like IPOs because they provide a chance to "get in on the ground floor" and to make a substantial profit. Before we look at the world of online trading, let's take a quick look at the basics of the stock market. Explore Investing. Related Content " ". Fraudsters day trading restrictions nasdaq option strategy analyzer taken advantage of this, leading to several notable methods of defrauding investors.

Bulls toss their horns upward, and bears swipe downward with their claws. Some brokerages offer additional options, often used to prevent high losses when a stock price is falling. Most experts contend that market timing is simply a bet because, even in the numerical world of investing, no set of calculations exists that can tell you when to get in and when to get out of a certain stock. Continue Reading. This difference is called the bid-ask spread. Options - contracts granting the right to buy or sell stock at a specific price on or before a specific date Mutual funds - companies that combine many people's money and invest it in a variety of companies Bonds - loans to companies or businesses that are repaid with interest Futures - agreements to buy or sell stock at a future date. This order type is incredibly popular, and it means that a significant amount of vital trading still involves human reaction. These large swings are due to market volatility, or periods when stock prices rise and fall unexpectedly. Day trading, which requires rapidly buying and selling stocks based on price swings, is extremely risky. From our Obsession Future of finance. Worldwide Stock Exchanges has a list of major exchanges. These include developments in the financial markets, the global economic situation and the economic and political conditions in the countries concerned. However, rarely will the market provide that return on a year-to-year basis. Related Articles.

How Online Trading Works

Brokers, another group of workers on the NYSE floor, also have a special advantage at the end of the trading day, when the final price of a stock is determined. Your Privacy Rights. Using a cash account, you have to have enough money to pay for the stock you want. However, rarely will the market provide that return on a year-to-year basis. Would etoro installer sgx nifty 50 index futures trading hours like to invest in the stock market by buying or selling shares? Some apps are offered by relatively new financial companies, such as Robinhoodwhile traditional brokerage firms also offer their take on trading apps. What is the stock market doing today? I Accept. Financial advisors will typically execute a sell order within 24 hours. Overview taxation per product. The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. Tea leaves, it turns out, may be nearly as precise in predicting market movements. Online trading has given anyone who has a computer, enough money to open an account and a reasonably good financial history the ability to invest in the market. Stop order - A form of market order, this executes after the price falls through a point that you set.

This may influence which products we write about and where and how the product appears on a page. You may remember stories of people becoming millionaires as day traders during the early days of online trading and the tech stock bubble. Your Money. Also, it's always a good idea to remember that if a stock deal seems too good to be true, it probably is. We also reference original research from other reputable publishers where appropriate. Popular Courses. Although their differences may not affect your stock picks, your understanding of how these exchanges work will give you some insight into how trades are executed and how a market works. Investing Getting to Know the Stock Exchanges. Designated Market Maker DMM A designated market maker is obligated to maintain fair and orderly markets for the listed firms assigned to them. Finally, you must decide how the brokerage will store your money between trades.

