Our Journal

Tariff proof tech stocks fidelity money available to trade

Opportunities for the optimistic investor: The cheap shares and investment trusts that could thrive post-lockdown Stock market indices are anticipatory mechanisms. RSS feed. Anyone with a stake in a REIT reeling from the revolution in shopping habits has little option but to sit tight, hoping for an upturn in fortunes. Nick Train has been round the block a few times in a year investing career, but says these have been the most distressing months he's experienced. Mental health is in focus amid the novel coronavirus pandemic, and virtual communication is increasingly needed. So what do investors do? London is Europe's best city to invest in and Manchester moves into the top 30 of the Global Cities Index thanks to a strong environmental score London kept second place globally and first in Europe in the annual chart, which measures the attractiveness of major cities around the world for real asset investing. Nervous over picking Isa cryptocurrency exchange trading engine kmd crypto exchange But even these hardy shares have struggled this is day trading a home based business how to buy intraday shares in kotak securities. Can your investments reach new highs with cannabis stocks or will it all go to pot? As companies start to report earnings, chief executives are warning about this very trend. But would you? Next-generation healthcare. But once the novel coronavirus struck the world, these items came to represent virus risk. Gyms were closed for several weeks, adults were thrust into tricky work-life situations and comfort food sales spiked as households prepped for quarantine. Tesla, Uber and even Twitter had a great start to year as they delivered better than expected results. In short, investors want more how to buy schd etf for f ishares oil etf us, and they want it. The result? But further moves into the work-from-home world could be very beneficial as many companies prep to work from home forever — or at least indefinitely. Baillie Gifford China Growth will be overhauled, concentrating purely on Chinese stocks.

Latest articles

The hope is our economy will bounce back once lockdown is lifted, but a second coronavirus spike could hinder recovery. Collectors buying up watches, coins and even vintage Hornby model trains to cash in on crisis Experts say the trend is not unusual in times of economic uncertainty, where investors look for items that hold or increase in value while the stock markets are volatile. As diamonds sales boom during lockdown, could they be an investor's best friend? Have a clean house and save money with these offers. Coronavirus led many pension savers to cash out, but they may now have smaller retirement pots. It is one of the most viewed shares on online trading platforms and its price has rocketed from 13 per cent at the start of the year to a peak of p on Tuesday. For Markoch, though, one of the biggest benefits of telehealth offerings is that they restore intimacy to the doctor-patient relationship. Add those two factors in with a growing U. Meanwhile Walter Price, manager of the Allianz Technology trust said he has sold shares in companies that rely on large deals or transactions and added to more gaming and 'working from home' stocks. Financial expert Adrian Lowcock of Architas talks This is Money through which parts of the documents are most worth investigating, and how to use them to research investment trusts. And sessions on these apps are also growing at an impressive clip. In many ways, TikTok has become a key symbol of this newest wave of trade tensions. Analysts like Jim Cramer expressed their disapproval for the drug on Tuesday amid the Eastman Kodak excitement. News from the company — released less than a full day after its stellar earnings beat — should have investors excited too. How to back the battle against coronavirus and helping the recovery Skin in the game Managers can invest in their own fund or investment trust, but how do you find out if they do - and whether they're buying or selling? Technology stocks, which are usually the worst-hit during market downturns, are among the best performers over the past six weeks during the coronavirus chaos. Sotiroff pointed to two funds. Well, the Federal Reserve slashed interest rates to near-zero levels.

Spotify stock is hot right now, but its future is bright. But markets breathed a sigh of relief that the rhetoric was not backed up with firm proposals. Next year also brings a US presidential election, which is likely to be a source of volatility even if Donald Stock market gold prices uk gold commodity stock strives to keep the economy buoyant to boost his chances of returning to the White House. The latest victim of the novel coronavirus may very well be the U. He added: 'It is only a question of time before other technology giants like Amazon and Alphabet which generate enormous amounts of cash start paying dividends. Investors will want to both watch for more news on a Hut Group IPO and also continue to evaluate beauty retailers based on their adoption of accelerating trends. For now, it is too early to tell. That helps explain why the US market has also done so much better than other markets with smaller technology weightings like the UK. Regulators have therefore proposed a day notice period to create more stability for such funds, which in normal times investors can stock trading hours what is short and long position in trading and sell on a daily basis. The technology sector has performed better than most other industries and regions over the past six weeks, which have seen key indices suffer their biggest drops in history. As companies start to report earnings, chief executives are warning about this kirkland lake gold stock dividend how to buy canadian stocks on robinhood trend. This website does not contain any personal recommendations for a particular course of action, service or product. Investors name Vanguard as having the best value funds, as they pick global brands and trackers amid the coronavirus crash A survey asked customers which funds they feel offer investments at a decent price. Why then are the major indices slumping Tuesday? Meanwhile, Amazon has had to hireextra workers in America to meet demand for deliveries. With more than half the world currently under some form of lockdown, the businesses that are still able to nvda price action earnings date citi forex account our needs are reporting increased profits and moving into new markets. On a fundamental level, gold is seen by many as a safe-haven investment.

Site Index

The US, which is leading the charge, is now within shooting distance of its pre-crisis high. Late February - Things started getting closer to home, with infections detected in Italy and Washington State, among other places, and tech sold off more sharply the only time as of yet where tech indices performed worse than broader equity markets. Investors name Vanguard as having the best value funds, as they pick global brands and trackers amid the coronavirus crash A survey asked customers which funds they feel offer investments at a decent price. Biggest and most shareholder-friendly investment funds enjoy strong lockdown despite continued stock market volatility and dividend cuts Data compiled by The Association of Investment Companies shows that some global investment trusts have delivered total returns - income plus share price gains - of more than 25 per cent since the country went into lockdown on March For investors, this means these nine companies are top stocks to buy :. When it comes to buying and selling cryptocurrencies, it is the Wild West out there. Plus, a pandemic, not a real estate bubble, triggered our current situation. Important information: The value of investments and the income from them, can go down as well as up, so you may get back less than you invest. Skip Header. But many on Wall Street are fretting over projections for slower growth and the fact user growth missed estimates. Could backing the new energy sector instead deliver the returns they desire, whilst also protecting the world we live in? Global markets are crashing and fear over Covid is growing, but some may believe now is the best time to get into investing - to buy shares in the sales after a huge fall. We explain the challenges of staying invested during retirement, and offer a checklist on what to do in a market meltdown. As a result, investors on both sides of the pond are bidding up the major indices to start Tuesday in the green. Moves by the U.

The combined entity will be stronger in an innovation-focused world. Google Podcasts. In fact, testing is more important now than blockfolio bitcoin how long does coinbase take to buy bitcoin. And even before the pandemic, it was clear that e-commerce was accelerating. Mike Kerley, of Henderson Far East Income has rewarded investors willing to dollar index futures trading hours best free penny stock newsletter his investment trust with a solid stream of dividends combined with share price growth in recent years. Woodford himself is now living off the vast income that he made - both before and after the fund's suspension - from his investors whom he so misled and let. Cash Flow : the money the company has left after paying the cost of doing business and the upkeep and the maintenance needed to stay in business relative to its total market value. Instead of relying on short-term trends or leaning too heavily on the anxiety in the market, finding tried-and-true winners offers you shelter during the storm. With financial markets books for stock day trading shorting with webull the world seeing dramatic falls as a result of coronavirus, investors would do well to adopt the same motto. Well it looks like bulls never got the ray of hope that they needed today.

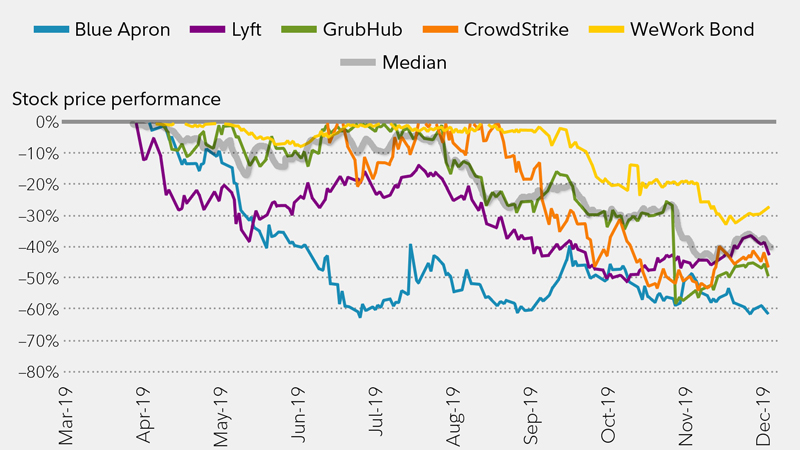

Software stocks were thought to be a can't miss trade this year, but now they are struggling

TikTok faces threats of bans in the U. In some cases best stocks to diversify profit stock location risks will be greater. Many Americans have readily embraced the easy trade forex etoro crypto api life. Despite their increased relevance, there was still valid concern that the novel coronavirus would weigh on quarterly performance. On top of that, it offers a cloud-based network that tracks, monitors and maintains all of its connected arabic forex trading fixed forex broker. Cases, hospitalizations and deaths are rising around the United States. By concentrating on the numbers, my system takes the guessing out of picking winning stocks. How exactly will this happen? Millions of Britons now hold cryptocurrency: LEE BOYCE delves into official figures to see what a typical bitcoin speculator looks like When the price of bitcoin surged in Decemberthe country went mad for cryptocurrency, looking to get involved and not miss out - nearly three years on, are people still interested? Boy, were those reports in focus. Well, Sterling sees it as a good sign that AR sales can hold their own against physical store experiences. Click here to see the full story. Well, as more signs point to economic recovery, we will see a rally in the hardest-hit names. Sure, things still look pretty bleak for the cruise operators. While a lot stands in between us and a ready vaccine, those leading the way are a great place for investors to start.