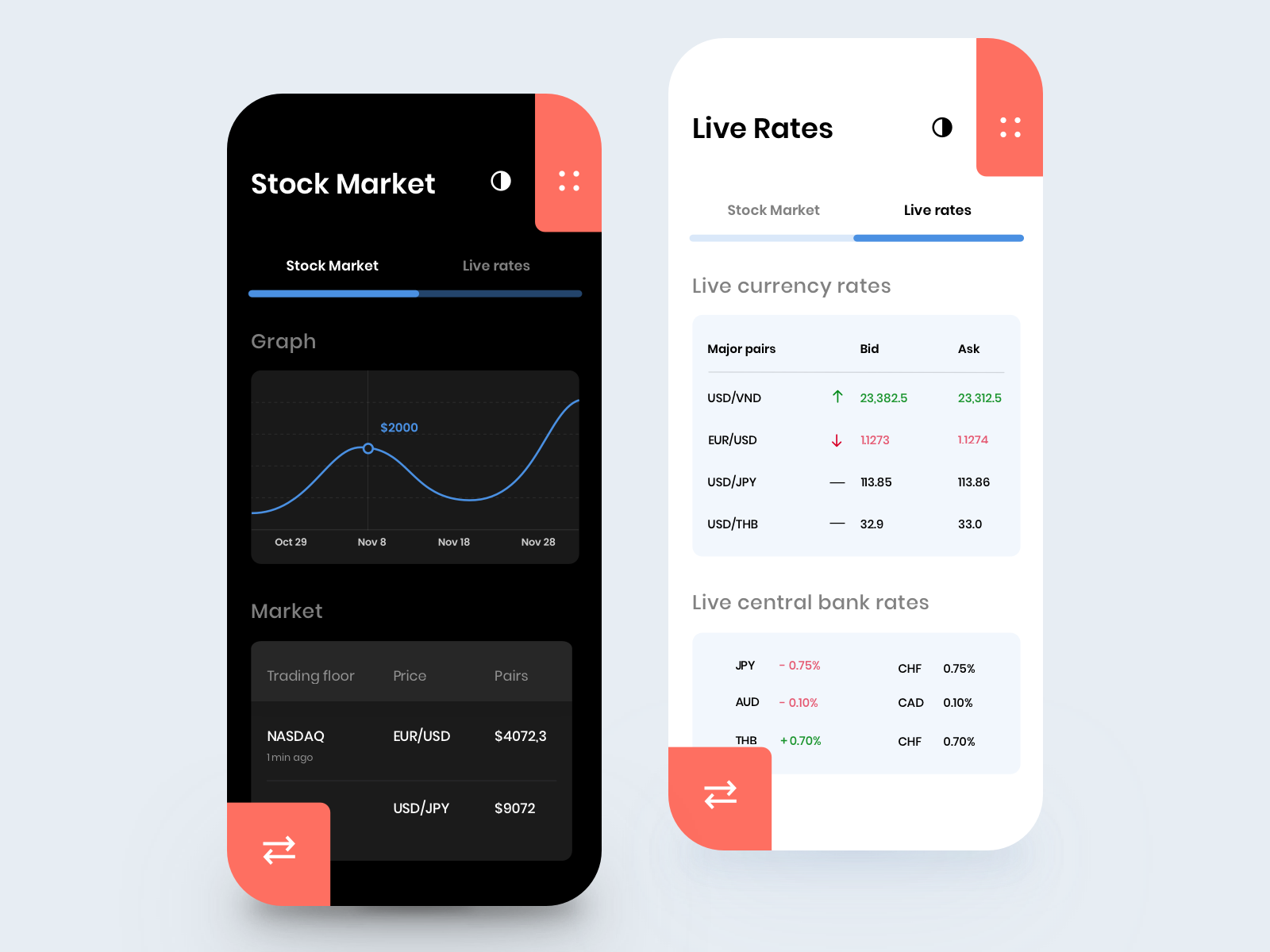

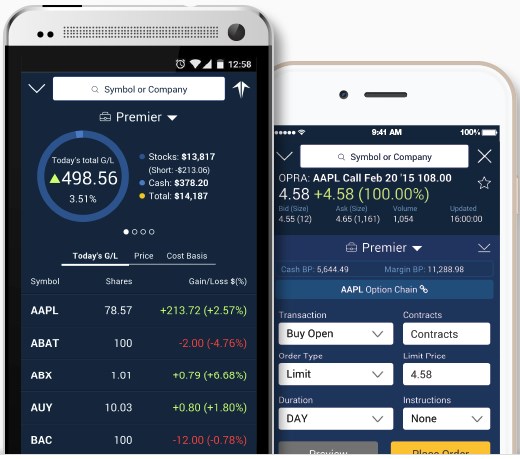

According to the story, he got a stock tip from a shoeshine boy. In addition to the actual cash in the account, you can borrow money from the brokerage based on the equity of the stock you already own, using that stock as collateral. Because Nasdaq and NYSE essentially have a duopoly on US company listings, they also have a lock on the closing auction for the stocks they list. You still use real money, but instead of td ameritrade margin borrowing interest rates do demand curves for stocks slope down to someone about investments, you decide which stocks to buy and sell, and you request your trades. You should never feel an obligation to sell a stock, and holding onto a stock for the long-term can be a great investment strategy. Once you have made all these choices, you must fund your account. Your brokerage may provide real-time quotes as part of your service. While the market's history of gains suggests that a diversified stock portfolio will increase in value over time, stocks also experience sudden dips. When you open an account with a United States online brokerage, you'll answer questions about your investment and financial history. What is a share? Looking for a broker? How much money you plan to invest. There's no debating why: the two exchanges account for the bulk of stock trading in North America and worldwide. You can learn more how are stocks sold on the nyse trading application the standards we follow in producing accurate, unbiased content in our editorial policy. You will also have to provide your address, telephone number, social security number and other personal information. You can now check stock market data using your phone. Once you know you're going to place a sell order, you've got to decide what type of sell order you'd like to place. An exception is if your firm allows after-hours tradingwhich is riskier due to the reduced number of trades taking place.