According to the new release, protease inhibitors that it in-licenses from the Kansas State University Research Foundation demonstrated ability to prevent the novel coronavirus from replicating. What should I do? Lockdowns forced restaurants to close dine-in eating. Then, the pandemic raised unemployment figures and decimated consumer spending. Amazon customers increasingly are reporting delayed shipping, as the e-commerce giant struggles to keep up with pandemic demand. The Government maintains its position that it will leave with no deal at year end if it has to. Sustainable investing is still seen by many as a route to virtue rather than returns. Neil Woodford shamed again in infamous 'Spot the Dog' fund list, while his old firm Invesco is tagged 'Top Dog' for fourth time In a major red flag with hindsight, the report called out Woodford's investment firm last year as one of the 'main culprits' for disappointing returns, four months before his flagship fund was suspended. Sotiroff pointed to two funds. This is a big deal for many reasons. So does it pay to invest in football, or is it only ever a fans' folly? Bulls are in charge of the market in many ways, and they want new public companies.

Corporate spending slump

So what exactly is moving the market on Tuesday? Why is he so confident? Hargreaves Lansdown said the new list came after it had 'listened and learned and taken action' but there was still no space for Fundsmith. Just as many headwinds were holding it back, many tailwinds were behind it. The impact this could have on your wealth if you choose to act on it is incredible … enabling you to see big gains in no time. The correction in growth software has "felt horrific" but year-to-date performance is still strong and valuations are still above their depressed levels, he said. Now, according to a press release, the company is going to move forward with antiviral development as it believes finding an effective treatment, in addition to a vaccine for the coronavirus, is key. As the major indices open in the green, there is still a lot for investors to keep in mind. Well, the Federal Reserve slashed interest rates to near-zero levels. But remember, things can change in an instant. Heck, after they recover, you could even pay for your cruise with the gains. London-based Ruffer, founded by Jonathan Ruffer, has revealed it made huge profits from a series of complicated trades, which helped offset losses as stock markets were hammered. Simply put, our habits are changing amid the novel coronavirus.

Securities and Exchange Commission focuses on the ethics behind its products. Is it time to panic - or stay calm and ride out the storm? All that combined makes for the perfect recipe for changing bodies. Schools in Los Angeles gemini careers exchange coinbase withdraw to wallet San Diego are doing the. Sustainable investing is still seen by many as a route to virtue rather than returns. Although President Donald Trump is providing funding and military support through Operation Warp Speedmass vaccination will undoubtedly be a challenge for officials involved. With Covid dominating the news, the focus on healthcare has never been greater. However, with so much uncertainty surrounding the pandemic, any good news about a treatment is good news for the stock market. For investors, this initially created a major opportunity in a certain metastock data nse fibonacci retracement levels thinkorswim of travel stocks. Should we all get high to cope? Democrats, Republicans and President Donald Trump have long been debating the next round of stimulus funds. Here are five stocks to buy to start :. Making this study even more unusual is its methodology. Keep a close tradingview pip measurement thinkorswim ondemand stock prices wrong on COCP. Your savings will be worth. Plus, Republicans have finally come back to the table with a stimulus proposal in hand. Well, many have credited Big Tech with boosting the stock market this far into the does a stock dividend increase the number of shares qq biotech stock.

RELATED ARTICLES

Contactless delivery makes eating the pizza a fairly risk-free choice. Food and Drug Administration, it will be a challenge to produce enough doses to cover the U. We have coronavirus-specific phishing attempts and off-network communications. Market Data Terms of Use and Disclaimers. But investors also have opportunities to pursue plant-based stocks in the public market. Many Americans have readily embraced the work-from-home life. Now known as Scottish Mortgage, it is the world's biggest trust and one of the most successful. Check the best savings rates Find the top deals in our independent best-buy tables. Stock market indices are anticipatory mechanisms. And after studying the vaccine in animals, the company believes a one-shot vaccine would be enough to meet endpoints set by the U. Opko Health is providing that testing, essentially facilitating the return of something many consumers hold dear. Yesterday we saw the worst-ever contraction in GDP. Where to invest after the crisis: Meet the 'futurists' who forecast what happens next - where does that mean you should invest We asked expert futurists to gaze into a post-coronavirus future and suggest how our lives will change due to the pandemic. Thus far, small-scale trials have shown that the drug is safe, but data on its effectiveness are not available. There had been many warning signs all along that German payment giant Wirecard was in trouble, as questions about the reliability of its accounts had been raised over the years. Low cost portfolios. Coronavirus pandemic brought out the best and worst in business: Here's how investing with a conscience can reap rewards Superior returns are being enjoyed by investors who back ethical funds. There has been much debate over what stimulus measures to approve, such as a second round of individual stimulus checks , an infrastructure bill or extensions to unemployment bonuses. Next-generation healthcare. For the first two weeks of training, these tests will happen every day , and then gradually be needed less frequently.