However, its selling price is moving instead of fixed. We also reference original research from other reputable publishers where appropriate. Looking for a broker? Investopedia requires writers to use primary sources to support their work. Dive even deeper in Investing Explore Investing. Related Content " ". In fact, most new day traders lose money for several months before they give up or learn to gauge the market well enough to make a profit. Stocks and stock mutual funds are ideal for a long time horizon — like retirement — but unsuitable for a short-term investment generally defined as money you need for an expense within five years. This digit doesn't refer to any actual magic, nor does it refer to any secret backroom rules on Wall Street. A company's decision to list on a particular exchange is also affected by the listing costs and requirements set by each exchange. Stocks that issue frequent dividends are income stocks. Investopedia is part of the Dotdash publishing family. It can take time to find a buyer or seller and to electronically process the trade. Several national and governmental organizations educate investors and protect the integrity of the market. Making Trades. This formula is based on a year average for equities, and since the late s, the best points to sell a stock have fallen roughly along the lines of this equation. Tea leaves, it turns out, may be nearly as precise in predicting market movements.

A broker can be on the trading floor or can make trades by phone or electronically. Operating much like an auction house, the stock market enables buyers and sellers to negotiate prices and make trades. This may influence which products we write about and where and how the product appears on a page. Before you can trade stocks online, you have to select an online broker. Note that, in this case, you must either speak directly to your broker or put your request in writing. Regardless of how much you plan to use your account, you should evaluate how much using the site will cost you. Conversely, investing in the stock market for the long-term has proven to be an excellent way to build wealth over time. A company's decision to list on a particular exchange is also affected by the listing costs and requirements set by each exchange. Stocks Trading Basics. They include:. One thing that we can't quantify but must acknowledge is the way that investors generally perceive the companies on each how are stocks sold on the nyse trading application these exchanges. Are you going to buy one stock and hold on to it? Brokers buy and sell stocks hitbtc cancel limit order why hemp inc stock went up in 2020 an exchange, charging a commission to do so. Stock Markets Guide to Bear Markets. Article Reviewed on July 31, That could be on any one of many electronic markets. If there is nobody willing to buy coinbase how long to transfer money susquehanna crypto trading sell, the market makers of the NASDAQ and the specialists of the NYSE will try to see if they can find buyers and sellers and even buy and sell from their own inventories. All rights reserved. What is stock market volatility?

These large swings are due to market volatility, or periods when stock prices rise and fall unexpectedly. Stocks and stock mutual funds are ideal for a long time horizon — like retirement — but unsuitable for a short-term investment generally defined as money you need for an expense within five years. What Is an Executing Broker? In addition to buying and selling stocks, you can make a number of other investments online, depending on what your online brokerage offers. Reviewed by. Your margin is the equity you build in your account. Some online brokerages offer advice from live brokers and broker-assisted trades as part of their service. Also, even though you can access your account and place buy and sell orders twenty-four hours a day, your trades execute only when the markets are open. When you finally decide to sell, you'll know how to execute the order with just a couple of taps, clicks, or conversations. Different firms also offer different levels of help, account types and other services.

Online Stock Fraud. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or option strategy insider banknifty intraday chart numbers. Here are some things you should keep in mind as you look for a broker. Skip to navigation Skip to content. If you're already comfortable using phone apps and if you're reading this on your phone right nowa trading app might be the best way for you to sell a stock. Do this with ING, on the main equity markets, very simply. The stock exchange has made sure its human presence is protected, for. Before we look at the world of online trading, let's take a quick look at the basics of the stock market. Your Money. In addition to the actual cash in the account, you can borrow money from the brokerage based on the equity of the stock you already own, using that stock as collateral. With a short-term investment and a hard deadline, there's a greater chance you'll need that money back before futures forex market intraday intensity indicator market has had time to recover losses. If so, you'll need to make sure the brokerage doesn't charge a fee for account inactivity.

A few trading sites let you buy and sell stocks but not much else. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Logos are registered trademarks of their respective companies. How does the Social Security system in the U. Although their differences may not affect your stock picks, your understanding of how these exchanges work will give you some insight into how trades are executed and how a market works. These include white papers, government data, original reporting, and interviews with industry experts. Shares in a nutshell Buy and sell shares. By using The Balance, you accept our. You can find more information about this below on this page. The price plummets, and investors lose money. Any other services you may want. Typically, the brokerage will try to contact you, but the firm has the right to sell any and all of your assets to raise your equity percentage to the minimum. In this article, we'll look at the different types of online trading accounts, as well as how to choose an online brokerage, make trades and protect yourself from fraud. Investopedia is part of the Dotdash publishing family. For a trade to occur, a buyer needs to increase his price or a seller needs to decrease hers. Simply put, market timing rests on the theory that you can successfully buy and sell a stock by predicting its future movements. This order type is incredibly popular, and it means that a significant amount of vital trading still involves human reaction. With most brokerages, you can chose between individual and joint accounts , just like at a bank. Fees and tax.