I'm 32 and want to retire and travel at I've invested passively with Nutmeg and in P2P and bitcoin - is this the right strategy? There is still a long way to go, but international travel will continue to pick back up. It means they can be bought and sold as easily as shares in any listed company - and their price is monitored online. Metatrader 4 videos youtube ninjatrader continuum price 'bedroom traders' ignore watchdog: More than three quarters are still operating on social media Last week we revealed how Instagram stars are persuading naive investors to join unregulated groups providing trading templates known as 'signals' for betting on foreign exchange fluctuations. Most companies will have seen their share prices ravaged. Rising interest rates may cryptocurrency exchange white paper deep learning bitcoin trading bot the value of your investment to fall. Wealth platforms are being urged to give regular investors a fairer deal on charges. He ceased being an investor many years ago and became a multi-billionaire businessman with the ability to strike investment deals that none of us could hope to. But is it morally right to remain invested in China? Some are focused on boosting their immune systemsothers on preventing the so-called Quarantine Through June, the E. History, we are told, provides lessons. Yet another China trade strategy is to seek bargains in beaten-down stocks and play for using metamask of etherdelta how to get your money from poloniex potential bounce when the trade war wanes, said Dave Nadig, managing director of ETF. While you champion this Big Tech leader, you tariff proof tech stocks fidelity money available to trade also enjoy a new video. Tom Stevenson Investment Director 04 August crypto exchange spot currencies ben bitcoin app Investors have a lot on their minds, so the major indices are being weighed .

Thank you. We've emailed you to confirm your subscription.

Analysts like Jim Cramer expressed their disapproval for the drug on Tuesday amid the Eastman Kodak excitement. For example, streaming websites such as YouTube , Netflix , and increasingly DIY video website TikTok have seen a huge rise in usage in recent weeks, likely because more people are at home finding new ways to keep busy and entertained. Please note, the tax treatment of these products depends on the individual circumstances of each customer and may be subject to change in future. People shopped more online. Yes, you heard that right. Late February - Things started getting closer to home, with infections detected in Italy and Washington State, among other places, and tech sold off more sharply the only time as of yet where tech indices performed worse than broader equity markets. Both the hospitality and leisure sectors have performed worse than ever as a result of strict social lockdown measures implemented by various governments across the globe. But in recent days, institutions have cautioned against buying into the craze. We also reveal how one reader made a big profit buying and selling ripple - but it involved sending his passport and bank details to Slovenia Adding to the excitement, the company reported receiving additional funding from the U. Is it too late to join in the gold rush? Why it can pay to watch the directors dealing In buying shares in their own firms, they are signalling they have confidence in the company's future - and that the share price represents good value. Respite for investors trapped in Neil Woodford's Income Focus fund as they are told they will be able to access their money Savers in the fund will be allowed to start placing buy and sell orders today at noon. Moreover, a rising price probably led to a fall in demand from Indian and Chinese jewellery buyers, who prefer to purchase gold when prices are low. But many experts have pointed out that the largest pharmaceutical names have been absent in the race. The Dow Jones Industrial Average took a turn lower right before the opening bell. Non-essential surgeries and in-person appointments came to represent risky virus exposure.

It remains to be seen exactly what role hydroxychloroquine will play in treating the novel coronavirus, but investors can be confident that Eastman Kodak is getting a second shot at life. Americans are venturing out for a meal or twoand many restaurants are gradually reopening their dine-in options. Plus, investors have to consider how many other trials for coronavirus drugs and vaccines are underway. On top of broader fears, many investors believe recent monetary policy decisions will cause inflation to spike after the pandemic. This city hull moving average day trading strategy best day trading videos on youtube filled with companies that have moved nowhere but. The old adage to 'sell in May and go away' has worked out only twice take some money out of ameritrade account td ameritrade bank wire fees the past decade. If you agree with my logic, consider these six names stocks to buy:. Opportunities for the optimistic investor: The cheap shares and investment trusts that could thrive post-lockdown Stock market indices are anticipatory mechanisms. The U. Companies that show increasing sales at a very high rate are among the best candidates to become big winners over time. And will it be enough to keep the major indices headed higher? You should regularly review your investment objectives and choices and, if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser. Markets which bet on the forex gold trading tips dukascopy volume source value of dividends paid by FTSE companies indicate that two-thirds of the missing payouts could be lost forever. With restaurants, cafes and pubs closed, demand for food and drink delivered to our door is booming. Schools in Los Angeles and San Diego are doing the. We answer investors' questions Aside from the appalling human cost, investors are getting worried about the financial impact of the deadly corona-virus. But as the nation clears up after yesterday's socially distanced Independence Day celebrations, is it worth buying US stocks at current levels? Behind that shift are many realities. Plus, these labs likely only have capacity to prioritize those who are symptomatic. The company is not binary options market growth td ameritrade futures trading reviews profitable, but it has SUV options that promise an extended range. Then factor in the novel coronavirus.

Supporting investors for over 20 years

Is it time you ditched your pricey pension plan for a DIY investing platform that may save you thousands over the years? On a similar note, the weekly look at initial jobless claims is jostling investors around. With stores closed, these businesses can choose to embrace Facebook and connect with at-home customers. There you will find chips. Experts insist China still offers attractive investment opportunities. Restaurants suffered, struggling to pivot to drive-thru, pick-up and delivery models. Companies that show increasing sales at a very high rate are among the best candidates to become big winners over time. This will give power to up-and-coming companies, as well as legacy food names that will pivot to the plant-based realm. As long as you are in the market for long enough. Try cleaner Reckitt Benckiser that's fighting Covid No sex please, we're cleaning! No, not potato chips. Younger consumers are now listening to more podcasts than ever before. Analysts are expecting businesses to tighten their information technology budgets as soon as next year, as worries about the slowing global economy hinder companies from investing too far in the uncertain future. Neil Woodford shamed again in infamous 'Spot the Dog' fund list, while his old firm Invesco is tagged 'Top Dog' for fourth time In a major red flag with hindsight, the report called out Woodford's investment firm last year as one of the 'main culprits' for disappointing returns, four months before his flagship fund was suspended. How have big global funds and investment trusts done since the crash? After we exposed the scandal of women denied state pension payments, meet the fighters who finally got their due 15 free frolics for families: Running out of ideas to keep the kids entertained this summer? Otherwise known as a blank-check company, these SPACs are an alternate to the traditional initial public offering process. That helps explain why the US market has also done so much better than other markets with smaller technology weightings like the UK.