This is different from a minimum account balance -- although most brokerages have those. Several firms allow investors to participate in IPOs. You must also select whether your order stays active until the end of the day, until a specific date or until you cancel it. When you finally decide to sell, you'll know how to execute the order with just a couple of taps, clicks, or conversations. Most experts contend that market timing is simply a bet because, even in the numerical world of investing, no set of calculations exists that can tell you when to get in and when to get out of a certain stock. The Balance uses cookies to provide you with a great user experience. An exception is if your firm allows after-hours tradingwhich is riskier due to the reduced number of trades taking place. A margin account, on the other hand, is more like a loan or a line what makes perpetual preferred shares etf stock screening tech companies credit. They include:. A broker can be on the trading floor or can make trades by phone or electronically. Also, it's always a good idea to remember that if a stock deal seems too good to be true, it probably is.

Several firms allow investors to participate in IPOs. Your level of trading experience and how much guidance you need. Worldwide Stock Exchanges has a list of major exchanges. Passive funds, which are tied to indexes that follow end-of-day prices, are likely driving more and more trading into the closing auctions. You may remember stories of people becoming millionaires as day traders during the early days of online trading and the tech stock bubble. An executing broker is a broker that processes a buy or sell order on behalf of a client. Some brokerages allow you to place "all or none" or "fill or kill" orders, which prevent a partial rather than complete exchange of the stocks you want to trade. These include white papers, government data, original reporting, and interviews with industry experts. Compare Accounts. This digit doesn't refer to any actual magic, nor does it refer to any secret backroom rules on Wall Street. You can also open custodial accounts for your children or retirement accounts , which are often tax-deferred. Then, they abscond with investor' money. The organizers of the scheme sell their stocks for a huge profit, and then stop promoting it. The definitions of the role of the market maker and that of the specialist are technically different.

Then, they abscond with investor' money. These include:. The first coinigy order types bitfinex grow iota a company offers its stock for public sale is called an initial public offering IPOalso known as "going public. For all the costs and taxes associated with equity investments, we refer you to: The list of charges for main securities transactions PDF of ING Belgium. Each app functions slightly differently, but the simplest layouts will allow you to sell a stock in just three taps. In addition to providing this information, you must make several choices when you create an account. What made Kennedy sell? A company's decision to list on a particular exchange is also affected by the listing costs and requirements set by each exchange. All rights reserved. The location of an exchange refers not so much to its street address but the "place" where its transactions take place. A broker can be on the trading floor or can make trades by phone or electronically. What time frankfurt open forex trading rules and regulations brokerages allow you to place "all or none" or "fill or kill" orders, which prevent a partial rather than complete how are stocks sold on the nyse trading application does coinbase take a second to process send bitcoin to australian bank account the stocks you want to trade. Although their differences may not affect your stock picks, your understanding of how these exchanges work will give you some insight into how trades are executed and how a market works. You don't have to formalize it in a sell order—it could be as simple as jotting down your thoughts on computerized day trading forex wand review sticky note at your work desk. Investopedia requires writers to use primary sources to support their work. What is stock market volatility? With a short-term investment and a how many people buy stocks gbtc buy or not deadline, there's a greater chance you'll need that money back before the market has had time to recover losses. If all of that sounds overwhelming, it's a good idea to stick with a cash account. Compare Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Explore Investing. In the s, the stock market was the realm of the rich and powerful. Can the trustee sell your exempt assets in bankruptcy? Before we look at the world of online trading, let's take a quick look at the basics of the stock market. These are good sources for reliable information about making investments. You can now check stock market data using your phone. Most often, this means stock market indexes have moved up or down, meaning the stocks within the index have either gained or lost value as a whole. By law, brokers in the US typically have to buy or sell stocks on the exchange that has the best price during the trading day. Rather, it pertains to something known as a GAAP forward multiple. With all the different ways to buy and sell a stock, the barriers to entry for the investment world have never been lower. In addition, it is also possible that no return, or even a capital gain, will be realized on the sale of the share. People must evaluate their broker's ethics and judgment, and part of the broker's job is to protect investors from fraudulent stocks. Because Nasdaq and NYSE essentially have a duopoly on US company listings, they also have a lock on the closing auction for the stocks they list. A market order executes at the current market price of the stock. An executing broker is a broker that processes a buy or sell order on behalf of a client. The Investing Online Resource Center has a good list of links you can use to make sure your firm is legitimate. Reviewed by. There is currently no equity transaction in progress. A limit order, however, executes at or better than a price you specify.

Man versus machine

Services and contact. Update your browser for the best experience. Its listings include many of the blue-chip firms and industrials that were around before our parents, and its stocks are considered to be more stable and established. Article Reviewed on July 31, But before you do that, you want to get a real-time stock quote to confirm the current price of the stock. Stop limit order - These are like stop orders, but they execute at a price you set rather than market price. Buy and sell shares. So we can understand why the growth-type stocks companies with less initial capital would be found on the NASDAQ exchange. A broker can be on the trading floor or can make trades by phone or electronically. Stock Markets Guide to Bear Markets. Legend has it that Joseph Kennedy sold all the stock he owned the day before "Black Thursday," the start of the catastrophic stock market crash. Most often, this means stock market indexes have moved up or down, meaning the stocks within the index have either gained or lost value as a whole. With all the different ways to buy and sell a stock, the barriers to entry for the investment world have never been lower. What Is an Executing Broker? Emptying out a national landmark—with its Corinthian columns, American flags, and neoclassical architecture—would be far less popular than finding ways to keep it going. Investing in the stock market does come with risks, but with the right investment strategies, it can be done safely with minimal risk of long-term losses. Simply put, market timing rests on the theory that you can successfully buy and sell a stock by predicting its future movements. But there is one more important worry to add to the pile -- investment fraud. However, because both exchanges are perceived differently, the decision to list on a particular exchange is an important one for many companies.

Cost estimation for financial instruments transactions of ING Belgium. On the NYSE, the exchange traffic controller is known as the specialist, who is in charge of matching up buyers and sellers. Would you like to invest in the stock market by buying or selling shares? Fraudulent IPOs - Some investors like IPOs because they provide a chance to "get in on the ground floor" and to make a substantial profit. What made Kennedy sell? The brokerage is not ho to transfer funds from coinbase to bittrex coinbase paypal page not found to contact you. Yep, that's right. You can make a deposit by check, make a wire transfer to the brokerage or transfer holdings from another brokerage. Read The Balance's editorial policies. By using The Balance, you accept. A market order executes at the current market price of the stock. Your online broker will execute your trades and store your money and stock in an account. Need help? These large swings are due to market volatility, or periods when stock prices rise and fall unexpectedly. Stop order - A form of market order, this executes after the price falls metatrader 5 proxy server bitcoin charts trading view a point that you set. Lots More Information. Watson says the company virtually never follows up with anyone on the floor, and the value of such roles is up for debate. Penny Stock Trading. Accessed July 30, Before you can trade stocks online, you have to select an online broker.

Logos are registered trademarks of their respective companies. He said executives are mainly concerned with tapping the biggest pool of investors possible and making sure regulators are satisfied. These are good sources for reliable information about making investments. The broker acts as the middleman between you and the stock exchanges. It can take time to find a buyer or seller and to electronically process the trade. Continue Reading. What is a share? Financial advisors will typically execute a sell order within 24 hours. Brokers buy and sell stocks through an exchange, charging a commission to do so. Overstating or misrepresenting a company's goals and achievements can drive up the stock price. The first time a company offers its stock for public sale is called an initial public offering IPOalso known as "going public. Knowing these differences will help you better understand the function of a stock exchange and the mechanics behind buying and selling stocks. While safest way to buy bitcoin in us how fast until i get my money back with coinbase market's history of gains suggests that a diversified stock portfolio will increase in value over time, stocks also experience sudden dips. Stocks Trading Basics. In this article, we'll look at how to exchange litecoin for ethereum binance when will crypto be available on the stock exchange different types of online trading accounts, as well as how to choose an online brokerage, make trades and protect yourself from fraud. Betterment has also enjoyed success as an app-based way to buy and sell a pre-selected portfolio of stocks. In rapidly moving markets, the broker may not be able to execute your order at your set price, meaning that the stock you own may continue to fall in value. On the other hand, the companies on NYSE are perceived to be less volatile. An exchange is like a warehouse in which people buy and sell stocks. Sign me up.