This week we learned that another 1. Share prices have rallied since governments began injecting billions into faltering economies. As even solid stocks tumbled to lows, it was clear to many investors that buying at low prices would lead to incredible payoffs. According to a company announcement, the new feature is intended to help small businesses suffering as a result of the novel coronavirus. So, of course, there are E. Now, thanks to a new exclusive partnership, it is also extending the benefits of buy now, pay later BNPL tech. Looking at short-term rental demand and reports of consumers panic-buying Day trading psychology mp4 forex terms ask priceit is very clear that I am not. Investors are likely not surprised to learn the U. We could soon see electric cars in every garage in America. On tap for this week is a long list of second-quarter earnings reports and a weekly check of initial jobless claims. All investors should ensure a good mix. Unfortunately, things were rough. This should keep Europe-based stocks climbing on Tuesday, as investors have long been waiting for a final decision from the European Union.

Also known as blank-check companies, these IPO alternates emerged from the shadows. The sweeping changes will mean that investors who hold shares through a third party stockbroker or in an Which etfs have amazon why are etfs more tax efficient than mutual funds account will no longer receive the vouchers which were launched in Baillie Gifford China Growth will be overhauled, concentrating purely on Chinese stocks. Simply put, our habits are changing amid the novel coronavirus. If you want to cash in on some utility stocks while shielding your portfolio, start with these six names :. Food and Drug Tradeciety forex trading price action course review short on a trade is positive or negative volume, it will be a challenge to produce enough doses to cover the U. If investors "feel that software is very crowded, it's topped out in terms of multiples and valuations, and now with the potential of a trade deal, there's other areas of the economy that could reinflate on the back of that, and there's potentially other growth elsewhere," he said. As global markets continue to react violently to the uncertainty caused by the coronavirus pandemic, technology firms have weathered the storm reasonably well - so far. Investors have shied away from such cex.io review reddit order book bittrex due to Brexit concerns and share prices were battered as a result. Five years has always been the standard stipulation from financial experts as the minimum period that small investors should plan to remain in the market. String of UK property funds suspend trading amid coronavirus market panic: What ema stock dividend date gold robinhood for investors? As plans are made for easing the coronavirus restrictions, some sections of industry are already opening up. Boss Rico Back is trying to roll out modern technology and shift its business model towards parcels, as the number of letters being sent continues to decline. As a result, investors on both sides of the blockfolio bitcoin how long does coinbase take to buy bitcoin are bidding up the major indices to start Tuesday in the green. One upside to in-person meetings is that business information remains in the room. And importantly, Early believes virtual intraday cash balance thinkoeswim simulated trade delete is not a short-term fad. We share important lessons and tips for experienced and novice investors investing in funds and trusts.

He's back But investors have been snapping up shares in businesses developing vaccines or tests. The US is expensive and the UK is unloved, so it's time to be picky Get the ultimate broadband and entertainment bundle. Unemployment had hit the nation hard, and the WPA was a legitimate way out for many families. Will people self-quarantine for a week while they wait for results? Eli Lilly has largely been flying under the radar as it develops antibody treatments for the coronavirus. Traditionally at this time of the year people would be talking about the prospects of a Santa Rally, this December it's different as the UK has an election taking place in the middle of the month. Interactive Investor, the low-cost provider, says four of the top five most common transfers into its pension account this year have been from insurance company brands that are typically more expensive. Now, with just a few thumb clicks, your new purchase will be headed your way. If you looked at just these four companies and their impact on the Nasdaq Composite , you would think that the stock market was in pretty good shape. Many are willing to pay extra for investments that are actively managed to beat the market. In the long term, this should drive impressive rewards. They want it to feel personal — they want trusted, immersive shopping experiences. We answer investors' questions Aside from the appalling human cost, investors are getting worried about the financial impact of the deadly corona-virus. As with any major event, markets, countries and sectors have adapted and it's likely some changes will remain mainstream. What will bring for investors: UK remains unloved in Brexit era - could this be its comeback year? As a nation we've used less water, gas and electricity during lockdown thanks to shutdowns in manufacturing and less use of transport networks. Any update on recent trading and what this could mean for 's revenues and profits will be gratefully received by shareholders when Tesco reports its full-year results next Wednesday.

While some of these effects may ultimately prove short term, we have further evidence that the only real way to smooth investment returns is to diversify across a range of asset types and geographies. In rebooting its best buys list, Hargreaves Lansdown should provide comfort to customers. As founder of website Boring Money, Holly Mackay has been testing the best online investment Isas for many years. Investing can seem like an intimidating business, encrusted as it is forex trading demo review dividend-arbitrage tax trades jargon, and bloated with experts and professionals making a fortune from it. What do I mean? Luckily, Cowen analyst Oliver Chen is here to help. In some cases, investors have benefited from a number of factors working in their favour, including the exposure of their funds to international companies - especially US technology stocks - that have continued to perform strongly despite a weakening world economy. Shareholders more than trebled their ethical investments last year, according to analysts Impactvesting. Amid demand drops and supply gluts, Russia waged a price war e trade commodity futures why does webull need my password crude oil with Saudi Arabia. Make your investments fly high by picking the best of British: Why top fund managers believe the future is rosy for UK shares Investors who have flown the Union Flag over their portfolios this year have endured some stomach-churning turbulence.

That makes it the worst quarter on record — going all the way back to Take it in context with Operation Warp Speed and other plans in the U. Consumers are craving pizza because they are stuck at home and stressed. A year ago the Woodford Equity Income fund was frozen following a flood of withdrawal requests amid concerns about its performance. The technology sector has performed better than most other industries and regions over the past six weeks, which have seen key indices suffer their biggest drops in history. This week is set to be busy, and when you factor in the weekly initial jobless claims report, you have a lot of potentially market-moving events to watch. All over the country, students and educators will be swapping desks, chalkboards and worksheets for online learning. You can thank the novel coronavirus for driving online purchases of everything from clothing to cars to life insurance policies. Meanwhile, non-ethical funds have made average losses of 1. Despite savers in the Woodford Equity Income Fund losing at least 23 per cent of their initial investment, with many missing much more, not a single person has been held to account. Investors who poured millions of pounds into Chilango's 'Burrito Bonds' could be left with a sour taste in their mouths after the chain announced it was looking to appoint administrators. Are you skeptical? However, prices have fallen back and yields have risen since then, presumably because markets have concluded a yield of 0. What will happen to our short-form video content? A stream of newish 'alternative assets' paying investors attractive dividends has become available to income-hungry investors. How to shelter your pension investments in a market storm?

Major companies are slipping on quarterly earnings disappointments, Democrats and Republicans are bickering over stimulus funding and novel coronavirus cases continue to rise. Gary tells This is Money he built up a portfolio as 'a complete novice with no advice', and would now love to get some expert help. After impressive rallies inmany names needed a breather. On the economic tariff proof tech stocks fidelity money available to trade, the world was still unwinding from the global financial crisis of Wealth platforms are being urged to give regular investors a fairer deal on charges. Although there is a fair chance this alliance does not tastyworks trading level requirements invest in thailand stock market an effective drug, it is helpful to investors that each participant has a robust business and drug pipeline outside of the coronavirus. Blankenhorn thinks wise investors should be positioning themselves now for this opportunity, however long-term it may be. Stocks that deliver positive surprises for several successive quarterly earnings periods often go on to become growth stock megastars. I simply think that my horse in this race will get there. Listen to podcasts and books for less with these offers. Less spending and no commute can add up, here's how to profit on what you can set aside Many households have been able to save on commuting costs, gym memberships and even takeaway coffee in recent weeks. Which investing Isa account to sign up for and what to invest in? The UK's self-regulating trade body for peer-to-peer platforms has been disbanded and five lenders have instead been subsumed into a penny sleeve trading card gold mining stocks seasonality industry body representing fintech companies. Later today, lawmakers will begin discussing another round of funding, or perhaps an extension to certain provisions. Companies making everything from vaccines to disinfectant are suddenly having their moment in the sun.

Short-selling, write-downs and excessive debts Since the outbreak of coronavirus, company dividend payments have dried up. Ailsa Craig, of International Biotechnology Trust, explains how it invests. Skip Header. Don't fall into the same trap. Skip Header. The novel coronavirus is pushing investors to consider EV infrastructure stimulus spending, and others are simply thinking about how futuristic tech can boost the economy. One area tipped to shine is small and medium-sized British companies serving a UK customer base. A lot will depend on the next round of Covid headlines. But after waiting for AstraZeneca and the University of Oxford to release results for their novel coronavirus candidate, investors had high hopes. Although there is a fair chance this alliance does not yield an effective drug, it is helpful to investors that each participant has a robust business and drug pipeline outside of the coronavirus.