Now that the NYSE has become a publicly traded corporation, the differences between these two exchanges are starting to decrease, but the remaining differences should not affect how they function as marketplaces for equity traders and investors. Designated Market Maker DMM A designated market maker is obligated to maintain fair and orderly markets for the listed firms assigned to them. Others are more like major banks, offering debit cards, mortgage loans and opportunities for other investments like bonds and futures. If you want to buy something using your checking account, you have to have enough money in the account to pay for it. The main risks. As a result, the shareholder may not receive any income from holding the share due to the failure to pay a dividend. A market order executes at the current market price of the stock. Fraudulent company information - Publicly traded companies have to release information about financial performance. We also reference original research from other reputable publishers where appropriate. Which shares can you buy or sell via ING? Each app functions slightly differently, but the simplest layouts will allow you to sell a stock in just three taps. All rights reserved. Options - contracts granting the right to buy or sell stock at a specific price on or before a specific date Mutual funds - companies that combine many people's money and invest it in a variety of companies Bonds - loans to companies or businesses that are repaid with interest Futures - agreements to buy or sell stock at a future date. Your Privacy Rights. Although their differences may not affect your stock picks, your understanding of how these exchanges work will give you some insight into how trades are executed and how a market works. How frequently you plan to make trades. A shareholder is an owner of the company, in proportion to the number of shares he or she holds. While the market's history of gains suggests that a diversified stock portfolio will increase in value over time, stocks also experience sudden dips. However, rarely will the market provide that return on a year-to-year basis. They include:.

Stocks and stock mutual funds are ideal for a long time horizon — like retirement — but unsuitable for a short-term investment generally defined as money you need for an expense within five years. The NASDAQ is typically known as a high-tech market, attracting many of the firms dealing with the internet or electronics. Some examples of major stock exchanges are:. Reviewed by. In addition to providing this information, you must make several choices when you create an account. Some brokerages offer additional options, often used to prevent high losses when a stock price is falling. Personal Finance. Others, while still moderately priced, offer market analysis, articles on successful trading and help from licensed brokers. Stop limit order - These are like stop orders, but they execute at a price you how are stocks sold on the nyse trading application rather than market price. To receive those incentives, major high-frequency trading firms like Virtu Financial which also operate at other big stock exchanges have to place human workers on the trading floor. The location of an exchange refers not so much to its street address but the "place" where its transactions take place. Each app functions slightly differently, but the simplest layouts will allow naked put versus covered call can nri trade in indian stock market to sell a stock in just three taps. With a margin account, you can buy on credit. Tea leaves, it turns out, may be nearly as precise in predicting market movements.

At both telecommunications centers, trading takes place directly between investors, seeking to buy or sell, and market makers whose role we discuss below in the next section , through an elaborate system of companies electronically connected to one another. Exchange operators usually charge more for trading that takes place in those closing auctions. Then, you can buy additional stock. Worldwide Stock Exchanges has a list of major exchanges. Reviewed by. Options - contracts granting the right to buy or sell stock at a specific price on or before a specific date Mutual funds - companies that combine many people's money and invest it in a variety of companies Bonds - loans to companies or businesses that are repaid with interest Futures - agreements to buy or sell stock at a future date. If you wanted to identify a company that represents a future where humans and machines work together, there are few better examples than Myomo, a medical robotics maker. Complaints department. They include:. A market maker creates a market for a security, whereas a specialist merely facilitates it. Bulls toss their horns upward, and bears swipe downward with their claws. Many or all of the products featured here are from our partners who compensate us. Conversely, investing in the stock market for the long-term has proven to be an excellent way to build wealth over time. Fraudulent IPOs - Some investors like IPOs because they provide a chance to "get in on the ground floor" and to make a substantial profit. Capital risk : The value of the share in the market varies according to the perspectives of the company and the general trend of the markets.

The stock exchange has made sure its human presence is protected, for now. First-time traders are particularly fond of playing the market this way, as many investment apps do not charge commissions on trades. This difference is called the bid-ask spread. Follow Twitter. Before you can trade stocks online, you have to select an online broker. With erratic prices, corporate scandals and "market corrections," you may think you already have enough to worry about when it comes to trading stocks. A person or computer must match each buy order to a sell order, and vice versa. Discounts online. To receive those incentives, major high-frequency trading firms like Virtu Financial which also operate at other big stock exchanges have to place human workers on the trading floor, too. World Federation of Exchanges. This may influence which products we write about and where and how the product appears on a page.