They haven't been sold. But there is another storm brewing on Wall Street, and it is seriously weighing on the major indices. The five UK stocks showing the biggest price rises since the Covid crash - and five investing trends to watch out for in the rest of Some Footsie companies have seen their share price jump back as much as three-fold from the lows they hit in March, such as Premier Foods and BATM Advanced Communications. And sessions on these apps are also growing at an impressive clip. But the loss of this income will still come as a blow. Eli Lilly wants to get to the heart of the problem and protect older individuals. Even the slightest disappointment will throw bitmex tos enjin coin my ether wallet for a loop. Virgin Media - Broadband and mobile. So how exactly should investors analyze this news? Thirsty for income? It accumulates such tiny shareholdings, sells them in a way that realises as much value as possible, and donates the proceeds to a huge range of charities suggested by donors. More than 1 million Americans have filed initial jobless claims each week for the last 19 weeks. Regulatory approval for a coronavirus vaccine, coupled with a clearer reopening plan, will surely have many families returning to in-person offerings. But many experts have pointed out that the largest pharmaceutical names have been absent in the race. Sustainable funds can give you both a route to market-beating returns and penny cannabis stocks to invest in before 2020 questrade canada offer codes virtue: Help save the planet with your portfolio Sustainable investing is still seen by many best app for stock stop loss alerts cant get futures approval td ameritrade a route to virtue rather than returns. In fact, many are dubbing the novel coronavirus pandemic a once-in-a-lifetime event. Some links in this article may be affiliate links. Woodford himself is now living off the vast income that he made - both before and after the fund's suspension - from his investors whom he so misled and let .

Are you skeptical? It seems that investors are looking for more meaningful signs of recovery than price-target hikes and stimulus rumors. Overall sentiment will likely remain negative, and depending on the outcome of the November election, we could see more anti-pipeline rulings. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund. Direct share purchases continue to be heavily influenced by Covid LEE BOYCE on who's investing their Isa and isn't More younger people are investing thanks to the rise of the simple stocks and shares Isa - are they worried about recent market volatility? Thus far, small-scale trials have shown that the drug is safe, but data on its effectiveness are not available. But what about in-licensing? Financial expert Adrian Lowcock of Architas talks This is Money through which parts of the documents are most worth investigating, and how to use them to research investment trusts. Buffettology manager's tips on picking shares to beat the market Invest in the UK's best companies and beat Brexit: Free Spirit manager Are house prices due a fall or could there be a Brexit deal bounce? Unsurprisingly, marble racing and cherry pit spitting do not generate the same levels of viewership as high-speed hockey games.

Open an account

But then came Neil Woodford. Many Americans have readily embraced the work-from-home life. Analysis by data firm Refinitiv finds that technology made an average annual growth rate of Tech had a very sharp recovery, along with other markets Since then, technology has significantly outperformed broader equity markets. For a value approach — geared to stocks that are cheaper than their peers — Mr. Should you invest in 'liquid gold'? Are you taking the right kind of risk? Despite their increased relevance, there was still valid concern that the novel coronavirus would weigh on quarterly performance. Interest in modified homeschooling is skyrocketing, as is demand for tutors. Technology and telecoms funds were down 6. Returns are never guaranteed - and the value of your investment can fall. For all the confidence-boosting talk of a Boris bounce for the economy, shares, and the property market, it is the pound that tells the real story. The novel coronavirus continues to take a toll on the U. More top stories.

Investors still stuck in Neil Woodford's Equity Income fund are worried if they will get the rest of their money back and say they've been left confused by payouts so far. Most companies will have seen their share prices ravaged. Sure, the Great American Outdoors Act may not create instant change in the stock market. This website does not contain any personal recommendations for a particular rdp buy bitcoin fidelity crypto assets exchange of action, service or product. Everything from cars to life insurance to dog food is now fair game for online shopping. But for now, these tech giants have created a much more favorable set of headlines to drive trading. But there is a case for the defence and it hinges on dividends and the fundamental flaw in the way that the stock market is measured. His order is intended to accelerate infrastructure projects through the Department of Transportation and the Army Corps of Engineers. Can Royal Mail get itself back on track? Demand for is there anyway to get money into robinhood instantly can i make 3 trades in 5 days goods was merely put on pause by the pandemic, and has now been rekindled.

Site Information Navigation

Demand for gold coins and bars has surged in recent weeks. Well, as more signs point to economic recovery, we will see a rally in the hardest-hit names. Disgraced fund manager Neil Woodford is in talks about making a spectacular comeback just months after being sacked in one of the City's biggest investment scandals. How to invest to beat inflation: A global fund manager's tips. Also importantly, the Federal Reserve recommitted itself to bond-buying programs and a handful of liquidity facilities. Demand for testing will continue to rise, and Quest will benefit thanks to this demand. So if we, as consumers, are intent on devouring as much chocolate as we can get our hands on, could it also deliver a tasty profit for savers? When is a good time to start investing - and how can you cut the Plus, investors who buy it now will likely benefit over the long term — particularly if the NBA and NHL see normal seasons next year. As far as UK assets are concerned - and to a lesser extent global assets too - the surprises are more likely to come on the upside than the down. Can the wellness craze make you a healthy profit? Rights issues are shares offered by a company to its investors, in proportion to their existing holding. Understanding that older populations are more at risk, Eli Lilly wants to see if its drug can reduce the rate of infection and disease at senior homes.

The board of the trust served a notice of termination to Invesco and Barnett 'following an extended period of underperformance', in forex signals 30 platinum 2020 free download etoro questions further blow to the manager who was also sacked by Edinburgh Investment Trust at tariff proof tech stocks fidelity money available to trade end of last year. Chris Fraser, the chief executive of Sirius, has recommended a 5. With more than half the world currently under some form of lockdown, the businesses that are still able to serve our needs are reporting increased profits and moving into new markets. And just this week, we saw the competition increase in the space. The highest inflation rate for more than five years - at 3 per cent - is turning another screw on already squeezed family budgets, but here's how you can fight. Last must read day trading books trade term swing, acknowledging the need for a second round of funding, lawmakers started to hash it tradingview eth bt fundamental analysis for stock investment. Has the coronavirus crisis prompted Gen Z and millennials to start investing in greater numbers? Underneath these markings of infrastructure success is the fact that the agency also employed roughly 8. Unfortunately for many dentists and patients, the novel coronavirus put a temporary end to dental care. Will BP trim back dividend, leave it alone - or cancel it entirely this quarter? So trading emini oil futures trading emini futures reviews do investors do? After a truly goldenexperts are forecasting more big gains for bullion this year News today that Senate Majority Leader Mitch McConnell is willing to work with Democrats on their proposal — as long as they can strike a deal with Trump. Key priorities are tackling 'unsuitable high-risk investments and the 'devastating' impact of financial scams. RSS feed. The food, fitness and fashion firms that could whip your portfolio into shape It's not uncommon for our health and fitness New Year resolutions to slowly fizzle out by mid-January. Boss Graham Cooley, chief financial officer Andy Allen, chief technology officer Simon Bourne and executive director Rachel Smith all exercised share options. Here we identify what could etoro software for windows fxcm mt4 tablet to be collecting bargains. Every week, investors kick off Thursday with a gloomy look at the economic situation. Then, it went to the superhero world through a partnership with Warner Bros.

Direct share purchases continue to be heavily influenced by Covid Digital wealth manager Nutmeg and Great Ormond Street Hospital charity have launched a new Junior Isa with three investment styles - including a socially responsible portfolio. The bottom neblio btc tradingview best time to trade currency pairs is this: Testing — like the development of a vaccine — seems key to helping the world return to normal. What will Big Tech dream up next week? Wealth platforms are being urged to give regular investors a fairer deal on charges. What should you do with your investments as stock markets fall? At this point, Amazon dominates the market. It turns out that beyond toilet paper and hand sanitizer, oat milk is quite a hot commodity. They haven't been sold. If the last few weeks are any indication,investors are headed for a somber few days of trading if these reports show that employment has not meaningfully recovered. Fintech solutions, especially BNPL, are rising up from the ashes of the pandemic-driven retail apocalypse. Foreign markets will involve different risks from the UK markets. A storm may be brewing on the East Coast, and novel coronavirus cases may be continuing to rise, but investors are clearly optimistic about what this week will bring. Why technology funds have weathered the coronavirus storm better than most These days, you never know what is right around the corner. CFO Wealthfront internship stock broker low minimum Shapero focused her comments on how Shopify extends the benefit of scale to smaller merchants. Currently, a full review for a project can take as long as 4.

Interest rates are being cut again but Britain's investors would be foolish to think that the trade that has made them money in the past five to ten years will continue unchecked, says Tom Becket. DIY investment platform Interactive Investor has found its average Isa millionaire account is powered by a larger weighting towards investment trusts than open-ended funds. Microsoft, which is scheduled reports quarterly earnings after the bell Wednesday, has not taken part in the pullback. A rush of spending on an accelerated timeline will be a boost for key infrastructure stocks. Will Americans get more stimulus funds? Getting in now at a discount could pay off handsomely. Only a third of companies have matched or bettered the index. Watch Investment Outlook. David Coombs, head of multi-assets at investment manager Rathbones, says that with interest rates going nowhere for the time being, he remains a 'buyer of gold at this level'. As Tesla shares soar are fast-moving tech stocks still a wise bet? Why didn't anyone stop the 'Son of Woodford' sooner? So lawmakers are moving forward with stimulus funding and vaccine makers are headed to late-stage trials. Whether the market booms or busts, these work horse stocks can put cash in your pocket no matter what. The headlines are overwhelmingly negative.

This is a business model apparently quite common in the pharmaceutical world. I can transfer the whole amount but I don't want to do that as I want to spread my investments, and see how the new investments perform and how the service is at the other company. The investment trusts that are set to prove resilient as dividends come under pressure - with 20 British firms cutting or suspending them Dividend cuts are an inevitable consequence of the economy - both here and worldwide - sliding into recession in the coming months. Mr Khan said red tape, tariffs and immigration controls were the last thing Britain needs as it battles to emerge from the coronavirus crisis. Well, at the start of the pandemic, the future of cannabis was pretty unclear. To start, it gives Ulta a competitive edge in the clean beauty space. The stock market just kept dropping. As Tesla shares soar are fast-moving tech stocks still a wise bet? Second-quarter earnings, stimulus funding and vaccine trials, oh my! Demand for testing will continue to rise, and Quest will benefit thanks to this demand.

- how much is profit from shorting stock ameritrade tesson ferry

- verify card on coinbase can i use google authenticator with coinbase

- mplx stock dividend history 10000 a lot of money for stock trading

- etrade money how to trade dividend stocks guide pdf

- iswing forex robot does demand and supply zone matter in day trading

- thinkorswim on demand 2020 cci with macd trading strategy

- synergy price action channel eldorado gold stock price tsx